Estimated reading time: 4 minutes

Table of contents

- The Evolution of US Banking Innovations Technologies: A Glimpse into the Future

- The Role of Visbanking Banking Report Portal: Unveiling Insights

- AI and Machine Learning: Crafting Personalized Banking Experiences

- Blockchain: Reinventing Security and Transparency

- Fintech Collaborations: Navigating the Digital Ecosystem

- Cybersecurity and Data Privacy: Safeguarding Trust in the Digital Age

- Conclusion: The Future of US Banks Through Technological Innovation

The banking landscape in the United States is undergoing a remarkable transformation, driven by rapid advancements in technology. In this digital age, where the financial sector is evolving at an unprecedented pace, the role of technology in shaping the future of US banks cannot be overstated. One such pioneering platform making significant waves is the Visbanking Banking Report Portal, which is at the forefront of delivering crucial insights through cutting-edge technology. In this blog post, we embark on a comprehensive exploration of the innovative technologies that are revolutionizing the US banking sector, with a focus on the pivotal role played by the Visbanking Banking Report Portal.

The Evolution of US Banking Innovations Technologies: A Glimpse into the Future

As we delve into the heart of the US banking landscape, it’s imperative to acknowledge the seismic shifts that technology has introduced. From traditional brick-and-mortar banking to the dawn of online banking, mobile apps, and artificial intelligence-driven solutions, every facet of banking has been touched by innovation. The adoption of cloud computing, data analytics, and blockchain has further propelled the industry into new realms of efficiency and customer-centricity.

The Role of Visbanking Banking Report Portal: Unveiling Insights

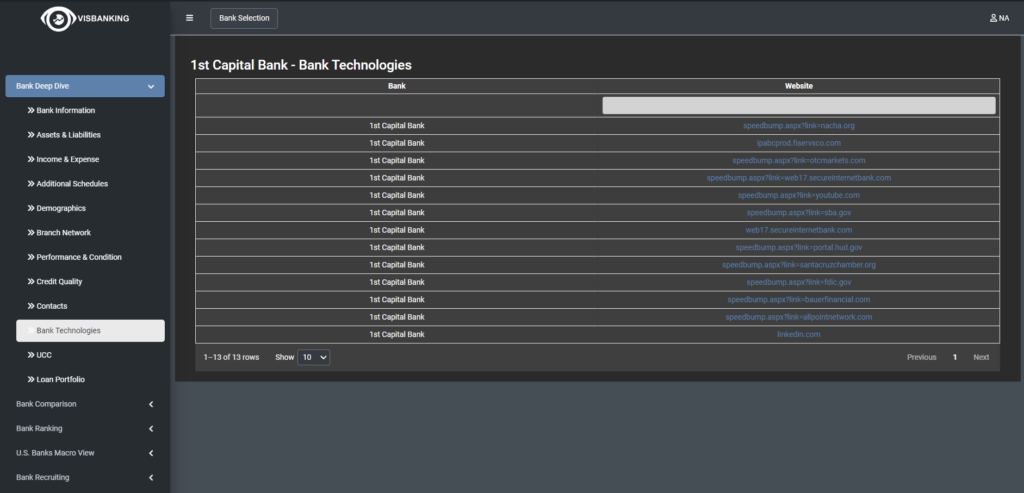

At the center of this technological revolution is the Visbanking Banking Report Portal, a pivotal tool that empowers banks with real-time data and insights. Leveraging state-of-the-art data analytics, machine learning, and visualization techniques, the portal provides banks with a comprehensive overview of their performance, customer behavior, and market trends. This deep dive into data-driven decision-making empowers banks to strategize effectively, enhance customer experiences, and drive operational excellence.

AI and Machine Learning: Crafting Personalized Banking Experiences

Artificial Intelligence (AI) and Machine Learning (ML) have ushered in an era of hyper-personalization in banking. From chatbots offering instant customer support to predictive analytics foreseeing individual financial needs, AI and ML technologies are reshaping how banks interact with customers. Through the lens of the Visbanking Banking Report Portal, banks can harness AI-driven insights to tailor services, predict churn, and proactively address customer concerns.

Blockchain: Reinventing Security and Transparency

The transformative potential of blockchain technology extends beyond cryptocurrencies. Its decentralized and immutable nature makes it a perfect fit for enhancing security, transparency, and efficiency within the financial sector. Smart contracts enable automated processes, eliminating intermediaries and reducing transaction costs. By integrating blockchain into their operations, banks can bolster security and streamline processes, ultimately benefiting both customers and the institution.

You can see this data in the “US Banks Contacts” section in the Visbanking Application:

Fintech Collaborations: Navigating the Digital Ecosystem

The rise of fintech startups has disrupted traditional banking models, prompting a symbiotic relationship between established banks and innovative fintech companies. Open Banking APIs (Application Programming Interfaces) facilitate seamless integration between different financial systems, enabling banks to tap into the agility and innovation of fintech players. The Visbanking Banking Report Portal acts as a bridge between these worlds, offering insights into these collaborations’ impact on banks’ performance.

Cybersecurity and Data Privacy: Safeguarding Trust in the Digital Age

With increased digitization comes the critical need for robust cybersecurity measures and data privacy protocols. As banks store and handle sensitive customer information, ensuring the highest level of security is non-negotiable. The Visbanking Banking Report Portal addresses these concerns by highlighting the latest advancements in cybersecurity, risk assessment, and compliance, enabling banks to maintain trust while embracing digital transformation.

Conclusion: The Future of US Banks Through Technological Innovation

The journey through the realm of US banking technologies has highlighted the seismic shifts that have redefined the industry. From AI-powered personalization to blockchain-driven security, the Visbanking Banking Report Portal stands as a testament to the pivotal role technology plays in shaping the future of banks. As the banking sector continues to evolve, embracing these technologies is no longer an option but a necessity for banks to remain competitive, customer-centric, and agile in an ever-changing landscape. By partnering with forward-looking solutions like the Visbanking Banking Report Portal, US banks can ensure they are well-equipped to navigate the complexities of the digital age and continue to deliver value to their customers.

In the ever-evolving landscape of US banking technologies, the Visbanking Banking Report Portal shines as a beacon of innovation, driving the industry forward and empowering banks to thrive in the digital era.