Estimated reading time: 4 minutes

Table of contents

In today’s digital age, where online banking and mobile apps dominate the financial landscape, the significance of physical bank branches might appear diminished. However, the US bank branch network remains a pivotal aspect of the banking industry, providing essential services and a local presence for customers. In this comprehensive analysis, we delve into the nuances of the US bank branch network, its growth trends, and its enduring impact on customers and communities.

The Evolution of US Bank Branch Networks

The journey of the US bank branch network has been one of evolution. Traditional branches were once primarily focused on transactions and account management. However, they have transformed into multifaceted centers that offer an array of financial services, including consultations, wealth management, and advisory services. With advancements in technology, many branches now incorporate digital solutions to enhance customer experiences and streamline processes.

Growth and Distribution Trends

The distribution of bank branches across the US is a testament to the intricate network that serves the nation’s diverse communities. Urban centers boast a higher density of branches, catering to the needs of densely populated areas. Suburban and rural regions also have their share of branches, ensuring that banking services are accessible to all citizens.

Growth trends within the US bank branch network have adapted to changing demographics and customer preferences. While the total number of branches has seen a gradual decline due to digitalization, this reduction has been met with an increase in strategically located branches that provide specialized services. Additionally, certain banks have embraced the concept of “micro-branches” – smaller, tech-enabled outlets that cater to on-the-go customers in high-traffic locations.

Customer-Centric Approach

In an era where online banking offers convenience at your fingertips, the significance of physical branches might be questioned. However, these branches continue to play a crucial role in providing a personalized, face-to-face banking experience. They remain essential for complex financial transactions, in-depth consultations, and building strong customer relationships based on trust.

Moreover, bank branches are not just transactional hubs; they serve as community centers. Many branches actively engage with local communities through initiatives such as financial literacy workshops, community events, and support for local businesses. This outreach cements their role as pillars of local economic development.

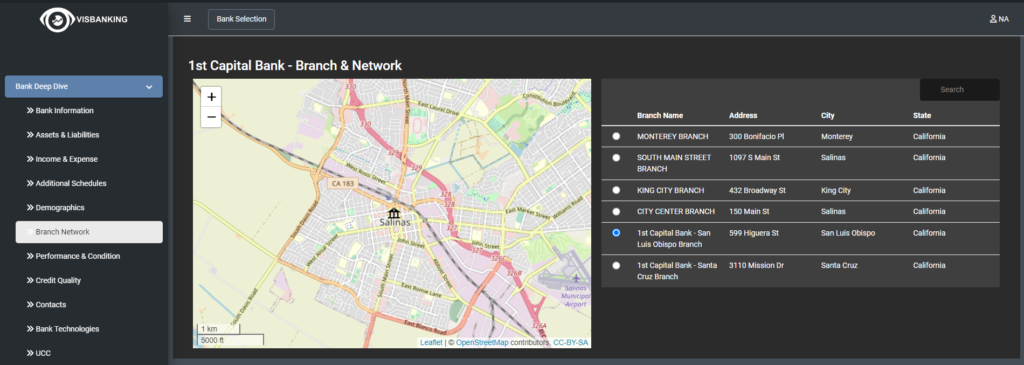

You can see this data in the “US Banks Contacts” section in the Visbanking Application:

The Digital Transformation of Bank Branches

The rise of digital banking has prompted banks to rethink the role of their physical branches. Rather than being competitors, digital and physical channels now complement each other. Many banks have introduced cutting-edge technologies within branches to enhance customer experiences. Interactive touchscreens, virtual reality tools for investment consultations, and AI-powered chatbots are becoming commonplace, fostering a seamless convergence of digital and physical banking.

Challenges and Opportunities

The evolution of the US bank branch network is not without challenges. Banks must strike a delicate balance between maintaining a physical presence and managing operational costs, especially as online banking gains traction. The ongoing need for technological integration and staff training to deliver a consistent omnichannel experience remains a priority.

However, challenges also bring forth opportunities. Adapting to changing customer expectations and leveraging technology can help branches transform into dynamic hubs of financial education, advisory services, and community engagement. By embracing these opportunities, the US bank branch network can remain relevant and impactful in the modern banking landscape.

Conclusion

In the tapestry of the US banking industry, the branch network continues to be a resilient thread that connects institutions to their customers and communities. While the landscape has evolved, the core value of in-person interactions, personalized services, and community engagement remains unchanged. As the banking sector marches forward into an era of digital innovation, the US bank branch network stands strong, adapting to change while upholding its essential role in shaping the future of banking.

So, the next time you walk into a bank branch, remember that it’s not just a physical space – it’s a testament to the enduring relationship between financial institutions and the people they serve.

Explore the comprehensive analysis of the US bank branch network, its growth, and its customer impact on our Visbanking Banking Report Portal.