The Industrial Bank: A Strategic Analysis for Banking Leaders

Brian's Banking Blog

The term industrial bank, often used interchangeably with Industrial Loan Company (ILC), represents more than a regulatory nuance—it signifies a competitive paradigm shift. An industrial bank is a state-chartered, FDIC-insured depository institution. Its defining characteristic is that its charter permits ownership by a commercial parent company, which remains outside the direct supervisory purview of the Federal Reserve under the Bank Holding Company Act.

For bank executives and directors, understanding this model is not an academic exercise; it is a critical component of strategic planning. This structure allows non-financial corporations to enter the banking sector, creating formidable competitors with fundamentally different cost structures and strategic objectives.

Decoding the Industrial Bank Model

An industrial bank operates as a specialized financial subsidiary, enabling a commercial parent—be it an automotive manufacturer, a technology conglomerate, or a national retailer—to offer banking services without subjecting the entire enterprise to the comprehensive regulatory framework of a traditional bank holding company.

The primary strategic advantage stems from this regulatory separation. The parent company can engage in a broad spectrum of commercial activities prohibited for traditional bank holding companies, while its ILC subsidiary benefits from federal deposit insurance. This creates a direct, powerful synergy: the parent can fund its lending operations with stable, low-cost consumer deposits rather than relying on more volatile and expensive wholesale funding.

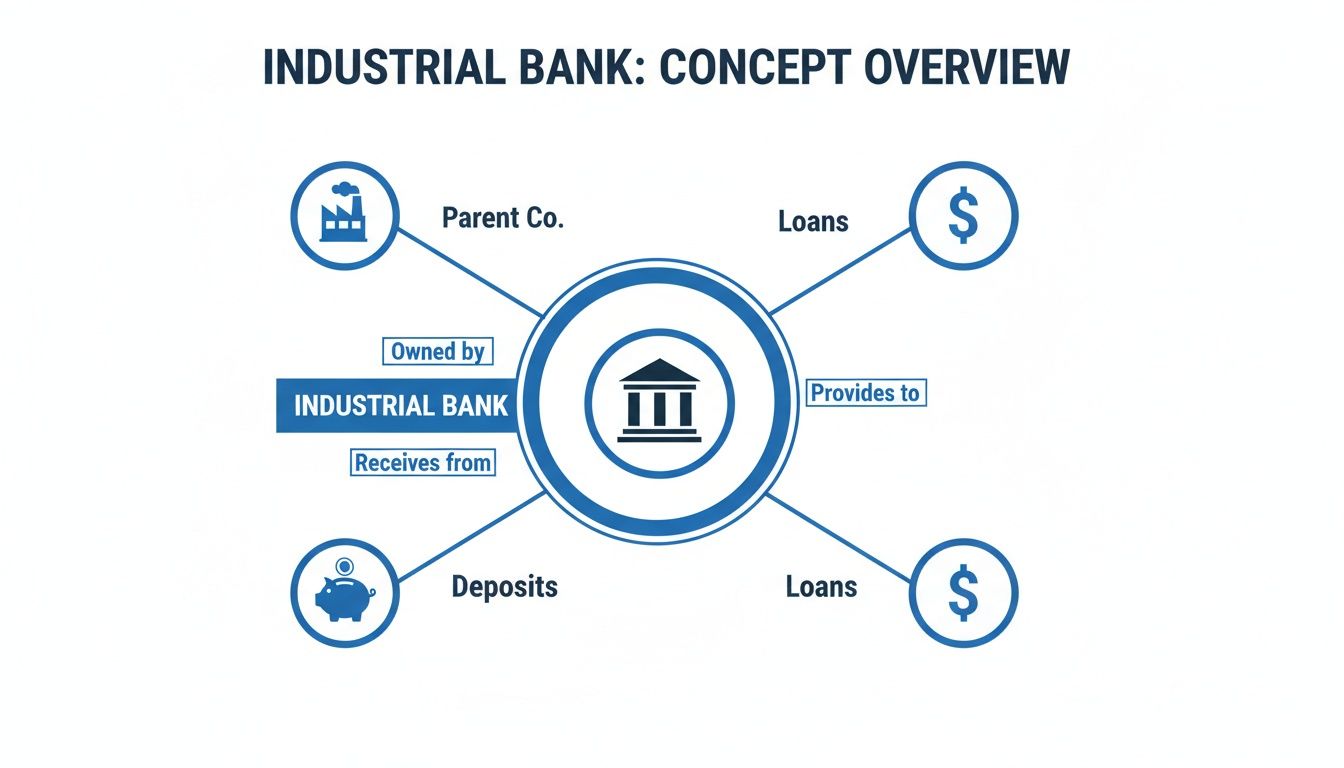

This diagram illustrates the core operational flow.

The model highlights a direct capital conduit from FDIC-insured deposits to fund loans, all under the umbrella of a non-bank commercial parent, creating a highly efficient, integrated financial loop.

To quantify the distinction, a direct comparison with commercial banks is necessary.

Industrial Bank vs. Commercial Bank: A Strategic Comparison

| Attribute | Industrial Bank (ILC) | Commercial Bank |

|---|---|---|

| Ownership | Can be owned by a non-financial, commercial parent company (e.g., retail, tech). | Owned by a Bank Holding Company (BHC) subject to Federal Reserve oversight. |

| Primary Regulator | FDIC and the respective state banking authority (e.g., Utah, Nevada). | Primarily regulated by the Federal Reserve (for BHCs), OCC, or FDIC. |

| Parent Company Regulation | Parent company is not subject to consolidated supervision by the Federal Reserve. | The Bank Holding Company is fully regulated by the Federal Reserve. |

| Permissible Activities | Parent company can engage in a broad range of commercial activities. | BHC activities are strictly limited to those "closely related to banking." |

| Geographic Footprint | Often operates nationally with a digital-first or specialized lending model. | Can be a national, regional, or community-focused institution. |

| Business Model Focus | Typically focuses on a specific niche, like consumer credit or small business loans. | Offers a wide array of services including checking, savings, mortgages, and wealth management. |

The ILC model offers a streamlined path into banking, but it creates a competitor fundamentally different from a traditional commercial bank.

A Controversial and Powerful Charter

The ILC charter remains a subject of intense debate. Critics contend it creates an unbalanced competitive landscape, allowing large commercial firms to access the federal safety net without the comprehensive Fed oversight applied to traditional banks. This ongoing controversy makes securing a new charter a rigorous and often protracted endeavor.

Despite these hurdles, the strategic appeal is undeniable. A fintech company securing an ILC charter can offer banking products directly to its established user base.

An ILC owned by a fintech with a national digital platform can leverage proprietary user data to originate loans at a fraction of a traditional bank's customer acquisition cost. For example, if a regional bank's average cost to acquire a new checking account customer is $350, a fintech ILC might convert an existing app user for less than $50.

This model transforms a technology firm into a direct financial competitor capable of operating with exceptional speed and data-driven precision.

For executives navigating an increasingly competitive market, understanding the strategic implications of the industrial bank is foundational. Analyzing the performance data of existing ILCs is the most effective way to anticipate their market strategies and formulate an effective competitive response. For those considering this path, a deep understanding of the chartering process is essential. You can learn more about the complexities of starting a bank in our guide on de novo banking.

The Strategic Imperatives Driving the ILC Charter

Understanding the industrial bank structure is necessary, but for executive decision-making, the critical insight lies in why a corporation undertakes the arduous process of obtaining an Industrial Loan Company (ILC) charter. This is not a regulatory loophole; it is a calculated strategic maneuver that unlocks significant competitive advantages unavailable to traditional banking institutions.

For a commercial enterprise, an ILC charter opens three primary strategic avenues.

These are not theoretical benefits. They translate into measurable gains in market share, profitability, and operational freedom, fundamentally altering the competitive dynamics of consumer and commercial finance.

Integrating Financing at the Point of Commerce

The most direct advantage is the ability to seamlessly embed financing within the core business. An ILC empowers a parent company to originate loans directly at the point of sale, creating a frictionless customer experience and capturing a revenue stream that would otherwise be lost to a third-party lender.

Financing evolves from a cost center or a cumbersome partnership into a profit center that reinforces brand equity.

Consider an automotive manufacturer like Toyota, which leverages its ILC to provide customers with immediate auto loans. This strategic integration is multifaceted:

- Accelerates Core Business Sales: Attractive, readily available financing is a direct lever to increase the parent company's sales volume.

- Captures Full Customer Lifetime Value: The company profits not only from the vehicle sale but also from the interest income generated over the life of the loan.

- Enhances Brand Loyalty: Controlling the financing experience ensures a high-quality process, fostering customer retention.

This synergy creates a formidable competitive moat. Data intelligence platforms that analyze market trends can draw a direct correlation between in-house financing capabilities and superior sales volumes for such integrated enterprises.

Securing a Structural Cost of Funds Advantage

Perhaps the most significant financial advantage is access to stable, low-cost funding via FDIC-insured deposits. A non-bank commercial firm must rely on more expensive and volatile sources, such as wholesale credit facilities or capital markets debt. These funding channels are not only costlier but can become inaccessible during periods of market stress.

An ILC, by contrast, can gather public deposits, creating a reliable, low-cost capital pool to fund its lending activities. The impact on profitability is substantial.

A quantitative example illustrates the advantage. An ILC funding a $500,000,000 loan portfolio with consumer deposits at an average cost of 2.5% operates with a distinct edge. A non-bank competitor funding a similar portfolio with wholesale funds at 4.5% faces a 200-basis-point disadvantage. This differential translates directly to an additional $10,000,000 in net interest income annually for the ILC.

This cost advantage enables the ILC to offer more competitive rates, absorb greater risk, or realize higher net interest margins. For bank executives, comparing the cost of funds for ILCs against other specialty finance companies using a data platform like Visbanking provides a clear, quantitative measure of their inherent profitability advantage.

Gaining Unmatched Operational Flexibility

The ILC structure offers a degree of regulatory freedom unavailable within a traditional banking framework. Because the parent company is not designated as a Bank Holding Company, it is not subject to consolidated supervision by the Federal Reserve. This liberates it to engage in a wide range of commercial activities that are prohibited for the owners of traditional banks.

This is the well-known—and often debated—separation of banking and commerce that defines the ILC charter.

A technology company, retailer, or industrial conglomerate can own a bank without divesting or constraining its primary commercial operations. It can continue to innovate, acquire other commercial businesses, and operate in unrelated sectors while its ILC subsidiary provides financial services. This is the optimal structure for any corporation that views financial services as a strategic component of a larger commercial enterprise, not as its core identity.

For any leadership team, a thorough understanding of these advantages is non-negotiable. The next logical step is to analyze the data on existing ILCs. The Visbanking platform allows you to benchmark their growth, efficiency, and profitability, providing the intelligence required to anticipate their strategic moves and formulate your own.

The Resurgence of the Industrial Bank Model

Industrial banks are not a recent innovation; they have a long history. Their modern resurgence, however, is a distinct phenomenon, driven by technology and commercial firms seeking to integrate financial services directly into their platforms.

To understand their current strategic relevance, one must look to their origins. These institutions were initially established to serve specific, often-neglected segments of the economy. They were specialists, not generalists—a characteristic that is the source of their power today.

A Masterclass in Niche Dominance

A prime historical example is the Industrial Bank of Korea, established in 1961 with a clear mandate: to support South Korea's small and medium-sized enterprises (SMEs). This was a deliberate government strategy to address a market failure, as commercial banks were primarily focused on large corporations.

By concentrating on this underserved segment, the bank developed a deep, defensible competitive advantage that has endured for over six decades. It is a powerful case study in how a focused banking strategy can create substantial, long-term value. You can analyze its impact on the South Korean economy here.

The lesson for today’s banking leaders is clear: hyper-focus on a specific segment is not a limitation but a strategic advantage. It allows an institution to build profound expertise, optimize operational efficiency, and design products precisely tailored to its target market—a strategy that large, diversified banks find difficult to replicate.

The New Wave of Specialized Lenders

Today, fintech and technology giants are executing this same playbook. They are not attempting to be universal banks. Instead, they leverage the Industrial Loan Company (ILC) charter to target specific, profitable markets that traditional banks have either overlooked or served inefficiently.

The parallels to the original model are striking:

- Niche Focus: Modern ILCs target specific customer segments, such as e-commerce merchants, gig economy workers, or prime consumers seeking unsecured credit.

- Embedded Finance: They integrate financial products—loans, payments, and deposit accounts—directly into the digital platforms their customers already use, creating a seamless user experience.

- Data-Driven Decisioning: They leverage vast, proprietary datasets to make sophisticated underwriting decisions and personalized offers, far surpassing the capabilities of legacy systems.

This is not a theoretical model; it is a market reality. A fintech with an industrial bank charter can analyze a merchant's real-time sales data on its platform and instantly pre-approve a working capital loan, eliminating cumbersome application processes. This data-driven approach can reduce loan origination costs by an estimated 30-40%.

This resurgence is defined by efficiency and focus. By adopting the industrial bank model, these new entrants are not merely entering the banking sector—they are re-engineering it around specific customer needs, powered by technology and data intelligence.

For executives at established banks, this trend signals a market shift toward hyper-specialized finance. To compete effectively, institutions must adopt a similar focus. Data intelligence is the key to identifying defensible market segments, benchmarking performance against new entrants, and protecting high-value customer relationships.

A platform like Visbanking provides the tools to dissect these emerging threats and translate raw market data into a decisive competitive strategy.

Assessing the Risks and Competitive Threats

While the industrial bank model offers clear strategic advantages to its proponents, its resurgence presents significant competitive and regulatory challenges that banking executives cannot afford to dismiss. The threat is twofold: agile, technology-driven Industrial Loan Companies (ILCs) directly targeting market share, and persistent regulatory uncertainty that could alter the competitive landscape with little warning.

The Fintech Competitive Threat

The most immediate danger comes from fintech-powered ILCs such as Block and SoFi. These are not merely new banks; they are integrated ecosystems adept at leveraging technology, proprietary customer data, and brand loyalty to capture market segments with surgical precision. Their entire operating model is engineered for efficiency, allowing them to attack profitable niches long dominated by legacy banks.

Consider this scenario:

A fintech ILC with a national digital footprint can originate small business loans at a 15% lower operational cost than a regional bank burdened by a physical branch network. By leveraging payment processing data for underwriting, it bypasses traditional marketing and origination expenses, enabling it to offer superior rates and faster approvals.

This is not a theoretical advantage; it is a structural one. These competitors are successfully eroding incumbents' customer bases by executing on several key differentiators:

- Integrated Ecosystems: Financial products are embedded seamlessly within the platforms users engage with daily, making the bank an invisible, frictionless component of the experience.

- Data-Driven Underwriting: ILCs utilize real-time transaction data to make faster, more accurate lending decisions, reducing risk while expanding credit access.

- Lower Customer Acquisition Costs: They convert millions of existing users from their core business (e.g., payment processing, investing) into banking clients at a marginal cost.

For a traditional bank, deploying a mobile application is an insufficient response. A fundamental re-evaluation of product delivery and cost structure is required to compete against the brutally efficient benchmark set by these new entrants.

Regulatory and Reputational Headwinds

Beyond direct competition, the industrial bank charter itself is a subject of perpetual debate in Washington, D.C. The core controversy—permitting the mixture of banking and commerce—is a recurring political issue. This creates a volatile environment where the rules governing competition can change unexpectedly.

This political tension creates tangible risks:

- Charter Moratoriums: Intense lobbying from traditional banking associations frequently results in regulatory pauses on new ILC charter approvals, disrupting strategic planning.

- Increased Scrutiny: The FDIC and state regulators are under political pressure to apply stringent standards to ILC applicants, making the application process lengthy, costly, and uncertain. A public denial can inflict significant reputational damage.

- Systemic Risk Concerns: The prospect of large corporations like Walmart pursuing ILCs has raised concerns among policymakers about systemic risk. The question of whether the failure of a massive parent company could destabilize its FDIC-insured subsidiary remains a key point of contention. A rigorous approach to Risk and Analysis is essential, but political dynamics are unpredictable.

A detailed understanding of industrial loan charters is critical. The charter's unique regulatory status is both its greatest strength and its primary vulnerability. For bank leaders, this necessitates developing strategies that are resilient to potential regulatory shifts.

Navigating this environment requires more than high-level awareness; it demands actionable intelligence. It is crucial to monitor not only the financial performance of ILC competitors but also the direction of political and regulatory sentiment. Data intelligence platforms provide the means to track these threats in real time. By analyzing call report data and performance benchmarks, leadership can shift from a reactive posture to a proactive strategy designed to defend market position.

Competing and Partnering in the New Financial Landscape

Understanding the industrial bank model is a prerequisite, but it is not a strategy. For bank executives and directors, the operative question is how to respond. The rise of specialized Industrial Loan Companies (ILCs) is not a passive trend but a fundamental market evolution that demands decisive action—through direct competition, strategic partnership, or a hybrid approach.

Inaction is the greatest risk. A clear-eyed, data-driven assessment of the competitive environment is the only viable starting point.

Fortifying Market Position Through Competitive Intelligence

To effectively defend market share against nimble, technology-centric ILCs, bank leaders must move beyond anecdotal evidence and engage in a granular analysis of their performance and strategy. This requires leveraging hard data to identify institutional vulnerabilities and pinpoint where new entrants are gaining traction.

A robust bank intelligence platform is an indispensable tool in this endeavor.

Consider a regional bank's leadership team observing an increase in consumer loan denials due to applicants' existing debt with a new fintech lender. Rather than operating on assumptions, they can use a tool like Visbanking’s Bank Performance module to benchmark directly against that specific ILC.

The data might reveal that the ILC's unsecured consumer loan portfolio grew by $150,000,000 in the prior quarter, achieved with a highly efficient 45% efficiency ratio, compared to the regional bank’s 62%. The competitive threat is no longer abstract; it is a quantifiable performance gap demanding a strategic response.

Armed with this specific insight, the bank can act. The data points directly to a competitor's operational advantage in a key product line. The strategic response could involve re-engineering their own digital loan origination process to reduce friction and lower costs, or launching a targeted marketing campaign to reinforce their value proposition to at-risk customer segments.

Without precise benchmarking data from call reports and other regulatory filings, any competitive strategy is merely a shot in the dark.

Creating New Revenue Streams Through Strategic Partnerships

The same market forces driving the industrial bank boom are also creating significant opportunities for partnership. Many fintech firms possess sophisticated user acquisition models and technology but lack the regulatory infrastructure and compliance expertise of an established bank. This creates a clear opening for Banking-as-a-Service (BaaS) models.

In a BaaS arrangement, a traditional bank provides its regulated financial "chassis"—FDIC insurance, payment rails, compliance oversight—allowing a fintech to build its products on top. A potential competitor is thus transformed into a fee-generating client. This effectively monetizes the bank's charter, creating a new, low-overhead revenue stream that diversifies income beyond traditional lending. As industrial banks emerge, understanding the payments ecosystem is vital. You can find excellent insights from payment experts that detail the infrastructure underpinning modern banking partnerships.

Proactive business development is key. Data intelligence can be used not just defensively but as a growth engine. Using a platform like Visbanking’s Prospect module, business development teams can screen for fintechs that have recently secured significant venture funding but have not yet obtained a bank charter. This is a strong indicator of a company with capital to invest in a BaaS partnership and an urgent need for speed to market.

This data-informed approach allows banks to engage potential partners long before they undertake the arduous process of applying for their own industrial bank charter.

For bank leaders, the options are clear: compete directly, forge strategic alliances, or risk being marginalized. In any scenario, the first step is to ground strategy in empirical data, moving from a position of reaction to one of command. A logical starting point is to benchmark your institution's performance against the leading ILCs to determine your precise competitive standing.

From Data to Decision: An Executive Action Plan

Understanding the industrial bank landscape is foundational. Translating that intelligence into a concrete, measurable action plan is what separates market leaders from followers. In this environment, a passive, observational stance is the most significant risk an institution can take.

A decisive, data-driven strategy serves as both offense and defense, enabling your institution to shift from reacting to market events to proactively shaping its competitive position. It is the key to identifying threats and seizing opportunities before they become widely apparent.

From Insight to Action

The following is a straightforward, four-step action plan for your leadership team to address the challenges and opportunities presented by industrial banks and their ILC charters.

Identify Key Competitors: Direct your strategy team to identify the top three ILCs active in your core markets. Utilize FDIC data to map their operational footprint and primary business lines. This provides a clear, factual basis for understanding your direct competition.

Implement Performance Monitoring: Establish a process using a bank intelligence platform to monitor the quarterly performance of these identified competitors. Track key metrics such as loan growth in specific portfolios (e.g., unsecured personal loans), shifts in deposit composition, and, critically, their efficiency ratios. A competitor operating at a 45% efficiency ratio holds a material cost advantage that must be quantified and addressed.

Analyze Relationship Vulnerabilities: Task your commercial lending division with analyzing UCC filings associated with these key ILCs. This data provides direct insight into their commercial lending activities and can identify which of your current clients may be at risk of being targeted by a competitor with a more integrated offering.

Conduct a Digital Experience Audit: Commission a rigorous, objective review of your institution's digital account opening and loan application processes. Benchmark the user experience—from application completion time to points of friction—against the top fintech-backed ILCs.

Executing this plan requires moving beyond static, periodic reports to a dynamic system of action. It is not enough to possess the data. Your team must be equipped with the tools to interpret market signals, execute a strategic response, and measure its impact.

This process is the essence of effective, data-driven management.

Ultimately, competitive advantage in this landscape is a function of superior intelligence. The Visbanking platform is engineered to provide that clarity, transforming complex market data into the actionable insights necessary to defend your market position and drive sustainable growth. Benchmark your bank against the key ILCs today—the opportunities you uncover may be surprising.

Common Questions Regarding Industrial Banks

What is the fundamental difference between an industrial bank and a credit union?

The core distinction lies in ownership structure and mission.

An industrial bank is a for-profit entity. It is state-chartered and typically owned by a commercial parent corporation, such as a retailer or technology firm. Its primary objective is to generate profit for its shareholders.

A credit union is a non-profit financial cooperative owned by its members. Any net income is returned to the members through more favorable rates and lower fees, rather than being distributed to external investors. This fundamental difference in purpose dictates their respective business strategies.

Why do more commercial corporations not establish industrial banks?

Although the Industrial Loan Company (ILC) charter is strategically attractive, obtaining one is a formidable challenge due to significant regulatory and political opposition.

Traditional banking lobbies have consistently opposed the expansion of ILCs, arguing they breach the statutory separation of banking and commerce and create an unfair competitive advantage.

Consequently, the FDIC subjects new charter applications to intense scrutiny. The process is expensive, protracted, and carries a high risk of denial, which can result in negative publicity. These substantial barriers lead many companies to pursue alternative strategies, such as Banking-as-a-Service partnerships.

How can a community bank effectively compete with a fintech-owned ILC?

Community banks cannot compete on technology alone, but they can leverage their intrinsic advantages: deep local market knowledge, personalized client service, and localized decision-making authority.

The optimal strategy involves using data intelligence to identify niche markets where these strengths create a defensible advantage, such as complex commercial loans that are ill-suited to a standardized, national underwriting model.

The winning formula is a hybrid approach: pair this high-touch expertise with best-in-class technology partners to streamline the digital experience for commodity products like account opening and consumer loans. This combination of modern convenience and expert, personalized service creates a powerful value proposition that national, digital-only ILCs find very difficult to replicate.

To accurately assess the competitive threat from emerging ILCs and identify your most promising strategic opportunities, you require the highest quality market intelligence. Visbanking provides the data and analytics necessary to transform market shifts into competitive advantages. Discover how our platform can sharpen your strategic decision-making at https://www.visbanking.com.

Similar Articles

Visbanking Blog

Capital Banking in the USA: An Overview of Investment Services, Financial Instruments, and Regulations

Visbanking Blog

Banking as a Service has major risks.

Visbanking Blog

Bank Risk Management: Protecting Assets in Uncertain Times

Visbanking Blog

Bank Regulatory Compliance: Navigating the Complex Maze

Visbanking Blog

Make Better Decisions with Confidence with BIAS, the Tailored Strategies Solution

Visbanking Blog

Understanding the Macro View of US Banks: Trends and Insights

Visbanking Blog

Navigating the Banking Landscape with BIAS as Your Compass

Visbanking Blog

Exploring Cutting-Edge Technologies Empowering US Banks: A Deep Dive into Visbanking Banking Report Portal

Visbanking Blog

Bank Branch Networks: Are Physical Locations Still Relevant?

Visbanking Blog