Estimated reading time: 4 minutes

Table of contents

The financial landscape of the United States is a complex web of institutions, regulations, and data. The Visbanking Banking Report Portal stands as a beacon of clarity in this intricate world, providing valuable insights into the workings of US banks. Among the treasure trove of information it offers, the “US Banks Additional Schedules” shine as a crucial resource for those seeking a deeper understanding of the financial health and operations of these institutions.

US Banks Additional Schedules: A Glimpse into Financial Dynamics

Financial reports are the lifeblood of understanding any organization’s performance, and banks are no exception. While traditional financial statements like balance sheets, income statements, and cash flow statements provide essential insights, they might not capture the full spectrum of a bank’s activities. This is where the US Banks Additional Schedules come into play.

What Are Additional Schedules?

Additional Schedules are supplemental financial disclosures that banks provide alongside their regular financial statements. These schedules offer a more granular breakdown of specific aspects of a bank’s operations, allowing analysts, investors, and regulators to gain a more comprehensive view of its financial dynamics. While standard financial statements provide an overview, these additional schedules dive deeper into critical areas, providing a more nuanced perspective.

Types of US Banks Additional Schedules

- Loan Portfolio Breakdown: This schedule offers a detailed breakdown of the bank’s loan portfolio. It categorizes loans by type, such as mortgages, commercial loans, and consumer loans, shedding light on the bank’s lending focus and risk exposure.

- Deposit Composition: This schedule provides insights into the bank’s deposit structure. It distinguishes between different types of deposits, such as savings, checking, and time deposits, aiding in understanding the bank’s funding sources.

- Credit Quality Indicators: These indicators delve into the quality of the bank’s loan portfolio. Metrics like non-performing loans, loan loss reserves, and charge-offs offer insights into the bank’s credit risk management.

- Securities Holdings: This schedule outlines the bank’s holdings of securities, such as bonds and equities. It showcases the bank’s investment strategy and potential exposure to market fluctuations.

- Derivative Activities: Derivatives can play a significant role in a bank’s risk management and trading activities. This schedule provides details on the bank’s derivative contracts and associated risks.

- Off-Balance Sheet Exposures: Banks often have off-balance sheet activities that can impact their financial health. These schedules outline contingent liabilities, commitments, and other off-balance sheet exposures.

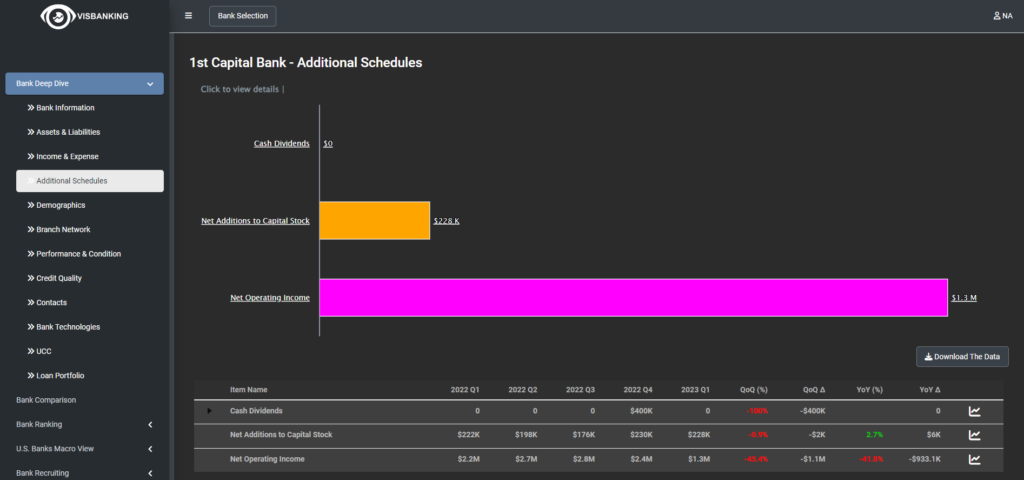

You can see this data in the “US Banks Contacts” section in the Visbanking Application:

Why Are Additional Schedules Important?

The significance of these additional schedules cannot be overstated. They offer transparency and detail that can enhance decision-making processes for investors, regulators, and other stakeholders. By understanding the intricate components of a bank’s operations, analysts can assess its risk profile more accurately, investors can make informed investment choices, and regulators can monitor compliance effectively.

Unlocking Insights with Visbanking Banking Report Portal

The Visbanking Banking Report Portal takes the power of these additional schedules to the next level. With a user-friendly interface and advanced analytical tools, the portal enables users to unlock insights that were previously hidden in the complexity of financial reports. Here’s how the portal enhances the understanding of US banks’ additional schedules:

- Interactive Data Visualization: The portal transforms raw data from additional schedules into interactive charts, graphs, and visual representations. This visual approach makes it easier for users to grasp complex financial concepts and spot trends.

- Comparative Analysis: The portal allows users to compare different banks’ additional schedules side by side. This feature is invaluable for investors and analysts looking to benchmark the performance and risk profiles of various institutions.

- Historical Trend Analysis: By accessing historical data through the portal, users can track changes in banks’ additional schedules over time. This aids in understanding how banks have adapted to market conditions and regulatory changes.

- Customizable Reports: Users can generate customized reports based on specific criteria, focusing on the areas of interest within the additional schedules. This tailored approach saves time and provides relevant insights.

Conclusion

In the realm of finance, knowledge is power, and the Visbanking Banking Report Portal empowers users with comprehensive insights into US banks’ additional schedules. These schedules provide a deeper understanding of banks’ operations, risk profiles, and strategic directions. By harnessing the capabilities of the portal, investors, analysts, regulators, and other stakeholders can make more informed decisions, contributing to a more transparent and robust financial system.

Unlock the potential of US Banks Additional Schedules with Visbanking Banking Report Portal, and embark on a journey of enhanced financial understanding.