Mastering Commercial Banking Relationship Management: A Data-Driven Executive Guide

Brian's Banking Blog

In commercial banking, the engine of profitability is not technology alone—it is the relationship manager (RM) armed with superior data intelligence. The most competitive institutions are transforming their RMs from service providers into strategic advisors, turning commercial banking relationship management into a decisive competitive advantage. This guide provides a direct framework for executives to implement this transformation and drive measurable growth.

The Relationship Manager Is Your Core Profit Center

For decades, the RM's primary function was to build trust and ensure smooth transaction processing. This model is now obsolete. The contemporary RM must operate as a strategic advisor, deeply integrated into the client’s business and equipped with market intelligence to anticipate future needs. This is not a minor adjustment to a job description; it is a fundamental shift that repositions the RM from a cost center to the bank’s primary profit driver. Every client interaction becomes a strategic opportunity to identify new revenue streams and secure long-term loyalty.

The Shift from Service to Strategic Advisory

The transition from a reactive "what can I do for you today?" model to a proactive, advisory role is the defining characteristic of market-leading commercial banks. It is the difference between waiting for a client to request a loan and identifying their need for capital before they do.

Consider this practical example: a traditional RM processes a client's request for an increased line of credit. A modern, data-driven RM, utilizing an intelligence platform like Visbanking's, observes that the client's inventory turnover has slowed by 15% relative to industry peers. Armed with this insight, the RM initiates a strategic discussion about supply chain financing or operational efficiency improvements long before the client faces a cash flow crisis. This proactive approach to challenges like managing cash flow in small business becomes a core value proposition.

This evolution is best understood through a direct comparison.

The Modern Relationship Manager's Evolving Role

| Attribute | Traditional RM (Past) | Data-Driven RM (Present & Future) |

|---|---|---|

| Primary Focus | Maintaining relationships, processing transactions. | Driving client growth, deepening wallet share. |

| Approach | Reactive (responds to client requests). | Proactive (anticipates client needs). |

| Key Tools | CRM, phone calls, in-person meetings. | BI platforms, market data, predictive analytics. |

| Value Proposition | Service and reliability. | Strategic advice and forward-looking insights. |

| Client Conversation | "How can I help you today?" | "Our market data indicates an opportunity we should discuss." |

This table illustrates the critical shift from a relationship maintainer to an indispensable strategic partner.

This evolution is not a choice; it is a market necessity. The bank that equips its RMs with predictive, data-backed advice will not only retain its best clients but will systematically acquire them from competitors operating on outdated models.

Commercial clients are demanding this level of engagement. Industry analysis confirms that 71% of business clients cite their relationship manager as the primary factor in their choice of banking partner. The human connection, supercharged by intelligent data, is the definitive differentiator. The mandate for bank executives is clear: equip your teams with the data intelligence required to win. In doing so, you transform RMs from client contacts into strategic assets who drive tangible growth for both the client and the bank.

Using Data Intelligence to Bridge the Expectation Gap

A critical vulnerability for most banks is the significant gap between what commercial clients expect and what their bank delivers. Clients often value their RMs but feel their businesses are fundamentally misunderstood. This perception erodes loyalty and creates opportunities for competitors. The solution is to arm RMs with data intelligence that closes this gap, elevating them from service representatives to indispensable advisors.

The data reveals a stark reality. While 81% of commercial clients view their RM as their primary contact, only 37% believe that manager truly understands their business challenges. This is not a personnel failure; it is a failure of tooling. The average RM manages a portfolio of approximately 100 relationships, but lacks the intelligence to cultivate the majority into deep, strategic partnerships. Deloitte’s analysis of supercharged client services confirms this disconnect. The directive for bank leadership is to provide RMs with the intelligence needed to convert transactional accounts into high-value advisory relationships.

Transforming Conversations with Actionable Data

Without robust data, client conversations are reactive and superficial. An RM might inquire about future capital needs, placing the analytical burden on the client. Data intelligence reverses this dynamic, enabling the RM to lead with insight.

Consider an RM preparing for a quarterly review with a regional manufacturing client. Instead of relying on the client's self-reporting, the RM uses a platform like Visbanking’s BIAS to benchmark the client against anonymized peer data. The platform reveals a critical inefficiency: the client holds 25% more cash than comparable firms in a low-yield deposit account, representing significant opportunity cost.

Armed with this specific data point, the RM transforms a routine check-in into a strategic consultation. The conversation shifts from "How is business?" to "I have identified an opportunity to improve your working capital efficiency, potentially increasing your annual return by $1.2 million. Let's review the structure."

This is the power of applied data. It elevates the RM from a reactive order-taker to a proactive advisor who demonstrates a superior understanding of the client’s business.

From Reactive Service to Proactive Partnership

This proactive advisory model is the foundation of modern commercial banking relationship management. It is about anticipating needs, identifying hidden risks, and uncovering opportunities before the client does. This capability is entirely dependent on integrated, real-time data intelligence.

Consider the following data-driven scenarios:

- Attrition Risk Identification: An intelligence platform flags a client’s declining deposit balances over six months and correlates it with a new UCC lien filed by a competitor. This provides an early warning, allowing the RM to intervene before the relationship is lost.

- Targeted Cross-Sell Opportunities: By analyzing a client’s payment cycles against industry benchmarks, an RM can move from speculative cross-selling to prescriptive solutions. The RM can present a specific treasury management service that solves a documented operational inefficiency.

- Data-Backed Credit Proposals: When a loan request is supported by data benchmarking the client’s projections against actual peer performance, the credit proposal becomes exponentially stronger. It transitions from a narrative to a data-validated case, enabling the credit committee to approve with greater speed and confidence.

In each instance, data transforms a transactional relationship into an advisory one. It provides your team with the capacity to deliver the targeted, strategic guidance that commercial clients require but rarely receive. The first step is to benchmark your current capabilities against the market to identify where data intelligence can deliver an immediate strategic advantage.

How to Measure Relationship Management Performance

To accurately gauge the effectiveness of your commercial banking relationship management strategy, you must abandon legacy metrics. Measuring call volume or meetings held is anachronistic. A modern, high-performance commercial bank measures what directly drives profitability: relationship depth, client value, and portfolio health. Adopting the right Key Performance Indicators (KPIs) provides leadership with an objective, real-time view of performance. These KPIs are not reporting metrics; they are strategic tools that dictate where to allocate resources and where to intervene.

Moving Past Activity and Into Profitability

Legacy metrics track activity; modern KPIs measure impact. The framework must draw a direct line from RM actions to the bank's bottom line, quantifying the quality and profitability of each client relationship. The objective is to ensure that effort translates directly into financial return.

The KPIs That Matter

Executive dashboards must focus on a core set of metrics that provide a holistic view of the commercial portfolio.

- Client Profitability Score (CPS): This is the ultimate measure of a relationship's financial contribution. It calculates net income by aggregating all revenue streams (interest, fees) and subtracting the total cost to serve (including cost of funds, operational expenses, and risk-adjusted capital). A high CPS signifies a healthy, profitable partnership.

- Product Penetration Ratio: This metric tracks the number of products or services utilized by each commercial client. A low ratio, such as 1.2 products per client, indicates a shallow, transactional relationship vulnerable to competitive poaching. A rising ratio demonstrates successful cross-selling and deeper integration into the client’s operations.

- Client Lifetime Value (CLV): This forward-looking metric forecasts the total net profit expected from a client over the entire duration of the relationship. CLV informs strategic decisions regarding client acquisition costs and retention investments.

- Net Promoter Score (NPS) for Commercial Clients: While often used in retail banking, a well-executed NPS program provides invaluable qualitative feedback on loyalty and service gaps within the commercial segment. It captures insights unattainable through purely quantitative measures.

The Data Engine That Makes It Possible

Tracking these advanced KPIs is impossible without a sophisticated data intelligence infrastructure. A platform like Visbanking’s BIAS is the engine that transforms these concepts from strategic theory into daily operational tools. It integrates disparate data sources—from the core banking system to UCC filings and market data—to calculate and visualize these metrics in real time.

Consider this real-world application:

An executive dashboard flags a portfolio of mid-market manufacturing clients with a Product Penetration Ratio of 1.5, significantly below the bank's target of 2.5. Simultaneously, the platform's peer data reveals that competitors are successfully deploying treasury management and trade finance solutions to this precise client segment.

This is not merely a data point; it is a strategic directive. Leadership can now deploy a targeted training initiative for the RMs managing this portfolio, equipping them with the product knowledge to deepen these relationships. Six months later, the dashboard confirms the ratio has increased to 2.2, generating an additional $750,000 in annualized fee income. This is the tangible result of data-driven performance management.

Essential KPIs for Commercial Relationship Management

| Metric | What It Measures | Why It Matters for Executives |

|---|---|---|

| Client Profitability Score (CPS) | Net income from a client, accounting for all revenue and costs. | Pinpoints which clients drive profit versus those draining resources. |

| Product Penetration Ratio | The average number of products used per commercial client. | A direct indicator of relationship "stickiness" and competitive vulnerability. |

| Client Lifetime Value (CLV) | The total projected net profit from a client over the entire relationship. | Guides strategic decisions on client acquisition and retention investment. |

| Net Promoter Score (NPS) | A client's willingness to recommend the bank to peers. | Provides qualitative insight into loyalty and uncovers service gaps before they cause churn. |

Ultimately, what gets measured gets managed. By adopting KPIs that reflect true relationship value and providing your team with the intelligence to act on them, you build a culture of accountability and high performance. The competitive landscape has changed; it is time to change the way you keep score.

The Technology Stack That Empowers Your Team

Effective commercial banking relationship management is no longer driven by intuition alone. Top-performing banks are powered by a sophisticated technology stack that transforms RMs into strategic, revenue-generating advisors. A standalone CRM is table stakes; the competitive advantage lies in an integrated ecosystem of tools. This modern stack functions as a proactive opportunity-identification engine. The CRM remains the core, but its power is amplified when connected to a business intelligence platform, real-time data feeds, and predictive analytics. This integration transforms a passive record-keeping system into a source of forward-looking, actionable intelligence.

The market is signaling a clear demand for this shift. The Greenwich Optimism Index recently surged from –4 to +40 in a single quarter—the largest increase in its history. This business confidence translates into demand for capital and smarter, tech-enabled banking services. As detailed in analyses of the future of commercial banking, institutions that invest in the right technology are strengthening, not replacing, the critical RM-client relationship.

The Core Components of a Winning Tech Stack

An effective technology stack is not a collection of software; it is an integrated system designed for performance. For bank executives, architecting this stack correctly is critical for capital allocation and achieving strategic goals.

Centralized CRM System: The foundation. This must be the single source of truth for all client interaction data, contact information, and relationship history. Data integrity within the CRM is non-negotiable.

Business Intelligence (BI) Platform: The brain of the operation. A platform like Visbanking’s BIAS integrates vast external datasets—such as FDIC call reports, UCC filings, and macroeconomic data—with your internal CRM data. This fusion provides the market context necessary to benchmark client performance accurately.

API-Driven Integrations: The connective tissue. Application Programming Interfaces (APIs) enable seamless, real-time data exchange between your core, CRM, BI platform, and other systems. This is essential for automating workflows and ensuring data fluidity.

Predictive Analytics and AI Engines: The forward-looking capability. AI models analyze the integrated data to identify patterns, predict client needs, and flag risks and opportunities far earlier than human analysis ever could.

From Data Entry to Actionable Intelligence

When these components operate in concert, they create an automated workflow that provides RMs with a significant competitive advantage.

Consider this operational scenario:

An RM concludes a call with a manufacturing client and logs a note in the CRM regarding the client's concern over rising inventory costs. This entry triggers an automated workflow. An API relays this information to the bank’s BI platform, which immediately pulls fresh market data on that industry, including competitor activity in supply chain finance. A predictive AI model analyzes the combined data and identifies a high-probability opportunity. An alert is generated on the RM's dashboard: "Client X's inventory turnover is 15% slower than the industry average. Competitor Bank Y recently filed three UCC liens for supply chain financing with similar local firms. Opportunity: Propose a targeted trade finance solution."

This entire process occurs automatically in the background. It transforms a reactive CRM entry into a proactive, data-validated sales engagement. The RM can now re-engage the client not with a generic follow-up, but with a specific solution to a documented problem, supported by hard market intelligence. A modern tech stack automates low-value research and delivers high-value, actionable insights. Investing in an integrated system empowers your RMs to operate at a higher strategic level, securing deeper client relationships and outmaneuvering the competition.

Implementing a Data-First Strategy That Works

Transitioning to a data-first model in commercial banking relationship management requires more than new software; it necessitates a cultural and operational transformation. It means reorienting the entire commercial division to act on empirical insights rather than intuition. For bank executives, this requires a deliberate, phased implementation designed to build momentum, demonstrate immediate value, and ensure long-term adoption. This is not simply a technology project; it is a strategic initiative demanding a clear roadmap, new skill sets, and unwavering executive commitment.

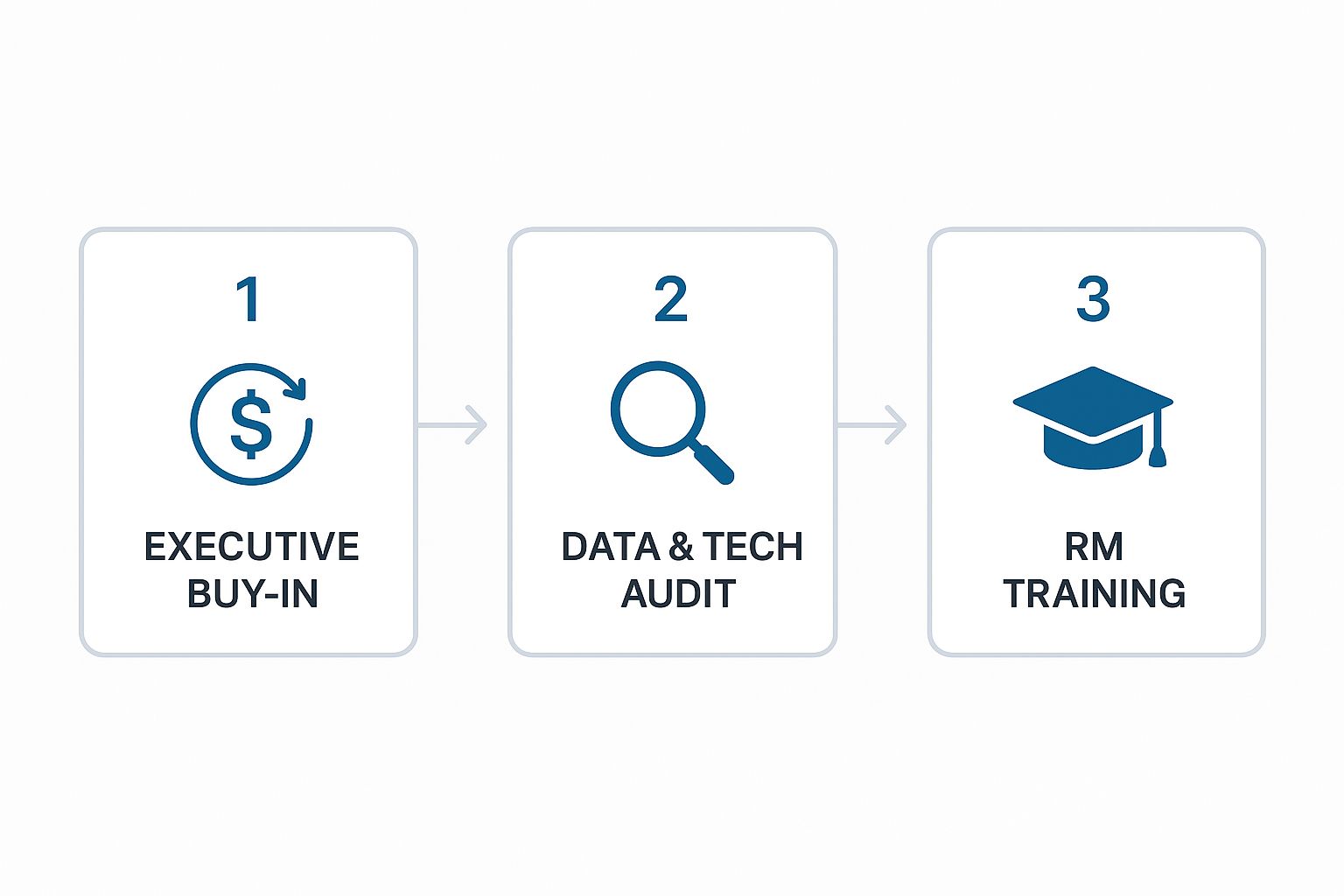

Secure Executive Buy-In with a Clear Business Case

The first step is to secure unequivocal support from the C-suite and the board. This is achieved not with technical specifications, but with a business case built on tangible ROI. Frame the investment in data intelligence as a direct driver of revenue growth, operational efficiency, and competitive advantage.

Use clear financial projections. For example, forecast a 5% increase in client retention by leveraging analytics to identify at-risk accounts. For a $5 billion bank, this could translate to preserving $10 million in annual revenue. Demonstrate how a 15% improvement in product penetration, driven by providing RMs with peer data, directly increases fee income. These are the metrics that secure budget allocation.

Conduct a Rigorous Data and Technology Audit

With executive backing, perform an objective assessment of your current data infrastructure. A data-driven strategy cannot be built on a foundation of poor-quality or siloed data. This audit must evaluate data quality, accessibility, and integration capabilities.

Address these critical questions:

- Data Silos: Where is our most valuable client and market data located? Do our core, CRM, and loan origination systems communicate effectively?

- Data Integrity: What is the verifiable quality of our data? Inaccurate data will undermine the most sophisticated analytical tools.

- Technology Gaps: What critical capabilities are we missing? Do we have a robust business intelligence platform, like Visbanking, capable of integrating external market data with our internal records?

This sequence is crucial: secure buy-in, audit the current state, and then empower your team.

Technology is an expense without skilled operators and strong leadership to guide its use.

Invest in Relationship Manager Training and Adoption

The most common failure point in these initiatives is underinvesting in human capital. Deploying a powerful data platform without training the team to use it is a recipe for failure. The objective is to cultivate a data-literate culture where RMs instinctively leverage analytics to prepare for client meetings, identify opportunities, and construct superior credit proposals. Training must be practical, role-specific, and focused on translating data points into compelling client conversations. Furthermore, any data strategy must adhere to rigorous data privacy best practices to maintain client trust.

To prove the concept and cultivate internal champions, execute a pilot program. Select a focused group of five to seven high-potential RMs, perhaps from a key industry vertical, and provide them with intensive training and dedicated support.

Their successes become powerful internal case studies. When an RM closes a significant deal because a BI platform identified a competitor's vulnerability, that success story will do more to drive adoption than any top-down mandate. Track their performance on KPIs like Client Profitability Score and new business generation against a control group. The results will validate the strategy and provide a blueprint for a bank-wide rollout. A data-first strategy is successful when it ceases to be a "project" and becomes the standard operating procedure.

Achieving Market Leadership Through Superior Relationships

In the intensely competitive commercial banking sector, the most durable competitive advantage is not technology itself, but the superior client relationships that technology empowers. Market leadership is achieved at the intersection of insightful people and intelligent data, creating a strategic moat that is difficult for competitors to replicate. This fusion is the new baseline for growth and profitability.

As an executive, your role is to champion this integrated vision. This requires viewing technology not as a cost-saving tool, but as a strategic asset that enhances the cognitive capabilities of your team. The primary objective is to equip your relationship managers with data intelligence that enables them to anticipate client needs with precision.

From Vision to Actionable Strategy

Executing this vision requires a data-first mindset, beginning with an honest assessment of your current position. Without a clear baseline, any new initiative is based on conjecture. The non-negotiable first step is a comprehensive audit of your existing relationship management capabilities. This analysis must extend beyond sales skills to evaluate the entire supporting ecosystem. How effective is your technology at identifying actionable opportunities? Do your KPIs accurately measure relationship profitability?

For example, if your portfolio-wide Product Penetration Ratio is 1.4, while top-quartile institutions achieve 2.5, that gap represents millions in unrealized revenue and a significant competitive vulnerability.

The path to market leadership is paved with data. It demands an objective self-assessment, benchmarking your performance against market leaders, identifying weaknesses, and systematically closing those gaps through targeted investments in personnel and technology.

This candid evaluation is the opening move in a strategy designed to win. We challenge you to benchmark your current performance against the broader market—a core function of the intelligence platform we built at Visbanking. Knowing your precise market position is the foundational step toward achieving market leadership.

Burning Questions Answered

How Do We Measure the ROI of New RM Technology?

ROI is measured by tracking key performance indicators before and after implementation. Focus on metrics that directly impact the bottom line: Client Profitability Score (CPS), Product Penetration Ratio, and Client Lifetime Value (CLV). For a $500,000 investment in a data intelligence platform, if within one year you achieve a 10% increase in CPS across the pilot group and reduce client churn by 15%—preserving $750,000 in revenue—you have a clear, quantifiable positive ROI. The objective is to link technology expenditure directly to gains in profitability and client retention.

What Is the Single Biggest Mistake Banks Make When Trying to Improve Relationship Management?

The most significant error is deploying new technology without addressing the underlying culture. Providing RMs with a powerful data platform without adjusting training, incentives, and performance management expectations renders the investment ineffective. RMs must be trained to transition from relationship builders to strategic advisors who use data to inform every client interaction. Leadership must align compensation and performance reviews with data-driven outcomes like relationship profitability, not with outdated activity metrics.

How Is a Data Intelligence Platform Different from a Standard CRM?

The distinction is fundamental. A CRM is a system of record—a passive database for storing client interaction data entered by your team. A data intelligence platform, like Visbanking’s BIAS, is a system of insight. It does not merely store internal data; it actively integrates and analyzes vast external market data, including regulatory filings, competitor actions, and economic trends. It provides the essential market context that a CRM cannot. A CRM tells you that you contacted a client last week. An intelligence platform tells you that the same client’s deposit balances are declining while three local competitors have filed new UCC liens against similar businesses. One is a historical record; the other is a strategic alert demanding immediate action.

Market leadership in commercial banking relationship management is built on a foundation of superior intelligence. It begins with benchmarking your performance to identify where a data-driven approach will deliver an immediate competitive advantage.

Ready to see how you measure up? Let's explore how Visbanking delivers the critical insights to turn your relationship managers into your most valuable profit centers.

Similar Articles

Visbanking Blog

BIAS: The All-in-One Solution for Banking Intelligence and Action

Visbanking Blog

BIAS: Your Competitive Edge in Banking Data Driven Strategy

Visbanking Blog

Banking Data Analytics: Turning Information Into Profit

Visbanking Blog

BIAS: The Smart Choice for Banking Intelligence and Action

Visbanking Blog

BIAS: The Smart Choice for Banking Intelligence and Action

Visbanking Blog

Make More Informed Decisions with BIAS, the Data-Driven Banking Solution

Visbanking Blog

AI Banking Revolution: How Machine Learning Transforms Finance

Visbanking Blog

BIAS: The Future of Banking Intelligence and Action System

Visbanking Blog

Why does bank data matter more than you think?

Visbanking Blog