What Is Financial Benchmarking? A Guide for Bank Executives

Brian's Banking Blog

Financial benchmarking is the disciplined practice of measuring a bank's performance against its peers, the broader industry, and its own historical results. For bank executives and board members, it is not a reporting exercise; it is a foundational tool for strategic decision-making. It provides the necessary context to translate raw financial data into a decisive competitive advantage.

Benchmarking answers the fundamental question every leadership team must address: “How is our performance relative to the competition, and what actions must we take based on that intelligence?”

The Strategic Imperative of Financial Benchmarking

Operating without a rigorous benchmarking framework is equivalent to navigating blind. Performance measured in a vacuum creates significant strategic risk, leaving an institution vulnerable to market shifts, competitive threats, and undetected internal inefficiencies. Benchmarking provides a data-backed reality check that validates strategy, exposes hidden risks, and challenges outdated assumptions.

The power of this discipline lies in the methodical comparison of Key Performance Indicators (KPIs) to understand not just what is happening, but why.

Consider a bank with a Net Interest Margin (NIM) of 3.9%. In isolation, this figure is meaningless. However, if a curated peer group of similarly sized institutions in the same market averages a 4.2% NIM, the story changes dramatically. That 30-basis-point gap is not just a number; it is a direct signal of potential underperformance in loan pricing, an elevated cost of funds, or a suboptimal asset mix that demands immediate investigation.

Core Objectives for Leadership

Effective benchmarking enables executives to answer critical strategic questions by placing performance under objective scrutiny. The primary objectives must be clear:

- Validate Strategic Direction: Does the data confirm our strategic initiatives are yielding superior returns? Benchmarking verifies whether a push into commercial lending or a new digital banking platform is outperforming competitor strategies.

- Identify Performance Gaps: Where, precisely, are we lagging? An elevated efficiency ratio or stagnant fee income growth becomes an undeniable focal point when measured against top-quartile peers, directing management attention to specific operational areas.

- Set Defensible Targets: Performance goals must be ambitious yet grounded in market reality. Benchmarking allows leadership to set targets based on the documented achievements of high-performing banks, not arbitrary assumptions.

This process forces leadership to look beyond internal metrics and understand the institution's true market standing. The following dimensions provide a clear framework for this comparative analysis.

Key Benchmarking Dimensions for Banking

| Dimension | Core Question for Executives | Example Metrics |

|---|---|---|

| Profitability | Are our returns superior to those of our direct competitors? | Return on Assets (ROA), Net Interest Margin (NIM) |

| Efficiency | How effectively are we managing operating expenses relative to revenue? | Efficiency Ratio, Non-Interest Expense to Assets |

| Growth | Is our growth in core areas outpacing the market and key rivals? | Loan Growth, Deposit Growth, Asset Growth |

| Risk Management | How does our risk profile and asset quality compare to peer institutions? | Non-Performing Assets (NPAs), Capital Adequacy Ratio |

This framework is not about data collection; it is about asking incisive questions to drive strategic action.

Financial benchmarking is a strategic process that involves comparing a company's financial performance metrics against industry standards or direct competitors to evaluate its competitive positioning and financial health. In fact, companies that actively engage in benchmarking have been shown to improve their financial efficiency by up to 15% within five years. Discover more insights about competitive analysis on icfo.pro

Data intelligence platforms like Visbanking’s BIAS are designed to execute this function with precision. By automating the intensive process of data aggregation and peer analysis, these systems empower executives to bypass manual labor and focus directly on what drives value: acting on insights to build a more resilient and profitable institution.

Using Benchmarking to Sharpen Bank Strategy

Effective benchmarking is not an academic exercise; it is the delivery of hard evidence required for critical strategic decisions. It moves leadership beyond subjective assessments to data-driven validation of business plans, identification of vulnerabilities, and agile responses to market dynamics.

Imagine the board is considering a significant capital allocation to enter a new lending vertical. Peer analysis can reveal whether other banks that made a similar move improved their Return on Assets (ROA) or merely diluted their Net Interest Margin (NIM). A speculative initiative is thereby transformed into a calculated, evidence-based decision.

From Data Points to Actionable Intelligence

The true value of benchmarking is its capacity to force difficult but necessary questions. If your bank's loan growth is 2% while your immediate peer group averages 6%, that data point is an unambiguous call to action. It mandates a rigorous review of the entire lending function, from underwriting standards and product offerings to market positioning and sales execution.

This is how a data-driven culture is forged. It begins with defining a strategic objective—such as improving profitability—and selecting the correct KPIs to measure progress. The evidence supports this approach: firms that use benchmarking to guide decisions see, on average, a 20% higher ROA than those that do not.

When you consistently stack your performance against direct competitors, you uncover the "why" behind the numbers. An efficiency ratio that's five points higher than your peers isn't just a metric—it's a massive red flag signaling bloated costs or underperforming revenue streams that need your immediate attention.

Setting Targets and Driving Accountability

Without an external yardstick, performance targets are arbitrary. Benchmarking provides a defensible framework for setting goals that are both challenging and realistic. Instead of targeting a generic 5% increase in non-interest income, a bank can aim to achieve the 75th percentile performance of its peer group—a specific, measurable, and far more meaningful objective.

This establishes clear accountability for the leadership team. You can dive deeper into this process in our guide on what is competitive benchmarking.

Tools like Visbanking’s BIAS are engineered for this level of strategic work. By automating the data gathering and visualization of peer performance, executives can advance directly to the critical tasks: interpreting the intelligence and determining the next course of action. This allows leadership to stop reacting to historical reports and start proactively shaping the bank's future.

Choosing Your Benchmarking Methodology

A commitment to data-driven strategy requires selecting the correct analytical methodology. The choice of comparison group directly dictates the quality and relevance of the insights generated. This decision separates meaningful strategic intelligence from a counterproductive waste of executive time.

Peer Benchmarking: The Precision Tool

Peer benchmarking is the microscopic examination of performance against direct competitors. This methodology involves comparing your institution against a carefully curated group of banks with similar asset size, business models, and geographic footprints. It is the tool for answering tactical questions that drive operational excellence.

For example, a Cost of Funds of 0.85% is just a number. But when compared to a direct peer average of 0.65%, it becomes an actionable signal to re-evaluate the bank’s deposit strategy and funding mix immediately. This level of granular insight is only possible through precise peer comparison.

Its use among Fortune 500 companies for strategic planning jumped 30% between 2005 and 2020, underscoring its value. Learn more about how financial benchmarking drives operational strategy.

Industry Benchmarking: The Wide-Angle Lens

Industry benchmarking provides a telescopic, panoramic view of the entire banking landscape. It compares your institution against broad market aggregates, such as all community banks in a specific region or all commercial banks nationwide. This is the method for identifying macro-level trends and systemic shifts.

Is the industry experiencing widespread margin compression? Is credit quality deteriorating across the sector? These are high-level strategic questions that a small peer group cannot adequately answer.

A common error is to rely exclusively on one methodology. The most effective strategies integrate both.

The smartest strategies use both methodologies together. Industry data shows you which way the river is flowing, and peer analysis tells you how well your boat is navigating the currents compared to your direct rivals.

Peer vs. Industry Benchmarking: A Strategic Comparison

The choice between these approaches is strategic, not technical. It depends entirely on the question leadership seeks to answer. This table outlines the appropriate use for each.

| Aspect | Peer Benchmarking | Industry Benchmarking |

|---|---|---|

| Focus | Direct competitors with similar business models | Broad market trends and systemic shifts |

| Goal | Tactical improvements & operational efficiency | Strategic positioning & long-term trend identification |

| Questions Answered | "Why is our efficiency ratio 5 points higher than Bank X?" | "Is the industry's reliance on fee income growing?" |

| Data Scope | Narrow, highly curated peer set | Wide, aggregated industry data sets |

| Primary Use Case | Performance gap analysis, competitive intelligence | Macroeconomic context, long-range strategic planning |

Both methodologies are essential components of a comprehensive strategic toolkit. Granular peer analysis is required for day-to-day competitive execution, while broad industry context is necessary to ensure long-term strategic alignment.

The integrity of these insights depends entirely on the quality of the comparison. A stale, irrelevant peer group is the most common point of failure. Modern data intelligence tools like Visbanking’s BIAS are critical because they enable the construction of dynamic, relevant peer groups that deliver actionable intelligence, not just data. The principles are universal; HR leaders use salary benchmarking tools for the same reason—to make competitive decisions based on relevant data.

Building a Modern Benchmarking Framework

A powerful financial benchmarking process is not a one-time project but a repeatable system integrated into the bank’s strategic rhythm. A disciplined, multi-step framework is required to transform raw data into decisive action, ensuring every analysis is purposeful, accurate, and tied directly to performance improvement.

The process must begin with a precise objective. A vague goal like "let's see how we compare" yields ambiguous, unusable results. A focused question, such as, "Why is our ratio of non-interest income to average assets 0.45% while our top three peers average 0.70%?" provides a clear analytical path.

With a focused question, the next step is selecting the correct Key Performance Indicators (KPIs). For the non-interest income question, analysis must go beyond the headline number to its components: deposit service charges, treasury management fees, and wealth management revenue. This level of detail is necessary to isolate the root cause of the performance gap.

Assembling an Accurate Peer Group

Constructing the peer group is the most critical step and the most frequently mishandled. Using a generic, pre-defined list of banks is a direct path to flawed conclusions. A peer group must be dynamic and tailored to the specific question at hand, aligning institutions by asset size, business model, geographic market, and strategic focus.

A $900 million community bank focused on commercial real estate lending cannot derive meaningful insights by comparing itself to a $5 billion institution with a dominant retail mortgage operation. The comparison is fundamentally misaligned. This is where data intelligence platforms like Visbanking’s BIAS become indispensable. They allow executives to filter and construct precise peer groups in minutes, eliminating the manual, error-prone data work that consumes valuable time.

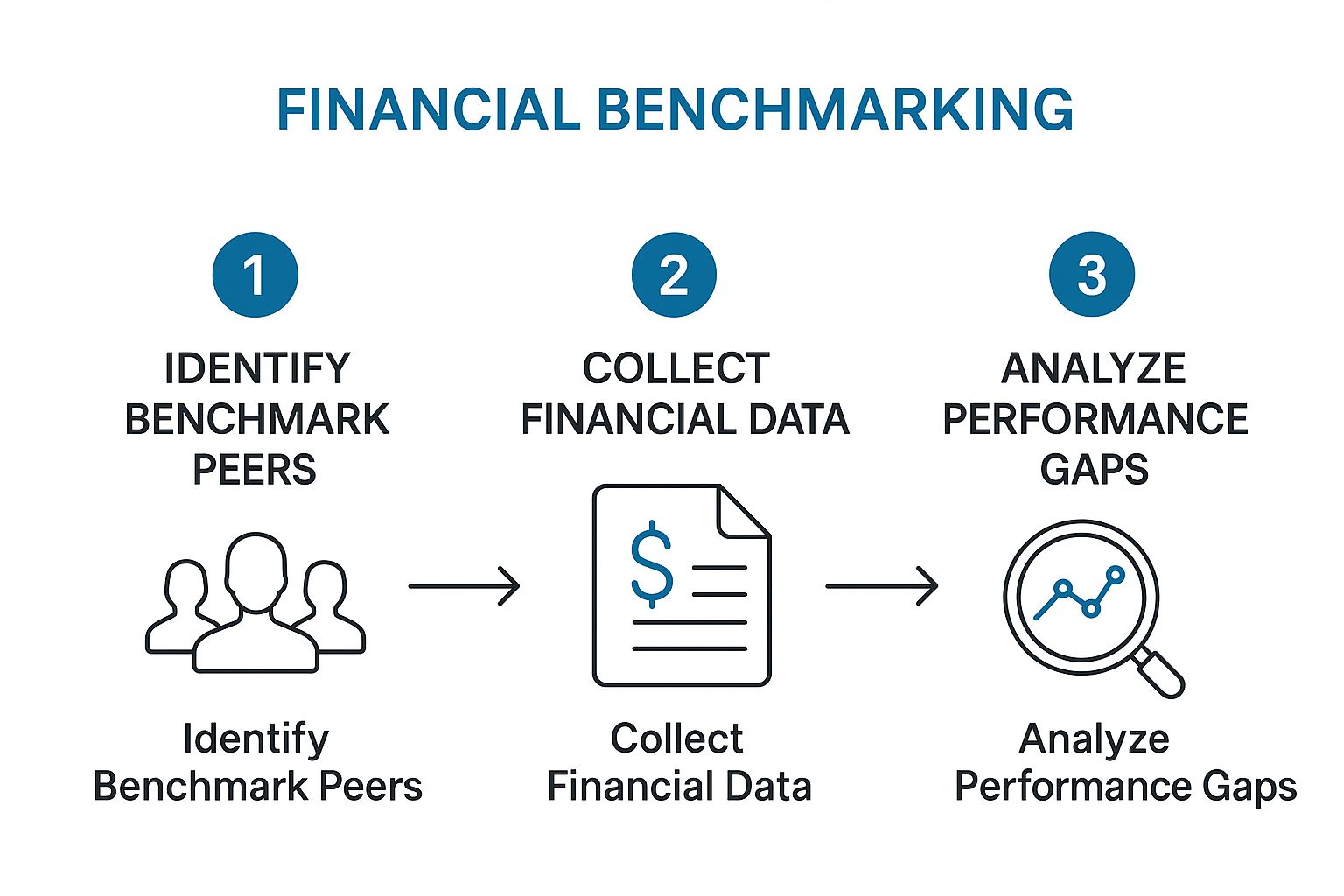

The infographic below illustrates the essential flow of a structured financial benchmarking analysis.

The visual reinforces a critical point: a successful process moves methodically from identifying the right peers, to gathering reliable data, and finally, to analyzing performance gaps with the intent to act.

From Analysis to Accountable Action

The final, non-negotiable step is converting findings into actions with clear ownership. Data without a decision is noise. If analysis reveals that high personnel costs are driving an unfavorable efficiency ratio, the output cannot be another report. It must be a concrete plan, such as re-evaluating staffing models, investing in automation, or optimizing compensation structures.

A rigorous benchmarking framework doesn't end with a report. It ends with a set of assigned action items, clear timelines, and defined owners. This is the discipline that turns analytical insights into tangible improvements in profitability and market position.

This repeatable process enables proactive leadership, replacing reactive analysis. It builds an organizational culture where data is the bedrock of every major decision.

Avoiding Common Benchmarking Mistakes

Even a well-designed benchmarking framework can fail without disciplined execution. The primary danger in financial benchmarking is not a lack of data, but a failure to challenge its context and, most importantly, a failure to act on it. Several common mistakes can render this powerful strategic tool ineffective.

The most frequent error is starting with a flawed peer group. Using a generic, static list of "competitors" can lead to comparing a specialized commercial lending strategy against a retail mortgage focus. This apples-to-oranges comparison generates insights that are irrelevant at best and dangerously misleading at worst.

Another critical mistake is focusing exclusively on historical data. While past performance provides context, it does not predict future trends. An over-reliance on rearview analysis leaves a bank vulnerable to emerging shifts in loan demand, rising funding costs, or digital disruptions that a forward-looking analysis would have identified.

Overcoming Analysis Paralysis

Perhaps the most damaging pitfall is analysis paralysis: drowning in data without making a single decision. This occurs when the process lacks a clear mandate for action. Reports are circulated, meetings are held, but the underlying performance issues remain unaddressed. The objective is not merely to know the numbers; it is to change them.

To break this cycle, every benchmarking review must conclude with a non-negotiable call to action.

Institute this rule: every benchmarking report presented to the executive team must conclude with three specific, measurable, and assigned action items. This simple discipline forces the conversation to shift from passive observation to active strategy, ensuring insights translate into tangible change.

For instance, if benchmarking reveals the bank's fee income is 0.45% of assets compared to a peer average of 0.75%, the following actions might be mandated:

- Action 1: The Chief Retail Officer is tasked with analyzing the product mix and fee structures of the top three performing peers, with a report due in 30 days.

- Action 2: The CFO will model the potential revenue impact of launching two new treasury management services by quarter-end.

- Action 3: The executive team will review proposals and approve a go-to-market plan within 60 days.

This execution-focused mindset is also vital for anticipating future challenges, a process detailed in our guide on effective stress testing for banks.

Ultimately, avoiding these mistakes requires a culture that prioritizes action over analysis. Data intelligence platforms like Visbanking’s BIAS are built for this purpose. They automate the labor-intensive work of data cleansing and dynamic peer group construction, allowing leadership to focus on the strategic implications and make the decisive calls that drive performance.

Turning Data Into a Competitive Edge

The purpose of financial benchmarking is not to produce reports. It is to win. For any bank serious about outperformance, benchmarking is a core leadership function, providing the context required to transform data into a decisive competitive advantage.

However, this process fails if the time from data acquisition to strategic debate is too long. The traditional approach—manual data pulls and cumbersome spreadsheets—consumes executive time that should be dedicated to strategy, not data reconciliation. Modern data intelligence platforms fundamentally change this dynamic.

From Manual Reporting to Strategic Action

Visbanking’s BIAS platform was built to solve this problem. It automates the arduous process of gathering clean, reliable data and constructing relevant peer groups. Complex metrics are visualized in intuitive dashboards, enabling executives to identify performance gaps in minutes, not weeks.

This speed liberates the leadership team to concentrate on the why behind the numbers.

For example, if a bank's Return on Assets (ROA) is 20 basis points below its custom peer group, the team can bypass data validation and immediately address the critical questions:

- Is the driver weak loan yields or an inefficient expense structure?

- Which specific peers are outperforming, and what are their operational differentiators?

- What targeted actions can we implement this quarter to close the performance gap?

The goal is to spend less time validating numbers and more time debating their strategic implications. When data is instant, accurate, and easily interpreted, the quality of executive decision-making improves dramatically.

This shift fosters organizational agility and a forward-looking perspective. By embedding benchmarking into the strategic planning rhythm, a bank can begin to anticipate market shifts rather than merely react to them. This capability can be enhanced with tools that project future performance, a topic we explore in our article on predictive analytics in banking.

Today’s market demands more than a rearview mirror. It requires a system that places actionable intelligence directly into the hands of decision-makers. It is time to put precise data to work building a stronger, more profitable bank.

Ready to see how your bank truly measures up? Benchmark your performance with Visbanking today.

Your Top Financial Benchmarking Questions Answered

How Often Should Our Bank Be Benchmarking?

Core performance indicators like the efficiency ratio and net interest margin should be benchmarked quarterly. This frequency is essential to detect negative trends before they materially impact performance.

For deeper strategic analyses, such as loan portfolio concentrations or market share, an annual review is standard. However, relying solely on periodic reports is insufficient. Modern data intelligence platforms provide continuous, real-time access to market data. This transitions the leadership team from periodic review to constant market awareness, enabling faster and more informed strategic adjustments.

What's the Biggest Mistake Banks Make When Picking a Peer Group?

The most significant error is a lack of precision. Using a broad national average renders the comparison useless. Conversely, a narrowly defined geographic group can create a blind spot to emerging competitors in adjacent markets.

A proper peer group must be constructed with strategic intent, balancing asset size, business model, and market focus. A bank specializing in agricultural lending requires a peer group of institutions with a similar ag concentration, not just a similar asset size. Any other approach will produce a flawed analysis of credit quality, yield, and profitability.

Achieving strategic clarity is not a matter of guesswork. It requires asking the right questions and measuring performance against the right competition. Visbanking provides the tools to replace assumptions with data-driven certainty.

See where your bank truly stands at https://www.visbanking.com.