How a Data Aggregation Company Delivers a Decisive Competitive Edge

Brian's Banking Blog

A specialized data aggregation company serves one core function for a bank's leadership: converting market noise into strategic clarity. By systematically collecting, cleaning, and standardizing vast amounts of fragmented financial data—from regulatory filings to economic reports—these firms deliver a single, verifiable source of truth. For executives and directors, this transforms raw information into a powerful tool for driving growth, managing risk, and outmaneuvering competitors.

Why Data Intelligence is No Longer Optional in Banking

The primary challenge for bank executives is not a lack of data, but a deluge of disconnected information. Critical metrics are buried across FDIC call reports, SEC filings, internal loan origination systems, and disparate economic databases. This fragmentation creates significant blind spots, making it difficult to answer fundamental questions with speed and certainty. How does your Net Interest Margin truly compare to your top five competitors? Which specific MSAs present the most immediate opportunity for commercial lending growth?

Obtaining answers often requires weeks of manual data extraction and reconciliation by analyst teams. By the time an insight is formulated, the strategic window may have closed. This is not merely an operational inefficiency; it is a direct threat to performance. Operating a financial institution on outdated or incomplete intelligence is akin to navigating capital markets with a lagging ticker—it invites unforced errors and missed opportunities.

From Information Overload to Confident Action

A data aggregation company purpose-built for the financial sector addresses this challenge directly. It functions as an intelligence engine, automating the laborious processes of data collection, cleansing, and normalization. This eliminates error-prone manual work that consumes valuable analyst resources. Instead of an analyst spending 40 hours standardizing call report data for 50 peer institutions, leadership can access a precise, apples-to-apples comparison in seconds.

For example, a bank might see its efficiency ratio is 58%. In isolation, this number is meaningless. But when benchmarked against a curated peer group, they might discover the top quartile operates closer to 52%. A data intelligence platform allows them to drill down instantly, revealing that top performers have, for instance, 15% higher noninterest income as a percentage of assets, providing a clear, actionable target.

The strategic value of data intelligence is not in possessing more information, but in accelerating the speed and confidence of critical decisions. It elevates analysis from a reactive, historical exercise to a forward-looking competitive advantage.

Building the Foundation for Market Leadership

Engaging a financial data partner provides the core infrastructure required for sustained market leadership. It delivers the unbiased, comprehensive view necessary to drive profitable growth and manage risk effectively.

This capability enables executives to:

- Benchmark Performance with Precision: Objectively assess loan growth, deposit costs, and efficiency ratios against any peer group, eliminating guesswork.

- Identify Granular Growth Opportunities: Pinpoint underserved markets, identify high-value commercial prospects, and capitalize on competitors' strategic weaknesses.

- Anticipate Market Shifts: Detect early warning signs in credit quality, liquidity, or interest rate risk by analyzing trends across the entire banking landscape.

A centralized data intelligence platform like Visbanking’s allows leadership to stop managing information and start weaponizing it, ensuring every major decision is underpinned by a complete and accurate market picture. Explore our data to see how your bank compares.

Turning Raw Data into Actionable Bank Intelligence

Raw financial data is analogous to crude oil. It is abundant—found in FDIC call reports, SEC filings, and economic releases—but is unusable in its raw state. A specialized data aggregation company acts as the refinery, transforming this raw input into the high-grade fuel required for a bank's strategic engine.

This process is far more complex than simple data scraping. It involves ingesting millions of data points from hundreds of sources, each with unique formatting, definitions, and quality levels. A metric as fundamental as "Net Interest Margin" can be calculated and reported differently across thousands of institutions, rendering direct comparisons meaningless without meticulous standardization.

The strategic value is created when this raw data is cleansed, standardized, and enriched, ensuring that every comparison is on a true apples-to-apples basis.

From Collection to Strategic Clarity

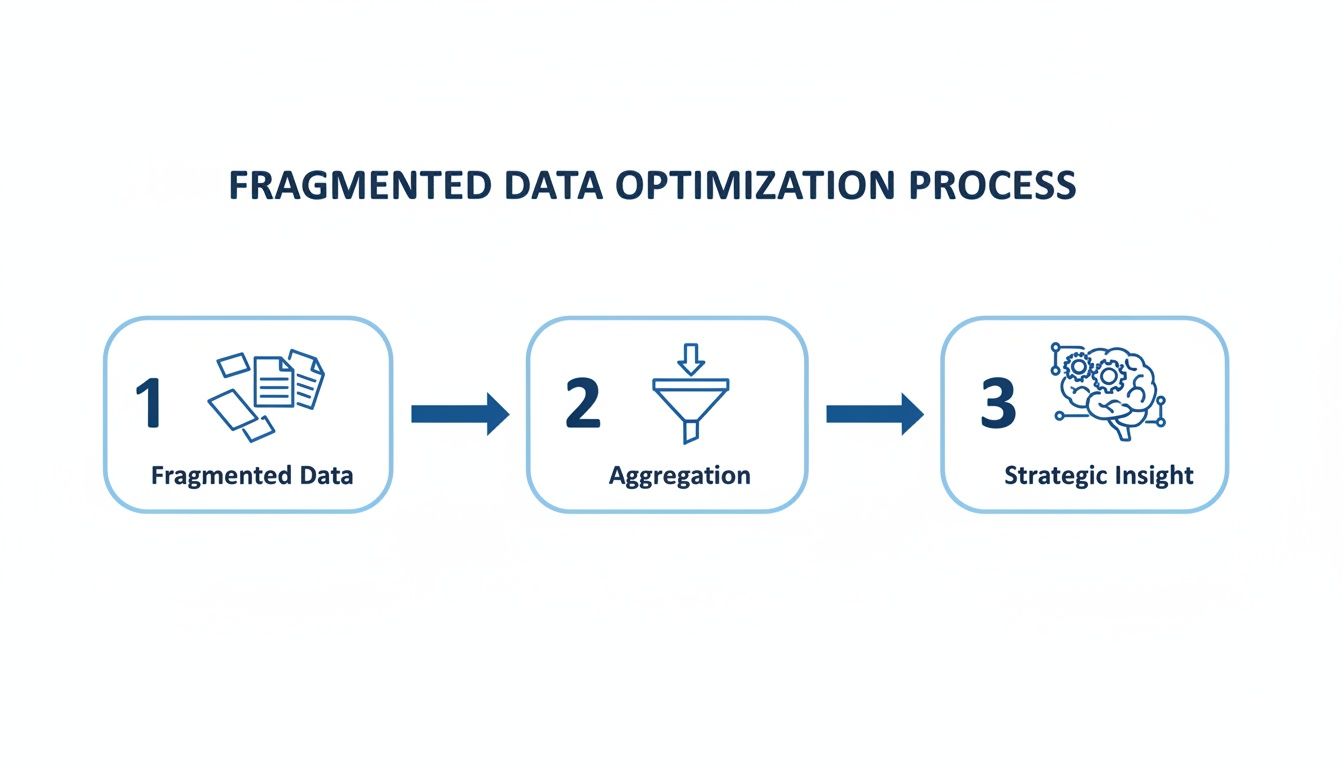

The transformation from fragmented data to a board-ready insight follows a disciplined, multi-stage process. Each step is designed to build institutional trust in the data, enabling confident, decisive action.

- Systematic Collection: Automated processes pull data from hundreds of public and proprietary sources, ensuring comprehensive and timely coverage.

- Rigorous Cleansing: Algorithms and subject-matter experts collaborate to correct errors, reconcile inconsistencies, and flag statistical anomalies that could distort analysis.

- Intelligent Normalization: This critical step creates consistency. For example, thousands of disparate loan portfolio categorizations are mapped into a single, unified classification system.

- Contextual Enrichment: Data is layered with additional context, such as linking executive compensation data to bank performance metrics or mapping branch locations to local demographic and economic data.

This disciplined methodology transforms chaotic information into a clean, structured asset ready for strategic application.

This process systematically funnels market noise into a refined, high-value asset for strategic decision-making.

The Imperative of Data Trust

For any bank executive, absolute trust in the underlying data is non-negotiable. Every significant decision—whether to enter a new market, adjust risk models, or launch a new product—is contingent on the quality of the information supporting it. This is why data lineage—the ability to trace any data point back to its original source document—is a critical requirement.

Trust is the foundational currency of banking. This principle extends directly to the data used to manage the institution. Without a transparent, auditable data process, strategic planning degrades into speculation.

Consider a practical application: a $7,000,000,000 bank needs to benchmark its commercial real estate loan performance. A premier data partner does not merely provide a summary number. It allows the executive to see precisely how the peer group was constructed, which specific call report line items were used, and how loan concentrations were normalized across every institution. This level of auditability elevates a dashboard from a visual aid into a trusted strategic instrument. The core principles of analytics for banking are built upon this foundation.

Effective intelligence also involves stress-testing strategies against historical data. Understanding methodologies for backtesting financial strategies sharpens this analytical edge. At Visbanking, our platform is engineered for trust, delivering the clean, structured, and auditable data required for confident action.

How to Select the Right Financial Data Partner

Selecting a data aggregation partner is not a software procurement exercise; it is a strategic decision that directly impacts the bank's capacity for informed leadership. The objective is to secure an intelligence partner that equips the executive team with the verifiable insights needed to make critical decisions on risk, growth, and profitability.

The evaluation must transcend a superficial feature comparison. The core assessment hinges on three pillars: the integrity of the data, the reliability of the delivery infrastructure, and an unwavering commitment to institutional-grade security. A basic data provider supplies spreadsheets; a true intelligence partner delivers a verifiable, auditable, and actionable view of the market. The consequences of a poor choice are significant—flawed data leads to flawed strategy and, ultimately, to financial underperformance.

Core Evaluation Criteria for Your Next Partner

To distinguish commoditized vendors from strategic partners, due diligence must focus on these non-negotiable criteria. They are the foundation of accurate, consistently available, and secure market intelligence.

Data Coverage and Lineage: Assess the depth of data coverage across all essential regulatory filings (FDIC, NCUA, SEC) and its enrichment with relevant market and economic data. Crucially, demand complete transparency in data lineage. Every data point must be traceable to its source document. Data that is not auditable is not suitable for a regulated financial institution.

Infrastructure and Reliability: Evaluate the data delivery mechanisms. A modern partner provides not just a web interface but also robust APIs for seamless integration with existing Business Intelligence (BI) tools and internal models. Scrutinize Service Level Agreements (SLAs) for data freshness and system uptime. In banking, stale data is functionally incorrect data.

Security and Compliance: This is a pass/fail criterion. The partner must demonstrate a robust security posture, validated by certifications such as SOC 2 Type II. Their entire operational framework must be built to meet the stringent data privacy and regulatory compliance standards of the financial services industry. Our guide to data governance in banking details why this is paramount.

Asking the Right Questions During Diligence

Beyond marketing presentations, the operational reality must be interrogated. The answers to these questions will reveal the true caliber of a potential partner.

The ultimate test of a data partner is not the aesthetic of its dashboard, but whether its data can be trusted without reservation in a high-stakes board meeting. Verifiability is not a feature; it is the entire foundation.

Let's apply this. An $8,000,000,000 asset bank needs to benchmark its commercial real estate loan portfolio against peers in the Southeast. A strategic partner provides the tools to dynamically construct that peer group, drill down into the raw call report data for each institution, and audit the precise calculation of metrics like loan concentrations. That level of control is what converts data into defensible intelligence.

This imperative is driving significant investment. The global data integration market, which powers every data aggregation company, is projected to grow from $13,970,000,000 to $15,190,000,000. Financial institutions are investing heavily in these capabilities, underscoring their strategic importance. More on this trend can be found in this analysis of how data integration is solving key AI adoption challenges on groupbwt.com.

Vendor Evaluation Checklist for Bank Executives

Use this checklist to structure your due diligence and compare potential partners based on the capabilities essential for a financial institution.

| Evaluation Criteria | Basic Provider Offering | Strategic Partner Standard |

|---|---|---|

| Data Lineage & Auditability | Provides summary data; sources are generalized. | Delivers 100% auditable data, with direct links back to original source filings. |

| Data Freshness (SLA) | Data updated weekly or monthly. | Data is updated within hours of public release, guaranteed by a strict SLA. |

| Integration & API Access | Limited API access, often for static data dumps. | Robust, well-documented APIs for deep integration with internal BI and risk systems. |

| Security & Compliance | States they are "secure"; may have basic certifications. | Holds advanced certifications like SOC 2 Type II; undergoes regular third-party audits. |

| Support & Expertise | Standard helpdesk support. | Dedicated banking industry experts provide support and strategic guidance. |

| Customization & Control | Fixed dashboards and reports. | Dynamic tools to build custom peer groups, metrics, and alerts on the fly. |

The right partner is an investment in institutional capability, providing a sustainable competitive advantage. The focus must be on data quality, reliability, and security to ensure your bank's strategy is built on a foundation of fact.

To see how your institution measures up using clean, aggregated data, start by benchmarking your bank today.

Driving Bank Performance with Aggregated Data

For a bank's leadership, the value of data is measured by its ability to drive tangible outcomes. The definitive test for any data aggregation company is its capacity to convert market intelligence into measurable improvements in profitability, efficiency, and risk management.

With clean, consolidated data, an institution shifts from a reactive to a proactive posture. This directly impacts key performance indicators, from Net Interest Margin (NIM) to talent retention. The following are four specific, numbers-driven examples of how aggregated data provides a decisive competitive edge.

Competitive Benchmarking

The executive team at a $5,000,000,000 bank believes its 3.15% Net Interest Margin is strong. However, using an aggregated data platform, they benchmark against a custom peer group of 50 similarly sized institutions and uncover a critical insight: the top quartile of their peers is consistently achieving a NIM of 3.45%.

Drilling down, the data reveals these top performers have a more profitable loan-to-deposit mix, with higher yields from C&I lending and lower funding costs. Armed with this specific, quantitative insight, the bank's leadership can now adjust its lending strategy and deposit pricing. They have a clear, data-driven mandate to capture an additional 30 basis points in margin, translating to $15,000,000 in annual pre-tax income.

Strategic Commercial Prospecting

Entering a new metropolitan area without market intelligence is a high-risk endeavor. Aggregated data from SEC filings, SBA loan records, and market reports enables a bank to identify high-value commercial clients with precision.

For example, an intelligence platform can flag mid-sized manufacturing firms with revenue growth exceeding 20% year-over-year that currently lack treasury management services from their primary bank. By focusing its outreach on this pre-qualified segment, the commercial lending team can increase its pipeline of qualified leads by 40% in six months. This transforms prospecting from a volume-based activity into a targeted, efficient growth strategy.

Proactive Risk Management

Effective risk management is predictive, not reactive. By continuously monitoring portfolio concentrations across a peer group, a bank can identify systemic risk building in the market long before it appears in its own portfolio.

A clear view of peer risk exposure is one of the most powerful leading indicators available. It allows an institution to learn from others' emerging risks without incurring the losses itself.

Imagine observing that several regional competitors have rapidly increased their exposure to non-owner-occupied commercial real estate, pushing their portfolio concentrations 25% above the peer average. This serves as a critical early warning. The bank's risk committee can then proactively review its own CRE concentration limits and underwriting standards, insulating the institution from a potential downturn that could severely impact its overexposed peers.

Aggregated data also forms the foundation for advanced risk tools. Implementing machine learning fraud detection is exponentially more effective when fueled by clean, comprehensive datasets.

Talent and Compensation Analysis

Securing and retaining top executive talent is a persistent challenge. A data aggregation company can consolidate and normalize public data on executive compensation—including salaries, bonuses, and equity awards—from all peer institutions.

A bank’s board can leverage this intelligence to construct a competitive offer for a new CFO. They might discover that peer banks in their region offer a 15% higher base salary but tie a significant portion of bonuses to improving the efficiency ratio. This allows them to design a compensation package that not only attracts the best candidate but also directly aligns their incentives with the bank’s primary strategic objectives.

Integrating Data Intelligence into Your Bank’s Workflow

The adoption of a data platform must be an accelerant, not an obstacle. The value of insights from a data aggregation company is nullified if the data is trapped within a siloed, cumbersome system. True value is realized only when sophisticated market intelligence becomes an intuitive, integrated component of the daily workflow for every key decision-maker.

A modern intelligence partner should deliver a solution, not a project. The objective is to provide the team with direct, curated insights without the burden of building and maintaining complex internal data pipelines.

Empowering Teams Without Overhauling Systems

Effective integration meets the team where they operate. A premier data partner understands its platform must complement—not compete with—the bank's existing technology stack. Accessibility and immediate utility are paramount.

In practice, this means:

- Flexible API Access: A robust, well-documented API is the cornerstone of modern integration. It allows the bank's technology team to pull clean, normalized data directly into proprietary risk models, internal dashboards, or existing Business Intelligence (BI) platforms.

- BI Tool Compatibility: Analysts operate within tools like Tableau, Power BI, and Excel. A top-tier data platform must connect seamlessly with these systems, enabling teams to build custom reports and analyses from a single, trusted source of truth.

- Pre-Built Dashboards and Reports: For immediate value, the platform should include intuitive dashboards that address common strategic queries, such as peer benchmarking, market share analysis, and M&A screening.

This multi-faceted approach democratizes analytics, moving powerful data from a few specialists to the decision-makers who need it most.

Beyond Technology: The Importance of Partnership

Technology alone is insufficient. Its value is contingent on adoption and effective application. A commodity vendor sells a license and provides a helpdesk. A true strategic partner invests in the bank's success through dedicated change management and expert support.

The ultimate measure of a data platform's success is not its technical specifications, but how quickly and deeply it becomes embedded in the bank's strategic decision-making process.

This requires the partner to provide comprehensive training tailored to different roles, from high-level executive briefings to in-depth workshops for financial analysts. Ongoing support must come from experts with deep banking industry knowledge who can act as an extension of the internal team. This ensures the institution extracts maximum value from its investment. For a deeper look at this process, learn more about strategic financial data integration.

The right data aggregation company ensures this transition is efficient and seamless, embedding a powerful platform into the institution's operational DNA.

Building Your Competitive Edge with Future-Ready Intelligence

Engaging a data aggregation company is an investment in future-readiness. It lays the essential data foundation for the next frontier of banking competition: the effective deployment of artificial intelligence and machine learning.

Clean, structured, and comprehensive data is the prerequisite for any predictive analytics initiative. With this foundation in place, a bank can transition from reacting to historical trends to anticipating future market dynamics. This includes identifying at-risk commercial loans months before traditional indicators show signs of stress, or personalizing product offers at scale using models that predict customer needs.

From Insight to Foresight

The leap from insight to foresight is impossible without an unwavering commitment to data quality. AI and machine learning projects are destined to fail without a partner managing the complex work of data aggregation and normalization. The principle of "garbage in, garbage out" is absolute.

The data aggregation market includes over 100 firms, but a significant portion of large financial institutions (42%) are already deploying AI, intensifying the pressure to establish a robust data infrastructure. A specialized partner helps banks avoid vendor lock-in and ensures the complete data lineage required for regulatory scrutiny and model validation. You can explore the market landscape and its key players on f6s.com.

The question is no longer if banks will leverage predictive analytics, but who will build the data superiority to do so effectively. Institutions that delay will be fundamentally outmatched by competitors capable of anticipating market and customer behavior with precision.

Secure Your Position as a Market Leader

Preparing for this future begins with a clear understanding of your current competitive position. Partnering with a specialized data aggregation firm is the most effective first step. It provides the clean, reliable intelligence needed to outperform peers today while building the essential groundwork for the advanced analytics that will define market leadership tomorrow.

This is not a theoretical exercise. The strategic advantage derived from aggregated data is measurable and immediate. Benchmark your bank against its peers to see the opportunities that emerge with complete market clarity.

A Few Questions We Hear from Banking Leaders

When evaluating a data aggregation partner, executives require direct and substantive answers. Here are the most common questions from banking leaders and our straightforward responses.

How Is Our Financial Data Kept Secure?

Security is paramount. Any credible firm serving the financial industry must operate under a framework such as SOC 2 Type II compliance. This is not a one-time certification but a continuous, rigorous audit of data management, security controls, and confidentiality protocols. All data is encrypted both in transit and at rest.

Critically, our focus is on aggregating publicly available regulatory and market data, not your institution's non-public customer information. The platform is designed for external market intelligence, which inherently minimizes your bank's risk exposure and keeps your most sensitive data securely within your own perimeter.

What’s the Real Timeline and What Resources Do We Need?

Modern, cloud-based intelligence platforms are designed for rapid deployment. Access is typically provisioned within days, not months, allowing for immediate value realization.

As a Software-as-a-Service (SaaS) solution, it requires zero integration with your core banking systems. This means no demand on your internal IT resources and no implementation risk. The only resource required from your institution is the time for key stakeholders to participate in tailored onboarding and training sessions designed to align the platform's capabilities with your specific strategic objectives.

How Does This Help Our Existing BI Team?

A data intelligence partner acts as a force multiplier for your analytics team. Currently, your analysts likely spend up to 80% of their time on the low-value, tedious tasks of data discovery, cleansing, and normalization.

By providing a clean, analysis-ready dataset, we liberate your team from data wrangling and empower them to focus exclusively on high-value strategic analysis. They can move directly to building predictive models, uncovering market trends, and delivering the forward-looking insights that leadership requires.

This shift transforms your analytics function from a reactive reporting center to a proactive decision-support engine, directly contributing to the bank’s competitive performance.

At Visbanking, we transform scattered data into your most powerful strategic asset. Our platform delivers the audited, reliable intelligence your leadership team needs to benchmark performance, identify opportunities, and manage risk with complete confidence.

Similar Articles

Visbanking Blog

The Future of Financial Analytics: Solutions by VISBANKING

Visbanking Blog

What do data science and the banking industry have in common?

Visbanking Blog

Banking Data Analytics: Turning Information Into Profit

Visbanking Blog

🔥 'Data is the new oil.'

Visbanking Blog

Make More Informed Decisions with BIAS, the Data-Driven Banking Solution

Visbanking Blog

Visbanking: Leading Financial Intelligence for Banks

Visbanking Blog

It’s not just about crunching the numbers

Visbanking Blog

In the world of banking, digital transformation is no longer a 'nice-to-have'. It's a necessity

Visbanking Blog

BIAS: The Smart Choice for Banking Intelligence and Action

Visbanking Blog