Third Party Risk Assessment Tips: Protect Your Business

Brian's Banking Blog

Understanding Modern Third Party Risk Assessment

Today's businesses rely heavily on third-party vendors. These partnerships, spanning from software providers to crucial supply chain links, offer significant advantages. Businesses gain scalability and access to specialized expertise. However, this interconnectedness brings a crucial element to the forefront: third-party risk. Understanding and mitigating this risk is no longer optional, but essential for business survival.

Why Traditional Approaches Fall Short

Traditional methods often involved static checklists and annual reviews. This approach is insufficient in our dynamic business environment. Risks are constantly evolving, driven by new technologies and increasingly complex cyber threats. A free vendor risk assessment template can be helpful for getting started. But simply checking boxes isn't enough. Modern assessments require a deeper understanding of interconnected risks and their potential impact.

The Shift in Risk Perception

Consider the growing focus on operational resilience. A 2025 global survey by EY found that 57% of major companies identified disruption of business operations as their primary exposure to third-party risk. This highlights a significant shift, placing business continuity and resilience as top priorities in third-party risk management (TPRM). Find more detailed statistics here. Modern assessments must go beyond basic cybersecurity evaluations and consider a vendor's ability to maintain operations during unexpected events.

Building a Modern Framework

A modern third-party risk assessment involves a shift towards continuous monitoring and dynamic risk analysis. This includes using technology to automate data collection and analysis, providing real-time insights into vendor performance and security.

Effective frameworks also prioritize vendor categorization based on criticality and potential impact. This allows for strategic resource allocation, focusing on high-risk vendors that require more thorough assessment. This proactive approach isn't just about compliance; it's about building resilient vendor relationships that contribute to long-term success.

The Business Case That Gets Executive Buy-In

Securing executive buy-in for a robust third-party risk assessment program requires a compelling business case. This means shifting the focus from alarming statistics to demonstrating how enhanced risk management directly protects revenue and creates a competitive edge. Market forces are increasingly emphasizing the importance of Third-Party Risk Management (TPRM), making a strong business case even more critical.

The global TPRM market is booming. Valued at roughly US$8.3 billion in 2024, it's projected to reach US$18.7 billion by 2030. This represents a compound annual growth rate of 14.5%. This rapid expansion highlights the growing recognition of third-party risk as a major business concern. Find more detailed statistics here. This growth also presents an opportunity to position third-party risk assessment not as an expense, but as a strategic investment.

Connecting Risk Management to Revenue

Effective risk leaders are framing third-party risk assessment as a revenue protection strategy. They show how disruptions caused by vendor failures directly impact the bottom line. Think about the potential costs linked to these issues:

- Data breaches: Loss of customer trust, regulatory fines, and legal battles.

- Operational disruptions: Lost productivity, product launch delays, and supply chain issues.

- Reputational damage: Negative press and decreased customer loyalty.

By quantifying these potential losses, risk leaders can highlight the financial advantages of a proactive risk assessment program. This approach resonates with executives focused on protecting and increasing revenue.

Positioning Risk Assessment as a Strategic Enabler

Leading organizations are taking it a step further. They're positioning TPRM as a strategic enabler. They demonstrate how robust risk assessment processes can achieve the following:

- Improve vendor selection: Identifying potential risks early leads to better vendor choices.

- Strengthen vendor relationships: Collaborative risk management fosters trust and improves communication.

- Enhance operational efficiency: Automated assessments streamline workflows and free up resources.

You might find this helpful: How to master regulatory compliance.

Demonstrating ROI and Measuring Program Value

A strong business case requires demonstrating Return on Investment (ROI) and setting clear metrics for measuring program value. This can include tracking:

- Reduction in vendor-related incidents: Show a decrease in security breaches or operational disruptions.

- Improved vendor performance: Measure improvements in vendor compliance and service quality.

- Cost savings: Quantify the savings achieved through automation and reduced manual work.

By linking third-party risk assessment to tangible business outcomes and showcasing its strategic value, risk leaders can secure the executive buy-in and resources needed to establish a genuinely effective program.

Building Assessment Frameworks That Actually Work

Moving beyond generic templates is crucial for effective third-party risk assessment. This means focusing on practical elements that deliver tangible results, not just ticking boxes. A robust framework starts with understanding vendor categories and creating questionnaires that provide actionable insights. This structured approach ensures your third-party risk assessment is both comprehensive and efficient.

Vendor Categorization: Identifying Critical Partners

Effective vendor categorization is the foundation of a successful third-party risk assessment framework. Not all vendors present the same level of risk. Categorizing vendors based on their access to sensitive data, their importance to business operations, and their potential impact on your organization is essential.

For example, a vendor handling customer payment information needs more scrutiny than an office supply vendor. This targeted approach helps allocate resources effectively, focusing on the highest-risk vendors.

Building Effective Assessment Questionnaires

Developing insightful assessment questionnaires is vital. This means asking questions that go beyond basic compliance and explore the vendor's actual security practices and resilience.

Consider these key areas:

- Data security: How does the vendor safeguard sensitive data?

- Incident response: What is the vendor's plan for security incidents?

- Business continuity: Can the vendor maintain operations during disruptions?

These questions provide a deeper understanding of the vendor's risk profile.

The following table provides a breakdown of the key components within a robust Third-Party Risk Assessment Framework. It highlights the purpose of each component, suggests an implementation priority, and lists key metrics for tracking success.

Third Party Risk Assessment Framework Components

| Component | Purpose | Implementation Priority | Key Metrics |

|---|---|---|---|

| Vendor Categorization | Identify and classify vendors based on risk level | High | Number of vendors categorized, Percentage of high-risk vendors |

| Assessment Questionnaires | Gather detailed information on vendor security practices | High | Completion rate of questionnaires, Number of identified vulnerabilities |

| Continuous Monitoring | Track vendor performance and identify emerging risks | Medium | Frequency of monitoring, Number of detected risk events |

| Reporting and Metrics | Measure the effectiveness of the risk assessment program | Medium | Number of reported incidents, Time to remediation |

This table summarizes the core elements required to build a strong and effective third-party risk assessment program. By prioritizing these components, organizations can proactively manage vendor risks.

Balancing Thoroughness and Efficiency

Balancing thoroughness with efficiency is a key challenge. Overly complex assessments can be resource-intensive, while superficial assessments might miss critical risks. The solution is to tailor the assessment to the vendor's risk level.

High-risk vendors require deeper assessments, while lower-risk vendors can undergo streamlined reviews. This risk-based approach ensures efficient resource use and minimizes unnecessary burdens.

Continuous Monitoring: Staying Ahead of Emerging Risks

Building adaptable, sustainable processes is essential for long-term success. This means moving beyond one-time assessments and implementing continuous monitoring. This ongoing surveillance helps detect and address emerging risks proactively.

Your third-party risk assessment should not be a static event, but a continuous effort that adapts to the changing risk landscape. Establish clear metrics and reporting procedures to track the program's effectiveness. This data-driven approach allows for continuous improvement and ensures your program remains effective.

Leveraging AI To Transform Risk Detection

The cybersecurity threat landscape is constantly changing. It's evolving faster than traditional third-party risk assessment methods can keep up with. This makes moving beyond reactive approaches to predictive risk management essential. Artificial intelligence (AI) is leading this change, reshaping how organizations detect and assess risk.

The Power of Predictive Risk Management

AI allows organizations to shift from reacting to incidents to predicting and preventing them. This proactive strategy is crucial in our interconnected world. A single vulnerability in a third-party vendor can have widespread repercussions. AI algorithms are great at analyzing huge datasets. They pinpoint subtle patterns and anomalies that humans would miss. This ability to predict potential risks based on historical data and new trends is changing third-party risk assessment.

Machine Learning: Automating and Enhancing Assessments

Machine learning, a subset of AI, is especially helpful in automating and improving third-party risk assessments. For instance, machine learning algorithms can automatically scan news, social media, and security databases. They look for information relevant to a vendor's risk profile. This automated data collection greatly reduces manual work. It lets risk professionals concentrate on strategic analysis and mitigation. To improve your risk detection, consider a vendor risk assessment template. Machine learning can also analyze existing questionnaires. This helps identify areas where questions can be improved for more useful answers.

Continuous Monitoring: Real-Time Risk Insights

AI is also key for continuous monitoring of third-party risk. Traditional assessments provide a single point-in-time view. AI-powered solutions offer real-time insights into a vendor’s security, financial health, and operational resilience. This constant monitoring helps organizations detect emerging threats early. They can act before these threats become major crises. Currently, only about 5% of organizations actively use AI for third-party risk management. This number is expected to grow as companies adopt automation. Learn more about this trend here.

Addressing Implementation Challenges and Expectations

While AI has significant potential in third-party risk assessment, it’s important to address implementation challenges and have realistic expectations. Integrating AI tools into current workflows takes careful planning. Organizations must have the expertise to interpret and act on AI-generated insights. AI is not a magic fix. It’s a powerful tool that needs strategic and ethical use. Learn more about managing financial risk here. Understanding AI's capabilities and limits helps organizations use it effectively. They can transform their risk assessment programs and create a stronger vendor ecosystem.

Implementation Strategies That Drive Results

Success in third-party risk assessment isn't just about the right tools. It's about building sustainable practices woven into your organization's fabric. This means developing programs that deliver both quick wins and long-term value. These programs need stakeholder buy-in, cross-functional teams, and effective management of cultural shifts that come with better risk assessment.

Building a Collaborative and Cross-Functional Approach

A successful third-party risk assessment program requires collaboration across different departments. This means breaking down silos and encouraging open communication between teams like IT, procurement, legal, and compliance.

Establish a Cross-Functional Team: Create a dedicated team with representatives from each relevant department. This team owns developing, implementing, and overseeing the third-party risk assessment program.

Define Roles and Responsibilities: Clearly outline each team member's responsibilities for accountability and avoid confusion.

Regular Communication: Implement regular meetings and reporting to keep stakeholders informed of progress and identified risks.

This collaborative approach ensures all perspectives are considered for a more comprehensive and effective program.

Prioritizing Assessments Based on Business Impact

Not all vendors pose the same level of risk. Prioritizing assessment efforts based on the potential impact of a vendor failure is key.

Categorize Vendors Based on Criticality: Group vendors based on their access to sensitive data, importance to business operations, and potential impact on your organization.

Focus on High-Risk Vendors: Dedicate more resources to assessing vendors that handle sensitive data or play a crucial role in your core business functions.

Streamline Assessments for Low-Risk Vendors: Use simpler assessments for vendors that pose minimal risk.

This targeted approach ensures efficient resource use and addresses the most critical risks first.

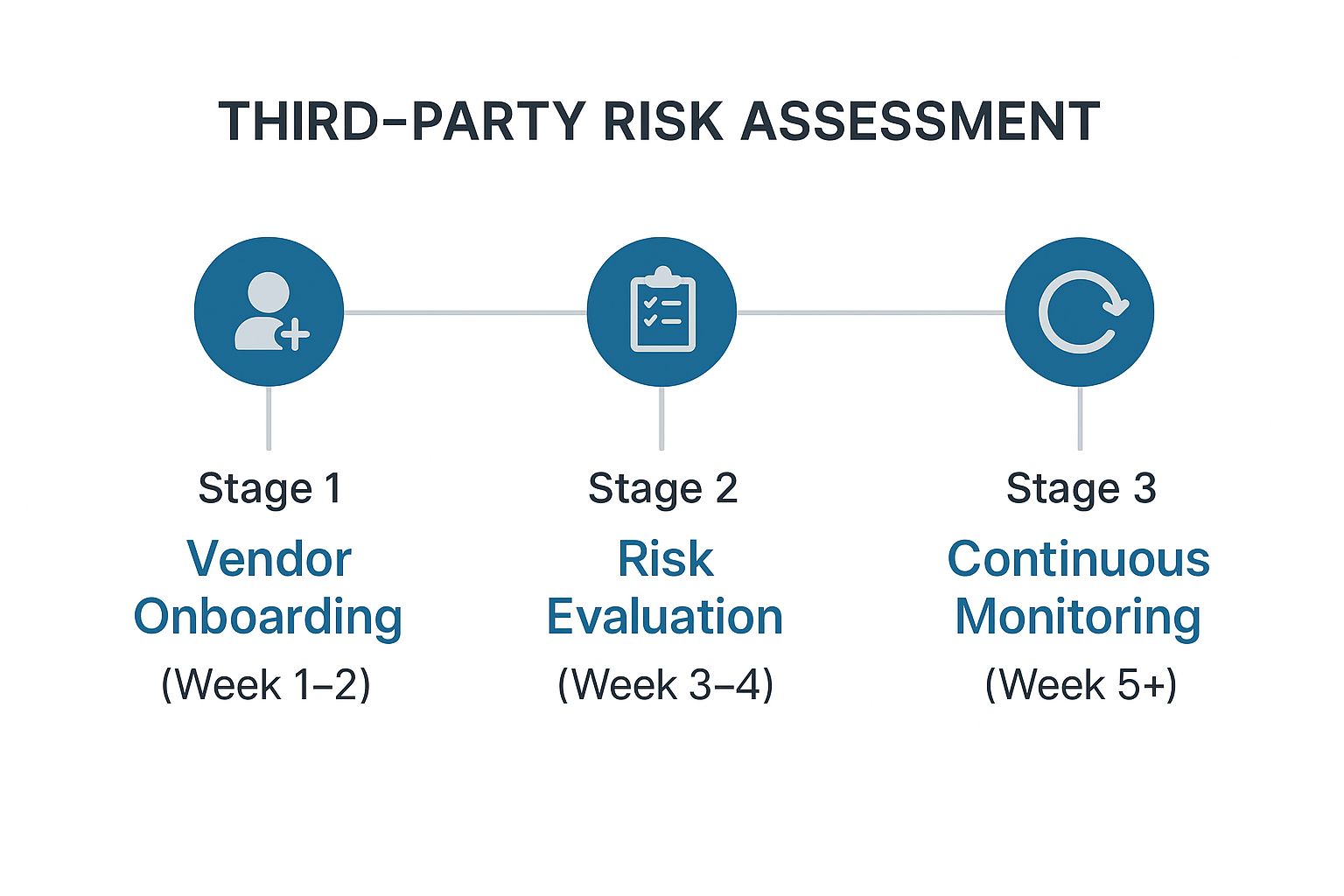

The infographic below visualizes the three key stages of implementing a third-party risk assessment process, showing the timeline for each phase.

This timeline shows that successful third-party risk assessment requires continuous monitoring beyond initial onboarding and evaluation. This ongoing process ensures potential risks are identified and addressed proactively.

Effective Communication With Vendors

Open communication with vendors is critical for a successful third-party risk assessment program. This includes communicating your expectations, providing feedback on assessments, and collaborating to address vulnerabilities.

Establish Clear Expectations: Provide vendors with clear guidelines on your security requirements and assessment process.

Regular Communication: Maintain consistent communication throughout the assessment process, providing updates and answering questions.

Collaborative Remediation: Work with vendors to develop remediation plans for any identified weaknesses, fostering a partnership approach to risk management.

This collaborative communication builds trust and ensures vendors actively participate in risk management.

Measuring Program Effectiveness and Continuous Improvement

Measuring your program's effectiveness is crucial for demonstrating its value and identifying improvements.

Establish Key Metrics: Define SMART (specific, measurable, achievable, relevant, and time-bound) metrics to track program performance. This might include the number of vendors assessed, identified vulnerabilities, and time to remediation.

Regular Reporting: Generate regular reports on program performance, highlighting successes and areas needing improvement.

Feedback Loops: Establish feedback mechanisms with stakeholders and vendors to gather insights and identify opportunities to enhance the program.

This data-driven approach ensures the program continuously evolves to meet changing business needs and the evolving threat landscape.

The following table provides a strategic roadmap for implementing a Third-Party Risk Management (TPRM) program.

TPRM Implementation Timeline And Milestones: A strategic roadmap showing key implementation phases, timelines, and success metrics

| Phase | Duration | Key Activities | Success Metrics | Common Challenges |

|---|---|---|---|---|

| Planning & Scoping | 2-3 Months | Define scope, identify stakeholders, establish objectives, secure budget. | Documented plan with clear objectives and stakeholder buy-in. | Lack of executive sponsorship, unclear objectives. |

| Design & Development | 3-6 Months | Develop policies and procedures, select and implement tools, design assessment questionnaires. | Finalized policies and procedures, GRC platform selected and configured. | Integration with existing systems, resistance to change. |

| Implementation & Rollout | 6-12 Months | Onboard vendors, conduct assessments, remediate identified risks. | Number of vendors assessed, number of risks remediated, time to remediation. | Vendor resistance, lack of resources. |

| Ongoing Monitoring & Improvement | Ongoing | Continuous monitoring of vendors, regular reporting, program review and improvement. | Improved risk posture, reduced vendor-related incidents. | Maintaining momentum, adapting to changing regulations. |

This table outlines the key phases, timelines, and milestones for a successful TPRM implementation. Each phase presents unique challenges, but by addressing them proactively, organizations can build a robust TPRM program that protects their business.

Staying Ahead Of Regulatory Requirements

The regulatory landscape surrounding third-party risk management is constantly changing. New requirements appear frequently, demanding more robust approaches to third-party risk assessment. This means organizations must not only meet current compliance standards but also anticipate what's coming next. This section explores current regulatory frameworks, their practical implications, and future developments likely to reshape the TPRM landscape.

Navigating the Current Regulatory Landscape

Several frameworks currently govern third-party risk assessment. These frameworks vary by industry and location, creating complexity for organizations operating across multiple jurisdictions. Key regulations include guidelines from the National Institute of Standards and Technology (NIST), the General Data Protection Regulation (GDPR), and industry-specific requirements, particularly within financial services.

For example, financial institutions face stringent regulations around data privacy, cybersecurity, and anti-money laundering. Understanding these specific regulatory demands is crucial for building compliant third-party risk assessment programs. Learn more in this article about new guidance for third-party risk management. This goes beyond simply checking boxes; it's about implementing practices that truly mitigate risk.

Building Adaptable Assessment Programs

Because regulatory requirements are dynamic, organizations need assessment programs designed for flexibility. This means adopting frameworks that can adapt to evolving regulations without needing major overhauls. Key characteristics of adaptable programs include:

- Modular Design: Breaking the assessment process into separate modules allows for easy updates and customization as regulations change.

- Centralized Risk Management Platform: Using a central platform to manage all aspects of third-party risk—from due diligence to continuous monitoring—allows for efficient tracking and reporting.

- Automated Workflows: Automating key assessment processes, like data collection and analysis, reduces manual effort and ensures consistency.

Industry-Specific and International Compliance

Industry-specific regulations often present unique challenges. In healthcare, for instance, HIPAA compliance adds a layer of complexity concerning patient data privacy. Organizations operating internationally must navigate diverse and often conflicting regulatory environments.

Building a global strategy for third-party risk assessment is essential. This strategy should be flexible enough to adapt to regional differences while maintaining a consistent core framework. This not only ensures compliance but also streamlines operations and reduces redundancy.

Emerging Trends and Standardization Efforts

Emerging areas like ESG (Environmental, Social, and Governance) risk assessment add further complexity to the regulatory landscape. These new considerations add more factors to third-party risk assessments, requiring organizations to evaluate vendors' sustainability practices and ethical conduct.

There's good news, though: regulatory trends are moving toward standardization. These efforts aim to create common frameworks and best practices for third-party risk assessment, which could eventually streamline compliance burdens. This anticipated shift toward standardization could simplify managing third-party risk across different industries and locations. By staying informed about these developments and adapting their assessment programs, organizations can effectively navigate the evolving regulatory environment.

Key Takeaways

This section offers practical advice and clear steps to improve your third-party risk assessment process. It provides guidance for strengthening your current risk posture and building a robust, long-term program. We'll explore vital success factors, frameworks for measuring progress, and strategies for demonstrating value to stakeholders. We'll also examine available templates and tools, constructing compelling business cases for resources, and staying current with emerging threats and regulatory requirements. Each recommendation includes timelines and resource needs to help you prioritize your efforts and achieve real improvements.

Immediate Actions for Strengthening Your Risk Posture

You can take several quick actions to bolster your third-party risk assessment process, even with limited resources. These initial steps create a solid base for a more complete program:

Preliminary Vendor Inventory: Identify all third-party vendors your organization works with, including software providers, service providers, and supply chain partners. This inventory is the starting point for your risk assessment efforts. Timeline: 1-2 weeks.

Categorize Vendors by Criticality: Group vendors based on their access to sensitive data, their importance to core business functions, and the potential impact of a disruption. Focus on high-risk vendors for detailed assessments. Timeline: 2-4 weeks.

Basic Security Assessments: Use readily available resources, such as questionnaires and online security ratings, to gain initial insights into the security practices of your critical vendors. Timeline: Ongoing.

Contract Review: Examine existing vendor contracts for security provisions, ensuring they align with your organization's risk tolerance. Timeline: Ongoing.

Building a Long-Term Third-Party Risk Management Program

A lasting third-party risk management program requires a strategic approach and continuous investment. These steps will help you create a program that provides long-term value:

Formal Policy Development: Create a formal document outlining your organization's approach to managing third-party risk, including defined roles, responsibilities, and assessment procedures. Timeline: 2-3 months.

Automation Investment: Investigate tools and technologies that can automate data collection, analysis, and reporting. This frees up valuable resources and improves efficiency. Timeline: Ongoing.

Continuous Monitoring: Establish processes for ongoing monitoring of vendor performance and security posture. This includes regular reviews, security ratings, and automated alerts. Timeline: 3-6 months.

Risk Awareness Culture: Educate stakeholders throughout your organization about the importance of third-party risk management and their roles in mitigating risks. Timeline: Ongoing.

Regulatory Awareness: Stay informed about the newest regulatory developments and adapt your program accordingly. Timeline: Ongoing.

Demonstrating Value and Securing Resources

To get executive buy-in and secure the resources you need, demonstrate the value of your third-party risk management program:

Key Metric Tracking: Monitor and report on important metrics, including the number of vendors assessed, identified vulnerabilities, and time to remediation.

Effective Communication: Regularly update stakeholders on the program's progress, highlighting successes and addressing challenges.

Alignment with Business Goals: Clearly show how a strong third-party risk management program contributes to protecting revenue, maintaining business continuity, and enhancing the organization's reputation.

By following these strategies, you can significantly improve your third-party risk assessment process and build a more resilient vendor ecosystem.

Ready to strengthen your bank's risk management and gain a competitive edge? Visit Visbanking today to learn how our Bank Intelligence and Action System (BIAS) can empower your institution with actionable insights and data-driven decision-making.