A Data-Driven Vendor Risk Management Process for Bank Executives

Brian's Banking Blog

A robust vendor risk management process is no longer a compliance function—it is a core strategic discipline for any banking institution. It requires the systematic identification, assessment, and mitigation of risks from third-party vendors, not just at onboarding, but throughout the entire relationship lifecycle. This proactive governance is essential to protect your bank's assets, reputation, and operational integrity.

Why Vendor Risk Management Is a Core Banking Strategy

For bank executives and directors, vendor risk management has migrated from the back office to the boardroom. The rapid integration of fintech partners, data processors, and core service providers creates significant growth opportunities, but it also introduces commensurate risks. Treating this function as a simple compliance checkbox is a strategic error in today's interconnected financial ecosystem.

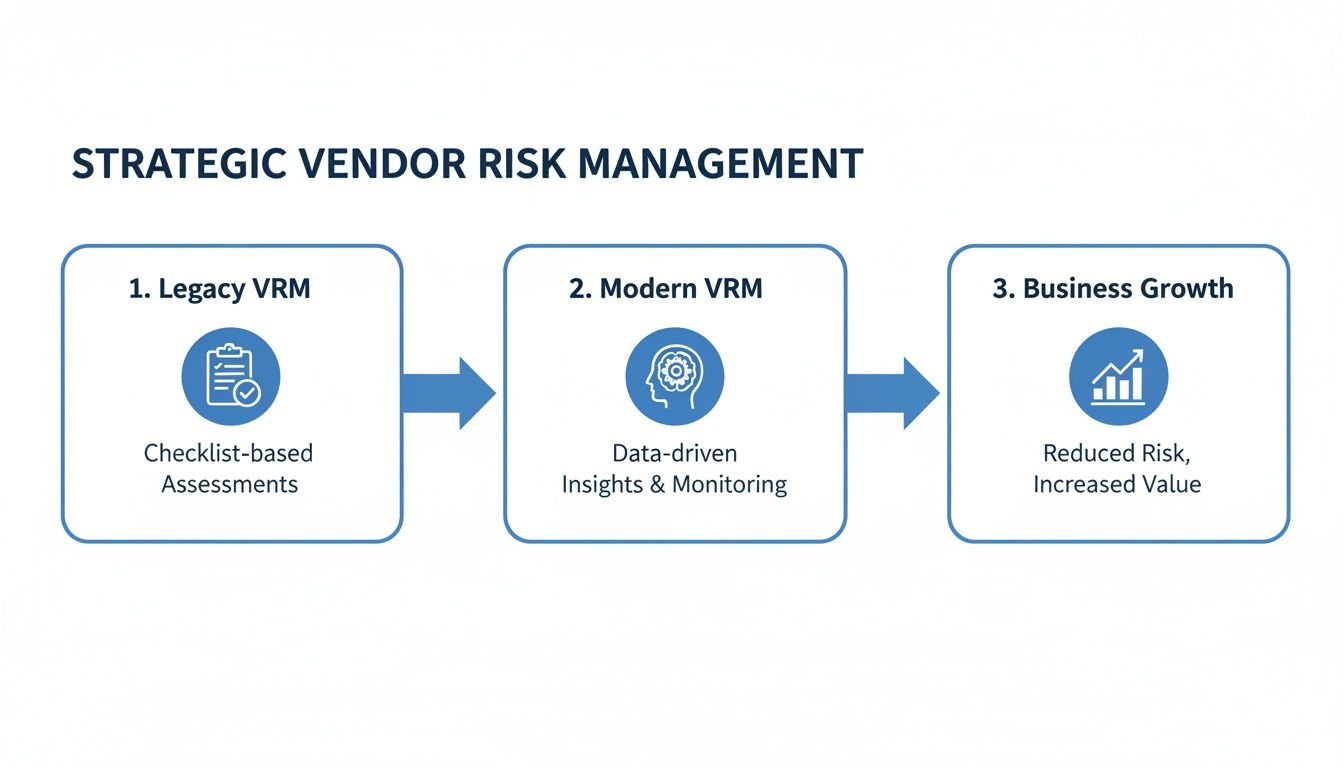

Legacy, check-the-box methods are static and reactive—the antithesis of what is required. They cannot keep pace with the dynamic nature of third-party relationships, where a vendor’s financial health or cybersecurity posture can degrade overnight. An effective vendor risk management process directly impacts your institution's balance sheet, reputation, and competitive position.

The Shift From Cost Center to Strategic Enabler

Market dynamics confirm this shift. The vendor risk management (VRM) market has expanded to a value of USD 13.47 billion and is projected to nearly double to USD 23.87 billion by 2030.

This growth is a direct response to escalating third-party risks. For instance, supply-chain cyber incidents surged by 431% between 2021 and 2023. A statistic of that magnitude elevates vendor vulnerabilities to a top-priority, board-level conversation.

This reality requires a new perspective. Leading institutions no longer view VRM as a cost center but as a strategic tool for growth and resilience. A strong program enables a bank to:

- Innovate Safely: Confidently partner with emerging fintechs to launch new products without exposing the institution to unacceptable operational or compliance risk.

- Protect Reputation: Avoid the significant reputational damage and customer attrition that inevitably follow a vendor-caused data breach or service disruption.

- Drive Sharper Decisions: Leverage empirical data to select partners who are not only capable but also financially and operationally sound, ensuring long-term stability.

A robust vendor risk management program is not about risk avoidance. It is about understanding, managing, and making informed decisions about the risks you are willing to accept to achieve strategic objectives. It transforms risk from a liability into a calculated component of your growth strategy.

The Role of Data Intelligence

Data intelligence is the linchpin of this strategic shift. Moving beyond periodic, manual reviews to a model of continuous, automated monitoring is critical. This is where platforms like Visbanking provide a distinct advantage. By aggregating disparate data sources—from FDIC call reports to UCC filings—a bank can develop a multi-dimensional, near real-time view of a vendor's health.

Consider a practical example: your core processor’s parent company begins to show signs of declining financial stability in its SEC filings, such as a debt-to-equity ratio increasing by 30% in two consecutive quarters. A data intelligence system flags this anomaly instantly. This allows you to proactively engage the vendor and review contingency plans long before it escalates into a crisis.

This proactive stance is precisely what regulators now expect. You can review the new guidance for third-party risk management from U.S. regulators to better understand these evolving requirements.

Ultimately, a modern vendor risk management process links vendor performance directly to your bank's own KPIs. It provides the foresight to convert potential disruptions into managed risks, ensuring your strategic partnerships accelerate growth, not impede it.

Building Your Defensible Vendor Risk Management Framework

A successful vendor risk management program is not an ad-hoc collection of checklists; it is built upon a solid, well-defined framework. This governance structure is your primary defense, providing the clarity and authority to satisfy regulators and navigate a dynamic market. Without a strong framework, your institution is merely reacting—playing defense instead of offense.

This structure must be formalized in a clear VRM policy approved by the board of directors. It should delineate the entire vendor lifecycle, from initial selection to final offboarding, with clear roles, responsibilities, and a specific risk appetite statement for third-party relationships. This statement is critical—it quantifies the level of risk the institution is willing to assume from vendors to achieve its strategic goals.

Moving Beyond Simple Vendor Classification

The strength of an effective framework lies in a data-informed approach to vendor classification. Applying generic "high," "medium," or "low" risk labels is an outdated model that is no longer sufficient. Today's banking environment demands a more sophisticated, multi-dimensional tiering system built on quantifiable factors.

A modern classification model examines metrics such as:

- Data Access: The type and volume of sensitive customer or bank data the vendor will handle.

- Operational Criticality: The degree of dependency on the vendor for core functions. A service disruption from a processor handling $50 million in daily transactions represents a fundamentally different risk than an outage from a marketing agency managing a $5,000 monthly ad spend.

- Financial Impact: The potential bottom-line financial loss resulting from a vendor failure or security breach.

This is not just a compliance exercise; it is about making better business decisions. The objective is to evolve from a legacy checklist approach to a modern, data-driven framework that fuels intelligent growth.

This shift transforms vendor risk management from a regulatory burden into an intelligent process that actively supports your bank’s strategic direction.

A Data-Driven and Dynamic Tiering System

A defensible system requires unified data intelligence. By integrating diverse data—from FDIC call reports and UCC filings to cybersecurity ratings—you gain a comprehensive, 360-degree view of a vendor's stability and risk profile. This is how you build a tiering system that is both dynamic and defensible. For a deeper dive into structuring this, consult our guide on the third-party risk management framework.

Consider a practical example: selecting between two cloud service providers. Vendor A is a well-established name, but recent UCC filings show it has taken on significant secured debt—a potential indicator of financial strain. Vendor B is a smaller competitor, but its financials are clean and its cybersecurity posture is excellent.

A data-driven framework surfaces these critical details. It enables a decision based on a complete risk profile, not just brand recognition or price. This is the difference between passively accepting risk and actively managing it with intelligence.

To help visualize this, here’s a sample model for classifying vendors based on their potential impact.

Vendor Tiering Model Based on Risk Exposure

| Tier | Risk Profile | Example Vendor | Due Diligence Level | Monitoring Frequency |

|---|---|---|---|---|

| 1 | Critical: Significant operational, financial, or reputational impact. | Core Processor, Cloud Host | Extensive, On-site Audits | Continuous / Quarterly |

| 2 | High: Major impact on specific business units or customer data. | Loan Origination System | In-depth, SOC 2 Review | Semi-Annually |

| 3 | Moderate: Limited impact on operations or non-critical data. | Marketing Agency | Standard Vetting | Annually |

| 4 | Low: Minimal operational or data risk. | Office Supply Company | Basic Verification | On Contract Renewal |

This structured tiering ensures resources are allocated where they matter most, applying the appropriate level of scrutiny to each partner.

This analytical rigor must also apply to vendor off-boarding, an area frequently overlooked. Your framework must include a plan for secure IT asset disposition. For instance, a comprehensive guide to secure hard drive disposal as a key part of your business risk management strategy can be an invaluable resource. A single misstep in this phase can expose your bank to significant legal and reputational damage long after a contract has ended.

Ultimately, your framework is the blueprint for all subsequent actions. By embedding data intelligence at its core, you create a system that not only satisfies examiners but also provides a distinct competitive advantage, enabling confident partner selection that contributes to the long-term resilience and growth of your institution.

Digging Deep: How to Execute Due Diligence with Precision

Effective due diligence is an investigation, not a paperwork exercise. Once your framework is established, the next step is a rigorous, evidence-based assessment of any potential vendor. This is where your theoretical risk appetite is tested against reality. Skimming a vendor's marketing materials or accepting self-reported claims at face value is insufficient. A defensible vendor risk management process demands verification, transforming raw information into actionable intelligence.

This level of scrutiny is more critical than ever. The average organization now manages 286 third-party vendors—a 21% increase in just one year. With 97% of organizations reporting at least one supply chain breach, the risk is both real and escalating. As you review these third-party risk management statistics, the need for a precise due diligence process becomes undeniable.

The Four Pillars of a Due Diligence Review

A thorough assessment dissects a vendor's entire operation to uncover both strengths and hidden vulnerabilities. Your review must be structured around four key risk domains, each requiring specific evidence.

- Financial Health: Look beyond surface-level figures. Request and analyze audited financial statements, including balance sheets and income statements. While a healthy balance sheet is a positive indicator, data platforms like Visbanking can dig deeper, cross-referencing public records like UCC filings that may reveal significant debt obligations not immediately apparent.

- Cybersecurity Controls: This is non-negotiable. At a minimum, require a recent, clean SOC 2 Type II report. However, do not stop there. Request evidence of penetration testing, their vulnerability management program, and data encryption standards for data in transit and at rest.

- Operational Resilience: A vendor failure is your failure. Demand to see their business continuity and disaster recovery plans. Scrutinize their recovery time objectives (RTOs) and recovery point objectives (RPOs) to ensure they align with your bank's operational requirements.

- Regulatory Compliance: Your vendors operate within the same regulatory landscape. Verify their compliance with key banking regulations such as FFIEC guidelines, OCC bulletins, and data privacy laws. This includes confirming they have robust internal compliance training and audit programs.

A Real-World Scenario: When Data Tells the Real Story

Imagine you are selecting between two fintech payment processors—a common scenario for a modern bank. This is where data intelligence transitions from a concept to a critical advantage.

On paper, Vendor A appears to be the clear choice. It presents impressive financials, boasting 25% year-over-year revenue growth and a strong capital position. It is a recognized industry leader.

Vendor B is a smaller competitor with a leaner balance sheet and more modest growth. A standard due diligence check would likely favor Vendor A based on financial strength alone.

However, a data intelligence platform like Visbanking flags a critical piece of information not included in their proposal: Vendor A was recently linked to an undisclosed data breach at another financial institution. The system connects news reports, legal filings, and other sources, estimating the total remediation cost for that breach at $2.5 million.

This single insight fundamentally changes the risk calculus.

Vendor B, though smaller, has an impeccable security record, with clean SOC 2 audits and positive industry feedback on its security practices. The perceived financial risk of its smaller balance sheet pales in comparison to the tangible cybersecurity and reputational risk posed by Vendor A.

This is what precision entails: uncovering the narrative behind the numbers. By integrating disparate data points, your bank can move beyond a simple checklist to make a strategic decision that balances innovation with prudent risk management.

Making these judgments consistently requires more than just data; it requires a system that connects the dots. To see how your own due diligence process measures up, you can explore our data and begin benchmarking key partners against objective, multi-source intelligence.

Negotiating Contracts That Mitigate Risk

Following a thorough due diligence investigation, the next critical step is to translate your findings into the vendor contract. This legal document is not mere paperwork; it is your most powerful tool for controlling risk. It is the mechanism by which your investigation's conclusions become legally-binding protections for your bank and its customers.

Standard legal templates are inadequate. In banking, contracts must be surgically precise, drafted specifically to address the risks identified during due diligence. This means embedding specific, unambiguous clauses that protect your institution when adverse events occur.

From Handshake to Hardcoded Protections

A well-structured contract transforms a simple vendor agreement into a partnership built on legal accountability. In the event of an incident, there should be no ambiguity regarding responsibility. For your critical vendors, your legal team must insist on several non-negotiable clauses.

Ensure these provisions are always included:

- Right-to-Audit Provisions: This grants you the explicit right to inspect a vendor's controls, processes, and facilities. It serves as a powerful deterrent against declining standards and is your primary tool for verifying ongoing compliance.

- Clear Data Ownership: The contract must state unequivocally that all customer and bank data belongs to your institution. It should also specify how that data is segregated, encrypted, and securely destroyed upon contract termination.

- Strict Breach Notification Protocols: Do not accept vague commitments to provide notice "in a timely manner." For a vendor handling sensitive data, requiring notification within 24 hours of breach discovery is not just reasonable—it is essential for effective incident response.

- Defined Liability Caps: The liability cap must be commensurate with the potential damage a vendor failure could cause. A low liability cap with a mission-critical vendor creates a dangerous asymmetry of risk between your institution and the vendor.

Codifying Performance with Financial Teeth

Protective clauses are essential, but the contract must also define what success looks like. This is accomplished through Service Level Agreements (SLAs) with meaningful financial penalties for non-performance. A vendor’s promise of "best effort" is unenforceable. You need quantifiable metrics.

Consider your digital banking platform provider. A weak SLA might promise "high availability." A strong SLA mandates 99.99% uptime and—critically—specifies the penalty for failure, such as a 5% credit on the monthly fee for every hour of downtime beyond the agreed-upon threshold.

This removes subjectivity from performance discussions. The contract itself becomes the arbiter, automatically enforcing accountability with financial consequences that impact the vendor's revenue.

This same level of detail must be applied to fourth-party risk. Your contract must hold your vendor accountable for the security and performance of their key suppliers. Insist on a clause requiring your approval before they engage any new critical subcontractor. This prevents a carefully vetted partner from outsourcing a core function to a high-risk firm without your knowledge.

Ultimately, a rigorous, well-drafted contract operationalizes your due diligence. It converts promises made during the sales process into legally enforceable commitments. By focusing on these specific, measurable terms, you build a contractual foundation that actively manages risk from day one through the end of the relationship.

To assess how your current vendor contracts compare to industry best practices, you can explore our data.

Moving Beyond Periodic Reviews to Continuous Monitoring

Vendor risk is not a static condition that can be assessed and filed away once a year. It is a dynamic variable that changes daily. A vendor’s financial stability, cybersecurity posture, or operational resilience can deteriorate in weeks, not years. The traditional “set it and forget it” approach—conducting an in-depth review at onboarding and then archiving the report—is a recipe for being blindsided by a critical failure.

In today's banking environment, the only defensible strategy is to shift from scheduled, manual reviews to a proactive, continuous monitoring model. This is how you transform your vendor risk management from a reactive, historical exercise into a forward-looking intelligence system.

Tune Into the Right Risk Signals

For your most critical vendors, monitoring must be relentless and focused on specific, measurable signals. Passive observation is insufficient; you must track the leading indicators of distress before they become the lagging indicators of failure.

Key signals to monitor include:

- Financial Health: Move beyond annual statements. Monitor for credit rating downgrades, adverse media coverage, or an increase in UCC filings that could signal financial distress. If a vendor’s primary lender shows a 15% drop in its own capital adequacy ratios, that is a significant red flag that requires immediate attention.

- Cybersecurity Posture: Last year’s SOC 2 report is obsolete. You need real-time intelligence on new vulnerabilities and security incidents. A 20% increase in open, high-severity vulnerabilities warrants an immediate response, not a note for the next scheduled review.

- Performance Against SLAs: Continuously track metrics such as uptime, incident response times, and transaction accuracy. Small but consistent failures to meet contracted Service Level Agreements are often early warnings of a larger operational breakdown.

This level of vigilance requires sophisticated systems. Attempting to manage this data flow manually will overwhelm your team. Effective bank risk management software is indispensable, integrating automated alerts and rich datasets to provide actionable insights.

Turn Raw Data into Decisive Action

Data collection is only the first step. The true value is realized when you operationalize this intelligence. An alert is useless without a clear, pre-defined protocol for action. This is how monitoring evolves from a passive notification system into an active engine for strategic decision-making.

Consider a real-world scenario. Your bank’s mobile application is powered by a critical fintech partner. An automated alert from a platform like Visbanking indicates that the vendor’s own primary lender—another financial institution—has just reported a significant drop in liquidity in its latest FDIC call report.

A periodic review model would miss this development until it was too late. The continuous monitoring model, however, triggers an immediate, pre-planned response.

The prescribed action is not panic; it is protocol. This single data point prompts your team to immediately request updated financials from the vendor, review existing contingency plans, and begin a quiet assessment of alternative providers.

The distinction is clear. You are not just reacting to a crisis; you are proactively managing a developing risk based on empirical data. You are acting on intelligence, not instinct.

Build a Proactive Risk Culture

This shift requires more than new tools; it demands a cultural change that begins at the top. The board and executive team must champion the move from calendar-based reviews to an event-driven monitoring mindset. It is about empowering your risk and compliance teams to act on subtle signals and ask difficult questions before a vendor’s problem becomes your bank’s problem.

By fully integrating continuous monitoring into your process, you create a powerful feedback loop that constantly re-evaluates the risk profile of every key partner against your bank's risk appetite. This is the hallmark of a resilient, forward-thinking institution that uses data not just to report on the past, but to command its future.

Common Questions from the Trenches

Executing a vendor risk management process inevitably raises practical questions. Here are common concerns voiced by bank leadership, with direct answers for executives and directors focused on strategic oversight.

How Do We Get the Board to Actually Care?

You secure the board’s attention by translating risk metrics into business impact. Frame the discussion around financial exposure and reputational damage, not compliance checklists.

Replace dense spreadsheets with a risk dashboard that quantifies what is at stake. Instead of merely listing vendors, present the risk in clear terms: "40% of our mortgage processing volume depends on a single vendor whose financial stability score declined by 15% this quarter."

This reframes the issue from a budget line item to a direct threat to shareholder value. When you position VRM investments as a defense of the bank's bottom line, the board’s role shifts from passive approval to active strategic guidance. You are connecting their fiduciary duty directly to your vendor risk program.

What's the Single Biggest Mistake Banks Are Making?

The most common and costly error is treating vendor risk management as a one-time event at contract initiation. Many banks conduct exceptional due diligence upfront and then effectively cease active management, filing the documentation away.

This is a critical failure. A vendor’s financial health, cybersecurity posture, and leadership can change rapidly. A pristine SOC 2 report from last year offers no protection against a zero-day vulnerability discovered yesterday.

Effective VRM is not a project; it is a lifecycle. The failure to continuously monitor a critical vendor after contract execution is a significant and avoidable institutional weakness. This is the gap where the most damaging vendor-related incidents originate.

How Do We Handle Risk from Our Vendors' Vendors?

Managing fourth-party risk—the risk from your vendors’ suppliers—is a complex but necessary challenge. A blind spot here represents a direct threat to your institution.

First, control begins with your contracts. Agreements with critical vendors must grant you the right to approve their key subcontractors. The contract must legally obligate them to enforce the same security and performance standards you require down to their own suppliers. This is your primary defense.

Second, leverage data intelligence tools to map these hidden dependencies. For example, if your core processor relies on a specific cloud hosting provider, you must understand the risk profile of that provider. A sudden credit downgrade or a data breach at that fourth party is now your problem, directly threatening your bank's stability.

This is about achieving a comprehensive view of the entire risk landscape. Proactive management means identifying these single points of failure in your extended vendor ecosystem and developing contingency plans before an incident occurs. This is what separates a reactive, check-the-box function from a truly strategic risk management program.

A resilient vendor risk management program is built on a foundation of superior data intelligence. At Visbanking, we aggregate financial, regulatory, and market data from multiple sources to provide the clear, predictive signals required to act with confidence. It is time to move beyond static reports and equip your team with the real-time insights needed to manage vendor risk decisively. Explore our data and discover how to transform risk management from a defensive necessity into a true competitive advantage.

Similar Articles

Visbanking Blog

What is a “Risk Continuum” and why on earth should you even care??

Visbanking Blog

Banking Data Analytics: Turning Information Into Profit

Visbanking Blog

Bank Risk Management: Protecting Assets in Uncertain Times

Visbanking Blog

Capital Banking in the USA: An Overview of Investment Services, Financial Instruments, and Regulations

Visbanking Blog

If you want your bank to be the most profitable in the long run - make the most of your CRM.

Visbanking Blog

🔥 'Data is the new oil.'

Visbanking Blog

Digital Banking Security: Protecting Your Money in Cyberspace

Visbanking Blog

Bank Regulatory Compliance: Navigating the Complex Maze

Visbanking Blog

Bank Capital Requirements: The Ultimate Survival Guide

Visbanking Blog