A Data-Driven Approach to Bank Customer Acquisition (B2B)

Brian's Banking Blog

In commercial banking, growth is no longer a game of chance; it is a discipline of precision. Sustainable expansion is now driven by superior data intelligence. Modern bank customer acquisition software (b2b) is not merely another CRM add-on. It is the core intelligence engine that transforms disparate market data into actionable growth strategies.

Why Banks Need an Intelligence Engine, Not Another Dashboard

Commercial banking has long operated on relationships and intuition. While essential, these elements are no longer sufficient to secure a competitive advantage.

Relationship managers are likely dedicating excessive time to manual prospecting, analyzing disconnected data, and relying on instinct to identify new business. This approach is not only inefficient; it represents a direct impact on the bottom line and a significant strategic risk.

The competitive landscape has evolved. Your competition is no longer confined to the bank across the street; it includes any institution capable of leveraging technology to identify and act on market signals with greater speed. A dashboard displaying last quarter's performance is obsolete. Bank leadership now requires an intelligence engine—a system that moves beyond retrospective reporting to provide proactive, predictive guidance.

The Shift: From Reactive Reporting to Proactive Strategy

Consider a common scenario: a relationship manager learns through informal channels that a local manufacturing company is planning an expansion. By the time they verify this information and establish contact, a competitor, armed with timely data, has already submitted a proposal.

An intelligence engine fundamentally alters this dynamic. Instead of pursuing rumors, your team receives automated alerts triggered by verified data points, such as:

- A recent UCC filing for new equipment financing.

- New online job postings for production managers.

- A public announcement detailing a capital expenditure plan.

This proactive intelligence enables your team to present a targeted, data-backed proposal weeks ahead of the competition. This is precisely the function of a true intelligence and action system like Visbanking—it converts raw data from sources like the FDIC and FFIEC into a tangible competitive edge.

Capitalizing on a Growing Market

The demand for these systems is reflected in market data. The third-party banking software market, which includes these acquisition tools, reached $6.77 billion and is projected to climb to $12.98 billion by 2033. For banking executives, the message is clear: the time to integrate predictive prospecting and leverage this expanding technology ecosystem is now. For a broader perspective on this trend, this analysis on strategic AI transformation in banking offers valuable context.

The objective is to equip your team with the foresight to act, not merely the hindsight to analyze. It is time to replace dashboards that report what happened with an intelligence engine that dictates what to do next.

Anatomy of High-Performance Acquisition Software

Not all platforms are created equal. Evaluating B2B bank customer acquisition software requires looking beyond marketing claims to assess the core capabilities that drive tangible opportunities.

A high-performance system is not a glorified contact database. It is a comprehensive intelligence engine designed to convert vast amounts of market data into profitable banking relationships.

A basic CRM is analogous to a paper map: it shows locations but offers no real-time intelligence on traffic, closures, or optimal routes. A modern acquisition platform is the equivalent of a dynamic navigation system, complete with real-time data and predictive analytics. It equips your team to anticipate market shifts and execute strategic moves, not just manage a static list of contacts.

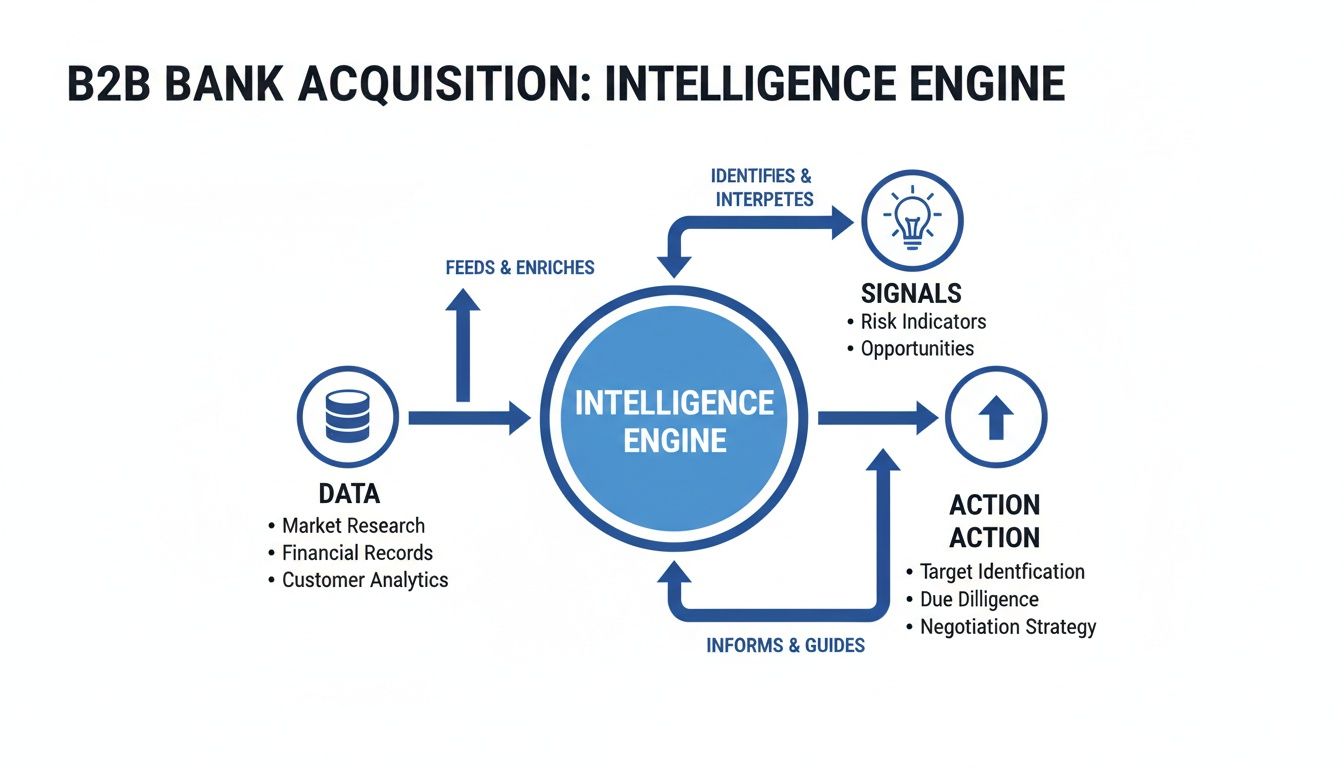

This diagram illustrates how a B2B acquisition intelligence engine translates raw data into clear growth signals.

This continuous loop—where intelligence drives action, which in turn generates new intelligence—is the mechanism for building sustainable growth momentum.

The 5 Pillars of an Effective System

To distinguish a true intelligence platform from a simple software tool, evaluate it against five essential pillars. Their integrated function provides a decisive competitive advantage.

Unified Data Aggregation: The foundation is data. A robust system aggregates a wide array of high-quality data sources. This includes regulatory filings such as FDIC call reports and FFIEC data, as well as UCC filings, SBA loan data, and broader market intelligence. The value lies in unifying these disparate sources to create a single, comprehensive view of any potential business client.

Advanced Prospecting and Filtering: This capability moves far beyond basic filters like company size or industry. High-performance software enables surgical targeting. For instance, a relationship manager could instantly generate a list of all commercial businesses in a specific county holding a CRE loan with a competitor and having recently filed a UCC for new equipment. This identifies a clear expansion signal and an opportune moment for outreach—a core function of modern bank prospecting software.

Relationship and Influence Mapping: Securing a B2B deal requires access to key decision-makers. An effective platform maps the professional networks within and between organizations. It should identify key executives and board members, revealing their professional histories to help your team find a warm introduction and understand the true lines of influence.

A platform that only provides a company name and address offers minimal value. The real advantage comes from seeing the people behind the business and their network, transforming a cold call into an informed, strategic conversation.

Predictive Analytics and Growth Signals: This is the critical differentiator. The system must do more than display data; it must identify "trigger events" that signal an impending opportunity. An alert that a competitor's CRE loan concentration is approaching its internal limit, for example, is a powerful signal that the institution may be looking to offload assets. Similarly, knowing a key executive contact has moved to a target company creates an immediate, high-value reason to connect.

Actionable Workflow Integration: Valuable insights are useless if they remain isolated in a dashboard. A top-tier system pushes actionable alerts and opportunities directly into your team's daily workflow. This means seamless integration with your CRM, email, or other communication platforms, ensuring that high-priority opportunities are never missed. This transforms the software from a research tool into an active partner in your bank's growth.

By measuring potential software against these five pillars, you can ensure you are investing in a true intelligence engine that delivers a measurable return, not just another subscription fee. The objective is simple: provide your team with the data-driven foresight required to win.

How to Convert Banking Intelligence into Revenue

Data is a cost center until it generates revenue. The best bank customer acquisition software (b2b) is not about accumulating information; it is about translating data into specific, profitable actions for your team. This is what distinguishes a simple dashboard from a true intelligence engine—the ability to convert raw numbers into tangible business growth.

Many platforms merely report historical events. True power lies in prescribing the next strategic move. It involves connecting seemingly unrelated data points—such as FFIEC call reports and executive career changes—to uncover opportunities hidden in plain sight. This is not abstract analytics; it is about clear, actionable signals that lead directly to new loans, deposits, and fee income.

From Regulatory Data to Portfolio Acquisition

Consider a practical application. A regional bank aims to expand its commercial real estate portfolio but wishes to avoid the lengthy and expensive process of originating every loan individually.

A sophisticated intelligence platform like Visbanking continuously monitors the regulatory filings of other banks. It can be configured to flag institutions whose CRE loan concentrations are approaching or exceeding internal policy limits—a significant pressure point.

- The Signal: The system identifies three competitor banks in adjacent markets with CRE concentrations exceeding 300% of total capital—a common regulatory concern. This insight is derived directly from public FFIEC reports. You now have credible intelligence that these banks may need to de-risk their portfolios.

- The Action: Your M&A team bypasses broad-based cold calling and instead contacts these three specific banks. The conversation is not speculative; it is a strategic proposal to help them solve a known problem.

- The Result: This targeted outreach is successful. Your bank acquires a $50 million CRE loan portfolio from one of the identified competitors, accelerating your growth strategy by months or even years through surgical precision.

Leveraging People Intelligence for High-Value Relationships

Institutional data is only part of the equation. One of the most potent, yet often overlooked, triggers for new business is executive movement. When a trusted contact moves to a new company, their banking relationships and preferences are likely to follow.

A robust acquisition platform tracks these key personnel changes, converting a simple job update into a perfectly timed revenue opportunity.

The optimal time to approach a B2B prospect is during a period of change. An executive move creates a window of opportunity to displace the incumbent banking relationship before it becomes entrenched.

Imagine a senior relationship manager has a strong rapport with the CFO of a local company.

- The Signal: The software alerts the manager that the CFO has accepted a new position at a larger manufacturing firm—a company that has been on your bank's prospect list for a year.

- The Action: The relationship manager acts immediately, contacting the CFO to offer congratulations. This leverages the existing relationship to initiate a timely conversation about the new company's banking needs.

- The Result: This proactive engagement leads to the manufacturer moving its treasury management services to your bank, securing a new relationship worth an estimated $150,000 in annual fee income—all generated from a single, timely data signal.

These examples illustrate the core function of a Bank Intelligence and Action System. It is about converting passive data into active, revenue-generating strategies. Equipping your team with such precise signals empowers them to act decisively, a critical element of modern lead generation for banks. A data-driven review of your own prospecting efforts can reveal where these opportunities lie.

Selecting the Right Technology Partner to Grow Your Bank

Choosing the software that will power your customer acquisition is a strategic decision that will shape your bank's growth trajectory for years. A superficial review of marketing materials is insufficient. A rigorous framework is required to identify a true intelligence partner, not just another software vendor.

A thorough evaluation must go beyond the user interface to examine the core components that drive real-world results. The objective is to secure a system that provides a durable competitive advantage. This requires a deep dive into data quality, system flexibility, and the provider's understanding of the banking industry. A misstep here costs more than money; it costs market opportunity.

Data Integrity Is Paramount

The value of an intelligence platform is directly proportional to the quality of its data. Insist on clear, verifiable answers regarding data sources, accuracy, and update frequency.

- Source Verification: Where does the data originate? Demand a detailed breakdown of sources, such as FDIC Call Reports, NCUA 5300 filings, UCC lien data, SEC filings, and professional graph data. Platforms like Visbanking are built upon this type of auditable, regulatory-grade information, ensuring your decisions are based on fact, not conjecture.

- Data Freshness: How frequently is the data updated? The market moves quickly. A system with quarterly data refreshes is already behind. Inquire about the latency of key datasets. A delay of even a few weeks on UCC filings or executive changes can mean the difference between winning a new relationship and being unaware of the opportunity.

- Data Synthesis: How does the platform connect disparate data points? The true value is realized when the system links a change in an FFIEC report to a specific executive's career move. A top-tier platform must demonstrate how it synthesizes these signals into a single, actionable client profile.

Integration and Interoperability

A powerful acquisition engine cannot operate in a silo. To be effective, it must integrate seamlessly with your existing technology and sales workflows. A standalone dashboard that requires manual data entry and cross-referencing is not a solution; it is a drain on productivity.

The most sophisticated analytics are worthless if they are not delivered directly to your relationship managers in a format they can act on immediately. The goal is workflow integration, not information silos.

Key considerations include:

- CRM Integration: Does the system connect with your CRM, such as Salesforce or nCino? Alerts and prospect intelligence should flow automatically into existing records without manual intervention.

- API Access: Does the vendor offer a robust API? This is critical for future-proofing your investment, providing the flexibility to build custom tools and integrate the platform more deeply with other internal systems as your needs evolve.

The entire banking industry is under pressure to modernize. The global core banking software market is projected to grow from $13.32 billion at a 10.2% CAGR, driven by banks replacing legacy systems with more agile technology. This trend highlights the critical importance of selecting partners whose technology can adapt and scale. You can discover more about this market shift and its implications.

Demonstrating ROI

A credible technology partner should be able to articulate a clear, quantitative path to a return on your investment, framed in the language of banking metrics, not technical jargon.

A compelling ROI case should address:

- Deal Velocity: By what percentage can the platform reduce the time from prospect identification to deal closure? A system that surfaces timely trigger events—such as a competitor approaching its CRE concentration limit—can shorten this cycle by 20-30%.

- Relationship Value: How does superior intelligence enable you to secure larger, more profitable deals? By understanding a prospect's full spectrum of needs upfront, your bankers can propose comprehensive solutions, increasing the average initial deal size.

- Operational Efficiency: How much non-selling time will the system save your team? A best-in-class platform should reduce manual research activities by at least 5-10 hours per week for each relationship manager.

By focusing on these three pillars—data integrity, seamless integration, and a clear ROI—you can select a bank customer acquisition platform that will be a genuine engine for growth. The next step is to benchmark your current acquisition performance to establish a clear baseline for improvement.

Embedding Software into Your Sales Culture

Acquiring sophisticated bank customer acquisition software is the straightforward part. The critical work—and the source of real value—is integrating it into your institution's sales DNA. Technology alone is an expense; adoption is what transforms it into a revenue-generating asset.

The objective is not merely to install new software. It is to fundamentally re-engineer your sales process, shifting your team from a reactive posture to a proactive, data-driven methodology.

This transformation requires a deliberate strategy, championed from the executive level. It is about evolving your relationship managers from traditional networkers into intelligence officers, equipped with the precise data needed to win high-value B2B relationships.

Championing a Data-First Sales Culture

This initiative must be driven from the top down. Executive sponsorship is non-negotiable. When the leadership team consistently frames this new intelligence software as a core strategic priority, the entire organization takes notice. This requires more than a memo; it demands that leaders actively use the platform's insights in sales meetings and strategic planning.

The most effective rollout strategy involves demonstrating immediate, tangible value. A phased approach that secures early wins is far more powerful than a large-scale, simultaneous launch.

- Pilot Program: Select a motivated team of high-performing relationship managers to lead the initial implementation.

- Targeted Goal: Assign a clear, measurable objective. For example: identify ten local businesses with maturing CRE loans at competitor banks within 30 days.

- Celebrate Success: When the pilot team secures a new deal using the software's intelligence, broadcast that success internally. Use it as a case study to build momentum and prove the system's value in concrete terms.

Rewiring Workflows and Incentives

Effective adoption is contingent on training. Generic, feature-focused tutorials are ineffective. Training must be structured around the real-world, revenue-generating activities your bankers perform daily.

A training module titled "How to Identify Under-Capitalized Businesses Prime for an Equipment Loan" will always be more effective than one named "Using the Advanced Filter Feature." Focus on the outcome, not the tool.

This practical approach ensures your team views the platform as their fastest path to exceeding quota, rather than as another administrative burden.

The final component is aligning compensation with desired behaviors. If the goal is to prioritize data-driven prospecting, incentives must reflect this. Consider rewarding metrics such as:

- The number of qualified opportunities generated directly from software signals.

- The reduction in the sales cycle for deals sourced through the platform.

For teams using tools like Visbanking's Talent and Intelligence modules, this means leveraging SBA and macro data to achieve 25-35% greater targeting accuracy. As core banking markets are forecast to reach $50-65 billion by 2032-34, this type of software is not a luxury; it is the statistical edge required to convert intelligence into market share. You can learn more about how the core banking software market is evolving to meet these demands.

Ultimately, successful integration is a cultural mandate. It requires leaders to champion a philosophy where decisions are guided by data, not solely by intuition. A critical examination of your current acquisition process will reveal precisely where an intelligence engine can make an immediate and decisive impact.

Measuring the True ROI of Your Acquisition Engine

Any significant technology investment presented in the boardroom must answer one fundamental question: What is the return? For bank customer acquisition software, the answer extends far beyond marginal efficiency gains. A true intelligence engine redefines competitive dynamics, creating compounding advantages over time. A comprehensive ROI analysis must consider both leading indicators of success and long-term strategic outcomes.

While lagging indicators like market share and overall Customer Acquisition Cost (CAC) are important, they are slow to reflect change. To validate the investment and build internal momentum, focus must be placed on leading indicators—the operational shifts that precede revenue growth. These metrics demonstrate that the system is an active performance driver, not a passive expense.

Leading Indicators: Early Proof of Value

Leading indicators provide immediate, tangible evidence that your new acquisition strategy is effective. They are the frontline metrics that show your team is operating with greater intelligence, speed, and precision.

Consider these real-world impacts:

- Reduced Prospecting Time: A relationship manager who previously spent 10 hours per week on manual research can now identify five high-potential targets in under two hours. This represents an 80% reduction in non-selling activity, freeing them to build relationships and close deals.

- Higher Quality Pipeline: Intelligence-driven prospecting eliminates guesswork. Instead of a pipeline filled with low-probability leads, your team engages with businesses that have verified needs. This consistently leads to a 15-20% increase in conversion rates, as every conversation is initiated from a position of insight.

- Accelerated Sales Cycles: Entering a meeting with prior knowledge that a prospect's current lender is over-leveraged in a specific asset class allows for a highly targeted and compelling pitch from day one. This level of intelligence can reduce the average sales cycle by 20-30%, converting potential revenue into actual revenue more quickly.

These are not theoretical benefits; they are the direct outcomes of equipping your team with a superior intelligence platform. For a detailed breakdown of this critical metric, our guide on calculating the bank customer acquisition cost provides a comprehensive framework.

The Ultimate ROI: A Sustainable Strategic Advantage

While efficiency gains provide a strong financial justification, the ultimate ROI of a Bank Intelligence and Action System is strategic. It is about developing the institutional capability to identify and capitalize on market opportunities before your competitors are even aware of them.

The true return on investment is not just about executing the same tasks faster. It is about gaining the foresight to execute entirely new strategies—to see market shifts, anticipate client needs, and make decisive moves while others are still analyzing last quarter's data.

Consider the strategic value of consistently being the first to contact a business that has just secured a new round of funding, or the first to offer a solution to a company whose key executive has just arrived from a competitor. This is not a matter of luck; it is a systematic advantage built on superior data intelligence.

This ability—to act with both speed and precision—is the most valuable currency in modern banking. It elevates your acquisition engine from a cost of doing business to the primary driver of defensible, long-term growth.

Frequently Asked Questions

Isn't This Just a Glorified CRM?

No. Your CRM is a system of record, a rearview mirror that documents your past and current relationships. It answers the question, "Who are our customers?"

Bank customer acquisition software is a forward-looking intelligence engine. It is designed to answer a far more profitable question: "Who should be our next customers?" It accomplishes this by analyzing external data—FDIC call reports, UCC filings, executive movements—to identify growth opportunities before they are widely known. Your CRM manages what you know; this software reveals what you need to know.

What is the Time to Value? Is This a Months-Long Project?

This is not a multi-quarter core system overhaul. Implementation is a matter of weeks, not months. The heavy lifting—aggregating and structuring vast amounts of public data—is handled by the provider.

Your team's involvement is focused on strategic onboarding sessions designed to translate data into opportunities. The objective is to have your relationship managers identifying actionable leads within the first week of use.

How Can We Trust the Data?

Data integrity is the bedrock of the system. The platform is built on a foundation of direct, primary-source data that is auditable and verifiable.

Financial data is sourced directly from immutable records like FDIC and FFIEC call reports. Business lending activity is derived from official SBA program data. Platforms like Visbanking employ proprietary systems to cleanse, structure, and cross-reference this information. You are acting on high-fidelity intelligence, not questionable third-party data.

Can We Directly Attribute This to Portfolio Growth?

Yes. A direct line can be drawn from platform activity to bottom-line results by tracking key performance indicators. This includes a 20-30% shorter sales cycle, a measurable increase in qualified meetings set by relationship managers, and improved conversion rates.

For example, when your team identifies three local companies with CRE loans maturing at a rival bank and subsequently wins one of those deals, that new relationship is directly attributable to the software's intelligence. This provides a clear, defensible ROI.

Ready to stop reacting and start proactively winning your next best customers? See how Visbanking turns market noise into your strategic advantage. Explore our bank intelligence platform today.

Similar Articles

Visbanking Blog

In the world of banking, digital transformation is no longer a 'nice-to-have'. It's a necessity

Visbanking Blog

How can data science transform the banking industry?

Visbanking Blog

Banking Data Analytics: Turning Information Into Profit

Visbanking Blog

Capital One Launches Enterprise B2B Software Business

Visbanking Blog

AI Banking Revolution: How Machine Learning Transforms Finance

Visbanking Blog

Revolutionizing Financial Hiring: How AI-Powered Talent Tools Transform Recruitment

Visbanking Blog

Revolutionize Banking with BIAS: A Path to Future Success

Visbanking Blog

Revolutionize Your Banking Operations with Data-Driven Insights from BIAS

Visbanking Blog

Get a Competitive Advantage with BIAS, the Proactive Banking Solution

Visbanking Blog