Estimated reading time: 4 minutes

Table of contents

Introduction

In the intricate world of finance, the stability and success of a bank rely heavily on its assets and liabilities management. These elements are at the heart of a bank’s operations, reflecting its financial health, risk exposure, and ability to meet obligations. In this blog post, we will embark on a journey to understand the nuanced interplay between bank assets and liabilities, shedding light on their significance and impact.

The Significance of Bank Assets and Liabilities

Bank assets and liabilities are the core components of a bank’s balance sheet, which serves as a snapshot of its financial condition at a specific point in time. Assets encompass everything a bank owns or controls, including cash, loans, investments, and physical assets. On the other side of the balance sheet, liabilities represent a bank’s obligations, such as deposits, loans from other financial institutions, and other debts.

Asset Categories and Their Impact

Banks typically categorize their assets into different groups based on their liquidity, risk, and return profiles. Cash and cash equivalents, including reserves held at central banks, fall under the most liquid category. These assets provide the necessary liquidity to meet day-to-day obligations and sudden withdrawals from customers. As we move along the liquidity spectrum, we encounter marketable securities, which are short-term investments that offer a balance between liquidity and return.

Loans and advances form a significant portion of a bank’s assets. They can range from mortgages to commercial loans. While they offer the potential for higher returns, they also carry higher risks, especially during economic downturns.

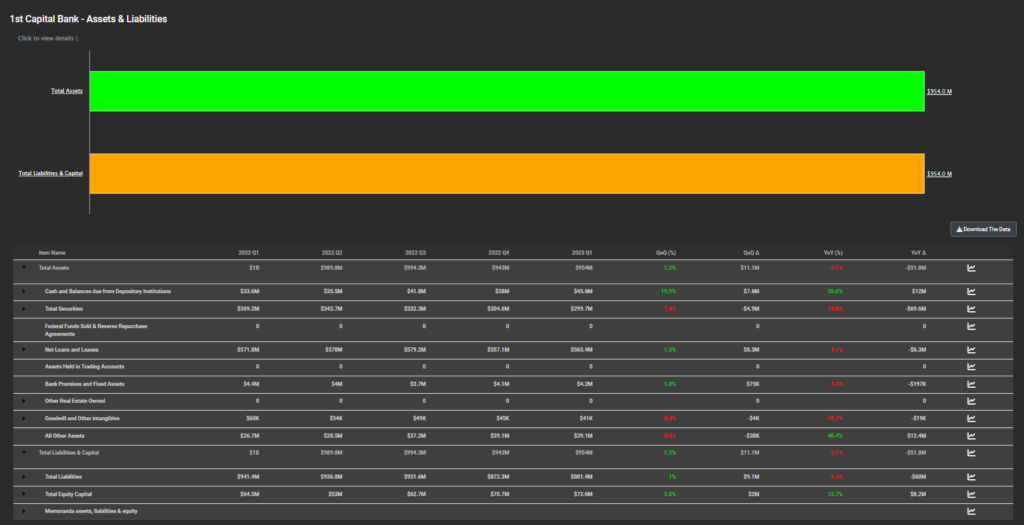

You can see this data in the “Bank Assets and Liabilities” section in the Visbanking Application:

Liabilities: The Funding Sources

Liabilities, on the other hand, represent the sources of funding for a bank’s assets. Deposits from customers, both individuals and businesses, form a substantial portion of a bank’s liabilities. These deposits are crucial for a bank’s day-to-day operations and lending activities.

Another significant liability category is borrowed funds from other financial institutions. Banks often borrow funds to manage short-term liquidity needs or to take advantage of investment opportunities.

Balancing Act: The Importance of Asset-Liability Management

Effective management of bank assets and liabilities is a delicate balancing act that influences a bank’s profitability, risk exposure, and overall stability. Asset-liability management (ALM) involves strategies to match the maturity, interest rate, and liquidity of assets and liabilities. By doing so, banks can mitigate risks arising from changes in interest rates and ensure that they have enough liquidity to meet their obligations.

Interest Rate Risk and ALM

One of the most significant challenges banks face is interest rate risk. If a bank’s assets and liabilities have different maturities, changes in interest rates can lead to a situation where the interest earned on assets doesn’t cover the interest paid on liabilities. ALM strategies focus on minimizing this risk by ensuring that the interest rate characteristics of assets and liabilities are aligned.

Conclusion

In the complex landscape of banking, the management of assets and liabilities is pivotal. It not only impacts a bank’s financial health and stability but also its ability to navigate economic fluctuations. By understanding the intricate relationship between these elements, banks can make informed decisions to optimize their operations and enhance their resilience in a dynamic financial environment.

As we conclude this exploration of bank assets and liabilities, we invite you to delve deeper into this fundamental aspect of banking on Visbanking’s Banking Report Portal. Understanding the core principles of assets and liabilities is a vital step towards comprehending the broader financial ecosystem.

Prepared and Developed by Muhammed Gorkem Kilic