The B2B Sales Funnel: A Data-Driven Framework for Banking Growth

Brian's Banking Blog

The B2B sales funnel is the blueprint for acquiring high-value commercial clients. It is a systematic process that guides a business from initial awareness of your institution to becoming a fully integrated banking partner. For bank executives, this is not marketing theory—it is the conversion of relationship management into a measurable science. A properly instrumented funnel creates predictable growth by enabling you to understand, measure, and optimize every stage of the client acquisition journey.

Why Your B2B Sales Funnel Is a Strategic Imperative

The traditional model of commercial client acquisition—relying primarily on personal networks and reputation—is no longer sufficient. In an environment of compressed margins and intense competition, operating on intuition alone is a direct threat to profitability.

A well-defined B2B sales funnel, fueled by precise data intelligence, is what separates growth-oriented banks from their peers. It empowers your commercial team to shift from a reactive to a proactive posture. It provides an objective, quantifiable view of how businesses discover your bank, evaluate your offerings, and ultimately decide to award you their business—or take it to a competitor.

From Concept to Competitive Edge

For a bank’s leadership, the sales funnel is more than a diagram; it is a critical management tool. It allows you to pinpoint precisely where the client acquisition process is underperforming, allocate resources for maximum impact, and forecast new business with greater accuracy. Without a structured funnel, your growth strategy is based on guesswork.

A structured sales funnel allows you to quantify your growth engine. It reveals not just who your future clients are, but how you will systematically win their business by understanding their journey.

Consider a common scenario: your relationship managers secure numerous initial meetings (Awareness) but receive few requests for proposals (Consideration). This is not a sales talent issue; it is a process failure. The data indicates an inability to articulate your value proposition effectively in early-stage interactions. A data-driven funnel exposes this weakness, allowing for targeted remediation. To properly structure this, one must understand the complete B2B sales and marketing funnel as a strategic framework.

The Four Core Funnel Stages in Banking

While each client’s path is distinct, it follows a predictable framework. The core funnel stages in a commercial banking context are outlined below.

Key B2B Sales Funnel Stages for Banking

| Funnel Stage | Objective for Banks | Example Activity |

|---|---|---|

| Awareness | Become a known, credible option when a business has a financial need. | A CFO researching a new commercial line of credit encounters your bank’s targeted analysis of capital strategies in their industry. |

| Consideration | Demonstrate superior value and expertise against specific competitors. | Your relationship manager presents a preliminary term sheet, using peer benchmark data to highlight industry-specific expertise and favorable covenants. |

| Decision | Win the business with a compelling, data-backed proposal. | You deliver a final proposal customized with insights into the company’s specific cash flow patterns and strategic growth objectives. |

| Loyalty | Deepen the relationship to maximize lifetime value and generate referrals. | Following loan closing, you proactively deliver an analysis showing how treasury management services can optimize their newly expanded operations. |

Each stage demands distinct actions from your team, supported by the right intelligence.

Platforms like Visbanking are engineered to provide the critical data points—from FDIC call reports to local UCC filings—that empower your team to execute the right move at the right time. By measuring each stage, you can identify and act upon your most significant growth opportunities.

Turning Data Into High-Value Opportunities

A B2B sales funnel is only as effective as the data that fuels it. For banking leaders, the objective is to convert broad market intelligence into specific, high-value commercial relationships. This process begins at the top of the funnel, where raw data informs strategic client acquisition long before an initial contact is made.

The strategy is not to cast a wider net, but to use precision data to target the right prospects with the right solutions.

The initial Awareness stage is where a data-first methodology provides a significant competitive advantage. Instead of relying on anecdotal market feedback, your team can analyze hard numbers from sources like FDIC call reports. This analysis can reveal underserved industries or geographic territories with unmet credit demand.

For example, a bank’s leadership team analyzes call report data and observes that competitors are reducing their commercial real estate (CRE) loan exposure in a specific county. Simultaneously, local economic data reveals a surge in warehouse and logistics construction permits. This is not a vague trend; it is a specific, actionable opportunity. Your bank can immediately direct its marketing and outreach efforts toward logistics companies in that county, armed with a clear understanding of the market dynamics. A hypothetical bank could identify a $50,000,000 opportunity pool in this niche alone.

From Awareness to Qualified Consideration

As prospects move into the Consideration stage, the funnel narrows, and precision becomes paramount. Mass-emailing generic offers to purchased business lists is not only inefficient but also damages your institution's credibility. The goal is to qualify prospects so rigorously that by the time a relationship manager engages, the conversation is already substantive.

This is where a unified intelligence platform is indispensable. Imagine your team is targeting mid-sized manufacturing firms. Instead of cold-calling from a directory, they can use a tool like Visbanking’s Prospect module to analyze Uniform Commercial Code (UCC) filings. A recent filing for new equipment signals expansion and a potential financing need.

An effective sales funnel doesn’t just generate leads; it manufactures qualified opportunities. It systematically filters the entire market down to the handful of prospects who have a demonstrable need and are most likely to convert.

Armed with this intelligence, a relationship manager can initiate contact with a highly relevant proposition: "I noted your recent equipment financing filing and wanted to discuss how our lending structures have helped similar manufacturers in your sector reduce capital costs by an average of 75 basis points."

This data-driven approach immediately elevates the interaction from a sales pitch to a strategic consultation, dramatically increasing the probability of securing a meeting. Explore further strategies in our guide on effective lead generation for banks.

Benchmarking Funnel Performance

Moving a prospect from awareness to serious consideration is a critical transition. Industry benchmarks provide a valuable reality check. In B2B sales, the overall lead-to-customer conversion rate often sits between a narrow 2% and 5%.

The conversion from a marketing qualified lead (MQL) to a sales qualified lead (SQL) is particularly challenging, with conversion rates often falling to between 15% and 21%. This significant drop-off is typically due to leads that are not genuinely sales-ready—a problem that data-driven qualification directly addresses. By leveraging intelligence tools that identify intent signals from multiple sources, your team can substantially improve these conversion rates. It is worth reviewing a detailed analysis of these B2B pipeline performance benchmarks to evaluate your own funnel’s performance.

The top and middle of your B2B sales funnel are about converting ambiguity into certainty. When your process is built on a foundation of precise, multi-sourced data, you equip your team to focus their efforts on the most promising opportunities and engage prospects with tangible value from the first interaction.

Mastering The MQL-to-SQL Handoff

The most critical—and frequently the most inefficient—stage of a bank’s B2B sales funnel is the handoff from a Marketing Qualified Lead (MQL) to a Sales Qualified Lead (SQL). This is the inflection point where initial interest either evolves into a tangible opportunity or dissipates, wasting valuable resources.

In commercial banking, this stage is particularly nuanced. A prospect’s initial engagement, such as downloading a whitepaper on treasury management, does not confirm their status as a viable, profitable client.

Success depends on a razor-sharp, data-backed definition of "qualified." An MQL is typically defined by behavior. An example is a controller at a local manufacturing company downloading your guide. This indicates interest, not immediate intent.

An SQL, conversely, is defined by hard data. It is the same controller’s company, but now your intelligence platform has flagged a new UCC filing for equipment financing and confirmed the company operates in an industry you are actively targeting. The potential conversation shifts from a general topic to a specific, timely need.

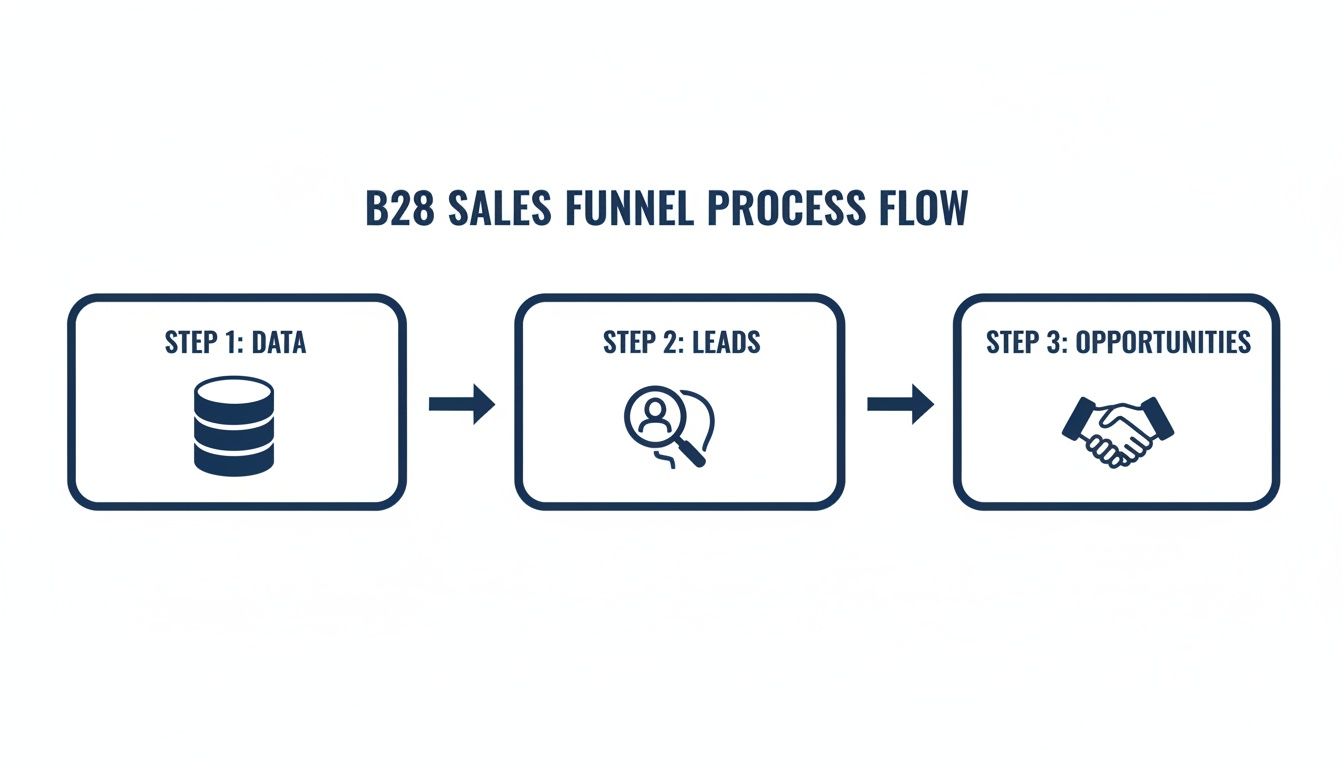

This flow from raw data to a real opportunity is a process of refinement, not just collection.

The key takeaway for banking leaders is clear: a high-performing sales funnel is not a passive system. It is an active, systematic process for converting vast amounts of data into high-value commercial relationships.

Why The Handoff Fails (And How Data Fixes It)

This handoff frequently breaks down due to a disconnect between marketing objectives and the realities of commercial banking. Marketing teams, often measured by lead volume, may pass along prospects that meet superficial criteria but lack the financial profile or immediate need required for a substantive discussion with a relationship manager.

This creates friction and inefficiency. Relationship managers waste time pursuing unqualified leads, the sales pipeline stalls, and team morale suffers. The MQL-to-SQL handoff is a notorious bottleneck in most B2B funnels, with an average conversion rate of just 12-18%. In commercial banking, where a relationship manager’s time is a prime asset, this inefficiency is exceptionally costly.

A disciplined MQL-to-SQL process, powered by predictive intelligence, is the single greatest lever for improving sales productivity. It ensures your top performers are engaging the right prospects at the optimal time.

This is precisely where a purpose-built banking sales intelligence platform provides a decisive advantage. Instead of relying on subjective judgment or manual research, the system automates qualification by identifying predictive signals.

Automating Qualification With Predictive Signals

Imagine your marketing efforts generate 100 MQLs from a recent webinar. The traditional approach involves manual review or arbitrary distribution among relationship managers.

The data-driven methodology is fundamentally different.

A platform like Visbanking’s BIAS can instantly enrich that MQL list against dozens of data sources. It functions as a powerful filter, automatically identifying the companies that are truly sales-ready. It searches for signals such as:

- Financial Health Triggers: A recent SEC filing indicating a strong cash position or disclosing upcoming capital expenditures.

- Expansion Indicators: New UCC filings for equipment or inventory, which strongly suggest a need for growth financing.

- Risk Profile Changes: Call report data showing a competitor is retracting from a prospect's core industry, creating a market opportunity.

- Leadership Movements: Key executive hires that often precede major strategic shifts.

This automated filtering can refine a list of 100 MQLs down to 10-15 high-priority SQLs. Your relationship managers now have a concise, targeted list and enter every conversation armed with genuine business insight. The result is a more effective sales funnel, a more efficient team, and a measurable impact on your bank's bottom line.

Closing High-Value Commercial Deals with Data

The bottom of the B2B sales funnel is where opportunities are won or lost. Success at this stage requires more than a competitive term sheet; it demands a consultative, data-backed approach that demonstrates undeniable value and differentiates your institution from competitors.

The objective is to shift the conversation from price to strategic partnership. A proposal focused solely on rates and fees is a commodity. A proposal armed with market intelligence and peer analysis transforms your relationship manager from a salesperson into a trusted advisor. This final stage is not merely about closing a transaction—it is about initiating a profitable, long-term relationship built on a foundation of data.

Elevating the Proposal with Benchmarking

Consider a common scenario: a relationship manager is pursuing a mid-market manufacturing firm that has been identified as a high-quality SQL. The company requires capital for expansion, and several other banks are competing for the business. The standard approach is to lead with an aggressive interest rate.

A data-driven strategy is fundamentally different. Using a tool like Visbanking’s Bank Performance module, the RM can benchmark the prospect's key financial metrics against its direct industry peers. They can analyze the prospect’s capital structure, inventory turnover, and debt service coverage ratios, comparing them to anonymized, aggregated data from similarly sized manufacturers in the same region.

With this intelligence, the proposal is no longer just a loan offer; it becomes a strategic financial plan.

Your proposal should answer the prospect's unasked question: "How can your bank make my business fundamentally stronger than my competitors?" Data is the only way to provide a credible answer.

Instead of just offering capital, your RM can demonstrate how the proposed financing will strengthen the company's balance sheet, bringing its capital structure in line with top-performing peers. This elevates the discussion from a transactional price negotiation to a consultative analysis of their business—a conversation your competitors cannot replicate.

Understanding Industry-Specific Win Rates

Data not only sharpens your proposals but also sets realistic expectations. B2B sales conversion rates vary significantly by industry. Data shows that sales call conversion rates can range from 13% to 25%. The financial services industry typically sees conversion rates in the 10-19% range, reflecting greater regulatory and product complexity.

For high-value opportunities, the challenge intensifies; deals exceeding $5 million convert at just 9.09%. These statistics underscore the necessity of a highly targeted, value-driven approach in commercial banking. To delve deeper into these benchmarks, you can read a detailed analysis of sales call conversion rates by industry.

Understanding these realities is critical for executive leadership. When your team is equipped with precise intelligence, they can focus their resources on opportunities with the highest probability of closing, effectively navigating the statistical challenges of high-value B2B sales. This is the core principle behind effective business banking prospecting software—using data to make superior strategic bets.

Ultimately, winning at the bottom of the funnel is determined by demonstrating superior insight. When your team can present a clear, data-supported narrative showing how your bank will tangibly improve a prospect’s competitive position, you create a powerful and often insurmountable advantage.

Building a Flywheel for Loyalty and Expansion

The traditional B2B sales funnel has a critical flaw, particularly for banking: it ends. Acquiring a new commercial client is not the finish line; it is the beginning of the relationship's most profitable phase. The most forward-thinking institutions are therefore replacing the linear funnel with a self-perpetuating growth flywheel.

In the flywheel model, the energy expended to acquire a client is converted into momentum. Each satisfied client becomes a source of new opportunities through referrals, expanded business, or adoption of additional products. This creates a powerful, compounding cycle where your best customers become your most effective sales channel.

From Acquisition to Proactive Partnership

Transitioning from a funnel to a flywheel requires a strategic shift in how you leverage data. The same intelligence platform that identified the prospect should now be used to monitor the client’s financial health, anticipate future needs, and proactively identify risks. This is not passive account management; it is an active, data-driven partnership.

For example, your team can monitor Home Mortgage Disclosure Act (HMDA) data associated with key commercial clients. A sudden increase in mortgage applications from their executive team could signal that the company is preparing for an acquisition and onboarding new leadership. This is a critical opportunity. Rather than waiting for a call, your team can proactively engage them with advisory services, acquisition financing, or expanded treasury solutions.

The ultimate goal is to transform your bank from a service provider into an indispensable financial partner. This is achieved by using ongoing data intelligence to anticipate a client’s next move before they make it.

This proactive approach converts a reactive service model into an offensive growth strategy. The critical insight for executives is that a unified intelligence platform like Visbanking’s BIAS is essential for powering both client acquisition and retention, ensuring no opportunity to deepen the relationship is missed.

Identifying Cross-Sell and Upsell Triggers

The flywheel gains momentum when you systematically identify opportunities to expand existing relationships. Your data should be continuously scanned for triggers indicating that a client's needs are evolving.

Consider these data-driven scenarios:

- Treasury Services Expansion: UCC filings show a client is increasing its inventory financing. This is a direct signal that their cash management needs are becoming more complex—an ideal moment to introduce advanced treasury services. A proactive proposal could save them $50,000 annually in processing efficiencies.

- Wealth Management Integration: SEC/EDGAR filings reveal that a client’s founder has initiated a stock sale plan. This is an immediate alert for your wealth management division to offer specialized advisory on tax strategy and investments.

- Credit Line Adjustments: Macroeconomic data from the Bureau of Labor Statistics (BLS) indicates rising input costs in a client’s industry. You can proactively offer to increase their operating line of credit to help manage potential cash flow constraints, reinforcing your role as a strategic advisor.

By integrating these data triggers into your post-sale process, you create a system for increasing client lifetime value. The flywheel doesn't just retain clients; it actively expands the business you conduct with them. This is how you maximize your return on acquisition cost.

The logical next step is to benchmark your existing client portfolio against these opportunities. Explore our data to see which of your clients are showing clear signals for expansion right now.

Putting Your Data-Driven Funnel Into Action

Understanding the theory of a B2B sales funnel is one thing; decisive, data-driven implementation is what secures commercial clients. This transition is not a minor adjustment but a fundamental shift from static, disconnected reporting to an integrated intelligence system. In the current banking environment, this is a strategic necessity.

A successful funnel is a measured funnel. Leadership must move beyond anecdotal evidence and focus on the quantitative metrics that define the health of the client acquisition engine. These metrics are the vital signs of your growth strategy.

Key Performance Indicators for Executive Oversight

To effectively manage your B2B sales funnel, your leadership team must monitor a concise set of KPIs at each stage. This provides a clear, numbers-based view of performance, highlighting bottlenecks before they impact growth targets.

- Top of Funnel (Awareness/Consideration): Monitor your Lead-to-Opportunity Rate. Of every 100 prospects engaged, how many convert into viable opportunities? A rate below 10% is a strong indicator that your initial targeting or value proposition is misaligned with the market.

- Middle of Funnel (Decision): Track Sales Cycle Length. What is the average time from initial conversation to a closed deal? If your average cycle extends beyond 90-120 days, it suggests friction in your decision-stage process or inefficiencies in proposal generation.

- Bottom of Funnel (Action): Analyze Customer Acquisition Cost (CAC) and Win Rate. A high CAC combined with a low win rate (e.g., below 20%) is an unsustainable model, indicating that excessive resources are being spent on deals ultimately lost to competitors.

The ultimate measure of a sales funnel is its efficiency. A superior process doesn't just win deals; it wins the right deals with a predictable, cost-effective, and repeatable methodology.

Attempting to derive this level of insight from siloed data sources is ineffective. A unified platform like Visbanking’s BIAS is essential for integrating disparate data points—call reports, UCC filings, market data—into actionable intelligence.

The path forward is clear. To build a predictable growth engine, you must instrument, measure, and optimize your sales process with intelligence. The first step is to establish a baseline. Explore our data to benchmark your current performance and identify the specific, high-value opportunities within your markets.

Frequently Asked Questions

Executing a data-driven B2B sales funnel for the first time can present challenges. Here are answers to common questions from bank executives.

How Is a B2B Sales Funnel Different for Commercial vs. Retail Banking?

The primary distinction lies in complexity and relationship depth. A retail banking funnel is optimized for volume and transactional speed—processing thousands of smaller, standardized products like checking accounts or auto loans. It is a high-volume, low-touch model that is heavily automated.

Commercial banking is the antithesis. The B2B sales funnel is high-touch, low-volume, and built on consultative relationships. A $5 million commercial real estate transaction involves multiple decision-makers and a sales cycle that can extend 90+ days. The required data—such as UCC filings, call reports, and peer financial benchmarks—is far more complex than a consumer credit score.

What Is the First Step to Building a Data-Driven Sales Process?

The foundational step is to centralize your intelligence. Most banks possess a wealth of valuable data, but it is typically fragmented across disparate systems, departments, and spreadsheets. The first action must be to consolidate this data into a single, cohesive system.

A platform like Visbanking’s BIAS is designed for this purpose. It integrates market data, prospect intelligence, and internal performance metrics into a single source of truth. With this foundation, you can define an ideal client profile, identify high-value targets, and equip your relationship managers with the insights needed to engage prospects with confidence and authority.

How Do We Accurately Measure the ROI of a Bank Intelligence Platform?

Return on investment is measured by quantifiable improvements in funnel efficiency. Focus on metrics that directly impact the bottom line.

- Increased Win Rate: Analyze your close rate on qualified opportunities before and after implementation. An increase of even 5% on your commercial loan portfolio translates directly to significant revenue growth.

- Shorter Sales Cycles: Measure the average time to close a deal. Reducing a 120-day cycle to 90 days allows your team to close more deals per quarter, thereby accelerating growth.

- Higher Customer Lifetime Value (CLV): A robust intelligence platform will identify cross-sell opportunities that would otherwise be missed. A 10% increase in products per client is a clear, measurable indicator of success.

A well-constructed B2B sales funnel is not merely a strategy; it is a growth engine. It transforms the "art" of client acquisition into a science. With Visbanking, you can build, measure, and optimize that engine with real data. See how you stack up against your peers and find your next big opportunity at https://www.visbanking.com.