The Executive's Guide to a Commercial Deposit Prospecting Tool

Brian's Banking Blog

In an environment of compressed margins and relentless competition, a commercial deposit prospecting tool is no longer a discretionary investment—it is a strategic necessity. It represents the critical shift from intuition-based relationship banking to a precise, data-driven discipline. For bank executives, this is the difference between guessing and knowing.

The Mandate for Data-Driven Deposit Growth

The era of passive deposit gathering is over. Strategic growth now requires an offensive, intelligence-led approach. Yet, many institutions remain handicapped by outdated methods: generic lead lists, broad marketing campaigns, and an over-reliance on anecdotal evidence. This approach guarantees wasted resources and unpredictable performance.

A modern commercial deposit prospecting tool corrects this fundamental flaw. It moves beyond simplistic firmographic data, providing a multi-dimensional, real-time view of the entire market landscape. By synthesizing disparate data sets, it equips your commercial teams with the actionable intelligence required to execute with confidence.

From Reactive to Proactive Growth

The core strategic advantage is the transition from a reactive to a proactive posture. Instead of waiting for a business to self-identify as a prospect, your institution can pinpoint ideal clients before they actively begin seeking a new banking partner.

Consider a practical application: your bank has a strategic objective to grow non-interest-bearing deposits by $20,000,000. An advanced prospecting tool can identify local manufacturing firms exhibiting strong growth indicators but currently banking with a competitor that is demonstrably losing deposit market share. This transforms a speculative cold call into a calculated, strategic engagement at a moment of maximum opportunity.

Key Strategic Advantages

A data-first methodology delivers tangible, bottom-line results and is a cornerstone of any effective strategy for lead generation for banks.

- Precision Targeting: Cease resource-intensive, low-yield activities. Focus your team’s efforts on high-value commercial clients with a quantifiable probability of conversion, directly improving return on investment.

- Competitive Intelligence: Gain a decisive intelligence advantage. Identify competitor vulnerabilities, track deposit outflows, and pinpoint specific industries or geographies where market share is available.

- Scalable Prospecting: Engineer a predictable, repeatable engine for deposit growth, moving beyond reliance on individual banker networks or subjective assessments.

The objective is to institutionalize prospecting as a science, not an art. With superior market intelligence, your bank can identify and capture high-value opportunities with surgical precision, gaining a significant competitive advantage in the pursuit of stable, low-cost funding.

For bank leadership, the directive is clear: to win, commercial teams must be armed with the intelligence to act decisively. The time has come to rigorously evaluate current methodologies and understand how a dedicated data partner can illuminate the path to predictable, profitable growth.

What Is a Modern Commercial Deposit Prospecting Tool?

A modern commercial deposit prospecting tool is not a static lead list. It is an integrated data intelligence platform engineered to provide a granular, multi-dimensional view of your market. Its purpose is to convert raw, complex data into a clear competitive advantage.

Traditional methods—relying on a banker's network or static business directories—are insufficient for generating predictable growth. A true prospecting platform ingests and synthesizes vast, disconnected datasets, including FDIC call reports, local economic indicators, UCC filings, and business demographics. This integration creates the actionable intelligence that allows your team to move beyond guesswork and make decisions based on empirical market reality.

Beyond the Rearview Mirror

A CRM is a rearview mirror; it provides an excellent record of past interactions. A modern prospecting tool is your forward-looking guidance system, mapping the entire competitive landscape and identifying opportunities long before they appear on a competitor's radar.

For example, your team aims to target healthcare practices with annual revenues exceeding $2,000,000. A standard list provides names and addresses. An advanced intelligence tool, like Visbanking, pinpoints which of those practices bank with a competitor that has lost deposit market share for two consecutive quarters. This intelligence transforms a cold outreach into a strategically timed, highly relevant conversation about a potential service gap.

The primary function of a commercial deposit prospecting tool is to translate market data into market opportunity. It provides not only the who to call, but the critical intelligence of why and when to call them.

From Data Points to Strategic Action

This capability fundamentally alters the nature of prospecting. It shifts from a high-volume, low-success activity to a high-value, strategic function. Rather than compelling bankers to pursue hundreds of low-probability leads, you deliver a curated list of high-potential targets. A superior platform will not only identify businesses with significant deposit potential but also uncover their existing banking relationships and illuminate service gaps your institution can exploit.

For bank executives, this means building a more efficient and effective commercial team. By leveraging dedicated bank prospecting software, you direct resources precisely where they will generate the highest return. This equips your team with the intelligence needed to craft compelling, data-backed value propositions that resonate with a prospect's specific circumstances.

Key Features That Drive Real Results

Not all platforms are created equal. The distinction between a simple data aggregator and a true commercial deposit prospecting tool is measured in bottom-line impact. For bank executives, the test of this technology is not its interface but its core ability to grow deposits and capture market share.

The best tools are built on a foundation of clean, multi-sourced data. However, their strategic value lies in the intelligence they derive from that data. Raw data is an inert asset; actionable intelligence is the finished product that drives executive decisions.

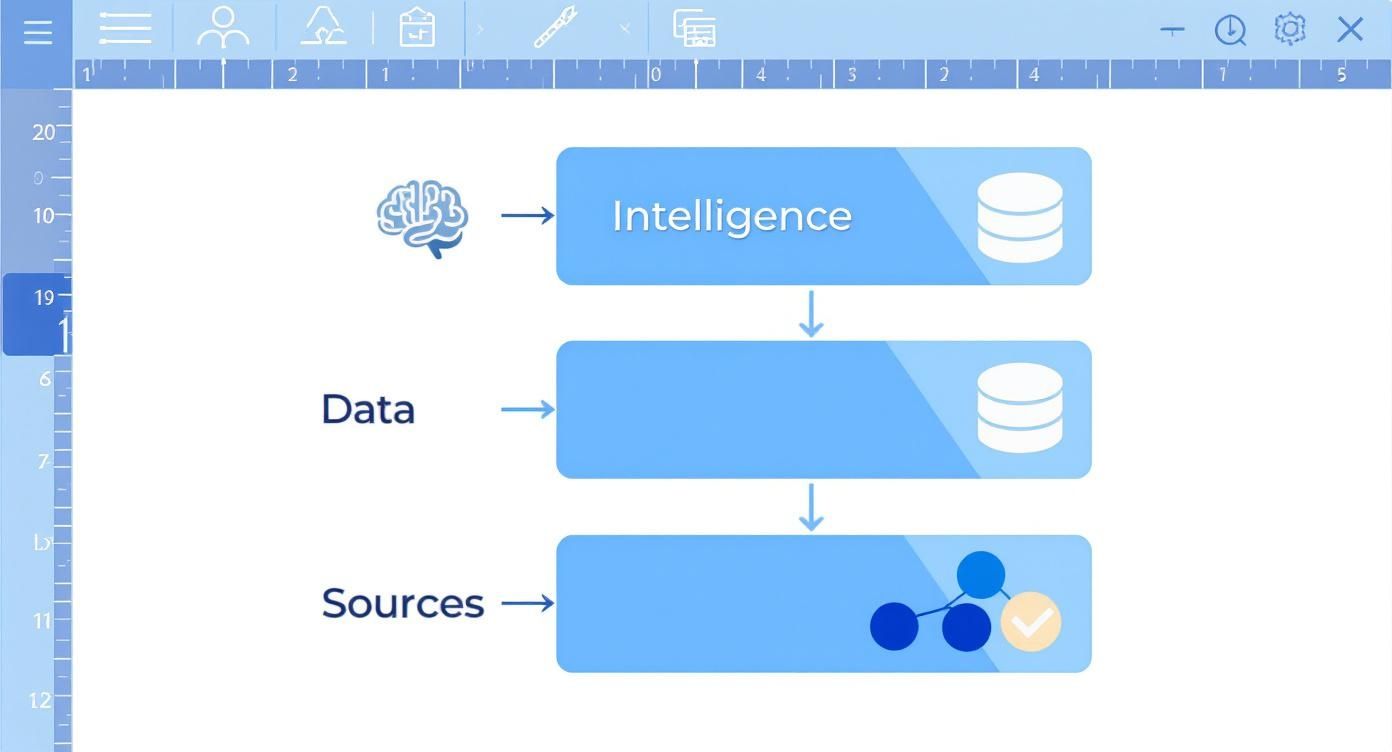

This process—transforming raw inputs like FDIC reports and economic data into a structured data layer and then into strategic intelligence—is what separates a clear insight from a sea of noise.

Market Share and Competitor Deep-Dives

The ability to analyze deposit market share with surgical precision is a game-changing feature. This goes far beyond generic county-level statistics. It means dissecting market share within specific industries (by NAICS code) and business archetypes. This is how you identify underserved niches and pinpoint precisely where a competitor is vulnerable.

Imagine your tool identifies that a rival bank’s deposits from local manufacturers (NAICS codes 31-33) have declined by 8% over the past two quarters—a $75,000,000 outflow. This is not just a data point; it is a clear strategic opportunity. Armed with this intelligence, your commercial team can launch a targeted campaign focused on manufacturers, directly addressing their needs with your bank’s specialized treasury services.

Predictive Modeling: Seeing Around the Corner

Elite platforms do not merely report on the past; they provide forward-looking intelligence. By analyzing a confluence of data points, they identify companies exhibiting signals of imminent banking needs. This is the foundation of proactive growth.

Consider this scenario: the system flags a privately-held construction company that has recently filed numerous UCC liens and increased its employee count by 30% year-over-year. These are not random events. They are clear indicators of rapid growth, signaling an impending need for more sophisticated cash management and lending products. This predictive insight allows your bankers to engage as strategic advisors, not as product vendors.

The ultimate measure of a prospecting tool is its ability to convert market data into a clear directive for action. It must answer not only "who?" but, more importantly, "why now?"

Essential Features vs. Standard Offerings

Evaluating these tools requires a focus on core capabilities. The table below provides a clear comparison between a basic tool and an advanced prospecting platform purpose-built for banking.

| Capability | Standard Tool (e.g., Basic CRM) | Advanced Prospecting Tool (e.g., Visbanking) |

|---|---|---|

| Market Share View | High-level county or state data, if any. | Granular analysis by industry (NAICS), zip code, and business type. |

| Competitor Insight | Manual research required; no direct tracking. | Automated tracking of competitor deposit outflows and market shifts. |

| Lead Quality | Static lists based on firmographics (size, industry). | Dynamic, predictive scoring based on growth signals and banking needs. |

| Local Economic Context | No integrated economic data. | Hyper-local economic trend data layered over prospect lists. |

| Actionability | Provides a "who to call" list. | Provides a "who to call, why to call them now, and what to talk about" directive. |

The conclusion is straightforward. Standard tools provide a map; advanced platforms provide a GPS with live traffic data. They don’t just show you the landscape; they guide your team through it with precision and confidence.

Turning Data Into Deposits

Data is a dormant asset until it drives profitable action. An effective commercial deposit prospecting tool does not merely present data; it delivers a clear, strategic roadmap for growth. It is the essential bridge between intelligence and execution.

Raw data is noise. Actionable intelligence is the signal that indicates a clear opportunity. The strategic value of an advanced platform like Visbanking is its ability to cut through that noise, identify competitor vulnerabilities, and highlight high-value targets, allowing your team to act with conviction.

From Data Points to Dollar Signs: A Real-World Playbook

Consider a tangible, numbers-driven scenario. A mid-sized bank establishes a goal to grow non-interest-bearing commercial deposits by $50,000,000 in the current fiscal year. Instead of a broad-based, low-yield approach, they deploy a prospecting tool to identify an underserved niche.

The platform immediately identifies the healthcare services vertical in a specific county as a prime opportunity, delivering two critical insights:

- Significant Balances: Local medical practices hold substantial deposits with competitor institutions.

- Competitor Vulnerability: Three major competitors have experienced consistent deposit outflows from this exact segment over the past two quarters.

This is not just data; it is an explicit market signal indicating that high-value businesses are likely receptive to a new banking relationship.

Armed with this intelligence, the commercial team designs a highly focused campaign. They bypass generic outreach in favor of an offering centered on specialized treasury management services tailored to the cash flow challenges of medical practices. The pitch is consultative, informed, and directly addresses the pain points driving attrition at competing banks.

The results are immediate. Within three months, the bank secures $15,000,000 in new non-interest-bearing deposits from the target healthcare vertical. This is not a fortunate outcome; it is a strategic victory engineered through data-driven action. This is not an anomaly. We have seen banks execute this precise playbook to increase deposits in a target segment by over 50% in as little as 90 days. Deeper insights on winning corporate deposits are available in this McKinsey analysis.

The core value proposition is this: a commercial deposit prospecting tool transforms your growth strategy from a game of chance into a predictable, repeatable science.

This is the outcome when data is translated into decisive action. The right platform enables you to identify your best opportunities, understand competitor weaknesses, and deploy your team's resources for maximum impact. When you benchmark your current efforts against the potential of this intelligence, a clear path to significant deposit growth emerges.

Integrating Prospecting Intelligence Into Your Bank Strategy

Acquiring a powerful commercial deposit prospecting tool is the starting point, not the destination.

True value is unlocked only when this intelligence is integrated into the fabric of your bank's operational rhythm and long-term strategic vision. This requires executive leadership to champion the cultural shift from intuition-led sales to data-driven execution.

The first step is to align the tool’s capabilities directly with the bank’s strategic goals. If the objective is to grow low-cost deposits by $100,000,000, the platform must be configured to identify the specific industries and local markets with the highest propensity to deliver on that goal. It becomes the engine driving your strategic plan, not an ancillary software tool.

This necessitates training commercial banking teams to operate as market analysts, not just as traditional relationship managers. They must be equipped to interpret the data, identify a competitor's vulnerability, and act on quantitative insights with complete confidence.

From Technology to Team Empowerment

Successful implementation is contingent upon collaboration. It requires breaking down departmental silos.

Marketing, sales, and strategy teams must operate from a single source of market truth. The platform's intelligence should be used to coordinate every aspect of the acquisition effort.

For instance, the tool identifies a significant deposit outflow from a local competitor. Marketing can immediately launch a geo-fenced digital campaign targeting businesses in that specific industry. Concurrently, the commercial team initiates outreach to those same prospects with a message that directly addresses the likely reasons for their dissatisfaction.

This is no longer just prospecting; it is a coordinated, high-impact growth operation. For more on creating this unified front, consult our guide on data integration best practices.

Measuring What Matters Most

To ensure accountability and justify the investment, clear Key Performance Indicators (KPIs) must be established. These should extend beyond simple activity metrics to measure true business impact.

- Cost per Acquired Deposit: Quantify the reduction in marketing and sales expenditures required to secure new commercial accounts through data-driven targeting.

- Time to Conversion: Measure the reduction in the sales cycle, from initial contact to first deposit, for prospects identified via the platform.

- Share of Wallet Growth: Track the increase in deposit balances from newly acquired clients over the first 6-12 months to measure relationship depth.

The scale of the market underscores the importance of this capability. According to Federal Reserve Economic Data (FRED), total deposits at U.S. commercial banks stood at approximately $17.2 trillion as of late 2023. The opportunity is immense. You can discover more insights about commercial banking deposits on FRED.

The ultimate goal is to embed this data intelligence into your institution's DNA. The tool is the catalyst; sustained success is the result of leadership's commitment to building a culture that acts decisively on intelligence.

This is not a software procurement decision. It is a fundamental choice about how your bank will compete—and win.

The Future of Commercial Deposit Acquisition

The competition for commercial deposits will only intensify. In an environment of compressed margins and heightened client expectations, the institutions that succeed will be those that treat data intelligence not as a feature, but as a core competency.

A passive approach to deposit gathering is a strategy for managed decline. The mandate for growth requires proactive, data-driven acquisition.

The future belongs to banks that can identify and secure high-value commercial deposits before their competitors are even aware an opportunity exists. This represents a fundamental shift from traditional relationship management to a model of predictive opportunity hunting. The ability to interpret market signals and act with speed is the ultimate competitive differentiator.

The Unstoppable Rise of Data-Driven Banking

This paradigm shift is evident across the financial services landscape. The demand for seamless digital experiences continues to elevate the role of technology. Innovations like Remote Deposit Capture (RDC) are no longer conveniences but essential components of a modern commercial banking offering.

The global market for RDC is projected to reach $342.85 million by 2025, with North America, led by the U.S., accounting for over 40% of that market. This indicates a deep, sustained investment in technologies that facilitate deposit gathering. You can discover more insights about RDC market growth on Cognitive Market Research.

In this new banking environment, your most valuable asset is not capital—it is intelligence. The ability to discern market shifts, anticipate client needs, and understand competitor vulnerabilities in real-time is what separates market leaders from the rest of the pack.

Banks that integrate a sophisticated commercial deposit prospecting tool are not merely keeping pace with these trends; they are defining them. They are empowering their teams to win the most valuable relationships by replacing subjective assessments with empirical data.

For bank leadership, the conclusion is clear. To secure a dominant market position, you must arm your commercial teams with the intelligence to act decisively. The first step is to benchmark your current prospecting effectiveness against what is now possible. It is time to explore how a dedicated data partner like Visbanking can illuminate the most direct path to profitable, sustainable growth.

We Hear You: Your Top Questions Answered

How does this differ from our existing CRM system?

An excellent and critical question. Your CRM is your system of record for existing relationships. It is designed to manage the customers you already have.

A commercial deposit prospecting tool is your system of acquisition. It is designed to survey the entire market for high-potential businesses you have not yet engaged, converting cold market data into qualified opportunities. One manages; the other hunts.

What is the typical ROI on these tools?

While results vary based on market dynamics and execution, the consistent outcome is a dramatic improvement in efficiency.

Your team shifts from making hundreds of low-probability calls to surgically targeting a competitor's vulnerable $50,000,000 deposit portfolio. The resource allocation model is completely transformed, driving down the cost of acquisition. The returns are not incremental; they are exponential.

How much training does our commercial team need?

The software itself is intuitive by design. The primary change is not technical; it is a shift in mindset—from relationship manager to data-driven strategist.

The best tools, like Visbanking, perform the complex data analysis, translating it into clear, actionable intelligence. This empowers your team to focus on what they do best: building relationships and closing business, now informed by a decisive market advantage.

Ready to stop guessing and start targeting? See how Visbanking can transform your prospecting strategy and reveal your clearest path to deposit growth. Explore our data and benchmark your market today.

Similar Articles

Visbanking Blog

Prospect AI Tool: Transforming Your Bank's Growth Strategy with Smart Targeting

Visbanking Blog

BIAS: The All-in-One Solution for Banking Intelligence and Action

Visbanking Blog

Banking Data Analytics: Turning Information Into Profit

Visbanking Blog

Prospect AI: Turn High-Value Leads into Loyal Customers

Visbanking Blog

Fastest Growing Banks: Who's Winning the Asset Race?

Visbanking Blog

Revolutionize Your Banking Operations with Data-Driven Insights from BIAS

Visbanking Blog

BIAS: The Smart Choice for Banking Intelligence and Action

Visbanking Blog

BIAS: The Smart Choice for Banking Intelligence and Action

Visbanking Blog

BIAS: The Power of Data and AI at Your Fingertips

Visbanking Blog