A Guide to Bank Operational Efficiency for Executive Leadership

Brian's Banking Blog

For bank executives, the drive for bank operational efficiency is not a matter of trimming budgets; it is a fundamental component of strategy, resilience, and competitive advantage. In a market defined by compressed margins and relentless competition, true efficiency is achieved not through reactive cost-cutting, but through a proactive, data-driven framework that builds a high-performing institution. This guide outlines the metrics, benchmarks, and strategic actions necessary to transform operational data into decisive leadership.

The New Mandate for Bank Operational Efficiency

The pressure on banking leadership to optimize every facet of the organization has intensified into a board-level imperative. The core challenge has shifted from reviewing surface-level metrics to constructing a comprehensive, contextualized view of performance, technology, and costs—specifically, how these elements measure up against direct competitors.

A Widening Performance Gap

Recent market volatility has amplified operational pressures. For example, 15 out of 26 large European banks are projected to see costs grow faster than revenue in 2024, a sharp increase from just three banks in 2023. In response, major institutions like Deutsche Bank and Standard Chartered are implementing multi-billion dollar efficiency programs focused on platform consolidation and workforce restructuring. Further details are available in recent banking industry outlooks and their implications for 2025.

This data presents a clear directive for executives: without a precise, data-backed operational strategy, an institution is already falling behind. The performance gap between the most efficient banks and the rest of the market is widening. The institutions that will lead are those capable of translating raw data into confident, decisive action.

The fundamental question every executive must answer is not "Are we efficient?" but rather, "How efficient are we compared to our direct competitors, and what is the quantifiable cost of any gap?"

Moving from Theory to Action

Achieving genuine operational efficiency requires an interconnected strategy, not a series of one-off projects. A decision to invest in new technology, for instance, must be directly informed by performance data from areas like team productivity or branch transaction costs. This is where modern data intelligence becomes indispensable.

A business intelligence platform like Visbanking’s BIAS provides the necessary framework. By analyzing your key performance metrics against a curated peer group, it delivers the clarity required for leadership to:

- Pinpoint Specific Weaknesses: Identify the exact operational areas where costs are misaligned or processes lag behind peer performance.

- Invest with Confidence: Allocate capital to technology and personnel initiatives proven to generate the highest return on investment.

- Drive Strategic Alignment: Ensure all departmental objectives contribute directly and measurably to the bank's overarching efficiency goals.

The following sections provide a practical roadmap for employing this data-first approach to transform your bank’s operational performance. To understand your current standing, Visbanking can provide a detailed benchmark analysis.

The Metrics That Define Operational Excellence

The adage "if you can't measure it, you can't manage it" is a foundational principle in banking. To build a sustainably profitable institution, leadership must move beyond anecdotal assessments and engage deeply with performance data. The right Key Performance Indicators (KPIs) are not merely for board reports; they are the vital signs of your bank's health, providing the diagnostic tools to manage with precision.

The “Big Four” of Bank Efficiency

While dozens of metrics can be tracked, a core set provides the most direct view of bank operational efficiency. The value lies not just in knowing the formulas, but in understanding the strategic story each metric tells. For executive leadership, these KPIs are essential for diagnosing financial health and operational effectiveness.

Here is a breakdown of the critical metrics that belong on every executive dashboard:

Essential Bank Operational Efficiency KPIs

| Metric | What It Measures | Strategic Implication for Executives |

|---|---|---|

| Efficiency Ratio | The cost to generate one dollar of revenue (Non-Interest Expense / Net Revenue). A lower number is better. | This is the primary gauge of profitability. A seemingly small 1.5% improvement in this ratio can translate to millions in additional pre-tax profit. |

| Cost-to-Income Ratio (CIR) | Closely related to the Efficiency Ratio, it offers a direct assessment of cost control relative to all income streams. | A high CIR signals an urgent need to investigate core operating expenses, such as personnel, technology, or real estate. |

| Return on Assets (ROA) | How effectively the bank utilizes its asset base to generate profit (Net Income / Total Assets). | This reveals how hard your assets are working. Top-quartile banks consistently outperform the industry benchmark, often exceeding 1.0%. |

| Net Interest Margin (NIM) | The profitability of the core lending and funding business (Interest Income vs. Interest Paid). | In a volatile rate environment, a stable or expanding NIM indicates a well-managed balance sheet and effective pricing strategies. |

Monitoring these four metrics provides a powerful, at-a-glance summary of your bank's performance. They are the foundation of any serious efficiency strategy.

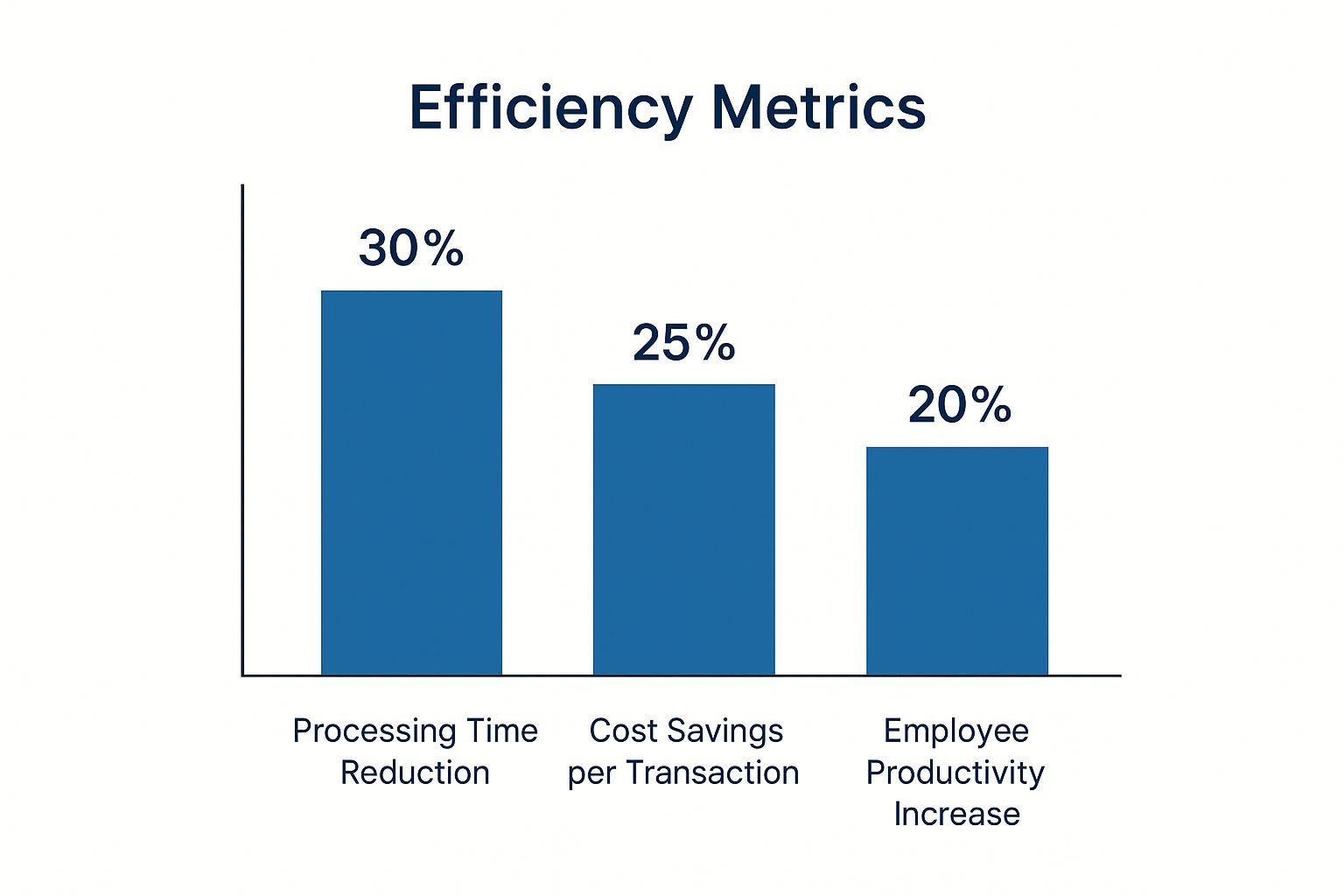

The relationship is direct: strategic investments in process automation and productivity yield tangible, measurable gains in these core metrics.

From Numbers on a Page to Actionable Intelligence

Tracking these KPIs internally is a necessary first step, but it is insufficient for strategic decision-making. Their true power is unlocked through peer comparison. A 62% efficiency ratio may seem high in isolation, but if it is best-in-class for your specific asset size and market, it tells a story of market leadership. This is where data intelligence platforms become non-negotiable.

Raw metrics tell you what is happening. Comparative data intelligence tells you why it matters—and what to do about it.

A platform like Visbanking’s BIAS automates this contextual analysis. It integrates your financial data and instantly benchmarks it against a curated peer group, revealing precisely where you lead, lag, or are simply average. This level of financial data integration transforms a static report into a dynamic roadmap for action.

Suddenly, you can diagnose with certainty whether a high CIR is driven by bloated overhead or by income streams underperforming the competition. That is the insight that enables confident investment, process re-engineering, and capital allocation. It is the difference between reacting to the market and leading it.

Unlocking Your True Position with Peer Benchmarking

Internal metrics provide only half the picture. Without proper context, performance data exists in a vacuum, leaving leadership to navigate with an incomplete map. For any institution serious about building a durable competitive advantage, strategic peer benchmarking is not optional—it is the only way to determine your true market position. This process must go beyond generic comparisons to national averages, which often produce distorted and misleading conclusions. True insight comes from measuring your institution against a carefully selected group of banks with a similar asset size, business model, and geographic footprint.

This distinction is critical. Consider the efficiency disparities among global banks, where many European institutions grapple with cost-to-income ratios exceeding 60%, as documented in global banking efficiency trends and forecasts on S&P Global. This starkly illustrates how differently banks manage costs and underscores the need for targeted, context-aware improvements.

The Peril of Flawed Comparisons

Consider a community bank with a 62% efficiency ratio. When compared against a national index hovering around 57%, this figure appears weak, potentially triggering misguided cost-cutting initiatives that could damage customer service or employee morale. However, if that same bank is benchmarked against its true peers—other community banks of a similar asset size within its region—its 62% ratio might emerge as best-in-class, demonstrating a highly effective operational model for its specific market.

An unflattering metric compared to a national average can easily be a sign of market leadership when viewed through the correct lens. Acting on incomplete data is one of the costliest mistakes an executive can make.

Without this nuanced perspective, leadership teams risk "solving" problems that do not exist while actual operational weaknesses erode the bottom line. This is how data intelligence moves a bank from guesswork to certainty.

From Ambiguity to Actionable Insight

The primary challenge for any executive team is translating performance data into confident action. A high-level metric like the efficiency ratio is a starting point, but it does not prescribe the next step. The strategic value lies in deconstructing that metric to understand its drivers.

A dedicated intelligence platform is the catalyst for this analysis. A tool like Visbanking’s BIAS automates the benchmarking process, delivering clean, apples-to-apples comparisons that eliminate analytical noise. Instead of just identifying a high cost-to-income ratio, you can instantly diagnose why it is high:

- Are your personnel costs as a percentage of assets significantly higher than your five closest competitors?

- Is your net interest margin lagging the peer average, indicating an income-generation problem rather than an expense problem?

- Are occupancy expenses per employee misaligned with other banks operating in similar markets? For instance, a bank with $3B in assets might find its occupancy expense is $18,000 per employee, while its direct peers average only $14,000—a $4,000 variance that, when multiplied across hundreds of employees, represents millions in potential savings.

This level of detail transforms a vague concern into a specific, addressable issue. The executive conversation shifts from "Our costs are too high" to "Our technology spend per employee is 15% above our peer average; we must analyze the ROI of our current IT investments." This is how data intelligence drives superior banking performance. It provides the evidence needed to focus resources, justify strategic initiatives, and drive real improvements in bank operational efficiency. To understand your bank's true position, request a customized benchmark analysis.

Making Strategic Technology Investments

Technology is the engine of modern bank operational efficiency, but undisciplined spending is a primary source of value destruction. The objective is not to acquire new technology for its own sake, but to make surgical investments that solve specific, measurable operational problems. For executives, this requires cutting through hype and focusing on high-ROI applications that demonstrably improve performance.

The scale of this challenge is significant. Global banks are projected to spend approximately US$176 billion on IT in 2025. Critically, only 39% of that expenditure is aimed at "change-the-business" initiatives like new product development. The majority is dedicated to fortifying core operations. This is not a defensive retreat but a strategic imperative to build a stable, efficient foundation, a trend detailed in the 2025 global banking outlook from EY. This spending pattern highlights a core truth: a high-tech superstructure cannot be built on a cracked data foundation.

From Automation to Intelligent Optimization

True efficiency gains are realized through intelligent optimization, not merely automating flawed processes. The most effective banks concentrate their technology spend in three key areas, each addressing a distinct form of operational drag:

- Robotic Process Automation (RPA) for the Back Office: RPA acts as a digital workforce for repetitive, rules-based tasks that create back-office bottlenecks. Automating processes like commercial loan compliance checks or new account verification can reduce processing times by over 50%. For example, a mid-sized bank could reallocate 3,000 hours of manual work annually by automating its SAR filing process, freeing up compliance officers for higher-value analysis.

- AI-Powered Analytics for Risk and Fraud: AI excels at identifying subtle patterns within massive datasets that are invisible to human analysts. By deploying AI, banks can refine real-time fraud detection, reducing false positives that alienate legitimate customers and enabling a more rapid response to sophisticated threats, thereby directly protecting the bottom line.

- Core System Modernization to Reduce Technical Debt: Legacy core systems act as an anchor on agility, creating data silos and inhibiting innovation. Modernizing the core is not merely an IT project; it is a business necessity that eliminates technical debt and creates the prerequisite platform for future growth and efficiency.

The Prerequisite: A Solid Data Foundation

The common denominator for these high-impact technology initiatives is clean, accessible, and contextualized data. One cannot effectively automate a convoluted process or derive insights from fragmented information.

A technology investment made without a clear, data-driven understanding of your competitive weaknesses is not a strategy—it's a gamble. The first step is always to diagnose the problem with precision.

An intelligence platform like Visbanking’s BIAS provides the strategic map to guide these significant investments. By benchmarking your bank against a relevant peer group, you can identify precisely where performance is lagging.

- Is your cost-per-loan origination 20% higher than your peers? That is a clear mandate to investigate RPA for your back-office lending functions.

- Are fraud losses eroding profits at a rate higher than the competition? That signals a need to invest in more sophisticated, AI-driven analytics.

This data-first approach ensures that every dollar of technology spend is directed at the largest performance gaps, thereby maximizing ROI and driving measurable improvements in bank operational efficiency. Executing these investments, particularly in AI, also requires specialized talent, a significant challenge detailed in this analysis on Hiring for AI in Non-Tech Industries: A Playbook for Retail, Finance, and Healthcare. Ultimately, technology is a tool whose power is determined by the strategy directing it. To ensure your investments deliver, begin with the data.

Optimizing Your Workforce and Processes

Technology investment is a critical component of efficiency, but it is only part of the equation. Sustainable gains in bank operational efficiency are ultimately realized through your two most significant assets: your people and your processes. How teams are structured and how core workflows are executed determines whether technology investments translate into bottom-line impact. The most forward-thinking banks are fundamentally re-evaluating workforce roles and process design, allowing hard data—not institutional habits—to guide operational strategy.

The Evolution of the Branch and Strategic Staffing

The role of the physical branch has irrevocably shifted from a transactional center to an advisory hub for high-value customer interactions. This transformation demands a new approach to staffing, moving away from siloed teller roles toward the "universal banker"—a cross-skilled professional capable of managing transactions, opening accounts, and initiating conversations about loans or wealth management.

Consider a practical example: a regional bank with $5 billion in assets retrained 25% of its teller staff into universal bankers. The results were measurable and swift:

- A 12% increase in product cross-sells within six months.

- A 4% reduction in net staffing costs due to improved operational flexibility.

- A quantifiable improvement in customer satisfaction scores related to in-branch problem resolution.

This is not a cost-cutting measure; it is a revenue-generating and customer-centric strategy. However, executing such a shift requires precise operational insights.

A major workforce transformation cannot be based on intuition. It must be underpinned by hard data that identifies which branches are underperforming on cost-per-transaction or where staffing levels are misaligned with peer benchmarks.

This is where data intelligence provides a decisive advantage. A platform like Visbanking’s BIAS can instantly identify branches with high transaction costs but low advisory sales—prime candidates for the universal banker model. It provides the empirical evidence required to execute these difficult but necessary strategic decisions. Exploring how to leverage these insights is central to boosting bank performance with Visbanking’s data insights.

Re-engineering Processes to Eliminate Bottlenecks

Inefficient internal processes are silent inhibitors of profitability. They increase operational risk, frustrate employees, and degrade the customer experience. The solution is a systematic, data-informed effort to identify and eliminate these bottlenecks, particularly in critical workflows like commercial lending or treasury management.

For example, a mid-sized commercial bank discovered its average commercial loan approval time was 35 days—a full 10 days longer than its direct competitors. A data-driven process analysis revealed that 40% of this cycle time was consumed by manual document hand-offs between siloed departments. By implementing a unified digital workflow, the bank reduced its cycle time to 22 days. This not only improved its competitive standing but also increased the capacity of its relationship managers, directly driving higher loan volume.

Identifying these specific operational drags without an external yardstick is nearly impossible. Peer benchmarks on operational metrics are a game-changer, revealing exactly where your processes lag and providing a clear target for improvements that will have the greatest impact on bank operational efficiency. Before you can act, you must see. Benchmarking your branch performance and process cycle times against true peers is the first step toward building a leaner, faster, and more profitable institution.

Turning Data Intelligence Into Decisive Action

Ultimately, top-quartile operational efficiency is not the product of isolated initiatives. It is the direct outcome of a leadership culture that makes consistently better and faster decisions fueled by data. The path to market leadership is defined by confident executive action, and every action must be grounded in a clear, quantitative understanding of how your institution performs against its true competitors.

This is the point where raw data is forged into strategic intelligence. A clear, benchmarked view of your core metrics against a relevant peer group provides the foundation. It empowers leadership to allocate capital, technology, and talent with precision, moving beyond broad, ineffective assumptions. When you can see that your cost-per-transaction at a specific branch is 25% higher than your peers, the decision to restructure is no longer a subjective debate; it becomes a data-backed imperative.

From Insight to Impact

The defining challenge for any executive team can be distilled into one question: Do we know exactly where we are inefficient compared to our competitors, and can we assign a dollar value to that inefficiency?

Consider a mid-sized bank with a $75 million non-interest expense budget. A peer benchmark analysis reveals its personnel cost per employee is 8% higher than the median for its asset class. This is not merely a statistic; it is a $6 million problem demanding immediate, focused analysis. This is the clarity that moves a leadership team from discussion to decisive action.

Data intelligence platforms are not built for passive observation. They are designed to reveal the narrative hidden within the numbers, transforming ambiguity into a clear mandate for change and arming executives with the evidence to act.

This is how leading institutions achieve and sustain superior bank operational efficiency. It requires replacing intuition-based leadership with an unwavering commitment to empirical evidence. This mindset also positions you to better forecast future challenges and opportunities, making an exploration of predictive analytics in banking a logical next step for maintaining a competitive edge.

Platforms like Visbanking’s BIAS deliver this capability directly, providing an unvarnished view of your performance gaps and strategic opportunities. This equips your leadership team with the confidence to act decisively and without hesitation.

The first step is to see where you truly stand.

Frequently Asked Questions

As a bank executive tasked with enhancing institutional performance, practical questions demand direct answers. Here are concise, actionable responses to the most common inquiries regarding operational efficiency.

What’s the First Step to Improve Our Bank's Operational Efficiency?

The definitive first step is to establish an objective, data-driven baseline. Before allocating capital to new technology or organizational restructuring, you must have a precise understanding of your current performance. This requires moving beyond internal dashboards and institutional assumptions.

The process begins with a rigorous analysis of your Key Performance Indicators (KPIs)—such as the Cost-to-Income Ratio, personnel cost per employee, and non-interest income as a percentage of assets. The critical element, however, is to benchmark these metrics not in isolation, but against a curated peer group of institutions with a similar asset size and business model. This data-first methodology, which is the core principle of platforms like Visbanking's BIAS, prevents misdirected investment and ensures that resources are focused on the largest performance gaps, where they will generate the greatest return.

How Do We Measure the ROI of Technology Investments?

Measuring the Return on Investment (ROI) for a technology initiative requires tracking specific, pre-defined operational metrics before and after implementation. The objective is to translate process improvements into financial terms.

For example, if implementing Robotic Process Automation (RPA) for loan processing, you must measure:

- The reduction in employee hours per loan.

- The decrease in costly manual errors and subsequent remediation.

- The acceleration of the loan cycle time, from application to funding.

Each of these improvements has a quantifiable financial impact. The savings from reduced labor costs and the potential revenue from increased loan throughput can be calculated against the initial investment. This disciplined tracking provides clear evidence of the technology's value and builds a robust business case for future capital allocation.

Our Cost-to-Income Ratio Is High. Where Do We Start Looking?

A high Cost-to-Income Ratio is a critical warning indicator, but it does not identify the underlying cause. A surgical diagnosis is required, not a broad mandate to cut costs across the board. The analysis must begin by deconstructing the ratio into its two components—costs and income—and benchmarking each against a relevant peer group.

A high Cost-to-Income Ratio is a symptom, not the disease. The cure lies in figuring out if your expenses are bloated or if your revenue engine is sputtering.

On the cost side, use benchmarking data to scrutinize major expense categories. Are personnel, technology, or occupancy expenses materially higher than those of your direct competitors? Concurrently, analyze the income component by examining your Net Interest Margin and non-interest income streams relative to peers. Often, the problem is not simply elevated costs but an underperforming revenue engine. A platform like Visbanking's BIAS automates this comparative analysis, immediately highlighting the specific areas of divergence and pointing leadership directly to the root of the problem.

Ready to stop guessing and start acting with data-backed confidence? Visbanking provides the peer-level intelligence you need to pinpoint inefficiencies and drive strategic growth. Explore how your institution measures up.