Estimated reading time: 5 minutes

Table of contents

Introduction

In the intricate realm of finance, where stability and reliability are paramount, credit quality plays a pivotal role in assessing the health of banks. The United States banking sector, a cornerstone of the global financial landscape, has long been subject to scrutiny and analysis. To shed light on the intricate details that underpin the industry’s foundation, VisBanking introduces its groundbreaking report portal, offering a comprehensive US Banks Credit Quality Chart. In this article, we delve into the significance of credit quality, the role it plays in the banking sector, and how the VisBanking Report Portal empowers stakeholders with crucial insights.

Understanding Credit Quality

Credit quality refers to the ability of borrowers, including individuals and institutions, to fulfill their financial obligations promptly. It is an essential metric in the financial world, reflecting the level of risk associated with lending money. In the context of US banks, credit quality directly affects their stability, profitability, and overall operational health.

The credit quality of a bank is influenced by a range of factors, including the economic environment, the creditworthiness of borrowers, the effectiveness of risk management practices, and the bank’s overall financial health. These factors combine to form a comprehensive picture of the bank’s ability to withstand economic fluctuations and mitigate potential losses.

The Role of Credit Quality in the Banking Sector

Credit quality holds immense significance for banks as it impacts various aspects of their operations:

- Risk Assessment: Credit quality is a vital indicator of the risk inherent in a bank’s lending portfolio. Banks with higher credit quality tend to have fewer non-performing loans and lower default rates, contributing to more stable and predictable earnings.

- Capital Adequacy: Regulators often require banks to maintain a certain level of capital to safeguard against potential losses. Credit quality influences the amount of capital a bank needs to set aside, with riskier assets requiring higher capital reserves.

- Liquidity Management: Banks with better credit quality are likely to have easier access to funding sources, including the interbank market and deposits from customers. This enhances their ability to manage liquidity effectively.

- Investor Confidence: A strong credit quality rating enhances investor confidence and can lower the cost of borrowing for the bank. It also helps in attracting investments from institutions and individuals alike.

- Market Reputation: Banks with a solid credit quality track record earn a positive reputation in the market, fostering customer trust and loyalty.

Introducing VisBanking’s Report Portal

VisBanking’s Report Portal is a groundbreaking platform designed to empower stakeholders with actionable insights into the US banking sector’s credit quality landscape. With a focus on transparency, accuracy, and user-friendliness, this portal provides a comprehensive Credit Quality Chart that serves as a valuable resource for analysts, investors, regulators, and banking professionals.

Key Features of VisBanking’s Report Portal:

- Comprehensive Data: The portal offers a wealth of data on credit quality metrics, including non-performing loan ratios, default rates, and risk assessment scores. This data is sourced from reliable and up-to-date financial reports of US banks.

- Interactive Visualizations: The Credit Quality Chart is presented through interactive visualizations, making complex financial data easily comprehensible. Users can customize views, compare banks, and analyze trends over time.

- Real-time Updates: The portal is updated regularly with the latest financial data, ensuring that users have access to the most current information for their analyses.

- Historical Comparison: Users can access historical data to identify patterns, trends, and changes in credit quality over different economic cycles.

- Educational Resources: The portal includes educational resources that explain key credit quality metrics, helping users understand the significance of each data point.

- User-Friendly Interface: The user interface is designed with simplicity in mind, making it accessible to both financial experts and those with limited financial background.

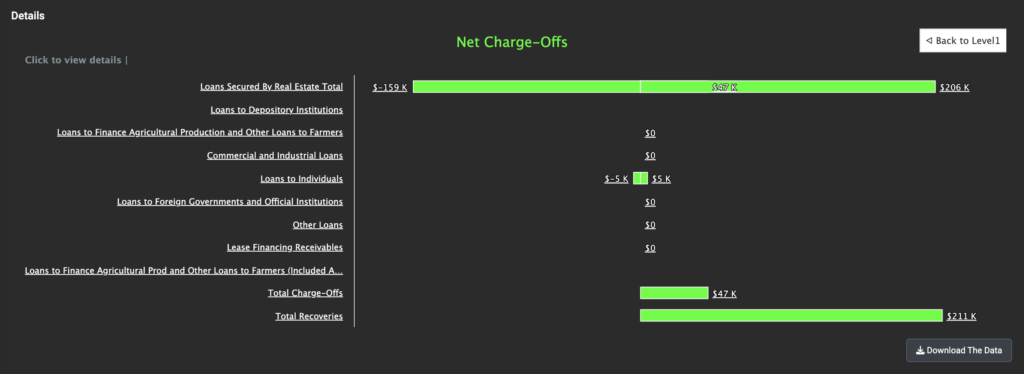

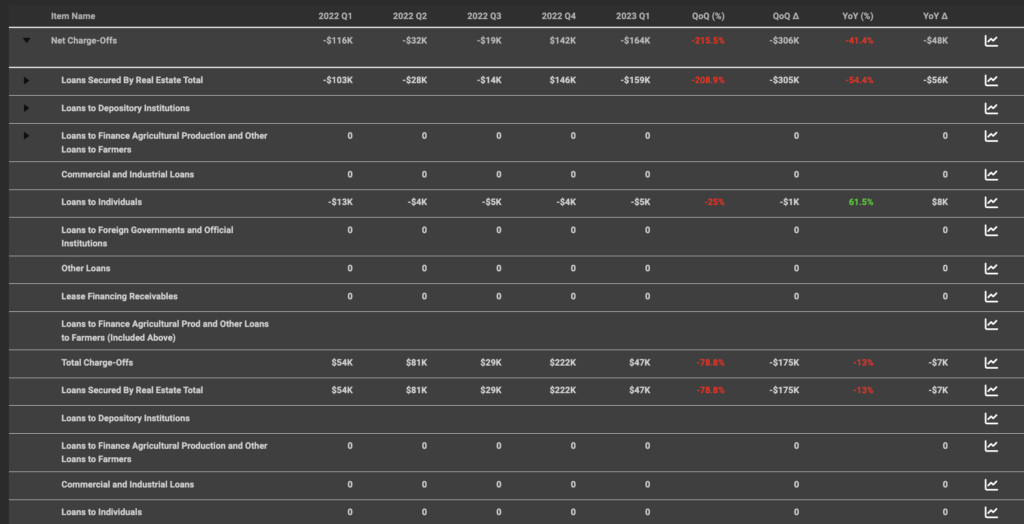

You can see this data in the “Credit Quality” section in the Visbanking Application:

The 10 US Banks with the Highest Credit Rating

When it comes to choosing a bank, one of the most important factors to consider is the bank’s credit rating. A high credit rating indicates that the bank is financially sound and has a low risk of default.

The following are the 10 US banks with the highest credit rating as of August 7, 2023:

- JPMorgan Chase

- Bank of America

- Wells Fargo

- Citigroup

- Morgan Stanley

- Goldman Sachs

- U.S. Bancorp

- Bank of New York Mellon

- Truist Financial

- PNC Financial Services

These banks have all been rated “AA-” or higher by at least one of the three major credit rating agencies (S&P Global Ratings, Moody’s Investors Service, and Fitch Ratings). This means that they are considered to be of very high quality and have a low risk of default.

It is important to note that credit ratings can change over time, so it is always best to check the latest ratings before making any financial decisions.

Here are some of the factors that credit rating agencies consider when assigning a credit rating to a bank:

- The bank’s financial strength

- The bank’s asset quality

- The bank’s liquidity

- The bank’s management

- The bank’s capital levels

Conclusion

In the dynamic landscape of finance, understanding credit quality is paramount to assessing the health and stability of US banks. The introduction of VisBanking’s Report Portal brings a new dimension of transparency and accessibility to this crucial information. Through its interactive Credit Quality Chart and comprehensive data offerings, the portal equips stakeholders with the tools they need to make informed decisions, analyze trends, and navigate the complexities of the US banking sector.

As technology continues to shape the financial industry, platforms like VisBanking’s Report Portal bridge the gap between intricate financial data and the individuals who seek to comprehend and utilize it. With a focus on empowering stakeholders, enhancing transparency, and promoting financial literacy, VisBanking’s innovative approach sets a new standard for accessing and understanding credit quality metrics in the US banking sector.