C&I Lending: A Bank Executive's Guide to Growth and Risk Management

Brian's Banking Blog

For bank executives, Commercial and Industrial (C&I) lending is not just another asset class—it's a direct reflection of your institution's role in the economy and a primary driver of the bottom line. Unlike real estate loans anchored to static property values, C&I facilities are dynamic. Repayment hinges entirely on a company’s ability to generate cash from its operations, making this a direct investment in business strategy and execution.

Effective C&I portfolio management demands a clear-eyed assessment of opportunity and risk, driven by data, not intuition.

Understanding Commercial And Industrial Lending

C&I lending is the financial engine for the real economy. These loans are structured to finance a business's operational needs and strategic growth, from managing inventory and funding payroll to acquiring a key competitor. A robust C&I loan portfolio is a definitive signal that a bank is deeply integrated into its local business ecosystem and is a core source of net interest income. Success requires a granular understanding of a borrower’s industry, cash flow cycles, and strategic objectives.

The Scale And Significance Of C&I Loans

The C&I lending market is a primary barometer of economic health. With outstanding loans at all U.S. commercial banks recently totaling $2.71 trillion, its scale is immense. Economic shifts are felt here first. For instance, between 2021 and 2023, the post-pandemic recovery drove a C&I loan expansion of over 20%. These trends are quantified in datasets like the senior loan officer surveys from the Federal Reserve.

For bank leadership, this volume presents a dual imperative: capture profitable market share while maintaining stringent underwriting discipline. It is a perpetual balancing act between driving growth and managing credit exposure.

A robust C&I portfolio is more than a collection of loans; it is a direct reflection of a bank’s ability to identify, assess, and finance the engines of economic growth. The banks that excel are those that can transform market data into actionable lending decisions.

From Balance Sheet To Strategy

Effective C&I lending transcends transaction processing; it is about structuring precise financing solutions that align with a client's business model. A revolving line of credit serves a company with seasonal cash flow, while a multi-year term loan enables a manufacturer’s capital investment. These loans are often the gateway to deeper, more profitable relationships encompassing treasury management, advisory services, and other high-fee business lines. For a deeper analysis of a key segment, see our guide on what is middle market banking.

Every C&I credit decision directly impacts your bank's performance. By leveraging data intelligence, you can identify high-growth industries, benchmark loan pricing against competitors, and proactively monitor portfolio health. This data-first methodology, central to Visbanking’s platform, transforms C&I lending from a traditional practice into a quantifiable competitive advantage. See how you measure up: analyze your bank's C&I performance and benchmark against peers.

Profiling The C&I Borrower And Loan Products

Superior C&I lending requires structuring the precise financial instrument a borrower needs to execute its strategy. The C&I landscape is vast, ranging from a regional manufacturer requiring a $500,000 line of credit for seasonal inventory to a national logistics firm seeking a $20 million term loan to expand its vehicle fleet.

Each business presents a unique credit profile. A software company's financials, with its recurring revenue and intangible assets, bear no resemblance to those of a construction contractor, which must finance heavy equipment and labor long before project revenues are realized.

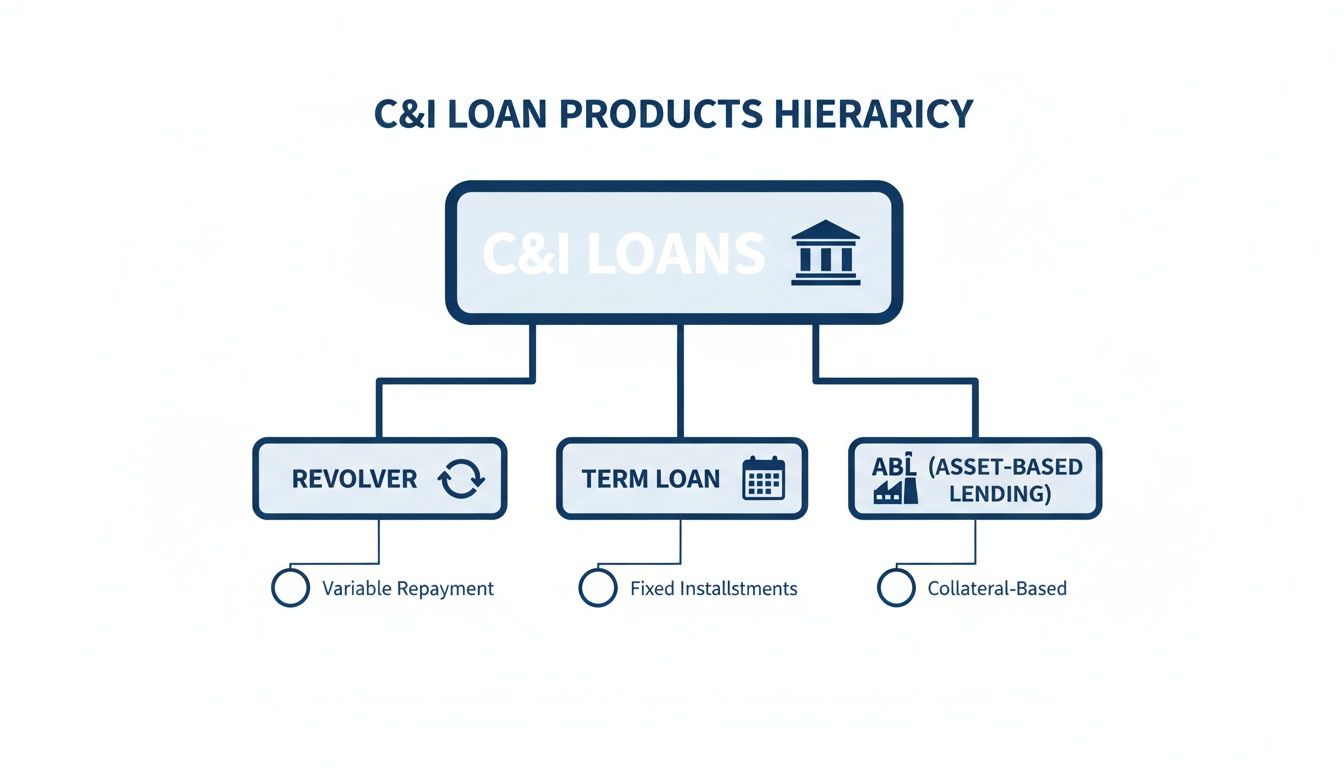

Common C&I Loan Structures

A commercial banker’s mandate is to match the correct loan product to the business's strategic objective, providing capital that fuels growth without imposing undue constraints.

Three primary structures form the core of most C&I portfolios:

- Revolving Lines of Credit: This facility provides flexible, on-demand access to capital up to a predetermined limit. It is the ideal instrument for managing working capital fluctuations, such as funding inventory purchases or bridging accounts receivable cycles. Companies pay interest only on the drawn amount, making it an efficient liquidity management tool.

- Term Loans: This is a lump-sum disbursement repaid over a fixed period with a predictable amortization schedule. Term loans are designed for specific, long-term capital investments—acquiring mission-critical machinery, financing a facility expansion, or funding a strategic acquisition. The fixed payment structure enables confident long-range financial planning.

- Asset-Based Lending (ABL): A specialized form of revolving credit, ABL facilities are secured by a company's most liquid current assets, typically accounts receivable and inventory. The available credit—the "borrowing base"—fluctuates directly with the value of this collateral. ABL is an optimal solution for distributors, manufacturers, and wholesalers with significant capital tied up in current assets.

Matching Products To Business Objectives

The critical skill is structuring the right facility for the right purpose. A mismatch between loan structure and business need creates risk for both the bank and the client. Funding a five-year equipment purchase with a one-year line of credit, for example, creates a dangerous asset-liability mismatch that can destabilize an otherwise healthy business.

A strategic approach aligns the financing instrument with its objective:

A high-growth SaaS company secures a $3 million revolver based on a multiple of its monthly recurring revenue (MRR) to manage payroll and sales commissions. Simultaneously, it obtains a $1.5 million term loan to finance the build-out of its data center. This dual structure provides operational flexibility for daily needs while supporting its long-term infrastructure investment.

This is where data intelligence provides a decisive advantage. Platforms like Visbanking empower relationship managers to identify companies exhibiting clear financing triggers. A recent UCC filing signals a potential equipment purchase—an ideal entry point for a competitive term loan offering. Industry data showing supply chain delays points to businesses that could immediately benefit from an ABL facility to manage rising inventory costs.

This data-driven approach shifts relationship management from reactive to proactive. By understanding a prospect’s needs before the first conversation, your team can present a solution that directly addresses their most pressing challenges.

Common C&I Loan Products And Their Business Use Cases

| Product Type | Typical Borrower Profile | Primary Business Use Case | Example Loan Size |

|---|---|---|---|

| Revolving Line of Credit | Businesses with seasonal sales cycles or fluctuating working capital needs, such as wholesalers or service firms. | Managing inventory levels, funding accounts receivable, and covering short-term operational expenses. | $250,000 to $5 million |

| Term Loan | Companies making significant capital expenditures, including manufacturers, transportation companies, and healthcare providers. | Purchasing heavy machinery, expanding physical facilities, or financing a strategic business acquisition. | $1 million to $25 million+ |

| Asset-Based Lending (ABL) | Distributors, manufacturers, and importers with high volumes of accounts receivable and inventory. | Unlocking working capital tied up in current assets to support rapid growth or manage uneven cash flow. | $5 million to $50 million+ |

The ability to win and retain high-quality C&I clients depends on serving as a strategic financial advisor. The foundation is mastering the product toolkit and using data to identify the right opportunities. Begin by analyzing your bank’s C&I loan concentrations to identify strengths and uncover your next growth opportunity.

C&I Underwriting And Credit Risk Management

Disciplined C&I lending is a continuous exercise in balancing opportunity with risk management. While the ‘Five Cs of Credit’ remain a valid framework, today’s market demands a more rigorous, analytical approach. For bank executives, the directive is to cultivate a credit culture where every decision is underpinned by quantitative data, not just qualitative judgment.

The foundation of any sound C&I credit decision is a forensic analysis of the borrower's financials. One must look beyond surface-level figures to understand the operational health, strategic execution, and repayment capacity of the business.

Core Financial Metrics for Underwriting

Three categories of financial metrics are non-negotiable in C&I underwriting. Each provides a distinct perspective on a borrower’s ability to service its debt.

- Cash Flow and Repayment Capacity: The Debt Service Coverage Ratio (DSCR) is the primary metric, measuring a company's ability to cover its debt payments from operating cash flow. A sustained DSCR below 1.0x indicates insufficient cash generation to meet obligations.

- Leverage: Ratios such as Debt-to-EBITDA and Debt-to-Equity quantify a company's reliance on borrowed capital. High leverage amplifies risk during economic downturns, significantly increasing the probability of default.

- Liquidity: Working capital and the Current Ratio assess a company's ability to meet its short-term obligations. A sharp decline in working capital can signal operational distress, such as unsalable inventory or deteriorating accounts receivable.

A well-managed manufacturing company should consistently maintain a DSCR above 1.25x. This 25% cash flow buffer demonstrates the financial resilience to absorb unforeseen expenses or a temporary revenue decline without threatening debt service capacity.

The different C&I loan products are all structured to meet very specific business needs, from day-to-day cash flow to big-picture investments.

While loan structures vary, their shared objective is to align perfectly with a specific corporate purpose, whether managing daily operations or financing a strategic expansion.

Covenants as an Early-Warning System

Loan covenants are not merely protective clauses; they are proactive risk monitoring tools. Well-structured financial covenants—such as maintaining a minimum DSCR or a maximum Debt-to-EBITDA ratio—function as tripwires. A covenant breach is not an automatic trigger for default but rather a contractual mechanism to compel a conversation with management. It provides a formal opportunity to diagnose underlying issues and collaborate on a resolution, transforming the lender-borrower relationship from transactional to consultative.

Benchmarking Portfolio Risk Against Peers

Individual loan underwriting is only part of the equation. Bank executives must continually assess the aggregate risk of the entire C&I portfolio. How do your delinquency and charge-off rates compare to a relevant peer group? This question is unanswerable without accurate, comparative data.

According to recent FDIC data, C&I loan delinquencies are currently ranging between 0.91% and 1.59%, with net charge-offs between 0.22% and 0.74%. These figures reflect a broad tightening of credit standards and economic headwinds for certain sectors. For a complete analysis, review the FDIC's complete quarterly banking profile.

Knowing where your bank stands is critical. A charge-off rate consistently above your peer average may indicate overly aggressive underwriting. Conversely, a rate significantly below the average could signal an overly restrictive credit box, causing you to lose profitable, well-structured deals to competitors. These risk metrics directly impact your P&L and your required allowance for credit losses.

Data intelligence platforms like Visbanking provide the necessary context, aggregating regulatory data to deliver a clear, comparative view. This enables leadership to ensure underwriting is both disciplined and competitive, building a C&I portfolio that drives sustainable profitability. Benchmark your bank’s performance against its peers to identify your competitive edge.

Navigating The Competitive And Regulatory Landscape

C&I lending operates at the intersection of stringent regulatory oversight and intense market competition. Bank leaders must navigate this dual challenge to build a portfolio that is both compliant and profitable. Success requires a holistic strategy that integrates regulatory imperatives with competitive realities.

The Regulatory Gauntlet: Concentration And Scrutiny

Federal regulators—the OCC, FDIC, and Federal Reserve—monitor C&I portfolios for risk concentrations with increasing intensity. As a bank’s exposure to a specific industry, geography, or collateral type grows, so do regulatory expectations for sophisticated risk management and capital planning. Scrutiny is directly proportional to risk. A heavy concentration in a volatile sector like transportation or speculative commercial development will trigger deeper examiner inquiry. Regulators will demand robust stress testing to demonstrate that the bank’s capital is sufficient to absorb losses in a severe downturn.

Regulators expect active management of concentration risk, not just identification. This requires establishing clear internal limits, conducting forward-looking stress tests, and ensuring the board of directors fully understands the portfolio’s vulnerabilities.

Failure to manage concentration risk can lead to supervisory actions, mandatory capital surcharges, and significant reputational damage. This is a matter of institutional stability, not just regulatory compliance.

The Competitive Battlefield: Banks, Non-Banks, And Private Credit

While regulators define the boundaries, the competitive arena determines profitability. Community and regional banks now compete against a diverse set of well-capitalized players:

- Non-Bank Lenders: Fintech firms leverage digital platforms to underwrite and fund smaller C&I loans with a speed that traditional banks often cannot match.

- Private Credit Funds: These funds have become dominant forces in middle-market lending, offering highly customized and flexible financing structures that fall outside conventional bank credit policies.

This competition compresses pricing and loosens terms. In a competitive market, it is not unusual to see spread compression of 15 to 25 basis points on high-quality middle-market credits. For example, a regional bank could lose a $10 million term loan for a prime manufacturing client to a private credit fund that can close two weeks faster and offer a more flexible covenant package. This represents not just a lost transaction, but a lost relationship and its ancillary revenue streams.

To compete effectively, banks must weaponize data. By integrating proprietary portfolio data with external market intelligence, leadership can identify underserved market niches, analyze competitor strategies, and refine pricing models. Platforms like Visbanking provide this critical context, transforming raw regulatory data into a competitive roadmap. Knowing precisely how your loan yields and risk profile compare to your peers enables you to make strategic decisions that protect margins and win the right C&I business. Benchmark against your peers today to see where you stand.

Using Actionable Intelligence To Win C&I Business

The passive, relationship-based model of C&I lending is obsolete. Growth now belongs to banks that proactively use data signals to identify opportunities before competitors are even aware a need exists. This approach does not replace relationship banking; it supercharges it. By equipping relationship managers with timely, relevant intelligence, every client interaction becomes more valuable. The modern strategy for winning C&I business is built on actionable intelligence—spotting specific data triggers that identify companies with an immediate need for capital.

Identifying High-Value Prospecting Triggers

Responding to a formal RFP means you are already competing on price and terms set by others. Proactive growth comes from identifying signals that a financing event is imminent. These data triggers are leading indicators of a capital need:

- UCC Filings: A new Uniform Commercial Code filing is a clear indicator of a recent asset purchase or a new credit relationship. This is a prime opportunity to engage with a competitive term loan or refinancing offer.

- Merger and Acquisition Activity: M&A events create immediate financing needs, from acquisition debt for the buyer to working capital lines for the newly combined entity.

- Key Executive Hires: The appointment of a new CFO or CEO, particularly one with a track record of growth, often precedes a new strategic plan that requires fresh capital.

- Supply Chain Disruptions: Industry-level data showing supply chain stress indicates that businesses in that sector are likely struggling with elevated inventory costs and strained cash flow—a perfect opening for an ABL or line of credit discussion.

Systematically tracking these signals allows your business development team to build a pipeline of qualified, high-intent prospects, focusing resources where they will generate the highest return.

A Data-Driven Workflow In Action

Imagine a relationship manager starting their week not with a list of cold calls, but with a dashboard of data-vetted opportunities.

This is how an intelligence-driven workflow operates:

- Spot the Signal: An RM uses a prospecting tool to identify manufacturers in their territory with a new UCC lien filed for machinery within the past 60 days.

- Vet the Company: The platform flags a mid-sized metal fabricator whose incumbent lender is a large, national bank known for slower service.

- Identify the Decision-Maker: The RM instantly accesses direct contact information for the company’s CFO.

- Execute an Informed Outreach: The banker calls the CFO, referencing the recent equipment purchase and offering to discuss a more efficient term loan structure to free up capital for their next strategic investment.

The conversation begins from a position of knowledge and relevance. The banker is positioned as a proactive advisor, not a generic salesperson. This transforms prospecting from a volume game into a strategic, high-precision exercise.

The objective is to shift from asking, "Who can we call?" to answering, "Who needs our capital right now, and why?" Actionable intelligence provides the answer.

From Raw Data To Decisive Action

The challenge for most banks is not a lack of data, but the fragmentation of that data across disparate systems. A true bank intelligence platform synthesizes these sources—call reports, UCC filings, market news—into a single, coherent signal.

Within Visbanking’s Prospect App, for example, a lender can see not only a target company’s financing triggers but also which competitors have existing relationships, providing the context needed to structure a superior offer.

This level of insight is what separates market leaders from the rest of the pack. You can learn more about this approach in our guide to business banking prospecting software. Integrating this intelligence into daily workflows is the definitive path to building a C&I portfolio that delivers consistent, profitable growth.

The Future Is Data-Driven C&I Lending

The fundamental purpose of C&I lending remains unchanged: finance business growth while managing institutional risk. However, the tools required to execute this mission have been revolutionized. The banks that will lead the next decade are those that master the flow of data, transforming it from a passive reporting tool into an active driver of strategic decisions.

This requires moving beyond static quarterly reports and legacy processes. It means arming your lending teams with real-time intelligence to underwrite with greater confidence, identify risks before they materialize, and target the best prospects with precision. A trusted relationship remains essential, but the speed and accuracy of data-driven insights will ultimately win the deal.

Redefining Your Competitive Edge

In the crowded C&I market, banks can either compete on the same terms as everyone else or change the terms of competition. Forward-thinking institutions are choosing the latter, using unified intelligence platforms to gain an objective, holistic view of the market. This enables leadership to answer critical strategic questions with speed and certainty:

- Performance: How does our C&I portfolio’s yield and risk profile truly compare against our top five local competitors?

- Opportunity: Which specific industries in our footprint are exhibiting the strongest demand for credit right now?

- Efficiency: How do we identify and engage the most profitable borrowers before our competition knows they are in the market?

The future of C&I lending belongs to the banks that can answer these questions faster and more accurately than their rivals. This is the new metric of success.

By integrating live market signals with proprietary performance data, your bank can uncover opportunities others miss, build a more resilient C&I portfolio, and drive superior, risk-adjusted returns.

The next step is to see this data in action. Benchmark your bank's performance against its peers and discover where your true competitive advantage lies.

C&I Lending FAQs

Even for seasoned executives, refining a C&I lending strategy prompts critical questions. Here are concise answers to common inquiries from bank leadership.

What Is The Definitive Difference Between C&I And Commercial Real Estate Lending?

The primary distinction is the source of repayment. For a C&I loan, repayment is generated by the operating cash flow of the business. The loan finances assets like inventory, equipment, or working capital, and the bank’s underwriting is a bet on the company’s core operational profitability.

In Commercial Real Estate (CRE) lending, the loan is secured by a physical property, and repayment is expected from the asset's rental income or proceeds from its sale. The viability of the tenant is a factor, but the performance of the underlying real estate asset is the primary consideration.

How Do The Best-Performing Banks Monitor Their C&I Loans Post-Closing?

Top-quartile banks combine traditional diligence with modern intelligence. Routine review of financial statements and covenant compliance remains fundamental. However, the competitive edge comes from augmenting this with external data monitoring. This includes tracking industry-level economic shifts, supply chain stress indicators, and public record data like new UCC filings from competing lenders. These external signals often provide an earlier warning of potential credit deterioration than a borrower’s quarterly financials.

How Can We Effectively Compete With Non-Bank And Private Credit Lenders?

Banks win by leveraging their inherent strengths—stable, low-cost capital, established client relationships, and a full suite of treasury and wealth management services—while adopting the speed and data-driven approach of their new competitors. The key is to neutralize their speed advantage. By implementing data intelligence tools to accelerate prospect identification and streamline underwriting, your bank can deliver term sheets faster. This combines the agility of a fintech with the stability and holistic value proposition that the best corporate clients demand.

Which Metrics Should A C&I Portfolio Manager Prioritize?

An effective C&I portfolio manager must maintain a dual focus on risk and profitability. The most critical metrics include:

- Risk Indicators: Portfolio-wide delinquency and charge-off rates, benchmarked continuously against a curated peer group. Concentration risk must be monitored by industry (NAICS code), geography, and loan type.

- Profitability Metrics: The portfolio’s net interest margin (NIM) and overall loan yield are crucial measures of return.

- The Ultimate Metric: Risk-Adjusted Return on Capital (RAROC). This metric synthesizes risk and return to determine if the portfolio is generating sufficient profit to compensate for the credit risks being assumed.

Ready to move from analysis to action? Visbanking provides the unified intelligence to benchmark performance, identify opportunities, and build a winning C&I portfolio. Explore our data and apps today.