Estimated reading time: 18 minutes

Table of contents

- I. Introduction

- II. What Are The Technologies Used in Banks?

- III. What Are The Most Technologically Advanced Banks in the USA?

- IV. How are U.S. banks enhancing security through biometric authentication methods?

- V. What are the customer benefits of using digital banking platforms?

- VI. What is The Role of AI in Modern Banking?

- VII. How are U.S. banks implementing AI to revolutionize their services and operations?

- VIII. Conclusion

I. Introduction

In the fast-paced world of modern banking, technology has become an indispensable force driving

unprecedented changes in the industry. Gone are the days of tedious paperwork and long queues at

bank branches. Today, cutting-edge technologies have revolutionized how financial institutions

operate and cater to their customers, enhancing both efficiency and security measures.

At the forefront of this transformation is the role of technology in enhancing customer experience. The

advent of digital banking solutions has empowered customers to access their accounts and conduct

transactions conveniently from the comfort of their homes or while on-the-go. With user-friendly

online and mobile banking applications available 24/7, traditional banking hours are no longer a

constraint for customers seeking seamless financial services.

Personalized services have taken center stage, thanks to technology’s ability to gather and analyze vast

amounts of customer data. Banks can now offer tailored loan options, customized investment plans,

and individualized financial advice, aligning their services with the unique needs and goals of each

customer.

In parallel, technology has bolstered the security measures that protect customer accounts and

sensitive data. Biometric authentication methods, such as fingerprint scans, facial recognition, and iris

scans, have emerged as more robust alternatives to traditional password-based systems. By adding an

extra layer of security, biometrics make it significantly more challenging for unauthorized individuals

to access critical account information.

The implementation of advanced encryption protocols ensures that customer data remains encrypted

and shielded during transmission, safeguarding it from potential cyber threats. Furthermore,

sophisticated fraud detection systems powered by technology actively monitor customer behavior and

transaction patterns, promptly identifying and mitigating suspicious activities in real-time.

As we delve deeper into the advancements brought about by technology in the U.S. banking industry,

this article will explore the latest trends and innovations. From the most technologically advanced

banks in the nation to the leading pioneers in technological adoption, we will examine how biometric

authentication methods and digital banking platforms enhance security and benefit customers.

Additionally, we will unravel the significant role of artificial intelligence (AI) in modern banking and

how U.S. banks are harnessing its potential. From AI-driven customer service interactions to AI-

powered fraud detection, the impact of artificial intelligence on the banking landscape is profound.

Join us on this informative journey as we uncover the transformative power of technology in U.S.

banks, shaping the future of banking as we know it.

II. What Are The Technologies Used in Banks?

In the rapidly advancing landscape of the U.S. banking industry, cutting-edge technologies

play a pivotal role in shaping the way financial institutions operate and serve their customers. From

streamlining internal processes to enhancing customer experiences, a diverse array of technologies

have become the backbone of modern banking, transforming the sector in unprecedented ways.

Online and Mobile Banking: Online and mobile banking platforms have revolutionized the way

customers interact with their banks. These digital channels enable customers to access their accounts,

check balances, transfer funds, and even apply for loans, all from the convenience of their

smartphones or computers. By eliminating the need for physical branch visits, online and mobile

banking offer unparalleled convenience and accessibility, catering to the fast-paced lifestyle of today’s

customers. Additionally, these platforms often come with intuitive interfaces, empowering users to

navigate through a wide range of banking services effortlessly.

Artificial Intelligence (AI) and Machine Learning: AI and machine learning have found profound

applications in various aspects of banking, redefining how banks analyze data, engage with customers,

and mitigate risks. AI-powered chatbots and virtual assistants handle routine customer queries and

provide instant support, significantly reducing response times and enhancing customer service.

Machine learning algorithms analyze vast amounts of data to identify patterns and trends, enabling

banks to offer personalized product recommendations and improve risk assessment for lending.

Moreover, AI-driven fraud detection systems continuously monitor transactions, swiftly identifying

suspicious activities and mitigating potential threats.

Blockchain Technology: Blockchain, the technology behind cryptocurrencies, has also found utility

in banking operations. Its decentralized nature ensures secure and tamper-proof transaction records,

reducing the risk of fraud and enhancing transparency. Banks are exploring blockchain for cross-

border payments, trade finance, and digital identity verification, among other use cases. Additionally,

smart contracts, which automatically execute predefined conditions once met, have the potential to

streamline various processes, such as loan approvals and supply chain management.

Data Analytics and Big Data: Banks deal with colossal amounts of data daily. Utilizing data

analytics and big data technologies, they can derive valuable insights into customer behavior,

preferences, and financial trends. These insights facilitate targeted marketing strategies, risk

management, and the creation of customer-centric products and services. By leveraging big data,

banks can also identify emerging market trends and capitalize on new business opportunities, fostering

innovation and growth.

Contactless Payment Solutions: Contactless payment methods, such as Near Field Communication

(NFC) and QR codes, have gained immense popularity in recent years. These technologies enable

customers to make swift and secure transactions without the need to physically swipe or insert cards,

enhancing both convenience and security. The widespread adoption of contactless payments has been

accelerated by the COVID-19 pandemic, as customers seek hygienic and touch-free payment options.

Cloud Computing: Cloud computing has revolutionized data storage and management for banks. It

provides flexible, scalable, and cost-effective solutions for storing vast amounts of data securely.

Additionally, it allows banks to deploy new applications and services more rapidly, keeping them agile

and responsive to market demands. Cloud-based solutions also facilitate seamless collaboration among

different branches and departments, promoting efficient teamwork and resource sharing.

Biometric Authentication: Biometric authentication methods, including fingerprint scans, facial

recognition, and iris scans, offer an additional layer of security in the authentication process. By

replacing or complementing traditional passwords, biometrics reduce the risk of unauthorized access

to customer accounts. The high level of accuracy and uniqueness associated with biometrics ensures

that customers’ identities are safeguarded, strengthening overall security protocols.

The adoption of these technologies not only streamlines banking operations but also

significantly improves efficiency. Banks can now offer faster and more personalized services, improve

risk management practices, and enhance security measures to protect both customer data and financial

assets. Embracing these advancements, U.S. banks continue to stay at the forefront of technological

innovation in the finance industry, catering to the evolving needs and expectations of their tech-savvy

customers.

III. What Are The Most Technologically Advanced Banks in the USA?

In the rapidly evolving landscape of the U.S. banking industry, some financial institutions

have distinguished themselves as pioneers by embracing technology and spearheading innovative

solutions. These banks have made substantial investments in digital transformation, pushing the

boundaries of what is possible in banking services. Let’s explore some of the leading banks in the USA

known for their technological advancements and the impact they have had on the industry:

JPMorgan Chase & Co.:

JPMorgan Chase & Co., commonly known as Chase Bank, is at the forefront of technological

innovation in the banking sector. The bank has made significant strides in offering seamless digital

experiences to its customers. Chase’s user-friendly online and mobile banking platforms provide a

comprehensive suite of services, including mobile check deposits, bill payments, and real-time

account alerts.

Moreover, Chase has harnessed the power of AI-driven chatbots to revolutionize customer service.

These virtual assistants provide instant support, handle routine inquiries, and assist in transactions,

freeing up human agents to address more complex customer needs. The bank’s technological prowess

has not only improved customer satisfaction but also elevated industry standards for digital banking.

Bank of America:

Bank of America has been a trailblazer in adopting technology to enhance customer experiences and

operational efficiency. The bank’s commitment to AI and machine learning has resulted in data-driven

insights that personalize services and identify areas for process optimization. Through AI-powered

algorithms, Bank of America tailors financial solutions to meet individual customer needs, creating a

more personalized banking experience.

The bank has also led the way in adopting biometric authentication methods, such as fingerprint and

facial recognition, to bolster security and simplify logins. By incorporating blockchain technology,

Bank of America has streamlined cross-border payments, offering faster and more cost-effective

solutions. These technological advancements have not only benefited customers but have also set new

benchmarks for the banking industry.

Wells Fargo:

Wells Fargo has been a frontrunner in utilizing technology to transform customer interactions and

enhance security. The bank has leveraged voice-activated banking, allowing customers to perform

tasks using voice commands through virtual assistants. This innovation has made banking more

accessible to a broader audience and improved the overall customer experience.

Furthermore, Wells Fargo’s focus on cybersecurity is evident through its implementation of

sophisticated fraud detection systems powered by AI. By constantly monitoring transactions and

detecting anomalies in real-time, the bank can proactively safeguard customer accounts from potential

threats. Through its technological advancements, Wells Fargo has demonstrated its commitment to

securing customer trust and data.

These leading banks in the USA have embraced technological advancements, setting new

industry standards for innovation and customer-centric services. Their investment in digital

transformation, AI, biometric authentication, and blockchain technology has not only streamlined

banking operations but also enhanced customer experiences and data security. As technology

continues to shape the banking landscape, these banks will undoubtedly play a crucial role in driving the industry forward, providing customers with cutting-edge solutions that cater to their evolving

financial needs.

IV. How are U.S. banks enhancing security through biometric authentication methods?

Biometric authentication, a cutting-edge security technology, has emerged as a game-changer in the

banking sector, offering robust and reliable identification methods based on unique biological traits.

By leveraging biometric data, such as fingerprints, facial features, and iris patterns, banks can

significantly enhance security measures, mitigating the risk of unauthorized access and financial fraud.

Biometric authentication provides several key benefits for the banking industry. Firstly, it offers a

higher level of security compared to traditional password-based authentication methods. Unlike

passwords that can be forgotten, stolen, or easily guessed, biometric traits are unique to each

individual, making them nearly impossible to replicate or forge. This high level of uniqueness and

accuracy ensures that only authorized individuals gain access to sensitive financial information.

Moreover, biometric authentication provides enhanced convenience and ease of use for customers.

With a simple touch of a fingerprint sensor or a quick facial scan, customers can seamlessly access

their accounts and perform secure transactions. This eliminates the need for customers to remember

and enter complex passwords, reducing the risk of login errors and enhancing the overall user

experience.

U.S. banks have been at the forefront of implementing biometric authentication methods to bolster

security. Many leading banks now offer biometric options as an alternative or complement to

traditional authentication methods. Customers can register their biometric data securely with the bank,

which is then used to verify their identity during subsequent logins or transactions.

Biometric technology has found wide application in mobile banking apps, enabling customers to

unlock their accounts and authorize transactions through fingerprint recognition or facial biometrics.

Additionally, some banks have integrated biometric features in their physical debit and credit cards,

providing an added layer of security for in-person transactions.

The adoption of biometric authentication extends beyond customer-facing applications. Within the

banking infrastructure, employees may use biometric access control to secure sensitive areas and data

centers, reducing the risk of internal security breaches. This multi-tiered approach to biometric

security ensures comprehensive protection for both customers and the bank itself.

While biometric authentication offers a new level of security, banks must remain vigilant in

safeguarding biometric data. Robust encryption measures and compliance with data privacy

regulations are essential to prevent unauthorized access to and misuse of biometric information.

In conclusion, biometric authentication methods have revolutionized security practices in the U.S.

banking sector. By leveraging unique biological traits for identification, banks can offer enhanced

security, seamless customer experiences, and protection against financial fraud. As biometric

technology continues to evolve, it is likely to play an increasingly critical role in safeguarding the

future of banking in an ever-changing digital landscape.

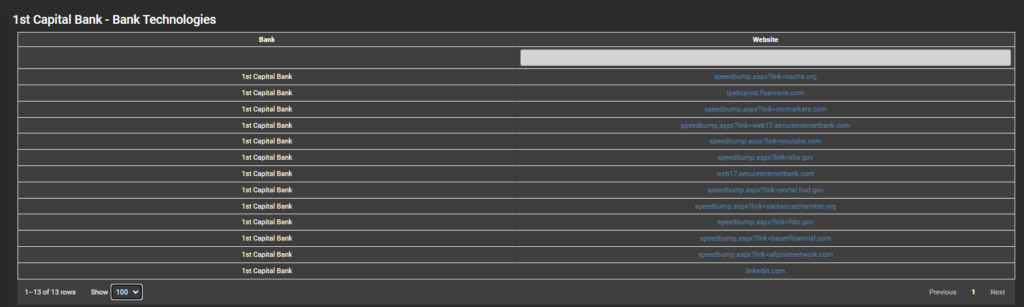

You can see this data in the “Bank Technologies” section in the Visbanking Application:

V. What are the customer benefits of using digital banking platforms?

Digital banking platforms have transformed the way customers interact with their banks, offering a

host of conveniences and benefits that have revolutionized the banking experience. As technology continues to advance, more and more customers are embracing these digital solutions for their ease of

use, accessibility, and personalized services.

At the core of digital banking platforms is the convenience they provide to customers. No longer

bound by traditional banking hours or the need to visit physical branches, customers can now access

their accounts and financial services at their fingertips, 24/7. The convenience of digital banking

allows customers to conduct transactions, check balances, and view transaction histories at their

preferred time and location, making banking more efficient and flexible.

One of the most significant advantages of digital banking platforms is the ability to perform online

transactions seamlessly. Customers can transfer funds between accounts, pay bills, and make

purchases online with just a few clicks. Digital payment options, such as mobile wallets and

contactless cards, have made cashless transactions the norm, offering customers a secure and swift

way to pay for goods and services.

Personalized services are another key benefit of digital banking platforms. Through data analytics and

AI-driven algorithms, banks can gain insights into customer behavior, preferences, and financial goals.

Armed with this information, banks can tailor product recommendations and offers that align with

each customer’s unique needs. Personalized financial advice, loan options, and investment strategies

are some of the ways digital banking platforms enhance customer satisfaction and financial well-

being.

Furthermore, digital banking platforms contribute to reducing paper waste and supporting

environmental sustainability. By providing electronic statements and encouraging digital

communication, banks help decrease the consumption of paper and promote eco-friendly banking

practices.

The security of digital banking platforms is also a top priority for banks and customers alike. Robust

encryption and multi-factor authentication measures ensure that customer data and financial

transactions remain secure from unauthorized access. Additionally, customers receive real-time alerts

and notifications for any suspicious activities, providing an added layer of security and peace of mind.

For individuals with busy lifestyles, digital banking platforms prove to be invaluable tools. Whether

on a business trip, vacation, or during odd hours, customers can manage their finances and stay

connected to their bank accounts without interruption. This level of accessibility and convenience

fosters a positive banking experience and strengthens the customer-bank relationship.

In conclusion, digital banking platforms offer a wide range of benefits for customers, transforming the

way they manage their finances. The convenience of 24/7 access to accounts, seamless online

transactions, and personalized services make digital banking a preferred choice for a growing number

of customers. As technology continues to advance, digital banking is expected to evolve further,

presenting even more innovative solutions to cater to the ever-changing needs of customers in the

modern world.

VI. What is The Role of AI in Modern Banking?

Artificial Intelligence (AI) has emerged as a transformative force, revolutionizing the banking

landscape in the USA. With its ability to process vast amounts of data and draw insights, AI has

become a valuable tool for banks to enhance efficiency, improve customer experiences, and strengthen

security measures. Let’s explore some of the ways AI is reshaping the future of banking:

AI-Powered Customer Service:

AI-driven chatbots and virtual assistants have become prominent features in modern banking. These

smart, conversational agents provide instant and personalized support to customers, answering queries,

addressing concerns, and guiding them through various banking processes. By automating routine

tasks, AI-powered customer service significantly reduces response times, ensuring swift and efficient

customer interactions.

Moreover, AI’s natural language processing capabilities enable chatbots to understand and respond to

complex customer requests, creating a more human-like conversational experience. As these AI

systems continue to learn from interactions, they become more adept at providing relevant and tailored

solutions, enhancing overall customer satisfaction.

Fraud Detection and Prevention:

AI plays a crucial role in strengthening security measures and safeguarding customer data from

fraudulent activities. AI-powered fraud detection systems continuously monitor transactions and

analyze patterns to identify suspicious behavior in real-time. By analyzing historical transaction data,

AI can pinpoint unusual activities and flag potentially fraudulent transactions, enabling banks to take

immediate action to protect customer accounts.

Additionally, AI helps banks stay ahead of evolving fraud techniques by learning from new patterns

and adapting its detection algorithms accordingly. This proactive approach ensures that banks can

effectively combat emerging threats and minimize the risk of financial losses due to fraud.

Enhanced Risk Management:

AI-powered risk management solutions have become indispensable tools for banks in assessing credit

risk, investment decisions, and compliance requirements. By analyzing vast amounts of financial data,

market trends, and macroeconomic indicators, AI can provide more accurate risk assessments, helping

banks make informed lending and investment decisions.

AI’s ability to analyze unstructured data, such as social media sentiments and news articles, also assists

banks in assessing potential risks associated with clients and investments. By gaining deeper insights

into the financial health of borrowers and investment prospects, banks can mitigate risks and optimize

their portfolios for better returns.

The integration of AI in modern banking has led to a paradigm shift in how financial

institutions operate and serve their customers. AI-powered customer service enables personalized and

efficient interactions, ensuring a seamless banking experience. AI’s contributions in fraud detection

and risk management have significantly strengthened security measures and minimized potential risks

for both banks and customers.

As AI continues to evolve, its applications in banking are bound to expand further, leading to

more innovative solutions that cater to the evolving needs of the industry and its customers.

Embracing AI-driven technologies, the banking sector in the USA is poised to witness continued

advancements, ushering in a new era of efficiency, security, and customer-centric services.

VII. How are U.S. banks implementing AI to revolutionize their services and operations?

Several forward-thinking U.S. banks have embraced artificial intelligence (AI) and leveraged

its potential to redefine banking services and operations. Through innovative AI use cases, these banks

have demonstrated the profound impact of AI implementation on customer satisfaction and operational efficiency. Let’s explore some specific U.S. banks that have successfully integrated AI and their transformative AI-driven initiatives:

Citibank:

Citibank, a leading global bank, has been at the forefront of AI adoption. The bank has deployed AI-

powered chatbots to deliver exceptional customer service. These chatbots engage with customers in

real-time, providing personalized assistance, answering queries, and assisting with transactions.

Customers benefit from instant support and round-the-clock availability, resulting in improved

customer satisfaction and reduced response times.

Citibank’s AI-driven fraud detection system is another standout initiative. By continuously analyzing

transaction patterns and customer behavior, the bank can swiftly detect and respond to suspicious

activities, safeguarding customer accounts from potential fraud. This AI-powered approach has

significantly enhanced security measures and instilled trust among customers.

Capital One:

Capital One is renowned for its innovative AI applications, notably exemplified through its Eno virtual

assistant. Eno utilizes natural language processing to engage with customers via text messages,

offering real-time balance updates, transaction alerts, and personalized spending insights. The

conversational interface has simplified customer interactions, leading to higher engagement and

satisfaction.

Capital One has also employed AI in credit risk assessment. By analyzing vast data sets, including

customer credit history, spending patterns, and external factors, the bank can make more accurate

lending decisions. This AI-driven approach has enabled Capital One to provide personalized credit

offers tailored to individual customers, further enhancing customer experience.

Bank of America:

Bank of America has harnessed the power of AI to streamline operational efficiency and customer

interactions. Erica, Bank of America’s AI-powered virtual financial assistant, serves as a personal

finance manager for customers. Erica offers budgeting advice, tracks spending, and assists in

achieving financial goals, providing customers with a seamless and personalized banking experience.

Moreover, Bank of America has successfully implemented AI for fraud prevention and detection. The

bank’s AI algorithms analyze transactions in real-time, swiftly identifying and addressing potential

fraudulent activities. This proactive approach has minimized losses due to fraud and strengthened

customer trust in the bank’s security measures.

Impact on Customer Satisfaction and Operational Efficiency:

The implementation of AI has had a profound impact on customer satisfaction for these U.S. banks.

AI-powered virtual assistants and chatbots offer personalized and instant support, meeting customers’

needs promptly and efficiently. The convenience and round-the-clock availability of these AI-driven

services have led to higher levels of customer engagement and loyalty.

AI-driven initiatives have also significantly improved operational efficiency for U.S. banks. By

automating routine tasks and leveraging AI for data analysis, banks can streamline internal processes,

reduce manual efforts, and optimize resource allocation. AI-powered risk assessment and fraud

detection have enhanced security measures, minimizing financial losses, and ensuring a more robust

banking ecosystem.

In conclusion, U.S. banks are increasingly embracing AI implementation to elevate customer

satisfaction and operational efficiency. By leveraging AI-driven virtual assistants, chatbots, and innovative risk management solutions, these banks are shaping a new era of banking, offering

personalized services and ensuring seamless interactions. As AI technology continues to advance, its

integration in the banking sector is expected to expand further, driving further advancements in

customer-centric services and operational excellence.

VIII. Conclusion

In conclusion, technology has become an indispensable and transformative force in the U.S. banking

industry, shaping the way financial institutions operate and serve their customers. From digital

banking platforms to cutting-edge security measures, technological advancements have redefined the

banking landscape, offering numerous benefits for both banks and customers a like.

The significance of technology in the banking sector lies in its ability to enhance customer experiences

and operational efficiency. Digital banking platforms provide customers with the convenience of 24/7

access to their accounts, enabling seamless online transactions and personalized services. Customers

can manage their finances with ease, leading to higher satisfaction and loyalty.

Moreover, the adoption of technology has resulted in more secure and robust banking services.

Biometric authentication methods, AI-powered fraud detection systems, and advanced encryption

techniques safeguard customer data and financial transactions, bolstering trust and confidence in the

banking system.

For banks, continuous technological advancements offer numerous advantages. AI-driven customer

service and chatbots streamline interactions, reducing response times and operational costs. Data

analytics and AI help banks make informed decisions, offering personalized financial products and

optimizing risk management strategies.

The integration of technology in the U.S. banking industry is an ongoing journey. As technology

continues to advance, banks are poised to explore new horizons, providing even more innovative

solutions to meet evolving customer needs. The synergy between technology and banking will drive

further growth, innovation, and improved financial services.

Overall, the marriage of technology and banking in the USA has paved the way for a dynamic and

customer-centric industry. With the rapid evolution of technology, the future holds exciting

possibilities for the banking sector, ensuring a seamless and secure banking experience for customers

while empowering banks to stay at the forefront of innovation. As the journey continues, the

partnership between technology and banking will undoubtedly usher in an era of enhanced efficiency,

customer satisfaction, and unparalleled opportunities for growth.