A Bank Executive's Guide to Dodd-Frank Section 1071 Compliance

Brian's Banking Blog

Dodd-Frank Section 1071 is not merely another regulatory update. It represents a fundamental shift in lending transparency, requiring financial institutions to collect and report extensive data on credit applications from small, women-owned, minority-owned, and LGBTQI+-owned businesses.

For bank leadership, this is not a compliance task to be delegated and forgotten. Section 1071 directly impacts risk management, market strategy, and competitive positioning. Viewing it as such is the first step toward transforming a regulatory mandate into a strategic advantage.

Framing 1071: Not a Burden, But a Strategic Play

The operational and strategic lift of implementing Section 1071 is significant. The Consumer Financial Protection Bureau (CFPB) designed this rule to enforce fair lending laws and create a clear, data-driven picture of the small business credit market.

However, a purely compliance-focused approach is a critical error in judgment. The data collected—applicant demographics, gross annual revenue, loan purpose—is a rich source of market intelligence. Deployed correctly, this information will drive superior business decisions.

From Compliance Headache to Competitive Edge

The responsibility of bank leadership is to reframe the internal conversation from a defensive, compliance-first posture to a proactive, data-driven strategy. This requires moving beyond simple data collection and integrating these new insights into the core of your decision-making process.

Consider a community bank with $1.5 billion in assets processing approximately 1,200 small business loan applications annually. Under Dodd-Frank 1071, this institution will possess standardized data on every applicant, including those it declined. This dataset—rich with demographics, NAICS codes, and precise geographic locations—presents an unprecedented opportunity for market analysis.

This is not about satisfying the CFPB. It is about gaining a granular, real-time understanding of your entire addressable market—including the business you currently turn away—and leveraging that intelligence to outperform competitors.

Turning Mandated Data Into Actionable Insights

When this mandated compliance data is integrated into a robust data intelligence platform, it transforms from a liability into a strategic asset. Bank executives can secure definitive answers to critical questions that were previously addressed with assumption and anecdote:

- Where are our market gaps? Are we systemically under-serving women-owned businesses in a specific high-growth census tract? For example, analysis might reveal a 15% lower approval rate for female-owned businesses in the 75201 ZIP code compared to male-owned businesses with similar financial profiles.

- What should our next product be? Does the data show a pattern of service-based businesses with revenue under $500,000 applying for lines of credit below our $50,000 minimum? This is a direct signal of unmet product demand.

- How do we compare to peers? What is our approval rate for minority-owned businesses versus the three other banks competing for market share in our primary county?

Answering these questions enables precise marketing, targeted product development, and reputational risk mitigation supported by empirical data. The first move is to benchmark your current small business lending performance. Understanding your position relative to peers provides the necessary context to win in this new era of transparency. Explore how data intelligence provides the clarity to act.

So, What Data Do You Actually Have to Collect?

Section 1071 is not a set of high-level principles; it is a granular data collection mandate. For bank leaders, understanding the specific data points is critical to grasping the operational scope and the strategic value of the asset being created.

The core requirement is to collect and report detailed information on credit applications from businesses with gross annual revenues of $5 million or less. This wide net captures a significant portion of a typical commercial loan portfolio, covering term loans, lines of credit, and merchant cash advances.

Turning an Application Into Reportable Data

The sheer volume of new data points required for each application is the first operational hurdle. Every application—whether approved, denied, or withdrawn—must be augmented with details previously tracked inconsistently, if at all.

Consider a local manufacturing company with $4 million in revenue applying for a $300,000 equipment loan. Previously, the process focused solely on financial viability. Today, that same application must capture over 20 new data fields for regulatory reporting.

This includes:

- Application Basics: A unique identifier, application date, and method of application (e.g., in-person, online).

- Loan Details: The credit purpose, type of credit, and the amount requested.

- Pricing Info: Key terms including the interest rate, total origination charges, and any prepayment penalties.

- Business Vitals: The applicant's gross annual revenue, NAICS code, number of employees, and time in business.

- Location, Location, Location: The census tract of the business's primary address, a critical data point for fair lending analysis.

The Demographic Data Challenge

The rule's most sensitive component is the requirement to collect demographic data on the business's principal owners, including self-reported race, ethnicity, and sex. This represents a significant departure from traditional commercial lending practices and introduces new considerations for staff training, customer interaction, and data privacy.

The critical takeaway for leadership is that this demographic data cannot simply be archived. It must be collected accurately, firewalled from underwriters to prevent any possibility of bias, and managed within a secure, auditable system. A failure at any point in this chain creates substantial compliance and reputational risk.

Attempting to manage this flow of sensitive information without a robust framework is an unacceptable risk. Strong data governance in banking is no longer an optional best practice—it is a prerequisite for operating under Section 1071.

This is where a purpose-built intelligence platform becomes indispensable. It automates validation of fields like census tracts and NAICS codes, flags missing data before it creates reporting errors, and establishes a secure repository for sensitive demographic information. By integrating this new data with existing market and peer data, platforms like Visbanking transform a compliance burden into a powerful strategic tool. The first step is to benchmark your performance to gain the context needed to navigate this new environment and uncover opportunities within the data.

Navigating The Tiered Compliance Deadlines

For effective resource planning and risk management, ambiguity is the enemy. The Consumer Financial Protection Bureau (CFPB) has acknowledged this by structuring the Section 1071 rollout with tiered deadlines based on a clear, objective metric: lending volume.

This phased approach recognizes the operational lift required, but it should not be misinterpreted as an invitation for delay. Identifying your institution's tier is the foundational step that dictates the timeline and urgency of your entire implementation plan, from capital allocation to project staffing. Misjudging your tier will lead to a reactive, last-minute scramble rather than a controlled, strategic deployment.

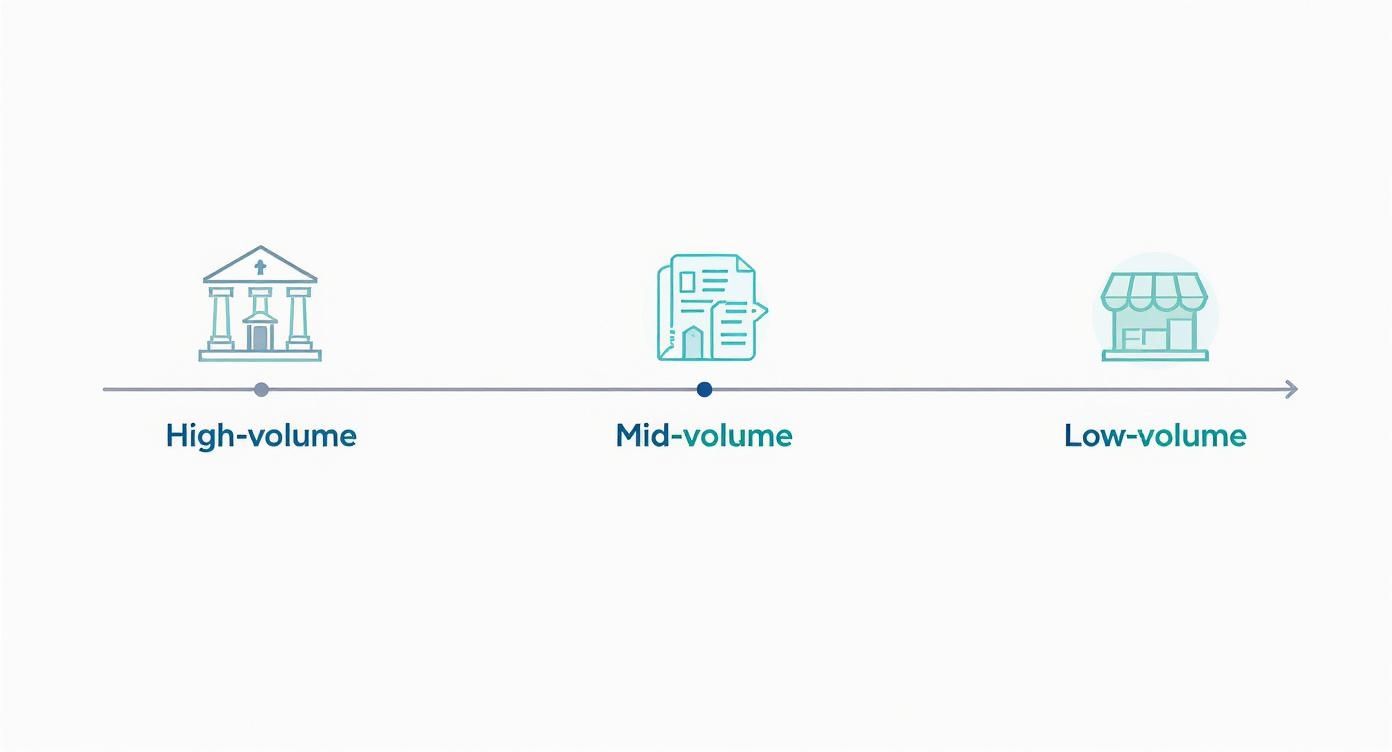

Pinpointing Your Compliance Tier

An institution's tier is determined by the number of covered small business credit transactions it originated in each of the two preceding calendar years. The thresholds are unambiguous.

- Tier 1 (High-Volume Lenders): Institutions originating at least 2,500 covered small business loans annually. Your deadline is the most immediate, and systems must be prepared first.

- Tier 2 (Mid-Volume Lenders): Institutions originating between 500 and 2,499 loans annually. You have a longer runway, but implementation must be well underway.

- Tier 3 (Low-Volume Lenders): Institutions originating between 100 and 499 loans annually. You have the most time, a strategic advantage that must be used for diligent planning and system selection.

This timeline visual clarifies how lending volume dictates an institution's place in the implementation queue.

The picture is clear: your bank’s origination activity directly determines its compliance schedule.

The Strategic Implications of Each Deadline

Section 1071 is a component of the Dodd-Frank Act, enacted in response to the 2008 financial crisis. Its primary objective is to bring transparency to fair lending practices for businesses owned by women, minorities, and LGBTQI+ individuals.

Following legal challenges and industry feedback, the CFPB has established new dates. The table below outlines the phased deadlines.

Section 1071 Compliance Tiers And Key Dates

The CFPB has established a tiered implementation schedule to ease the transition for financial institutions. Your compliance deadline is determined by your annual small business loan origination volume from the preceding two years. Here’s a clear breakdown of the tiers and their corresponding dates.

| Lender Tier | Annual Origination Threshold | Compliance Date | First Data Submission Deadline |

|---|---|---|---|

| Tier 1 | 2,500+ loans | October 1, 2024 | June 1, 2026 |

| Tier 2 | 500 - 2,499 loans | April 1, 2025 | June 1, 2027 |

| Tier 3 | 100 - 499 loans | January 1, 2026 | June 1, 2028 |

For a deeper dive into the rule's history and the shifting regulatory landscape, Wolters Kluwer provides some excellent insights. Knowing these dates is step one; the next is to develop a concrete action plan.

For a bank originating 3,000 small business loans annually (Tier 1), the clock is ticking. Budgets for software acquisition, IT integration projects, and staff training must be approved and in motion now.

Conversely, a community bank with 350 annual originations (Tier 3) has more time. That time must be used strategically for vendor due diligence, process redesign, and thorough staff training. Waiting is not a strategy.

Regardless of your tier, the objective is the same: use this mandate as an opportunity to build a more intelligent and responsive lending operation.

The most critical action for any executive team today is to obtain a precise, verified count of its current origination volumes. That single number dictates your entire compliance roadmap.

A data intelligence platform like Visbanking provides instant benchmarking of your lending volumes against clean, aggregated regulatory data. This delivers the certainty required for effective planning, ensuring your institution targets the correct deadline and can convert this requirement into a tangible strategic advantage.

Building Your Implementation Roadmap

Preparing an institution for Dodd-Frank 1071 is not a departmental project; it is a bank-wide initiative requiring a formal strategic plan. Bridging the gap from regulatory text to flawless execution demands a roadmap that anticipates challenges, aligns key personnel, and integrates new processes into the fabric of your lending operations.

A reactive approach invites operational chaos, data integrity failures, and significant compliance risk. A proactive roadmap, however, transforms this challenge into a structured, manageable process that builds institutional resilience and intelligence.

Assemble Your Cross-Functional Task Force

The first imperative is to establish a dedicated, cross-functional task force. A siloed approach will fail. Success requires the combined expertise of every functional area involved in the lending process, ensuring a comprehensive view from the outset.

This group is not an administrative committee; it is the strategic command center for 1071 implementation. It must be composed of leaders with the authority to make decisions and allocate resources.

Your core team must include representation from:

- Lending: To provide frontline perspective on customer impact and workflow integration.

- Compliance: To ensure adherence to the rule and manage regulatory risk.

- Information Technology (IT): To oversee data architecture, system integration, and security.

- Data Analytics: To architect the processes for data capture, validation, storage, and strategic analysis.

This task force will own the implementation plan, drive accountability, and ensure alignment with the bank’s broader strategic objectives. Executing a change of this magnitude requires a disciplined regulatory change management process, which this team must champion.

Conduct a Rigorous Gap Analysis

With the team in place, the next step is a comprehensive gap analysis. You cannot chart a course without knowing your precise starting location. This requires a deep examination of current data systems, technology infrastructure, and lending workflows.

Ask the difficult questions: Where does our data reside today? What is the current flow from application to decision? Where are the manual workarounds, disparate spreadsheets, and legacy systems that will fail under the weight of Dodd-Frank 1071?

For example, a $2.5 billion community bank mapped its entire small business loan process and identified four critical points where 1071 data collection would likely break down. By identifying these weaknesses early, they preempted significant future reporting errors, saving an estimated 250 hours of subsequent manual remediation. This is the tangible return on investment of upfront diligence.

A roadmap built on assumptions will fail. A roadmap built on a candid assessment of technological and procedural gaps becomes a reliable blueprint for success.

Prioritize Technology and Training

Your gap analysis will invariably highlight two critical needs: technology investment and staff training. These are the twin engines that will power a successful implementation.

Technology Selection: Manual data entry and validation are not viable solutions. The volume and sensitivity of this data demand a robust technology platform. The right solution must handle data collection, perform complex validations, ensure secure storage, and generate flawless CFPB submission files. The task force must evaluate vendors based on their ability to integrate with the existing loan origination system and scale for future needs.

Training Protocols: Your loan officers are the frontline of this change. They require training to collect sensitive demographic information professionally, accurately, and without introducing bias. This cannot be a single webinar; it must be a sustained program covering not just the how but the why, empowering staff to address customer inquiries with confidence.

Developing this roadmap is how you take control of the Dodd-Frank 1071 mandate and shift from a reactive to a preparatory posture. That process begins with knowing exactly where you stand.

Turning Compliance Data Into A Strategic Asset

The dominant narrative surrounding Dodd-Frank 1071 centers on the burdens of compliance. This perspective is shortsighted. Astute bank executives recognize that the data being collected for the CFPB is a powerful tool for driving defensible, profitable growth.

This regulation imposes a level of data discipline on small business lending that few banks have ever achieved. For the first time, you will possess a complete, standardized dataset of your entire application funnel—approvals and denials—enriched with demographic and financial details. To view this as a mere cost center is to miss the strategic opportunity entirely.

Uncovering Hidden Market Opportunities

The strategic value is unlocked when your Dodd-Frank 1071 data moves from the compliance department to the strategy committee. Analyzing these new data points allows leadership to pivot from anecdotal decision-making to data-driven strategy.

Imagine your analysis reveals a high denial rate for applications from women-owned businesses in a specific high-growth commercial district. Further investigation shows a common theme: these businesses are requesting working capital loans under $75,000, while your bank’s product minimum is $100,000. This is not a collection of rejections; it is a clear market signal for a new product offering.

The question shifts from, "What do we believe the market needs?" to "What is our data telling us the market is actively demanding?" This transforms compliance from an expense into an engine for product innovation and growth.

By layering this internal data with broader market intelligence, you can identify underserved communities, refine loan products, and deploy business development resources with precision. This is the function of modern business intelligence analytics—translating raw numbers into a sustainable competitive advantage.

From Raw Data To Actionable Intelligence

Nationally, Section 1071 aims to close significant data gaps in the $600+ billion annual small business lending market. The historical lack of data has obscured credit challenges for women- and minority-owned businesses, which now represent approximately 40% of all U.S. small businesses. By collecting this data, you are not just complying with regulation; you are building a proprietary map of these vital economic trends within your own market.

A dedicated data intelligence platform is the key to unlocking this value. It enables you to:

- Segment Performance: Analyze approval and denial rates by race, ethnicity, sex, and location. This allows for proactive fair lending risk management and the identification of untapped market segments.

- Identify Product Demand: Discover patterns in credit requests from specific demographic or industry groups. Analysis might reveal a surge in applications from minority-owned logistics firms for which your current loan products are a poor fit.

- Optimize Outreach: Use geographic data to map application origins. This provides business development officers with a data-driven roadmap for focusing their efforts on areas of proven, unmet demand.

Compliance data, properly leveraged, becomes a strategic GPS. It informs executive decisions on everything from marketing campaigns to branch strategy, all supported by hard evidence from your own operations.

First, however, a baseline is required. Before you can find opportunities in your future 1071 data, you must understand your current market position. Benchmarking your small business lending against peers provides the context needed to move forward with confidence.

Preparing Your Bank For The Future Of Lending

Viewing Section 1071 as merely another compliance burden is a strategic misstep. This regulation is not simply about new reporting requirements; it represents a fundamental and permanent shift toward data transparency in lending.

Consider it the catalyst for modernizing your bank's data infrastructure. The future of lending is data-driven, and this rule provides the blueprint. Framing this transition as a strategic investment, not a cost, is the critical first step toward gaining a sustainable market advantage.

For context on current lending decision frameworks, particularly in the commercial space, review these insights on commercial property loan requirements.

Navigating The Shifting Sands Of Regulation

The regulatory environment for Dodd-Frank 1071 continues to evolve, demanding vigilance from leadership. The CFPB's latest proposals aim to refine the rule's focus, concentrating data collection where it will yield the most impactful insights.

For instance, one proposal narrows the definition of a small business from $5 million in revenue to $1 million, sharpening the focus on true micro-enterprises. Concurrently, the lender origination threshold may increase from 100 to 1,000 annually, concentrating the rule on higher-volume institutions. This mirrors the pragmatic, phased approach seen with HMDA implementation.

You can review the CFPB’s rationale on their proposed changes.

These potential adjustments are not a signal to pause preparations. They are a directive to prepare smarter. The core mission of data transparency remains unchanged. The banks that build flexible, data-centric operating models now will be the market leaders of tomorrow.

The logical starting point is to gain an unambiguous understanding of your market position today. You must know your performance metrics not just for internal reporting, but in direct comparison to your competitors.

This is precisely where data intelligence provides clarity. Before filing a single compliance report, benchmark your small business lending performance against your peers. This allows you to shift from a defensive posture to an offensive strategy, fully prepared for the new era of data-driven lending.

Want to see how you measure up? Explore how Visbanking provides the peer and market context required to act with confidence.

Burning Questions About Dodd Frank 1071

As leadership teams grapple with the implications of Dodd-Frank 1071, several key questions consistently arise. Here are direct answers to the most common inquiries from bank executives.

What's The Real Risk If We Don't Comply?

Non-compliance presents a dual threat of severe financial penalties and significant reputational damage. The most immediate risk is the imposition of substantial civil monetary penalties by the CFPB. For a larger institution, a pattern of reporting failures could easily result in penalties reaching seven figures.

Beyond fines, non-compliance attracts intense regulatory scrutiny of your entire fair lending program. This leads to costly, time-consuming examinations and mandated corrective actions, diverting executive focus from strategic growth to crisis management.

How Is Section 1071 Different From HMDA?

While both regulations mandate demographic data collection, the comparison ends there. HMDA is focused exclusively on home mortgages. Section 1071 is designed specifically for small business lending.

Consequently, the required data points are fundamentally different. HMDA centers on borrower and property characteristics. Section 1071 drills into business attributes. For example, a $250,000 small business loan requires reporting the company's gross annual revenue and number of employees—fields that do not exist in HMDA reporting.

The bottom line is that your HMDA systems cannot be repurposed for Section 1071. A distinct, purpose-built strategy for collecting, validating, and submitting this unique commercial lending data is required.

Do We Really Need Special Software For 1071?

For nearly any financial institution, attempting to manage Dodd-Frank 1071 compliance with spreadsheets or legacy systems is an unacceptable operational risk. The mandate involves over 20 data fields per application, complex validation rules, and specific CFPB submission formats. A manual approach is a recipe for error and non-compliance.

A dedicated platform is not a luxury; it is a necessity. It automates critical validation checks, ensures sensitive demographic data is firewalled from underwriters, and produces flawless submission files. The investment is not merely about penalty avoidance—it is about liberating your team from manual data tasks to focus on strategic analysis and growth.

Mastering Section 1071 begins with a clear understanding of your current market position. Visbanking provides the peer and market data to benchmark your small business lending, preparing you for this new era of transparency. Explore our data and act with confidence.

Similar Articles

Visbanking Blog

Bank Capital Requirements: The Ultimate Survival Guide

Visbanking Blog

Bank Regulatory Compliance: Navigating the Complex Maze

Visbanking Blog

Why Your Bank's Tier 1 Capital Ratio Could Save It From Crisis

Visbanking Blog

The FFIEC: Regulating and Supervising Financial Institutions to Maintain a Safe and Sound Financial System

Visbanking Blog

The Future of Financial Analytics: Solutions by VISBANKING

Visbanking Blog

Bank Failure: Understanding the Risks and Protections for Consumers

Visbanking Blog

Capital Banking in the USA: An Overview of Investment Services, Financial Instruments, and Regulations

Visbanking Blog

BIAS: The Power of Data and AI at Your Fingertips

Visbanking Blog

Exploring Cutting-Edge Technologies Empowering US Banks: A Deep Dive into Visbanking Banking Report Portal

Visbanking Blog