The Modern Fraud Risk Manager in Banking

Brian's Banking Blog

The role of a fraud risk manager has evolved from a back-office compliance function into a strategic leadership position. Reactive transaction blocking is obsolete. The modern imperative is to build a resilient, data-driven fraud prevention framework that protects the bottom line while enabling profitable growth. For bank executives and directors, understanding this shift is critical to institutional stability.

Defining the Modern Fraud Risk Manager

Today's fraud risk manager operates at the intersection of data science, regulatory compliance, and business strategy. This leader's effectiveness directly impacts the bank's profitability, customer trust, and long-term viability. The primary mandate is to balance aggressive risk mitigation with a frictionless customer experience—protecting institutional assets from an expanding array of threats without impeding legitimate business.

This challenge is escalating. In 2024, consumer fraud losses increased by 25% year-over-year, exceeding $12.5 billion globally. With approximately 60% of financial institutions reporting a rise in fraud attempts, the pressure to perform has never been greater.

A Strategic Imperative

An effective fraud risk manager does more than stop crime; they enable secure innovation. By embedding risk intelligence into the product development lifecycle, they ensure that new services launch without introducing unacceptable vulnerabilities. A core component of this is effective Chargeback Risk Management, which is foundational to financial stability.

For the board and the C-suite, the fraud risk manager is the strategic advisor who translates complex threat data into clear business risks and opportunities. This guidance informs critical decisions on technology investments, operational adjustments, and the bank’s overall risk appetite.

Ultimately, this role is a cornerstone of any robust financial institution risk management program. When this leader is equipped with superior data intelligence—such as the peer and market analytics from Visbanking—the institution transitions from a defensive posture to a proactive, strategic one.

Mapping Core Responsibilities to Business Outcomes

A top-tier fraud risk manager translates operational duties into measurable business outcomes. The objective is not to build an impenetrable fortress but to design an adaptive fraud framework that connects every core responsibility directly to the bank's financial health and market position. This involves conducting sophisticated risk assessments for new products and overseeing intelligent transaction monitoring systems—actions that are foundational to launching innovative banking services securely.

From Risk Modeling to Profit Protection

Consider the launch of a new real-time payment service. An experienced fraud risk manager models potential threat scenarios before the product goes live. They might identify account takeover as the primary risk, projecting potential first-quarter losses of $500,000.00 if the threat is not addressed.

A fraud risk manager's value is not measured solely by the fraud they prevent, but by the secure growth they enable. By quantifying and mitigating risk, they provide the executive confidence required to pursue new revenue streams.

Armed with this data-driven forecast, the manager architects a precise defense, such as implementing dynamic velocity limits tied to user behavior and selecting a monitoring tool engineered to maintain fraud losses below a target threshold of 0.05% of transaction volume. This proactive stance ensures a new product launches both profitably and securely.

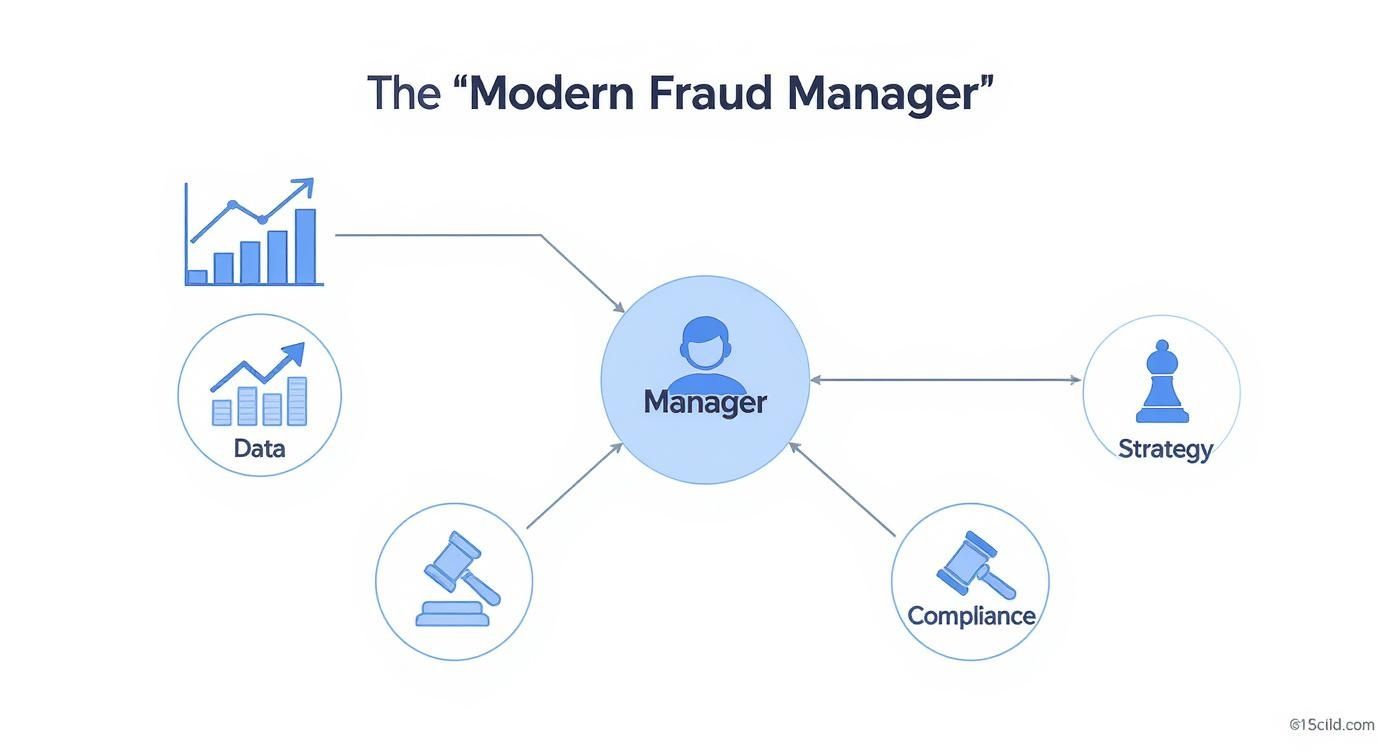

The diagram below illustrates how a modern fraud risk manager integrates data, strategy, and compliance to drive these outcomes.

This role does not operate in a silo. It sits at the intersection of critical business functions, converting disparate inputs into a cohesive risk strategy that protects and enables the institution.

Connecting Actions to the Bottom Line

To demonstrate value, core responsibilities must be mapped to tangible institutional benefits. The following table breaks down how operational duties create strategic outcomes.

Key Responsibilities Mapped to Banking Outcomes

| Core Responsibility | Description | Strategic Business Outcome |

|---|---|---|

| Fraud Framework Design | Architecting a comprehensive strategy that balances robust security with a seamless customer experience. | Reduces friction for legitimate customers while raising barriers for criminals, improving retention and lowering fraud-related operational costs. |

| Technology Oversight | Evaluating and deploying best-in-class fraud detection and prevention technologies. | Slashes false positive rates, which reduces manual review costs and improves the efficiency of risk operations. |

| Regulatory Adherence | Ensuring compliance with key regulations such as the Bank Secrecy Act (BSA) and other mandates. | Protects the institution from significant fines, regulatory actions, and material reputational damage. |

By empowering your fraud risk manager with superior data intelligence, like the peer performance benchmarks available in Visbanking, you equip them to make stronger, evidence-based decisions. Benchmarking your institution's fraud metrics against the industry pinpoints strategic opportunities for improvement.

Building a High-Impact Fraud Management Team

A top-tier fraud risk manager is a strategic asset who requires a specific blend of analytical acumen, technological fluency, and leadership. Building a team around such a leader is a direct investment in your bank's resilience and competitive advantage. The objective is to move beyond simple compliance and cultivate a culture of proactive threat mitigation.

This leader must be capable of analyzing complex, unstructured data to identify emerging threats. They need the technical expertise to not only use AI and machine learning platforms but to challenge their models and understand their limitations. These tools are the backbone of modern fraud detection, and their effective oversight is non-negotiable.

A deep understanding of the regulatory environment, including the Bank Secrecy Act (BSA), is essential. However, what distinguishes a great fraud manager is the ability to translate this complex information into a clear, actionable narrative for the board and executive team.

From Data Modeler to Strategic Advisor

The ability to connect data to strategy is what separates a competent manager from an indispensable one. For instance, following a major data breach at a national retailer, a strategic fraud manager immediately assesses the downstream risk to your institution.

A fraud risk manager’s true value is measured not by the fraud they stop, but by the secure growth they enable. They must convert abstract data into concrete defensive actions that protect the balance sheet and preserve customer trust.

Using predictive modeling informed by external intelligence, they might forecast a 15% increase in synthetic identity fraud attempts against your bank over the next six months. This is not an abstract statistic; it is a direct threat to new account originations and the loan portfolio. A strategic leader acts on this intelligence immediately, building the business case for enhanced identity verification controls and behavioral biometrics at the point of account opening. This proactive posture neutralizes threats before they materialize into losses, saving capital and protecting the bank's reputation.

Cultivating Essential Competencies

To build this capability, executives must recruit and develop leaders with these core skills:

- Quantitative Acumen: The ability to understand, interpret, and challenge analytical models from internal teams and third-party vendors.

- Decisive Communication: The skill to brief the board on emerging threats with clarity, linking every dollar of investment in fraud prevention directly to P&L protection.

- Cross-Functional Leadership: The capacity to collaborate with IT, marketing, and product development to integrate fraud prevention into the core fabric of the business, not as an afterthought.

Arming your fraud risk manager with the best available data is paramount. Platforms like Visbanking provide the external benchmarks and peer analytics needed to identify vulnerabilities and build an irrefutable case for strategic investment.

Tapping into Technology and Data Intelligence

In modern fraud prevention, technology is the central nervous system of the entire defense strategy. For a fraud risk manager, mastering the technology stack is not an IT function—it is a core strategic responsibility. Static, rules-based engines are relics. Today’s environment demands dynamic, AI-powered systems capable of analyzing thousands of data points in real time.

This is a strategic necessity, not an upgrade. A legacy system flagging all transactions over $10,000.00 creates operational drag, burying analysts in false positives and frustrating legitimate customers. A modern, AI-driven platform applies contextual analysis, assessing the transaction amount, customer location, device ID, and historical behavior simultaneously. This intelligence enables the system to flag a fraudulent $500.00 purchase while seamlessly approving a legitimate $15,000.00 transaction from an established client.

The business impact is immediate: reduced manual review costs, lower fraud losses, and an improved customer experience. Superior data intelligence is a competitive differentiator.

From Reactive Rules to Predictive Smarts

The strategic value of a modern fraud risk manager lies in shifting the institution's posture from reactive to predictive. This requires a sophisticated technology stack built on machine learning and behavioral analytics. Instead of merely responding to known fraud patterns, these systems establish a baseline of normal behavior for each customer, enabling the detection of subtle anomalies that signal malicious activity.

An institution's fraud prevention is only as strong as the data that powers it. The real goal isn’t just to buy technology, but to build an intelligence system that turns raw data into decisive, protective action.

This is where data becomes a decisive weapon. Technologies like behavioral biometrics can detect subtle changes in typing cadence or mouse movements indicative of an account takeover. Device fingerprinting can identify login attempts from compromised hardware. A simple rules engine would miss these critical signals.

The Booming Market for Fraud Prevention

This technological arms race is driving significant investment. The global fraud detection and prevention market, valued at $52.82 billion in 2024, is projected to reach $246.16 billion by 2032. North America commands 41.56% of this market, with the banking and financial services industry as the primary driver. You can explore more data on these market dynamics to understand how this trend is shaping institutional strategy. For executives, the directive is clear: investing in the right fraud technology is a direct investment in future profitability and stability.

This is why external intelligence is so critical. A platform like Visbanking provides a fraud risk manager with the ability to benchmark their institution’s technology and performance against peers. By analyzing industry-wide data, they can identify defensive gaps and build a data-backed case for investing in the tools needed to close them. Explore our data to benchmark your institution’s performance and inform your next strategic move.

Integrating Fraud and Cyber Risk Strategies

In banking, the distinction between financial fraud and a cyberattack has effectively been erased. For executive leadership, managing these threats in separate silos is no longer merely inefficient; it is a critical vulnerability. A sophisticated fraud risk manager understands that phishing, malware, and ransomware are not just IT issues—they are primary vectors for large-scale financial crime.

Consider a targeted phishing campaign against a bank's commercial clients. The attack begins as a cybersecurity breach, but its objective is financial fraud. The resulting account takeovers can lead to fraudulent wire transfers exceeding $2 million. A top-tier fraud risk manager collaborates directly with the CISO to build layered defenses that address the entire attack chain.

A Unified Defense Framework

This requires dismantling departmental silos to create a unified defense. It means sharing threat intelligence in real time and co-developing incident response plans. To combat modern threats, institutions must implement robust secure data destruction practices and establish a clear command structure for incident response.

The scale of the challenge is immense. By 2025, an estimated 800,000 cyberattacks are projected to occur globally each year, with approximately 300,000 new malware variants created daily. This relentless onslaught puts digital assets at constant risk, creating countless opportunities for fraudsters.

A modern fraud risk manager must possess dual expertise, understanding that a compromised password can be as damaging as a forged check. Their role is to ensure the bank’s defenses address the full threat landscape, from the initial malicious click to the final fraudulent transaction.

Tying Cyber Metrics to Financial Outcomes

A crucial element of this integrated approach is translating cyber risk into financial terms for the board. A structured framework is essential, and our cybersecurity risk assessment template provides a valuable starting point. Rather than reporting the number of malware threats blocked, the manager must model the potential P&L impact of a ransomware attack that disables the loan origination system.

Using a data intelligence platform like Visbanking, a manager can benchmark their defenses against peers. They might discover their bank’s account takeover losses are 30% higher than the industry average following similar cyber incidents. Armed with this comparative data, they can build a compelling business case for investing in advanced controls like behavioral biometrics or device fingerprinting that directly counter these blended threats.

How Data Intelligence Drives Smarter Decisions

A Fraud Risk Manager is only as effective as the data they command. Relying solely on internal transaction data is like navigating a highway by looking only in the rearview mirror. Without a broader market perspective, a bank operates with significant blind spots. A manager might see stable internal fraud rates and assume all is well, while competitors are experiencing a sharp decline in the same fraud category due to superior technology. External intelligence eliminates these blind spots.

From Internal Data to Industry Foresight

Consider a practical example. A manager at a $5 billion asset bank uses an external data platform and discovers their institution’s check fraud loss rates are 20% higher than the peer average for banks of a similar size. This single data point transforms the internal conversation from a routine operational update into a strategic alert.

Armed with this benchmark, the fraud risk manager can construct an undeniable business case for investment. They can demonstrate to the board not only their own loss figures but also that peer institutions reduced similar losses by 30% after implementing upgraded check imaging and verification technology.

This is what separates a tactical fraud fighter from a strategic leader. It’s not just about stopping today's fraudulent transactions. It’s about making smart, evidence-based investments to protect the bank and help it grow. You shift from being a cost center to a genuine value driver.

This data-driven approach elevates the role from reactive to proactive. By understanding industry-wide trends, managers can better leverage tools like predictive analytics in banking to anticipate and neutralize the next major threat before it impacts the balance sheet.

The directive for executive leadership is clear: equip your fraud risk manager with the external data required for a complete operational picture. Benchmark your performance with Visbanking to uncover hidden risks and identify strategic opportunities.

A Few Questions From The Board

Even with a clear strategic mandate, practical questions from leadership are inevitable. Here are common inquiries from executives, with answers framed for board-level discussion.

How Does This Role Actually Deliver Tangible ROI?

A strategic fraud risk manager delivers ROI by shifting the bank's posture from reactive loss chasing to proactive loss prevention. For example, if peer data from Visbanking reveals your institution’s account takeover fraud losses are 15% above the benchmark for your asset size, this is no longer an opinion—it is a data-backed call to action.

The manager can then present a business case for investing in behavioral biometrics, a technology proven to reduce this specific fraud type by over 40%. The ROI is not a vague projection; it is a direct calculation of preventable losses.

What's the Single Most Critical Skill for a Modern Fraud Manager?

While technical expertise is a baseline requirement, the most critical skill is decisive communication. The fraud manager must be a translator, converting complex threat data into a clear business case that resonates with the board. They must be able to articulate precisely why a 10% increase in phishing attempts poses a seven-figure threat to the commercial loan portfolio. This ability to connect threat intelligence to the P&L is what distinguishes a functional operator from a strategic leader who secures the resources needed to protect the bank.

How Do We Measure Their Success Beyond Just Stopping Losses?

Success is measured on both defensive and offensive contributions. While reducing fraud losses is the primary metric, a top-tier manager also enables secure business growth.

Key performance indicators of success include:

- Reduced False Positive Rates: Demonstrates the fine-tuning of security controls to minimize friction for legitimate customers, which is crucial for retention.

- Faster New Product Onboarding: Indicates that risk assessments are efficient and integrated, allowing the bank to innovate and launch new services safely and ahead of competitors.

Ready to provide your fraud risk manager the peer benchmarks and industry intelligence required for strategic leadership? Protect your institution and unlock new growth opportunities. Explore our data to see precisely where you stand and determine your next strategic move.

Similar Articles

Visbanking Blog

AI Banking Revolution: How Machine Learning Transforms Finance

Visbanking Blog

Bank Risk Management: Protecting Assets in Uncertain Times

Visbanking Blog

Digital Banking Security: Protecting Your Money in Cyberspace

Visbanking Blog

Banking Data Analytics: Turning Information Into Profit

Visbanking Blog

BIAS: The All-in-One Solution for Banking Intelligence and Action

Visbanking Blog

Revolutionize Your Bank with BIAS, the Bank Intelligence and Action System

Visbanking Blog

BIAS: The Future of Banking Intelligence and Action System

Visbanking Blog

BIAS: The Smart Choice for Banking Intelligence and Action

Visbanking Blog

BIAS: The Smart Choice for Banking Intelligence and Action

Visbanking Blog