The Utah Industrial Bank Playbook for Executives

Brian's Banking Blog

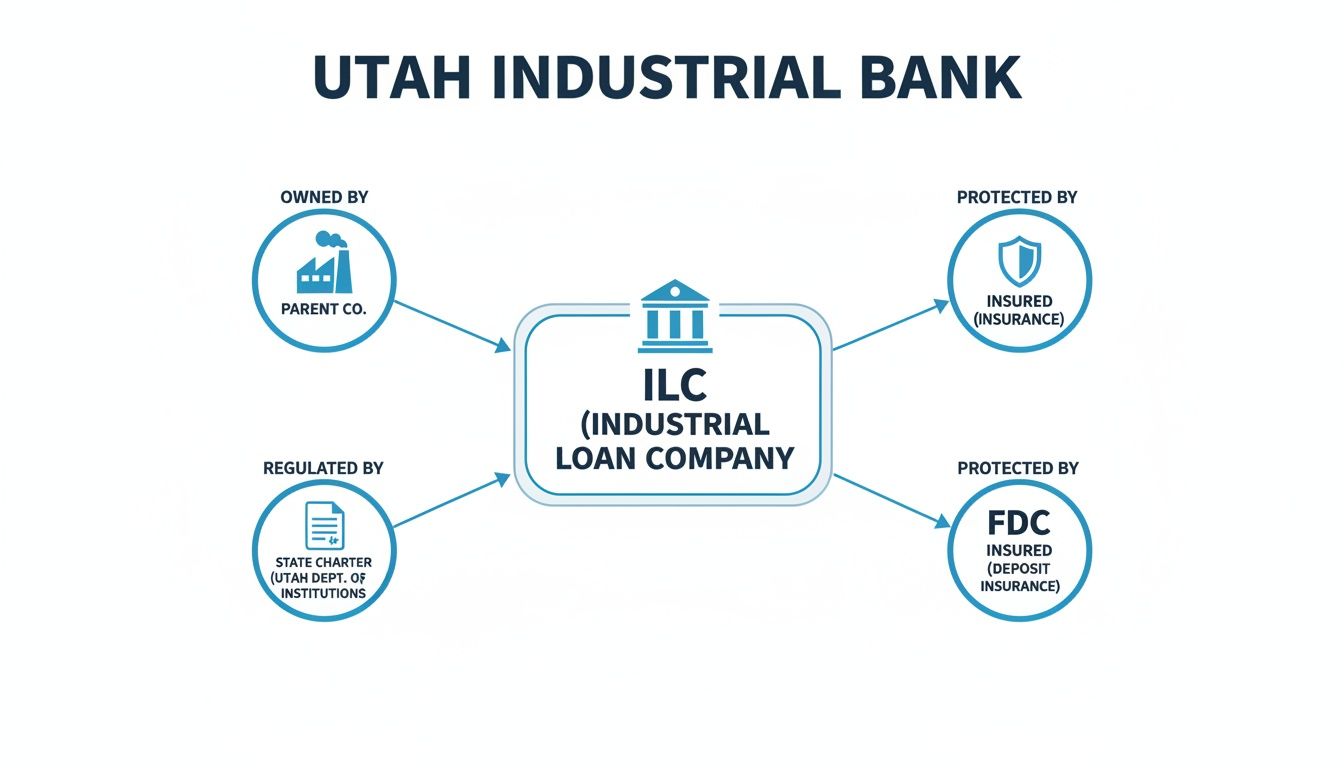

A Utah industrial bank, formally known as an Industrial Loan Company (ILC), is a state-chartered, FDIC-insured financial institution with a critical distinction: its parent company is not a bank.

This unique structure allows commercial enterprises—from automotive manufacturers to technology corporations—to own a depository institution without subjecting the parent entity to Federal Reserve oversight as a Bank Holding Company. For bank executives, understanding this model is not an academic exercise; it is a competitive imperative.

The Strategic Significance of the Utah Industrial Bank Model

The Utah industrial bank charter is a potent competitive force gaining momentum. Unlike traditional commercial banks, ILCs operate under a framework designed to maintain a clear separation between banking and commerce. This structure provides commercial firms a direct, federally insured conduit into the U.S. banking system, enabling them to vertically integrate financial services that directly support their core operations.

The strategic appeal is straightforward. A parent company can establish a captive bank to serve its ecosystem of customers and partners. For example, an automotive firm can charter an ILC to streamline floor-plan financing for its dealership network. A financial technology company can use one to originate loans and process payments for its merchant base. This creates a highly efficient, self-contained financial ecosystem.

The strategic advantage of the ILC charter is its precision. It enables a commercial parent to embed financial services at the point of maximum impact—whether at the point of sale, across a dealer network, or within a software platform. This is a formidable competitive moat.

Differentiating the Models: A C-Suite Briefing

A clear understanding of the structural differences is essential to gauging their market impact. The key distinctions that define a Utah industrial bank are:

- Ownership: The parent entity is a commercial, non-financial corporation.

- Regulation: The Utah Department of Financial Institutions (DFI) serves as the primary chartering and supervisory authority, while the FDIC provides federal oversight and deposit insurance.

- Business Focus: Operations are typically specialized, designed to directly support the parent company’s commercial activities, such as targeted lending or payment services.

This specialized operating model is a primary driver of their often superior performance metrics.

This table provides a concise comparison for executive review.

Utah Industrial Bank vs. Commercial Bank: Key Differences

| Attribute | Utah Industrial Bank (ILC) | Traditional Commercial Bank |

|---|---|---|

| Ownership Structure | Owned by a commercial (non-financial) parent company. | Typically owned by a Bank Holding Company (BHC). |

| Primary Regulator | State authority (Utah DFI) and the FDIC. | Subject to oversight from the Federal Reserve, OCC, or FDIC. |

| Parent Company Oversight | Parent company is not regulated by the Federal Reserve. | The Bank Holding Company is regulated by the Federal Reserve. |

| Business Scope | Highly specialized, focused on supporting the parent's business. | Offers a broad range of financial products and services. |

| Branching | Often operates with a limited physical footprint or none at all. | Typically maintains a physical branch network for customer service. |

Ultimately, these structural differences result in distinct operating models and performance outcomes.

For example, an ILC focused solely on a single loan product can achieve an efficiency ratio of 45%. This provides a significant operating advantage over a community bank managing diverse business lines and a branch network, which might average closer to 60%.

Monitoring these focused competitors is essential. Using a data intelligence platform like Visbanking, executives can benchmark their institution's performance directly against these specialized players. This is how raw market data is converted into a decisive strategic advantage.

Deconstructing the Industrial Bank Charter

To effectively compete with—or provide services to—a Utah industrial bank, executives must first understand its unique structural underpinnings. The power of the industrial loan company (ILC) charter originates from a specific exemption within the Bank Holding Company Act of 1956.

This exemption allows commercial firms to own an FDIC-insured bank without being regulated by the Federal Reserve as a bank holding company. This is a primary attraction for established brands seeking entry into the banking sector.

The Regulatory Framework in Action

Instead of Federal Reserve supervision of the parent, regulatory authority is bifurcated. The Utah Department of Financial Institutions (DFI) oversees the state charter, while the FDIC provides federal supervision and deposit insurance.

This dual-oversight model creates a streamlined path for the parent company. It can continue its primary business activities while the ILC subsidiary operates as a state-chartered bank, adhering to all federal regulations for safety and soundness.

This diagram illustrates the framework:

As shown, the parent company operates outside the Federal Reserve’s BHC framework, interfacing directly with state regulators and the FDIC.

However, this structure includes a critical limitation: ILCs owned by non-financial firms with consolidated assets of $100 million or more are prohibited from offering traditional demand deposit (checking) accounts. This restriction compels them to be innovative in their funding strategies, often relying on savings accounts, certificates of deposit, and other specialized lending products.

For a deeper analysis of the regulatory landscape, our overview of the regulatory agencies for banks is a valuable resource.

Historical Context, Modern Implications

The contemporary industrial bank is not a recent innovation. The model dates back more than a century, created to provide credit to industrial workers excluded from traditional banking.

Their resilience was proven during the Great Depression. Between 1934 and 1938, while commercial banks failed in droves, ILC assets grew by 65% and their loan volumes increased by 81%.

This legacy of focused, specialized lending remains central to their identity. Following Utah's decision to lift a moratorium on new charters in 1997, ILCs were granted nearly all the powers of state-chartered commercial banks, catalyzing the model's modern resurgence.

Understanding these origins and regulations is a strategic asset. It provides the context needed to anticipate ILCs' market movements and identify opportunities for partnership or competition. With a tool like Visbanking, this knowledge becomes actionable, enabling real-time tracking of everything from their asset growth to loan portfolio composition.

Analyzing The Modern Industrial Bank Landscape

To fully grasp the power of the Utah industrial bank charter, one must move beyond regulatory theory and analyze the institutions themselves. This is not a monolithic market; it is a diverse ecosystem of highly specialized banks, each leveraging the charter to achieve specific business objectives for its non-financial parent.

The result is a collection of banking operations that are focused, efficient, and often deliver exceptional financial performance.

The key is strategic alignment. An industrial loan company (ILC) is engineered to serve its parent's ecosystem, creating a powerful feedback loop that traditional banks cannot replicate. They are not attempting to be universal providers; they aim for market leadership within a well-defined niche.

Profiles In Specialization

Examining these banks in operation provides the clearest insight into their competitive advantage. Each offers a case study in how to integrate financial services to support a larger commercial mission.

The following is a brief overview of several major players.

Profile of Major Utah Industrial Banks

A snapshot of prominent Utah ILCs, their parent companies, and primary business focus.

| Industrial Bank Name | Parent Company | Primary Business Focus | Approximate Asset Size |

|---|---|---|---|

| Square Financial Services | Block, Inc. | Small business loans and deposit products for Square merchants | $3.5 billion |

| BMW Bank of North America | BMW Group | Dealer network financing and commercial loans | $7.5 billion |

| Sallie Mae Bank | Sallie Mae | Private student loans and consumer banking products | $27 billion |

| Celtic Bank | Celtic Bancorp, Inc. | SBA and small business lending nationwide | $3 billion |

These examples demonstrate the precision with which these institutions leverage their charters to fuel parent company operations.

Consider Square Financial Services, an ILC owned by Block, Inc., with assets exceeding $3.5 billion. Its sole purpose is to provide capital and deposit products to the millions of merchants within the Square payment ecosystem. This creates a closed-loop system where banking services are embedded directly into the business relationship, enhancing both client retention and revenue.

Similarly, BMW Bank of North America, with over $7.5 billion in assets, is almost entirely dedicated to supporting the BMW dealer network. It provides the commercial loans for inventory and dealership financing essential to the parent’s sales operations. This is a classic captive finance model, enhanced with an FDIC-insured banking charter.

These are not outliers; they are the standard. A modern Utah industrial bank is a precision instrument, engineered to solve a specific commercial problem with superior efficiency and a streamlined regulatory structure.

Data-Driven Competitive Insights

Analysis of performance data reveals patterns that every executive should monitor. A significant factor shaping the competitive landscape for all institutions, including ILCs, is the proliferation of digital banking in modern finance. Their typically branchless, technology-forward models confer a substantial advantage in operational efficiency.

An ILC dedicated to credit card origination, for instance, might operate with an efficiency ratio below 40%—a figure most community banks find unattainable.

Mastering these performance metrics is the first step toward building a sound competitive strategy. By tracking loan concentrations, funding sources, and profitability ratios, executives can identify both threats and opportunities. Does a competitor’s rapid growth in a niche signal an untapped market? Does a significant shift in their deposit mix reveal a funding strategy that could be countered or adopted?

This level of analysis demands real-time, granular data. This is where tools like Visbanking’s platform become indispensable, moving an institution from passive observation to active strategy. It provides the capability to benchmark against any industrial bank and dissect its performance, component by component.

This is how raw market intelligence is transformed into a tangible, defensible advantage.

Benchmarking ILC Performance Against Traditional Banks

Effective strategy is built on quantitative analysis, not intuition. To truly understand a Utah industrial bank, an executive must move beyond its charter and scrutinize its performance data. By leveraging aggregate FDIC call report data, one can draw sharp, actionable comparisons between Industrial Loan Companies (ILCs) and traditional commercial banks. This is not an academic exercise; it is the source of critical competitive intelligence.

Analysis of key performance indicators (KPIs) reveals clear patterns that highlight the ILC model's inherent advantages. Their focused, often branchless business models translate directly into superior operational efficiency. It is not uncommon for a specialized ILC to operate with an efficiency ratio near 45%. In contrast, a typical community bank, burdened with a diversified loan portfolio and a physical branch network, often operates with an efficiency ratio closer to 60%.

Key Performance Differentiators

This efficiency advantage cascades across other critical metrics. Consider Return on Assets (ROA), a fundamental measure of profitability. A well-run ILC, by minimizing overhead and concentrating on high-margin niche lending, can sustain an ROA significantly above the industry average for commercial banks of a similar asset size.

For example, a hypothetical ILC that provides product financing for its parent company might consistently post an ROA of 1.75%. A comparable commercial bank might struggle to achieve 1.10%. That 65-basis-point differential, while seemingly small, represents a substantial long-term gap in profitability and capital generation. It is the direct result of a business model engineered for a single purpose.

The Net Interest Margin (NIM) often reveals a similar dynamic. Many ILCs fund their specialized, higher-yield loan portfolios with non-core deposits like CDs and brokered funds, rather than low-cost transaction accounts. This, combined with a built-in loan origination ecosystem—such as the parent company’s customer base—dramatically reduces client acquisition costs and enhances profitability.

The key takeaway for executives is that ILCs are not merely smaller, esoteric banks. They are highly optimized financial instruments, designed to dominate specific operational niches. Their performance metrics confirm this.

Turning Data into a Competitive Edge

While understanding broad trends is valuable, the most potent strategic insights come from granular, bank-to-bank comparisons. This is where data intelligence platforms become mission-critical. Relying on industry averages is insufficient when a specific ILC competitor is gaining traction in a core market.

Informed decisions require the ability to conduct detailed peer analysis. A robust data platform allows an executive to deconstruct a specific Utah industrial bank's performance on a quarterly basis. It reveals their loan concentrations, funding mix, asset quality trends, and profitability metrics—and places that data directly alongside your own institution’s performance. This process transforms broad market awareness into a precise, actionable competitive advantage.

For those seeking to deepen their analysis, frameworks like Uniform Bank Performance Reports offer a standardized methodology for dissecting and comparing institutional performance. Applying this rigor to the ILC sector enables executives to identify strategic opportunities and mitigate potential threats with confidence. The data provides the map; strategy dictates the destination.

Using Data to Spot Opportunities and Risks

For sales, risk, and relationship management teams focused on the Utah industrial bank sector, the landscape is rich with actionable signals. However, these signals are buried in data that must be actively monitored. Static regulatory filings are insufficient for decisive action. The key is to transform quarterly FDIC call report data into proactive triggers that illuminate both commercial opportunities and emerging risks.

By monitoring the right metrics, your teams can move from a reactive to a predictive posture, anticipating client needs and market shifts.

Prospecting with Precision

For business development teams, specific data points serve as clear indicators of opportunity. A significant increase in a particular loan category or a sharp rise in total assets suggests an ILC is scaling its operations and likely requires new or expanded correspondent banking services.

Consider these data-driven signals:

- Rapid Asset Growth: An ILC reports a 25% year-over-year increase in total assets, from $800 million to $1 billion. This level of growth places significant strain on internal operations and is a strong indicator of an impending need for treasury management, cash vault services, or loan participations.

- A Surge in C&I Lending: An industrial bank’s Commercial & Industrial (C&I) loan portfolio grows by $150 million in a single quarter. This signals an aggressive growth strategy and presents a timely opportunity to offer loan participations or specialized credit services to support that expansion.

- New Product Lines: The appearance of a new loan category on an ILC’s call report indicates a strategic pivot. This is the ideal moment to engage leadership with a discussion about correspondent services tailored to that new market segment.

For an executive, these data points are direct invitations to engage. A sharp increase in assets is a clear signal that an institution’s needs are evolving, creating a window to introduce solutions that facilitate their next growth phase.

Monitoring for Risk

For risk management and credit teams, the same data serves as a critical early-warning system. The specialized nature of a Utah industrial bank means that negative trends can accelerate rapidly, making automated surveillance essential for managing exposure.

Key red flags include:

- Declining Asset Quality: An increase in noncurrent loans from 0.50% to 1.25% of total loans over two quarters demands immediate attention. It may indicate systemic stress within their niche loan portfolio.

- Shifts in Funding Sources: A sudden, increased reliance on brokered deposits or other volatile funding sources can signal liquidity pressure. Such a change in the funding mix is a critical risk indicator.

Historically, Utah industrial banks have demonstrated strong performance and steady growth, often with lower delinquency rates than their peers. Discover more insights about the history of industrial loan companies to understand their decades of resilience. However, their unique models still demand vigilant oversight.

The primary challenge is timing. By the time these trends are identified through manual review of quarterly reports, the optimal window for action may have closed. This is precisely where a platform like Visbanking’s BIAS provides a decisive advantage. It automates the surveillance process, delivering alerts on critical changes directly to your CRM or internal communication channels. It transforms static data into actionable intelligence, empowering your teams to act with speed and precision.

Benchmark ILC performance or explore our data to see how timely intelligence can drive your strategy forward.

Turning Analysis into Action: Your Executive Playbook

Analysis without action is an academic exercise. For bank executives, insights into the Utah industrial bank landscape must culminate in a decisive, structured plan.

Whether the objective is competition, partnership, or service provision, a methodical, data-driven framework is required to convert market awareness into market share.

This framework consists of four pillars, guiding the transition from high-level strategy to tactical execution and ensuring every action is informed.

Define Your Target Market

First, identify the specific segment of the industrial loan company (ILC) market that represents the greatest opportunity for your institution. A generalized approach is ineffective. Focus on a niche where your bank’s core competencies create a distinct competitive advantage.

A newly chartered, fintech-owned ILC experiencing rapid asset growth has fundamentally different needs than a mature ILC focused on automotive financing. The former may require sophisticated treasury management and high-volume ACH services, while the latter could be a prime candidate for loan participations.

An effective strategy begins with a clear hypothesis, such as: “Fintech-owned ILCs with assets between $500 million and $2 billion represent an underserved market for our correspondent banking services.” This specificity is the foundation of a data-driven outreach campaign.

Identify and Map Key Relationships

Once the target profile is defined, use a data intelligence tool to identify specific institutions and, critically, their key decision-makers. A review of public filings and professional networks can reveal not only the executive team but also their existing business relationships.

Intelligence of this nature transforms a cold outreach into an informed, strategic engagement. Discovering that a target ILC’s CFO previously worked at a bank that utilizes your core processing provider, or that their head of lending has a professional connection to one of your board members, provides a valuable entry point.

Benchmark and Tailor Your Value Proposition

Before initiating contact, benchmark your offerings against the target ILC's performance and operational structure. Analyze their FDIC call report data: What is their efficiency ratio? What is their funding composition? What are their primary loan concentrations?

If data reveals a target is heavily reliant on brokered deposits, this indicates a potential vulnerability and a significant opportunity for your institution. It signals a need for more stable, relationship-based funding. Your value proposition should lead with tailored deposit solutions, supported by data demonstrating how you can enhance their liquidity profile. This is not sales; it is consultative problem-solving.

Deploy Automated Intelligence Triggers

The most effective strategies are proactive. Establish automated alerts to monitor your target list for key growth signals or risk indicators.

An alert indicating a target’s C&I loan portfolio has increased 20% in a single quarter should serve as an immediate trigger for your relationship team to engage. Concurrently, managing these opportunities effectively requires building a robust data strategy for AI and compliance, ensuring all data-driven initiatives are executed within a sound governance framework.

This is the modern executive playbook: a systematic process for converting the unique dynamics of Utah's industrial bank ecosystem into tangible business outcomes. The final step is to equip your teams with the intelligence tools required to execute this playbook with speed and precision.

Explore Visbanking's data to benchmark your institution and uncover opportunities in the ILC market.

Common Questions About Utah Industrial Banks

As a bank executive, you likely have questions regarding the strategic implications of these specialized institutions. The following addresses several common inquiries.

Can Any Company Charter an Industrial Bank?

Yes, this is the model's core appeal. Both financial and non-financial corporations—from global automotive brands to major technology firms—can apply for an ILC charter. This allows them to own an FDIC-insured depository institution without subjecting the parent company to Federal Reserve supervision as a Bank Holding Company.

What Are the Primary Activities of ILCs?

Most ILCs maintain a narrow focus, concentrating on specialized lending that supports their parent company’s core business.

Common areas of operation include:

- Credit Cards: Issuing credit products for retail partners or an existing customer base.

- Auto Loans: Operating as a captive finance arm to facilitate vehicle sales through the parent's dealer network.

- Small Business Lending: Providing capital and deposit products to an integrated ecosystem, such as a fintech’s merchant network.

How Can a Traditional Bank Compete with ILC Efficiency?

Attempting to match their efficiency in a niche market is challenging. The more effective strategy is to leverage the core strengths of community and regional banks: deep, relationship-based commercial lending, sophisticated treasury management, and trust services. Alternatively, establishing partnerships to offer correspondent banking services can be a highly effective approach.

The key is to use robust data to identify your competitive advantage. For example, if an ILC achieves a 45% efficiency ratio in a shared niche, analyze their model for gaps. Data may reveal a lack of sophisticated cash management solutions, creating a clear opening for your institution to present a superior value proposition.

Are Industrial Banks a Recent Phenomenon?

No. ILCs have existed for over a century, originally established to provide credit to industrial workers who lacked access to traditional banks. Their strategic role has evolved dramatically over the past two decades as large commercial and technology firms have recognized the value of integrating financial services directly into their core business operations.

Monitoring the Utah industrial bank sector requires sharp, timely intelligence. Visbanking provides the data and analytics platform to benchmark performance, identify strategic opportunities, and translate insight into action. Explore our bank intelligence tools today.