Data as a Service: The Decisive Edge for Banking Leaders

Brian's Banking Blog

In banking, the mandate for faster, more intelligent decisions is absolute. Data as a Service (DaaS) represents the critical evolution from possessing raw information to commanding curated, actionable intelligence on demand. It is the capability that transforms disconnected data points into a unified, strategic asset for your leadership team.

From Data Overload to Decisive Action

Many banks are drowning in data yet starved for insight. Legacy systems and siloed information do not create foresight; they create friction, leaving executives to make critical calls with an incomplete picture. The core problem is not a lack of data—it is the operational drag of making it useful.

Valuable executive and analyst time is consumed wrestling with cumbersome spreadsheets and assembling reports from disparate sources. This methodology is untenable when competitors can identify market shifts and seize opportunities in minutes, not weeks.

The Strategic Shift to Intelligence on Demand

A Data as a Service model fundamentally alters this dynamic. Consider it a utility—a reliable, always-on resource your team can access instantly. Instead of consuming your best analysts' time with the low-value work of data aggregation and cleansing, DaaS delivers analysis-ready intelligence directly to them.

Consider a practical scenario: a board meeting is in two days. You require a peer analysis comparing your loan growth and net interest margin against a specific competitor set over the last three years.

- The Legacy Method: An analyst spends days extracting separate FDIC call reports, manually keying figures into a spreadsheet, verifying for errors, and finally, constructing charts. The resulting report is static and immediately dated. For a mid-sized bank, this process can easily consume 40 analyst hours, representing a direct cost of over $4,000 for a single report.

- The DaaS-Powered Method: Using an intelligence platform like Visbanking, you generate that same board-ready analysis in under five minutes. The data is current, validated, and instantly benchmarked.

This is the competitive advantage. By shifting your team’s focus from data preparation to strategic application, they can concentrate on what drives value: interpreting trends, anticipating market movements, and executing confident, data-backed decisions.

The objective is to spend less time managing data and more time acting on it. DaaS eliminates the operational friction between your bank’s data and its strategic potential, converting a reactive process into a proactive capability.

This is not an IT project; it is a strategic imperative. The ability to rapidly connect performance metrics, market opportunities, and competitive threats provides leadership with the clarity to act decisively. Explore Visbanking's data to benchmark your institution and begin turning intelligence into action.

What Data as a Service Means for Your Bank

Managing all institutional data in-house is analogous to building a private power plant to keep the lights on. It is a massive capital and operational expenditure—complex, costly, and a significant distraction from the core business of banking.

Data as a Service (DaaS) provides the intelligent alternative. It is equivalent to plugging into the utility grid. You receive precisely the power you need, on demand, without the burden of operating the plant. It marks a fundamental shift from building data infrastructure to consuming intelligence.

Subscribing to Intelligence, Not Just Data

This is the key distinction for bank leadership. With DaaS, you are not merely purchasing raw data feeds. A provider like Visbanking performs the heavy lifting: aggregating, cleansing, and structuring vast quantities of data from sources like the FDIC, NCUA, and SEC.

The value is not the raw information; it is the "service" of having curated, analysis-ready intelligence delivered directly into your decision-making workflows.

You are not buying raw data; you are subscribing to an institutional intelligence capability. This is the pivot that moves your organization from being data-rich to insight-driven.

This is rapidly becoming the industry standard. The global DaaS market was valued at $14.36 billion in 2023 and is projected to reach $17.38 billion in 2024, signaling a definitive industry move toward outsourced intelligence.

This model flips the resource allocation paradigm. Instead of analysts spending 80% of their time preparing data, they can now invest 80% of their time acting on it. This is a strategic force multiplier.

From Operational Burden to Strategic Asset

Let's examine the practical implications by comparing the legacy model with the DaaS approach.

Traditional Data Management vs. Data as a Service

| Attribute | Traditional In-House Approach | Data as a Service (DaaS) Model |

|---|---|---|

| Time to Insight | Weeks or days. Analysts manually collect, clean, and merge data from multiple sources like call reports and internal systems. | Minutes. Access pre-validated, unified datasets for immediate peer benchmarking, market analysis, or board reporting. |

| Resource Cost | High. Requires dedicated IT staff, data engineers, expensive software licenses, and ongoing infrastructure maintenance. | Predictable subscription. Eliminates capital expenditure on hardware and reduces specialized staffing requirements. |

| Strategic Focus | Data preparation. Teams are bogged down in the mechanics of data wrangling, reacting to requests rather than identifying opportunities. | Data application. Teams focus on high-value analysis, identifying competitive threats, and uncovering growth opportunities. |

| Data Governance | Fragmented. Managing compliance and security across siloed data sources is a constant challenge. | Centralized and Secure. Providers manage data pipelines with built-in security and auditability, simplifying governance. |

The DaaS model liberates your institution from the technical grind, allowing a singular focus on strategic outcomes.

Of course, this shift must occur within a complex regulatory framework. DaaS adoption must align with data privacy laws and robust information security standards. A qualified DaaS partner simplifies this. A well-architected service ensures that strong principles of data governance in banking are embedded from inception.

Ultimately, DaaS is the mechanism for converting data from a costly operational burden into your most powerful strategic asset. When you need to benchmark your efficiency ratio or identify the next major commercial lending opportunity, the answer should be seconds away, not weeks.

Calculating the ROI of a DaaS Strategy

For bank executives, every strategic investment must demonstrate a clear path to the bottom line. Data as a Service (DaaS) is not an abstract IT initiative; it is a direct investment in operational efficiency, accelerated growth, and proactive risk management. The return is tangible and measurable across the three core pillars of your institution.

This is not theoretical. The Banking, Financial Services, and Insurance (BFSI) sector alone constituted $2.53 billion of the DaaS market in 2023. The total market is projected to grow by $40.76 billion between 2024 and 2029. This momentum underscores the industry's direction.

You can review the complete analysis of DaaS market trends on fortunebusinessinsights.com.

Pillar 1: Supercharging Operational Efficiency

The most immediate return from a DaaS strategy is the elimination of low-value work consuming your analysts' time. Consider the routine task of preparing a quarterly peer performance report for the board. This currently involves manual downloads of FDIC call reports, painstaking data entry into spreadsheets, and chart creation.

- Before DaaS: An analyst team might spend 500 hours per quarter aggregating and preparing this data. At a loaded cost of $100 per hour, this represents $50,000 per quarter—or $200,000 annually—spent on data preparation, not analysis.

- After DaaS: With an intelligence platform like Visbanking, those same board-ready reports are generated in minutes. This frees up nearly all 500 hours for high-value work: identifying performance gaps, modeling "what-if" scenarios, and providing actionable strategic recommendations.

This reclaimed time is a direct, hard-dollar labor saving. More importantly, it transforms your analytical function into a strategic asset.

The primary ROI from DaaS is measured in reclaimed hours. It elevates your sharpest analysts from data janitors to strategic advisors, directly fueling the quality and velocity of every executive decision.

Pillar 2: Accelerating Commercial Growth

A DaaS platform extends beyond internal process optimization. It equips your front-line teams with the intelligence to win high-value commercial relationships. In banking, growth is a function of speed and precision—knowing which prospects to target, understanding their needs, and engaging them before competitors.

A DaaS-powered tool, such as Visbanking’s Prospect module, consolidates disparate public datasets into a clear map of opportunity. Imagine your commercial lending team wants to identify businesses with immediate borrowing needs.

Instead of undirected cold calls, they can instantly identify companies with recent UCC filings or active SBA loans. They can map existing relationships and pinpoint key decision-makers. This transforms a low-probability outreach into a targeted, intelligence-led conversation. This methodology can increase qualified commercial leads by 30% or more and significantly shorten sales cycles by removing guesswork.

Pillar 3: Proactive Risk Management

The final, most critical return is proactive risk management. A single, real-time view of market and counterparty data reveals early warning signs that are invisible within siloed data environments.

For example, by integrating market data with a commercial borrower's financial filings, a DaaS system can flag deteriorating conditions months before they would surface in a standard review. Averting a single multi-million-dollar loan default can fund an entire data intelligence investment for years.

These returns all derive from a single capability: having clean, connected data available for critical decisions. A crucial first step is to benchmark your performance with Visbanking’s data.

How DaaS Drives Bank Performance

Theory is insufficient; results are what matter. For bank executives, the true measure of a Data as a Service (DaaS) strategy is its impact on the balance sheet and competitive position. A robust DaaS platform is not about data collection; it is about converting abstract data points into direct, decisive action across your most critical operations.

Modern banking intelligence platforms, like Visbanking's Bank Intelligence and Action System (BIAS), are engineered to deliver these outcomes. They provide focused, workflow-ready applications designed to solve specific, high-value challenges where speed and accuracy are paramount.

From Weeks of Analysis to Seconds of Insight

Strategic planning and board reporting have historically been resource-intensive endeavors. The fundamental task of benchmarking against peers—a critical prerequisite for goal-setting—could consume an analyst for weeks of manual FDIC call report extraction, spreadsheet manipulation, and data verification.

A DaaS-powered system collapses this timeline from weeks to seconds.

Imagine the board requests an analysis of your bank's Return on Assets (ROA) and efficiency ratio against the top quartile of community banks in your state over the past five years.

- The Old Way: An analyst invests 40+ hours downloading individual call reports, normalizing data, calculating peer group averages, building charts, and formatting a presentation. The final report is a static snapshot, obsolete upon the next quarterly data release.

- The DaaS Way: Using Visbanking’s Bank Performance module, you select your peer group from over 4,600 institutions, choose your metrics (ROA, efficiency ratio), and define the timeframe. The system instantly generates a dynamic, board-ready analysis.

The primary benefit is not just time savings; it is the elevated quality of the strategic discussion. Instead of debating data accuracy, your leadership team can immediately address the critical questions: Why is our efficiency ratio lagging, and what levers can we pull to correct it?

Pinpoint Your Next High-Value Commercial Client

In commercial lending, growth is predicated on identifying and engaging the right clients before competitors. Traditional prospecting is an inefficient mix of fragmented data and anecdotal leads.

DaaS inverts this model by unifying disparate public data sources—such as UCC filings, SBA loan records, and corporate registrations—into a single, searchable intelligence layer. This enables lending teams to become proactive.

For example, a commercial loan officer using Visbanking’s Prospect module can set an alert for any local business that files a UCC-1 financing statement with a competitor. This filing is a clear indicator of a borrowing need. The platform can then instantly surface the company's executives, their professional network, and any existing ties to your bank. A cold call becomes a warm, data-informed conversation, dramatically increasing the probability of winning the business. This is how leading banks are increasing qualified leads by 30% or more.

This process is powered by a feature store—a central repository of curated data points ready for immediate analysis. To understand the underlying technology, see our guide on what a feature store is.

Recruit Top-Tier Talent with Surgical Precision

Ultimately, a bank's performance is driven by its people. The competition to attract and retain high-performing loan officers and wealth managers is intense. A DaaS approach provides a significant advantage in this war for talent.

Visbanking’s Talent module, for instance, is built on a professional graph of over 2.6 million banking professionals. Instead of sifting through generic LinkedIn profiles, you can identify individuals with the specific, proven track records you require. A bank seeking to expand its C&I lending portfolio can pinpoint loan officers at competing institutions who consistently originate high-value deals in that exact vertical.

This precision targeting eliminates guesswork from recruiting, reduces acquisition costs, and helps ensure you build the team capable of executing your strategic vision. Each of these examples—strategic planning, commercial prospecting, and talent acquisition—draws a direct line from unified data to superior business outcomes.

Ready to see how your institution measures up? Benchmark your bank's performance against any peer group and start turning data into your most valuable asset.

A Leadership Roadmap for DaaS Implementation

Integrating Data as a Service (DaaS) into your bank is a strategic initiative, not an IT project. Success requires a focused, leadership-driven roadmap that demonstrates value quickly and secures institutional buy-in. The objective is to embed data intelligence so deeply into the bank’s operating rhythm that it becomes the default for every significant decision.

For many banks, this journey involves a strategic assessment of the current technology stack and often includes targeted legacy system modernization strategies. The approach is not a disruptive overhaul but a disciplined, phased integration of superior data into the daily workflows that drive the bottom line.

Secure an Early Win with a Pilot Project

The fastest path to enterprise adoption is delivering tangible results. Initiate with a high-value, high-visibility pilot project that clearly demonstrates the power of clean, unified data. Focus on a specific, measurable pain point.

Strong candidates for a pilot include:

- Streamlining Board Reporting: Automate the multi-day process of creating peer analysis and performance dashboards into an on-demand report.

- Accelerating Commercial Prospecting: Equip a small team of lenders with a DaaS-powered tool to target the best commercial clients in a key market.

- Enhancing M&A Due Diligence: Utilize a unified data platform to gain a rapid, comprehensive view of a potential acquisition's financial health and market position.

A successful pilot not only proves the concept but also creates internal champions who will advocate for broader adoption.

Define and Measure What Matters

From the outset, establish clear Key Performance Indicators (KPIs) that link the DaaS initiative to measurable business outcomes. This shifts the conversation from technology features to financial impact.

The goal is not merely to install a new platform; it is to drive specific, concrete improvements. KPIs provide the evidence that your investment is generating returns and will guide the expansion of the strategy.

Establish specific and aggressive KPIs:

- Efficiency: Reduce time spent on peer analysis and board reporting by 90%.

- Growth: Increase qualified commercial leads generated by the pilot team by 25% within six months.

- Risk: Decrease the time required for an initial credit risk assessment on new prospects by 50%.

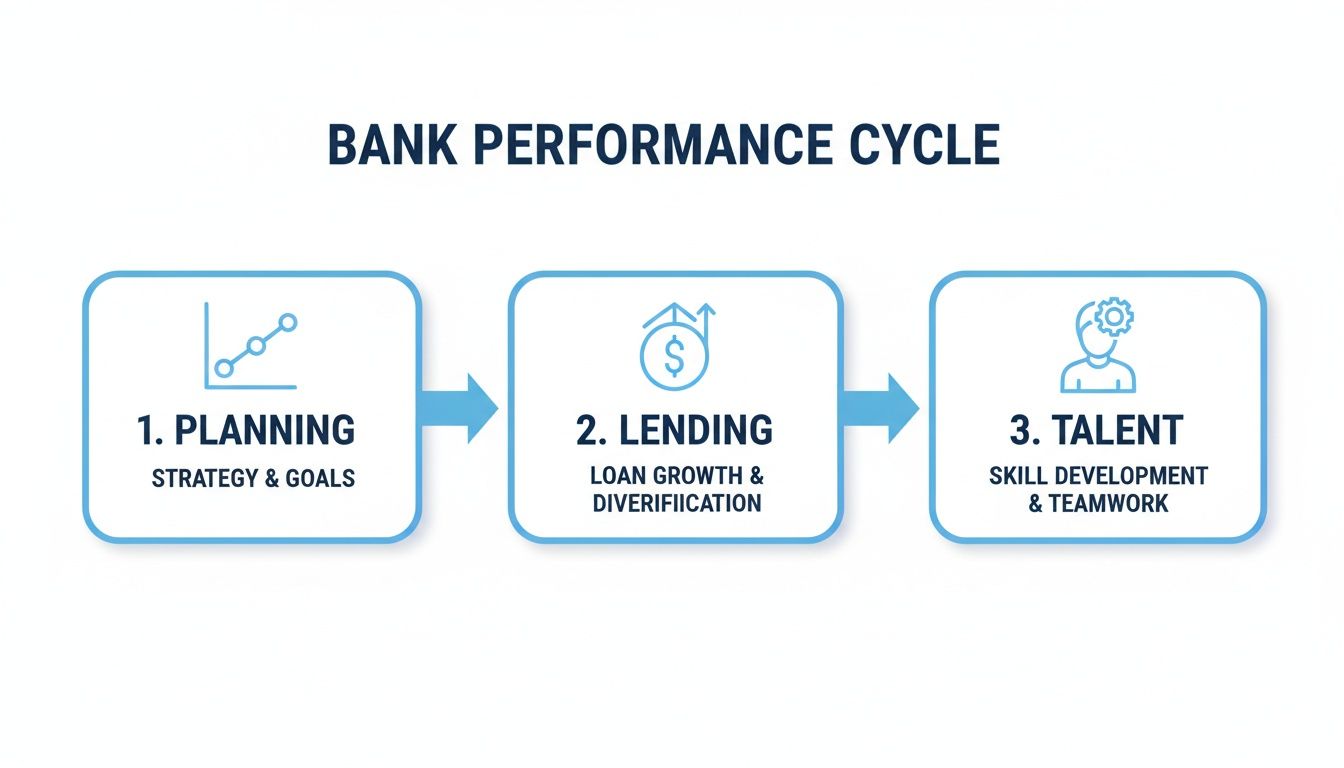

The diagram below illustrates how DaaS serves as the foundation for core banking functions—from strategic planning to lending and talent.

This cycle demonstrates how integrated data intelligence connects strategic planning, lending execution, and talent management into a unified, performance-driven engine.

Choose the Right Partner and Champion Adoption

Your choice of partner is critical. You require a provider with deep banking industry expertise—one that offers analysis-ready applications, not just raw data feeds that create new integration challenges. A partner like Visbanking delivers curated intelligence that plugs directly into banking workflows, enabling your team to act on insights immediately. This is built upon a solid foundation of effective financial data integration.

Finally, implementation must be championed by leadership. Actively integrate these new data-driven insights into daily routines, from the boardroom to the weekly sales meeting. The moment data becomes the expected standard for substantiating a proposal or defending a decision, you have achieved a true transformation.

Making Your Next Strategic Move Data-Driven

In the current banking environment, the velocity and quality of decisions are paramount. Every major strategic choice must be supported by solid, accurate, and timely intelligence.

This is the role of Data as a Service (DaaS). It is the connective tissue that links scattered data points into a coherent, strategic picture. It elevates strategy from an exercise in intuition to a precise discipline.

With on-demand intelligence, you cease reacting to the market and begin to proactively shape it. DaaS reduces operational friction, fuels sustainable growth, and provides a clearer view of risks and opportunities on the horizon.

The True Cost of Inaction

For a bank's board and executive team, the relevant question is no longer about the cost of adopting a DaaS platform. The real question is the opportunity cost of maintaining the status quo.

Relying on slow, disconnected, and manual data processes is a strategic choice that cedes ground to competitors daily.

How many high-value commercial relationships were missed because your team could not identify them first? How much capital is allocated inefficiently because your peer analysis is three weeks out of date? Each instance represents a tangible loss to the bottom line, caused directly by an obsolete approach to data.

Adopting a platform like Visbanking's BIAS is not an operational expense. It is a critical investment in your bank's future competitiveness. It shifts your team's focus from low-value data preparation to high-impact strategic action.

Turning Data into a Decisive Weapon

A robust DaaS strategy delivers a clear and compounding advantage. It provides your teams with the ability to anticipate customer needs, the agility to move faster than competitors, and the confidence to act decisively on data-backed opportunities.

Consider the impact:

- Decisiveness: When a board member's question can be answered in minutes instead of days, the entire strategic planning cycle accelerates.

- Precision: Targeting the right commercial clients or recruiting top-tier talent ceases to be guesswork and becomes a science.

- Foresight: Connected data reveals subtle risk indicators and market shifts long before they become existential threats or missed opportunities.

The time has come to stop managing data and start deploying it as your most powerful strategic asset. When your entire leadership team operates from a single source of truth, every decision becomes sharper, faster, and more impactful.

It is time to make data your decisive weapon. The first step is to establish a clear baseline. Benchmark your bank’s performance against your peers and discover what a truly data-driven strategy can reveal.

Frequently Asked Questions About DaaS in Banking

As bank executives and directors evaluate strategic options, several key questions about Data as a Service (DaaS) consistently arise. Clarity on these points is essential for making a confident, informed decision.

How Is DaaS Different From Just Buying Data?

This distinction is critical. Buying data is typically a one-time transaction for a static file. DaaS, conversely, is an ongoing subscription to intelligence.

A DaaS provider delivers a continuous, updated stream of data that has already been cleansed, integrated, and prepared for analysis. For example, instead of receiving a raw FDIC call report file requiring extensive manual sorting, a platform like Visbanking allows you to instantly benchmark your loan growth against a custom peer group over the last five years. You are not buying raw data; you are subscribing to an analytical capability.

What Are the Security and Compliance Implications?

For any financial institution, security and regulatory adherence are non-negotiable. A qualified data as a service provider does not introduce risk; it helps manage it.

These platforms are built on secure, audited cloud infrastructure (such as AWS or Azure) designed to meet stringent financial services standards. Every data pipeline is auditable, ensuring data integrity and providing a clear chain of custody. This centralized approach is often more secure and governable than managing disparate, siloed data systems in-house.

We Already Have a BI Team, Why Do We Need DaaS?

DaaS is not intended to replace your Business Intelligence or analytics team; it is designed to supercharge them.

Currently, your analysts likely spend up to 80% of their time on data preparation—locating, cleaning, and attempting to merge different datasets. This is a significant resource drain and a misapplication of your best analytical talent. A DaaS platform automates this tedious data engineering work.

By offloading data preparation, you empower your team to shift its focus from building reports to driving business outcomes. Their role elevates from data wrangler to strategic advisor, focused on uncovering the "why" behind the numbers.

This single change can transform your BI function from a reactive cost center into a proactive strategic asset that identifies growth opportunities and mitigates risks before they materialize.

Ready to see how a DaaS approach can transform your bank's performance? Visbanking provides the unified intelligence and actionable insights your leadership team needs to make faster, more confident decisions. Explore Visbanking's data intelligence platform today.

Similar Articles

Visbanking Blog

In the world of banking, digital transformation is no longer a 'nice-to-have'. It's a necessity

Visbanking Blog

Banking Data Analytics: Turning Information Into Profit

Visbanking Blog

Big data in banking – overwhelming or game-changing?

Visbanking Blog

How can data science transform the banking industry?

Visbanking Blog

What do data science and the banking industry have in common?

Visbanking Blog

It’s not just about crunching the numbers

Visbanking Blog

BIAS Unleashed: Transforming Banking in the Digital Age

Visbanking Blog

Unlocking the Power of Multi-Sourced Data: How BIAS Empowers Banks

Visbanking Blog

Why does bank data matter more than you think?

Visbanking Blog