The Strategic Threat of Industrial Loan Charters

Brian's Banking Blog

Once a niche corner of the financial sector, industrial loan charters (ILCs) are re-emerging as a significant strategic threat to traditional banks. This unique charter provides a direct path for technology and commercial giants to enter the banking sector, often without the comprehensive regulatory oversight that federally chartered institutions must navigate. For bank executives and directors, ignoring this competitive shift is a critical strategic error.

The Resurgence of a Potent Banking Charter

The ILC is not a new financial innovation; it is a fundamental restructuring of the competitive landscape with deep historical precedent. While today's applicants are predominantly fintech and large commercial firms, the ILC model has historically demonstrated its advantages during periods of economic stress.

Consider the Great Depression. While thousands of U.S. commercial banks failed, ILCs became a crucial source of consumer credit. Between 1934 and 1938, total ILC assets grew by approximately 65%, with loans increasing by 81%. In contrast, commercial bank assets expanded by just 22%, and loans grew a mere 9% during the same period. This historical performance is detailed in the historical context of ILCs and their impact on U.S. credit markets.

Implications for Your Institution

History is repeating, but with a digital-first approach. The applicants are no longer the industrial firms of the past; they are today's cash-rich giants in technology, retail, and specialty finance. These companies are not merely testing the waters—they are entering core banking with significant competitive advantages:

- Access to FDIC-Insured Deposits: ILCs can attract low-cost, stable deposits insured by the U.S. government, directly challenging your bank's primary funding source.

- A Lighter Regulatory Framework: An ILC's parent company is exempt from Federal Reserve supervision as a bank holding company. This allows it to bypass numerous activity restrictions and consolidated capital requirements that apply to your institution.

- Embedded Customer Bases: A technology company with an ILC can instantly offer banking products to millions of existing users, acquiring customers at a fraction of the cost of traditional marketing and branch networks.

This is not a minor regulatory loophole; it is a structural advantage that reshapes the competitive dynamics of the industry. By understanding the mechanics of ILCs and identifying the key players, your leadership team can transition from passive observation to proactive defense. The first step is leveraging precise data to benchmark your institution and identify these new competitors before they erode your market share.

How an ILC Sidesteps Traditional Bank Regulation

The core strategic advantage of an Industrial Loan Charter lies in its unique regulatory structure. At its foundation, an ILC is a state-chartered, FDIC-insured bank, similar to many community banks. The critical difference is in the supervision of its parent company.

The parent company owning the ILC is granted an exemption from being classified as a Bank Holding Company (BHC). While this may appear to be a technicality, it is the central pillar of the ILC's value proposition.

This single exemption allows large commercial firms—from technology platforms to automotive manufacturers—to own a bank without submitting to the comprehensive oversight of the Federal Reserve. The ILC subsidiary, typically chartered in states like Utah, is supervised by the state banking regulator and the FDIC. A thorough understanding of the roles of these different regulatory agencies for banks is no longer optional for bank executives; it is essential for strategic planning.

At the bank level, an ILC can offer a full suite of products, from FDIC-insured deposits to commercial loans, competing directly with traditional institutions.

The Parent Company Advantage

While the ILC subsidiary operates under standard banking regulations, its parent company can continue its primary commercial activities without the stringent limitations imposed on traditional BHCs.

This structure effectively bypasses the long-standing "separation of banking and commerce." It creates a capital-efficient, streamlined entry point into banking for firms that would not otherwise consider the BHC framework. Staying ahead of these regulatory nuances requires deep expertise, often cultivated through dedicated regulatory compliance training.

This regulatory arbitrage is not a footnote; it is the core strategic advantage of the ILC. It permits a well-capitalized commercial entity to fund its operations with low-cost, government-insured deposits while avoiding the intensive consolidated oversight that governs traditional banking groups.

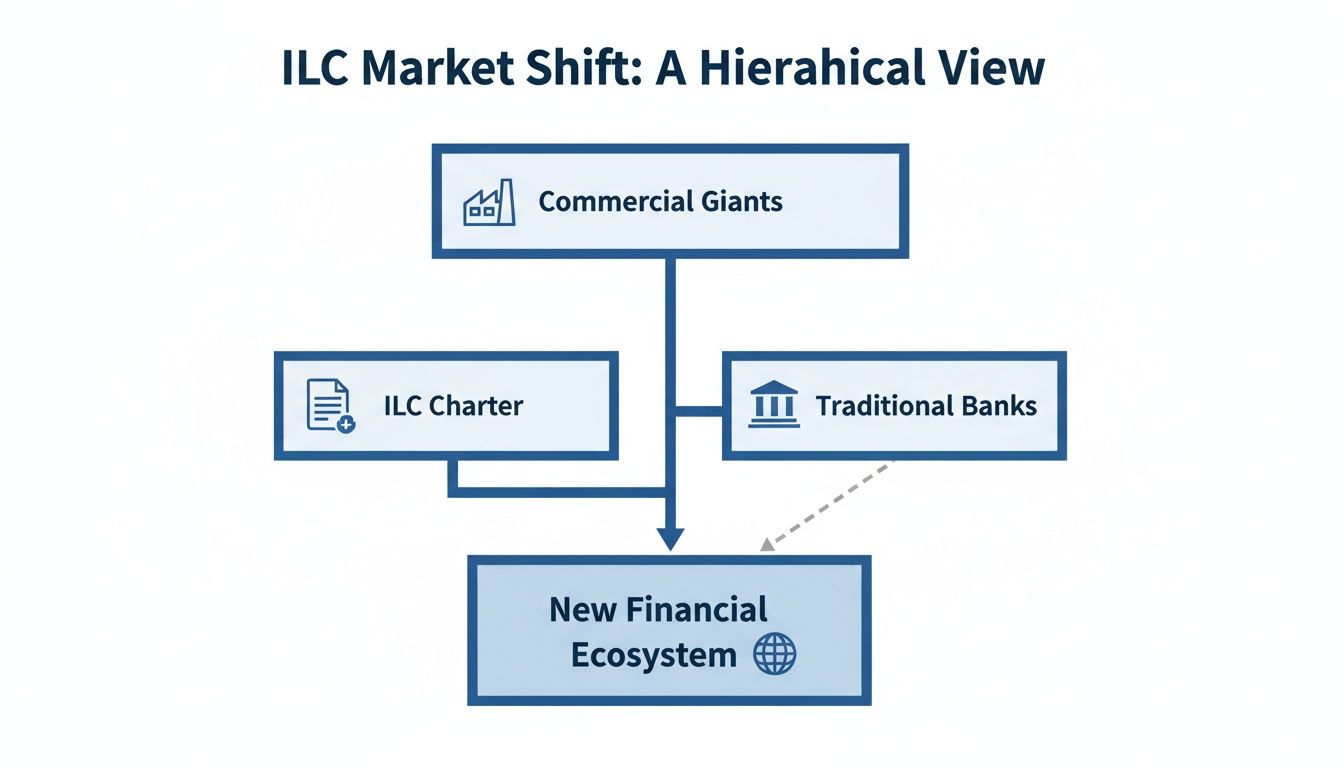

The following diagram illustrates how commercial players leverage the ILC charter to enter the banking ecosystem directly.

This structure provides a direct channel for non-banks to gain the benefits of a bank charter without incurring the full regulatory costs at the parent level. For instance, an automaker's ILC could gather $2 billion in deposits to fund its auto loan portfolio—a funding source significantly cheaper than capital markets.

Bank Charter Comparison At a Glance

To fully appreciate the ILC's distinct position, a side-by-side comparison with other charter types is instructive. The differences in oversight and ownership are stark.

| Attribute | Industrial Loan Charter (ILC) | National Bank Charter | State Non-Member Bank Charter |

|---|---|---|---|

| Primary Federal Regulator | FDIC | Office of the Comptroller of the Currency (OCC) | FDIC |

| Parent Company Regulation | No consolidated Fed supervision; parent is not a Bank Holding Company (BHC). | Federal Reserve supervises the BHC. | Federal Reserve supervises the BHC. |

| Permissible Parent Activities | Unrestricted commercial activities (e.g., retail, auto manufacturing, technology). | Limited to activities "closely related to banking." | Limited to activities "closely related to banking." |

| Geographic Scope | Can operate nationwide with FDIC approval. | Can operate nationwide. | Primarily operates in-state, can branch out with approvals. |

| Key Advantage | Allows commercial firms to own a bank and access FDIC-insured deposits without BHC restrictions. | Uniform national standards and preemption of many state laws. | More flexibility in charter options and state-level regulatory relationships. |

This comparison clarifies that the ILC is a fundamentally different entity, designed to bridge commerce and banking in a way other charters cannot.

Monitoring ILC applications and performance is a strategic imperative. Utilizing a data platform like Visbanking to benchmark your institution against these emerging competitors is the first step toward building a defense in this evolving landscape.

Assessing the Strategic Impact on Your Bank

For bank executives, the rise of the industrial loan charter is not a distant, theoretical threat. It is a direct assault on your core business model. The ILC provides well-capitalized commercial firms a regulated entry into banking, allowing them to compete for your customers' deposits and loans with a significantly lighter regulatory load at the parent-company level.

This is more than a new competitor. Consider a major technology or fintech firm—with its vast user base and sophisticated data analytics—launching its own bank via an ILC. It could seamlessly integrate a high-yield savings account into its existing application, attracting FDIC-insured deposits at a scale and velocity that would require a community bank decades to achieve.

The Erosion of Your Funding Base

The most immediate threat is to your deposit franchise. These new entrants do not require a physical branch network; they can attract stable, low-cost funding entirely through digital channels.

A specialty lender with an ILC, for example, could raise $500 million in online deposits at a blended rate of 4.50% to fund its national lending operations. Your institution might be paying 5.25% for local certificates of deposit while maintaining a costly branch infrastructure.

That 75-basis-point funding advantage directly impacts the bottom line, enabling them to offer more competitive loan rates or simply realize a higher net interest margin. This is a structural advantage that is difficult to counter. Furthermore, they can cross-sell other financial products within their proprietary digital ecosystems, creating a closed loop that is difficult for traditional banks to penetrate.

The modern ILC is not merely another niche competitor. It is a vehicle for nonbanks to systematically dismantle the traditional banking model, beginning with its most valuable asset: low-cost deposits.

This is not a future scenario; it is a present reality. Historical data confirms the ILC's potential for rapid growth. Between 1997 and 2006, total ILC assets grew by over 750%, from $25.1 billion to $212.8 billion. Deposits grew by more than 1,000% over the same period. By the late 2000s, the largest ILCs were already significant institutions, holding tens of billions in assets. You can review the historical asset growth of ILCs from the Federal Reserve for a detailed analysis.

Responding with Data Intelligence

Operating without clear market intelligence is no longer viable. To counter this threat, your leadership team must move from discussion to data-driven measurement.

You must be asking pointed, data-backed questions:

- Which firms currently have ILC applications pending, and what are their proposed business models?

- How do the deposit rates offered by new ILCs compare to ours and those of our direct competitors?

- Are we observing a loss of loan volume in key segments—such as small business or auto lending—to these new entrants?

Obtaining clear answers is the foundation of a robust defense. A bank intelligence platform like Visbanking is essential. It provides the raw data necessary to benchmark your performance against these new competitors, enabling you to translate market intelligence into a concrete action plan.

Analyzing Modern ILC Competitors

The industrial loan charters of today bear little resemblance to their historical predecessors. They are now wielded by sophisticated, data-native fintech and specialty finance firms, posing a direct, asymmetric threat to traditional banks.

To effectively analyze this threat, you must deconstruct their technology-driven business models rather than viewing them as conventional bank competitors.

Consider Block, Inc. (formerly Square) and its ILC, Square Financial Services. This is a prime example of a closed-loop ecosystem. Block leverages its ILC to originate commercial loans to the millions of small businesses on its payment processing platform. Underwriting is driven by real-time transaction data, providing a significant speed and accuracy advantage over traditional banks that rely on historical financial statements.

The Data and Distribution Advantage

These firms are not just competing at the market's periphery. They are targeting high-margin business lines with a powerful structural advantage rooted in data and distribution.

An ILC like Block's can analyze a merchant's daily sales volume and render an underwriting decision in minutes. If a coffee shop experiences a 15% sales increase over a weekend, Block's algorithm can generate a pre-approved working capital loan offer by Monday morning. This level of speed and precision is unattainable through legacy processes.

Nelnet Bank employs a similar playbook. It uses its ILC to refinance student loans, tapping directly into the vast customer base of its loan servicing division. This embedded distribution channel dramatically reduces customer acquisition costs, a major expense for consumer lenders.

A clear pattern emerges. These models share key characteristics:

- Proprietary Data Streams: They leverage unique, real-time data from their core commercial business to make superior credit decisions.

- Embedded Distribution: Banking products are integrated directly into an existing application or ecosystem, rendering traditional marketing expenditures nearly obsolete.

- Lower Operating Costs: A branchless, digital-first operational model results in overhead costs that are a fraction of a typical community or regional bank's.

These ILCs operate less like traditional banks and more like technology companies that possess a bank charter. Their true competitive edge lies not only in regulatory arbitrage but in a fundamentally more efficient model for customer acquisition and data-driven risk assessment.

Turning Intelligence into Action

Recognizing the threat is insufficient. To compete effectively, you need a granular, data-backed understanding of their strategies and performance. A robust intelligence platform is no longer a luxury but a necessity for survival.

It enables your leadership team to move beyond anecdotal evidence and benchmark your institution against these new players on the metrics that matter: loan yields, funding costs, and market penetration.

This threat is distinct from the risks associated with Banking as a Service (BaaS) partnerships. While BaaS introduces third-party risk, ILCs are direct, chartered competitors operating in your market. For more on this distinction, it is useful to understand why Banking as a Service has major risks that require specific monitoring.

To succeed, you must monitor ILC performance as closely as you do your traditional peer group. A platform like Visbanking provides the tools to track their regulatory filings, analyze their call report data, and convert that raw intelligence into actionable defensive strategies for your front-line teams.

Building Your Data-Driven Defense Strategy

Passive observation of the rise of industrial loan charters is a losing strategy. Bank leadership must shift from observation to action. The imperative is to construct a data-driven counter-strategy that anticipates competitive threats before they fully materialize. This is not merely defense; it is about leveraging market intelligence as an offensive tool.

The first step is establishing an early warning system. ILCs have a history of generating significant policy debate. When Wal-Mart applied for an ILC in 2005, the ensuing opposition prompted the FDIC to impose a moratorium on applications from commercial firms, a pause later extended by the Dodd-Frank Act until 2013.

These policy shifts are leading indicators. Tracking regulatory developments and new applications in real time is the only way to gain foresight into emerging competition.

From Monitoring to Benchmarking

Once an ILC competitor is identified, the next step is a deep-dive competitive analysis. This requires moving beyond simple awareness to systematically benchmarking your bank’s performance against theirs. This process reveals their strategic impact and exposes your own vulnerabilities.

Consider a scenario where a new fintech-backed ILC specializing in auto lending enters your primary market. Using a platform like Visbanking, you can pull its quarterly call report data and compare it directly to your own portfolio.

You might discover its average auto loan yield is 45 basis points lower than yours. Further analysis reveals its cost of funds is a full 60 basis points cheaper. This data provides the complete picture: the ILC can maintain a superior net interest margin while aggressively capturing market share.

An effective defense requires more than awareness. It demands a granular, data-driven understanding of how a competitor’s structural advantages translate into performance metrics that directly impact your P&L.

This level of detail transforms the conversation from a vague threat to a concrete, numbers-based problem that leadership can address with precision. A core component of this is implementing robust risk management practices to proactively manage the challenges these new competitors introduce.

Equipping Your Front Line with Intelligence

The final, critical step is to arm your commercial and retail teams with this intelligence.

When a business client mentions an attractive working capital offer from a new fintech ILC, your relationship manager cannot be caught unprepared. They must be equipped with hard data on that competitor's model.

Your team should be able to pivot the conversation, highlighting the value your institution provides that the competitor cannot replicate—be it deep expertise in complex cash management or the ability to structure larger, more sophisticated credit facilities. This data-backed approach shifts the discussion from a commodity-based price competition to a value-based relationship.

Building this rapid-response capability requires a commitment to a new operational model. By leveraging powerful analytics for banking, you empower your teams to act decisively. With Visbanking, you can analyze peer performance data, create meaningful benchmarks, and provide your lenders with the specific intelligence they need to defend your institution and win business.

Your Game Plan for the ILC Era

Industrial loan charters are no longer a footnote in banking strategy; they are a permanent and growing feature of the competitive landscape. ILCs provide a direct, regulator-approved pathway for large commercial and technology firms to enter your core business, competing for the same assets and liabilities upon which your institution depends.

For bank directors and executives, the directive is clear: understand this threat, quantify its impact on your performance, and formulate a sophisticated, data-backed response.

Failure to act will result in the erosion of market share in deposits, loans, and the high-value relationships that anchor your balance sheet. These new competitors are often equipped with superior data and more efficient distribution channels, allowing them to acquire customers and underwrite risk with an efficiency that many traditional banks cannot match. Their structural advantage, stemming from the parent company's exemption from Fed supervision, translates directly to the bottom line.

The time for passive observation has passed.

It is not enough to be aware of the ILC threat. Your bank's long-term success depends on translating knowledge into action. This requires shifting from vague awareness to a concrete, metric-driven plan to defend your franchise.

Utilize the available tools to benchmark your institution against these new players. Monitor the regulatory pipeline. Arm your teams with the intelligence required to win. The first, non-negotiable step is a comprehensive peer analysis to establish exactly where you stand.

A platform like Visbanking provides the clear, unfiltered data required to transform market shifts into a winning strategy. Start exploring the data, benchmark your performance, and prepare for the competitive landscape of tomorrow.

A Banker's ILC Field Guide: Your Questions Answered

When I discuss industrial loan charters with bank executives, a consistent set of precise questions arises. Answering them is critical to understanding how ILCs fit into your competitive landscape.

Are ILCs a Free-for-All? Any Restrictions?

Not entirely. While offering significant flexibility, ILCs operate within specific regulatory guardrails.

Under federal law, an ILC with $100 million or more in total assets is prohibited from offering demand deposits (i.e., traditional checking accounts) unless it was grandfathered in prior to the Competitive Equality Banking Act of 1987. This is a meaningful restriction.

Consequently, most modern ILCs, particularly those backed by fintech firms, focus on savings accounts, certificates of deposit, and specialized lending products. For a company whose primary objective is loan origination or gathering deposits for funding, this limitation is not a significant operational hurdle.

Why Is Everyone Rushing to Utah for These Charters?

The answer is simple: Utah established itself decades ago as the premier jurisdiction for ILCs and has developed unparalleled regulatory expertise. Its Division of Financial Institutions possesses a deep, nuanced understanding of the ILC model, creating a predictable and stable supervisory environment.

This institutional knowledge is invaluable to applicants, as it removes regulatory uncertainty. It has made Utah the chartering state of choice for today's players like Block and Nelnet, just as it was for industrial giants like BMW and General Motors in previous decades. While other states could technically charter ILCs, none can match Utah’s proven track record and supportive regulatory infrastructure.

How Do We Actually Compete with a Fintech-Owned ILC?

This is the critical strategic question. Competing requires a two-pronged approach: leveraging your inherent strengths while using data to counter their advantages.

First, double down on what their automated, one-size-fits-all platforms cannot replicate: high-touch advisory services, deep-rooted community engagement, and the sophisticated relationship banking you provide to your core commercial clients. This is your defensible territory.

Simultaneously, you must become surgically precise with data. You need a granular understanding of their product offerings, interest rates, and target customer segments. This is where a platform like Visbanking becomes an essential tool. Imagine equipping your relationship managers with the exact rates a rival fintech ILC is offering on small business loans in your specific market. That is not just competing; it is winning. It empowers your team to counter offers intelligently and articulate the superior value your institution delivers beyond a quarter-point on a rate sheet.

Transitioning from observation to active competition is the strategic imperative. Visbanking provides the banking intelligence and peer analysis tools to benchmark your performance, identify threats from ILCs as they emerge, and equip your team to win business. Explore our data and analytics platform today.

Similar Articles

Visbanking Blog

Capital Banking in the USA: An Overview of Investment Services, Financial Instruments, and Regulations

Visbanking Blog

<strong>The Ultimate Guide to Bank Loans: How to Find the Best Deal and Avoid Getting Burned</strong>

Visbanking Blog

Make Better Decisions with Confidence with BIAS, the Tailored Strategies Solution

Visbanking Blog

Bank Failure: Understanding the Risks and Protections for Consumers

Visbanking Blog

Revolutionize Your Bank with BIAS, the Bank Intelligence and Action System

Visbanking Blog

Bank Risk Management: Protecting Assets in Uncertain Times

Visbanking Blog

How does a bank decide whether or not your business qualifies for a loan?

Visbanking Blog

"Ever wondered how businesses fuel their dreams? 🚀"

Visbanking Blog

Bank Capital Requirements: The Ultimate Survival Guide

Visbanking Blog