Estimated reading time: 2 minutes

We created a proprietary Predictive Model for Bank Failure based on linear regression and machine learning that uses over 20 distinct metrics analyzed on a quarterly basis, including Capital, Asset Growth, Non-Performing Loans, Loan Losses, and Operating Losses. The model has been back tested using all bank data and the associated bank failures from 2011 to 2020.

Failure has been defined in much the same way as the regulatory agencies define it – insolvency which leads to a shutdown of the bank as we know it.

This gives us a high level of confidence that without intervention, these banks will not survive.

So, why are these banks in danger? Here are a few highlights for each bank:

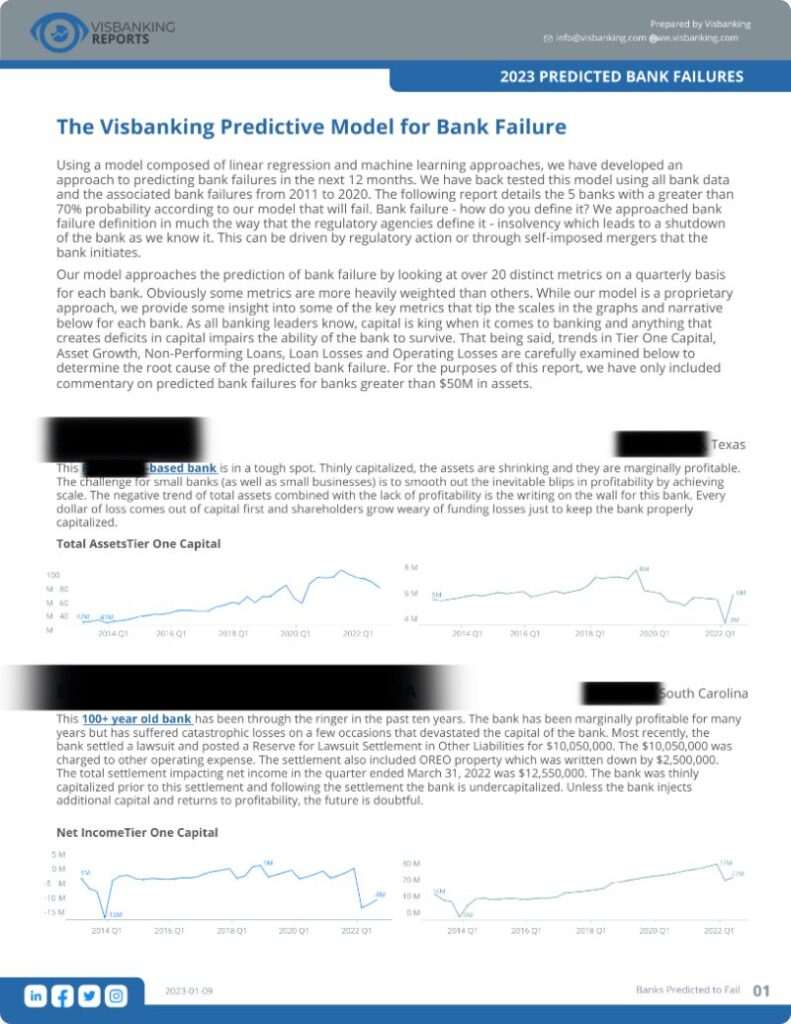

BANK 1 (Texas): Thinly Capitalized with Shrinking Assets and Marginal Profitability

– The bank’s small size makes it difficult to smooth out fluctuations in profitability.

– The bank’s total assets have been shrinking, further exacerbating the issue.

BANK 2 (South Carolina): Thinly Capitalized with Marginal, Sometimes Negative Profitability

– A $12.5 million lawsuit settlement in 2022 has left the bank in a precarious financial situation.

– Without a capital infusion, the bank will not survive.

BANK 3 (Missouri): Mortgage Origination Firm with Out-of-control Costs

– The bank’s income statement is primarily driven by non-interest income, making it vulnerable to economic storms like the current one with higher interest rates.

– The bank’s survival may hinge on a capital injection from its parent company.

BANK 4 (Texas): Very Similar to Bank 3

– Also recovering from significant losses in 2020 due to negative servicing fees of over $20 million per quarter for the entire year.

– The bank is attempting to turn things around through non-interest expense reduction.

BANK 5 (North Dakota): Ample Deposits but Unhealthy Balance Sheet

– With almost $200 million in assets, the bank only has just over $20 million in loans.

– The bank needs to raise its loan-to-asset ratio from 10% to 50% to address this major opportunity cost.

Interested in the full report – BANK NAMES INCLUDED?

DM me and I’ll send it your way.

—

Follow Brian on Linkedin: Brian Pillmore