Estimated reading time: 4 minutes

Table of contents

Introduction

The US banking industry plays a crucial role in the nation’s economy, shaping financial landscapes, aiding businesses, and serving individuals’ financial needs. To gain a comprehensive understanding of the industry’s health, trends, and future prospects, the Visbanking Banking Report Portal stands as a valuable resource. This blog post delves into the realm of US banks’ performance conditions, leveraging the insights and data provided by the Visbanking Banking Report Portal.

The Dynamics of US Banks Performance

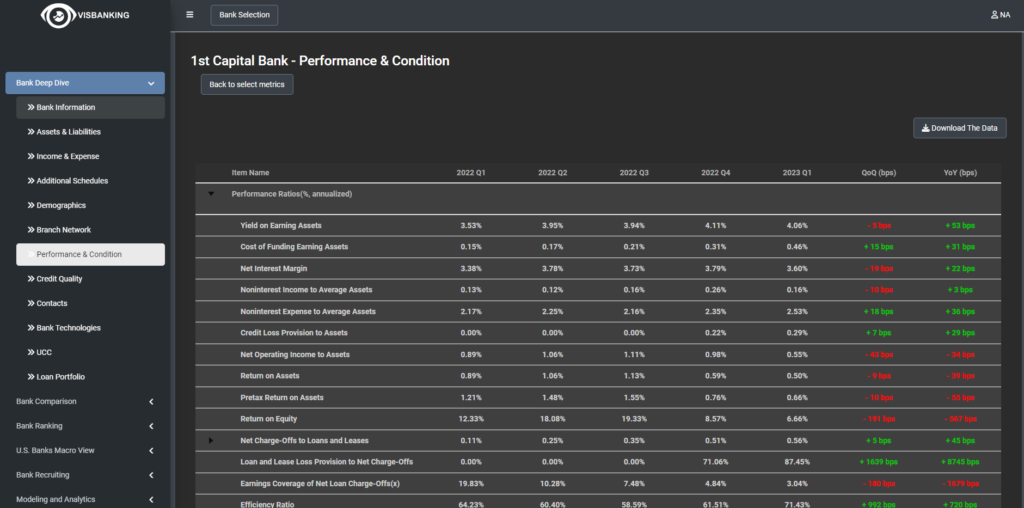

As the cornerstone of the US financial system, banks’ performance conditions are a critical indicator of economic stability and growth. Through the Visbanking Banking Report Portal, we can analyze a myriad of factors that contribute to these conditions. From asset quality and loan portfolios to capital adequacy and profitability ratios, this portal provides a comprehensive overview of how various US banks are faring.

US banks performance Key Metrics for Evaluation

The Visbanking Banking Report Portal allows us to delve into key metrics that provide a holistic view of US banks’ performance. Some of these metrics include:

- Asset Quality and Credit Risk: Exploring metrics like non-performing loan ratios and provision for loan losses gives insights into banks’ asset quality and how they manage credit risk.

- Capital Adequacy: The portal presents information about capital adequacy ratios, indicating the financial strength and stability of banks.

- Profitability Ratios: By analyzing metrics such as return on assets (ROA) and return on equity (ROE), the portal helps gauge banks’ profitability and efficiency in utilizing their resources.

- Loan Portfolios: Visbanking’s data enables us to understand the composition of banks’ loan portfolios, revealing their exposure to various sectors and their risk diversification strategies.

- Market Share and Growth: The portal provides insights into how individual banks are faring in terms of market share, customer acquisition, and geographic expansion.

You can see this data in the “US Banks Contacts” section in the Visbanking Application:

Identifying Trends and Challenges

With the data-rich environment that the Visbanking Banking Report Portal offers, it becomes easier to identify trends and challenges that the US banking industry is facing. For instance, the portal might reveal shifts in lending preferences, changes in customer behavior towards digital banking, or emerging regulatory challenges. This information can guide banks in adapting their strategies to navigate the evolving landscape effectively.

Benchmarking and Decision-Making

The Visbanking Banking Report Portal is not just a source of information; it serves as a benchmarking tool for banks to measure their performance against peers. With a clear picture of where they stand relative to others in the industry, banks can make informed decisions to enhance their operations, optimize resource allocation, and drive innovation.

The Path Forward

As the financial world continues to evolve, the significance of understanding US banks’ performance conditions cannot be understated. The Visbanking Banking Report Portal empowers stakeholders, from industry analysts to policymakers, to gain actionable insights into the dynamics of the US banking sector. By leveraging the portal’s data-driven approach, the path forward for banks involves not only navigating challenges but also harnessing opportunities for growth and resilience.

US Banks Performance Conclusion

The Visbanking Banking Report Portal is a treasure trove of insights that unveil the intricacies of US banks’ performance conditions. From asset quality to profitability, the portal offers a comprehensive toolkit to assess the industry’s health and trajectory. As the landscape of finance evolves, this resource remains invaluable for anyone seeking a deep understanding of the US banking industry’s past, present, and future. Explore the portal’s offerings today to stay ahead in the dynamic world of finance.

In this blog post, the keyword for the title is “US banks performance conditions.” The 5 to 6-word version of the meta description is “Uncover US banks performance with Visbanking.”