Business Intelligence for Banks Driving Growth

Brian's Banking Blog

In a hyper-competitive market like banking, winning isn't just about good old-fashioned service anymore. It's about making smarter, faster decisions. This is where business intelligence comes in, turning mountains of raw data into clear, actionable insights. It gives you a real-time view of performance, risk, and what your customers are really doing.

For the institutions that get it right, this isn't just an advantage—it's how they're leading the pack.

The New Competitive Edge in Banking

Think of a pilot flying through a nasty storm. Without modern instruments, they're flying blind, just reacting to turbulence as it hits and hoping for the best. That’s what banking without business intelligence feels like—a reactive, high-risk gamble against volatile market conditions.

Think of a pilot flying through a nasty storm. Without modern instruments, they're flying blind, just reacting to turbulence as it hits and hoping for the best. That’s what banking without business intelligence feels like—a reactive, high-risk gamble against volatile market conditions.

Now, picture a pilot with a state-of-the-art cockpit dashboard. They see the weather patterns miles ahead, anticipate the bumps, and chart the safest, most efficient course.

Business intelligence for banks is that advanced dashboard. It provides the clarity and foresight you need to navigate the financial world with confidence. It’s no longer a "nice-to-have" tech option; it's a core strategic asset for survival and growth.

Turning Data into Decisions

Every bank is sitting on a goldmine of data from transactions, customer chats, and market feeds. The problem? Historically, this information has been locked away in different systems, creating massive operational blind spots. According to PwC, payments alone generate about 90% of a bank’s useful customer data. Without the right tools, that goldmine remains completely untapped.

Business intelligence gives you the framework to finally put that data to work.

- Consolidate Information: Pull data from your core banking systems, CRMs, and fraud platforms into one single, unified view.

- Analyze Performance: Track key performance indicators (KPIs) for branches, products, and even individual employees in real-time.

- Identify Trends: Uncover the hidden patterns in customer behavior, market shifts, and operational holdups you'd otherwise miss.

Business intelligence is the engine that converts raw transactional and customer data into the actionable insights that power smarter decisions. It’s the difference between guessing what your customers need and knowing what they need, often before they do.

This isn't a luxury anymore. With the speed of modern payments and customers who expect more, the banks that can actually read their own data are the ones that will win. You can use BI to pinpoint which customer segments are most profitable or which marketing campaigns are actually delivering a return.

This isn't just theory; it directly hits the bottom line. Research from McKinsey shows that banks using BI tools effectively can boost their operational efficiency by up to 20%. By turning raw numbers into clear, strategic actions, business intelligence is paving the way for a more proactive, resilient, and profitable future in banking.

What Business Intelligence Really Means for Banks

Let's cut through the jargon. At its heart, business intelligence in banking is about taking all the raw, scattered bits of data your bank generates and turning them into a clear picture that tells you what to do next.

Think of it as your bank's central nervous system. It pulls in signals from everywhere—the teller line, the loan department, the marketing team, the trading desk—and translates them into smart, coordinated actions. It's the difference between flying blind and having a full command center guiding your every move.

Without it, every department is an island. Your lending team has no idea what marketing just learned about customer behavior, and your risk department is a step behind on spotting unusual transaction patterns. Business intelligence is the bridge that connects these islands, making sure the entire organization moves as one.

This isn't just some abstract concept; it's a fundamental shift in how banks operate, moving from guesswork to informed strategy.

From Old-School Reports to Modern Intelligence

For decades, banks ran on static, historical reports. You'd get a monthly printout telling you what happened last month, long after the opportunity to act had passed. It was like driving by only looking in the rearview mirror. Modern BI flips that script entirely. It's dynamic, forward-looking, and happens in real-time.

This table shows just how big that leap is:

Traditional Reporting vs Modern Business Intelligence

| Aspect | Traditional Reporting | Modern Business Intelligence |

|---|---|---|

| Focus | What happened? (Historical) | Why is it happening and what's next? (Diagnostic & Predictive) |

| Data | Siloed, often manual | Centralized, automated |

| Speed | Weekly or monthly | Real-time, on-demand |

| Format | Static PDFs, spreadsheets | Interactive dashboards, live charts |

| Audience | A few analysts or executives | Accessible to teams across the bank |

| Outcome | Reactive decisions | Proactive, data-driven strategies |

The shift is clear: we're moving from a passive review of the past to an active engagement with the present and future. This is the new standard for staying competitive.

The Engine Behind Banking Intelligence

So, how does this actually work? It’s not magic. It's a well-oiled machine built from a few key parts that turn chaotic information into a real strategic advantage.

The market is betting big on this. The global business intelligence software market, which recently stood at USD 41.74 billion, is expected to skyrocket to USD 151.26 billion in the next ten years. Why? Because banks and other industries are realizing this is the key to sharper decision-making and better market predictions. You can read more about the explosive growth in the BI software market and what's driving it.

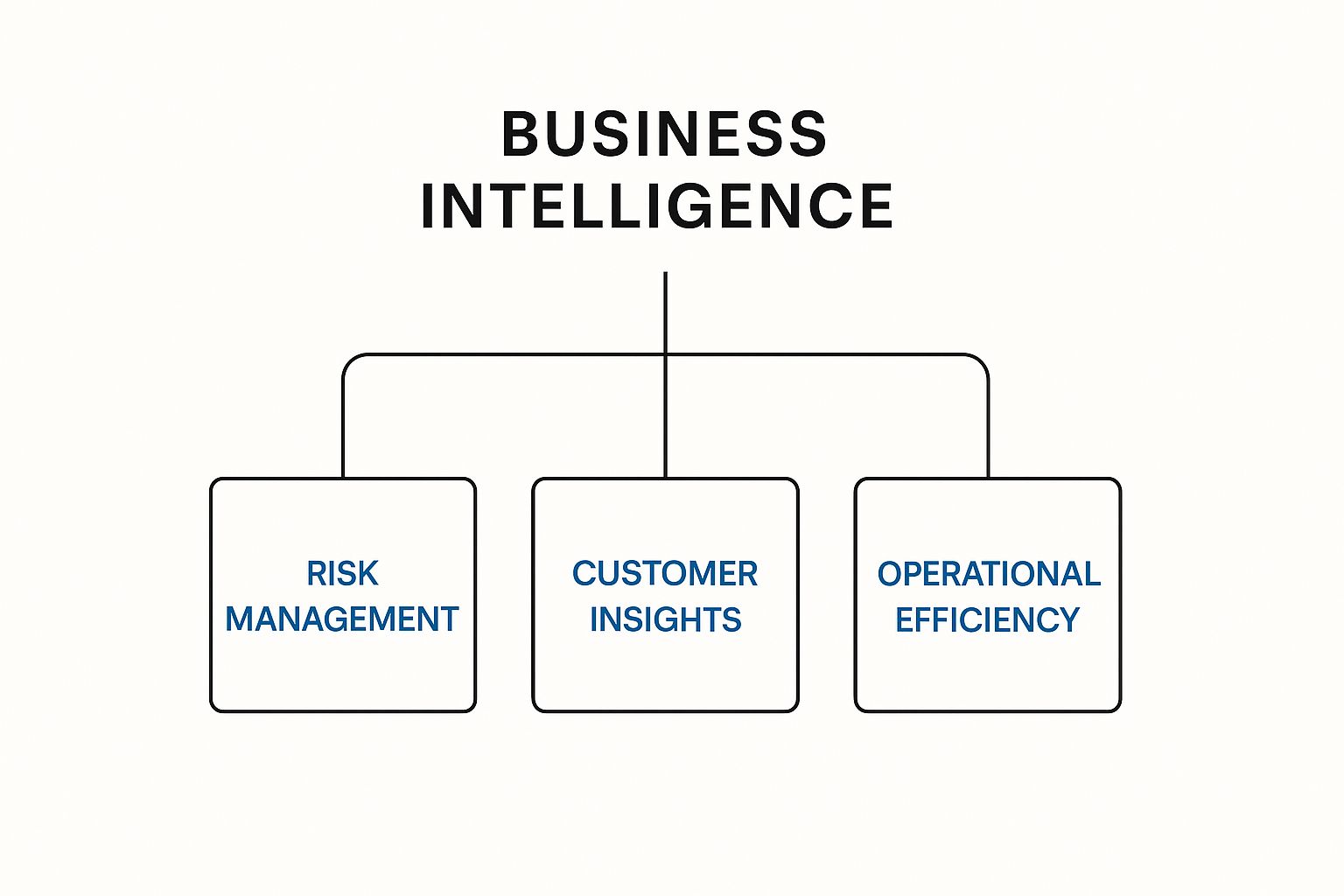

This infographic shows how all these efforts line up to support the top priorities for any bank.

As you can see, a solid BI foundation is what makes world-class risk management, deep customer understanding, and incredible operational efficiency possible. It's not just a nice-to-have; it’s the bedrock of a successful modern bank.

How Data Becomes Insight: A Quick Tour

Let’s follow a piece of data on its journey through a modern BI system.

The Data Warehouse: Your Bank's Digital Memory. This is the highly organized, secure vault where all your historical data lives. Think of it as the bank's institutional memory, holding everything from transaction logs to every customer interaction.

ETL: The Data Concierge. ETL stands for Extract, Transform, Load. This is the behind-the-scenes process that acts like a diligent concierge. It extracts data from all your different systems (the core, CRM, etc.), transforms it into a clean, standard format, and loads it into the warehouse, ready for its close-up.

Dashboards: The Cockpit View. This is where you see the results. Interactive dashboards are your cockpit, displaying all that organized data as easy-to-read charts, graphs, and key metrics. This is what turns a million rows in a spreadsheet into a clear story, letting a branch manager see daily loan performance or an executive track growth against goals with a single click.

A BI platform doesn't just show you numbers; it answers your most pressing questions. It moves beyond "what happened?" to tell you why it happened.

That's the real power of business intelligence for banks. It closes the gap between data and decision, empowering you and your team to lead with confidence.

Key Benefits of BI for Financial Institutions

It's one thing to talk about the mechanics of business intelligence, but what really gets a banker’s attention is the impact on the bottom line. Let's move past the theory. The real value of business intelligence for banks is in the tangible results it produces—smarter decisions that drive profitability, build rock-solid customer relationships, and shield the institution from risk.

It's one thing to talk about the mechanics of business intelligence, but what really gets a banker’s attention is the impact on the bottom line. Let's move past the theory. The real value of business intelligence for banks is in the tangible results it produces—smarter decisions that drive profitability, build rock-solid customer relationships, and shield the institution from risk.

When a bank truly embraces BI, it stops just reacting to market shifts and starts anticipating them. That leap from a defensive crouch to a proactive stance is where the magic really happens.

Deeper Customer Understanding and Personalization

BI is the difference between generic, one-size-fits-all service and experiences that feel hyper-relevant.

Picture this: a customer has been steadily growing their savings account and, on the side, has started browsing Zillow. A sharp BI platform can connect these seemingly separate dots—account activity, web behavior, maybe even demographic info—to tell a powerful story.

Instead of just waiting for that customer to walk in and ask for a loan, the bank can proactively reach out with a pre-approved mortgage offer that fits their financial reality perfectly. That's what a 360-degree customer view delivers. You're turning cold, routine data into a timely, valuable service that builds incredible loyalty.

Business intelligence transforms customer data from a static record into a dynamic story. It tells you not just who your customers are, but what they are about to need.

This kind of personalized approach has a direct line to growth. Banks can finally pinpoint their most profitable customer segments and build products that solve their specific problems, boosting both retention and the opportunity to cross-sell.

Proactive Risk Management and Compliance

In our world, managing risk isn't just important; it's everything. For too long, we've relied on looking in the rearview mirror, reviewing historical data after a problem has already surfaced. BI completely flips the script by using predictive analytics to flag risks before they blow up.

A BI system, for example, can scan thousands of loan accounts in real time. It's looking for those subtle shifts in payment habits, credit scores, or a business customer's activity that signal trouble ahead. It can spot patterns that suggest a borrower might be heading toward default months in advance. That early warning gives you time to step in with real solutions, protecting your assets and helping your customer avoid disaster.

It's no surprise the global business intelligence market was valued at around USD 30.1 billion and is projected to hit USD 116.25 billion within nine years, with a powerful CAGR of nearly 14.98%. This explosive growth is being driven by industries like ours, especially in North America, as we invest heavily to gain these predictive advantages.

This proactive mindset extends to regulatory compliance, too. BI tools can automate the grunt work of generating complex compliance reports, ensuring they're accurate and freeing up your team from drowning in spreadsheets. They can finally focus on strategy, not data entry.

Improved Operational Efficiency

Inefficiencies are the silent killers of profit in a bank. They hide in slow-moving processes, underperforming branches, and product lines that just aren't pulling their weight. Business intelligence drags these issues out into the sunlight.

- Branch Performance: A regional manager can see, at a glance, which branches are hitting their goals and which are lagging, then drill down with a click to find out why.

- Process Bottlenecks: Dashboards can map out the entire loan approval journey, pinpointing exactly where applications get stuck and for how long.

- Resource Allocation: By analyzing ATM usage patterns, a bank can perfect its cash replenishment schedules and machine placements, slashing service costs.

These aren't just minor tweaks. They add up to massive cost savings and create a leaner, more agile bank. To see how these benefits come together, check out our guide on the fundamentals of banking data analytics.

How Banks Use Business Intelligence in the Real World

Theory is great, but seeing business intelligence for banks in action is what really opens your eyes. It's the difference between reading a car's manual and actually getting behind the wheel. Let’s move past the concepts and into the real world to see how BI solves the tough, everyday problems banks face.

These aren't some far-off, futuristic ideas. They're practical applications happening right now, delivering real, measurable returns for banks smart enough to put their data to work.

From figuring out who your best customers are to stopping fraud dead in its tracks, BI gives you the clarity you need to not just survive, but thrive.

Use Case 1: Customer Segmentation and Profitability

Imagine you're running a regional bank that wants to grow. You have tons of products, from simple checking accounts to complex wealth management services. The million-dollar question is: who are our most valuable customers, and how do we find more people just like them?

This is a classic banking headache, and it's exactly where BI shines. By pulling in data from your core systems, CRM, and even online banking activity, you can finally build a true picture of profitability.

- Putting the Pieces Together: The BI platform gathers everything—account balances, transaction histories, loan data, and service fees—for every single customer.

- The Profitability Breakdown: It then crunches the numbers to figure out the net value of each relationship. This isn't just about the revenue they bring in; it's also about what it costs you to serve them.

- Smart Grouping: The system then automatically sorts customers into meaningful segments, like "High-Value Families," "Small Business Power Users," or "Low-Margin Savers."

Suddenly, your marketing team can stop throwing money at broad, ineffective campaigns. Instead, they can aim directly at attracting more "High-Value Families," because they know for a fact that this segment drives the highest return.

A BI-driven customer view does more than just organize your contacts; it reveals the hidden economic engine of your bank. It shows you exactly which relationships are pushing growth and which ones are a drain on your resources.

Use Case 2: Real-Time Fraud Detection and Prevention

Fraud is a constant, fast-moving threat. With old-school reports, by the time you spot a suspicious pattern, the money is usually long gone. Real-time BI dashboards, on the other hand, give your security team the power to act now.

Picture a fraud analyst’s dashboard. It’s not showing what happened yesterday—it’s monitoring transactions as they happen. The system is built on rules and machine learning models that have learned what "normal" looks like across millions of customers.

When a transaction sticks out—say, a debit card is suddenly used in another country just minutes after a local purchase—an alert flashes on the dashboard instantly. This lets the security team:

- Jump on It: Immediately drill down into the transaction details and customer history.

- Get on the Phone: Quickly call the customer to see if the purchase is real.

- Shut It Down: Block the card before any more damage can be done.

This proactive approach saves millions every year and, just as importantly, protects the bank's hard-earned reputation. It’s a perfect example of how business intelligence provides an immediate and powerful defense against financial crime.

Use Case 3: Credit Risk Modeling and Lending Decisions

Making smart lending decisions is the heart of banking. A BI-powered credit risk model goes way beyond a simple credit score, looking at thousands of data points to give you a much richer, more accurate picture of risk.

When a loan application lands on your desk, the BI system can dig into:

- Cash Flow Patterns: Analyzing the applicant's account to see how stable their income and spending really are.

- Industry Trends: For a business loan, it can check how the applicant's performance stacks up against industry benchmarks.

- Relationship History: It considers the applicant's entire history with the bank, not just a single snapshot in time.

This deeper dive leads to faster, smarter, and more confident lending decisions. Just look at Karnataka Bank, a leading commercial bank in India. After implementing an enterprise BI tool, they generated over 100 Crore INR (1000 Million INR) in new business from these kinds of data-driven moves. Their dashboards gave them clear views on everything from branch productivity to non-performing assets, helping them take action and dramatically improve their collections.

To get the full picture, banks also need to capture insights directly from their customers. This is where tools like specialized bank survey software come in, helping to gather the kind of qualitative feedback that numbers alone can't provide. These examples make it clear: business intelligence isn't about making pretty charts. It's about building a stronger, more efficient, and more profitable bank.

A Strategic Roadmap for BI Implementation

Diving into business intelligence without a clear plan is like trying to build a new branch without a blueprint. You might get a structure up, sure, but it won’t actually serve your customers or your team. A winning BI initiative isn't about the tech itself—it's about the strategic thinking behind it. Think of it as a business project, not just an IT one.

This roadmap is a high-level guide for banking leaders ready to finally make their data work for them. It’s all about setting clear goals, establishing strong governance, and taking a people-first approach. Get this right, and your BI investment will deliver a powerful, measurable return.

Start With a Clear Business Objective

Here's the single biggest mistake I see banks make: they chase BI for technology’s sake. The most successful projects always start by answering one simple question: What specific business problem are we trying to solve?

Don't try to boil the ocean. A vague goal like "improve efficiency" gets you nowhere. Get specific. Is your main headache high customer churn? Are you bogged down by slow loan processing times? Or do you just need a better handle on branch-by-branch profitability?

Focusing on one high-impact problem creates immediate value and builds momentum. It gives you a clear metric for success, proves the ROI fast, and makes it a whole lot easier to get buy-in for what comes next.

Establish Strong Data Governance

Let’s be blunt: your BI system is only as good as the data you feed it. That old saying, "garbage in, garbage out," is gospel in banking, an industry built on accuracy and trust. This is where data governance comes in. It’s non-negotiable.

Data governance is simply the set of rules and roles that ensures your data is consistent, trustworthy, and secure. It answers the critical questions:

- Who owns the data? You need to assign clear ownership for customer data, transaction data, and so on.

- What does 'good' look like? Define your quality standards for what makes data "clean" and "complete."

- Who gets to see what? Implement role-based permissions so people only see the information they actually need for their job.

Without this foundation, you’re just building fancy dashboards on shaky ground. Trust will erode, and the whole project will be undermined. A huge part of this is integrating information from all your different systems. For a deeper dive, check out our insights on effective financial data integration strategies.

"A BI tool without data governance is like a high-performance sports car without a steering wheel. It has immense power, but you have no control over where it goes, and it's bound to crash."

Choose the Right Platform and Foster Culture

Once your strategy and governance are solid, then you can pick the technology. In our world, business intelligence for banks is what drives smart strategic moves. It’s no surprise the market for BI management software is expected to jump from USD 32.6 billion to USD 36.11 billion in the next year. This growth is all about the need for real-time analytics and solid governance.

When you're looking at platforms, find one that's actually built for banking. Look for key features like:

- Seamless Integration: Can it easily connect to your core, your CRM, and other key data sources without a massive IT project?

- User-Friendly Dashboards: Are the interfaces intuitive enough for non-technical folks to explore data without needing an IT degree?

- Scalability and Security: Will it grow with your bank and meet the intense security standards our industry demands?

The Visbanking platform, for example, was designed from the ground up to provide clear, actionable insights by benchmarking performance and flagging key opportunities.

This screenshot from Visbanking shows how complex bank performance data can be simplified into a clean, intuitive dashboard, putting real strategic insights right at your fingertips.

But at the end of the day, the tech is just a tool. The real magic happens when you build a data-driven culture. This means training your people, celebrating data-informed wins, and encouraging everyone to be curious. When your employees feel empowered to ask questions and find answers in the data, you’ve finally unlocked the true power of business intelligence.

The Future of Banking Is Predictive and Automated

Business intelligence for banks is moving into a new, much more powerful chapter. We're shifting away from simply explaining what happened yesterday and are now starting to accurately predict what will happen tomorrow—and even getting advice on the best way to respond. This whole leap forward is being fueled by a powerful mix of BI with Artificial Intelligence (AI) and Machine Learning (ML).

Think about it this way: traditional BI gave us a clear rearview mirror, showing past performance. This new generation of smart systems uses that same history to build models that can forecast what's coming. We're moving from a reactive stance to a truly proactive one. It’s no longer about digging into last quarter's churn rate; it's about spotting which specific customers are at risk of leaving next month and automatically kicking off a campaign to keep them.

The Rise of Hyper-Personalization

This fusion of BI and AI is unlocking a level of personalization that just wasn't possible before. AI algorithms can now look at a customer's entire financial life—their spending habits, how fast they're saving, their loan payments, even outside life events—to get ahead of major milestones.

Imagine a system that flags a young couple saving aggressively and making small, regular payments to a wedding planner. The BI system, powered by AI, can put two and two together. They’re probably planning a wedding and will need a mortgage soon. It can then proactively offer a tailored home loan package, landing at the exact moment the customer needs it most. This isn't just good service; it's a game-changing competitive advantage.

The real goal of modern BI is to get from insight to action without any friction. That means anticipating what customers need and automating the best response, turning data into a seamless, valuable experience.

From Dashboards to Conversations

Another big shift is the move toward conversational analytics. The days of needing a data scientist to write complex code are fading fast. Soon, a bank executive will be able to just ask their BI system in plain English: "Which of our small business loan products had the highest default rate in the last six months, and what did those borrowers have in common?"

The system will instantly crunch the numbers and serve up a clear, data-backed answer, maybe with a few charts and a summary. This puts incredible analytical power right in the hands of decision-makers, letting them make strategic changes and fix operational problems much faster.

The future of banking intelligence isn't just about looking at data; it's about getting ahead of trends and automating smart responses. To really get a handle on this shift, you can explore the core concepts of predictive analytics in banking and see how these models are built. This combination of BI and AI is where the next wave of industry leaders will be born.

Got Questions About BI in Banking? We've Got Answers.

Jumping into business intelligence can feel like navigating a new city—it's exciting, but you're bound to have some questions. Here are a few common ones we hear from banking pros, with straight-to-the-point answers to help you find your way.

We’re a Small Bank. Where Do We Even Begin?

Don't try to boil the ocean. Seriously. The biggest mistake smaller and community banks make is trying to tackle everything at once with a massive, bank-wide data project. It's a recipe for burnout.

Instead, pick one single, high-impact business problem and solve it. That's it. Maybe it’s figuring out which checking accounts actually make you money, or perhaps it's slashing the approval time for small business loans. By starting with a specific pain point, you get a quick win, prove the value of business intelligence for banks, and build the momentum you need for what comes next. This approach gets everyone on board because they see a real, tangible result.

How Does This Stuff Actually Help with Compliance?

Regulatory reporting is a grind. We all know it. It's often a manual, soul-crushing process that ties up your best people for weeks. Business intelligence tools flip that script by automating the grunt work of pulling data and building reports.

Instead of your analysts wrestling with a dozen different spreadsheets, a BI platform can pull it all together in minutes.

What BI really delivers is a single source of truth. It ensures your compliance data is consistent, accurate, and completely auditable. This drastically cuts the risk of human error and gives regulators the transparency they’re looking for.

Suddenly, your compliance team is free to focus on what they do best: interpreting regulations and managing risk, not just chasing down numbers.

Can BI Even Talk to Our Old Core System?

This is the million-dollar question, and the answer is a resounding yes. Modern BI platforms are built from the ground up to integrate with the mix of systems banks actually use.

Whether your data is locked in a legacy core, a shiny new CRM, or a handful of third-party apps, BI tools use specialized connectors and processes (known as ETL) to gather it all. Think of a good BI solution as a universal translator—it sits on top of your existing tech stack and creates one unified view, without forcing you to rip out the systems you already depend on.

Is a BI Platform a Replacement for My Data Analyst?

Not at all. A BI platform doesn't replace your data analyst; it gives them a superpower. It's a critical distinction.

Here’s how to think about it:

- A Data Analyst is the strategist. They’re the skilled expert who asks the tough questions, spots the patterns, and uncovers the insights that drive your bank forward.

- A BI Platform is the workhorse. It’s the tool that does all the heavy lifting—automating data collection, cleaning it up, and serving it on a silver platter through dashboards and reports.

A BI platform is the souped-up race car, but your analyst is the expert driver who knows the track and how to win the race. You need both to get to the finish line first.

Ready to stop asking questions and start finding answers in your own data? Visbanking gives your bank the clarity to benchmark performance, spot opportunities, and make decisions with confidence. See how the BIAS platform works.