Estimated reading time: 4 minutes

Table of contents

The modern landscape of banking and finance is a dynamic and interconnected realm, where relationships and connections play a pivotal role in driving business success. Whether you’re an entrepreneur seeking funding, a corporation looking to expand, or an individual searching for personalized financial solutions, establishing the right contacts within the US banking sector can be a game-changer. In this comprehensive guide, we delve into the intricacies of US banks contacts and how they can fuel partnerships and growth, making every financial interaction seamless and productive.

The Power of Connections in the Financial World

In an era dominated by data and technology, the significance of personal connections might seem diminished. However, the banking and financial industry is an exception. While automation and algorithms play a significant role, the ability to form genuine relationships with key stakeholders remains unparalleled. When it comes to US banks, establishing strong connections can open doors to funding opportunities, tailored financial solutions, and strategic partnerships.

The Landscape of US Banks Contacts

The Visbanking Banking Report Portal serves as a valuable resource, offering access to a vast repository of US banks contacts. From retail banks to investment institutions, this portal acts as a bridge, connecting businesses and individuals with the right professionals. Navigating the complex network of contacts within the US banking sector can be a daunting task, but with the right tools and insights, it becomes an achievable endeavor.

Types of US Banks Contacts

The world of US banking is multifaceted, encompassing a variety of institutions and professionals. Some key contacts to consider include:

- Commercial Bankers: These professionals focus on businesses’ financial needs, offering services such as loans, credit lines, and treasury management solutions.

- Investment Bankers: Investment bankers facilitate capital raising and M&A transactions. They connect businesses with potential investors and offer expert advice on strategic financial decisions.

- Private Bankers: Private bankers provide personalized financial services to high-net-worth individuals and families. Their expertise lies in wealth management, estate planning, and investment advisory.

- Relationship Managers: These professionals are the bridge between clients and the bank. They ensure that clients’ financial needs are met and act as a point of contact for various banking services.

- Credit Analysts: Credit analysts assess the creditworthiness of individuals and businesses applying for loans. Their insights help banks make informed lending decisions.

- Mortgage Specialists: For individuals seeking home financing, mortgage specialists guide them through the loan application process and provide insights into mortgage options.

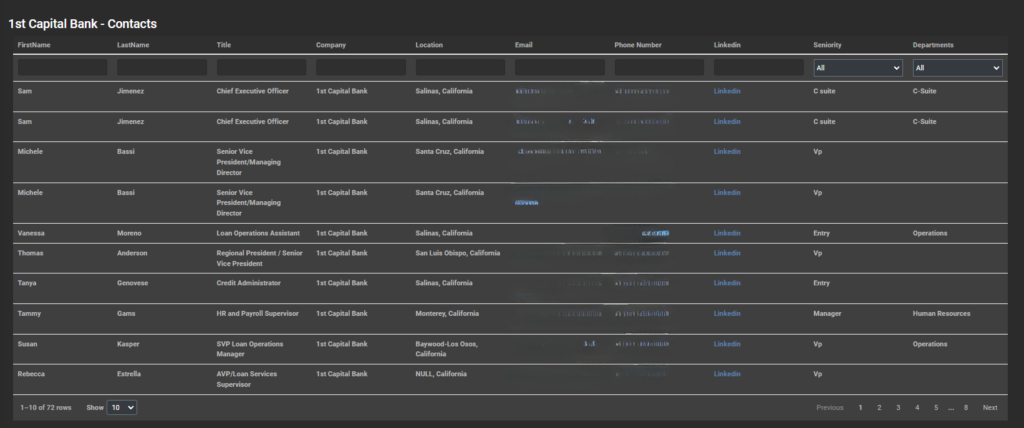

You can see this data in the “US Banks Contacts” section in the Visbanking Application:

Navigating the Portal: How to Find and Utilize US Banks Contacts

The Visbanking Banking Report Portal simplifies the process of discovering and engaging with US banks contacts. Its user-friendly interface allows users to search for contacts based on various criteria, such as location, type of banking institution, and specialization. This ensures that businesses and individuals can identify the contacts most relevant to their needs, saving valuable time and effort.

Upon finding the desired contacts, the portal provides comprehensive profiles, including professional backgrounds, areas of expertise, and contact information. Armed with this knowledge, users can initiate conversations confidently, knowing that they are engaging with the right professionals who can address their specific financial requirements.

Enhancing Partnerships and Fueling Growth

Establishing connections within the US banking sector is not just about immediate transactions; it’s about fostering long-term partnerships that drive sustained growth. A strong network of contacts can lead to collaborative opportunities, innovative financial solutions, and a deeper understanding of the market landscape. As businesses expand and evolve, having the right contacts can provide a competitive edge, enabling them to pivot swiftly in response to changing market conditions.

The Future of US Banks Contacts

In an ever-evolving digital landscape, the role of US banks contacts continues to evolve. The Visbanking Banking Report Portal serves as a testament to the power of technology in facilitating meaningful connections. As the portal continues to expand its offerings and capabilities, businesses and individuals can expect an even more streamlined experience in accessing the critical contacts that can shape their financial journey.

Conclusion

Navigating the world of US banking is no longer a solitary journey. With the Visbanking Banking Report Portal at your fingertips, discovering and engaging with the right US banks contacts has never been easier. These connections have the potential to redefine your financial landscape, transforming transactions into partnerships and paving the way for unprecedented growth. In an interconnected world, success is often measured by the quality of relationships you forge – and in the realm of US banking, those relationships begin with the right contacts.

So take the leap, explore the possibilities, and unlock the doors to a world of financial opportunities through the power of US banks contacts. Fuel partnerships, embrace growth, and embark on a journey that promises nothing short of success.

Prepared and Developed by Muhammed Gorkem Kilic