Mastering Bank Customer Acquisition Cost: A Strategic Guide for Executives

Brian's Banking Blog

For any bank executive focused on growth, new customer acquisition is paramount. The critical question, however, is not just how many, but at what cost? That dollar figure is your bank customer acquisition cost (CAC), one of the most direct measures of your growth engine's efficiency.

CAC is not merely an expense line; it is a direct reflection of your marketing and sales strategy's ROI. Mastering this metric is fundamental to building profitable, long-term institutional value.

What Is Bank Customer Acquisition Cost, and Why Does It Matter to the Board?

For a bank’s leadership, Customer Acquisition Cost is the speedometer for its growth engine. Viewing CAC as a strategic investment rather than a simple cost cultivates a culture that prioritizes intelligent, sustainable growth over mere volume.

However, a surface-level understanding is insufficient and potentially dangerous. The fully-loaded cost to acquire a new retail checking account is fundamentally different from what it takes to land a high-value commercial lending client. Aggregating these figures into a single "blended" CAC means you are operating without clear vision and almost certainly misallocating capital.

The Imperative of Segmenting Acquisition Costs

Consider this scenario: a community bank invests $200,000 in a digital marketing initiative. The campaign successfully generates 800 new retail checking accounts and 20 new small business loans.

A simple, blended CAC would be $243.90 per customer ($200,000 / 820). On its face, this figure may seem acceptable. But it obscures the critical underlying economics.

A more rigorous, data-driven analysis is required:

- Retail Checking: If $120,000 of the budget was allocated to the retail campaign, the true CAC for each checking account is $150.00.

- Commercial Lending: If the remaining $80,000 was focused on the business campaign, the CAC for each new commercial client is $4,000.00.

This granular detail enables strategic decision-making. Is a $150.00 CAC for a retail account a sound investment based on its projected lifetime value? Is a $4,000.00 expenditure justified to acquire a new commercial relationship?

Without this segmented view, a bank operates with a massive blind spot, potentially over-investing in low-margin customers while under-investing in its most profitable segments.

Calculating a true, segmented CAC is the foundation of any intelligent growth strategy. With the precise data intelligence provided by platforms like the Visbanking platform, leadership can move beyond broad assumptions to take decisive, profitable action. Once this clarity is achieved, benchmarking these metrics against peers is the final step to outperforming the market.

Calculating Your Bank's Fully-Loaded Acquisition Cost

Determining the true cost to acquire a new customer is the bedrock of a sound growth strategy. While simple calculations are tempting, a "fully-loaded" CAC provides the clarity necessary for effective capital allocation.

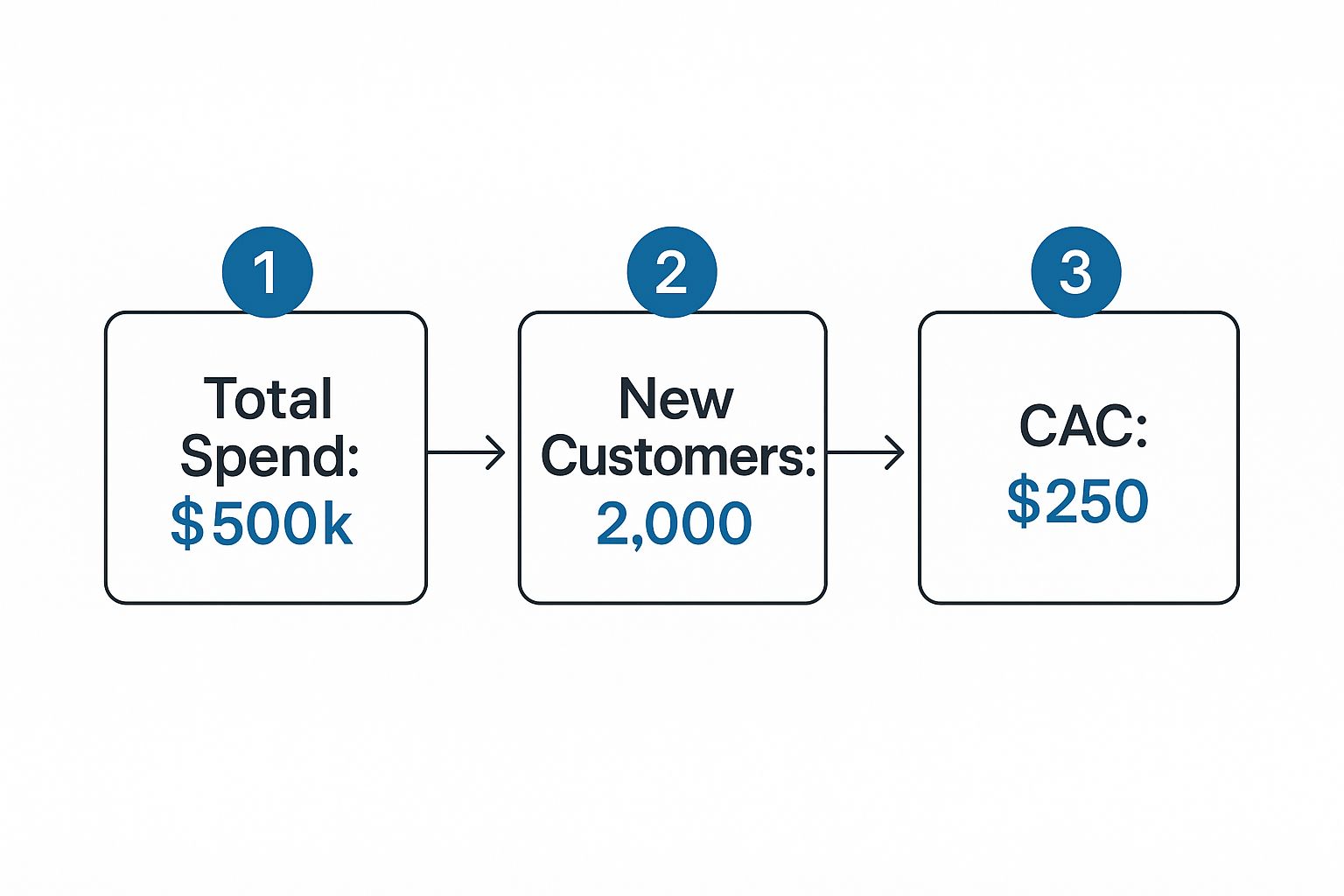

The basic formula is straightforward: divide total acquisition-related expenditures by the number of new customers acquired over a defined period. The critical discipline, however, lies in accounting for every dollar contributing to that effort.

Defining the "Spend" Bucket

To calculate a true, fully-loaded CAC, disciplined tracking of all direct and indirect costs is non-negotiable. It is common to overlook items like a proportional share of a loan officer's salary or CRM platform costs. These omissions create a deceptively low CAC, leading to flawed strategic conclusions.

Ensure your calculation includes expenditures from these key areas:

- Marketing & Advertising: All digital advertising (Google, social media), content creation, SEO, and traditional media buys.

- Personnel Costs: A proportional allocation of salaries and commissions for all staff involved in acquisition, including loan officers, business development teams, and branch personnel.

- Technology & Tools: Costs for CRM, marketing automation software, and analytics platforms used to execute and track campaigns.

- Overhead & Compliance: A portion of general overhead and the compliance team's time allocated to reviewing marketing materials and onboarding processes.

Imagine a regional bank executes a quarterly campaign for a new high-yield savings account. A high-level view might appear as follows:

This yields a baseline CAC of $250.00. The strategic value, however, is unlocked by deconstructing this number.

The Strategic Necessity of Granularity

How was the $500,000.00 allocated? What if $400,000.00 invested in digital channels generated 1,800 customers (a $222.22 CAC), while the remaining $100,000.00 in print advertising yielded only 200 customers (a $500.00 CAC)?

Suddenly, the strategic imperative is clear. This analysis has exposed a significant efficiency gap between channels.

A blended, top-line CAC conceals these critical performance disparities. Without the ability to attribute costs to specific channels and customer segments, you are operating without intelligence and wasting capital.

This is where a robust data intelligence platform becomes essential. Manual tracking of disparate costs is inefficient and prone to error. A system like Visbanking’s BIAS platform automates this data aggregation, providing bank leaders with a clear, accurate, and segmented view of their customer acquisition cost. It replaces guesswork with decisions backed by hard data.

Once internal metrics are established, the next logical step is competitive benchmarking. This transforms internal data from a simple report card into a powerful strategic weapon.

Benchmarking Your CAC Against Industry Peers

Knowing your bank's customer acquisition cost is a necessary first step, but the metric is meaningless in isolation. Its strategic value is unlocked only through comparison against direct competitors. Without this context, you are operating in a vacuum. Is your $250.00 CAC indicative of a highly efficient marketing operation, or is it a signal of bloated, underperforming spend?

Benchmarking transforms historical data into a competitive advantage. It empowers leadership to understand real-world performance, set meaningful goals, and hold teams accountable for results that matter in the marketplace—not just within the institution.

The Digital vs. Traditional Efficiency Divide

Across the banking industry, a significant efficiency gap exists between digital-first institutions and traditional banks encumbered by legacy branch networks. This is not a minor variance; it is a fundamental difference in go-to-market strategy and operational efficiency.

For example, a traditional bank might expend $150.00 to acquire a new customer, factoring in branch and staff overhead. A digital competitor can often achieve the same result for as little as $30.00 through automated, streamlined onboarding. More detailed banking statistics from industry analyses confirm this trend.

This efficiency gap represents a direct threat to market share and profitability. A competitor acquiring customers for a fraction of your cost has a significant capital advantage, enabling reinvestment into superior technology, talent, and product innovation.

Turning Peer Data into Decisive Action

Comparative data is not a judgment; it is a diagnostic tool that pinpoints areas for strategic focus.

- Operational Drag: If your CAC is significantly higher than peer institutions of a similar size and model, it often indicates friction in your sales or onboarding processes.

- Channel Inefficiency: Benchmarking can quickly reveal over-reliance on expensive channels that competitors are using more sparingly or have abandoned entirely.

- Misaligned Value Proposition: A high CAC may also signal that your marketing message is not resonating, requiring higher spend to achieve the same acquisition volume.

This is precisely where a platform like Visbanking provides immense value. It removes guesswork by displaying your bank's marketing efficiency alongside a curated peer group. It transforms raw data into a clear competitive scorecard, enabling you to identify weaknesses and deploy capital with confidence. Benchmark your performance with Visbanking to turn data into a strategic asset.

Actionable Strategies to Reduce Acquisition Expenditures

Once your CAC is calculated and benchmarked, the next step is optimization. Reducing acquisition spend is not about broad budget cuts; it is about the precise reallocation of capital from underperforming initiatives to those delivering superior returns. This requires a data-driven approach.

True cost reduction is achieved by manipulating three primary levers: refining the channel mix, sharpening customer segmentation, and optimizing the conversion funnel. Success in each area depends on quality data to identify opportunities that will materially impact the bottom line.

Fine-Tune Your Channel Mix

Not all acquisition channels deliver equal value. As the earlier example illustrated, a bank might acquire accounts for $222.22 through paid search while spending $500.00 per account via print advertising. A single, blended CAC completely masks this crucial distinction. Once the data is segmented, the necessary actions become self-evident.

The objective is to systematically reallocate budget from high-cost, low-yield channels to more efficient ones. This is not a one-time adjustment but a continuous cycle of analysis, testing, and optimization.

For instance, if data reveals a competitor achieves a significantly lower CAC through local business partnerships, that is a direct call to action. Pilot similar programs, measure the results, and if successful, scale the initiative to drive down your own blended CAC.

Sharpen Your Customer Segmentation

Acquiring a new customer is a tactic. Acquiring a profitable customer is a strategy.

A low CAC becomes a vanity metric if it is achieved by acquiring a high volume of low-balance, low-engagement accounts. The most effective way to reduce wasteful spending is to cease marketing to unprofitable segments. This requires moving beyond basic demographics to focus on customers with a high predicted Lifetime Value (LTV).

Spending $300.00 to acquire a commercial client with a $10,000.00 LTV is a sound investment. Spending $150.00 on a retail customer projected to generate only $400.00 in LTV is not. Effective targeting is about acquiring valuable relationships, not merely opening accounts.

Your own institutional data is the key. Analyze your most valuable customers to identify common characteristics—be it industry, business size, or specific financial behaviors. Use these insights to build lookalike audiences for digital campaigns and tailor messaging to attract more of these ideal clients.

Plug Leaks in the Conversion Funnel

Finally, you must optimize your conversion process. Every potential customer who abandons an online application represents a sunk acquisition cost.

By analyzing user journey data, you can pinpoint the exact points of friction. Is the application form too long? Does the identity verification step have a high failure rate? Addressing these seemingly minor roadblocks can have a significant positive impact on your conversion rate, which directly lowers your effective CAC.

These are not theoretical exercises; they are practical, data-backed strategies to improve efficiency and profitability. With Visbanking’s BIAS platform, you gain the peer benchmarks and internal analytics needed to make these strategic decisions with confidence.

Explore our data to identify your institution's greatest opportunities for improvement.

Lessons from the Fintech Acquisition Model

The fintech sector provides a compelling case study in the perils of undisciplined acquisition spending. For years, the prevailing strategy was growth at any cost, fueled by venture capital.

This mentality created an unsustainable bidding war for customers, driving bank customer acquisition costs to astronomical levels. The average cost to acquire a single fintech customer has reportedly reached $1,450.00. This figure is bloated by intense competition and the significant expense of building brand trust from scratch. A full analysis of customer acquisition cost statistics offers a deeper look at these trends.

The "Growth-at-All-Costs" Trap

The primary lesson for traditional banks is this: do not mistake activity for achievement. Fintechs became focused on user growth, often neglecting the underlying profitability of those users. Investors are now scrutinizing this flawed model.

Compounding the problem is a severe customer retention issue, often called the "leaky bucket" problem.

A reported 73% of new users abandon fintech apps within the first week.

Consider the financial implication: nearly three-quarters of that enormous acquisition expenditure is effectively wasted on transient users who provide zero long-term value.

This serves as a critical warning for community banks and credit unions expanding their digital footprint. Allocating capital to digital advertising simply to match a fintech's user growth is a strategy destined to destroy value. The objective is not merely to acquire a customer, but to initiate a profitable, long-term relationship.

Applying These Lessons to Your Bank's Strategy

The strategic path forward involves adopting the best of the fintech world—agility and a focus on user experience—without inheriting their flawed economic models. This requires a disciplined, data-driven approach to avoid the cash-burn trap.

Before scaling any digital campaign, leadership must ask critical questions:

- What is our true digital application completion rate, and how does it compare to our peers?

- Are we tracking the engagement of digitally-acquired customers in their first 30-60 days?

- Is our bank customer acquisition cost justified by the lifetime value of the specific customer segments we are targeting?

Answering these questions requires business intelligence, not just raw data. Using a platform like Visbanking's BIAS, you can benchmark every stage of your digital funnel and acquisition efficiency against a curated peer group. This enables you to build a digital strategy founded on profitability, not vanity metrics. Explore our data to see how your efficiency compares.

Connecting CAC to Lifetime Value for Profitable Growth

Analyzing customer acquisition cost in a vacuum is a critical strategic error. It represents a cost without context. Its true power is revealed only when paired with its counterpart: Customer Lifetime Value (LTV).

LTV is the total net profit an institution can expect from a single customer relationship over its entire duration. The ratio of LTV to CAC is the ultimate measure of profitable, sustainable growth. This single metric cuts through operational noise to answer the most fundamental question for any executive team: is our growth engine creating long-term value, or is it merely consuming capital?

Interpreting the LTV to CAC Ratio

Within the financial services industry, a healthy LTV to CAC ratio is generally considered to be 3:1 or higher. For every dollar invested in acquiring a new customer, the institution should expect at least three dollars in return over the life of that relationship.

Consider two institutions. Bank A has a CAC of $250.00 and an average customer LTV of $1,000.00, yielding a robust 4:1 ratio. Bank B also has a $250.00 CAC, but its average LTV is only $600.00, resulting in an unsustainable 2.4:1 ratio. Though their acquisition spending is identical, Bank A is building a far more profitable and resilient business.

A ratio below 3:1 is a clear indicator to leadership that the growth model is flawed. The cause is typically one of three issues: overspending on acquisition, attracting low-value customers, or failing to retain and deepen existing relationships.

This is where sophisticated data intelligence transitions from being a historical reporting tool to a predictive strategic asset. By accurately modeling both sides of the LTV-to-CAC equation, you can forecast the impact of strategic shifts, ensuring that every dollar of your marketing budget is not just spent, but invested in profitable, long-term growth.

Understanding this balance is the key to outperforming the market. To see how your institution's efficiency metrics stack up, it is essential to benchmark your performance with Visbanking’s comprehensive data.

Common Questions from Bank Leadership

When discussing customer acquisition, executives consistently face a core set of strategic challenges. Here are answers to the most pressing questions.

What is a Good Customer Acquisition Cost for a Bank?

There is no single "good" CAC. The metric's validity is entirely dependent on its relationship to Customer Lifetime Value (LTV).

For example, a $150.00 CAC to acquire a new retail account may seem efficient. However, if that customer only generates $400.00 in lifetime value, the resulting margin is too thin to support sustainable growth.

The guiding principle is to target an LTV to CAC ratio of at least 3:1. For every dollar invested in acquisition, you should generate at least three dollars in long-term profit. A ratio below this benchmark is a clear signal that the acquisition strategy requires re-evaluation.

How Can Community Banks Compete with National Institutions?

Community banks cannot outspend national competitors; therefore, they must out-strategize them. The key is to leverage agility and local market knowledge to achieve surgical precision in targeting and efficiency.

Instead of broad, expensive campaigns, focus on profitable niche segments that larger banks often overlook. A community bank can achieve a superior CAC by concentrating on specific channels, such as strategic partnerships with local businesses or hyper-targeted digital campaigns aimed at specific professional groups within its footprint.

Data intelligence platforms act as a great equalizer, enabling smaller institutions to identify these pockets of opportunity and prove ROI, thereby maximizing the impact of every budget dollar.

How Often Should We Review CAC?

CAC should be a standing agenda item for quarterly executive meetings. This cadence is appropriate for identifying meaningful trends and making high-level strategic decisions without reacting to short-term market noise.

However, the underlying data should be monitored at the operational level on a monthly basis. Marketing and finance teams should track channel performance to identify and address struggling campaigns or inefficient spending early, allowing for course correction before it negatively impacts quarterly results.

This rhythm—monthly tactical monitoring combined with quarterly strategic review—is essential for building a disciplined, data-driven growth culture.

The insights required for more efficient growth reside within your bank's performance data. With Visbanking, you can move beyond guesswork and benchmark your acquisition metrics against a curated peer group. Identify your opportunities and execute your next strategic move with confidence. Explore our data to see how you compare.

Similar Articles

Visbanking Blog

Banking Data Analytics: Turning Information Into Profit

Visbanking Blog

Revolutionize Your Banking Operations with Data-Driven Insights from BIAS

Visbanking Blog

Fastest Growing Banks: Who's Winning the Asset Race?

Visbanking Blog

Net Interest Margin Secrets: How Top Banks Maximize Profits

Visbanking Blog

How Bank Efficiency Ratios Reveal Hidden Operational Costs

Visbanking Blog

Optimizing Commercial Banks with Visbanking Intelligence

Visbanking Blog

AI Banking Revolution: How Machine Learning Transforms Finance

Visbanking Blog

In the world of banking, digital transformation is no longer a 'nice-to-have'. It's a necessity

Visbanking Blog

BIAS: Your Competitive Edge in Banking Data Driven Strategy

Visbanking Blog