How Executive Leadership Can Weaponize a Bank Prospect Database

Brian's Banking Blog

A modern bank prospect database is not a static spreadsheet; it is a dynamic intelligence engine. For executive leadership, it represents a core strategic asset that enables a fundamental shift from reactive marketing to proactive, data-driven client acquisition. It is the mechanism for identifying high-value commercial and retail opportunities before competitors know they exist.

The Modern Bank Prospect Database as a Strategic Asset

In today's hyper-competitive market, reliance on traditional prospecting is a direct path to market share erosion and margin compression. While a CRM is essential for managing existing client relationships, a true bank prospect database is an offensive weapon engineered for intelligent growth. It synthesizes financial, regulatory, and market data to reveal opportunities hidden in plain sight.

The distinction is critical for executive decision-making. One system maintains the status quo; the other builds future revenue streams.

Consider two banks competing for middle-market commercial clients. One relies on its traditional CRM and relationship manager networks. The other leverages a dynamic prospect database. The second bank can achieve a 15% higher conversion rate on its commercial loan outreach. This is not driven by more calls, but by more intelligent calls. Its system identifies specific financial triggers—such as recent capital raises, UCC filings, or key executive changes—that signal an immediate need for new credit facilities.

From Contact List to Intelligence Engine

The strategic value of a modern database lies in its ability to transform raw data points into actionable intelligence. It moves beyond basic firmographics to understand the narrative behind the numbers, providing a clear, evidence-based view of:

- Market Penetration: Where are the underserved industries or geographic corridors populated with your ideal commercial clients?

- Competitive Displacement: Which of your competitors' clients are exhibiting behaviors—such as aging credit lines or operational inefficiencies—that indicate they are receptive to a superior banking relationship?

- Product Development: What market-wide data trends can inform the demand for new treasury management, lending, or wealth advisory products?

This represents a significant leap in institutional capability. According to the World Bank’s Global Findex Database, 79% of adults globally now have a bank account, a substantial increase from 51% in 2011. This expanded market is accessible only to institutions equipped with the tools for precise targeting.

A prospect database must answer the primary question for any leadership team: "Where will our next phase of profitable growth originate?" If its sole function is to generate call lists, it is failing as a strategic asset.

This data-first approach is the bedrock of modern financial strategy. For a deeper analysis of data-driven decision-making, see our guide on business intelligence for banks. At Visbanking, we view this capability not as a tool, but as the central nervous system for any bank or credit union committed to disciplined growth.

Comparing Database Architectures: In-House Build vs. Third-Party Platform

When commissioning a prospect database, executives face a critical decision: build a proprietary system or partner with a specialized platform. This is not an IT line item; it is a fundamental allocation of the bank's most valuable resources—capital, talent, and executive focus. The chosen path will dictate the speed and efficacy of new business acquisition.

The In-House Build: A Costly Pursuit of Control

The primary argument for an in-house build is control—the ability to tailor a system to precise, internal workflows. However, the true cost of this control must be scrutinized.

Developing a secure, intelligent, and scalable database from the ground up is a significant undertaking. Initial capital expenditures often exceed $500,000, exclusive of data sourcing costs. Post-launch, annual operational expenses for maintenance, security, and data updates can easily surpass $100,000.

Furthermore, such a project requires specialized talent—data scientists and engineers—that are in high demand and command premium compensation. Every dollar and man-hour invested in building this internal infrastructure is a resource diverted from the bank's core mission: lending capital and winning clients.

The Third-Party Platform: A Strategic Accelerator

Partnering with a specialized provider like Visbanking fundamentally alters the economic and strategic equation. A prohibitive capital expenditure is replaced with a predictable operating expense, allowing the bank to bypass a multi-year, high-cost R&D cycle.

The primary advantage is speed to market. An advanced prospecting tool can be deployed to your team in weeks, not years, providing an immediate competitive edge through actionable, real-time data.

These platforms also absorb the operational burden of data enrichment, security protocols, and regulatory compliance. This frees leadership to concentrate on strategic execution rather than infrastructure management. The industry trend is clear: global banks are projected to spend US$176 billion on IT, with 39% of that investment targeting major growth initiatives. With a forecasted return on equity (ROE) of 11.7%, the industry is investing in technology that directly impacts performance.

For executive evaluation, a direct comparison is illuminating.

Strategic Comparison of Prospect Database Architectures

This table provides a concise analysis for leadership, comparing the strategic realities of a proprietary build versus licensing a ready-made data intelligence platform.

| Decision Criterion | In-House Build (Proprietary System) | Third-Party Platform (e.g., Visbanking) |

|---|---|---|

| Total Cost of Ownership (TCO) | Significant upfront CapEx ($500,000+) plus high, ongoing operational costs. | Predictable, subscription-based OpEx. Eliminates budgetary uncertainty. |

| Speed to Market | Extremely slow. A 12-24+ month development and deployment timeline is standard. | Exceptionally fast. Go-live in weeks, delivering an immediate market advantage. |

| Data Enrichment & Analytics | Requires building, managing, and funding all analytical capabilities internally. A constant, heavy investment. | Immediate access to advanced analytics and multi-source data without any internal R&D burden. |

| Scalability & Maintenance | An internal responsibility. The entire burden falls on internal IT and engineering teams. | Seamlessly managed by the provider, who handles performance, security, and updates. |

| Compliance Overhead | Full ownership of risk. Sole responsibility for data privacy (CCPA, SOC 2, etc.). | The platform manages the compliance burden, significantly reducing institutional risk and workload. |

This comparison underscores a clear strategic conclusion: partnering with a third-party expert is a direct investment in speed, efficiency, and focus.

The critical question for leadership is not can we build a database, but is building one the highest and best use of our capital and talent? A third-party platform allows those resources to be reallocated from infrastructure development to revenue generation.

The choice is a reflection of core strategy. For institutions whose goal is to deploy capital efficiently and accelerate competitive positioning, a data intelligence partnership is the most logical path.

Explore how Visbanking can benchmark your market position.

The Essential Data Pillars of a High-Value Database

A high-performance bank prospect database is not a monolithic file but a structure built upon four interconnected data pillars. For executives, understanding these pillars is foundational to transitioning from simple list-pulling to proactive, intelligence-led business development.

The absence of any one pillar creates a strategic blind spot. Their integration, however, provides a multi-dimensional, actionable view of the most promising prospects.

Firmographic and Demographic Data

This is the foundational layer—the "who and what" of the target market. For commercial banking, firmographic data includes industry classifications (NAICS), annual revenue, and employee count. For retail banking, demographic data covers key attributes like income levels, life stages, and geographic location.

This layer enables precise market sizing. For example, a bank can instantly segment all manufacturing companies with revenues between $10,000,000 and $50,000,000 within a specific three-county area, thereby defining the total addressable market for a new commercial lending initiative.

Technographic and Behavioral Data

This pillar reveals how a prospect operates. Technographic data identifies the technology stack a company relies on—its core banking systems, payment processors, and digital channel adoption. Behavioral data analyzes transaction patterns and engagement with financial products.

This intelligence is critical for competitive displacement. A business reliant on an outdated core system or underutilizing digital treasury tools represents a clear opportunity. This data signals a strategic opening to lead with the bank's superior technology and advisory services.

A prospect's technology stack is a direct indicator of its operational sophistication and potential pain points. It reveals not just who they are, but where their frustrations likely lie, providing your team with a strategic entry point for discussion.

Intent and Trigger Data

This is the most dynamic and actionable pillar. Intent and trigger data capture real-time events that signal an immediate need for banking services. These include merger announcements, key executive appointments, significant SEC filings, or major capital raises. Robust data governance in banking is essential for managing this continuous flow of time-sensitive information.

Consider a mid-sized logistics company that has just announced a $15 million Series B funding round. This is a high-value trigger event, signaling an immediate need for services ranging from treasury management and commercial credit to wealth management for the executive team. A superior prospect database connects these events to actionable opportunities automatically.

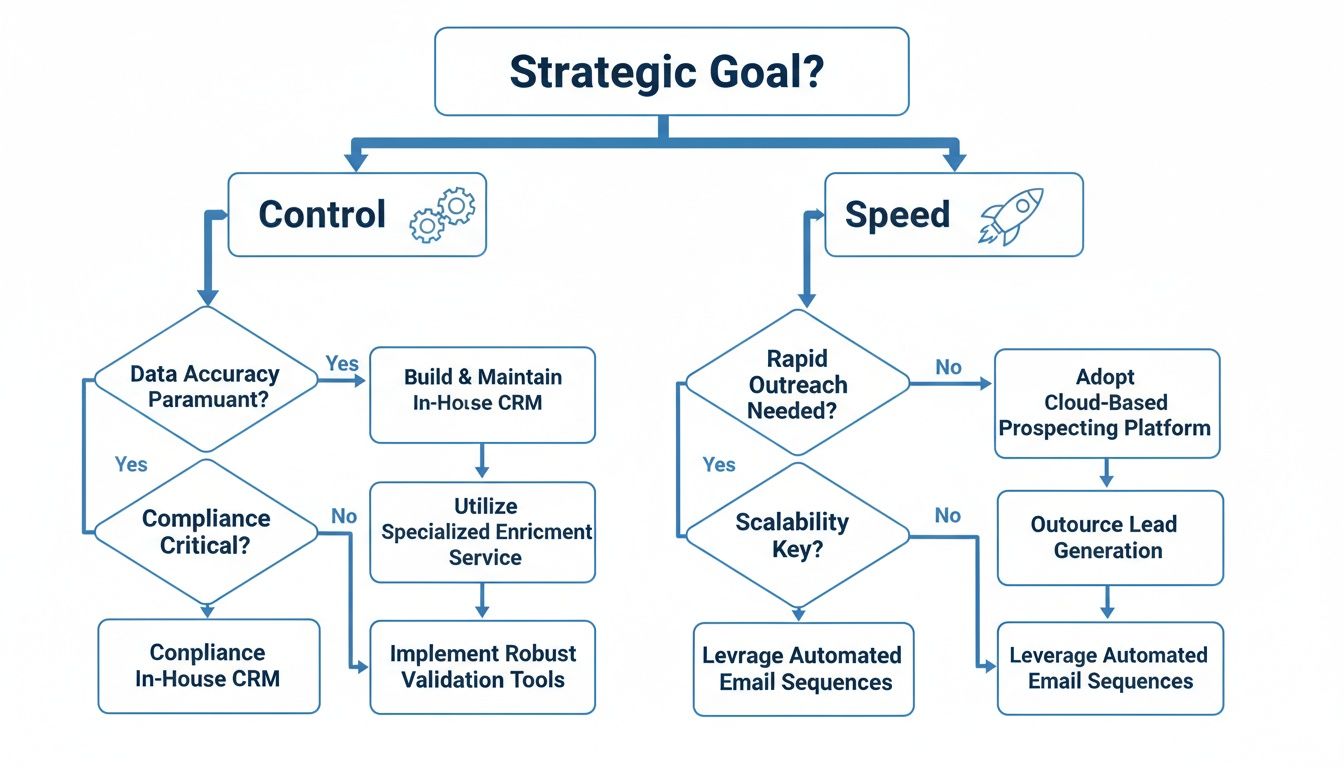

This infographic illustrates how strategic goals—control versus speed—should inform your database architecture decision.

As the visual clarifies, the decision is a strategic trade-off between the complete customization of a proprietary build and the immediate market advantage of a specialized platform. By integrating these four data pillars, your institution can move from speculation to precision execution.

Activating Your Database for Measurable Growth

A premier bank prospect database is not a passive repository; it is a dynamic engine that must be activated to generate returns. For leadership, the ultimate measure of this investment is its direct impact on the balance sheet. Value is created when raw data is converted into tangible commercial and retail opportunities.

This transition from data to revenue is achieved by executing precise, targeted campaigns that are impossible with traditional methods. This is about engineering growth with surgical accuracy.

Use Case 1: Strategic Commercial Loan Portfolio Expansion

A mid-sized regional bank aims to expand its commercial loan portfolio. Instead of a broad, inefficient marketing campaign, the team utilizes its prospect database to apply a multi-layered filter, identifying prime, underserved businesses ripe for a new banking relationship.

The methodology is as follows:

- Filter by Firmographics: Isolate all privately held companies in the logistics sector within a 150-mile radius.

- Qualify by Revenue: Narrow the list to businesses with annual revenues between $10 million and $50 million.

- Identify Triggers: Critically, filter for companies with UCC filings indicating credit facilities more than five years old—a strong signal of potential refinancing or expansion needs.

The result is a highly qualified list of 62 target companies. Assuming an average loan size of $1.2 million, the bank has just constructed a potential new business pipeline exceeding $75 million. This is how data transforms speculative outreach into a calculated growth strategy.

Use Case 2: Acquiring High-Net-Worth Clients

A bank's wealth management division seeks to acquire new high-net-worth clients. Using the intelligence from its prospect database, the team can identify individuals who have recently experienced a significant liquidity event—the clearest indicator of an immediate need for sophisticated financial advisory services.

A liquidity event is the single most critical trigger for wealth management prospecting. A database that surfaces these events in near real-time provides a decisive competitive advantage, allowing your team to be the first to offer value.

The strategy involves monitoring for triggers such as M&A announcements or large insider stock sales. When a local technology founder sells their company, the system flags the event instantly. A wealth advisor can then execute a timely, informed outreach with a proposal tailored to managing the proceeds—a direct path to a new multi-million-dollar relationship. To fully leverage this data, it is worth exploring how leveraging AI to significantly increase revenue can amplify the intelligence gathered.

Use Case 3: Data-Driven Geographic Branch Expansion

Before committing millions to a new branch, leadership requires a high degree of confidence in the investment. A bank prospect database is an essential tool for de-risking this major capital expenditure.

The process involves layering multiple data sets onto a geographic map:

- Prospect Density: Pinpoint zip codes with a high concentration of ideal commercial and retail prospects that are currently underserved by competitors.

- Demographic Trends: Analyze population growth, average household income, and small business formation rates in target areas.

- Competitor Saturation: Visualize competitor branch locations to identify strategic gaps in the market.

This data-driven approach allows the bank to select a new location with the highest probability of profitability, ensuring the investment generates returns from day one. To learn more about identifying these market gaps, review our insights on bank prospecting software. The right platform transforms expansion from a gamble into a calculated investment.

How to Select the Right Data Intelligence Partner

Selecting a third-party data provider is a strategic decision, not a procurement exercise. The chosen partner will directly shape your market intelligence and, consequently, your capacity for growth. The evaluation must extend beyond a superficial feature comparison.A premier partner delivers more than a list of contacts; they provide an intelligence engine that integrates into the bank's operational rhythm. This requires asking the critical questions that distinguish true strategic partners from mere data resellers.

Core Evaluation Criteria

When vetting potential partners, the leadership team must focus on four critical areas. A rigorous evaluation ensures the selected bank prospect database is both actionable and secure, providing a solid foundation for the bank's acquisition strategy.

- Data Accuracy and Refresh Cadence: What is the verified accuracy rate of the data, and how frequently is it updated? Stale information wastes valuable resources and erodes opportunity. A top-tier provider should guarantee an accuracy rate—95% or higher—and be transparent about its refresh cycle. For dynamic trigger data, daily or weekly updates are the standard.

- Integration and Workflow Compatibility: Can the platform integrate seamlessly with your CRM, core systems, and marketing automation tools? A siloed database creates inefficiency. Maximum value is realized when intelligence flows directly into the existing workflows of your client-facing teams.

- Analytical Horsepower: Does the platform offer capabilities beyond basic filtering? Look for a partner that provides predictive insights, market-share analysis, and relationship mapping. For instance, can it flag a competitor's commercial clients with loans approaching maturity? Can it map connections between local executives and your board members? This is the distinction between a directory and a strategic weapon.

- Security and Compliance: Does the provider hold key certifications, such as SOC 2? Any partner handling sensitive market and prospect data must provide verifiable proof of its commitment to security and regulatory compliance. This is non-negotiable.

The true value of a data partner is not measured by the volume of their data, but by the quality of the market-specific intelligence that data generates—intelligence your team can act on immediately.

Ultimately, the decision rests on finding a partner whose tools align with the bank's long-term strategic growth objectives. The goal is not merely to purchase data, but to equip your team with the intelligence that drives decisive action.

To see how a true data intelligence platform operates, benchmark your bank’s market position with Visbanking.

Turning Data Intelligence Into Market Dominance

A modern bank prospect database is not a marketing tool; it is a competitive weapon. For banking leaders, its adoption represents the definitive transition from reactive list-pulling to proactive, intelligence-driven business acquisition.

The ability to identify untapped commercial markets, defend existing client bases, and drive predictable growth is no longer a competitive advantage—it is the baseline for survival and, ultimately, for market leadership.

The institutions that internalize this and deploy high-caliber data intelligence will define the future of the industry. By moving beyond static information to dynamic insights, your team can pinpoint high-value opportunities with precision—from identifying commercial clients with maturing credit lines to engaging wealth management prospects immediately following a liquidity event. This is not guesswork; it is the conversion of every outreach into a high-probability, calculated action.

In today's financial landscape, the victors are not always the largest institutions; they are the most informed. Actionable intelligence is the ultimate differentiator that converts market potential into measurable revenue.

This is the new standard for strategic growth. Do not simply compete—dominate your market by making smarter, faster, data-backed decisions.

Ready to uncover your most valuable hidden opportunities? Benchmark your bank’s market position and discover how our data intelligence platform can reveal your next high-value prospects.

A Few Lingering Questions

When evaluating a technology that can fundamentally alter your growth trajectory, questions are expected. Here are answers to a few of the most common inquiries from bank executives.

How Is a Bank Prospect Database Different From Our CRM?

An excellent question. Your CRM is defensive; it is designed to manage and retain existing relationships by tracking interactions and service history. Its focus is retention.

A bank prospect database, conversely, is offensive. It is an acquisition weapon, providing deep intelligence on high-value commercial and retail prospects you do not yet have. It delivers insights into their needs, financial triggers, and the optimal time to engage. One protects your current market share; the other enables you to capture new territory.

What's a Realistic ROI on This Kind of Investment?

While outcomes vary by institution, a 5x-10x return within 18 to 24 months is a realistic expectation. This is not speculative; it is based on measurable improvements in key performance indicators.

We are talking about tangible gains, like increasing conversion rates on commercial loan campaigns from a typical 1% to 4% or higher. It also involves reducing customer acquisition costs by focusing resources on high-probability targets and uncovering specific cross-sell opportunities to increase share-of-wallet.

How Do We Handle Regulatory Compliance?

Compliance is paramount, particularly under regulatory frameworks like GDPR and CCPA. A top-tier data partner such as Visbanking assumes this burden. These platforms are architected with compliance as a core feature.

They ensure all data is sourced ethically, maintain robust security protocols (e.g., SOC 2 certification), and manage all opt-out mechanisms. An in-house build places this entire compliance burden on your internal legal and IT teams. Partnering with an expert effectively outsources this risk, allowing you to focus on your core competency: banking.

A powerful bank prospect database isn’t just a tool; it’s the engine for intelligent, strategic growth. At Visbanking, we deliver the decision-ready analytics you need to spot and seize high-value opportunities with confidence. Explore our platform to see how data intelligence can reveal your next best prospects.

Similar Articles

Visbanking Blog

Revolutionize Your Banking Operations with Data-Driven Insights from BIAS

Visbanking Blog

Prospect AI Tool: Transforming Your Bank's Growth Strategy with Smart Targeting

Visbanking Blog

Empowering Banks with Visbanking's Enterprise Solution: Performance, Prospects, and Talent Insights

Visbanking Blog

Fastest Growing Banks: Who's Winning the Asset Race?

Visbanking Blog

Banking Data Analytics: Turning Information Into Profit

Visbanking Blog

List of Banks by Asset Size

Visbanking Blog

Make Better Decisions with Confidence with BIAS, the Tailored Strategies Solution

Visbanking Blog

Explore Banking Data: Financial Analysis with VISBANKING

Visbanking Blog

BIAS: Your Competitive Edge in Banking Data Driven Strategy

Visbanking Blog