How to Find a DUNS Number for Strategic Business Verification

Brian's Banking Blog

To find a company's D-U-N-S Number, the most direct method is the official Dun & Bradstreet lookup tool, using the company's legal name and address. For entities engaged in government contracting, the SAM.gov database is an alternative verification source. This nine-digit identifier is the lynchpin for accessing comprehensive business credit history and validating corporate identity, forming the foundation of rigorous due diligence.

Why the DUNS Number Is a Cornerstone of Commercial Banking

The D-U-N-S® Number is not a procedural formality; it is a fundamental tool for risk management and opportunity identification in commercial banking. It serves as the universal key to a unified, transparent view of any business entity, linking disparate data points—from credit histories and corporate family trees to regulatory filings. For bank leadership, mastering the D-U-N-S system is a critical step toward building a data-driven, resilient institution.

The Foundation of Business Identity

Established in 1963 by Dun & Bradstreet, this unique nine-digit identifier has served as the global standard for business verification for over 60 years. Its strategic importance was underscored when the U.S. government mandated it for all federal contractors for nearly two decades, from October 2003 until April 4, 2022. This requirement highlights its power in streamlining oversight and ensuring entity resolution.

Consider the underwriting process for a $5,000,000 credit facility for a prospective manufacturing client. Their D-U-N-S Number enables an immediate review of payment history with suppliers, clarifies their position within a larger corporate structure, and confirms their operational history. All critical risk factors are consolidated and tied to this single, trusted identifier.

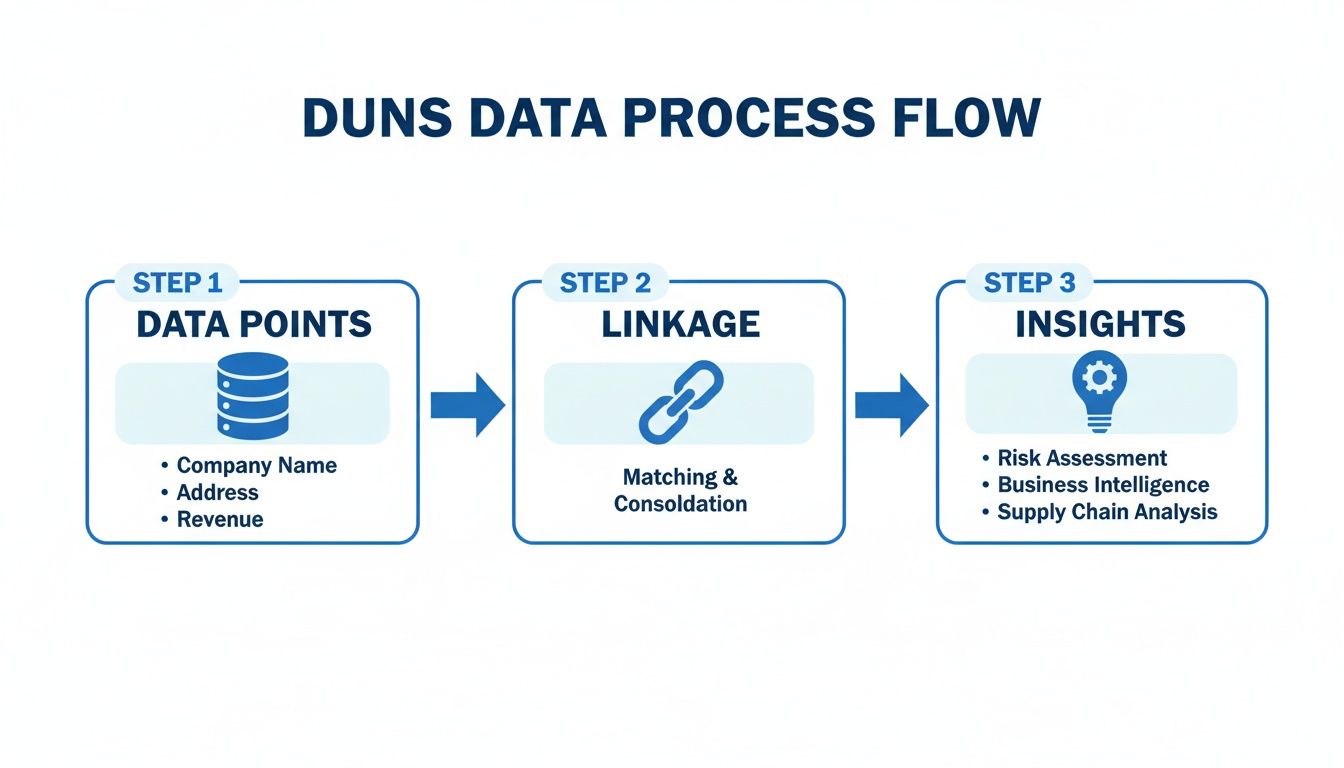

From Data Points to Strategic Action

Without a universal identifier, risk analysis becomes a manual, error-prone process of reconciling inconsistent data. A minor variation, such as "ABC Corp" versus "ABC Corporation," can create duplicate profiles, leading to a fragmented and unreliable view of the client. The D-U-N-S Number eliminates this ambiguity.

For bank leadership, the strategic value of the D-U-N-S system is its ability to create a single source of truth for every commercial client. This data integrity underpins every significant decision, from individual loan approvals to portfolio-wide risk analysis.

Integrating this identifier into core banking systems empowers lending and relationship management teams to make faster, more informed decisions. By connecting the D-U-N-S Number to comprehensive market and regulatory data, platforms like Visbanking transform this identifier into a strategic asset. You can learn more about what a DUNS number is and its applications. This integration enables banks to benchmark performance and identify new opportunities with analytical certainty.

Efficient Methods for Locating a Company's DUNS Number

In banking, operational efficiency and data accuracy are paramount. Rapidly locating a company's D-U-N-S Number is a crucial first step in any substantive due diligence process. Knowing the most effective channels can significantly reduce administrative burden.

The most reliable method is to consult the source directly: the official Dun & Bradstreet lookup tool. This should be the first step in any verification workflow, requiring only the company's legal name and address for an initial check.

Leveraging Public Filings and Government Databases

For larger or publicly-traded companies, public records offer a reliable verification channel. For instance, a commercial loan officer underwriting a $10,000,000 credit line for a public company will often find the borrower's D-U-N-S Number within its 10-K report filed with the SEC. This approach simultaneously locates and validates the number against an official document.

Another key resource is SAM.gov. Any business that has contracted with the U.S. federal government must be registered in this system. A search can instantly confirm the D-U-N-S Number for any company within the government's supply chain, providing a swift and authoritative check.

Comparing Key DUNS Number Lookup Channels

Different scenarios require different tools. The following table outlines the primary lookup methods and their optimal use cases.

| Lookup Method | Optimal Use Case | Speed | Data Required |

|---|---|---|---|

| D&B Official Lookup | Initial verification for any business | Fast (minutes) | Legal Name, Address |

| SEC Filings (e.g., 10-K) | Due diligence on publicly traded companies | Moderate (depends on search proficiency) | Company Name, Ticker Symbol |

| SAM.gov | Verification of government contractors | Fast | Company Name, CAGE Code |

| Direct D&B Contact | Complex cases or failure of other methods | Slow (days) | Detailed Company Information |

The objective is to select the channel that provides the most reliable information in the least amount of time for the specific client engagement.

Institutionalizing the Verification Process

Effective due diligence is built on standardized, repeatable processes. The goal is not merely to find a number but to validate a company's legitimacy. In global markets, for example, a trade license Dubai online check serves a similar purpose: confirming corporate identity via a trusted source.

This lookup should become an institutional reflex—the starting point of a comprehensive intelligence workflow. That nine-digit number is the key that unlocks a universe of data, enabling a complete picture of risk and opportunity.

Mastering DUNS Verification for Proactive Risk Mitigation

Locating a company's D-U-N-S® Number is the first step. The critical function—the one that protects the bank's balance sheet—is verification. For banking professionals, this is not a compliance exercise but a strategic imperative to prevent fraud and ensure regulatory adherence. A standalone number is merely data; its validation transforms it into actionable intelligence.

During new client onboarding, the D-U-N-S Number provided must be cross-referenced against the official Dun & Bradstreet database. Key verification points include the legal business name, physical address, and corporate structure. Even minor discrepancies can signal significant risk.

From Verification to Actionable Insight

Vigilance is non-negotiable. A prospective borrower listing "ABC Manufacturing Inc." on a loan application when the D-U-N-S record shows "ABC Manufacturing LLC" is not a clerical error. It is a fundamental difference in corporate liability and structure that materially alters the risk assessment.

Similarly, an outdated address may indicate operational disorganization or a deliberate attempt to obscure the true place of business.

The D-U-N-S verification process should be viewed as the first line of defense in the KYC and onboarding workflow. It elevates a compliance task to a strategic advantage, safeguarding the institution from shell companies and other financial threats.

Integrating Verification into Core Workflows

This verification step must be embedded into standard operating procedures, becoming an automatic action for the entire team. Consider a relationship manager assessing a $2,500,000 credit application. That manager should be able to verify D-U-N-S details within minutes, confirming the entity’s legitimacy before committing further institutional resources to the deal.

This rigorous, upfront diligence is how high-quality commercial portfolios are built. When every client record is anchored to a verified D-U-N-S Number, the institution creates the clean data foundation required for advanced analytics. Platforms that leverage Dun & Bradstreet data can then provide a deeper understanding of market dynamics, enabling teams to benchmark performance and act on opportunities with confidence.

What to Do When a Company Lacks a D-U-N-S® Number

Inevitably, your team will encounter a prospective client without a D-U-N-S® Number. This is not an automatic disqualifier but a scenario that requires a clear, strategic response.

The initial step is to determine the reason. Is the company a new venture, a sole proprietorship, or simply unfamiliar with the D&B system? These are common and legitimate explanations. A mature, established business that lacks a formal credit identity, however, warrants deeper scrutiny.

Transforming a Data Gap into a Strategic Advantage

The most effective response is to guide the business toward registration. This should be framed not as a hurdle, but as a value-added service that strengthens their financial standing. Explain that a D-U-N-S Number is the first step to building a robust business credit file, which can unlock more favorable financing terms and foster a transparent, durable banking relationship.

By adopting a policy that encourages D-U-N-S registration, a bank establishes profound data consistency across its portfolio. This streamlines future credit assessments, sharpens risk modeling, and provides a clean, reliable dataset for market analysis.

The Strategic Payoff of Data Integrity

Consider the long-term impact. If a bank onboards 100 new small business clients in a year and 20% lack a D-U-N-S Number, it faces a choice: allow that data gap to persist or guide those 20 clients through registration. Achieving uniform indexing across the entire cohort is a strategic victory.

This is where data intelligence platforms like Visbanking deliver exponential value. With standardized identifiers in place, a bank can benchmark cohort performance, analyze market penetration, and identify cross-sell opportunities with a precision that is otherwise unattainable.

For clients ready to proceed, our guide on how to get a DUNS number provides clear instructions. Assisting a client in obtaining a D-U-N-S Number strengthens their business and fortifies your bank’s data foundation.

Turning DUNS Data into a Competitive Advantage

Finding a D-U-N-S® Number is step one. The strategic imperative is to use it as a master key to unlock a holistic view of clients, prospects, and the broader market. The number is the thread that connects disparate data points into a coherent intelligence picture.

When integrated into a banking intelligence system, a D-U-N-S Number can instantly synthesize information from FDIC call reports, UCC filings, and SEC disclosures for a single business entity. This capability elevates the process from simple data retrieval to genuine strategic insight.

From Identifier to Intelligence

Let's consider a practical application. A bank is evaluating a mid-market manufacturing firm for a $15,000,000 line of credit. With an integrated platform, the firm's D-U-N-S Number does more than confirm its identity. It populates a dashboard revealing the company's complete lending history with other financial institutions, highlights recent executive changes, and flags potential regulatory issues.

This represents the shift from reactive data review to proactive, predictive analysis. The bank is no longer just seeing data; it is identifying signals that sharpen credit decisions and accelerate the underwriting process.

This is how a true competitive advantage is forged. It refines prospecting, enables more substantive client conversations, and ultimately drives profitable growth. The manual task of finding a D-U-N-S Number is merely the entry point. The strategic goal is to leverage platforms that convert that identifier into decisive, actionable intelligence.

Key Executive Questions on the DUNS Number System

For banking leaders, precise understanding of business identifiers is crucial. Here are direct answers to common questions regarding the D-U-N-S® Number.

Is a DUNS Number a Legal Requirement for All Businesses?

No. There is no statute mandating that every business must obtain a DUNS Number to operate. It is, however, a de facto global standard for commerce. Its use was essential for U.S. federal government contractors until April 2022, and today, many lenders and suppliers require it for credit applications and contracts. For banks, using the DUNS system is a best practice for robust commercial due diligence.

Can a Business’s DUNS Number Change?

Rarely. The D-U-N-S Number is designed to be a permanent identifier for a business entity at a specific physical location, which is the source of its value as a data anchor. However, a significant corporate event such as a merger, acquisition, or headquarters relocation can result in the issuance of a new D-U-N-S Number for the new or relocated entity. This necessitates periodic data hygiene to ensure the number on file remains accurate.

For bank executives, the stability of the DUNS Number is its primary asset. It provides a consistent anchor for tracking a client's performance through economic cycles, but its integrity depends on confirming its validity during pivotal events.

How Is a DUNS Number Different from a Tax ID Number?

The distinction is critical. A D-U-N-S Number is a global business identifier issued by Dun & Bradstreet for commercial credit and identity verification. An Employer Identification Number (EIN) is a federal Tax ID issued by the U.S. Internal Revenue Service (IRS) exclusively for tax administration purposes. Though both are typically nine digits, their functions are entirely separate. A bank requires both to build a complete client profile—one for risk assessment and identity resolution, the other for tax and regulatory compliance.

At Visbanking, we transform these foundational identifiers into strategic intelligence. By integrating D-U-N-S data with thousands of regulatory and market sources, we provide banking teams with the clarity required to act decisively. Explore our platform to see how unified data can drive your institution's growth.