What Is a Feature Store and How Does It Power AI in Banking?

Brian's Banking Blog

To a banking executive, a "feature store" may sound like more technical jargon. In reality, it is the engine powering your bank's entire AI and machine learning strategy.

A feature store is a centralized, governed repository for managing the critical data signals—or "features"—that predictive models rely on. It is the single source of truth where your most valuable data is transformed into ready-to-use intelligence for making high-stakes decisions, from credit risk to fraud detection.

Why a Feature Store Is Your Bank's AI Engine Room

In banking, every decision must be precise, timely, and defensible. The quality of your AI and machine learning outcomes depends entirely on the quality and consistency of the data you feed them. This is where a feature store transitions from an IT concept to a core strategic asset.

At its heart, a feature store solves a critical operational problem: data chaos.

Without one, different departments—risk, marketing, commercial lending—build their own data inputs, often reinventing the wheel. The risk team might calculate a customer's 90-day transaction average for a credit model, while marketing creates a nearly identical metric for predicting churn. This duplication is not just inefficient; it creates dangerous inconsistencies.

The Problem of Inconsistent Intelligence

When data teams work in silos, they inevitably create slightly different versions of the same business metric. One team might exclude pending transactions from a balance calculation, while another includes them.

This leads to models that cannot be reliably compared or trusted. In a heavily regulated industry like banking, that is a critical failure. A feature store eliminates this risk by creating a single, governed definition for every feature.

A feature store acts as a centralized repository, ensuring that a feature like "customer lifetime value" is calculated identically whether it is being used for a loan application, a fraud alert, or a marketing campaign. This consistency is the foundation of trustworthy AI.

From Concept to Core Infrastructure

The need for this centralized system became clear as banks began to scale their AI initiatives. Between 2017 and 2021, feature stores evolved from a novel concept to essential infrastructure.

The reason? Data scientists were spending an inordinate amount of time on redundant data preparation, creating a dangerous gap between how a model was trained and how it performed in the real world.

Understanding how a feature store fits into your bank's broader AI digital transformation is key to unlocking its value. It is about building a data foundation that supports your entire analytics ecosystem. This shift is central to how AI and big data are revolutionizing banking, helping institutions move from reporting on the past to taking proactive, intelligent actions.

This concept of a robust data foundation for AI has a direct impact on how banks operate and compete. To make this tangible, let's examine the specific capabilities a feature store provides and the direct benefits they bring to banking.

Key Feature Store Capabilities for Modern Banking

The table below breaks down the core functions of a feature store and connects them to real-world banking outcomes.

| Capability | Description | Direct Banking Benefit |

|---|---|---|

| Centralized Management | A single, shared repository for all features used in ML models across the bank. | Consistency & Trust: Eliminates duplicate work and ensures that "customer risk score" means the same thing everywhere. |

| Data Governance | Enforces access controls, data quality rules, and standards for feature creation and use. | Compliance & Auditability: Simplifies regulatory reporting and proves data integrity to auditors. |

| Feature Lineage | Tracks the origin and transformation history of every feature, from raw data to model input. | Model Defensibility: Provides a clear, traceable path to explain why a model made a specific decision. |

| Online & Offline Serving | Serves features at low latency for real-time decisions (e.g., fraud) and high throughput for batch jobs (e.g., training). | Operational Agility: Powers both instant, customer-facing applications and large-scale analytical model development. |

| Feature Discovery | Allows data scientists to easily find, understand, and reuse existing, high-quality features. | Faster Innovation: Drastically cuts down model development time, allowing the bank to respond to market changes faster. |

| Monitoring | Actively monitors for data drift and feature quality, alerting teams to potential model degradation. | Proactive Risk Management: Catches data issues before they lead to poor model performance and bad business outcomes. |

These capabilities are not just technical details—they are fundamental enablers of a modern, data-driven banking strategy. They build the trust, speed, and reliability needed to confidently deploy AI in core operations.

At Visbanking, we view the feature store as the engine that drives intelligent action. It provides the vetted, real-time data needed to power our Bank Intelligence and Action System, enabling executives to act on opportunities with speed and confidence.

How a Feature Store Delivers Instant Intelligence

To understand the strategic importance of a feature store, one must look at its architecture. The system is designed for two distinct but equally critical jobs: deep historical analysis and immediate, real-time decision-making. This dual capability is the core advantage that powers smarter banking.

Think of it as having two specialized databases working in perfect harmony.

On one side is the offline store. This is your massive archive, built to hold terabytes of historical data. It is where data science teams train predictive models and where the detailed records required for regulatory audits are maintained.

Then you have the online store, which is optimized for speed. Its sole purpose is to serve pre-calculated features in milliseconds. This is what fuels live decisions, such as approving or denying a credit card transaction at the point of sale.

Balancing Historical Insight with Real-Time Action

Let's use an analogy from within the bank itself. The offline store is like your historical records archive. It contains everything needed for annual reporting, long-term strategic planning, and deep-dive risk assessments. It is comprehensive, but you would not use it to check a customer's current balance.

The online store, on the other hand, is the teller’s terminal. It needs to pull up a customer's live account details instantly to process a withdrawal. It delivers the exact information needed, the second it is needed, with zero delay.

A feature store's architecture uniquely balances the need for large-scale historical analysis with the demand for immediate intelligence. This structure ensures that your long-term strategy and your frontline decisions are powered by the same consistent, high-quality data.

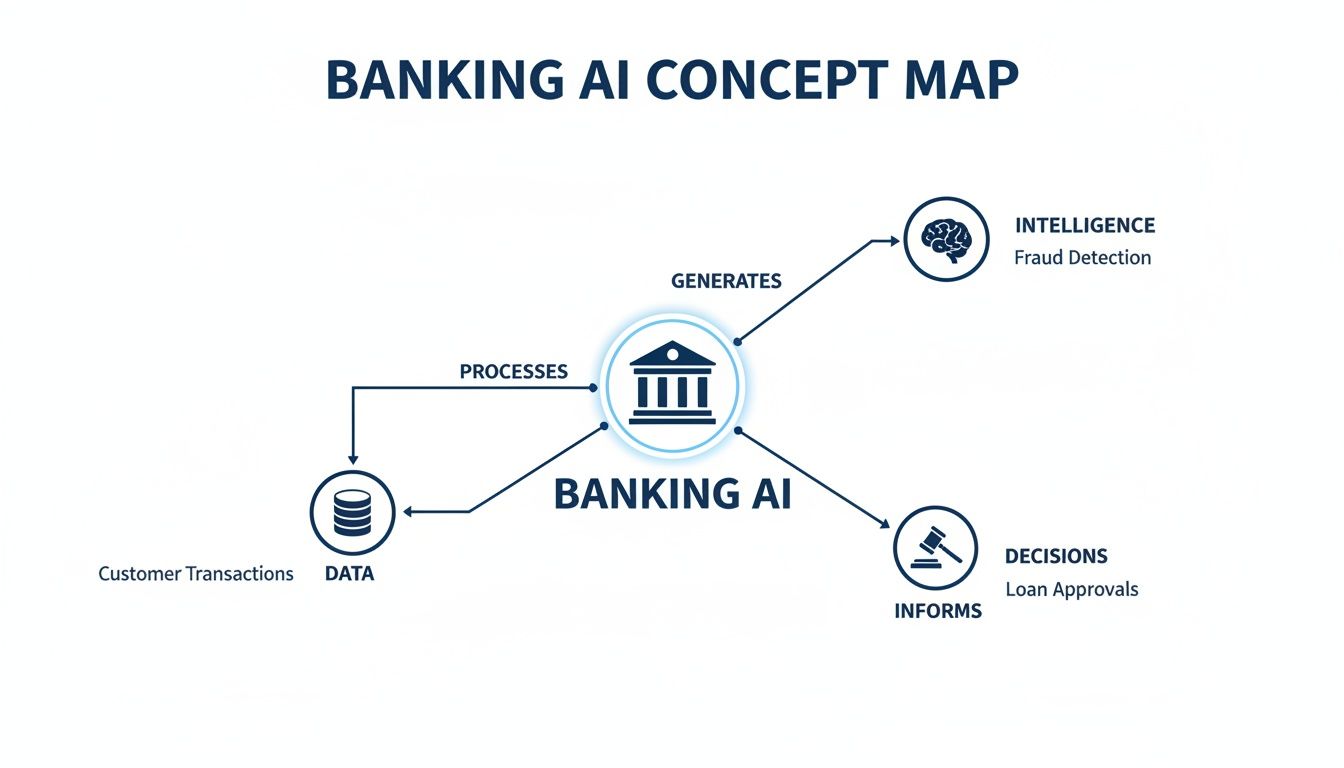

This is what it looks like in practice. You start with raw banking data, transform it into ready-to-use intelligence, and then apply it to critical decisions like stopping fraud or approving loans.

The image makes it clear: the feature store is the engine that turns mountains of data into the specific, timely insights you need to act decisively.

The Governance Layer: A Central Registry

Connecting these two stores is a central feature registry. This is a governed, searchable catalog for every feature. It documents what each data point is, how it was created, who owns it, and how it is being used across the bank.

For bank leadership, this registry is a critical tool for governance and auditability. It guarantees that every data point feeding your most important models is documented, discoverable, and transparent—a non-negotiable requirement in financial services.

Modern feature stores are built for scale. The offline stores handle terabytes of historical feature data, while the online stores serve up features in milliseconds for real-time use cases. This dual-architecture is a game-changer for financial institutions, where compliance demands auditable records going back years. Having the ability to manage that history while delivering answers with sub-millisecond latency is a fundamental shift. You can discover more about how this architecture supports AI in finance on Aerospike.com.

This combination of scale and speed differentiates a feature store from legacy data systems. It is built to serve two masters—the regulator demanding historical proof and the customer demanding an instant decision—without compromising on either.

Visbanking’s platform is built on this principle. We provide intelligence pulled from deep historical data, such as five years of peer performance trends, and package it in a way that enables immediate action. Our system helps you benchmark your institution against peers and spot opportunities you might have otherwise missed.

Feature Stores vs. Traditional Data Warehouses

Your institution has already made significant investments in data infrastructure. You have a data warehouse for reporting and perhaps a data lake for raw data exploration. So the question every director asks is, "Why do we need another system?"

The difference is purpose. It is about shifting from looking in the rearview mirror to acting on what is directly in front of you.

A data warehouse is your bank's official historian. It is built for retrospective analysis, answering questions like, "What happened last quarter?" Its job is to power executive dashboards, produce performance reports, and handle regulatory filings by organizing historical data.

A data lake, in contrast, is an unfiltered reservoir. It holds everything from raw transaction logs to customer call notes, giving data scientists a place to explore and find new patterns. It is a sandbox for research, not an operational system.

A System Built for Action

A feature store is neither a warehouse nor a lake. It is an operational system built for a specific purpose: making intelligent, real-time decisions. It is designed to answer the question, "What is the optimal action to take, right now?"

It achieves this by serving curated, ML-ready data that is perfectly consistent between model training (offline) and live decisions (online). This single point of consistency is what prevents a model's performance from degrading the moment it goes into production.

A data warehouse can tell you a customer's average balance over the last quarter. A feature store serves up that same customer's average balance over the last 90 days, their transaction frequency in the last 24 hours, and their current credit utilization ratio—all in under 10 milliseconds—to drive an instant loan approval.

That is the core difference. Warehouses report. Feature stores act.

Comparing Data Management Systems for Banking

It is useful to see where each system fits. This table breaks down their unique roles within a bank's technology stack, highlighting the critical gap a feature store fills.

| System | Primary Purpose | Data Type | Speed | Key Use Case in Banking |

|---|---|---|---|---|

| Data Warehouse | Historical reporting and business intelligence (BI) | Structured, aggregated, historical | Slow (minutes to hours) | Generating quarterly performance reports |

| Data Lake | Raw data storage and exploratory analysis | Raw, unstructured, semi-structured | Very slow (hours to days) | Discovering new customer behavior patterns |

| Feature Store | Powering live, automated decisions with ML models | Curated, validated, real-time features | Extremely fast (milliseconds) | Approving or denying a transaction instantly |

The table makes it clear: neither a warehouse nor a lake is built for the low-latency, high-consistency demands of operational AI. Attempting to retrofit these systems for real-time decisions almost always leads to brittle, unreliable models that fail when needed most. For a closer look at updating your data stack, check out our guide on data integration best practices.

This is the jump from passive dashboards to active, intelligent banking that platforms like Visbanking enable. We provide the operational intelligence layer—backed by a powerful feature store—that turns your bank's data from a historical archive into a real-time, revenue-generating asset.

With this architecture, you can deploy models that drive immediate results, benchmark their performance, and spot new opportunities with data that is not just correct, but ready to use right now.

Driving Operational Excellence and Governance

A feature store is more than just a piece of technology—it is an engine for operational discipline and tight governance. For bank leadership, this translates to three concrete benefits: eliminating redundant work, accelerating model deployment, and ensuring rock-solid auditability. These are not minor tweaks; they are fundamental improvements to how a bank uses data to compete.

The most immediate benefit is the reduction of redundant work. Your risk, marketing, and commercial lending teams all analyze similar customer signals. Without a central hub, each department spends time and resources building its own pipelines to calculate similar metrics, such as "customer lifetime value" or "90-day transaction volume."

That siloed approach is a significant drag on efficiency and a source of dangerous inconsistencies.

A Single Source of Analytical Truth

By centralizing features, a feature store creates a single, trusted source for the data that powers your decisions. Imagine calculating "customer total deposits" once, validating it, and then making it securely available to every department. The efficiency gains are both massive and immediate.

Feature stores enable this by allowing teams to share and reuse feature pipelines across numerous machine learning projects. Once a feature is logged in the store's central registry, it is instantly discoverable and ready for use in any model, anywhere in the bank. This single move slashes redundant data engineering work. You can see how this works in more detail over at Feast.dev.

This centralized logic ensures every model, whether for risk or marketing, operates from the same consistent data.

Slashing Time-to-Market for New Models

The second major benefit is speed. In today's market, the ability to launch new analytical models quickly is a significant competitive advantage. A feature store acts as a launchpad, providing data science teams with a library of vetted, production-ready features.

Instead of spending 80% of their time preparing data, your teams can focus on the innovative work that drives business value.

With a pre-built catalog of trusted features, the model development lifecycle shrinks from months to weeks. A new fraud detection model, for example, can be deployed in record time to counter an emerging threat, potentially saving the bank millions.

This agility allows the bank to respond to market shifts, new regulations, or competitive threats with sharp, data-driven strategies rather than reacting after the fact. It transforms the data science team from a research function into a core driver of business value.

Bulletproof Auditability and Regulatory Compliance

Finally, and most critically for banking, a feature store delivers an exceptional level of governance and auditability. For every data point a model uses, it creates a clean, immutable record of its origin and calculation method. This is known as data lineage.

This is essential when regulators conduct examinations. When an auditor asks why a loan was denied, you can produce a precise, time-stamped record of every feature that informed that decision. You can show not just the data, but its exact version and the logic used to create it.

This level of transparency achieves several key objectives:

- Proves Fairness: It provides hard evidence to demonstrate that your decisioning models are unbiased and applied consistently.

- Simplifies Reporting: It automates a significant portion of the documentation required for regulatory compliance, reducing the burden on your teams.

- Strengthens Control: It provides a complete audit trail, ensuring all data usage aligns with both internal policies and external regulations.

This transparent framework is non-negotiable in modern banking. For a deeper look at this, check out our thoughts on data governance in banking.

Platforms like Visbanking are built for this reality. By providing an integrated system with feature store capabilities, we arm your institution with the intelligence to act decisively. You can benchmark against your peers and explore new opportunities, knowing your decisions are backed by governed, auditable, and completely consistent data.

Real-World Feature Store Applications in Banking

Theory is one thing, but bottom-line impact is what matters. A feature store's value is not in the technology itself, but in its ability to drive faster, smarter, and more profitable decisions. For banking leaders, this means turning abstract data concepts into concrete outcomes that protect the balance sheet and open new revenue streams.

This is where a feature store becomes a core operational asset.

Let's examine three critical banking functions where a feature store makes an immediate, measurable difference. These are not hypothetical scenarios; they demonstrate how curated, real-time features deliver a level of speed and intelligence that legacy systems cannot match.

Application 1: Real-Time Fraud Detection

In fraud prevention, every millisecond counts. A model's ability to block a fraudulent transaction depends entirely on the speed and quality of the data it receives. A feature store is engineered for this high-stakes moment.

Consider a fraudulent card-present transaction for $2,500 is attempted. The fraud model has less than 50 milliseconds to make a decision. The feature store instantly feeds the model a handful of critical, live features about this specific transaction:

- Transaction frequency in the last hour: The value is

5, whereas the 90-day average is just0.2. - Geographical distance from last purchase: The last transaction was 1,200 miles away, only 15 minutes prior.

- Transaction amount vs. 30-day average: This purchase is 10x the customer's typical spending.

With these pre-calculated, low-latency features, the model immediately flags the anomaly and declines the $2,500 charge. Without a feature store, attempting to compute this data on the fly would be too slow. The funds would already be lost.

Application 2: Dynamic Credit Risk Scoring

Traditional credit scoring is retrospective, relying on static data that is often months old. It is slow and frequently misjudges the potential of new businesses or individuals with thin credit files. A feature store revitalizes this process, using live data to build a more accurate, up-to-the-minute risk profile.

Imagine a small business applies for a $75,000 line of credit. Their traditional credit score is borderline. But a feature store serves up dynamic features that paint a different picture:

- Recent changes in direct deposit amounts: The business's average daily deposit is up 40% over the last 60 days.

- Number of credit inquiries in the last 30 days: The value is

1(this application), showing they are not desperately rate shopping. - Cash flow volatility score: A feature calculated daily that has dropped by 25% in the past quarter, signaling growing stability.

Armed with this real-time intelligence, the bank can confidently approve the loan, securing a valuable new commercial client. This moves the institution from reactive, history-based lending to proactive, opportunity-based decisioning.

This is precisely what a data intelligence platform like Visbanking is designed to do—turn raw data points into actionable signals that enable you to act with confidence.

Application 3: Proactive Customer Churn Prevention

It is far more profitable to retain a high-value customer than to acquire a new one. A feature store powers predictive models that can identify subtle signs of churn long before a customer leaves, providing an opportunity to intervene.

Suppose a model is monitoring a high-net-worth client with over $500,000 in deposits. The feature store tracks behavioral features that are updated daily:

- Login frequency: It has dropped from an average of

12times a month to just2in the last 30 days. - Reduction in primary savings balance: The balance has fallen by $150,000 in the last two weeks, with no corresponding move to other internal accounts.

- Automated transfer cancellations: The client recently stopped two recurring monthly transfers.

The model flags this customer as a high churn risk and automatically triggers a workflow. A senior relationship manager receives an alert with this context, prompting a proactive retention call. It is a targeted, data-driven action that can save a key relationship.

In all of these cases, the feature store is the operational bridge connecting raw data to decisive action. By serving consistent, governed, and timely features, it gives banks the power to protect assets, win new business, and retain their most valuable customers.

Visbanking’s platform puts this concept into practice, providing the curated intelligence needed to benchmark performance, spot opportunities, and act on risks. We invite you to explore how our data can drive your next critical decision.

How to Implement Feature Store Capabilities

The value of a feature store is clear. The question is how to implement it. For bank leaders, the chosen path directly impacts budget, timeline, and competitive agility.

The default option is to build it in-house. This is a massive undertaking—a multi-year, multi-million-dollar project requiring elite, specialized engineers who are in short supply.

This is not a simple IT project. It involves piecing together complex open-source tools, navigating the steep learning curve of production-level data systems, and managing significant execution risk. Projects are often delayed, budgets double, and the final product frequently fails to meet the strict performance and compliance demands of the banking industry.

The Strategic Alternative: Build vs. Buy

The real question for any bank is not if you need this capability, but how you acquire it. Do you tie up capital and talent in a massive internal infrastructure project, or do you partner with an expert who has a production-ready system available today?

Building a feature store is a means to an end, not the end itself. The goal is not to become an expert in data infrastructure; it is to use data to make faster, smarter, more profitable banking decisions. The fastest path to that value is by focusing on your core business: banking.

This is where the Visbanking Bank Intelligence and Action System (BIAS) provides a decisive advantage. We have built the complete, production-grade MLOps infrastructure—including a powerful feature store—into the core of our platform. You do not have to build anything.

Activating Intelligence on Day One

Instead of getting mired in a costly and complex infrastructure project, our platform allows you to proceed directly to value creation. We have done the heavy lifting, unifying data from sources like the FDIC, NCUA, and BLS and transforming it into thousands of high-value, validated features, ready for immediate use.

This changes the dynamic entirely. Your focus shifts from wrestling with data pipelines to asking the strategic questions that drive your business forward:

- Benchmarking Performance: How does our loan growth compare to our top five competitors over the last three quarters?

- Identifying Opportunities: Which commercial clients in our market show signs of needing a new line of credit?

- Mitigating Risk: Are we seeing early warning signs of credit risk emerging in our small business loan portfolio?

The message is simple: stop dedicating your best resources to building data plumbing. Start putting intelligence to work. We invite you to see for yourself how our platform turns complex data into decisive action.

Explore our data and discover how you can benchmark performance, find new opportunities, and get ahead of risk with speed and confidence.

A Few Common Questions

As banking leaders consider what a feature store means for their institution, several key questions arise. Let's address them directly, focusing on business impact rather than technical specifications.

Do I Need a Big Data Science Team to Make This Work?

No. While a dedicated data science team could certainly build custom models with a feature store, that is not where the immediate value lies for most banks. The real power comes from platforms that have this capability already integrated.

A system like Visbanking’s, for instance, delivers pre-built applications that are powered by a feature store behind the scenes. This means your leadership gets the benefit of advanced analytics—like dynamic peer benchmarking and predictive risk signals—without having to hire a new machine learning team. The feature store is the engine under the hood, turning complex data into the clear, actionable insights your executive team needs.

How Does This Actually Help with Regulatory Compliance?

Think of a feature store as your single source of truth for governance. It creates a transparent, centralized hub for the data fueling your most critical models. It automatically logs feature lineage, which means you can trace exactly how a feature was calculated and what its value was at the moment a decision was made.

When an auditor asks why a particular loan was denied, you can pull up a complete, timestamped record of every single data point that went into that decision. Instead of manually digging through spreadsheets, you can demonstrate a fair, consistent, and completely defensible process, backed by hard evidence.

This is not a "nice-to-have"; it is a core function that directly mitigates significant regulatory risk.

Isn't This Just Another Data Silo?

It is the opposite. A feature store is designed specifically to break down data silos and enforce consistency across the entire bank. It eliminates the need for the risk, marketing, and commercial lending teams to create separate, slightly different versions of customer data.

Instead, the feature store centralizes these critical signals. This ensures everyone—from the front line to the boardroom—is working from the same vetted, consistent data. The result is more accurate models, a massive reduction in duplicated work, and improved collaboration between departments. It turns siloed data into a shared, strategic asset.

Getting from raw data to a decisive action requires a new kind of infrastructure—one built for speed, governance, and intelligence. Visbanking provides this system right out of the box, so you can focus on strategy, not servers.

Explore our data to see how you can benchmark performance and act with confidence.

Similar Articles

Visbanking Blog

AI Banking Revolution: How Machine Learning Transforms Finance

Visbanking Blog

Revolutionizing Financial Hiring: How AI-Powered Talent Tools Transform Recruitment

Visbanking Blog

BIAS: The Power of Data and AI at Your Fingertips

Visbanking Blog

Fastest Growing Banks: Who's Winning the Asset Race?

Visbanking Blog

Prospect AI Tool: Transforming Your Bank's Growth Strategy with Smart Targeting

Visbanking Blog

BIAS: The All-in-One Solution for Banking Intelligence and Action

Visbanking Blog

In the world of banking, digital transformation is no longer a 'nice-to-have'. It's a necessity

Visbanking Blog

BIAS: The Future of Banking is Revoluzationizing

Visbanking Blog

Bank Interest Rate Predictions: What Experts See Coming

Visbanking Blog