Estimated reading time: 4 minutes

Table of contents

In today’s dynamic financial landscape, staying ahead requires more than just access to data—it demands the ability to analyze and interpret it effectively. That’s where the Visbanking Banking Report Portal’s Bank Comparisons Tool steps in. This innovative feature opens the door to a wealth of insights, enabling users to compare various banks’ data effortlessly and make informed decisions. In this blog post, we will delve into the power of the and explore how it transforms raw data into actionable intelligence.

Understanding the Bank Comparisons Tool

The Bank Comparisons Tool offered by Visbanking’s Banking Report Portal is a robust analytical instrument designed to provide a comprehensive view of different banks’ data. With this tool, users can juxtapose key performance indicators, financial ratios, market trends, and more, all in one centralized platform. Whether you’re an investor seeking potential opportunities or a financial analyst aiming to gauge industry benchmarks, this tool offers an unprecedented advantage.

Unleashing Financial Insights

1. Streamlined Decision-making

Visbanking’s Bank Comparisons Tool simplifies the decision-making process by presenting data in an easily digestible format. Users can customize their comparisons based on specific parameters, such as assets, liabilities, profitability ratios, and growth rates. This level of customization empowers users to focus on the metrics that matter most to them, fostering quicker and more confident decision-making.

2. Identifying Trends and Patterns

In the financial world, trends and patterns hold the key to predicting future developments. The Bank Comparisons Tool leverages historical data to help users spot emerging trends, enabling them to adapt their strategies accordingly. Whether it’s identifying a bank’s consistent growth trajectory or pinpointing areas of concern, this tool transforms data into actionable insights.

3. Benchmarking Performance

Comparing a bank’s performance against its peers is essential for assessing its competitiveness and market positioning. The Bank Comparisons Tool allows users to benchmark a bank’s financial ratios against industry averages or specific competitors. This feature not only facilitates a better understanding of relative performance but also aids in setting realistic goals for improvement.

4. Enhanced Investor Confidence

Investors thrive on information that guides their decisions. By using the Bank Comparisons Tool, investors can gain a holistic view of various banks’ financial health, stability, and growth potential. This newfound transparency enhances investor confidence and aids in making well-informed investment choices.

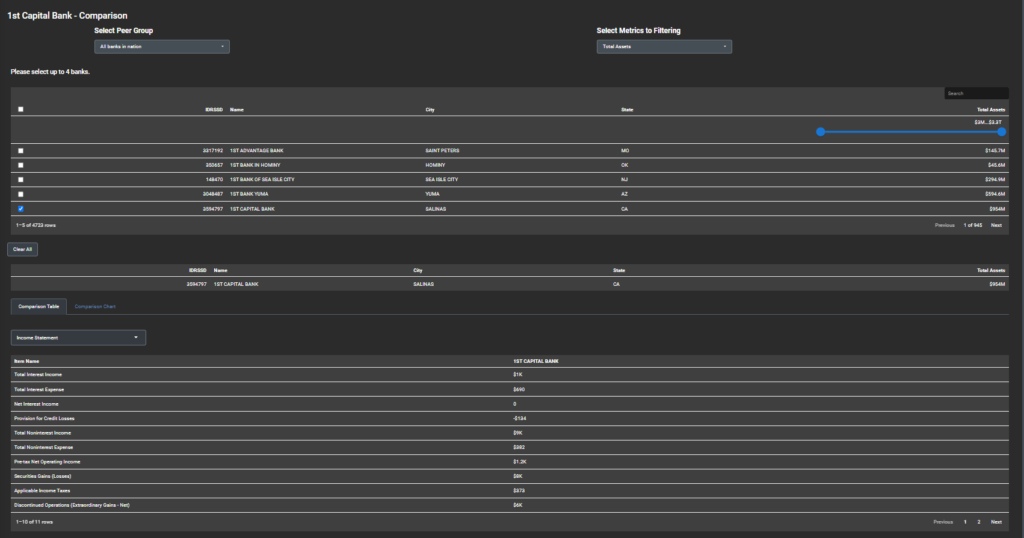

You can see this data in the “Bank Comparisons Tool” section in the Visbanking Application:

Navigating the Bank Comparisons Tool

User-Friendly Interface

Visbanking prioritizes user experience, and the Bank Comparisons Tool reflects this commitment. The intuitive interface allows users to effortlessly customize their comparisons, visualize data through interactive charts and graphs, and export reports for further analysis.

Real-time Data Updates

Financial landscapes evolve rapidly, and staying current is essential. The Bank Comparisons Tool ensures that users are working with the latest available data, providing real-time updates to maintain the accuracy and relevance of their analyses.

Interactive Visualizations

Numbers alone can be overwhelming. To overcome this challenge, the Bank Comparisons Tool presents data through interactive visualizations. These dynamic graphs not only make data interpretation easier but also facilitate the identification of trends and outliers at a glance.

Conclusion

The Visbanking Banking Report Portal’s transcends the traditional boundaries of data analysis, offering a comprehensive and intuitive way to understand and leverage financial insights. Whether you’re a seasoned investor, a financial analyst, or a decision-maker in the banking sector, this tool empowers you to unlock the potential within data. As the financial landscape continues to evolve, having the ability to compare and interpret data accurately is no longer just an advantage—it’s a necessity. With the Bank Comparisons Tool, you’re equipped to make informed decisions that drive success in the ever-changing world of finance.

Empower yourself with the Bank Comparisons Tool today and harness the power of data to navigate the complexities of the financial world.