Sales Analysis Software: A Strategic Imperative for Executive Decision-Making

Brian's Banking Blog

In a volatile financial landscape, relying on intuition to guide a financial institution is no longer a viable strategy—it's a significant liability. True sales analysis software for banking is not merely a reporting tool. It is the engine that transforms vast quantities of raw data into forward-looking intelligence, enabling executives to act decisively rather than reactively.

Moving Beyond Intuition in Modern Banking

Historically, banking decisions were driven by experience and retrospective performance analysis. This approach was adequate in a predictable market. Today's environment demands a more sophisticated methodology.

Relying on intuition and manual spreadsheets is inefficient and exposes an institution to unacceptable risk. The new competitive baseline is not about incremental effort; it is about leveraging data-driven foresight to achieve strategic objectives.

This transition is not a niche trend but a market-wide imperative. The global market for sales analytics technology is projected to expand from US$5.5 billion in 2026 to US$12.5 billion by 2033. Financial institutions, which constituted approximately 32% of this market in 2025, are at the forefront of this adoption curve. Banks are leveraging these tools to navigate complex regulatory environments and generate reliable revenue forecasts, a trend confirmed by recent market analysis. You can learn more about the rapid growth of sales analytics software and its industry impact.

From Reactive Reporting to Predictive Intelligence

The critical differentiator is timing. Traditional analysis involves days of manipulating call report data in spreadsheets simply to understand last quarter's peer performance. This backward-looking process identifies opportunities long after their strategic value has diminished.

An institution equipped with an automated intelligence system operates on a different plane. It detects market shifts and performance deviations in near real-time, providing the executive team with the critical window to act while the opportunity is still relevant.

A truly effective sales analysis software platform for banking does not just report on the past quarter. It synthesizes internal and external data to project future outcomes, empowering your teams to act before competitors even recognize the trend.

A Practical Example of the New Baseline

Consider two regional banks competing for the same commercial lending clients.

- Bank A adheres to traditional methods. Its team pulls quarterly FDIC data, spends a week formatting it in Excel, and presents its findings. They discover a competitor has captured significant market share in the local manufacturing sector, but this "insight" is 90 days out of date.

- Bank B utilizes an integrated sales analysis software platform like Visbanking. The system provides continuous peer benchmarking and market monitoring. It automatically flags a surge in UCC filings from local manufacturing companies and correlates this with positive BLS employment data for the same sector.

Relationship managers at Bank B receive an automated alert. They immediately pivot their outreach strategy to target high-potential prospects, securing a three-month lead on Bank A.

This scenario represents the new reality of competition. The advantage lies not with the institution that possesses the most data, but with the one that can convert it into actionable intelligence that drives immediate, revenue-generating activity. In today's hyper-competitive environment, this capability is essential for managing risk and achieving sustainable growth.

The first step is to establish a clear baseline. It is time to explore how your institution’s performance stacks up against your closest peers with real-time, actionable data.

The Core Capabilities Driving Executive Decisions

Generic sales software often presents a blizzard of dashboards and metrics, leaving leadership to connect the dots. For banking executives, this is insufficient. The objective is not more data; it is clearer, faster answers to high-stakes questions regarding risk, market share, and growth.

This is where true banking intelligence platforms distinguish themselves. They are defined by capabilities that directly inform executive strategy, moving far beyond simple reporting to provide a clear view of future possibilities.

These core features translate directly into tangible outcomes, separating platforms built for the complexities of modern banking from generic business tools. The focus shifts from historical review to proactive, intelligence-driven action.

Predictive Forecasting Beyond the Pipeline

Standard sales forecasting is often limited to pipeline mathematics—a simple calculation of potential deals. In an industry as sensitive to economic fluctuations as banking, this approach is dangerously myopic. A bank’s true opportunities and exposures are linked to broader economic health, not just its current prospect list.

Effective sales analysis software for banks must therefore incorporate sophisticated predictive forecasting. This capability extends beyond the pipeline to model "what-if" scenarios, integrating external economic data such as employment trends from the Bureau of Labor Statistics (BLS) or regional economic output figures.

For example, your bank could model the potential impact of a 0.5% rise in unemployment on its commercial real estate loan portfolio in a specific MSA. Instead of conjecture, leadership receives a data-backed projection of default rates and demand shifts. This allows you to adjust lending criteria or fortify risk reserves before a downturn materializes, not after.

Uncovering Hidden Value with Relationship Intelligence

A bank’s most valuable assets are its relationships. Yet critical connections are often buried in siloed systems or exist only as institutional knowledge. Relationship intelligence features systematically map these connections to surface opportunities that would otherwise be missed.

By integrating data from sources like UCC filings, professional graph data, and internal client records, a platform can reveal non-obvious links.

Consider a scenario: your commercial lending team is pursuing a mid-market manufacturing company. A powerful relationship intelligence tool could instantly flag that a key board member at that company is also a high-value private banking client. This insight transforms a cold call into a warm, high-level introduction, fundamentally altering the engagement.

This capability transcends a simple CRM contact list. It generates a dynamic map of your institution's entire network, providing your team with the intelligence to navigate complex client ecosystems and identify the most efficient path to key decision-makers. This process is central to modern business intelligence for banks.

Before addressing the final core capability, it is crucial to connect these software features to the outcomes that matter at the executive level. The true value lies in how these tools drive tangible results that impact the balance sheet and inform board-level conversations.

Translating Software Features into Executive Outcomes

| Core Capability | Traditional Approach (The Problem) | Modern Platform Solution (The Outcome) | Impact on Key Metrics |

|---|---|---|---|

| Predictive Forecasting | Relying on historical pipeline data, ignoring market shifts and leading to reactive decision-making. | Integrating economic data to model future scenarios, enabling proactive risk management and strategic planning. | Improved Loan Loss Provisions, Enhanced Asset Quality, Optimized Capital Allocation |

| Relationship Intelligence | Missing key connections, losing opportunities, and enduring long sales cycles due to a lack of shared network insight. | Automatically mapping internal and external relationships to reveal warm introduction paths and cross-sell opportunities. | Increased Wallet Share, Higher Net New Household Growth, Reduced Customer Acquisition Cost |

| Peer Benchmarking | Using static, quarterly reports that are outdated upon review, providing a historical snapshot instead of a live view. | Continuous, automated analysis of FDIC/NCUA data, delivering real-time competitive insights and market alerts. | Increased Market Share, Improved Net Interest Margin (NIM), Better ROA/ROE Performance |

This table illustrates the shift from basic reporting to strategic intelligence. A platform like Visbanking doesn't just display data; it empowers your leadership to make smarter, faster decisions that directly improve the bank's financial performance.

Continuous Automated Peer Benchmarking

Understanding your competitive position is fundamental. However, traditional peer benchmarking is often a static, labor-intensive exercise performed quarterly or annually. By the time the report is complete, the market has already evolved.

The new standard is continuous, automated peer benchmarking that provides a real-time pulse on your performance.

A modern platform continuously ingests and analyzes performance data from over 4,600 institutions, using the latest FDIC and NCUA call reports. This allows executives to instantly assess their bank’s standing on key metrics—such as loan growth, net interest margin, or deposit mix—against a curated peer group.

If a competitor suddenly captures 2% additional market share in C&I loans within your primary county, you should not wait three months to learn about it. An automated system can trigger an immediate alert, enabling your team to analyze the competitive action and formulate a timely response. This transforms benchmarking from a historical report card into a dynamic strategic weapon.

Creating a Single Source of Truth from Disparate Data

An institution's data is its most valuable asset, yet it is often its most fragmented. Critical insights remain locked in disparate systems, preventing a clear, holistic view of performance and risk. This forces leadership to make high-stakes decisions with an incomplete picture—an unsustainable position in today's market.

The primary function of any effective sales analysis software for banking is to resolve this fragmentation. It must serve as a central Bank Intelligence and Action System (BIAS), integrating, cleansing, and connecting disparate data streams into a single, reliable source of truth. Without this foundation, any subsequent analysis is fundamentally flawed.

Integrating Internal and External Data Feeds

The challenge for banks lies in the sheer variety of relevant data sources. A genuine intelligence platform must seamlessly blend internal operational data with external market context.

- Internal Sources: This is the bedrock of your operations, encompassing data from your core banking system, CRM platforms like Salesforce, and treasury management systems. It holds the history of your client relationships and institutional performance.

- External Sources: This provides the broader market picture. A powerful platform must integrate a wide range of public and proprietary sources, including FDIC call reports, UBPR data, SEC filings, Bureau of Labor Statistics (BLS) employment data, and UCC filings.

Integrating these diverse data threads is complex but non-negotiable. For executives who require reliable data pipelines without the operational burden, mastering financial data integration is the first step toward building a truly intelligent institution.

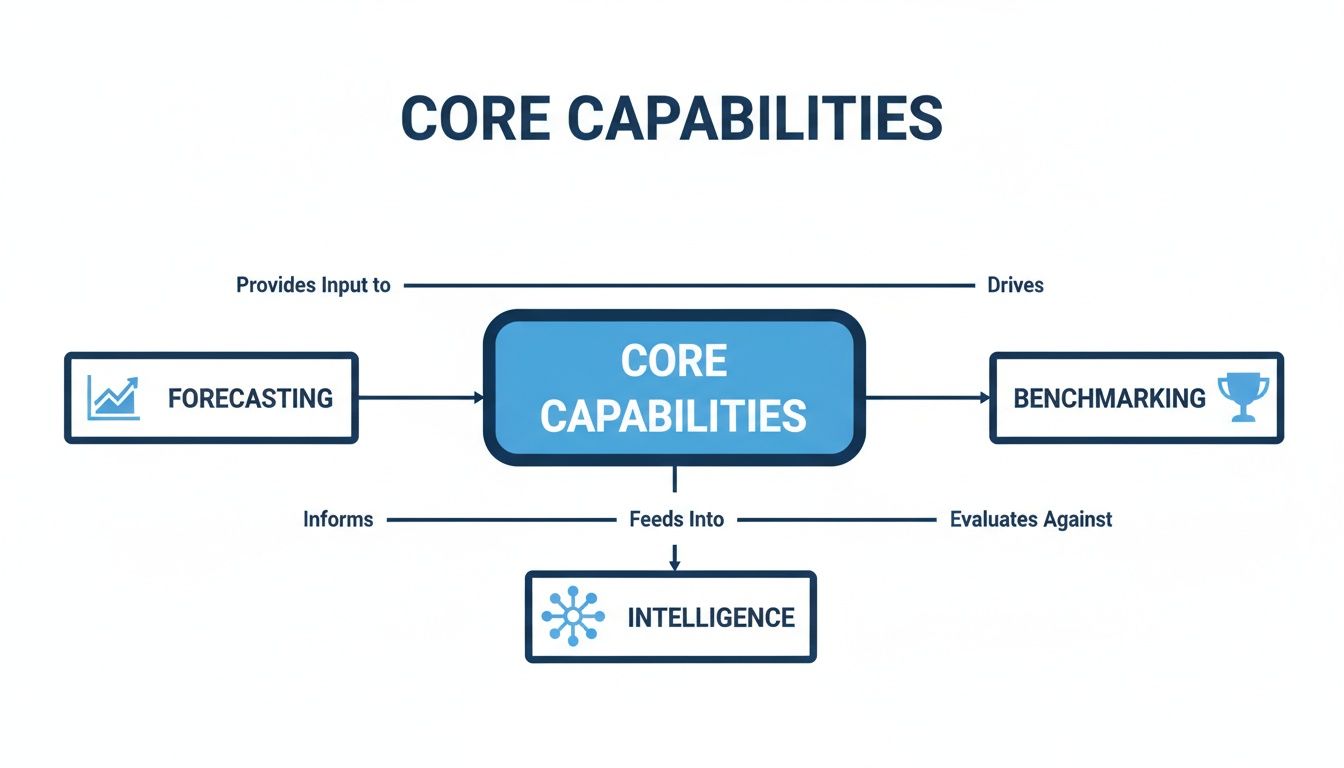

The diagram below illustrates how a central intelligence system connects these core capabilities, transforming raw data into strategic assets.

As shown, forecasting, intelligence, and benchmarking are not discrete activities. They are deeply interconnected components of a single, unified system.

From Data Wrangling to Decisive Action

The true value is not in data aggregation but in the actions it enables. When data pipelines are robust and automated, leadership can shift its focus from questioning data integrity to formulating strategy.

A unified data environment elevates the executive conversation. The question changes from, "Can we trust this number?" to "What is the most intelligent action we can take based on this insight?" This shift is the key to gaining a competitive advantage.

Consider a practical, high-stakes example. Your bank has a significant concentration of commercial loans in the regional logistics and transportation sector. Your internal data appears strong, with delinquencies at a low 0.75%.

An integrated intelligence platform provides a more complete picture. It overlays your internal numbers with external data, revealing a 15% decline in regional transportation jobs over the past six months from BLS statistics. It also cross-references SEC filings from local logistics companies, flagging compressed profit margins.

Instead of waiting for delinquencies to rise, the system generates a predictive alert. Your team can now proactively engage at-risk clients, tighten underwriting standards for new loans in that sector, and re-evaluate portfolio risk months before adverse events impact your balance sheet. This demonstrates the tangible power of moving from fragmented data to unified intelligence.

The ultimate objective is to provide leadership with the confidence to act decisively. When your data is clean, connected, and contextualized, your strategy can be equally focused.

Putting Intelligence into Action with Practical Use Cases

Executives are accountable to a board and require tangible results, not theories. A premier sales analysis software platform must draw a direct line from data insights to bottom-line impact. These real-world applications are where the value of moving beyond static reporting becomes unequivocally clear.

The contemporary banking environment requires more than just identifying prospects; it demands a deep understanding of their business needs and precise timing for outreach. A unified intelligence system demonstrates its power by converting raw data into revenue-generating opportunities.

This shift from data collection to active sales guidance is reshaping the entire sales technology market. What was a USD 31.26 billion industry in 2025 is projected to more than double to USD 63.15 billion by 2030. While traditional CRMs remain significant, the primary growth is in AI-powered tools that provide real-time guidance to sales teams. This signals a clear market preference for intelligence over simple record-keeping. You can discover more insights about the evolution of the sales software market and its strategic implications.

Use Case 1: Precision Prospecting in Commercial Lending

Consider a relationship manager tasked with growing a C&I loan portfolio. The traditional approach involves cold calls, networking events, and sifting through outdated business directories—a high-effort, low-yield process.

A modern sales analysis software platform fundamentally alters this workflow.

- Identify High-Potential Triggers: The system automatically scans public records, flagging mid-sized manufacturing firms in key counties that have recently filed a UCC. This is a strong buying signal, indicating equipment purchases or expansion.

- Add Market Context: It then validates this opportunity by cross-referencing these companies with BLS and market data, confirming 3.5% quarter-over-quarter growth in local manufacturing.

- Map the Relationship Path: Finally, the platform analyzes the bank’s internal data and professional networks, discovering that a key executive at a target company is an alumnus of the same university as one of your board members.

This integrated process transforms a cold lead into a highly qualified prospect with a clear path for a warm introduction. Such a systematic approach can increase the number of qualified leads in a pipeline by over 40%.

For bank leadership, this is not merely a sales tactic; it is a repeatable, scalable methodology for gaining market share. It ensures that your most valuable assets—your relationship managers—are focused on opportunities with the highest probability of closing.

Use Case 2: Uncovering Hidden Cross-Sell Revenue

Many institutions leave significant revenue unrealized by not fully serving their existing commercial clients. A customer utilizing treasury management services may be an ideal candidate for a line of credit, but this opportunity is often missed because the relevant data resides in separate, unconnected systems.

This is where a dedicated banking sales intelligence platform like https://visbanking.com/banking-sales-intelligence-platform becomes a strategic asset. It consolidates data from disparate systems to provide a comprehensive view of each client relationship, illuminating profitable gaps.

The process is straightforward:

- Unify the Data: The system integrates and analyzes data from your core, treasury management platform, and CRM.

- Identify the Opportunity: It automatically flags all commercial clients who use treasury services, maintain an average daily balance over $250,000, and do not have a loan with your institution.

- Prioritize and Act: This curated list is instantly converted into a high-priority cross-sell campaign. Your relationship managers receive alerts with complete profiles for each target, including industry details and recent deposit trends.

By systematically identifying and acting on these internal opportunities, a bank can increase its cross-sell revenue by as much as 15% in the first year. This shifts your team from being reactive order-takers to proactive, data-driven advisors.

These use cases illustrate the core principle of modern banking intelligence: connecting disparate data points to create clear, actionable directives. The ultimate value lies not in the dashboard itself, but in the intelligent decisions it facilitates.

Selecting the Right Banking Intelligence Partner

Selecting a software vendor is a strategic decision with institution-wide implications, not a simple IT procurement. Bank executives must look beyond feature checklists. The right partner provides more than software; they deliver a clear path from data complexity to decisive, profitable action.

A generic solution designed for retail or technology sales will fail to capture the nuances of the banking industry.

This choice has never been more critical. The market for sales intelligence is projected to grow by USD 4.86 billion between 2024 and 2029, with North American banks leading this adoption. Institutions are increasingly replacing expensive, slow-moving consultants with intuitive, data-rich platforms that can effectively analyze sales cycles and predict customer churn. You can explore more on the sales intelligence market trends to understand the velocity of this shift.

When vetting a potential partner, focus on the core attributes that separate true banking intelligence platforms from the generic market noise.

Evaluating Data Fidelity and Banking Expertise

The first line of inquiry must concern the data itself. A powerful analytics engine is useless if it operates on low-quality or irrelevant information. Your success depends on a partner’s ability to integrate the specific data that drives banking decisions.

- Regulatory and Market Data: Does the platform natively integrate FDIC call reports, UBPR data, NCUA 5300 filings, and macroeconomic indicators from the BLS? If your team must manually source and upload this data, the system is already a failure.

- Banking-Specific Expertise: Was the solution developed by professionals who understand the business of banking? A partner with deep industry DNA will have pre-built workflows that matter, such as analyzing Net Interest Margin (NIM) compression or tracking loan concentration risk relative to peer groups.

A platform that cannot speak the language of banking is a liability. For example, a generic tool might track "sales." A banking-specific system tracks C&I loan origination volume and its direct impact on your risk-adjusted return on capital. The distinction is critical.

Measuring the Path to Actionable Intelligence

The true test of any sales analysis software is whether it enables your team to act faster and more intelligently. Many platforms stop at the dashboard, presenting aesthetically pleasing charts that are interesting but not instructive. This is a critical failure.

A banking intelligence platform should not be a passive reporting tool. It must be an active system that surfaces opportunities, flags risks, and delivers alerts directly into the workflows of your relationship managers and lending officers.

A true intelligence partner provides a clear path to action. For instance, instead of merely showing that a competitor's deposit market share grew by 1.5% last quarter, an action-oriented system would:

- Identify the specific branch locations and product types that drove that growth.

- Cross-reference that data with your own client list to flag customers at risk of attrition.

- Generate a prioritized call list of these at-risk clients for proactive engagement by your team.

This is the standard of performance. Do not settle for a system that merely displays data. Demand a partner that helps you act on it. A logical starting point is to see how your own institution compares to the competition.

Explore how your bank’s performance compares to your peers by requesting a custom benchmark analysis today.

Getting Your Team On Board and Proving the Payoff

The most advanced sales analysis platform is a wasted investment if your team does not use it. For bank leaders, driving adoption is not an IT rollout; it is a cultural shift that must be championed from the top.

The objective is to create an environment where data is not confined to the analytics department—it becomes the common language for decision-making across the institution.

Attempting an enterprise-wide, overnight implementation is a recipe for failure. The prudent approach is to start with a focused pilot, achieve a significant win, and let that success drive broader adoption.

Land Some Quick Wins to Show Everyone What's Possible

The ideal starting point is your commercial lending team. This group operates on metrics, and their success is directly tied to the bank's profitability, making them perfect champions for a new, data-driven methodology.

Provide them with the platform and a clear, specific objective. For example: "Increase our qualified pipeline value from mid-market manufacturing clients by 15% in the next six months."

When the team uses the software to identify superior prospects and map relationship paths—and subsequently achieves that goal—you have a powerful internal case study. This success provides the evidence needed to generate enthusiasm from other departments, such as treasury management and private banking.

Measure What the Board Actually Cares About

To justify the investment and build momentum, success must be measured in terms that resonate with the board. Avoid vague metrics like "user engagement." You must connect platform usage directly to business outcomes.

Ultimately, the only meaningful measure of an intelligence platform is its impact on the balance sheet. You must demonstrate how data-derived insights are driving tangible improvements in profitability, market share, and risk management.

Focus on metrics that tell a compelling story:

- Growth in Qualified Pipeline Value: Quantify the dollar value of new, high-probability opportunities identified through the platform.

- Lower Customer Churn: Demonstrate a measurable reduction in the attrition of high-value commercial clients by identifying at-risk relationships proactively.

- Faster, Smarter Decisions: Measure the reduction in time from identifying a market opportunity to executing a strategic response, proving increased institutional agility.

Ultimately, the right technology partner is more than a software vendor; they are a strategic guide. It is time to move beyond wrestling with disconnected data and begin executing decisions backed by real intelligence. The first step is to see your own bank through a new lens.

Request a complimentary peer benchmark analysis to see how you stack up against the competition and pinpoint your biggest opportunities for growth.

Your Questions, Answered

When considering new technology, asking incisive questions is a fiduciary responsibility. Here are answers to some of the most common inquiries we receive from banking executives evaluating a dedicated sales intelligence platform.

How Is This Different From Our CRM and BI Tools?

This is a critical distinction. Your CRM functions as your bank's institutional memory—a record of customer interactions and transactions. Your traditional BI tools are like a history book, effective for retrospective analysis of past performance.

A true bank intelligence platform, like Visbanking, serves as a forward-looking strategy partner. It integrates vast quantities of external data that your other systems cannot—such as FDIC call reports, UCC filings, and BLS data.

It then overlays this market intelligence onto your internal data to provide a live, actionable strategic plan. Your CRM tells you who your client is. An intelligence platform tells you their industry is facing headwinds and a competitor is actively targeting similar businesses. It transforms data from a static report into a strategic "go" signal.

What's the Typical Implementation Timeline?

We have all experienced large-scale enterprise IT projects that consume years and significant internal resources. That is not this model.

The Visbanking platform was built for banking, with pre-configured data integrations and workflows designed for your specific operational needs. The implementation process is rapid and focused on immediate value delivery. A partner-led implementation ensures your team is not mired in technical details. Most institutions begin deriving actionable insights in a matter of weeks, not quarters.

How Do You Ensure Our Sensitive Data Remains Secure?

In banking, data security is non-negotiable. It is not a feature; it is the foundation of our architecture. The Visbanking platform is built with production-grade security designed to exceed the stringent regulatory requirements of the financial industry.

This includes end-to-end encryption, strict access controls, and a complete audit trail. We manage the security and governance, allowing you to focus on the intelligence with full confidence that your institution's and clients' data is secure.

At Visbanking, we believe the right intelligence is what separates the banks that merely compete from those that dominate their markets. It’s time to move past static reports and empower your team with a platform that transforms complex data into clear, decisive action.

See how your institution stacks up. Explore your data and benchmark your performance at Visbanking.