Estimated reading time: 4 minutes

Table of contents

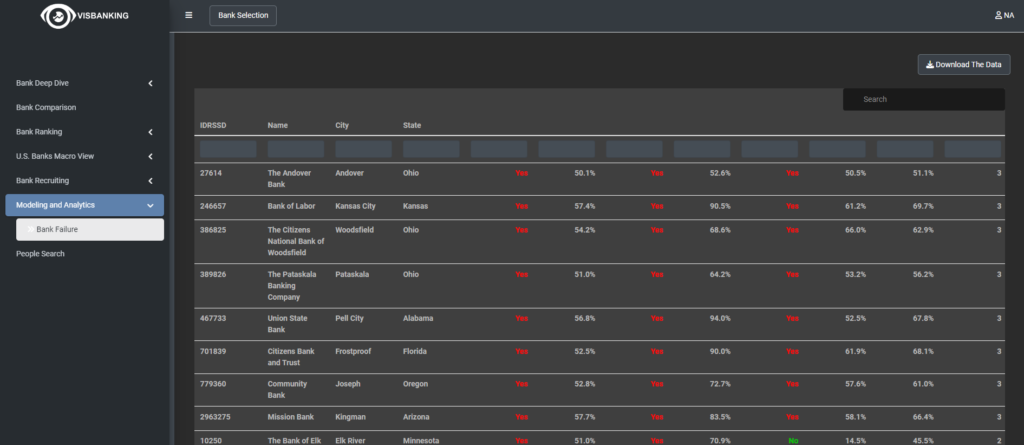

In today’s fast-paced financial landscape, staying ahead of the curve requires access to accurate and comprehensive data insights. For the banking sector, this translates to understanding the intricacies of US bank operations, trends, and performance. The emergence of advanced data analysis tools and platforms has made it easier than ever to delve deep into this realm. One such groundbreaking solution is the Visbanking Banking Report Portal, a powerful resource that offers unparalleled access to US bank modeling and analysis.

Unveiling US Bank Modeling and Analysis

US banks play a pivotal role in the global financial system, influencing economic growth, monetary policy, and consumer financial well-being. Analyzing their operations and performance goes beyond mere statistical exploration – it helps unveil the underlying dynamics driving their success and resilience.

The Visbanking Banking Report Portal serves as a beacon of insight, providing financial professionals, regulators, and researchers with a centralized hub for US bank data. Whether you’re seeking to assess the health of specific banks, identify trends in loan portfolios, or analyze deposit growth across regions, this platform offers an array of tools to facilitate these tasks.

Key Features and Functionalities

- Comprehensive Data Repository: The backbone of any effective bank analysis is data availability. Visbanking’s portal boasts a vast and up-to-date repository of US bank data, ranging from balance sheets and income statements to loan performance metrics and capital adequacy ratios.

- Interactive Visualization Tools: Navigating through intricate financial datasets can be challenging, but the portal’s interactive visualization tools simplify this process. Users can create custom charts, graphs, and dashboards to visualize trends, making complex data easily digestible.

- Benchmarking and Comparative Analysis: Gain a competitive edge by benchmarking the performance of different banks against one another. This feature enables users to identify outliers, spot industry leaders, and assess areas for improvement.

- Predictive Modeling and Scenario Analysis: Understanding future possibilities is crucial for effective decision-making. The portal offers predictive modeling capabilities, allowing users to simulate various scenarios and evaluate potential outcomes based on historical data and market trends.

- Regulatory Compliance Insights: For regulators, staying informed about the compliance status of banks is essential. Visbanking’s portal provides real-time insights into regulatory compliance metrics, helping regulatory bodies monitor and enforce industry standards.

The Power of Informed Decision-making

In the dynamic world of banking, where market conditions can change rapidly, informed decision-making is paramount. The Visbanking Banking Report Portal empowers users to make strategic choices backed by data-driven insights. Here’s how the portal’s offerings translate into real-world benefits:

- Risk Management: Identifying potential risks is a cornerstone of effective banking operations. With the portal’s risk analysis tools, banks can assess their exposure to various risks, from credit risk to market risk, and implement mitigation strategies.

- Market Trend Prediction: The ability to predict market trends is invaluable. By leveraging predictive modeling, banks can anticipate shifts in customer behavior, interest rate fluctuations, and other market dynamics, positioning themselves for success.

- Performance Optimization: Understanding what drives high performance is key to optimizing operations. Banks can analyze their financial performance, identify areas of strength, and uncover opportunities for improvement.

- Enhanced Regulatory Compliance: Navigating the complex landscape of regulatory compliance is made easier through the portal’s real-time insights. Banks can proactively address compliance issues, avoiding penalties and reputational damage.

You can see this data in the “US Banks Contacts” section in the Visbanking Application:

Unleash the Potential of US Bank Modeling Analysis

In a sector as competitive and regulated as banking, staying ahead requires more than intuition – it demands actionable insights drawn from accurate and comprehensive data analysis. The Visbanking Banking Report Portal serves as a cornerstone in this pursuit, enabling financial professionals to unravel the complexities of US bank operations.

Whether you’re an analyst seeking to identify investment opportunities, a regulator ensuring industry compliance, or a researcher studying financial trends, the portal’s array of tools empowers you to transform data into actionable knowledge. As the financial landscape continues to evolve, having a reliable and robust platform like the Visbanking portal is no longer a luxury – it’s a necessity for success.

Conclusion

The age of data-driven decision-making has transformed how industries operate, and banking is no exception. The Visbanking Banking Report Portal brings the power of sophisticated data analysis to the fingertips of those navigating the intricate world of US banking. With its comprehensive data repository, interactive visualization tools, predictive modeling capabilities, and compliance insights, the portal equips professionals with the tools needed to navigate uncertainty, uncover opportunities, and make informed choices in an ever-changing financial landscape. Embrace the future of banking analysis with Visbanking and unleash the potential of your institution’s data.