How to Conduct Market Research for Your Bank

Brian's Banking Blog

In banking, strategic decisions are driven by one of two things: gut instinct or hard data. Market research is the disciplined process of gathering and analyzing that data, converting it into quantitative and qualitative intelligence that informs high-stakes capital allocation.

This is not an academic exercise. It is the fundamental process for understanding the competitive landscape, identifying unmet customer needs, and pinpointing genuine growth opportunities. Effective market research ensures every major decision is underpinned by evidence, mitigating risk and driving sustainable growth.

Why Market Research Is a Core Banking Function

While executive intuition is valuable, today’s financial market demands data-backed conviction. Market research cannot be viewed as a discretionary expense; it is an essential tool for risk management and strategic growth.

Granular intelligence—from a competitor’s CD rates to demographic shifts in a target county—directly impacts your most critical decisions.

Consider the approval of a multi-million-dollar branch in a new market. Guesswork is a liability. Data intelligence, however, can model the deposit potential, household income levels, and competitive saturation with precision, turning a high-risk bet into a calculated investment.

From Data Points to Strategic Advantage

Systematic research provides the hard evidence required to act decisively and gain a tangible edge. Instead of reacting to competitors, you can anticipate market movements and dictate the terms of engagement.

- Informed Product Development: Is there a quantifiable demand for a high-yield savings account among high-earning millennials in your primary service area? Data intelligence platforms like Visbanking can segment demographic trends against existing product penetration, confirming or denying the business case.

- Confident Expansion Strategy: A competitor’s branch closure may appear to be an opportunity. But if market data reveals the closure was driven by declining local business formation and a 15% drop in household income, that insight prevents a poor capital allocation.

- Profitable Pricing Decisions: Setting loan and deposit rates in a vacuum erodes net interest margin. Real-time competitive analysis ensures your pricing is both attractive to the market and profitable for the institution.

In banking, the purpose of market research is not to confirm existing beliefs. It is to challenge assumptions with empirical evidence to de-risk major capital allocations and strategic commitments.

The global market research industry grew from $71.5 billion to nearly $130 billion between 2016 and 2023. This growth underscores its escalating importance in corporate boardrooms. Banks that fail to invest in comprehensive research will be outmaneuvered by more agile, data-informed competitors.

Ultimately, a deep understanding of your competitive landscape, which enables a clear market positioning strategy, is the most critical outcome of thorough market research. It is the difference between navigating with a compass and navigating by opinion.

Turning Business Goals Into Research Objectives

Effective market research begins with discipline. Vague questions yield unusable data—a classic case of "garbage in, garbage out" that wastes time and capital.

The first step is to translate high-level business goals into sharp, measurable research objectives. This discipline converts a strategic wish list into an operational plan.

From Vague Ambition to a Quantifiable Question

A goal such as "grow our loan portfolio" is strategically useless for research. It provides no focus and no clear parameters for investigation. To be effective, the objective must be sharpened to ensure the resulting data directly informs revenue and market share growth.

A superior approach reframes the broad goal into a specific, answerable question. This disciplined framing ensures the research budget is deployed against questions that directly impact the bottom line.

For example, instead of the generic goal, a focused objective is:

Identify which three counties in our state have the highest concentration of businesses with $5 million to $20 million in annual revenue and the lowest C&I loan penetration from community bank competitors.

The difference is stark. This objective is specific, measurable, and points directly to a strategic prize. It establishes clear boundaries for data collection and analysis, focusing the team's effort on a tangible opportunity. It also defines what success looks like: a ranked list of target markets based on objective criteria.

Defining Your Research Parameters

To achieve this level of clarity, every business goal should be deconstructed into specific questions that data can answer.

Begin with this framework:

- Geographic Focus: Where, precisely, are we looking? A specific state, county, or a set of census tracts? Precision prevents resource waste on markets you will never enter.

- Customer Segment: Who is the target? Define them by revenue size (e.g., businesses with $2,000,000 – $10,000,000), industry (using NAICS codes), or demographic profiles (e.g., high-net-worth individuals over 50).

- Competitive Landscape: Who are the specific competitors? Are we concerned with the top three national banks, or is the focus solely on local credit unions and community banks?

- Product Specificity: What product are we assessing? Commercial real estate loans, treasury management services, or a new consumer deposit product? Each requires a distinct line of inquiry.

This level of detail is non-negotiable for conducting market research that produces actionable intelligence.

This is precisely where tools like Visbanking provide value. The platform is designed to answer these granular questions, allowing executives to slice market data by these exact criteria. It transforms broad boardroom discussions into targeted data queries, delivering the hard numbers needed to benchmark competitors and identify underserved niches before committing capital.

Designing Your Bank's Research Framework

Once the objective is defined, the next step is to construct a disciplined framework to obtain the answers. A robust research plan is not about commissioning sprawling, time-consuming studies. It is about surgical execution, blending different data types to create a comprehensive view of the market.

The goal is a practical, cost-effective process that delivers insights ready for board-level discussion.

This requires two types of information: primary data and secondary data. Understanding how and when to deploy each is critical for efficiency.

- Primary data is information you collect directly for a specific purpose, such as targeted client surveys, focus groups, or one-on-one interviews with business owners. It is tailored to your exact questions but can be resource-intensive.

- Secondary data is existing information collected by other entities. This includes regulatory filings (e.g., Call Reports), demographic reports from the Census Bureau, or industry benchmarks. Its power lies in its immediate availability and ability to provide a broad market overview at a fraction of the cost.

Striking the Right Balance

For most strategic banking decisions, a sequential approach is optimal. Start wide with secondary data to identify trends and narrow the field of options. Then, deploy targeted primary research to validate hypotheses and add qualitative depth.

Consider a potential acquisition. The first move should not be to commission an expensive brand perception study.

Instead, a more prudent first step is to leverage a data intelligence platform to rapidly analyze the target bank's call report data.

A platform like Visbanking can instantly show how the target’s loan portfolio, deposit growth, and efficiency ratio compare to its direct competitors. This secondary analysis might reveal in minutes that the target’s ROA has lagged local peers for eight consecutive quarters—a significant red flag that warrants further investigation.

This single piece of secondary data facilitates a more informed internal discussion before any capital is spent on custom research. If the financial metrics remain compelling, then you can proceed to targeted interviews with local business owners to assess the bank’s reputation and service quality—qualitative context that raw numbers alone cannot provide.

Before selecting methods, it is crucial to understand the strategic role of each research type. This table breaks down the core differences as they apply to banking decisions.

Primary vs. Secondary Research Methods for Banks

| Methodology | Description | Typical Banking Application | Key Strategic Question Answered |

|---|---|---|---|

| Primary Research | Data collected directly by your bank for a specific purpose. Includes surveys, interviews, focus groups, and direct observation. | - Gauging customer satisfaction with a new digital product. - Interviewing local business owners about their lending needs. - A/B testing marketing messages for a new checking account. |

"Why are our customers behaving this way?" or "What is the 'on-the-ground' perception of our brand in this new market?" |

| Secondary Research | Analysis of existing data collected by third parties. Includes call reports, census data, industry reports, and competitor financial statements. | - Benchmarking your bank’s performance against peers. - Identifying underserved C&I lending markets by county. - Analyzing demographic shifts to inform branch strategy. |

"Where are the largest market opportunities?" or "How do our financial metrics compare to the competition?" |

By understanding these distinctions, you can construct a research plan that begins broadly and cost-effectively with secondary data, then focuses with precise primary research where it delivers the most value.

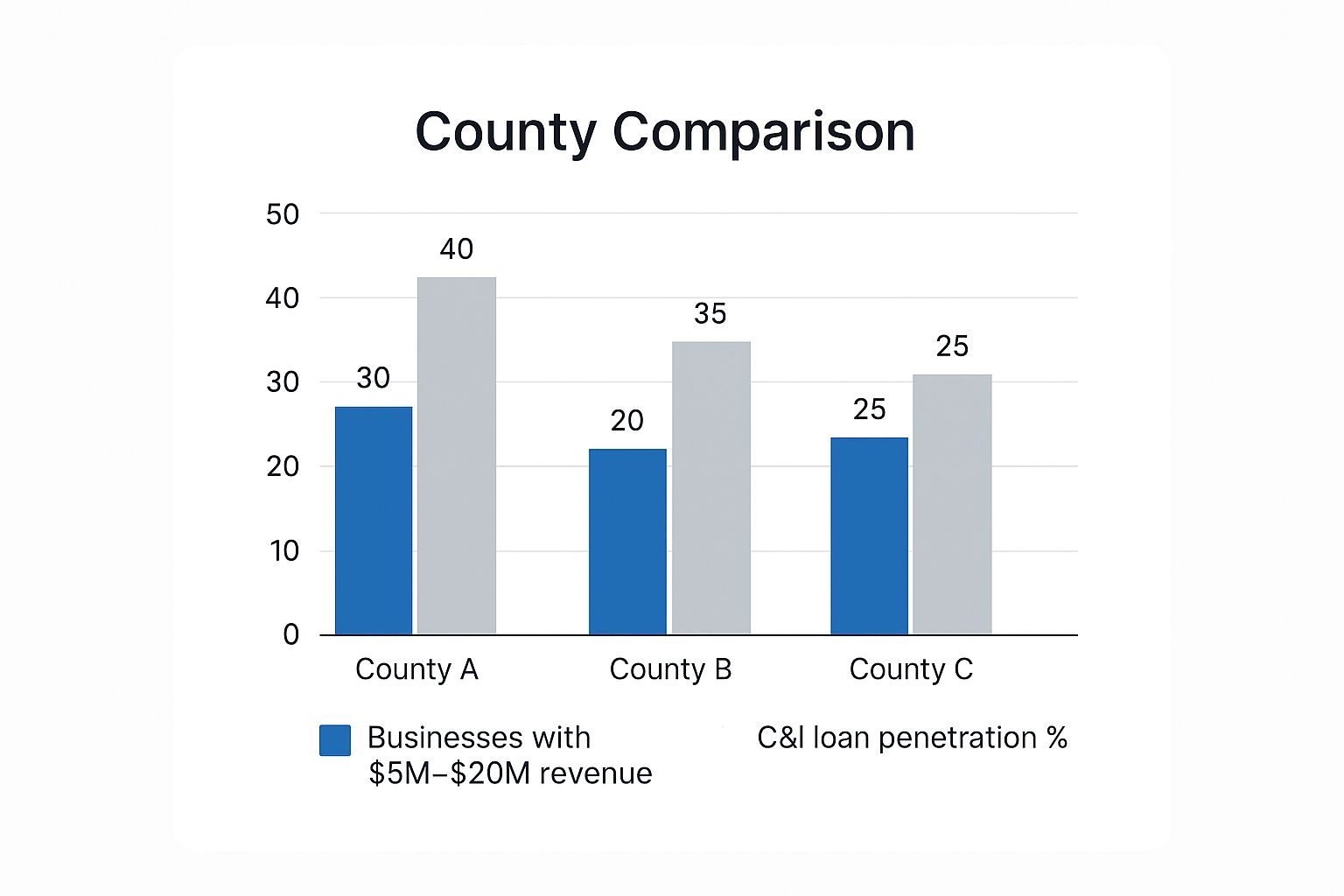

This approach helps visualize opportunities clearly. This chart, for example, blends business density data with C&I loan penetration across three distinct county markets.

The data makes the conclusion clear: County C, despite having fewer high-revenue businesses than County A, is a significantly underserved market with much lower loan penetration. This insight elevates the discussion from a hunch to a quantifiable, defensible growth strategy.

By combining readily available market data with your bank’s strategic goals, you can pinpoint the most profitable opportunities with confidence. To see how your institution stacks up, explore how Visbanking’s data can sharpen your own strategic framework.

Putting Your Data Collection and Analysis into Action

With a defined framework, the focus shifts to execution. This is where well-defined objectives meet raw data, and the work of converting information into intelligence begins.

This is not about running historical reports. The objective is precision—a disciplined process of gathering and interpreting information to generate forward-looking, predictive insights.

The process starts by synthesizing data from disparate sources. This means combining your bank’s internal transaction histories with powerful external data sets to build a true 360-degree view of your market.

Marrying Internal and External Data

Your own customer data is an underutilized asset. Transactional data reveals customer behavior, product adoption rates, and potential attrition risks. But this provides only an internal view.

To gain a complete market perspective, you need external context. Regulatory call reports are invaluable for this. By analyzing competitor filings, you can benchmark performance, anticipate market shifts, and identify service gaps they are not filling. For a different angle on this, some of the concepts from unlocking value with analytics for insurers can spark ideas applicable to banking.

The strategic imperative is to move from reactive analysis to predictive intelligence. Do not simply report that a competitor’s deposits grew last quarter. Determine their likely next move based on their performance patterns and the broader market dynamics.

This is what data intelligence platforms like Visbanking are designed to facilitate. They integrate these internal and external data streams, making it possible to identify opportunities that would otherwise remain buried in spreadsheets.

For example, analysis might show that 30% of your small business checking customers hold their primary business mortgage with a competitor. That is not just a statistic; it is a clear, quantifiable signal for a targeted cross-selling campaign with a defined market size.

From Raw Numbers to Smart Decisions

Data accumulation is easy. The value is created in the analysis. This means interpreting your findings to directly answer the strategic questions defined in the planning phase.

A common mistake is delivering a "data dump" to the leadership team. The analyst’s role is to be a translator, extracting the "so what?" from the numbers.

Here is what that looks like in practice:

- Sizing Opportunities: Quantify the total addressable market. Your analysis might reveal a specific county has $500 million in addressable small business deposits, yet is served by only two competitor branches. That is a well-defined market opening.

- Assessing Competitive Threats: Be specific about competitor actions. Data may show a local credit union has captured 15% of the new auto loan market in the last six months by offering a rate 25 basis points below yours. This is a direct threat to your portfolio.

- Identifying Product Gaps: Determine which services your customers are sourcing elsewhere. You might discover high-net-worth clients are increasingly using non-bank providers for wealth management, signaling a vulnerability or an opportunity.

Analytical tools continue to evolve. AI is playing a larger role in predictive analysis, helping researchers anticipate trends and improve efficiency. This is critical, as customer behaviors now change more rapidly than ever.

Ultimately, successful execution is about weaving a strategic narrative from individual data points. When you systematically collect and analyze the right information, your bank can pursue growth opportunities with speed and confidence.

Turning Data Into a Board-Ready Strategic Plan

You have completed the analysis and unearthed powerful insights. But raw data is noise. A deck full of spreadsheets will not secure a "yes" from the board; it will obscure the opportunity you have worked to uncover.

The critical final step is to translate complex findings into a compelling narrative that moves leadership from insight to action. The key is to frame every data point in the context of financial impact. The board must see a direct line from your research to the bank’s balance sheet.

From Analysis to Recommendation

A powerful report tells a concise story. It begins with a direct executive summary and supports it with curated data. You must anticipate the board's primary questions and answer them proactively.

Do not present disconnected facts. Your role is not data reporter; it is strategic advisor. Synthesize your findings into a coherent argument for a specific course of action, guiding the decision with data-backed confidence.

Every board-ready presentation must address these four points:

- The Quantifiable Opportunity: What is the size of the prize in dollars?

- A Specific Recommendation: What, precisely, should the bank do? No ambiguity.

- The Investment Case: What capital, personnel, and timeline are required?

- Projected ROI: What are the clear, measurable financial success metrics?

Your objective is not to present data; it is to present a decision. Frame your findings as a definitive business case that shows a clear path from investment to quantifiable returns.

Consider the difference. A weak, observation-based statement is: "County X has favorable demographics." This is an incomplete thought that forces the board to deduce its strategic implication.

A strong, data-driven recommendation is a complete business case:

"Based on our research, entering Market X presents a clear opportunity to capture an estimated $25 million in new core deposits within 18 months. We recommend a capital allocation of $750,000 for a de novo branch, with a projected breakeven in 36 months and a five-year ROA of 1.2%."

This provides the board with everything needed for a decision. It details the specific financial projections and timelines required to make an informed capital allocation, providing the confidence to act.

Benchmarking and a Final Gut Check

Before presenting to the board, conduct one final validation. How does this proposed opportunity compare to your bank's current performance or other initiatives competing for budget?

Platforms like Visbanking are ideal for this final benchmark. You can compare the projected metrics of the new venture against your own historical data and that of your peers. This adds a critical layer of validation, ensuring the recommendation is not just attractive in a vacuum but is strategically sound relative to other options.

Ultimately, your success hinges on translating rigorous market research into a simple, powerful story about profitable growth. When you can do that, you provide the board exactly what it requires: a data-backed plan to win.

To see how your bank's current strategy measures up, explore our data intelligence platform and start making more informed decisions today.

Your Questions, Answered

Implementing formal market research is not about adding complexity; it is about shifting from intuition-based to evidence-based decision-making.

Here are answers to common questions from bank executives integrating data intelligence into their strategic planning.

How Can a Community Bank Do This on a Shoestring Budget?

This is not about hiring expensive consultants or conducting massive surveys. The key is to focus on high-impact, low-cost data.

Begin with your own customer data. It is a rich source of behavioral trends and profitable segments that you already own. For example, analyzing your own data might reveal that your top 10% of commercial depositors generate 60% of your non-interest income, a segment that warrants a dedicated retention strategy.

Next, leverage publicly available regulatory data, such as call reports. This allows you to benchmark your performance against direct competitors without any additional research spend. A data intelligence platform that aggregates this public information is far more efficient and affordable than a one-off study. The strategy is to focus on answering one or two critical business questions per quarter, not to boil the ocean.

What's the Single Biggest Mistake You See Banks Make?

Conducting research without a specific business decision tied to the outcome. Many institutions gather fascinating data that culminates in a report that sits on a shelf. The information is interesting, but not actionable.

Effective research always begins with the decision it is meant to inform. For example: "Should we invest $2.5 million in a new branch in the 75205 zip code?" or "Should we price our new 12-month CD 15 basis points above the market average to gain $50 million in deposits?"

This focus ensures every research dollar is directly linked to a measurable financial outcome.

How Often Should We Be Doing This?

Market research is not a one-time project; it is a continuous function. Major strategic deep-dives may occur annually, but competitive monitoring must be ongoing.

Key metrics—such as competitor deposit rates, new product launches, and marketing campaigns—should be tracked at least quarterly. A data intelligence platform provides an "always-on" market view, enabling you to react to changes in real-time. For instance, knowing a competitor raised its money market rate by 50 basis points on Monday allows you to craft a response by Tuesday, not a month later.

This continuous intelligence turns research from a line-item expense into a significant competitive advantage, allowing you to identify opportunities before competitors do.

At Visbanking, we transform complex data into clear, actionable intelligence. Our platform provides banking executives with the tools to move from analysis to decisive action, improving performance, targeting, and risk foresight.

Benchmark your performance and see what our data can do for you.

Similar Articles

Visbanking Blog

Capital Banking in the USA: An Overview of Investment Services, Financial Instruments, and Regulations

Visbanking Blog

BIAS: Your Competitive Edge in Banking Data Driven Strategy

Visbanking Blog

Navigating the Landscape of Bank Recruitment in the U.S.

Visbanking Blog

Banking Talent Crisis: Why Top Professionals Are Leaving

Visbanking Blog

Revolutionize Your Banking Operations with Data-Driven Insights from BIAS

Visbanking Blog

Make Better Decisions with Confidence with BIAS, the Tailored Strategies Solution

Visbanking Blog

Get a Competitive Advantage with BIAS, the Proactive Banking Solution

Visbanking Blog

Navigating Bank Recruitment: Strategies for Success in the Financial Sector

Visbanking Blog

Banking Data Analytics: Turning Information Into Profit

Visbanking Blog