What Is Middle Market Banking? A Strategic Guide for Bank Executives

Brian's Banking Blog

For bank executives, "middle market" is more than a buzzword. It represents the powerhouse of the U.S. economy—a distinct ecosystem of dynamic, complex companies with annual revenues typically between $10 million and $1 billion. This segment is a substantial, often underexploited, growth engine for financial institutions that can master its unique demands.

This is not a larger version of small business banking nor a scaled-down version of corporate banking. It requires a dedicated strategy, a specialized team, and a data-driven approach to capture its full potential.

The Overlooked Growth Engine in Your Portfolio

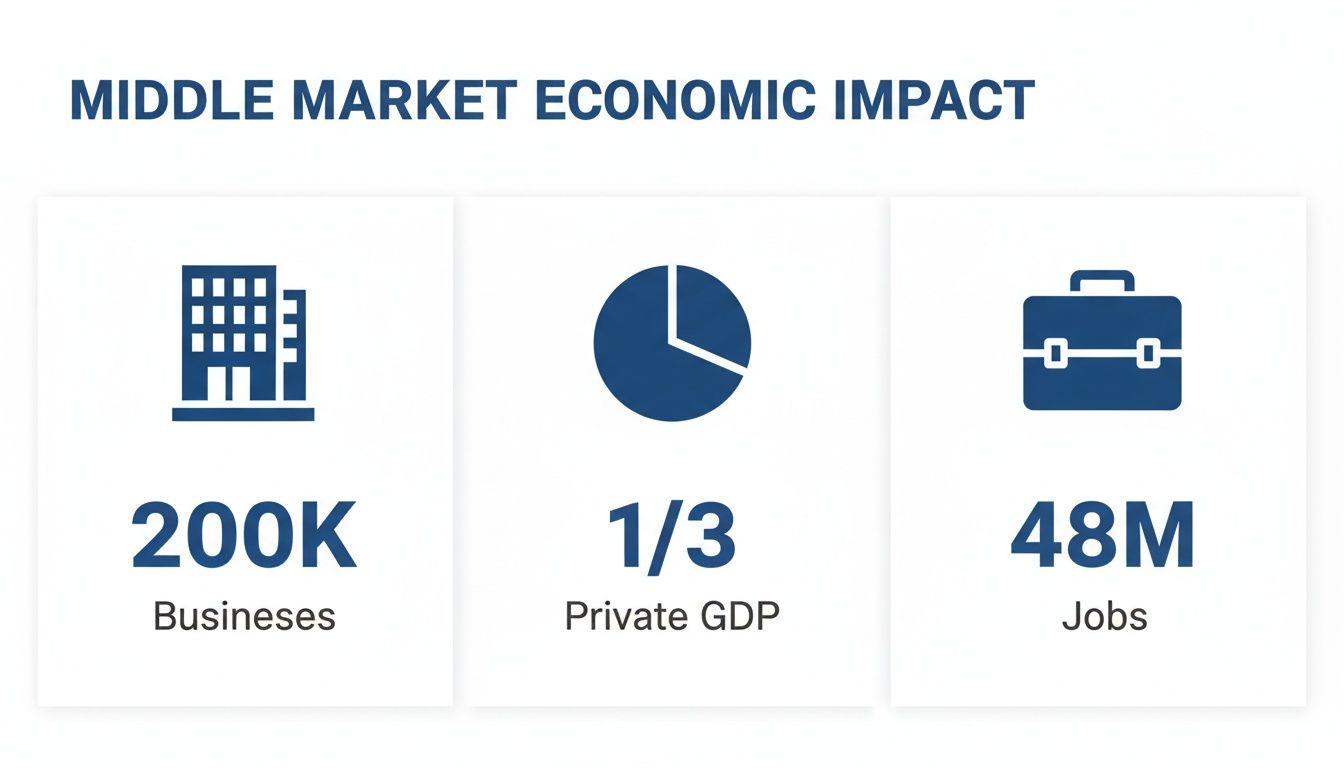

The middle market is the backbone of the American economy, demonstrating consistent resilience and growth that often outpaces other sectors. The data confirms its significance. The National Center for the Middle Market reports nearly 200,000 such businesses in the U.S., collectively accounting for one-third of private sector GDP and employing approximately 48 million people. Critically, their year-over-year revenue growth has averaged an impressive 12.4%.

The Scale of the Opportunity

This segment is not a niche; it is a fundamental component of the economic landscape.

This potent combination of scale and dynamism makes the middle market a prime target for banks seeking to build high-value, long-term relationships.

Why Data Must Drive Your Strategy

Winning in this space requires moving beyond intuition to data-backed decisions. Modern intelligence platforms are no longer a luxury; they are essential for competitive execution.

Your leadership team must have precise answers to critical questions:

- Which specific middle market industries are expanding within our geographic footprint?

- Which high-potential companies are underserved by their current financial partners?

- How does our performance in key metrics compare to the competitors currently winning this market share?

The challenge is not merely identifying the middle market; it is dissecting it with surgical precision. Success is determined by the ability to pinpoint the right clients, anticipate their complex needs, and deliver a value proposition that is both compelling and difficult to replicate.

A data-first mindset provides the foundation for a winning strategy. By leveraging granular market data, banks can replace broad assumptions with targeted, decisive actions. Effective bank customer segmentation is the critical first step. With a platform like Visbanking, you can zero in on these opportunities, benchmark your position, and equip your teams with the intelligence required to win.

Understanding the Middle Market Client Profile

A common and costly mistake is to view middle market clients as scaled-up small businesses. These companies operate in a different league, facing unique growth pains and financial complexities that demand a strategic partnership, not a transactional relationship.

They are not a monolith. One day you are advising a third-generation manufacturing firm on succession planning; the next, you are structuring acquisition financing for a private equity-backed technology company. Each possesses a distinct risk appetite and strategic vision.

Beyond the Balance Sheet: A Cascade of Needs

For a middle market company, every major decision triggers a chain reaction of financial requirements. A single strategic move, such as expanding into a new international market, creates a cascade of interconnected challenges that a standard, siloed banking approach will fail to address.

Consider a $75 million manufacturing client diversifying its supply chain by sourcing components from Southeast Asia. This decision generates a web of immediate needs:

- Growth Capital: They require more than a simple inventory loan. A flexible line of credit is essential to manage the setup costs and cash flow gaps associated with establishing new supplier relationships.

- International Trade Finance: To mitigate risk with new overseas partners, they will need letters of credit to secure transactions and foreign exchange services to manage currency fluctuations.

- Treasury Management: The CFO is now managing multiple currencies and international payments. Sophisticated cash management tools are required to provide visibility and control over global liquidity.

- M&A Advisory: If the company considers acquiring a local distributor to solidify its presence, it will need a banking partner capable of providing sound advice on deal structure and valuation.

This is the essence of middle market banking: seeing the entire board. Today's request for a line of credit is directly linked to tomorrow's treasury management needs and next year's potential M&A transaction.

Data intelligence provides a significant competitive advantage here. A platform like Visbanking enables your team to identify signals—such as a surge in UCC filings or new SBA loan activity—that indicate a company is preparing for growth. This allows you to anticipate complex, multi-product needs before the client even makes a request.

Instead of reacting to a loan application, you can proactively present a comprehensive solution. This data-informed strategy is the core of effective commercial banking relationship management. It elevates your institution from a mere lender to an indispensable strategic partner.

Structuring Your Bank for Middle Market Dominance

Attempting to serve the middle market by reassigning retail lenders or asking corporate banking teams to "think smaller" is a flawed strategy. Success demands a purpose-built team and a structure designed to handle the complexity and relationship-driven nature of these clients.

The cornerstone of a high-performing middle market team is the senior relationship manager (RM). This individual is not just a lender; they are a strategic advisor and the client's single point of contact, orchestrating specialists from treasury, capital markets, and wealth management as needed.

Assembling the Elite Team

A winning middle market unit is lean, experienced, and empowered. The most effective model is a cohesive "pod" structure.

- Senior Relationship Manager: The quarterback who owns the client relationship and directs strategy.

- Credit Analyst/Underwriter: A dedicated partner who understands the story behind the financials, assessing enterprise value and growth trajectory beyond simple credit scores.

- Treasury Management Officer: The specialist who designs sophisticated cash management solutions that create sticky, non-credit relationships and generate fee income.

- Support Staff: An associate who manages daily operational tasks, freeing the RM to focus on high-value strategy and business development.

This pod structure streamlines the credit process from a bureaucratic bottleneck into a swift, collaborative effort tailored to the nuanced financials of a growing business. Mastering this workflow is a significant driver of bank operational efficiency.

A flawed structure treats a $50 million credit request from a fast-growing logistics firm the same as a $500,000 small business loan. A winning structure deploys a dedicated team that can analyze complex cash flow projections, model acquisition scenarios, and price the entire relationship—not just the debt.

Using Data to Build Your A-Team

Recruiting and retaining top-tier RMs is the most critical component of a successful middle market strategy. These bankers control large, profitable portfolios.

Data intelligence is your secret weapon in the war for talent. By analyzing FDIC call reports and peer data across 4,600+ institutions, you can identify high-performers before your competitors. For RMs, this means pinpointing companies that require the specific services middle market banks excel at—larger credit lines, asset-based loans, and treasury management for firms with 100+ employees and $10M–$500M in revenue. You can find more on that in this detailed guide to middle market banking.

With tools like Visbanking’s Prospect and Talent modules, you can map the most valuable client relationships in any market and identify the bankers managing them. This transforms team-building from a reactive HR function into a strategic offensive, allowing you to benchmark your own team, recruit proven talent, and structure your bank to dominate the market.

Core Products and Relationship-Based Pricing

Success with middle market clients requires moving beyond off-the-shelf products. The objective is not to sell a loan; it is to become the complete financial backbone for a growing enterprise.

Your product suite must be deep enough to handle the diverse needs of a dynamic company, extending far beyond a standard commercial line of credit.

- Asset-Based Lending (ABL): Unlocks working capital tied up in accounts receivable and inventory, providing flexible financing that scales with business performance.

- Equipment Financing: Enables capital-intensive growth without depleting cash reserves.

- Treasury and Cash Management: This is the anchor of the relationship. Sophisticated solutions for cash flow control, fraud protection, and payment automation are non-negotiable.

- International Trade Finance: Essential for any company with a global supply chain, including letters of credit and foreign exchange services.

- Capital Markets Access: Provides clients with tools like interest rate swaps and other derivatives to manage exposure to market volatility.

The Discipline of Relationship Pricing

The fundamental shift in middle market banking is from transactional, rate-sheet pricing to a holistic, relationship-based model. Pricing a middle market loan is a strategic calculation based on the total economic value of the client partnership.

A 5.00% interest rate on a loan may appear weak in isolation. But if the same client maintains $2.5 million in non-interest-bearing deposits and generates $60,000 in annual treasury fees, the total relationship profitability is compelling. Understanding the full picture is the key to a successful middle market strategy.

This requires your relationship managers and credit officers to analyze the full profitability of the client relationship, not just the spread on a single loan.

A Practical Pricing Example

A $50 million distribution company requires a $10 million line of credit. A bank with a transactional mindset might offer Prime + 1.00%.

A true middle market bank conducts a deeper analysis:

- Credit Analysis: The bank assesses the risk and initially proposes a rate of Prime + 1.25%.

- Deposit Relationship: Analysis reveals the distributor holds $3 million in operating accounts at a competitor. Securing these non-interest-bearing deposits significantly increases the relationship's value.

- Treasury Fees: The bank identifies inefficiencies in the company's payment processes and proposes a treasury solution that will generate $75,000 in annual fee income while improving the client's operations.

With the new deposits and fee income factored in, the bank can re-price the loan to a more competitive Prime + 0.75%. The client receives superior pricing on their debt, and the bank secures a stickier, more profitable, multi-product relationship.

Data intelligence platforms are critical to this process. Using a platform like Visbanking, your team can benchmark competitor pricing and accurately model the profitability of these complex deals. This moves decision-making from estimation to data-backed precision, ensuring every deal is both competitive and accretive to the bank.

Winning the Market with a Data-Driven Strategy

Relying on intuition and an established Rolodex is no longer sufficient in the competitive middle market landscape. The paradigm has shifted from reactive relationship management to proactive market domination. Success is determined not by who you know, but by what you know—and knowing it before your competitors.

Modern intelligence platforms transform abstract strategic goals into a concrete plan of attack. They enable bank leaders to move from gut feelings to precise, actionable data to answer their most pressing questions. This is a fundamental change from tending an existing portfolio to actively conquering new territory.

From Data to Decisive Action

Granular data enables surgical precision. For banks targeting high-value middle market clients, targeted Account-Based Marketing (ABM) strategies, powered by a multi-dimensional market view, are transformative.

This translates into practical applications:

- Bank Performance Analysis: Benchmark your loan growth, deposit share, and fee income against specific competitors in any MSA. This identifies where rivals are gaining share and, more importantly, reveals weaknesses in their portfolios that you can exploit.

- Targeted Prospecting: Move beyond generic call lists. By analyzing UCC filings, SBA loan data, and corporate registrations, you can build a pipeline of companies actively seeking capital or clearly outgrowing their current bank.

- Predictive Risk Signals: Avoid being blindsided by credit deterioration. Data intelligence provides early warning signs, such as declining cash flow indicators or new liens on portfolio clients, enabling proactive intervention rather than crisis management.

A data-driven strategy is not about dashboards; it is about superior decision-making. The objective is to arm your relationship managers with such a powerful informational advantage that they enter every meeting already understanding the prospect’s financial position, growth trajectory, and primary banking challenges.

Use Case: Expanding a Manufacturing Portfolio

A regional bank wants to increase its market share in the manufacturing sector. The traditional approach involves purchasing a list and initiating cold calls.

A data-driven approach is fundamentally different.

Using a platform like Visbanking, the team executes a targeted strategy:

- Identify High-Growth Sub-Sectors: They analyze market data to pinpoint niche manufacturing areas—such as medical device components or aerospace parts—that are outperforming the broader sector.

- Pinpoint Target Companies: Within these sub-sectors, they use Prospect to identify companies with revenues between $20 million and $100 million that have recently filed for new equipment liens or secured an SBA 7(a) loan—clear indicators of expansion.

- Understand Existing Relationships: The platform reveals which competitors hold these relationships and, critically, identifies any signs of service gaps or market share erosion for those incumbents.

This segment’s stability consistently attracts commercial lenders. Globally, these lenders became the top source of capital in 2024, offering more attractive debt than private equity. You can read the full report on Key.com for further detail on these capital trends.

Armed with this intelligence, the bank’s RM arrives with a data-backed solution that converts market insight directly into new revenue. To see how your institution stacks up, explore our peer benchmarking data today.

Key Questions for Bank Executives

Executing a successful middle market strategy requires addressing critical questions at the board level. Below are direct answers to the issues that determine success or failure in this segment.

How Much Capital Should We Allocate to Middle Market Operations?

The allocation decision must be based on data, not historical precedent. The determining factor is the opportunity cost within your specific market. You must benchmark your Return on Assets (ROA) against direct competitors in your primary footprint.

For example, your commercial loan portfolio may be generating an ROA of 1.10%. If a data intelligence platform reveals that a local peer specializing in middle market lending is achieving 1.35% in the same territory, that 25-basis-point gap represents a significant opportunity. This intelligence provides the justification to reallocate capital and top talent to pursue higher-margin business. The Bank Performance module from Visbanking enables this direct, apples-to-apples comparison, transforming a budget estimate into a calculated, strategic investment.

Can We Compete Without a Full-Scale Capital Markets Division?

Yes, and for most community and regional banks, it is the most prudent strategy. The key is to focus on dominating the core relationship products: commercial lending, asset-based lending, and treasury management. These services generate sticky, low-cost deposits and substantial fee income.

The objective is not to replicate a money-center bank. It is to become so proficient at delivering the essential financial infrastructure that a middle market company cannot operate without you. Indispensability in cash management and credit is infinitely more valuable than being a marginal player in derivatives.

A laser-focused strategy, executed with superior service and deep local market knowledge, will consistently outperform larger, slower-moving competitors.

How Do We Justify the Investment in Advanced Data and Technology?

The justification is rooted in both offensive and defensive strategy. Without modern data intelligence, your bank is operating blind—unaware of which top clients are being targeted by competitors and unable to identify high-potential prospects before they appear on generic call lists.

Consider the financial impact of losing a single $25 million client relationship to a competitor with superior data. The annual loss in interest income, treasury fees, and deposits could easily exceed $500,000. The ROI on a platform that provides early warnings on at-risk clients and flags new opportunities becomes self-evident. Tools like the Prospect and Bank Intelligence modules from a platform like Visbanking are not an expense; they are an essential investment in protecting your balance sheet and driving profitable growth. They provide your team with a clear roadmap for winning the market, one targeted relationship at a time.

Your bank's success in the middle market hinges on turning market insights into decisive action. Visbanking is the intelligence platform built to help you make faster, data-driven decisions. You can benchmark your performance, find qualified prospects, and see market shifts before they happen. See how our data can give you the competitive edge you need at https://www.visbanking.com.

Similar Articles

Visbanking Blog

Fastest Growing Banks: Who's Winning the Asset Race?

Visbanking Blog

Why Bank Financial Data Matters: Insights and Applications for Individuals and Businesses.

Visbanking Blog

Small Business Banking: Finding the Right Financial Partner

Visbanking Blog

Banking Data Analytics: Turning Information Into Profit

Visbanking Blog

<strong>The Ultimate Guide to Bank Loans: How to Find the Best Deal and Avoid Getting Burned</strong>

Visbanking Blog

Unlocking Growth: A Comprehensive Guide to US Banks Contacts

Visbanking Blog

Why Small Community Banks Are Outperforming Mega Banks

Visbanking Blog

The world is getting smaller every day.<br>Here’s how you can use that to your advantage in banking/finance. 👇

Visbanking Blog

Capital Banking in the USA: An Overview of Investment Services, Financial Instruments, and Regulations

Visbanking Blog