A Guide to Allowance for Credit Losses for Bank Executives

Brian's Banking Blog

The allowance for credit losses (ACL) is not an accounting abstraction; it is a direct measure of an institution's foresight and resilience. For a bank's leadership, it represents the calculated reserve against expected future credit losses within the current loan portfolio. A well-managed ACL is a core strategic asset, fundamental to capital adequacy, earnings stability, and the execution of long-term strategy.

The Strategic Importance of the ACL

For bank executives and board members, the allowance for credit losses transcends its function as a balance sheet entry. It is a dynamic indicator of financial health and risk management discipline. In the current economic climate, the ACL's integrity is the foundation of sound banking, directly influencing capital allocation, loan pricing, and stakeholder confidence.

The transition to forward-looking standards like CECL fundamentally altered the nature of the ACL. The calculation evolved from a reactive, history-based exercise to a proactive, predictive discipline. It is no longer sufficient to provision for losses only when they become probable. Leadership must now defend a forecast of lifetime losses, a mandate that requires robust data intelligence and an objective assessment of economic headwinds.

The High Cost of Miscalculation

Underestimating credit risk has severe consequences. The 2007-2009 financial crisis provides a stark reminder.

In the seven years preceding the crisis, U.S. commercial banks expanded loan portfolios by 85%. Concurrently, their credit loss reserves grew by only 21%. This significant disparity between loan growth and risk provisioning left many institutions critically exposed when market conditions deteriorated. The ratio of loan loss reserves to total loans fell to a low of 1.16% in 2006, before surging to over 3.70% by early 2010 as banks rushed to cover escalating defaults. Historical data is available in reports from the Congressional Research Service.

This history underscores a critical truth: a misjudged ACL is a direct threat to an institution's viability and reputation.

An effective Allowance for Credit Losses is not a defensive measure; it is an offensive strategic tool. It informs loan pricing, guides capital allocation, and provides the board with the confidence to pursue growth, even in uncertain economic conditions.

From Compliance Burden to Competitive Intelligence

Treating the ACL as a mere compliance exercise is a significant strategic error. Leading institutions now leverage the allowance process to generate competitive intelligence. The key is deploying high-quality data to move beyond baseline calculations and uncover actionable insights.

A sophisticated ACL process, powered by robust data tools, enables executives to:

- Benchmark performance against peer institutions to validate assumptions and identify strategic outliers.

- Stress-test portfolios against various economic scenarios to uncover hidden vulnerabilities before they materialize.

- Communicate the bank's risk posture with clarity and authority to the board, regulators, and investors.

Mastering the ACL means converting a regulatory requirement into a strategic advantage. By benchmarking provisioning levels and methodologies, an institution can ensure it is not merely compliant, but optimally positioned for intelligent, sustainable growth.

See how your bank’s ACL stacks up against the competition with Visbanking’s comprehensive data tools.

Navigating the CECL Standard

The Current Expected Credit Loss (CECL) standard represents a fundamental shift in risk management, replacing the rearview mirror of incurred losses with a forward-looking perspective. It has transformed the allowance for credit losses from a passive reserve into an active forecast that directly shapes strategic decision-making.

Under the legacy "incurred loss" model, banks established reserves only when a loss was deemed "probable." This reactive approach meant that provisions often lagged behind deteriorating economic conditions, as was evident during the 2008 financial crisis.

The Forward-Looking Mandate of CECL

CECL requires banks to estimate lifetime expected losses at the moment of loan origination. This forward-looking mandate eliminates the practice of waiting for clear signs of impairment.

The ACL process must now integrate economic forecasts—unemployment rates, interest rate movements, real estate values, and other relevant factors. Consider a $50 million commercial real estate portfolio:

- Incurred Loss Model: The bank might reserve $500,000 (1.0%) based on historical charge-off rates.

- CECL Model: If forecasts predict rising vacancy rates and a slowing economy, the bank's model might require an initial ACL of $750,000 (1.5%) to account for expected lifetime losses. This $250,000 difference is a direct result of the forward-looking requirement.

CECL transforms the allowance for credit losses from an accounting entry into a strategic forecast. Defending this forecast requires robust data, clear methodologies, and a forward-looking view of risk that permeates the entire organization.

Initial concerns suggested CECL might constrain lending during economic downturns. However, research from the Federal Reserve indicates it may actually smooth lending cycles over time by encouraging more disciplined provisioning during periods of growth. Read more about the Federal Reserve's findings on CECL's impact on bank lending.

Strategic Implications for Bank Executives

CECL's influence extends far beyond the finance department, impacting core strategic functions.

Key areas of impact include:

- Capital Planning: Higher initial provisions under CECL can directly affect regulatory capital ratios. This necessitates tighter integration between the ACL process and capital planning, requiring more sophisticated bank stress testing models.

- Loan Pricing: Lifetime loss expectations must be incorporated into loan pricing from inception. The required upfront reserve for a 10-year commercial loan will differ significantly from that of a 5-year loan, directly impacting profitability margins.

- M&A Due Diligence: Acquiring another institution now involves inheriting a loan portfolio with embedded lifetime loss estimates. Acquirers must conduct rigorous due diligence on the target's CECL methodology, assumptions, and data integrity.

CECL compels banks to anticipate and provision for risk proactively. This requires an ACL process that is compliant, transparent, and—most importantly—defensible. Access to comprehensive peer and macroeconomic data is essential for validating internal assumptions and building a resilient forecast.

ACL Calculation Methodologies: A Leadership Primer

The calculation of the allowance for credit losses under CECL is a data-intensive discipline requiring a blend of historical performance, current conditions, and supportable economic forecasts. For executives and directors, understanding these methodologies is essential for challenging assumptions and ensuring the bank's ACL is both adequate and strategically sound.

There is no single prescribed formula; the chosen methodology must align with the portfolio's characteristics and the quality of available data.

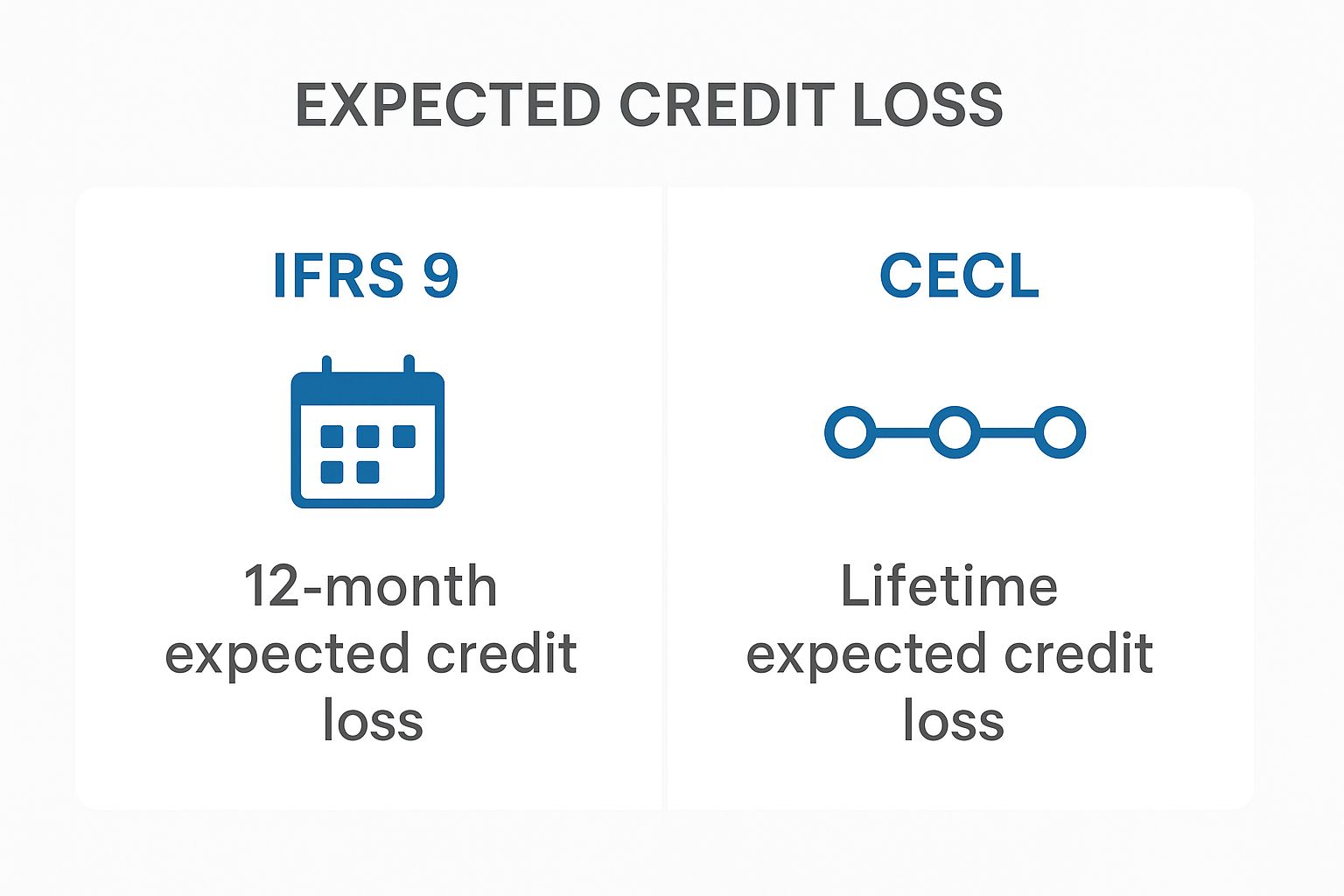

The critical shift is from a retrospective to a prospective view of risk. The following infographic highlights the fundamental difference between the IFRS 9 standard and the U.S. CECL standard, emphasizing CECL's comprehensive lifetime loss approach from day one.

CECL's requirement to estimate losses over the entire life of an asset upon origination is a significantly more demanding standard than the 12-month window used in other frameworks for assets that have not shown significant credit deterioration.

Core Methodologies in Practice

While numerous models exist, they generally fall into a few primary categories. The selection of a methodology is a strategic decision that directly impacts the accuracy of the ACL and the resources required for its maintenance.

This table provides a high-level overview of the most common CECL calculation methodologies.

Comparison of Key CECL Calculation Methodologies

| Methodology | Core Principle | Primary Data Needs | Best Suited For |

|---|---|---|---|

| Loss-Rate Methods | Applies historical loss rates (e.g., vintage analysis), adjusted for forecasts. | Extensive, stable historical loan performance data. | Homogenous portfolios like auto loans or credit cards. |

| PD / LGD | Estimates Probability of Default (PD) and Loss Given Default (LGD) for each loan. | Detailed borrower risk data, collateral values, economic variables. | Complex commercial portfolios with significant individual risk. |

| Discounted Cash Flow | Projects and discounts future loan cash flows to determine the expected loss. | Loan-specific cash flow projections and appropriate discount rates. | Individual credit-impaired assets or loans with unique structures. |

Each model offers a distinct perspective on risk. The strategic imperative is to select the one that most accurately reflects the characteristics of the loan portfolio.

Application: A CRE Portfolio Example

Consider a community bank with a $100 million commercial real estate (CRE) portfolio. Simply applying its historical charge-off rate of 0.5% is insufficient under CECL. The forecast must be built with greater rigor.

A defensible ACL is constructed in layers:

- Layer 1: Historical Loss Data: The bank analyzes its own historical performance on CRE loans, segmented by property type (e.g., office vs. retail) and geography.

- Layer 2: Current Conditions & Qualitative Factors: Management incorporates current market intelligence. If local office vacancy rates have increased from 10% to 15% over the past year, the historical loss rate for that segment must be adjusted upward, with clear documentation justifying the change.

- Layer 3: Reasonable & Supportable Forecasts: The bank incorporates forward-looking economic data. If consensus forecasts predict rising unemployment and declining property values over the next 18 months, these variables must be integrated into the model, likely increasing the required allowance.

A defensible ACL is not based on a single data point. It is the product of a methodical synthesis of internal history, real-time market intelligence, and credible economic forecasts. The board's responsibility is to challenge these inputs to ensure they are reasonable, well-documented, and consistently applied.

Manual data aggregation for this process is inefficient and introduces significant risk of error. Modern data platforms are essential for success. Effective financial reporting automation integrates internal and external data feeds, ensuring the ACL calculation is both accurate and auditable. When executed correctly, the ACL is transformed from a regulatory burden into a powerful strategic instrument.

Connecting the ACL to Boardroom Decisions

The allowance for credit losses (ACL) should not be viewed as an operational detail confined to the finance department. For directors and senior executives, it is a critical strategic lever with a direct and material impact on key performance indicators and enterprise-level decisions.

Every adjustment to the ACL has immediate consequences for a bank's financial statements, influencing profitability, capital adequacy, and the capacity for growth.

The Direct Impact on Net Income

The most direct link between the ACL and financial performance is the provision for credit losses. This income statement expense is the mechanism for adjusting the ACL on the balance sheet. When economic forecasts worsen or portfolio risk increases, the provision must rise, directly reducing pre-tax income.

Consider this practical scenario:

- A mid-sized bank with $4 billion in assets initially forecasts a $25 million annual provision for credit losses.

- Mid-year, signs of economic stress emerge, particularly within its commercial real estate portfolio. A reassessment is required.

- The updated model revises the necessary provision upward by $10 million to a new total of $35 million.

This $10 million increase directly reduces pre-tax profit. If the bank's annual net income target was $40 million, this single adjustment represents a 25% reduction, impacting earnings per share and shareholder returns.

The question for the board is not just what the provision is, but why. A defensible, data-driven narrative is required to explain these changes to investors and regulators.

This dynamic was amplified by the adoption of CECL. Data from the National Credit Union Administration, for example, showed a $3.8 billion (41.4%) annual increase in the provision for loan and lease losses following the implementation of the new standard, as detailed in the NCUA's quarterly data summary.

Guarding Regulatory Capital and Lending Capacity

The ACL serves as the first line of defense against loan defaults and is a key component in the assessment of regulatory capital. An insufficient ACL signals weak risk management and can trigger regulatory actions, including capital directives that restrict growth.

Conversely, an overly conservative allowance, while seemingly prudent, creates a strategic drag. It unnecessarily suppresses reported earnings and ties up capital that could be deployed for profitable lending or returned to shareholders.

Leadership must navigate this balance, maintaining an ACL that is both prudent and efficient—sufficient to absorb expected losses without unduly constraining strategic objectives.

Asking the Right Questions in the Boardroom

Effective governance requires directors to move beyond passive acceptance of the final ACL figure. The board must actively challenge the underlying assumptions, a task that is impossible without access to reliable data.

Key questions for the board include:

- How does our ACL align with our stated risk appetite? An institution pursuing higher-yield, higher-risk lending should expect to maintain a proportionally larger ACL than a more conservative peer.

- How do our provision expense and ACL coverage ratio compare to our peers? Being an outlier is not inherently negative, but it demands a compelling, data-supported explanation.

- Are our economic forecasts reasonable and aligned with our strategic plan? The assumptions driving the ACL must be consistent with those used for capital planning and growth projections.

Answering these questions requires robust intelligence on internal performance and external market conditions. A platform like Visbanking provides the essential peer benchmarks and market data to contextualize a bank's ACL. By comparing allowance levels against a curated peer group, the board can validate internal models and make informed, data-driven decisions with confidence.

Leveraging Data Intelligence for a Superior ACL Process

Under the CECL standard, the quality of a bank's allowance for credit losses (ACL) directly reflects the sophistication of its data and analytical capabilities. Reliance on manual spreadsheets and siloed information is no longer a viable operating model; it is a significant institutional risk. Forward-thinking banks recognize that a modern data intelligence framework is a powerful competitive advantage.

The right data platform transforms the ACL from a reactive, compliance-driven calculation into a proactive strategic tool that informs high-level decision-making.

Benchmarking Against Relevant Peers

An ACL developed in isolation lacks a critical component: external validation. Without benchmarking against institutions with similar business models and risk profiles, a bank cannot objectively assess the reasonability of its own assumptions.

Data intelligence platforms provide access to aggregated, anonymized peer data, offering an essential reality check. For example, a $3 billion institution with a significant multifamily lending portfolio models an expected loss rate of 0.75%. A data platform reveals that the median for a comparable peer group is 0.60%. This 15-basis-point variance prompts critical questions:

- Is our portfolio demonstrably riskier than our peers'?

- Are our economic forecasts more pessimistic?

- Is there a potential calibration issue within our model?

This external perspective is invaluable for challenging internal assumptions and defending the ACL to the board and regulators.

Integrating Dynamic Economic Data

CECL requires the integration of "reasonable and supportable forecasts." However, sourcing, validating, and integrating macroeconomic data—such as unemployment projections, GDP growth, and commercial property indices—is a complex task. Many ACL models falter by using static or overly simplified economic inputs.

A modern data framework automates this process, seamlessly feeding relevant macroeconomic variables into ACL models and enabling robust scenario analysis. Executives can instantly quantify the potential impact of a 1% rise in unemployment on consumer loan portfolios or a decline in office property values on CRE concentrations. This capability elevates the ACL from a static figure to a dynamic risk management instrument. A strong bank data governance program ensures these external inputs are managed with the same rigor as internal data.

Translating Complexity into Clarity for Executive Action

The most sophisticated ACL model is ineffective if its outputs cannot be clearly understood by the board. Directors must be able to grasp the key drivers of the allowance and its strategic implications.

Data intelligence acts as the bridge between complex analytics and executive decision-making. It transforms intricate model outputs into clear, intuitive dashboards that visualize key trends, peer comparisons, and portfolio vulnerabilities.

Instead of dense spreadsheets, leadership receives a concise chart benchmarking the ACL coverage ratio against peers, or a heat map identifying risk concentrations. This shifts the boardroom conversation from methodological details to strategic consequences, empowering leadership to act decisively with data-backed confidence.

To benchmark your institution's allowance for credit losses, explore how Visbanking’s peer analysis tools can deliver the clarity and context your board requires.

The ACL as a Competitive Differentiator

Managing the allowance for credit losses has historically been viewed as a compliance function. This perspective is now obsolete. In the current banking environment, mastery of the ACL is a distinct competitive advantage.

Institutions that invest in data, refine their methodologies, and embed the ACL process into their strategic framework can price risk more accurately, allocate capital more efficiently, and navigate economic volatility with greater confidence.

The primary takeaway for executives is this: the ACL is not a static accounting entry but a dynamic barometer of institutional health and a critical input for strategic planning. This requires a commitment to data infrastructure and a culture where data-driven risk assessment informs every significant decision. The ACL process cannot be siloed; it must be integral to conversations about capital management, loan pricing, and M&A strategy.

When the ACL process is fueled by robust data and contextualized with peer benchmarks, it ceases to be an obligation and becomes a driver of performance. The guiding question evolves from, "Are we compliant?" to "Where is the opportunity?"

Consider a bank evaluating expansion into a new lending market. A static, backward-looking ACL provides no insight into the potential risks. However, an ACL process informed by benchmark data on peer performance in that specific market offers a data-driven preview of potential credit costs. This intelligence enables the bank to set risk-adjusted pricing and establish realistic performance targets from the outset.

With clear, benchmarked insights, the allowance for credit losses becomes an engine for intelligent growth. It begins with a precise understanding of your position relative to the competition.

Benchmark your institution’s ACL with Visbanking’s peer analysis tools. Gain the intelligence needed to act with confidence.

Frequently Asked Questions

A firm grasp of the allowance for credit losses is non-negotiable for bank leadership. It is a cornerstone of institutional strategy. The following provides direct answers to common questions raised in the boardroom.

How Does the Allowance for Credit Losses Differ from Charge-Offs?

The allowance is a forecast; a charge-off is a historical event. They are related but distinct concepts.

The Allowance for Credit Losses (ACL) is a balance sheet reserve representing the best estimate of future credit losses expected from the current loan portfolio. It is a proactive provision based on models and economic forecasts.

A charge-off is a reactive accounting action. It occurs when a specific loan is deemed uncollectible and is removed from the balance sheet. This action reduces the ACL reserve. The expense recorded on the income statement to replenish the allowance is the "provision for credit losses."

What Is the Board’s Primary Responsibility in ACL Oversight?

The board's role is not to perform calculations but to provide effective governance and credible challenge to management's proposals.

This responsibility centers on three key duties:

- Methodology Approval: Ensure the bank employs a sound, well-documented process for calculating the allowance.

- Assumption Scrutiny: Challenge the economic forecasts and qualitative factors used in the model. Are they reasonable and consistent with the bank's strategic plan?

- Control Verification: Confirm that robust internal controls governing the ACL data and calculations are in place and are tested regularly.

A director’s most effective tool is incisive questioning. How does our allowance compare to our peers? Are our assumptions aligned with industry consensus? Answering these requires access to reliable external data.

The board’s role is not merely to approve a number. It is to ensure the ACL is a well-defended estimate that accurately reflects the bank’s risk profile and can withstand scrutiny from auditors and regulators.

Can Our Bank Change Its ACL Methodology?

Yes, but any change must be driven by a sound business reason, not by a desire to achieve a particular accounting outcome. A change in methodology should be a deliberate, strategic decision.

Justification for a change may include a significant shift in portfolio composition, the availability of higher-quality data, or the adoption of a more accurate modeling technique.

Regulators will closely scrutinize any change, particularly if it is frequent or poorly documented. The rationale must be robust, formally approved, and clearly demonstrate how the new method provides a more precise estimate of expected losses. Consistency is paramount.

Transform your allowance for credit losses from a regulatory requirement into a strategic asset. With Visbanking, you can benchmark your ACL methodology, assumptions, and coverage ratios against a curated peer group. Equip your board with the context to move from estimation to confident, data-driven decision-making.

Explore the Visbanking platform and discover how comparative data can provide a decisive strategic edge.

Similar Articles

Visbanking Blog

CFPB: Borrowers Entitled to Explanation for Credit Denial, Even if Credit Decisions are Based on Complex Algorithms

Visbanking Blog

OCC to Cut Bank Assessment Fees by 40% in 2023

Visbanking Blog

<strong>For Credit Suisse, Many Months of Chaos and Uncertainty Leave it in Market Spotlight</strong>

Visbanking Blog

Unveiling the US Banks Credit Quality Chart on VisBanking Report Portal

Visbanking Blog

Make More Informed Decisions with BIAS, the Data-Driven Banking Solution

Visbanking Blog

JD Power Study Finds Decline in Credit Card Spending

Visbanking Blog

Bank Capital Requirements: The Ultimate Survival Guide

Visbanking Blog

Make Better Decisions with Confidence with BIAS, the Tailored Strategies Solution

Visbanking Blog

BIAS: Pioneering the Future of Banking Analysis

Visbanking Blog