Market Intelligence Solutions for Modern Banking

Brian's Banking Blog

In today's banking environment, executives are not short on data; they are inundated. The critical challenge is translating that data into decisive action. A true market intelligence solution is not another data repository. It is an action-oriented system engineered to convert a deluge of information into clear, confident strategies for growth, risk management, and talent acquisition.

Moving Beyond Dashboards to Decisive Action

Bank leadership teams spend their days analyzing dashboards filled with FDIC call reports, FFIEC filings, and economic data. Yet, the fundamental question persists: how does this information translate into a profitable decision? The institutions that will lead the market tomorrow are those that weaponize this complexity.

Consider a modern market intelligence solution as your institution's central nervous system. It integrates disparate financial, regulatory, and market data streams into a single, unified view designed for executive decision-making. This is the mechanism by which banks shift from observing trends to shaping the market.

From Data Overload to Strategic Clarity

The primary function of market intelligence is to answer high-stakes questions with speed and conviction. Instead of directing your analyst team to spend hours manually compiling reports to understand a competitor's loan portfolio, a market intelligence platform delivers a comprehensive analysis instantly. This is a fundamental operational shift required to maintain a competitive edge.

This demand for clarity is fueling significant investment. The global market for these solutions, currently valued at $12.1 billion, is projected to reach $21.4 billion by 2031. This is not speculative growth; it is a direct response to the urgent need for tools that can synthesize complex data—like FDIC call reports and BLS macro series—into actionable strategy. You can explore the research behind this market growth to understand the critical role these platforms play in financial services.

A market intelligence solution must do more than report what is happening. It must explain why it is happening and guide leadership on how to respond, integrating seamlessly into existing strategic workflows.

This transition from static reports to dynamic intelligence is transformative. Let's examine the distinction.

The Evolution From Traditional Reporting to Modern Intelligence

This table contrasts the outdated approach of static data reporting with the dynamic capabilities of modern market intelligence solutions, highlighting the shift from passive observation to active, data-driven decision-making.

| Capability | Traditional Reporting (The Past) | Market Intelligence Solution (The Future) |

|---|---|---|

| Data Access | Static, historical reports (e.g., quarterly PDF) | Real-time, interactive data feeds |

| Analysis | Manual data aggregation and spreadsheet work | Automated analytics and visual dashboards |

| Focus | "What happened?" (Lagging indicators) | "Why is it happening and what's next?" (Leading indicators) |

| Output | Dense tables requiring interpretation | Actionable insights and targeted recommendations |

| Speed | Weeks or days to generate a report | Instant answers to complex queries |

| Goal | Inform | Empower and guide action |

The takeaway is unambiguous: while traditional reporting offers a rearview-mirror perspective, a modern intelligence solution provides foresight, illuminating opportunities and risks before they materialize.

The Core Function of Modern Intelligence

At its core, this technology provides a decisive edge through superior information. It is engineered to help your institution:

- Benchmark with Precision: Instantly assess your performance against any peer group—from a local competitor to national top-performers—on critical metrics like loan growth, net interest margin, and efficiency ratio.

- Identify Growth Opportunities: Pinpoint your next high-value commercial client. By tracking market signals like UCC filings or SBA loan data, you can identify companies in expansion mode that require immediate banking services.

- Anticipate Market Shifts: Proactively address economic headwinds. A robust system will flag early warning signs in specific industries or regions, providing the necessary lead time to adjust your lending strategy and risk models.

Embedding these capabilities into strategic planning and business development creates a foundation for sustainable growth. To win in this market, you must see the field more clearly and act faster than the competition. Visbanking provides this clarity, enabling your leadership team to move from analysis to action. We invite you to explore our data and benchmark your performance.

The Anatomy of a Bank-Centric Intelligence Platform

Not all intelligence platforms are created equal. A generic business intelligence tool can produce a chart of your own loan performance, but a true market intelligence solution engineered for banking operates on a different level.

Consider it less a reporting tool and more a private intelligence agency for your executive team. It is built to transform raw field data into clear, actionable briefs. Your bank is already saturated with data; what you require is synthesized, forward-looking intelligence.

A purpose-built platform achieves this by integrating high-value data sources that generic tools cannot access. The strategic value lies not in a single data stream, but in their intelligent fusion.

Core Data Streams: The Engine of Insight

A powerful, bank-centric platform must integrate a specific set of data to provide a complete market picture. For a data-driven strategy, these capabilities are non-negotiable.

Here is what executives should demand:

- Regulatory Filings: This extends beyond your own institution's filings. It requires complete, continuous access to FDIC Call Reports and NCUA 5300 data for all 4,600+ institutions. This provides an unparalleled view of competitor and peer strategies.

- Commercial Activity Signals: Data such as Uniform Commercial Code (UCC) filings and Small Business Administration (SBA) loan data serve as an early warning system. For example, a sudden spike in UCC-1 filings from a local manufacturer signals immediate capital needs.

- Macroeconomic and Market Data: Integrating data from the Bureau of Labor Statistics (BLS) and Bureau of Economic Analysis (BEA) adds essential context. It helps determine whether a competitor's slowdown is an isolated issue or a broader regional headwind requiring a strategic response.

Aggregating these sources is only the first step. The true value is realized when this raw data is transformed into predictive signals for your team. You can see precisely how Visbanking accomplishes this by reviewing the specific datasets Visbanking integrates.

From Raw Data to Actionable Analytics

An effective platform functions as an analytical engine, processing millions of data points to answer your most critical questions. For instance, instead of merely showing that a competitor’s commercial real estate portfolio grew by $50 million last quarter, the system should reveal how they achieved it.

It might connect that growth to a cluster of new SBA 504 loans in a specific industrial park, instantly exposing their precise go-to-market strategy.

An effective market intelligence solution doesn’t just show you data; it delivers answers. It shifts your team from asking "What happened?" to understanding "Why did it happen, and what is our next move?"

This is where features like automated peer benchmarking and trend analysis become indispensable. A director should not have to wait a week for an analyst to compile data. With the right platform, they can instantly see how their net interest margin compares to top performers in their asset class, identify the drivers of any performance gap, and model strategic adjustments—all within a single session. For a deeper analysis of banking analytics, consult our guide to business intelligence for banks.

Predictive Signals and Workflow Integration

The final component is delivering intelligence to the right people at the right time. Predictive alerts must integrate directly into your team's existing workflows. An alert that a key commercial client is exhibiting signs of risk cannot be another lost email; it must trigger a specific workflow for the relationship manager within your CRM.

Imagine the system detects that three of your mid-sized commercial clients in the logistics sector have experienced a 15% decline in key financial ratios for two consecutive quarters. This is not a coincidence; it is a predictive signal of industry-wide distress.

A truly intelligent platform will not only flag this trend but also provide a list of every other client in your portfolio with a similar risk profile, enabling proactive outreach to mitigate potential losses.

This is what a system designed for action provides. By blending comprehensive data, powerful analytics, and seamless workflow integration, a bank-centric market intelligence solution gives leaders the confidence to make faster, smarter decisions. Now, let’s discuss how this translates directly into measurable growth.

Turning Intelligence into Commercial Growth

Bankers are measured by results. The only relevant question for a market intelligence solution is whether it can drive tangible commercial growth.

An effective platform achieves this by cutting through market noise, transforming vast quantities of data into precise, actionable opportunities for your business development teams. This is how you transition from cold calling to closing high-value commercial relationships.

The market data supports this. The sales intelligence solutions market, a key component, is already a $2.95 billion industry projected to reach $6.68 billion by 2030. This growth is driven by platforms that excel at integrating disparate data—SEC, BLS, and UCC filings—to build powerful relationship maps. For your relationship managers, the impact is immediate: teams leveraging this intelligence see connect rates increase by 30-50%.

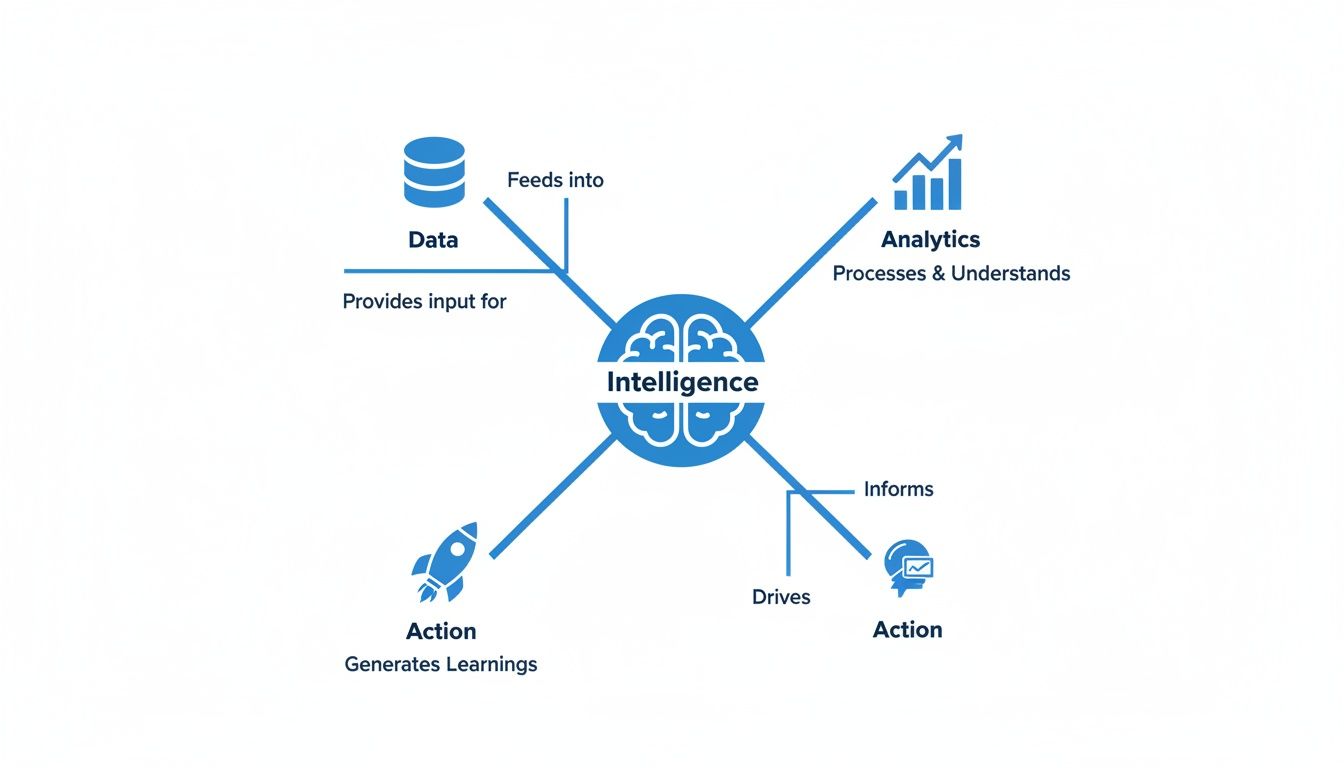

The process is a simple, powerful cycle.

You ingest data, analyze it for insights, and execute a decisive action. That action generates new data, refining the intelligence loop for greater precision over time.

Pinpointing High-Value Commercial Prospects

Traditional prospecting is inefficient, relying on stale lists and intuition. A modern intelligence platform inverts this model, using real-time market signals to identify companies actively seeking capital.

Consider this practical example: a local manufacturing company files five UCC-1 statements in two weeks for new equipment purchases. This is a clear signal of expansion and an immediate need for financing.

A sharp intelligence solution captures this activity instantly. Your team receives an alert not just with the company's name, but with context on their current banking relationships and likely capital needs. Your relationship manager can then present a perfectly timed, relevant proposal for a $2,500,000 line of credit. You are no longer a salesperson; you are a strategic partner who arrived at the critical moment.

Finding Hidden Cross-Sell and Upsell Opportunities

Significant growth opportunities often exist within your current client base. Market intelligence excels at uncovering them by mapping complex corporate and personal relationships that would otherwise remain invisible.

For example, the platform might flag that the CFO of a major commercial client also serves on the board of a fast-growing nonprofit that banks with a competitor.

That single insight is invaluable. It transforms a routine check-in call into a strategic conversation, providing a warm introduction to pitch the nonprofit and displace a competitor using a trusted, existing relationship.

This is how your relationship managers evolve into true advisors, identifying client needs and connecting opportunities to drive new business from established accounts. To explore advanced prospecting strategies, see our guide on how to conduct market research.

De-Risking Strategic Market Entry

Expanding into a new territory is among the highest-risk initiatives a bank can undertake. A misstep can result in millions in wasted capital and a multi-year setback. Market intelligence removes the guesswork, providing a data-backed, granular view of a market before committing resources.

Suppose your institution is considering a new branch in an adjacent county. The traditional approach involved basic demographic analysis. The modern method uses an intelligence platform for surgical-grade competitive analysis.

In minutes, you can analyze the loan portfolios of the top five banks in that market. You might discover that while the major players are competing fiercely for commercial real estate, the rapidly growing healthcare services sector is underserved. This insight defines your market entry strategy: you enter with a laser focus on healthcare, avoiding a costly competitive battle and positioning your bank for immediate, profitable growth.

Strengthening Risk Foresight and Strategic Planning

Market intelligence is not solely a tool for growth; it is one of the most effective defensive instruments a bank possesses. In an increasingly volatile economy, the ability to anticipate and mitigate risk separates top performers from the rest. A robust market intelligence solution cuts through the noise, converting disconnected data points into a clear picture of emerging threats.

This transforms risk management from a reactive, compliance-driven function into a proactive, strategic advantage. Instead of waiting for quarterly call reports to reveal a problem, you identify warning signs in real time, enabling swift action to protect your balance sheet and reputation.

Gaining Early Warnings on Portfolio Risk

Consider the management of concentration risk in your commercial loan portfolio. Suppose you have significant exposure to the regional transportation and logistics sector. On the surface, each individual loan appears sound.

A market intelligence platform is designed to connect disparate data points. It can identify subtle, correlated signals of distress long before they appear on financial statements.

For example, the system might flag a cluster of logistics clients whose financial ratios are deteriorating in unison. It could reveal that three of these companies saw their days sales outstanding (DSO) increase by 20% last quarter, while their debt-service coverage ratios became dangerously thin. These are not three isolated issues; this is a systemic warning for a key industry within your portfolio.

This early warning provides your risk officers the time to reassess exposure, tighten underwriting standards for new loans in that sector, and engage with at-risk clients. It is the difference between loss avoidance and crisis management. This type of forward-looking analysis is essential; learn more in our guide on what is scenario planning.

Pressure-Testing Strategic Plans with Peer Data

Market intelligence serves as the ultimate validation for strategic planning. Every multi-year plan is built on assumptions about the market, competition, and economy. A data-driven platform allows your board and executive team to rigorously test these assumptions against hard market data.

Imagine your bank's strategic plan calls for 15% annual growth in multi-family real estate lending for the next three years.

A market intelligence platform provides a crucial reality check. An analysis of your top-performing peers in the same market might reveal a starkly different picture: best-in-class competitors are achieving only 8% growth, and their delinquency rates on those same loans have increased by 50 basis points in the last six months.

This single insight fundamentally alters the strategic conversation. The 15% growth target now appears not merely optimistic, but reckless. The data has provided the precise figures needed to recalibrate your strategy to one that is sustainable and defensible, shifting from aspiration to data-backed validation.

Market intelligence platforms are built to monitor these critical metrics, providing the necessary context to make informed, strategic decisions.

Key Performance Indicators Tracked by Market Intelligence Solutions

| Metric Category | Example KPI | Strategic Implication |

|---|---|---|

| Loan Portfolio Quality | Non-Performing Loan (NPL) Ratio by Sector | Identifies early credit deterioration in specific industries, signaling concentration risk. |

| Deposit & Funding | Cost of Funds vs. Peer Group | Benchmarks funding efficiency and flags potential pressure on net interest margin (NIM). |

| Growth & Market Share | Loan Origination Volume by Product | Measures competitive performance and reveals where market share is being won or lost. |

| Profitability | Return on Average Assets (ROAA) | Provides a clear, standardized measure of how effectively assets are generating profit compared to rivals. |

| Operational Efficiency | Efficiency Ratio | Highlights opportunities to optimize cost structures and improve operational leverage against the market. |

By embedding this data-driven validation into your planning cycle, you ensure every strategic initiative is built on a foundation of fact. This is how resilient, high-performing institutions are built.

Evaluating and Implementing an Intelligence Solution

Selecting a new intelligence platform is a significant capital and operational commitment. The decision must be driven by one criterion: tangible business results. If a platform cannot deliver measurable value quickly, it is a liability, not an asset.

When vetting potential partners, executives must ask sharp, outcome-focused questions that cut through sales rhetoric to reveal the true capability of a proposed market intelligence solution.

The business intelligence market is projected to reach $64.3 billion by 2035, growing at a 7.1% CAGR. This growth is driven by banking leaders who demand auditable analytics that can untangle complex financial and regulatory data. In the U.S., which accounts for nearly 20% of this market, tools that can dissect FFIEC/UBPR and HMDA data are non-negotiable for accurate peer benchmarking and identifying growth opportunities. As you can learn from the full market analysis, the trend is clear: banks are choosing workflow-ready applications that deliver immediate wins over protracted, resource-draining custom projects.

Key Evaluation Questions for Executive Teams

Before committing, your leadership team must secure satisfactory answers to these critical questions.

- How quickly can you demonstrate value? Prioritize solutions with ready-to-deploy applications. A six-month, resource-intensive implementation before seeing any ROI is a non-starter in the current market.

- Can you explain your analytics? "Black box" algorithms are a significant risk in a regulated industry. Demand full transparency. Your partner must be able to explain precisely how their engine derives its insights so you can defend every data-driven decision to regulators and your board.

- Does this integrate with our existing workflows? A platform that requires your team to operate outside their current CRM and communication tools will fail. Effective intelligence solutions embed insights directly where your team works.

A Phased Roadmap for Implementation and ROI

Once a partner is selected, avoid a "big bang" implementation. A phased rollout is essential for building internal momentum and demonstrating the platform's value. Securing strong implementation support is crucial for a smooth transition.

A logical roadmap delivering immediate impact follows this structure:

- Phase 1: Launch a High-Impact Pilot (Weeks 1-4) Start with a targeted, high-value initiative. Equip a small group of top commercial lenders with the platform’s prospecting tools. Set a clear objective: identify 20 new, high-quality prospects using UCC filings and SBA loan data within 30 days. This creates a quick, undeniable success story.

- Phase 2: Expand to the Full Team (Weeks 5-12) Leverage the pilot's success to drive adoption across the entire commercial banking team. The early wins serve as powerful internal case studies, turning your first users into advocates.

- Phase 3: Integrate Strategic & Risk Functions (Quarter 2 Onward) With the growth engine established, roll out the platform’s capabilities to your strategy and risk teams. Use peer benchmarking and portfolio analysis tools to pressure-test strategic plans and identify early indicators of credit deterioration.

This methodical approach avoids the pitfalls of large-scale BI projects that often collapse under their own weight. By focusing on immediate, workflow-ready applications, you empower your teams and begin realizing a clear return on investment in months, not years.

The goal is to select a solution that feels less like a complex IT project and more like activating a new strategic capability, empowering your bank to make smarter, faster decisions and build a lasting competitive advantage.

Gaining the Final Advantage, From Insight to Action

In modern banking, possessing the most data does not guarantee success. The decisive advantage comes from the speed and efficacy with which you convert that data into action. A dedicated market intelligence solution is the engine that transforms scattered information into a powerful strategic asset.

These platforms are the connective tissue linking your growth, risk, and talent strategies to market realities. They provide the validated, unbiased intelligence needed to pursue ambitious growth, identify portfolio risks before they escalate, and recruit the specific talent required to execute your vision. This is how top-performing banks consistently outperform their competitors.

Answering the Questions That Matter Most

Executives must be able to answer critical questions with speed and certainty:

- Which of our top commercial lenders is a serious flight risk to a competitor in the next six months?

- Who are the top five most profitable commercial clients banking with our primary rival, and what products are they using?

- Where is the hidden concentration risk in our loan portfolio that a standard industry code analysis will miss?

Answering these questions is no longer a luxury; it is the benchmark for effective leadership and governance. The gap between needing the answer and having it instantly is where market share is won and lost.

A purpose-built intelligence platform closes that gap. It provides direct, immediate answers, enabling your leadership team to move from debate to execution with confidence.

The best first step is to experience this clarity for yourself. Stop making decisions based on outdated data and begin executing a forward-looking strategy informed by real-time market signals. We invite you to see how your institution compares. Benchmark your bank's performance today and understand the power of a true intelligence advantage.

Your Top Questions, Answered

Bank executives are rightfully skeptical of new technology. Here are direct answers to the most common questions we receive.

How Is This Different From Our In-House BI Tools?

Your current Business Intelligence (BI) tools are like your car's dashboard: they show your speed, fuel level, and engine temperature—critical information about your vehicle. However, they provide no information about traffic, road conditions, or potential detours. They operate in a vacuum.

A true market intelligence solution is your GPS, traffic report, and weather forecast combined. It integrates your internal data with a complete view of the external environment—regulatory filings from all 4,600+ U.S. banks, real-time UCC filings, economic shifts, and critical personnel changes. Your BI tool reports what happened inside your bank. Market intelligence reveals what is happening across the entire market, why it is happening, and where the opportunities lie for your next strategic move.

What's a Realistic ROI?

Let's move beyond abstract metrics to concrete financial returns.

For your growth teams, what is the value of increasing qualified prospect connect rates by 30-50%? That is what our clients report. They shift from pursuing cold leads to targeting prospects with validated, immediate needs, significantly shortening the sales cycle.

On the risk side, the ROI is measured in loss avoidance. Identifying a deteriorating credit or a dangerous portfolio concentration months before your traditional review process can save millions. For strategy, making a single M&A or market entry decision with precise data instead of intuition can be the difference between a major success and a costly write-off. Conservatively, we see clients achieve a 3-5x return within the first 12-18 months.

How Tech-Savvy Do Our People Need to Be?

None. This platform was built for bankers, not data scientists. Your relationship managers, market presidents, and board members require answers, not another complex software application to learn.

A platform like Visbanking’s performs the complex data engineering, aggregation, and modeling behind the scenes. Your team interacts with simple, clear applications that deliver immediately actionable insights. If your team can use LinkedIn or their CRM, they possess the necessary skills to derive immediate value. The objective is to put data into the hands of the people who can use it to win.

It all comes down to turning market noise into a decisive advantage. Visbanking provides the clarity to see the field and the tools to make the winning play.

See how you really stack up and find the opportunities you're missing right now.