Estimated reading time: 4 minutes

Table of contents

The financial world is a complex web of numbers, strategies, and decisions that drive economies forward. Within this intricate system, banks play a pivotal role, serving as the backbone of financial transactions and economic growth. In the United States, the banking sector is particularly significant, with a myriad of institutions each contributing to the nation’s economic vitality. In this comprehensive overview, we will delve into the realm of US banks’ income and expenses, using the powerful tools of the Visbanking Banking Report Portal to illuminate key insights and trends.

Understanding the Importance of Financial Analysis

At the heart of every successful banking institution lies an effective understanding of its financial landscape. Income and expenses serve as crucial indicators, offering insights into the institution’s profitability, operational efficiency, and overall financial health. With the advent of modern data analytics, institutions now possess the means to delve deeper into their financial data, allowing for informed decision-making and strategic planning.

Exploring Income Patterns in US Banks

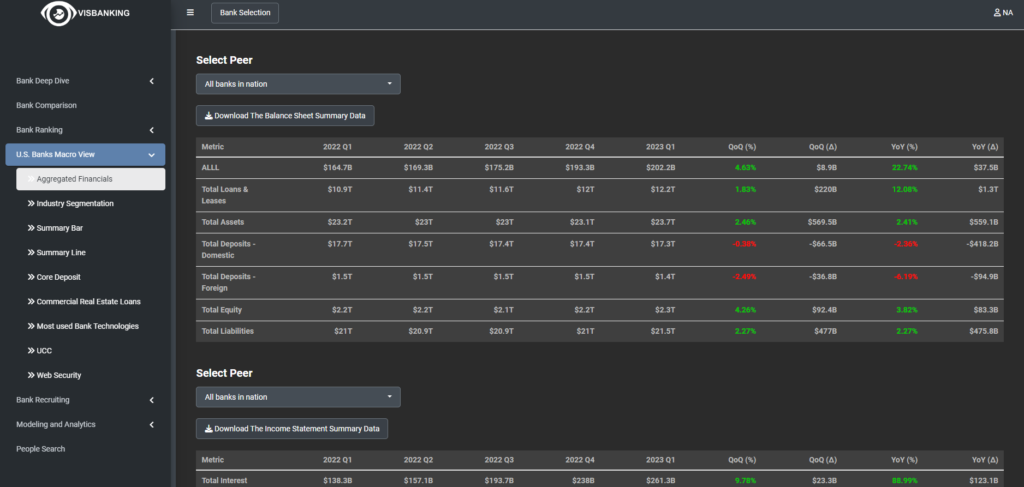

The income generated by US banks is a direct reflection of their operational activities and investment strategies. The Visbanking Banking Report Portal allows us to track these income sources with precision, categorizing them into various streams such as interest income, fees and commissions, trading gains, and more. By analyzing the proportions and growth trajectories of these income sources, we can identify trends and shifts in the industry’s landscape. For instance, is the recent surge in online banking impacting interest income, or are traditional lending practices still the primary contributor?

Unveiling the Complexities of Banking Expenses

On the flip side, understanding expenses is equally vital. Operational costs, salaries, regulatory compliance, and technology investments all contribute to the expenses borne by banks. The Visbanking Banking Report Portal enables a granular examination of these expenses, allowing us to see where institutions allocate their resources. Are banks dedicating more funds to technology and digital transformation? How are compliance costs impacting their bottom line? These questions can be answered through meticulous expense analysis. financial landscape

Spotlight on Profitability and Efficiency

One of the ultimate goals of analyzing income and expenses is to gauge the overall profitability and efficiency of banks. With the data insights from the Visbanking Portal, we can calculate key performance indicators such as Return on Assets (ROA) and Return on Equity (ROE). These indicators provide a snapshot of how effectively a bank is utilizing its assets and capital to generate profits. By comparing these indicators across different banks, we gain valuable insights into which institutions are excelling and which might need to fine-tune their strategies.

You can see this data in the “US Banks Contacts” section in the Visbanking Application:

Navigating the Regulatory Landscape

The world of banking is heavily regulated, with various laws and standards in place to ensure stability and consumer protection. The Visbanking Banking Report Portal doesn’t just offer data; it also provides tools to assess regulatory compliance costs. As banks adapt to ever-evolving regulations, these insights become invaluable for anticipating the financial impact of compliance efforts.

Predictive Insights and Future Strategies

The power of data analytics goes beyond current assessments; it extends to predictive insights that can shape future strategies. By analyzing historical data trends using the Visbanking Portal, banks can make informed predictions about future income and expense patterns. This forecasting ability guides strategic decisions, aiding in the allocation of resources and the formulation of growth plans.

Conclusion

In the intricate world of US banking, numbers tell a story of innovation, challenges, and growth. The Visbanking Banking Report Portal serves as a window into this narrative, offering a comprehensive overview of income and expenses. As banks continue to navigate a rapidly evolving financial landscape, the insights gleaned from these analyses become instrumental in shaping their trajectories. With the right tools and data-driven strategies, US banks can position themselves for success in an ever-changing economic environment.

So, dive into the Visbanking Banking Report Portal and explore the wealth of information it offers. Discover the trends, decipher the patterns, and gain a deeper understanding of the financial dynamics that drive the US banking industry forward.