The Banking Sales Intelligence Platform Playbook

Brian's Banking Blog

A banking sales intelligence platform is more than an enhanced CRM. It is a strategic system engineered to convert raw data into measurable growth opportunities. These platforms synthesize your internal client data with external market signals, equipping your team to anticipate client needs and identify revenue streams well ahead of the competition.

This Isn't Your Grandfather's CRM

In an environment of compressed margins and aggressive fintech competition, the traditional reactive sales model in banking is obsolete.

While your bank’s CRM is an essential system of record, it functions as a rearview mirror, chronicling past interactions and closed deals. A banking sales intelligence platform, by contrast, is your forward-looking guidance system.

The strategic imperative is to shift from a reactive to a proactive posture. This means moving beyond managing existing relationships to actively pursuing the next significant opportunity.

For example, a CRM can report a commercial client's current loan balance. An intelligence platform, however, will issue an alert the moment that same client files for a construction permit. This is a definitive buying signal—a clear indicator of an impending need for new financing or treasury services.

From Drowning in Data to Making Decisive Moves

Every bank possesses vast stores of data. The challenge lies in converting this dormant information into a competitive advantage. A sales intelligence platform is the engine that connects disparate data points to create a coherent picture of your market and clients.

- Uncover Overlooked Revenue: Instantly identify commercial prospects that fit your ideal client profile but are currently banking with a competitor. For instance, a community bank could generate a list of all local businesses with an SBA loan over $350,000 nearing maturity, creating a highly targeted list for a refinancing campaign.

- Preempt Competitive Threats: Receive alerts when executives at key commercial accounts connect with bankers at a rival institution on LinkedIn. This allows relationship managers to defend the relationship before it is compromised.

- Deepen Strategic Partnerships: Move beyond product sales. By understanding a client’s complete ecosystem—including their key suppliers and customers—you can offer strategic counsel that establishes your bank as an indispensable partner, not merely a vendor.

This represents a fundamental strategic shift, not just a technological upgrade. The financial institutions that will lead in the coming years will be those using intelligence to anticipate market changes and act on opportunities others have not yet identified.

Ultimately, a banking sales intelligence platform replaces guesswork with data-backed foresight. It provides the actionable intelligence required to lead the market, compelling a critical evaluation of your current strategy against this proactive, data-first approach.

What Is a Modern Banking Sales Intelligence Platform?

A modern banking sales intelligence platform is the central nervous system for your bank's growth engine. It represents a significant advancement from the static, historical perspective of a traditional CRM.

Consider it an aircraft cockpit, consolidating all critical, real-time information necessary to navigate complex market conditions and secure new business with precision.

The system is built on three pillars: data unification, advanced analytics, and workflow integration. It merges your internal CRM data with a continuous stream of external market intelligence—from FDIC call reports and SEC filings to news alerts and executive changes.

Unifying Internal and External Data

The primary function of these platforms is to eliminate data silos. The system automates the laborious process of information gathering, allowing relationship managers to focus on execution.

- Internal Data: Your existing proprietary assets, including client history, transaction records, and product utilization.

- External Data: Publicly available information such as regulatory filings (e.g., UCCs), business credit reports, and other market signals.

- People Data: Key personnel intelligence, including executive movements, professional networks, and board memberships.

This synthesis transforms raw data into a strategic asset. For example, the platform can instantly flag that a commercial client has secured a $10,000,000 venture capital investment. This is a powerful, immediate signal for treasury management needs—an opportunity a standalone CRM would miss entirely. This transition from a static database to a dynamic intelligence hub is transformative.

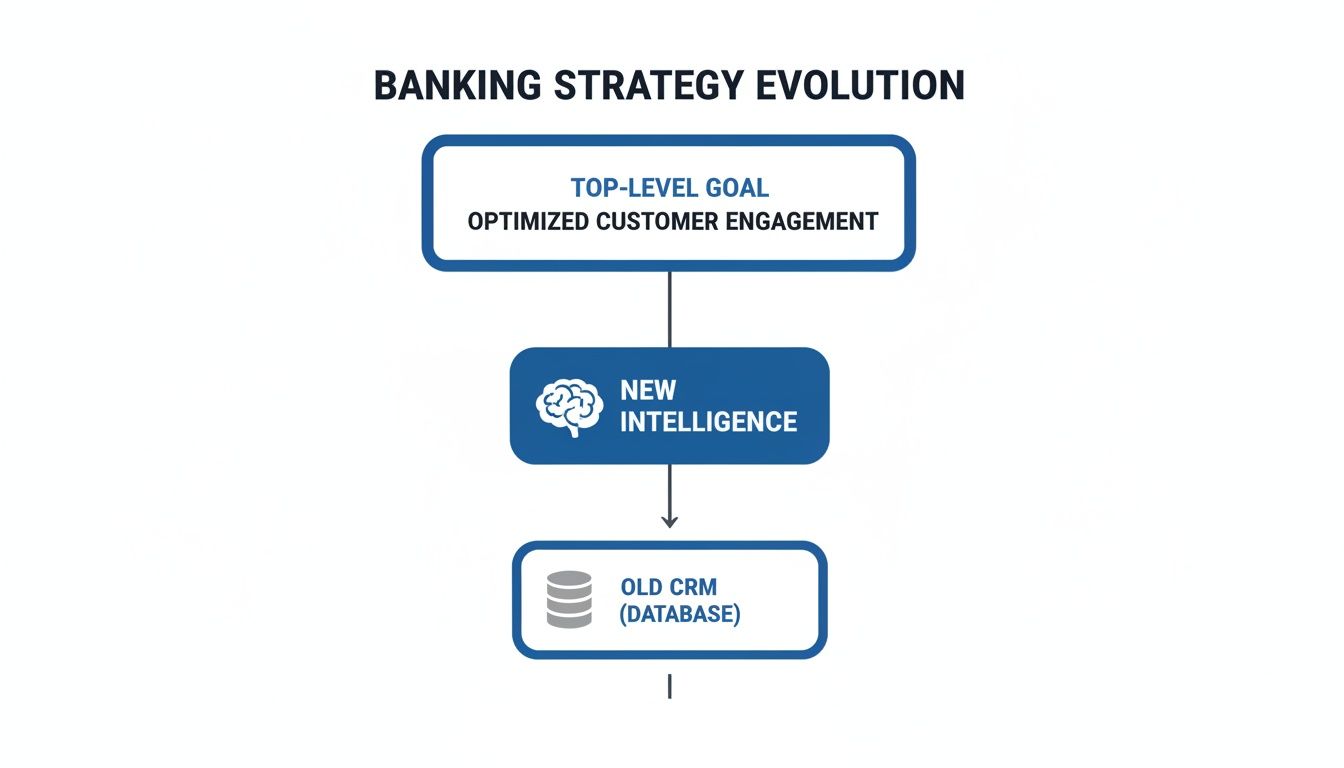

This diagram illustrates the evolution from a basic CRM to a true intelligence platform.

The focus shifts from data storage to generating forward-looking insights that compel action, not just reaction.

Driving Action Through Analytics

The analytical engine is where the platform's true power lies. Here, AI algorithms process millions of data points to identify patterns, predict future needs, and score opportunities.

The system answers critical business questions: Which prospects are most likely to require a commercial real estate loan in the next quarter? Which current clients exhibit attrition risk? For a deeper examination of these concepts, review our guide on what business intelligence analytics entails.

The financial services industry’s reliance on these tools is undeniable. The BFSI sector is projected to account for 24.90% of the global sales intelligence market by 2025—a market valued at $4.5 billion. This market penetration underscores the industry's need for real-time intelligence to navigate intense competition and sophisticated client demands.

The platform delivers these insights directly into the daily workflows of your sales, marketing, and relationship management teams. It is not another dashboard for passive observation; it is an integrated tool that empowers your bankers to act faster and more strategically.

How Intelligence Drives Real Commercial Outcomes

A banking sales intelligence platform is a direct investment in your revenue engine. Its purpose is to convert vast quantities of data into tangible commercial results, transforming market signals into closed deals and a measurable return on investment.

The performance gains from shifting to a proactive model are substantial. An analysis of over 10,000 sales professionals revealed that sales intelligence contributes to 32% higher win rates and a 28% reduction in sales cycle length. In commercial banking, these metrics are even more pronounced, with teams reporting 23% improved loan portfolio performance and a 34% increase in cross-sell success.

From Signal to Signature

Consider a typical scenario for a commercial banking team. A mid-sized manufacturing company in your territory secures a $15,000,000 Series B funding round. Traditionally, your bankers might learn of this weeks later, long after competitors have already submitted proposals.

With an intelligence platform, an automated alert is delivered to your relationship manager's inbox the moment the funding is publicly filed. This is not just an alert; it is a comprehensive briefing detailing the company, the amount raised, the key investors, and the decision-makers.

This signal enables a timely, relevant outreach regarding treasury management, commercial credit lines, or international trade services. It is a prime example of effective lead generation for banks.

This advantage fundamentally changes the competitive landscape. Your team transitions from order-takers to proactive advisors. Instead of waiting for an RFP, they initiate the conversation based on a verified business need. This is how you become a strategic partner.

This capability directly impacts the bottom line. If such intelligence-driven targeting increases qualified commercial leads by 40%, a 15% increase in new commercial accounts is a realistic outcome. For a mid-sized bank, this could translate into an additional $5,000,000 in new deposits annually.

The following table illustrates this strategic shift from a "wait and see" to a "seek and solve" approach.

| Activity | Traditional Banking Approach (Reactive) | Intelligence-Driven Approach (Proactive) |

|---|---|---|

| Lead Generation | Relies on referrals, cold calls, and inbound inquiries. | Uses data triggers to identify companies with immediate needs. |

| Client Outreach | Generic pitches based on product lists. | Tailored conversations based on specific company events (e.g., funding, M&A). |

| Timing | Often late to the conversation, after competitors are engaged. | First to the table, initiating contact at the moment of opportunity. |

| Role of Banker | Product salesperson, responding to stated needs. | Strategic advisor, anticipating future needs based on intelligence. |

| Sales Cycle | Longer, with more discovery and qualification needed. | Shorter and more efficient, as the initial need is already validated. |

This is not simply a new tool; it is a superior operating model that positions your team to control the engagement.

Activating Opportunities in Wealth Management

These principles are equally potent in wealth management and private banking. An intelligence platform acts as a surveillance system, continuously scanning for executive moves, board appointments, and significant liquidity events across your client and prospect base.

Here’s how it works:

- Executive Job Changes: A senior executive at a major local company departs. The platform flags this event instantly, creating a prime opportunity for a conversation about a 401(k) rollover.

- Company Acquisitions: An alert signals that a privately held company has been acquired. This informs your wealth advisors that the owners are poised for a major liquidity event and require immediate, sophisticated wealth planning and investment advice.

By automating the discovery of these critical trigger events, a platform like Visbanking frees your advisors from manual research. They can then allocate their time to high-value activities: building relationships and delivering expert advice, armed with the precise intelligence needed to act at the decisive moment.

The Role of AI in Precision Targeting and Risk Mitigation

If data is the new oil, artificial intelligence is the refinery. For modern banking sales intelligence platforms, AI is the analytical engine transforming raw, disconnected data into a competitive advantage. It enables surgical precision in both offensive growth strategies and defensive client retention efforts.

AI models continuously analyze millions of data points to score opportunities, predict client attrition, and recommend the "next best product" with remarkable accuracy.

This is not a future trend; capital is flowing toward proven results. The global market for AI in banking is projected to grow from $23.6 billion in 2024 to $299.09 billion by 2033. This growth is driven by performance: 75% of companies now use advanced AI for sales forecasting, and 60% use it to analyze customer behavior, automating tasks that were once manual and inefficient.

Making Your Bankers Smarter, Not Replacing Them

AI augments the expertise of your bankers; it does not replace them. It serves as a diligent research assistant, freeing relationship managers to focus on their core strengths: building relationships and conducting high-value strategic conversations.

The technology serves two critical functions: sourcing new revenue and protecting existing assets.

Offensive Strategy: AI can scan the market to identify "lookalike" prospects that mirror the profile of your most profitable commercial clients, analyzing factors from industry and revenue to growth trajectory. This generates a hyper-targeted list for business development. We explore this further in our guide on transforming your bank's growth strategy with smart targeting.

Defensive Strategy: The system can also identify at-risk commercial clients. Declining transaction volume, negative news sentiment, or a new UCC lien filing can trigger a predictive alert, giving your team the opportunity to intervene and secure the relationship before competitors are aware of any vulnerability.

This means your team is no longer reacting to past events. They are equipped to act on future opportunities and risks, armed with a data-driven foresight that provides a clear, defensible advantage.

Imagine an AI model alerting your team that a portfolio company has just filed a patent for a new logistics technology. This is a powerful signal of potential needs for international trade financing or an expanded credit line. Your banker can now approach the client with a timely, relevant solution before they even begin to explore their options. Reviewing the best AI for financial analysis tools can provide a broader sense of the landscape.

This is how you build a proactive, opportunity-driven culture. It begins with having the right intelligence.

How to Pick the Right Platform and Actually Use It

Selecting a banking sales intelligence platform is a strategic decision, not a feature-comparison exercise. It is an investment in your institution's capacity for growth.

For executives, the evaluation must be rigorous, focusing on data integrity, seamless integration, and a clear path to return on investment.

A platform’s value is dictated by the quality of its data. The first question for any vendor must be about data sourcing and quality control. Vague responses are a significant red flag. You must confirm whether the data originates from auditable sources like FDIC call reports, UCC filings, or SEC data. This is a matter of accuracy, compliance, and trust.

Your Core Evaluation Checklist

A sound decision hinges on three key areas that distinguish a transformative platform from expensive shelfware.

- Data You Can Trust: Demand transparent answers on data sources, update frequency, and verification processes. In banking, auditable data trails are a baseline requirement.

- Plays Well with Others: The platform must integrate seamlessly with your existing technology stack, whether it is Salesforce, nCino, or another core system. Poor integration will cripple user adoption.

- Grows With You: Assess the platform's scalability. Can it support your top commercial lending team today and your entire retail network tomorrow? Inquire about the vendor’s support model and confirm they possess deep financial services expertise.

A polished demo can be misleading. A critical error is choosing a platform that is visually appealing but fails to solve your specific business problems. The right partner will demonstrate precisely how their system can identify credit-worthy businesses in your market or map complex client relationships, not just present an attractive dashboard.

A Practical Game Plan for Rollout

Once a partner is selected, a phased rollout is the most effective approach. Focus on securing an early win to build momentum and demonstrate the platform's value.

- Start with a Pilot: Launch with a single, high-impact team, such as your top commercial lenders. Establish clear, measurable objectives from the outset. For example, target a 25% increase in qualified, data-driven leads within the first quarter.

- Make It Easy to Use: The most advanced technology is useless if it goes unused. Prioritize platforms with an intuitive user interface and a vendor that provides robust training and ongoing support.

- Measure, Tweak, and Expand: Closely monitor the pilot program’s results. Leverage this success to build the business case for expanding the rollout to other divisions, such as wealth management or treasury services.

The right choice comes down to providing your teams with intelligence they can act on. Begin by benchmarking your current prospecting efforts against the capabilities of a modern platform. Exploring the data within a system like Visbanking is a logical first step toward building a more intelligent, proactive institution.

It's Time to Stop Reacting and Start Winning

In today's competitive market, waiting for customers to articulate their needs is a strategy for obsolescence. The financial institutions gaining market share are those using data to understand their clients' businesses, predict their next moves, and deliver strategic advice preemptively.

The transition from reactive relationship management to proactive, data-driven intelligence is no longer a luxury; it is the cost of entry for future success.

Integrating a banking sales intelligence platform is a fundamental strategic pivot, not just a technology upgrade. It provides the foundation necessary to operate with precision and speed, converting market intelligence into tangible results on your balance sheet.

What's Coming Next?

This technology is evolving rapidly. Two key trends demand executive attention:

- Generative AI for Outreach: Imagine an AI that drafts a personalized outreach email to a prospect based on a newly filed UCC lien, or a note to a current client acknowledging their recent expansion. This will enable bankers to scale high-touch, personal engagement without sacrificing efficiency.

- Smarter Predictive Analytics: Soon, these platforms will move beyond historical analysis to predict future events with increasing accuracy. Consider a model that identifies which of your commercial clients are most likely to require acquisition financing in the next 12 months based on their growth trajectory and industry dynamics.

Your future growth depends on the quality of the intelligence you use today. The institutions that thrive will be those built on a foundation of proactive, data-driven decision-making.

It is time for an objective assessment. How do your current capabilities compare to this proactive model? To understand what is required to compete and win, you must see the real-time data and analytics that a system like Visbanking provides.

Got Questions? We've Got Answers.

Evaluating a banking sales intelligence platform is a significant capital decision. It is prudent to have questions about its practical application and impact. Here are answers to common inquiries.

Isn't This Just Another CRM?

No. Your CRM is your bank's rearview mirror—a system of record for managing existing client data and tracking past interactions.

An intelligence platform is your forward-looking guidance system—a system of action. It integrates your internal data with external market signals like UCC filings, executive changes, or regulatory data. This allows you to identify new opportunities that a CRM, by its nature, cannot see. It directs your focus to what comes next.

What Kind of ROI Are We Talking About?

While results vary, institutions that adopt this technology report compelling, measurable gains.

Top performers consistently achieve metrics such as:

- A 30-40% increase in qualified leads, driven by timely and relevant outreach.

- A 25-30% reduction in the sales cycle, as teams engage prospects with pre-validated needs.

- A significant increase in cross-sell and up-sell revenue by proactively identifying client needs.

The objective is not just operational efficiency; it is driving top-line growth and building an undeniable business case for the investment.

The core value is the shift from a reactive to a proactive posture. Instead of waiting for a loan application, the platform alerts you when a company’s activity indicates a need for credit. Your team is positioned to be the first to engage, not the last.

How Painful Is the Implementation?

This is not a multi-year IT project. Modern platforms are designed for rapid deployment and seamless integration.

The key is to partner with a vendor that specializes in financial services and offers pre-built connectors for your existing systems, such as Salesforce or nCino. A prudent rollout begins with a targeted pilot program designed to deliver value within a single quarter. This approach secures early wins, builds internal support, and creates momentum for a broader, bank-wide implementation. The goal is rapid, tangible results.

The future of your bank's growth will be driven not by dashboards, but by superior intelligence. Visbanking delivers the Bank Intelligence and Action System designed to help your team move from looking at data to taking decisive action. See how you stack up and explore what our data can do for you today.

Similar Articles

Visbanking Blog

Banking Data Analytics: Turning Information Into Profit

Visbanking Blog

In the world of banking, digital transformation is no longer a 'nice-to-have'. It's a necessity

Visbanking Blog

BIAS: The Smart Choice for Banking Intelligence and Action

Visbanking Blog

BIAS: The Smart Choice for Banking Intelligence and Action

Visbanking Blog

BIAS: The All-in-One Solution for Banking Intelligence and Action

Visbanking Blog

BIAS: The Future of Banking Intelligence and Action System

Visbanking Blog

How can data science transform the banking industry?

Visbanking Blog

Revolutionize Your Bank with BIAS, the Bank Intelligence and Action System

Visbanking Blog

Why does bank data matter more than you think?

Visbanking Blog