How to Get a DUNS Number: A Guide for Banking Executives

Brian's Banking Blog

The mechanics of obtaining a D-U-N-S Number are simple: an application is filed on the Dun & Bradstreet website. The standard process is free and takes up to 30 business days. An expedited service is available for a fee.

For banking executives, however, the procedural details are secondary. The critical issue is not how a client gets a DUNS number, but why it is an indispensable asset for your institution's risk management and strategic growth.

The DUNS Number: A Linchpin for Data-Driven Risk Assessment

The nine-digit D-U-N-S identifier is the foundational element for modern commercial risk assessment. It transforms a name on a loan application into a quantifiable entity within the global business ecosystem, enabling data-driven decisions that are otherwise impossible.

Operating without this identifier is equivalent to underwriting with incomplete information. With it, your institution gains access to a verified data stream that fuels more intelligent, rapid, and defensible credit decisions.

Consider a relationship manager evaluating a $2,500,000 line of credit for a prospective manufacturing client. The DUNS number provides immediate access to the D&B PAYDEX score, revealing payment histories and trade experiences—data not found on a standard financial statement. A PAYDEX score of 75, for instance, indicates payments are made, on average, 5 days beyond terms, a critical leading indicator of potential cash flow distress that warrants further investigation.

From Administrative Requirement to Strategic Asset

The DUNS number functions as a universal translator, unifying disparate data points into a coherent narrative of a business's operational health and credit risk. It empowers your institution to:

- Verify Corporate Identity with Certainty: Instantly confirm the legal name, physical address, and corporate hierarchy of a potential borrower. This is the first line of defense against fraud and ensures data integrity from origination.

- Access Objective Credit & Payment Metrics: Gain insight into objective credit scores and verified payment histories. This layer of third-party intelligence provides a crucial check against internally generated assessments.

- Map Complex Corporate Structures: Uncover parent companies, subsidiaries, and affiliates. This visibility is essential for identifying hidden risks—and opportunities—within a corporate network.

For bank leadership, a client’s DUNS number is more than an identifier; it becomes an integral component of your institution’s data intelligence framework. It is the anchor that allows platforms like Visbanking to enrich a client profile with market data, peer benchmarks, and competitive insights, converting raw information into a clear path for strategic action.

Guiding a commercial client through the DUNS application process is not merely a service—it is a direct investment in the quality and utility of your bank's own data assets. To understand the strategic implications in greater detail, you can learn more about its role in our detailed article.

A Practical Guide to Obtaining a DUNS Number

For a commercial client, the nine-digit DUNS number is the first step toward establishing a credible business identity. For your bank, guiding them through this process is an early opportunity to demonstrate value while strengthening your own data infrastructure.

The process is straightforward, but precision from the outset is paramount. Coaching your relationship managers to ensure clients have the correct information prepared minimizes delays and ensures the resulting data is clean. Inaccurate data at this stage creates downstream complications in underwriting, risk assessment, and compliance.

Required Information for Application

Ensure your client has compiled the following information before beginning the application. This preparation streamlines the process.

- Legal Business Name: Must match official registration documents. No DBAs.

- Business Address: The physical headquarters address. P.O. boxes are not accepted.

- Key Principals: Names of owners or senior executives for verification.

- Legal Structure: e.g., LLC, S-Corporation, C-Corporation, Sole Proprietorship.

- Year of Formation: The year the business was legally established.

- Primary Line of Business: A specific description of core operations.

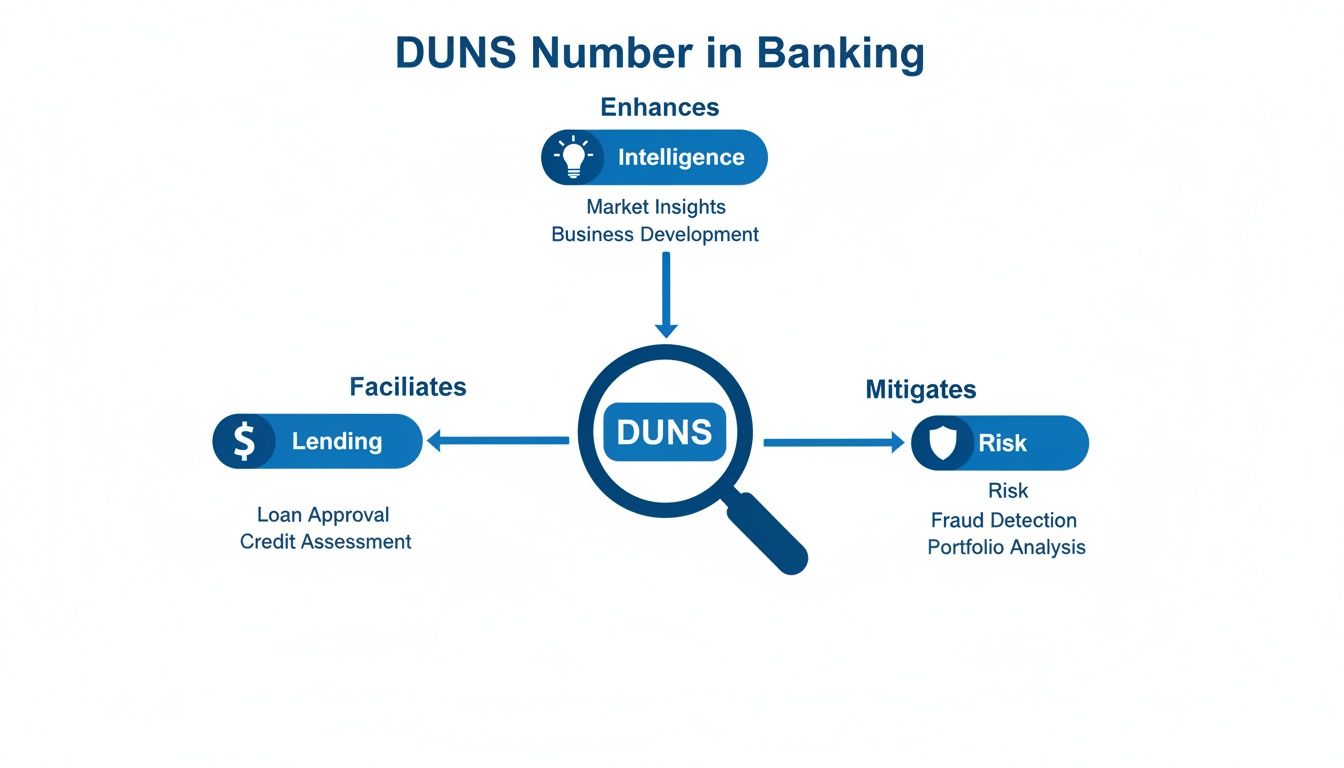

This identifier is the anchor for critical banking functions, connecting lending decisions, risk management, and market intelligence.

As illustrated, this single number is foundational to a connected data strategy.

The Application Process and Timelines

First, a client must verify that a number does not already exist. Direct them to the Dun & Bradstreet D-U-N-S Number lookup tool to prevent the creation of a duplicate record. A duplicate splits a company’s credit history and creates significant data integrity issues.

If no number exists, they may proceed with the application.

DUNS Application Checklist and Timelines

This table outlines the requirements and timelines, which is crucial for managing client expectations and providing sound strategic advice.

| Requirement/Feature | Details | Strategic Consideration for Banks |

|---|---|---|

| Legal Business Name | Must match official registration exactly. | Ensures clean data for KYC/AML checks and underwriting. |

| Physical Address | No P.O. Boxes. A verifiable street address is required. | Essential for location-based risk analysis and market segmentation. |

| Key Principals | Names of owners/executives for verification. | Connects the business entity to individuals for holistic risk assessment. |

| Standard Application | Free. Up to 30 business days. | Suitable for new businesses not facing immediate financing deadlines. |

| Expedited Application | $229. Within 8 business days. | A prudent investment for clients with urgent loan closings or contract bids. |

| Site-Specific ID | Each physical location requires its own unique DUNS number. | Critical for banks tracking performance and risk across a multi-location enterprise. |

Obtaining the number is the starting point. Your guidance on when to advise a client to pay for expedited service is a mark of a strategic partner.

The decision to invest $229 in an expedited application is a clear strategic calculation. For a client seeking to close a time-sensitive $5,000,000 commercial real estate loan within two weeks, the fee is a rounding error compared to the cost of delay. Conversely, for a new small business establishing its credit file, the standard 30-day timeframe is typically sufficient.

This level of advisory elevates your institution from a service provider to a strategic advisor.

Once the DUNS number is obtained, it can be integrated into your workflows. A platform like Visbanking ingests this identifier and instantly enriches it with market and peer data. It all starts here, turning a simple application into a long-term data advantage. I encourage you to see how this foundational data can be used to benchmark performance and find new opportunities.

The Strategic Value of the DUNS Number Post-Issuance

Acquiring a DUNS number for a client is a tactical necessity. For banking leaders, the strategic imperative is to convert this nine-digit identifier into an asset that drives superior, data-informed decisions.

The DUNS number is the key that unlocks Dun & Bradstreet’s Live Business Identity, providing a dynamic, real-time view of a company's commercial activity that transcends static, point-in-time financial statements.

For example, a relationship manager is underwriting a $1,500,000 commercial loan for a local manufacturer. The financials appear sound, but they represent a historical view.

With the client's DUNS number, the manager can instantly access a much richer, forward-looking dataset.

This is where abstract data becomes tangible risk assessment. The DUNS number provides direct access to intelligence not available in standard financial disclosures.

From Identifier to Intelligence

The DUNS number is far more than a tracking code. It is the entry point to a global commercial database, enabling your team to pull objective, third-party verified information that directly impacts underwriting and portfolio management.

This access reveals critical insights:

- Verified Payment Behavior: The D&B PAYDEX® Score offers a standardized measure of a company's payment habits, compiled from millions of real-world trade experiences. A score below 80 is an immediate red flag, signaling late payments that may indicate underlying cash flow issues.

- Corporate Linkages: The DUNS system maps corporate structures, revealing parent companies, subsidiaries, and other related entities. This is essential for identifying contagion risk, such as a financially distressed parent entity drawing on the resources of your borrower.

- Public Filings and Legal History: Access records of liens, judgments, and bankruptcies, providing a clear view of a company's financial stability and litigation risk.

This level of insight is possible because the D-U-N-S system is the backbone of one of the world's largest commercial databases, containing over 600,000,000 global business records. For a relationship manager, a client’s DUNS number anchors them in this massive, verifiable system, revealing everything from employee counts to payment trends.

Integrating Data for Competitive Advantage

Possessing DUNS data is standard; integrating it for strategic advantage is what separates market leaders. Its true power is realized when it is incorporated into a broader intelligence framework, such as the Bank Intelligence and Action System offered by Visbanking.

We integrate this foundational DUNS data with other critical sources—including FDIC call reports, UCC filings, and SBA loan data. The result is a comprehensive, 360-degree view of a business and its position within its specific market.

This process transforms a DUNS number into an actionable signal. Imagine combining a client's PAYDEX score with peer data from FDIC reports. A relationship manager can now benchmark that client's financial health against its direct competitors. That transforms a simple credit check into a strategic conversation about market position and growth.

Ultimately, knowing how to get a DUNS number is table stakes. The real advantage comes from your bank's ability to systematically use that data to make sharper decisions. By exploring a comprehensive Dun & Bradstreet data integration, you can turn this universal identifier into a genuine competitive advantage.

DUNS vs. UEI: A Critical Distinction for Lenders

A frequent point of inquiry from banking leadership is the distinction between the D-U-N-S Number and the federal Unique Entity Identifier (UEI). Misunderstanding this difference can create significant friction in commercial lending operations.

The bottom line is this: The U.S. government changed its internal system for tracking contractors. For the private sector and commercial credit assessment, the DUNS number remains the undisputed global standard.

In April 2022, the federal government ceased using the DUNS number for entities registering in its System for Award Management (SAM.gov), replacing it with its own UEI. This was a purely administrative change to streamline federal contracting and grant-making processes. Any commercial client bidding on a government contract must obtain a UEI from the SAM.gov portal.

The Private Sector Operates on the DUNS Standard

The government's internal shift has no bearing on how commercial credit is evaluated in the private sector. The D-U-N-S Number remains the universal identifier for business credit reporting. It is the key that unlocks the comprehensive Dun & Bradstreet credit file, the PAYDEX score, and the critical corporate family tree. For any credible underwriter, this data is non-negotiable.

Your client may therefore possess two distinct numbers:

- UEI: This indicates the entity is registered to do business with the U.S. federal government. It is an administrative ID for public sector contracting.

- DUNS Number: This is the identifier relevant to your institution. It provides access to their commercial credit history, payment behavior, and overall financial stability profile.

It is a common misconception that the UEI has superseded the DUNS number for all purposes. For your bank's credit committee, a client's UEI is largely irrelevant. It is their DUNS number that provides the actionable intelligence required to approve a $5,000,000 line of credit or accurately assess supply chain risk.

Ensuring Data Integrity and Operational Efficiency

Correctly distinguishing these identifiers directly impacts your bank’s operational efficiency. Loan origination software, CRM platforms, and data enrichment processes must be configured to use the DUNS number as the primary key for client data. This is the only method to ensure access to meaningful risk and credit information.

When a relationship manager encounters a client focused on their UEI for a government contract, it presents a valuable advisory opportunity to explain why maintaining an accurate DUNS profile is critical for securing private sector financing.

This data discipline is fundamental to robust regulatory compliance risk management and prepares your institution for emerging reporting mandates, such as those detailed in our analysis of Dodd-Frank Section 1071 compliance.

Ultimately, intelligence platforms like Visbanking are architected to ingest the DUNS number—not the UEI—to connect a business to a universe of market data and peer analysis. Ensuring your teams understand this distinction protects the integrity of the data that drives your most critical lending decisions.

Activating Data for Decisive Action

Obtaining a DUNS number is a necessary first step. However, for banking leaders, the identifier itself is of little value. Its power is unlocked only when integrated into a broader intelligence system that transforms static data points into forward-looking insights.

Static, rearview-mirror reports are insufficient in today's dynamic market. The objective must be to create a living system that synthesizes disparate data into a coherent narrative about future performance and risk.

The central question for every executive is how to convert this number from a compliance checkbox into a revenue-generating asset. The answer lies in data integration. A DUNS number should not exist in a silo; it must serve as the master key that connects and contextualizes information across your institution.

From Static Reporting to Strategic Foresight

Consider a commercial lending portfolio of $500,000,000. The traditional approach involves a periodic review of quarterly financial statements.

A data-driven institution, however, uses each borrower's DUNS number to maintain a continuous pulse on their PAYDEX scores, new UCC filings, and any changes in their corporate family tree. For instance, an alert is triggered when a key borrower's average days-to-pay metric slips from 15 to 45 days over a 90-day period.

This shifts the portfolio management paradigm from reactive to proactive. Instead of discovering a borrower's cash flow crisis months after the fact, you identify leading indicators of distress in near real-time. This early warning enables timely intervention, proactive risk mitigation, and more constructive client engagement.

The competitive advantage is realized through data synthesis. A client's DUNS number, when enriched with FDIC call report data and local economic indicators, transcends a simple credit file. It becomes a predictive signal of their market share, competitive positioning, and growth potential.

This is the core function of a Bank Intelligence and Action System like Visbanking. We leverage foundational identifiers like the DUNS number to connect disparate datasets, extracting insights that would otherwise remain buried. This moves your institution beyond the basics of "how to get a DUNS number" to the advanced strategy of "how to use it to outperform the market."

The challenge for banking leadership is to transition their organizations from data collection to data activation. The tools are available. The imperative now is to implement the strategy and discipline required to convert information into clear, profitable action. A logical starting point is to benchmark your institution’s performance and identify the opportunities a connected data strategy can unlock.

Executive FAQ: The DUNS Number

For banking professionals, the DUNS number is a critical tool for client advisory and institutional risk management. The following provides direct answers to common questions.

Does Each Business Location Require a Unique DUNS Number?

Yes. This is a critical point. A DUNS number is assigned to a specific physical location. It functions as a unique address for a distinct business entity.

This means every branch of your bank and every individual location of your commercial clients must have its own number. For a retail client seeking a $10,000,000 credit facility across 20 locations, this is not an administrative burden. It is the mechanism by which your underwriters can differentiate the performance of high-performing locations from underperforming ones, rather than analyzing a single, consolidated and potentially misleading financial picture.

How Does a DUNS Number Impact a Business Credit Profile?

The DUNS number is the foundational key to the Dun & Bradstreet credit profile. It is the identifier upon which the Live Business Identity, payment history, and all related data are structured.

Most importantly, it is used to calculate the D&B PAYDEX score, the industry benchmark for measuring a company's payment velocity. For your credit teams, a strong PAYDEX score is a clear, quantitative signal of a disciplined, well-managed enterprise.

A business without a DUNS number is effectively invisible within the D&B ecosystem. No DUNS number means no credit file and, therefore, no PAYDEX score. This creates a significant information vacuum for any lender and materially increases perceived risk.

Can a Client Update Their DUNS File Information?

Yes, and it is a best practice they should be encouraged to follow. Dun & Bradstreet provides a free portal, D&B iUpdate, where any company can review and correct its information.

Your relationship managers should advise clients to regularly update their legal name, address, executive team, and revenue figures. This facilitates your institution's annual reviews and KYC processes, ensuring that the data informing your credit decisions is accurate and reliable.

Is the DUNS Number Obsolete Following the Government's Adoption of the UEI?

No. While the U.S. government transitioned to the Unique Entity Identifier (UEI) for its internal contracting via SAM.gov, the scope of the UEI is limited to that specific function.

The UEI is for transacting with the federal government. The DUNS number remains the essential global identifier for commercial credit and risk data that your bank relies upon for underwriting and portfolio management. They are two distinct identifiers for two separate purposes.

At Visbanking, we transform foundational data points like the DUNS number into actionable intelligence. Our platform integrates these identifiers with thousands of other sources, enabling banking leaders to move from data observation to decisive, market-leading action.

See how you stack up and find your next big opportunity today.