The Relationship Manager Prospecting Tool: A Data-Driven Mandate for Growth

Brian's Banking Blog

A modern relationship manager prospecting tool is not simply a CRM; it is a data intelligence engine. Its purpose is to systematically identify and qualify high-value commercial banking opportunities with precision, enabling relationship managers (RMs) to act on market signals before the competition.

This approach replaces anecdotal referrals and intuition with a data-driven framework for growth. It equips your RMs to engage the right prospect at the right time, armed with insights that demonstrate a clear understanding of their business needs. For any financial institution serious about expanding its commercial portfolio, this is no longer an optional upgrade—it is a strategic necessity.

Moving Beyond Referrals in Commercial Banking

For decades, commercial banking growth was a function of personal networks and established relationships. While valuable, this model is insufficient to drive predictable pipeline growth in today's competitive landscape, which is increasingly populated by non-traditional lenders and fintech challengers.

Sustainable growth requires a proactive, intelligence-led strategy. This transforms your RMs from reactive networkers into strategic advisors who can anticipate client needs. To win business from sophisticated commercial clients, your team must demonstrate a deep understanding of their operations from the first interaction. Waiting for a warm introduction is a defensive posture that concedes the advantage to more agile competitors.

The Shift to Proactive, Data-Driven Prospecting

This is where a dedicated relationship manager prospecting tool fundamentally alters the competitive dynamics. Instead of relying on static call lists, these platforms function as dynamic intelligence hubs, synthesizing disparate data sources into actionable leads.

The practical implications for your team are significant:

- Precision Targeting: Identify companies that match your ideal client profile based on revenue, industry, location, and recent financing activity. For instance, a bank can instantly isolate all manufacturers within a 50-mile radius with annual revenues between $10 million and $50 million.

- Timely Intervention: The system flags trigger events in near real-time. A UCC lien filed for new manufacturing equipment is not just data; it is a direct signal of an immediate financing need, prompting an outreach call that is both relevant and timely.

- Informed Outreach: RMs enter conversations equipped with knowledge of a prospect's existing banking relationships and operational capital needs. A cold call is transformed into a strategic consultation.

This is a market-wide shift. The global sales prospecting tool market is projected to reach approximately USD 5.8 billion by 2025, growing at a compound annual growth rate of 15%. This expansion confirms that data-driven prospecting is the new operational standard, and banking is at the forefront of this evolution.

A purpose-built tool like Visbanking's Prospect empowers your team to stop reacting to market movements and start capitalizing on them. To build effective lead generation strategies for banks, an investment in a dedicated intelligence platform is the critical first step.

What Defines a Powerful Prospecting Platform?

The market is saturated with generic prospecting tools, most of which are little more than digitized contact lists. A high-impact relationship manager prospecting tool is fundamentally different; it is a dynamic intelligence engine engineered to surface qualified opportunities with the necessary business context for immediate action.

The distinction lies in knowing not just who to call, but why and when to engage them. The core of this advantage is banking-specific data. A basic tool provides a name and number. A strategic platform integrates real-time data feeds that signal commercial intent, turning raw information into a decisive competitive edge for your relationship managers.

The Components of a True Intelligence Engine

An effective platform does not merely present data; it translates market signals into actionable leads. This is achieved through several non-negotiable components that provide a comprehensive view of the commercial landscape.

Key features that separate strategic tools from simple databases include:

- Real-Time Data Integration: The platform must aggregate data from sources critical to commercial banking, such as UCC filings (indicating equipment purchases), commercial real estate transactions (signaling expansion), and SBA loan data (revealing financing history).

- AI-Powered Prioritization: Raw data is noise. A superior platform uses intelligent scoring models to rank prospects based on their likelihood to need banking services, ensuring RMs focus their efforts on the most promising opportunities.

- Granular Filtering Capabilities: Your team requires the ability to segment market data with precision—by industry (NAICS code), annual revenue, employee count, geographic territory, and specific trigger events.

A platform that simply tells an RM a business exists provides no value. A platform that informs them a business in their target industry secured a $750,000 equipment loan from a competitor—and provides the CEO’s direct contact information—delivers actionable intelligence.

From Data Points to Strategic Conversation

Armed with this level of synthesized intelligence, an RM's outreach becomes immediately relevant. The generic "checking in" call is replaced with a targeted, value-driven opening.

For example: "I noted your company recently filed to finance new manufacturing equipment. I wanted to discuss how our C&I lending terms could better support your capital expenditure strategy as you expand."

This approach transforms the engagement from a sales pitch into a strategic consultation. It positions your bank not as a commodity vendor, but as an informed partner who understands the prospect’s business trajectory. Platforms like Visbanking’s Prospect are built on this principle—designed to deliver not just leads, but the deep context required for high-value client acquisition.

Explore our data to see how your team can pinpoint its next major client relationship.

Turning Data Points Into An Actionable Pipeline

Access to vast data sets is meaningless without a clear path from insight to revenue. For bank executives, the strategic value of a relationship manager prospecting tool lies in its ability to convert market intelligence into a tangible, high-value opportunity pipeline.

This is about moving beyond abstract analytics and into concrete, strategic actions. An effective platform gives your relationship managers the precise intelligence needed to connect with a prospect at the moment of need, armed with a compelling, data-backed reason to engage.

From Strategy to Execution: A Practical Example

Consider an RM tasked with growing their commercial and industrial (C&I) loan portfolio by $15,000,000 this fiscal year. The traditional approach—relying on referrals and cold outreach—is inefficient and yields unpredictable results.

With a modern prospecting tool like Visbanking’s Prospect, the RM executes a more surgical strategy:

- Define the Target: They set filters for manufacturing companies within their designated territory.

- Qualify by Size: They narrow the list to businesses with annual revenues between $5,000,000 and $25,000,000—the bank’s defined sweet spot for C&I lending.

- Identify a Trigger Event: They filter for companies that recently filed UCCs, a clear indicator of immediate equipment financing needs.

The screenshot below illustrates how quickly a tool like Visbanking can surface these hyper-targeted opportunities.

Within seconds, the tool generates a list of 50 qualified companies matching these exact criteria, complete with executive contact information and insights into their current banking relationships.

This represents a fundamental shift from tedious manual research to automated, intelligent discovery. The process is not only faster but significantly more effective because it is based on real-time market activity. This is the core principle of modern business intelligence in banking—creating a direct line from a market signal to a qualified lead.

What previously required a week of speculative research is now accomplished in an afternoon of targeted outreach. The RM’s first call is no longer an interruption; it is a timely, relevant consultation about a verified business need.

This data-driven precision is transforming sales operations across industries. The global CRM market, a related technology, is projected to reach USD 81.2 billion by 2025. This growth is fueled by analytics and AI-powered tools that have been shown to boost conversion rates by over 20%. You can explore the expansion of predictive sales intelligence in this comprehensive market report.

By converting raw data into an actionable pipeline, your bank can dramatically improve the probability of success on every outreach.

Quantifying the Impact on Your Bottom Line

Any new technology investment must be justified by a clear return. For a relationship manager prospecting tool, the value proposition is quantifiable through improved conversion rates and optimized allocation of your team's time.

Consider the practical impact. An RM using traditional methods—cold calls, public record searches, and intuition—may achieve a 2% lead-to-client conversion rate. This is a labor-intensive process with low yields.

Now, equip that same RM with a data-driven tool that identifies high-intent prospects based on trigger events. The conversion rate can realistically increase to 5% or higher. For an RM working 100 prospects a month, this is the difference between acquiring two new clients and five. Scaled across a 10-person commercial banking team, this translates to 360 additional high-value clients annually.

Unlocking Efficiency and Strategic Focus

Beyond higher close rates, the most significant impact is the reclamation of your RMs' most valuable asset: time.

An RM can spend 10 hours per week on manual prospecting—a full business day dedicated to sifting through outdated lists and pursuing dead ends. A purpose-built prospecting tool can reduce this time to 3 hours per week.

This efficiency gain provides each RM with an additional 7 hours every week to focus on high-value activities: building relationships, structuring complex deals, and driving revenue. You are not just purchasing software; you are investing in more revenue-generating time for your most critical talent.

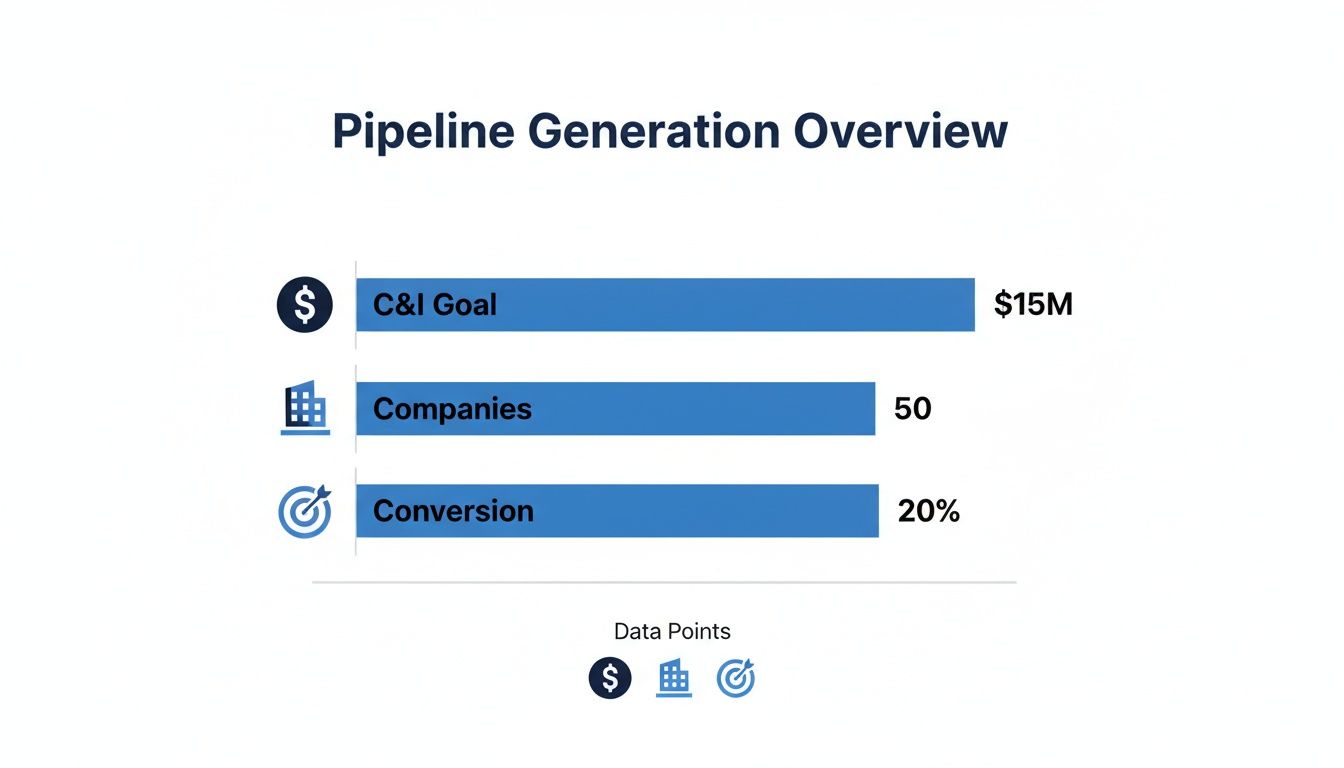

A clear pipeline begins with clear objectives. The visual below demonstrates how targeted prospecting directly supports a major C&I goal.

This demonstrates how a strategic list of target companies, combined with a reliable conversion rate, forms the foundation for achieving a multimillion-dollar objective.

The business case is straightforward: Better data creates better leads, which frees up RM time for more effective relationship building. Each link in this chain contributes directly to the bank's bottom line.

ROI Projection: The Financial Impact of a Prospecting Tool

The following table models the potential annual revenue impact for a 10-person RM team, assuming each new C&I client relationship generates $15,000 in first-year revenue.

| Metric | Before Tool Implementation | After Tool Implementation | Annual Impact |

|---|---|---|---|

| RM Prospecting Time | 10 hours/week | 3 hours/week | 3,640 hours reclaimed annually |

| Conversion Rate | 2% | 5% | +3% improvement |

| New Clients (10 RMs) | 240/year | 600/year | 360 additional clients |

| New Annual Revenue | $3,600,000 | $9,000,000 | +$5,400,000 |

The results are definitive. By shifting from low-yield activities to high-potential, data-vetted opportunities, the team becomes substantially more efficient and profitable.

This focused approach also positively impacts a critical metric: customer acquisition cost. As our guide on bank customer acquisition cost details, targeting the right prospects reduces wasted effort and makes every new client relationship more profitable from its inception.

Ultimately, this is not an investment in software; it is an investment in a strategic asset designed to produce a clear, measurable return. Explore how Visbanking’s data can help your institution build a more profitable and efficient growth engine.

Selecting the Right Prospecting Partner

Choosing a prospecting platform is a strategic decision that extends beyond a feature comparison. The right partner provides more than software; they deliver verifiable intelligence that directly informs your growth strategy. Generic sales platforms are ill-suited for commercial banking, as they lack the specific data context necessary to identify genuine lending and deposit opportunities.

Bank leadership must look past marketing claims and evaluate potential partners based on what truly drives results. The decision should hinge on several non-negotiable criteria that distinguish a true banking intelligence provider from a generalist software vendor.

Key Evaluation Criteria for a Banking Platform

When vetting a potential partner, focus on these four critical areas. They represent the difference between a tool that delivers a strong ROI and one that becomes shelfware.

- Data Integrity and Sourcing: What is the origin of the data? A credible partner will be transparent about their sources, whether UCC filings, SBA loan records, or commercial real estate data. Inaccurate or outdated information renders the tool useless and damages your RMs' credibility.

- CRM Integration: The platform must integrate seamlessly with your existing workflow, not create another data silo. Robust CRM integration is essential for a smooth transition from prospect identification to client onboarding.

- User Adoption and Usability: A powerful tool is worthless if it is not used. The interface must be intuitive for bankers, allowing them to identify opportunities in minutes, not hours. High user adoption is a leading indicator of a successful implementation.

- Industry Expertise and Support: Your partner must understand the banking industry. When your team requires support, they should interact with industry experts who can provide relevant strategic advice, not a generic help desk.

The ultimate question is not, "What features does this tool have?" but rather, "How will this platform enable my RMs to acquire more of the right type of business?" A partner like Visbanking is built on a foundation of banking-specific data, ensuring every insight is directly aligned with your strategic objectives.

The need for industry-specific solutions is a clear market trend. The Partner Relationship Management (PRM) software market, for example, is projected to reach USD 226.51 billion by 2030. This growth underscores the increasing demand for specialized tools that address unique industry challenges. You can dig into the research behind this growth for a broader perspective.

Choosing the right partner is an investment in a direct pipeline from market intelligence to profitable growth. We invite you to benchmark our data and evaluate the impact a banking-first approach can have on your team's performance.

Integrating Prospecting Intelligence Into Your Growth Strategy

Acquiring a powerful relationship manager prospecting tool is a critical first step. However, its ultimate value is realized only when its intelligence is woven into the operational fabric of your bank's growth strategy. Without a disciplined implementation and adoption plan, even the most advanced platform will fail to deliver its intended ROI.

For bank leadership, the objective is to elevate this tool from a sales accessory to a core strategic asset. This requires fostering a culture where data-driven prospecting is the operational standard, not an option. Success depends on user adoption and the clear alignment of the tool's output with the bank's financial objectives.

Driving Adoption and Measuring Performance

To maximize the return on this investment, a clear framework connecting tool usage to business outcomes is essential. Your Relationship Managers (RMs) must see a direct correlation between platform engagement and their ability to meet and exceed their goals.

A successful implementation framework includes:

- Establishing Clear KPIs: Define and track metrics directly linked to the tool's function. These should include the number of qualified leads generated, the conversion rate of those leads, and the reduction in time spent on manual research.

- Integrating into Workflow: The platform must become the starting point for all new business development. Mandate its use in weekly pipeline reviews and strategic planning sessions.

- Providing Continuous Training: A single training session is insufficient. Ongoing education on new features and advanced search methodologies ensures your team is maximizing the value of the data.

A prospecting tool is not just a sales utility; it is a strategic intelligence asset. The insights it generates should inform not only individual RM activities but also the bank's broader market strategy.

For example, if the platform’s analytics reveal a significant increase in equipment financing UCC filings within a specific three-zip-code radius, that is more than a collection of leads; it is a market signal demanding a strategic response.

This intelligence should trigger a coordinated effort, such as a targeted digital marketing campaign for that geography or a focused outreach initiative by the commercial team assigned to that territory.

This is how raw data is converted into decisive action, transforming your team from a reactive sales force into a proactive, intelligence-led growth engine. To understand how granular data can sharpen your own market strategy, we encourage you to explore our data and benchmark it against your current approach.

Frequently Asked Questions

Adopting a data-driven prospecting strategy naturally raises important questions for bank executives. Below are answers to the most common inquiries we receive.

How Is a Banking Prospecting Tool Different From a General CRM?

A general CRM is a system of record, designed to manage existing relationships. It is your internal database.

A specialized relationship manager prospecting tool is a system of discovery. It is engineered to analyze external, banking-specific data sets—such as UCC filings, commercial real estate transactions, and SBA loan data—to uncover new lending and deposit opportunities that a standard CRM is not designed to identify.

What Is the Typical Onboarding Time for Relationship Managers?

Implementation is swift. Modern, cloud-based platforms are designed for rapid deployment, not lengthy IT projects.

Most relationship managers become proficient with the core functionalities after a single training session, typically lasting one to two hours. The objective is to integrate the tool seamlessly into their daily workflow. A key factor is selecting a partner that provides dedicated, banker-specific training to ensure immediate adoption and productivity.

How Can We Measure the ROI of This Investment?

The ROI is measured through tangible improvements in key performance indicators (KPIs) that directly impact the bottom line.

- A significant increase in the volume of qualified leads generated per RM.

- An improved lead-to-client conversion rate, for example, an increase from 2% to 5%.

- A quantifiable reduction in hours spent on manual prospecting, freeing up time for revenue-generating activities.

- Measurable portfolio growth in targeted loan and deposit categories.

By tracking these metrics before and after implementation, the financial impact becomes clear and undeniable. For additional information, you may find relevant insights in these frequently asked questions from other industry leaders.

A modern prospecting tool enables your team to transition from building lists to executing an intelligent, proactive growth strategy. With Visbanking, you equip your relationship managers with the market intelligence required to identify and win high-value commercial clients before your competitors are even aware of the opportunity.

Similar Articles

Visbanking Blog

Prospect AI Tool: Transforming Your Bank's Growth Strategy with Smart Targeting

Visbanking Blog

Banking Data Analytics: Turning Information Into Profit

Visbanking Blog

BIAS: The Smart Choice for Banking Intelligence and Action

Visbanking Blog

BIAS: The Smart Choice for Banking Intelligence and Action

Visbanking Blog

BIAS: The All-in-One Solution for Banking Intelligence and Action

Visbanking Blog

Revolutionize Your Banking Operations with Data-Driven Insights from BIAS

Visbanking Blog

Make More Informed Decisions with BIAS, the Data-Driven Banking Solution

Visbanking Blog

BIAS: The Future of Banking Intelligence and Action System

Visbanking Blog

In the world of banking, digital transformation is no longer a 'nice-to-have'. It's a necessity

Visbanking Blog