Strategic Workforce Planning: A Data-Driven Mandate for Bank Executives

Brian's Banking Blog

In an industry defined by market volatility and regulatory pressure, superior talent strategy is the definitive competitive advantage. Strategic workforce planning is the discipline that achieves it. It is the analytical process of ensuring a bank has the right talent, with the right skills, positioned to execute its business strategy—not just today, but three to five years from now.

The New Reality for Bank Talent Strategy

Between intense competition for specialized talent, the relentless pace of digitalization, and an ever-changing regulatory environment, bank executives face a complex set of human capital challenges. Strategic workforce planning (SWP) provides a clear, data-driven framework to convert these pressures into strategic opportunities. It elevates the HR function from a reactive, administrative cost center to a core driver of institutional value.

This is no longer about managing headcount. It is about leveraging predictive analytics and real-time market intelligence to anticipate skill gaps, optimize labor costs, and build a workforce resilient enough to capitalize on future disruption. In short, it is about making calculated talent investments that yield a direct, measurable return to the bottom line.

From Headcounts to High-Impact Capabilities

Relying on simple headcount metrics is an obsolete model for the modern financial institution. The focus must pivot to capabilities. Consider a bank aiming to launch a new digital wealth management platform. The objective is not merely to hire "more advisors." The requirement is for a precise blend of professionals skilled in data analytics, cybersecurity, client-facing technology, and high-net-worth relationship management.

Effective SWP translates this business objective into a concrete talent acquisition and development plan. For example, a robust analysis might project a shortfall of 15 data scientists and 10 cybersecurity analysts over the next two years to support the platform's roadmap. This specific, forward-looking insight enables leadership to act decisively, well ahead of the need.

By forecasting future talent requirements with this level of granularity, banks can shift from scrambling to fill critical roles to proactively building the human capital that delivers a sustainable competitive edge.

Addressing the Modern Talent Challenge

The banking industry faces a significant talent drain. Retaining top performers and attracting new ones has become a critical strategic issue. The first step in countering this trend is to understand the real market dynamics behind the banking talent crisis.

SWP provides the analytical tools to respond effectively. It enables banks to identify flight-risk employees and model the impact of interventions like compensation adjustments or targeted development programs. This is where data intelligence platforms like Visbanking become indispensable. They deliver the external market data required to benchmark a talent strategy against competitors, ensuring it is not just internally consistent but externally competitive.

Core Concepts of Modern Workforce Planning

To execute strategic workforce planning effectively, leadership must move beyond simplistic headcount reports toward dynamic, skill-based forecasting. The framework rests on three pillars: determining future skill requirements (demand forecasting), assessing current capabilities (supply modeling), and quantifying the difference between the two (gap analysis). Mastering this framework transforms workforce planning from a reactive exercise into a powerful predictive tool.

Consider the financial stress tests that are standard practice for bank boards. SWP applies the same rigorous, scenario-based logic to human capital. It allows leadership to model the talent implications of a major acquisition, the rollout of AI-powered underwriting tools, or a sudden market downturn, thereby mitigating operational and strategic risks.

Demand Forecasting: What Skills Will You Need?

Demand forecasting identifies the talent required to achieve specific strategic objectives. This is not guesswork; it is a quantitative exercise that projects human capital needs based on growth targets, technology roadmaps, and anticipated market shifts.

For example, if a bank’s three-year strategy includes growing its commercial lending portfolio by $500 million, a demand forecast translates that financial goal into a precise hiring plan. The model might indicate that achieving this target requires eight additional commercial loan officers with C&I lending expertise, three credit analysts skilled in advanced risk modeling, and two compliance specialists versed in emerging regulatory frameworks. Without such foresight, strategic growth initiatives inevitably collide with talent bottlenecks.

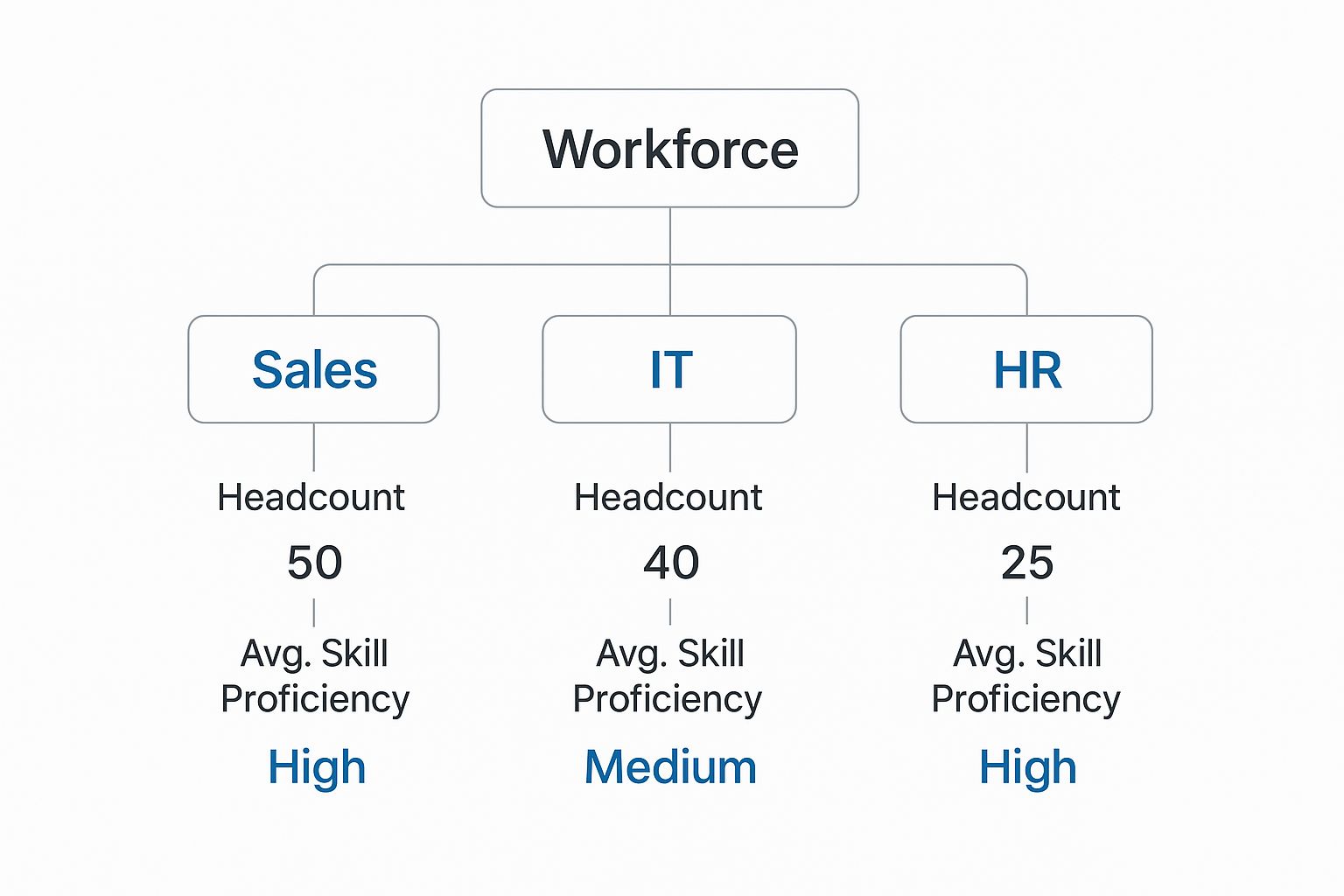

The image below illustrates the structure of a bank, emphasizing that a simple headcount is insufficient. Understanding the skill proficiency within each team is what matters.

This underscores a critical point: knowing your headcount is operational. Understanding the proficiency of your people is strategic, allowing you to identify performance gaps before they become critical failures.

Supply Modeling: What Talent Do You Already Have?

Once future needs are defined, the next step is a clear-eyed assessment of current capabilities. Supply modeling is a comprehensive inventory of the existing workforce—its skills, competencies, experience levels, and performance. It is a data-driven audit of the internal talent pool.

This process often uncovers latent strengths and, more critically, hidden vulnerabilities. A supply model might show an abundance of senior relationship managers but reveal that 60% of them are within five years of retirement. This data point immediately flags a significant succession risk and a potential loss of key client relationships, providing the impetus to build a functional succession plan.

Gap Analysis: Where's the Disconnect?

Finally, gap analysis compares the demand forecast with the supply model to identify specific disconnects between the workforce you have and the one you need. It illuminates critical skill shortages and surpluses.

A gap analysis might reveal a projected deficit of five data scientists in 18 months alongside a surplus of traditional branch managers. This insight drives clear, actionable decisions. Do you retrain high-performing managers for new roles in digital client engagement? Do you initiate an external recruitment campaign? Or do you explore acquiring a smaller firm with the requisite talent? Each option carries distinct costs, timelines, and risks.

To inform these decisions, internal data is not enough. The following table contrasts obsolete headcount planning with modern, strategic forecasting.

Traditional Headcount Tracking vs Strategic Skill Forecasting

The outdated practice of employee counting is being replaced by a more sophisticated, forward-looking approach centered on skills and capabilities. Here is a direct comparison:

| Capability | Traditional Planning | Strategic Forecasting |

|---|---|---|

| Focus | Counting people and filling open positions. | Aligning talent with future business strategy. |

| Time Horizon | Short-term (Quarterly/Annually). | Long-term (3-5 Years). |

| Data Used | Headcount, attrition, and budget data. | Internal skills data, market trends, and business goals. |

| Primary Goal | Meeting current staffing needs. | Building a workforce that is agile and future-ready. |

This evolution is non-negotiable. While traditional planning maintains operational stability, strategic forecasting ensures the bank is positioned to win in the future, transforming its workforce into a true competitive asset.

This is where external market intelligence is crucial. Platforms like Visbanking provide the data to make the optimal decision. By benchmarking compensation against competitors and analyzing regional talent availability, leadership can select the most viable path forward. This process is essential for anyone navigating the landscape of bank recruitment. Fusing internal knowledge with external market reality produces a workforce strategy that is not just ambitious, but achievable.

How SWP Drives Tangible Business Outcomes

The primary function of strategic workforce planning is to elevate talent from a back-office administrative topic to a boardroom-level strategic imperative. It is the connective tissue between human capital strategy and the bank's financial performance. SWP provides the framework for addressing the most significant pressures executives face, from controlling the escalating costs of digital transformation to ensuring regulatory compliance expertise.

The link between talent planning and the bottom line is direct and measurable. For example, by accurately forecasting the need for skills in high-growth areas like AI-powered fraud detection, a bank can preemptively launch targeted upskilling programs for its existing analysts instead of scrambling to hire expensive external contractors later.

A robust data forecast might reveal a critical gap of 10 cybersecurity analysts emerging within two years. Armed with this intelligence, the bank can establish an internal certification program. Such a move could reduce reliance on external hiring by 25%, saving hundreds of thousands in recruiter fees and contract labor costs. This is SWP in action: turning foresight into financial advantage.

The table below outlines how a proactive workforce strategy delivers concrete business results.

Key Metrics Impacted by Strategic Workforce Planning

| Business Metric | Potential Impact | Data Point |

|---|---|---|

| Recruitment Costs | Reduced reliance on external agencies and premium salaries for last-minute hires. | Up to 30% reduction in cost-per-hire by building internal talent pipelines. |

| Employee Attrition | Improved retention through clear career pathing and upskilling opportunities. | Banks with mature SWP can see a 15-20% lower attrition rate in critical roles. |

| Time-to-Productivity | Faster onboarding and integration for new hires who fill well-defined roles. | New hire productivity can increase by 25% in the first six months. |

| Project ROI | Projects are staffed correctly from the start, avoiding costly delays and skill gaps. | Reduces budget overruns on key initiatives by an average of 10-15%. |

These metrics demonstrate that investing in SWP is not an HR expense; it is a direct investment in the bank's financial health, operational stability, and long-term viability.

Enhancing Competitive Differentiation

In a fiercely competitive labor market, the bank that secures critical talent first gains a decisive advantage. Data-driven strategic workforce planning delivers the intelligence to identify and attract key professionals long before rivals recognize the need. It provides a map of the talent landscape, revealing where competitors are hiring and which skills they are prioritizing.

Imagine a competitor is quietly building a new fintech division. Intelligence tools, like those available through Visbanking, can detect subtle hiring patterns for roles like "blockchain developer" or "UX designer" in specific geographies. This insight provides a crucial head-start to either counter-recruit or strengthen internal teams before a competitor's new product ever reaches the market.

This proactive stance creates a powerful competitive moat. While other banks react to market shifts, you are already executing a talent strategy aligned with future opportunities, with the right people in place to innovate and capture market share.

Improving Operational Efficiency and Mitigating Risk

Beyond competitive advantage, SWP delivers fundamental improvements to daily operations. When talent supply is precisely aligned with business demand, the costly inefficiencies of being overstaffed in one division and critically under-skilled in another are minimized.

Effective planning also mitigates significant risks, particularly those related to attrition. For example, identifying a high concentration of retirement-eligible executives in the commercial lending division allows for the implementation of a structured succession plan over 24 months. This foresight prevents the sudden loss of institutional knowledge and critical client relationships that could otherwise severely impact revenue.

Strategic workforce planning is not an HR exercise; it is a core business discipline. It translates talent management into a quantifiable impact on productivity, employee engagement, and organizational resilience.

The talent shortage is a structural reality. Global analysis shows that only 29% of businesses believe talent availability will improve between 2025 and 2030—a sharp decline from 39% in 2023. To combat this, 70% of organizations plan to hire for new skills, while 51% are focused on redeploying current employees into high-growth roles. These figures underscore a landscape of increasing complexity, making a sophisticated, data-informed strategy essential. Further details are available in the World Economic Forum's detailed report.

By embracing a data-centric approach, your bank can confidently navigate these challenges. To see how your talent metrics stack up against your peers, explore Visbanking’s comprehensive benchmarking data.

Executing a Data-Driven Workforce Strategy

A strategic workforce plan is merely theoretical until it is executed. Transforming a strategic document into tangible results requires a disciplined, data-centric approach integrated into the bank's core operational and risk management functions. Every decision concerning human capital must directly support a defined business objective.

Execution relies on three core methodologies: scenario planning, skills gap analysis, and supply modeling. These should be viewed not as HR processes, but as essential financial planning tools. Just as a bank would never ignore interest rate scenarios when managing its balance sheet, it must apply the same rigor to modeling its talent to preempt operational and competitive threats.

Getting the Right People in the Room

Execution begins with a cross-functional governance committee. This is not an HR meeting; it requires the active participation of leaders from HR, Finance, and key business lines like commercial lending and wealth management. Their mandate is to ensure the workforce plan is directly integrated with the bank’s annual strategic objectives and capital allocation plans.

This structure prevents the plan from becoming a siloed academic exercise. When the head of commercial lending is involved in forecasting the need for credit analysts with specialized skills in renewable energy finance, the plan gains immediate operational relevance and executive buy-in. It becomes a shared roadmap for growth.

The Power of a Continuous Feedback Loop

The most effective workforce plans are not static annual reports; they are dynamic instruments. This requires a continuous feedback loop that incorporates real-time labor market data to refine forecasts and adapt strategy. Relying on last year's survey data is equivalent to driving while looking only in the rearview mirror.

Consider a sudden surge in competitor hiring for private bankers in a key market. This is a critical market signal. With real-time intelligence, the governance committee can react in weeks, not months—perhaps by accelerating a leadership development program or adjusting compensation to retain top talent. This agility separates market leaders from laggards.

A workforce plan without a feedback loop is an educated guess. A plan powered by continuous data intelligence is a strategic asset that allows you to anticipate and respond to market forces before they impact your bottom line.

Breaking Free from Short-Term Thinking

A shocking number of organizations remain trapped in short-term planning cycles. Research shows that only 12% of HR leaders in the U.S. conduct strategic workforce planning that looks out three years or more. While 73% of organizations engage in some form of operational workforce planning, they often fail to connect today’s staffing needs with the long-term skills demanded by transformative trends like AI. This disconnect creates profound risk. You can find a full analysis of how organizations approach future workforce challenges on McKinsey.com.

This short-term focus is particularly perilous in banking, where skills in compliance, data science, and digital product management are evolving rapidly. A bank planning to launch an AI-powered underwriting platform in two years must address the talent implications now. It needs to begin identifying internal candidates for upskilling, developing targeted training, and initiating recruitment for external experts. This is precisely why modern recruitment tools are no longer optional; see our guide on how AI-powered talent tools transform financial hiring.

Without this forward-looking approach, a multi-million dollar technology investment is likely to underperform due to a predictable talent bottleneck. By synchronizing workforce planning with the bank's long-range strategic goals, you ensure talent readiness is a core component of every major initiative, from M&A due diligence to new market entry.

Translating Market Intelligence Into Action

A strategic workforce plan developed solely on internal data operates with a critical blind spot. While understanding internal skills and turnover is essential, it is the external view—of the market, competitors, and the labor pool—that transforms planning into a competitive weapon.

This is where sophisticated data platforms provide a decisive edge. Tools like Visbanking's Business Intelligence and Analytics Solution (BIAS) function as a bank's market intelligence hub, translating raw market data into clear, actionable signals. Instead of relying on stale annual surveys, leaders gain a live view of hiring trends, salary benchmarks, and emerging skill demands.

Scanning the Competitive Horizon

Effective workforce planning allows you to anticipate competitors' strategic moves. By monitoring labor market data, you can detect subtle shifts in their talent strategy that reveal their intentions.

For example, if your primary competitor in the Dallas-Fort Worth market suddenly begins posting numerous jobs for commercial lenders specializing in healthcare finance, it is a strategic indicator. They are not merely filling vacancies; they are signaling a major push into a new vertical.

This is the kind of intelligence that allows you to shift from a defensive to an offensive posture. You can immediately assess your own bench strength, decide whether to counter-hire specialists, reinforce client retention efforts, or strategically reallocate resources.

This foresight provides a critical time advantage, enabling a well-considered response rather than a panicked reaction to a competitor’s press release.

Modeling Talent Availability and Cost

Another critical application of market data is modeling the true cost and availability of talent in different markets. Imagine your bank plans to expand into Nashville and needs to hire a team of 15 fintech developers and 10 digital marketing specialists over the next 18 months.

An interactive data platform provides answers in minutes:

- What is the median salary for a senior fintech developer in Nashville versus your headquarters in Atlanta?

- What is the size of the available talent pool with these specific skills in the Nashville metropolitan area?

- Are local universities producing graduates with these skills, indicating a future talent pipeline?

This data allows you to build a financial and operational plan grounded in reality. You might discover that while developer salaries are 12% lower in Nashville, the available talent pool is 30% smaller. This necessitates a more aggressive recruiting budget or an extended timeline. The conversation shifts from "I think we should..." to "The data shows us..."

Forecasting Attrition Risk from External Pressures

Market intelligence serves as an early warning system for employee turnover. If a large national bank announces a new operations center in your primary market, your top operational, compliance, and IT staff immediately become their prime recruiting targets.

By integrating this market event with your internal employee data, you can predict which employees are most at risk. The analysis might reveal that 40% of your mid-level operations managers are now compensated 15% below the new market rate your competitor is establishing.

This insight enables a preemptive response. You can implement targeted salary adjustments or retention bonuses for critical employees before they receive competitor offers. This ability to connect an external event to an internal vulnerability is the hallmark of a modern, data-driven workforce strategy.

To see how your bank's talent metrics compare to regional and national benchmarks, explore the data intelligence tools that industry leaders are using to build a competitive edge.

Putting Strategic Workforce Planning to Work

Theory is secondary to execution. For bank executives, the success of strategic workforce planning is not measured by a polished report, but by tangible results that strengthen the balance sheet and create a sustainable competitive advantage.

The following scenarios illustrate how data intelligence transforms abstract plans into decisive, profitable actions. Each case addresses a common challenge in modern banking, drawing a direct line from a data-driven workforce strategy to measurable financial and operational outcomes. These are not hypotheticals; they are blueprints for success.

Case One: Getting Ahead of Attrition

A national retail bank faced a costly turnover problem in its mortgage division, with annual attrition at 25%. This led to constant recruitment pressure and inconsistent client service. The leadership team decided to move from a reactive to a predictive footing.

Using predictive attrition modeling, they integrated internal performance and compensation data with external market benchmarks from a platform like Visbanking. The model identified a key vulnerability: top-performing loan officers with three to five years of experience were being actively poached. Competitors were offering compensation packages that were, on average, 12% higher, along with clearer paths to management.

This was not merely an HR issue. This specific cohort was responsible for over 40% of new mortgage originations. Their departure represented a direct blow to the bank's revenue.

Armed with this insight, the bank executed two precise interventions:

- Targeted Compensation: They implemented a new bonus structure and salary adjustment for this high-risk group, positioning their total compensation slightly above the new market average.

- Leadership Development: They launched a fast-track management program tailored to these high-performers, directly addressing the career progression gap.

The results were swift. Within 18 months, attrition in the division fell from 25% to 17.5%—a 30% reduction. The bank calculated an annual savings of approximately $4 million in recruitment and training costs, demonstrating a clear return on its data-driven investment.

Case Two: Building Talent from Within

A mid-sized commercial bank with $15 billion in assets identified data analytics as critical to its future in credit risk and client acquisition. However, hiring experienced data analysts was slow and expensive, with senior roles remaining vacant for over 90 days. The bank opted to build talent internally.

A comprehensive skills gap analysis mapped the current workforce's analytical capabilities against future requirements. The analysis revealed a hidden talent pool: highly capable financial analysts and IT professionals with strong quantitative foundations. They lacked proficiency in modern data visualization tools and predictive modeling.

This is the strategic value of SWP. It is not just about identifying deficits; it is about uncovering and leveraging untapped internal potential.

Instead of competing in a saturated external market, the bank invested in its own people:

- Custom Upskilling: It partnered with a local university to create a six-month certification program focused on the specific data science skills the bank required.

- Internal Career Paths: It established clear pathways for program graduates to transition into new data analytics roles with enhanced compensation and responsibility.

This "build-first" strategy was a decisive success. The bank increased its internal promotion rate by 40% within two years and reduced the time-to-fill for senior analytics roles to under 30 days by creating a proven internal talent pipeline.

Case Three: Planning for Growth Before It Happens

An investment bank prepared to launch a tech-forward wealth management platform aimed at a younger, digitally native clientele. Leadership recognized that success depended entirely on having the right advisors in place on day one—professionals skilled in both digital tools and complex financial products.

Using scenario planning, the team modeled the workforce requirements under aggressive, moderate, and conservative growth projections. They leveraged external market data to identify where to find tech-savvy financial advisors, what their compensation expectations would be, and what competitors were doing.

This forward-looking analysis ensured the talent strategy was perfectly synchronized with the product launch. Six months prior to launch, a highly targeted recruitment campaign successfully onboarded a specialized team. Because the workforce plan was integral to the business strategy, the new division was fully staffed, trained, and prepared on day one.

The result: the new wealth platform exceeded its first-year revenue target by 15%. Leadership directly attributed this success to having the right talent in place to execute the strategy—a feat made possible only through meticulous, data-driven workforce planning.

These cases confirm that strategic workforce planning, when powered by precise data intelligence, is a fundamental driver of business performance. To understand how your institution's talent metrics compare to the market, it's time to explore the benchmarking data that informs these winning strategies.

Common Questions We Hear About SWP

When leadership teams begin to engage with strategic workforce planning, several key questions consistently arise. Addressing these early is critical for achieving executive alignment and ensuring the successful implementation of the plan. Below are direct answers for banking leaders.

How Do We Get Started With the Data We Have Right Now?

The most common mistake is waiting for "perfect" data. Do not fall into this trap. Begin by integrating existing data sources: your HRIS for employee demographics, your performance management system for skills assessments, and your financial data for compensation.

The objective of this initial step is not to achieve perfection, but to establish a baseline. This process will inevitably reveal data gaps—perhaps your skills data is outdated or performance metrics are inconsistent across divisions. This is a positive outcome. Identifying what you don't know creates a clear roadmap for data improvement.

From this baseline, you can layer in external intelligence, such as the market compensation data available through Visbanking, to provide critical context for your internal numbers. This transforms a simple data audit into a strategic analysis.

What's the Best Way to Actually Measure the ROI?

To prove the value of strategic workforce planning, talent initiatives must be directly linked to financial outcomes. Ambiguous goals like "improving our culture" are insufficient. The focus must be on concrete metrics that resonate with the board and stakeholders.

The most effective method for demonstrating ROI is to draw a direct line from a specific workforce action to its financial impact. This reframes SWP from an HR cost center to a verifiable source of value creation for the bank.

Before initiating a plan, define the key performance indicators (KPIs) you will track. For example:

- Reduced Attrition Costs: Quantify the savings from a 5% reduction in turnover for a key role like a commercial loan officer. If the fully-loaded cost to replace one is $150,000, preventing five departures saves the bank $750,000.

- Lower Recruitment Expenses: Demonstrate the reduction in cost-per-hire achieved by filling more senior positions through internal promotion.

- Productivity Gains: Link faster time-to-fill for critical roles to project success. Measure the revenue impact of having key personnel in place and productive sooner, thereby keeping strategic initiatives on schedule.

When you present hard numbers like these, the business case for strategic workforce planning becomes undeniable.

A robust strategic workforce plan is no longer optional; it is a prerequisite for competitive survival and success in the banking industry. The decisive shift is moving from intuition-based assumptions to decisions grounded in hard data.

With Visbanking, you can benchmark your talent metrics, analyze competitor strategies, and access the market intelligence required to build a workforce capable of winning now and in the future. Explore Visbanking's data intelligence tools and see how your bank stacks up.

Similar Articles

Visbanking Blog

Banking Talent Crisis: Why Top Professionals Are Leaving

Visbanking Blog

BIAS: Your Competitive Edge in Banking Data Driven Strategy

Visbanking Blog

Navigating Bank Recruitment: Strategies for Success in the Financial Sector

Visbanking Blog

Banking Data Analytics: Turning Information Into Profit

Visbanking Blog

Revolutionize Your Banking Operations with Data-Driven Insights from BIAS

Visbanking Blog

Navigating the Landscape of Bank Recruitment in the U.S.

Visbanking Blog

Capital Banking in the USA: An Overview of Investment Services, Financial Instruments, and Regulations

Visbanking Blog

Empowering Banks with Visbanking's Enterprise Solution: Performance, Prospects, and Talent Insights

Visbanking Blog

Outperform with Confidence: How Visbanking's Performance Tool Transforms Banking Strategy

Visbanking Blog