A Strategic Guide for Bank Executives on How to Find a DUNS Number

Brian's Banking Blog

For immediate verification, the fastest method to find a D-U-N-S number is the free lookup tool on the Dun & Bradstreet (D&B) website. Input the company’s precise legal name and official address to retrieve its unique nine-digit identifier.

D-U-N-S Numbers: A Strategic Asset for Banking Decisions

For banking executives, a D-U-N-S number is not merely an administrative detail; it is the master key to a commercial client's comprehensive financial narrative. This identifier is the linchpin for critical banking functions, from assessing creditworthiness and executing due diligence to identifying untapped growth opportunities. It serves as the universal translator that consolidates disparate data points into a single, coherent business identity.

Established in 1963, the Data Universal Numbering System (D-U-N-S) remains the global standard for business identification. Today, the D&B database contains over 500 million records, cementing its position as the definitive source for entity verification worldwide.

Dun & Bradstreet’s platform is the primary source for D-U-N-S number management. Its focus on providing data and analytics to drive confident business decisions aligns directly with a bank’s requirement for reliable client intelligence.

Turning an Identifier into Actionable Intelligence

How does this identifier translate into decisive action? A D-U-N-S number provides direct access to tangible, actionable intelligence.

For example, a commercial loan officer can use it to instantly pull a D&B PAYDEX score. A PAYDEX score of 75 indicates the prospect pays, on average, five days before terms are due—a strong positive signal. Conversely, a score below 50 is a definitive red flag for consistent late payments. This single metric can materially alter a lending decision. Leading data platforms, like a sophisticated CRM for investment banks, centralize this client data, using the D-U-N-S number as the foundational element for deeper analysis.

For a bank executive, understanding a client's D-U-N-S is the first step toward transforming a simple identifier into a comprehensive risk and opportunity profile.

At Visbanking, we view this identifier as a gateway. It enables us to fuse D&B data with FDIC call reports and UCC filings, creating a complete, actionable picture of your commercial relationships. For a deeper analysis, see our guide on what a D-U-N-S number means for your bank. Our platform is engineered to connect these dots, empowering your institution to benchmark clients, mitigate risk, and pinpoint prime growth opportunities with precision.

How to Efficiently Locate a Client's D-U-N-S Number

For relationship managers and business development officers, obtaining a client's D-U-N-S number must be a swift, efficient process. Time spent searching for this identifier is time not spent on strategy or client engagement.

Several reliable methods exist. The key is knowing which to use first and what information is required. The most direct path is the Dun & Bradstreet lookup tool. It is free, authoritative, and should be your initial step. However, precision is critical: you must use the client’s exact legal business name and official physical address. Using a DBA ("doing business as") name or an incorrect address will yield no results and waste valuable time.

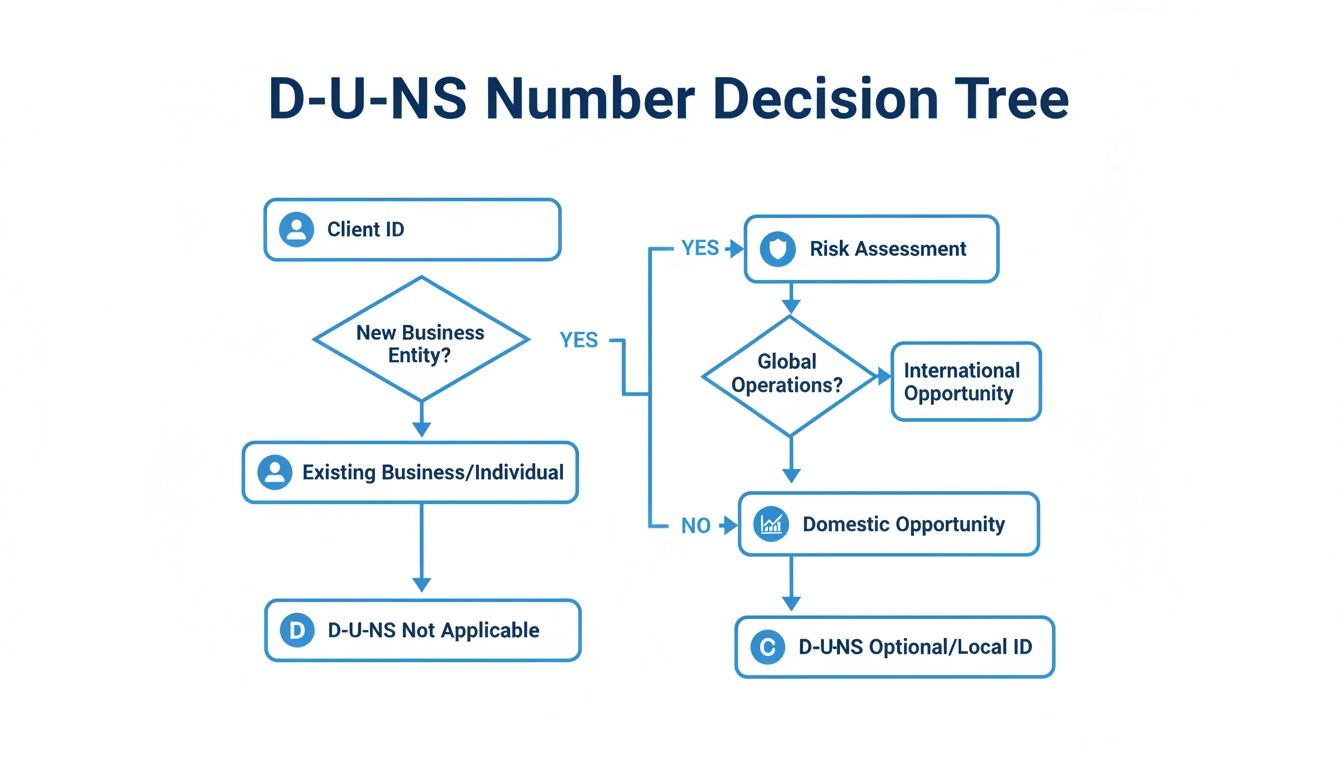

This flowchart outlines the decision-making process, illustrating how finding the D-U-N-S number is the critical first step toward comprehensive risk assessment and opportunity analysis.

This process is not an administrative chore; it is the strategic key that unlocks a deeper level of data intelligence.

This process is not an administrative chore; it is the strategic key that unlocks a deeper level of data intelligence.

Alternative Sourcing Methods

Before turning to external tools, consult your bank's internal records. This data is often captured during client onboarding. Key documents include:

- Original credit applications: A standard field on most commercial loan documents.

- Legal agreements: Review master service agreements or major contracts.

- Treasury management setup forms: A common requirement for ACH or wire services.

For clients engaged in federal contracting, the System for Award Management (SAM.gov) is another robust source. Although the government now uses the Unique Entity ID (UEI), D&B remains the validation service, and a SAM.gov search can often reveal the associated D-U-N-S number.

To clarify these options, consider the following comparison.

D-U-N-S Number Search Method Comparison

This table outlines the optimal approach based on available information and urgency.

| Method | Required Information | Typical Speed | Best For |

|---|---|---|---|

| Dun & Bradstreet Lookup | Exact legal name & physical address | Instant (if successful) | Quick, direct verification with precise client details. |

| Internal Bank Records | Client name or account number | Minutes to hours | Existing clients where the number was captured during onboarding. |

| SAM.gov Search | Company name or CAGE code | Near-instant | Clients known to be government contractors or grant recipients. |

| Visbanking Platform | Company name, D-U-N-S, or other identifiers | Instant | Integrating the D-U-N-S number with a full suite of regulatory and market data. |

The optimal method is the one that delivers accurate information most efficiently, allowing your team to focus on strategic analysis.

Finding the D-U-N-S number is step one. The static identifier is the entry point; the real value lies in the dynamic data linked to it.

This is where a platform like Visbanking provides a decisive advantage. We don't just help you find the number; we connect it to a universe of regulatory and market data. By linking that single identifier to FDIC call reports, UCC filings, and more, we transform a simple lookup into a complete, 360-degree client profile. To see this in action, learn how to look up a company using a D-U-N-S number and elevate your performance benchmarking.

The Critical Importance of Verification

Finding a D-U-N-S number is only the preliminary step. The essential work begins with verification, which underpins sound financial decisions. An unverified number is a potential liability in risk modeling. A verified one is the foundation for accurate underwriting and a clear view of client opportunities. Verification ensures the number corresponds to the correct legal entity, mitigating costly errors in underwriting and compliance.

The verification process is straightforward. A best practice is to cross-reference the D-U-N-S record with the official Secretary of State business registry where the company is incorporated. This confirms the legal name, status, and address. Your bank's own client onboarding records provide another layer of confirmation.

From Verification to Actionable Intelligence

Once verified, the number becomes a powerful analytical tool. This is where data drives action. A relationship manager can use the number to instantly access a client’s comprehensive Dun & Bradstreet report. This goes beyond a basic credit check, providing deep insights into the business’s operational and financial health. Critical metrics become available:

- D&B PAYDEX® Score: An 80 indicates consistent on-time payments, whereas a score below 50 signals payment delinquency. This distinction is fundamental to risk assessment.

- Corporate Linkage: Instantly visualize complex ownership structures, parent companies, and subsidiaries to understand the full scope of a relationship and its associated risks.

- Financial Stress Score: Predicts the probability of severe financial distress within the next 12 months, offering a forward-looking perspective that historical financials cannot provide.

Benchmarking and Strategic Growth

With verified data, your team can shift from a reactive to a proactive stance. Consider a commercial lender evaluating a manufacturing client with $10,000,000 in annual revenue. By benchmarking this client against industry peers, the lender might discover their payment score is in the top quartile, yet they lack a significant line of credit. This is not a risk to be managed, but a clear, low-risk growth opportunity.

The D-U-N-S number is more than an administrative requirement; it is a strategic asset. This system has enabled over 587 million businesses globally to establish credibility and access capital, fundamentally shaping modern commerce. Learn more about how this system became the standard for business identity.

This level of insight is precisely what the Visbanking platform is designed to deliver. We integrate Dun & Bradstreet data with regulatory filings and market intelligence, enabling your bank to benchmark clients and identify strategic moves with unparalleled clarity and speed.

Managing Missing or Inaccurate D-U-N-S Information

Inevitably, an underwriter or relationship manager will encounter a client whose D-U-N-S information is missing or outdated. This is not a minor inconvenience; it is a significant operational risk that can corrupt risk models, pollute CRM data, and negatively impact portfolio health.

When a high-value commercial prospect lacks a D-U-N-S number, your team must guide them. The standard process involves requesting a new number from Dun & Bradstreet, which can take up to 30 business days—a timeline that can jeopardize a time-sensitive deal. For urgent cases, D&B offers expedited services for a fee, delivering the number in a few business days.

Correcting Inaccurate Data

More frequently, a D-U-N-S number is associated with incorrect data—a legal name change, a former headquarters, or an executive who departed years ago. This outdated information degrades risk assessments and creates compliance vulnerabilities.

For example, if a client’s address is incorrect, your bank may miss critical UCC filings, resulting in a skewed picture of existing liens. The client must submit an update request through Dun & Bradstreet’s online portal. Ensuring the accuracy of this data is essential for the integrity of your bank’s decision-making engine.

Assisting a client in correcting their D-U-N-S registration is not administrative support; it is a value-add service that demonstrates a commitment to their success and strengthens the banking relationship.

This is where reliance on static data points gives way to a dynamic intelligence platform. Visbanking provides a live, synthesized view by integrating multiple data sources. When a client’s D-U-N-S information is updated, our system reflects it immediately, ensuring your team operates with the most current and reliable intelligence. Check out how our unified data helps benchmark performance and crush risk.

From Identifier to Intelligence: The Modern Banking Advantage

To be clear: mastering "how to find my D-U-N-S number" is merely the first rung of the ladder. For banking leaders, the power is not in the nine-digit code but in the intelligence it unlocks. The D-U-N-S number is the key to an ecosystem of data, transforming a simple identifier into a strategic asset. It is the thread that weaves scattered datasets into an actionable picture of risk and opportunity.

Unifying Data for Predictive Insight

Leading banking platforms must move beyond simple lookups. The strategic imperative is to integrate D-U-N-S-linked corporate data with other sources to identify predictive signals before they become market trends.

Consider the power of integrating these data points:

- Regulatory Filings: Combining D-U-N-S data with FFIEC and NCUA 5300 call reports provides a validated, regulator-vetted view of a company’s financial health and business relationships.

- Market Data: Integrating SBA and HMDA data reveals a client's market position, complete loan history, and competitive standing.

- People Data: Layering in executive profiles and professional networks identifies the key decision-makers and influencers essential for strategic engagement.

This integrated approach creates a sustainable competitive advantage and exemplifies how unlocking business growth with customer data has become essential for modern financial institutions.

A standalone D-U-N-S number offers a snapshot. An integrated one provides the entire film, revealing trends, predicting behavior, and highlighting opportunities before your competitors see them.

This framework shifts your institution from being reactive to being intelligence-driven. Visbanking was built for this purpose. We provide the tools not just to find the number, but to connect it to a universe of intelligence. Explore our platform to see how unified data can redefine performance benchmarking, sharpen prospecting, and fortify risk management.

D-U-N-S Numbers: Executive Q&A

In commercial banking, D-U-N-S numbers raise high-stakes questions. Below are direct answers to common executive inquiries.

Is a D-U-N-S Number Still Required for Government Contracts?

The U.S. government has transitioned to the SAM.gov Unique Entity ID (UEI) as the primary identifier for federal awards. However, Dun & Bradstreet remains the entity validation service provider for the government. Consequently, obtaining a D-U-N-S number is often the foundational step to acquiring a UEI. For banks, it remains a critical data point for assessing the creditworthiness and history of any client operating in the public sector.

How Long Does It Take for a Business to Get a D-U-N-S Number?

Standard issuance of a free D-U-N-S number from Dun & Bradstreet typically takes up to 30 business days. For time-sensitive transactions where a delay is unacceptable, D&B offers expedited services that can deliver a number in a few business days for a fee. This is a critical detail for relationship managers onboarding new commercial clients who require immediate access to credit or other banking services.

Can I Find a D-U-N-S Number for an International Company?

Yes. The D-U-N-S system is a global standard, with millions of businesses registered worldwide. Dun & Bradstreet’s global lookup tools can be used to find and verify numbers for international entities. This capability is essential for banks involved in international trade finance, performing due diligence on foreign partners, or serving multinational corporations.

A client with a D-U-N-S number demonstrates a level of operational maturity. It enables a cleaner assessment of commercial credit risk by separating the business's credit file from the owner's personal financial history.

Does a Small Business or Sole Proprietorship Need a D-U-N-S Number?

While not always a strict legal requirement, it is highly advisable. A D-U-N-S number establishes a distinct credit file for the business, separate from the owner's personal credit. From a lender’s perspective, this separation is fundamental to accurately underwriting small business loans and lines of credit. Advising a small business client to obtain one is a value-add service that improves risk assessment for your institution.

At Visbanking, we transform identifiers into intelligence. Our platform connects D-U-N-S-linked data with regulatory filings and market signals to give your institution a decisive edge. Explore how Visbanking can help you benchmark performance and uncover new opportunities.