Estimated reading time: 16 minutes

Table of contents

Introduction

The U.S. banking system stands as the cornerstone of the nation’s economy, wielding a significant influence on financial activities and the livelihoods of millions of Americans. As the backbone of economic transactions, savings, investments, and loans, the health and performance of the U.S. banking system have far-reaching implications. In this article, we delve into the key elements that define the U.S. banking landscape, with a particular focus on assessing the strength, stability, and credit ratings of its prominent banks. Understanding these crucial aspects will shed light on the system’s resilience and its ability to weather economic storms, thereby shaping the financial well-being of both individuals and the broader economy. So, let’s embark on an insightful journey into the intricacies of the U.S. banking system.

What are U.S. Bank Credit Ratings?

Credit ratings are vital indicators of a bank’s financial health and creditworthiness, making them an essential aspect of the U.S. banking system. These ratings are assessments provided by credit rating agencies, such as Standard & Poor’s (S&P), Moody’s, and Fitch, to determine the risk associated with a bank’s debt obligations. Represented by a combination of letters and symbols, such as AAA, AA+, A-, B, etc., credit ratings offer valuable insights into a bank’s ability to fulfill its financial commitments, including interest payments and the repayment of principal amounts.

Define Credit Ratings and Their Significance for Banks

Credit rating agencies employ rigorous evaluation processes to arrive at a bank’s credit rating. A high credit rating, often signified by AAA or AA, indicates a low credit risk for investors and depositors. Such ratings are usually conferred upon banks that exhibit a strong financial position, excellent risk management practices, and a track record of consistent performance. These banks are considered more likely to meet their obligations, inspiring confidence among stakeholders.

One of the primary benefits of a high credit rating for a bank is the ability to borrow funds at lower interest rates. Investors perceive these banks as having lower risk, leading to reduced borrowing costs and enhanced profitability. As a result, banks with strong credit ratings can leverage this advantage to expand their lending activities, generate higher revenues, and pursue growth opportunities.

How Credit Rating Agencies Assess Banks’ Creditworthiness

The assessment of a bank’s creditworthiness is a complex and comprehensive process conducted by credit rating agencies. These agencies use sophisticated methodologies and analytical tools to evaluate various aspects of a bank’s financial position and performance.

Some key factors that credit rating agencies examine include:

Capital Adequacy: The level of capital reserves a bank holds to absorb potential losses.

Liquidity: The ability of a bank to meet its short-term obligations.

Asset Quality: The quality and performance of the bank’s loan portfolio and other assets.

Earnings: The bank’s profitability and ability to generate sustainable income.

Risk Management Practices: The effectiveness of the bank’s risk management policies and procedures.

Business Strategy: The bank’s overall business strategy and long-term sustainability.

Additionally, credit rating agencies consider external factors, such as the economic environment and industry-specific challenges that could impact the bank’s financial stability.

Discuss the Impact of Credit Ratings on a Bank’s Operations and Reputation

The credit rating assigned to a bank significantly influences its day-to-day operations and strategic decisions. A higher credit rating attracts more customers and investors, as it instills confidence in the bank’s ability to safeguard deposits and deliver positive returns. This, in turn, can lead to increased business opportunities and access to a broader customer base.

Moreover, a positive credit rating can enhance a bank’s reputation in the financial markets and among its peers. It serves as a vote of confidence, encouraging other financial institutions to collaborate, lend, or invest with the bank. A strong credit rating also signals stability, making it an essential consideration for potential partners and counterparties.

Conversely, a lower credit rating may lead to higher borrowing costs and hamper a bank’s ability to attract deposits and investments. It can also result in a loss of trust among customers and investors, leading to reputational damage and potential difficulties in raising capital.

In conclusion, credit ratings are crucial assessments that impact a bank’s operations, investor perception, and overall reputation. Maintaining a strong credit rating is vital for a bank’s sustained success, as it reflects its financial strength and stability in the dynamic landscape of the U.S. banking system. Banks must proactively manage their creditworthiness to build and retain trust with stakeholders, supporting their mission of providing reliable and secure financial services to individuals and businesses alike.

How Strong is the U.S. Banking System?

The strength of the U.S. banking system is a critical aspect that determines its resilience and ability to withstand economic challenges. This strength is a result of various factors working in tandem to create a solid foundation for the financial sector. In this section, we will delve into the key elements that contribute to the strength of the U.S. banking system.

Explain the Factors that Contribute to the Strength of the U.S. Banking System

- Diversified Banking Landscape: One of the key strengths of the U.S. banking system lies in its diversified landscape. The country boasts a wide range of banks, including large national banks, regional banks, community banks, and credit unions. This diversity fosters healthy competition and provides consumers and businesses with a wide array of financial services tailored to their specific needs. It also contributes to financial stability by reducing the concentration risk associated with a few dominant institutions.

- Robust Regulatory Framework: The U.S. banking system operates under a comprehensive regulatory framework that ensures stability and protects consumers and depositors. Regulatory agencies, such as the Federal Reserve, the Office of the Comptroller of the Currency (OCC), and the Federal Deposit Insurance Corporation (FDIC), play a vital role in overseeing and enforcing banking regulations. These agencies work to prevent excessive risk-taking, monitor systemic risks, and ensure that banks adhere to prudent lending practices.

- Stringent Risk Management Practices: The U.S. banking system places a strong emphasis on risk management. Banks are required to adhere to strict risk management practices, which include robust internal controls, risk assessments, and stress testing. Regular stress tests evaluate a bank’s ability to withstand adverse economic scenarios, ensuring preparedness for potential financial downturns. By actively managing risks, banks can identify vulnerabilities and take preemptive measures to safeguard their financial health.

- Financial Innovation and Technology: The U.S. banking system embraces financial innovation and technology, which contributes to its strength and adaptability. Advancements in technology have revolutionized the way banks operate, enabling them to streamline processes, enhance efficiency, and deliver innovative products and services to customers. Online and mobile banking, digital payments, and artificial intelligence-driven customer service are examples of technological innovations that have transformed the banking landscape, benefitting both banks and consumers.

Discuss the Role of Robust Regulations and Government Oversight

The U.S. banking system benefits from robust regulations and diligent government oversight, which promote stability and protect both customers and financial institutions. Key regulatory bodies, such as the Federal Reserve, play a crucial role in monitoring banks’ activities, ensuring compliance with established rules, and stepping in to prevent systemic risks. By maintaining the safety and soundness of the banking system, regulators help bolster public confidence in the financial sector.

Government oversight is essential in monitoring the banking industry’s adherence to consumer protection laws, fair lending practices, and anti-money laundering regulations. This oversight helps maintain trust in the banking system and ensures that customers’ rights are protected. Additionally, it fosters transparency, accountability, and ethical conduct within the banking industry.

Analyze the Capitalization and Liquidity Levels of Banks and Their Implications

The capitalization and liquidity levels of banks play a pivotal role in determining their financial strength and capacity to absorb losses. Capital serves as a financial buffer against unexpected losses, acting as a cushion for a bank’s balance sheet. Banks with sufficient capital reserves are better equipped to weather financial crises and economic downturns, reducing the likelihood of bank failures.

Likewise, liquidity is crucial for banks to meet their short-term obligations, such as customer withdrawals and payment processing. Banks with adequate liquidity are more resilient during times of economic stress, as they can readily meet the demand for cash without jeopardizing their operations.

The implications of strong capitalization and liquidity are multifold. Firstly, it enhances the stability of the banking system, reducing the likelihood of a liquidity crisis that could ripple through the financial markets. Secondly, it boosts investor confidence, attracting more capital investment into the banking sector. Robust capitalization also allows banks to extend credit to individuals and businesses, supporting economic growth and development.

In conclusion, the U.S. banking system’s strength is underpinned by its diversified landscape, robust regulatory framework, and stringent risk management practices. Government oversight ensures compliance with regulations and protects the interests of customers and depositors. Adequate capitalization and liquidity levels further fortify the banking system, fostering stability and confidence. A strong banking system serves as a crucial pillar of the U.S. economy, supporting sustainable growth and facilitating financial well-being for individuals and businesses alike. As the banking industry continues to evolve in the face of technological advancements and changing economic landscapes, a commitment to prudent practices and vigilant oversight will remain essential to maintaining the strength and stability of the U.S. banking system.

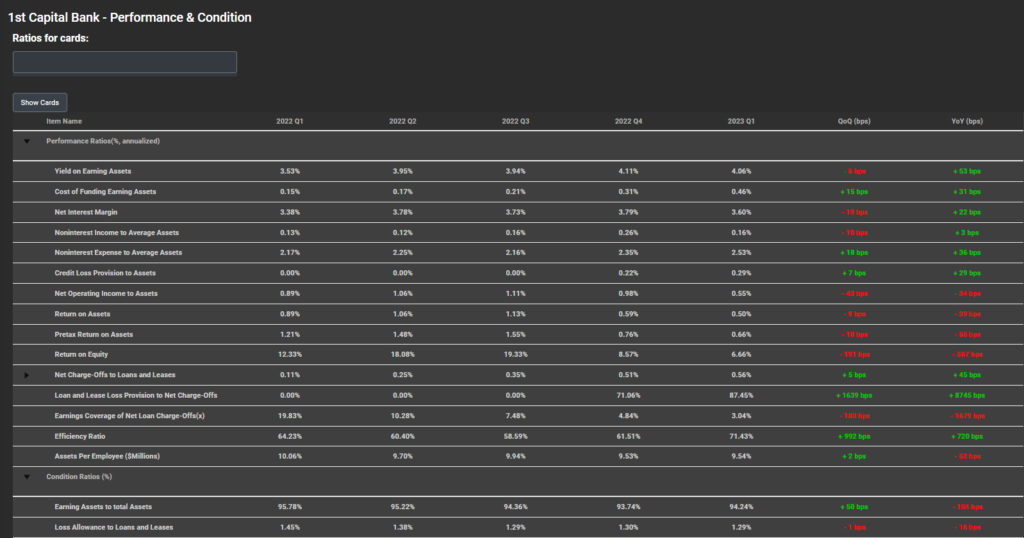

You can see this data in the “Performance & Condition” section in the Visbanking Application:

How Stable is the U.S. Banking System?

The stability of the U.S. banking system is closely intertwined with its strength and resilience. Over the years, the U.S. government and regulatory authorities have implemented various measures to enhance the stability of the banking system, especially in the wake of the 2008 financial crisis. In this section, we explore some of the crucial steps taken to bolster the stability of the U.S. banking system.

Reforms: Implementation of Reforms to Address Vulnerabilities and Enhance Stability

In the aftermath of the 2008 financial crisis, which exposed significant weaknesses in the global financial system, the U.S. banking sector underwent substantial reforms to address vulnerabilities and improve stability. The Dodd-Frank Wall Street Reform and Consumer Protection Act, signed into law in 2010, aimed to overhaul financial regulation and enhance consumer protection.

Some key reforms introduced through Dodd-Frank include:

Increased Capital Requirements: Banks were required to hold higher levels of capital as a safeguard against potential losses, ensuring they have sufficient buffers to weather financial shocks.

Strengthened Regulatory Oversight: The Act enhanced the regulatory authority of institutions such as the Federal Reserve and the Consumer Financial Protection Bureau, granting them greater oversight and enforcement capabilities.

Volcker Rule: This rule restricts banks from engaging in proprietary trading and limits their investments in hedge funds and private equity, reducing speculative activities that could jeopardize financial stability.

Systemically Important Financial Institution (SIFI) Designation: The Act established a framework to designate certain large financial institutions as SIFIs, subjecting them to additional regulations to mitigate systemic risks.

These reforms aimed to create a more transparent, accountable, and resilient banking system, reducing the probability of a financial crisis similar to the one witnessed in 2008.

Stress Testing: Regular Stress Testing of Banks to Ensure They Can Withstand Adverse Economic Scenarios

Another significant measure taken to bolster the stability of the U.S. banking system is the implementation of regular stress tests. The Federal Reserve conducts Comprehensive Capital Analysis and Review (CCAR) and Dodd-Frank Act Stress Tests (DFAST) annually on large banks. These stress tests simulate adverse economic scenarios, including severe recessions and financial market disruptions, to assess banks’ ability to withstand such events.

Through stress testing, regulators can identify vulnerabilities and weaknesses in individual banks and the broader banking system. Banks are required to demonstrate that they can maintain sufficient capital levels and continue their operations even in highly adverse conditions. Banks that do not meet the minimum capital requirements are subject to restrictions on dividends and share buybacks, ensuring they prioritize capital preservation during times of economic stress.

The results of stress tests are made public, enhancing transparency and providing investors, depositors, and the public with insights into the health of the banking system. By subjecting banks to rigorous stress testing, regulators can proactively address potential risks and foster a culture of risk management and prudence within the banking industry.

In conclusion, the stability of the U.S. banking system is a result of continuous efforts to enhance its resilience and reduce systemic risks. The implementation of key reforms, such as increased capital requirements and strengthened regulatory oversight, has created a more robust and accountable financial landscape. Regular stress testing ensures that banks are prepared to withstand adverse economic scenarios, providing greater confidence to consumers and investors. While challenges may emerge in the future, the U.S. banking system’s commitment to prudent practices and vigilant oversight remains instrumental in maintaining its stability and protecting the interests of all stakeholders.

What are the Recent Developments and Challenges?

The U.S. banking sector operates in a dynamic and ever-changing economic landscape, facing both opportunities and challenges that shape its strength and stability. In this section, we explore some recent developments that have impacted the U.S. banking system, as well as potential challenges that the sector faces in the current economic climate.

Recent Developments and Challenges in the U.S. Banking Sector

The U.S. banking sector operates in a dynamic and ever-changing economic landscape, facing both opportunities and challenges that shape its strength and stability. In this section, we explore recent developments that have impacted the U.S. banking system, as well as potential challenges that the sector faces in the current economic climate.

Recent Developments in the U.S. Banking Sector

Advancements in Financial Technology (Fintech): Over the past decade, financial technology (fintech) companies have emerged as formidable players in the banking industry. Fintech firms leverage technological innovations to offer innovative financial services and products, disrupting traditional banking practices. Mobile banking apps, peer-to-peer payment platforms, robo-advisors, and cryptocurrency services are some of the fintech solutions that have gained popularity among tech-savvy consumers.

The rise of fintech has led to increased competition in the banking space, prompting traditional banks to adapt to changing consumer preferences and demands. To stay competitive, many banks have invested in fintech partnerships, embarked on digital transformation initiatives, and introduced their own digital banking platforms. These efforts aim to enhance customer experiences, streamline operations, and offer innovative financial solutions.

Low Interest Rate Environment: In response to economic challenges, central banks around the world, including the U.S. Federal Reserve, have kept interest rates at historically low levels. The primary goal has been to stimulate economic growth and support borrowing and investment activities.

While low-interest rates benefit borrowers by reducing the cost of borrowing, they present challenges for banks. Banks generate a significant portion of their revenue from the spread between interest earned on loans and interest paid on deposits. With interest rates at historically low levels, banks face reduced net interest margins, impacting their profitability. In this environment, banks must explore alternative revenue streams, such as fee-based services, wealth management, and investment banking, to offset the impact of low-interest rates on their bottom line.

Consolidation and Mergers: The U.S. banking sector has experienced a wave of consolidation and mergers in recent years. Larger banks have acquired smaller regional and community banks to expand their market presence, gain economies of scale, and achieve cost efficiencies. Consolidation can lead to stronger banks with broader capabilities, allowing them to better serve their customers and adapt to industry changes.

However, the trend of consolidation also raises concerns about reduced competition in certain markets. Smaller banks, which may have played crucial roles in serving local communities, might face challenges in competing with larger, more diversified institutions. Regulators must strike a balance between promoting healthy competition and ensuring the stability of the financial system.

Challenges in the Current Economic Landscape

Cybersecurity Risks: As the banking sector becomes increasingly digitalized, banks face growing cybersecurity threats. Cybercriminals continuously evolve their tactics to target sensitive customer data, financial transactions, and critical infrastructure. A successful cyberattack can have severe repercussions, leading to financial losses, reputational damage, and potential legal liabilities.

Banks must invest significantly in robust cybersecurity measures to safeguard their networks, customer information, and financial transactions. This requires not only the deployment of advanced cybersecurity tools but also continuous monitoring, threat intelligence sharing, and employee training to combat phishing and other social engineering attacks.

Economic Uncertainty: The COVID-19 pandemic has underscored the vulnerability of the global economy to unforeseen shocks. The U.S. banking system faces uncertainties related to economic recovery, interest rate changes, and potential market fluctuations. The pace and trajectory of economic recovery can significantly impact banks’ asset quality, loan performance, and profitability.

To navigate economic uncertainties, banks must maintain strong risk management practices and adequate capital buffers. They must also closely monitor economic indicators and stress-test their portfolios to assess their resilience under different economic scenarios.

Regulatory and Compliance Burden: While regulations are essential for maintaining financial stability and protecting consumers, an overly complex and burdensome regulatory environment can hinder banks’ agility and innovation. Compliance with an ever-expanding array of regulations consumes significant time and resources, diverting banks’ focus from core business activities.

Regulatory compliance costs can disproportionately affect smaller banks, potentially leading to reduced credit availability and less competition. Regulatory reforms that promote efficiency, streamline reporting requirements, and encourage fintech innovations can strike a balance between maintaining a robust regulatory framework and fostering innovation in the banking sector.

Changing Consumer Behavior: The preferences and expectations of consumers are continually evolving in response to technological advancements and shifts in societal norms. Increasingly, consumers demand seamless, personalized, and accessible banking experiences that align with their digital lifestyles.

To address changing consumer behavior, banks must embrace technological innovations and offer convenient digital solutions. Providing user-friendly mobile banking apps, enhancing online banking services, and introducing personalized financial advice through AI-driven platforms can help banks retain existing customers and attract new ones.

Recent developments in the U.S. banking sector have introduced both opportunities and challenges. Advancements in fintech have reshaped the industry’s landscape, while a low-interest-rate environment has prompted banks to explore new revenue streams. Consolidation and mergers have redefined market dynamics, leading to increased competition among banks.

However, challenges such as cybersecurity risks, economic uncertainty, regulatory burdens, and changing consumer behavior demand constant vigilance and adaptability. To maintain their strength and stability, banks must remain proactive in managing risks, embracing technological advancements, and complying with evolving regulations. The U.S. banking system’s ability to navigate these challenges will determine its resilience and continued contribution to the nation’s economic prosperity. A forward-thinking approach that prioritizes innovation, customer-centricity, and risk management will position banks for success in the ever-evolving financial landscape.

Conclusion

In this article, we have explored crucial aspects of the U.S. banking system, focusing on its credit ratings, strength, stability, recent developments, and challenges. Here are the key points discussed:

- U.S. Bank Credit Ratings: Credit ratings play a pivotal role in determining a bank’s creditworthiness, reflecting its ability to meet financial obligations. Higher credit ratings inspire confidence among stakeholders and lead to lower borrowing costs for banks.

- Strength of the U.S. Banking System: The strength of the U.S. banking system is supported by a diverse landscape of banks, robust regulatory frameworks, and stringent risk management practices. Financial innovation and technology also contribute to the system’s resilience.

- Stability of the U.S. Banking System: Efforts such as post-2008 financial crisis reforms, stress testing, and regulatory oversight have enhanced the stability of the U.S. banking system. However, it continues to face challenges such as economic uncertainties, cybersecurity risks, and changing consumer behavior.

Importance of a Strong and Stable Banking System

A strong and stable banking system is of paramount importance for the U.S. economy and consumers. The banking system serves as the backbone of the economy, facilitating financial transactions, supporting businesses, and providing essential services to individuals. A robust banking system fosters economic growth, promotes investment, and ensures the efficient allocation of resources.

For consumers, a stable banking system instills confidence in the safety of their deposits and financial transactions. It offers access to credit, savings, and investment opportunities, enabling individuals to achieve their financial goals and build a secure future. A stable banking system underpins overall financial stability, creating a conducive environment for prosperity and progress.

Encouragement to Stay Informed and Seek Expert Advice

As the U.S. banking system continues to evolve, it is essential for individuals and businesses to stay informed about banking-related news, regulatory changes, and market developments. Staying informed allows individuals to make informed financial decisions, choose suitable banking products, and leverage new opportunities.

In complex financial matters, seeking advice from qualified financial experts is invaluable. Financial experts can provide personalized guidance, tailored to individual circumstances and goals. Consulting financial advisors can help individuals optimize their financial plans, manage risks, and make prudent investment choices.

In conclusion, a strong and stable banking system is the backbone of the U.S. economy, supporting growth, stability, and prosperity. By understanding the importance of credit ratings, the factors contributing to strength and stability, and the challenges faced by the banking system, individuals can navigate the financial landscape more effectively. Staying informed and seeking professional advice will empower readers to make sound financial decisions, ensuring a secure and promising financial future for themselves and their families.