A Guide to Performance Measurement Systems for Bank Executives

Brian's Banking Blog

In modern banking, intuition is a liability. A robust performance measurement system is not merely an IT expenditure; it is the strategic command center for your executive team. It transforms raw, disparate data into a unified, actionable view of your institution's health, enabling you to identify top performers, correct inefficiencies, and allocate capital with precision.

Moving Beyond Intuition in Executive Decisions

Effective leadership is no longer a matter of instinct. It demands a data-backed understanding of every facet of the organization, from branch-level profitability to the productivity of individual loan officers. Anecdotal evidence and gut feelings are insufficient for navigating today's competitive market.

This is where a modern performance measurement system provides a decisive advantage. It moves your team beyond cumbersome, siloed spreadsheets and static monthly reports, delivering a dynamic, real-time view of bank operations. This is the critical distinction between possessing data and leveraging it to drive strategic outcomes.

From Reactive Reporting to Proactive Strategy

Traditional performance review has always been a reactive exercise. A report summarizing last month's performance arrives weeks after the period closes. By the time a decision is made, the opportunity has passed or the problem has escalated.

Consider a quarterly report that lands on your desk revealing a $1.5 million increase in non-interest expenses. By the time your team identifies the cause—perhaps an unfavorable vendor contract or inefficient operational workflows—your institution has been bleeding capital for months.

A modern system inverts this paradigm. It delivers real-time or near-real-time intelligence, allowing leadership to address issues as they emerge, not after they have impacted the bottom line.

A true performance measurement system does not simply provide a rearview mirror. It offers a clear map of your current position and illuminates the most profitable path forward. It transforms your data from a static record into a competitive weapon.

The Power of Integrated Intelligence

This proactive capability is derived from consolidating data from disparate sources—the core system, CRM, and loan origination software—into a single source of truth. This integration reveals connections and opportunities that are invisible when data remains trapped in departmental silos.

Suddenly, you can obtain definitive answers to critical strategic questions:

- Which loan officers are originating the most volume, and which are delivering the highest net interest margin?

- Is a $500,000 marketing campaign for new deposits attracting profitable, core relationships, or rate-sensitive customers who will churn in six months?

- How does our efficiency ratio of 0.62 compare to peer banks of a similar asset size within our specific market?

Answering these questions with confidence is the essence of data-driven decision-making. It is precisely what platforms like Visbanking are engineered to provide—giving executives the intelligence needed to benchmark performance and make strategic adjustments that directly impact profitability.

The Four Pillars of a Banking Performance System

A high-performance system is not a dashboard; it is an integrated command center for executing your bank's strategy. To move from reactive reporting to proactive decision-making, this system must be built upon four foundational pillars.

Weakness in any one of these pillars compromises the entire structure, creating dangerous blind spots. They must function in concert to convert scattered data points into a tangible strategic advantage.

This balanced perspective is non-negotiable. It demonstrates how financial results, client satisfaction, and internal operational stability are interconnected components of a single, successful strategy.

Pillar 1: The Right Key Performance Indicators

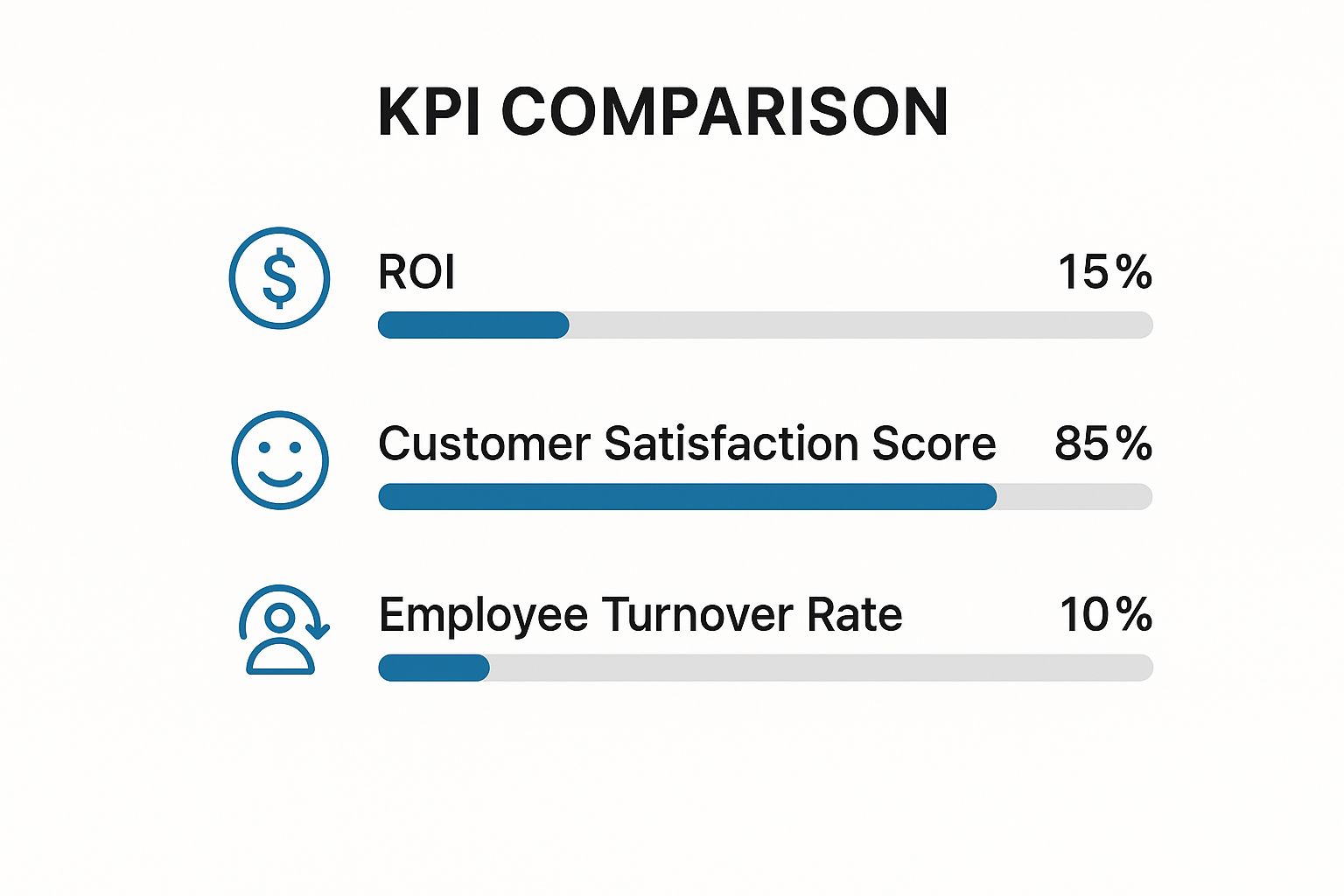

First, you must measure what matters. Generic KPIs yield generic results. Effective measurement requires focusing on indicators tied directly to your bank's strategic objectives. This means moving beyond top-line revenue to the metrics that drive profitability and long-term stability.

Essential KPIs for any financial institution include:

- Net Interest Margin (NIM): The fundamental measure of profitability from core lending and investment activities.

- Efficiency Ratio: A critical gauge of operational discipline, revealing the cost to generate each dollar of revenue.

- Return on Assets (ROA): The ultimate measure of management's effectiveness in deploying the bank's assets to generate profit.

- Loan Origination Volume: A leading indicator of growth trajectory and market share capture.

By defining the right KPIs, you align every team—from lending to marketing—toward a common set of strategic goals.

Pillar 2: Centralized Data Aggregation

Next, this critical data must be consolidated. One of the most significant challenges for banks is the persistence of data silos. Information trapped in the core, the CRM, and loan software cannot provide a holistic view of the institution.

True strategic insight emerges only when you can connect disparate datasets. Your performance measurement system must serve as the central hub—the single source of truth—that your leadership team relies on for high-stakes decisions.

For example, by integrating marketing spend from your CRM with deposit growth from your core system, you can directly attribute a $50,000 digital campaign to a 12% increase in new accounts from your target demographic. This is the power of unified data.

The distinction between legacy reporting and a modern performance system is stark. It is the shift from rearview analysis to a real-time GPS for navigating the future.

Traditional Reporting vs Modern Performance Measurement

| Attribute | Traditional Reporting (e.g. Spreadsheets) | Modern Performance System (e.g. Visbanking) |

|---|---|---|

| Focus | Backward-looking (What happened?) | Forward-looking (What's next & why?) |

| Data | Siloed and manually pulled | Centralized and automatically aggregated |

| Output | Static, dense PDFs and reports | Interactive, visual dashboards |

| Insight | Limited to surface-level numbers | Deep drill-down and trend analysis |

| Timing | Delayed; often weeks or a month old | Real-time or near real-time |

| Actionability | Requires manual interpretation | Delivers clear, actionable intelligence |

This table illustrates not just a technological change, but a fundamental shift in strategic management—from data custodian to data-driven leader.

Pillar 3: Advanced Analytics and Reporting

The third pillar is the conversion of aggregated data into actionable intelligence. Raw numbers are useless without context. A superior system employs analytics to identify trends, flag anomalies, and present complex information in an instantly comprehensible format.

This is where sophisticated business intelligence for banks is indispensable. Instead of wading through a 50-page PDF, executives interact with live dashboards, enabling them to drill down and understand the "why" behind the numbers in seconds.

Pillar 4: Competitive Benchmarking

Finally, internal metrics are meaningless in a vacuum. Knowing your ROA is 1.1% is an isolated fact. Knowing it is 0.25% below the median for your direct competitors is a call to action. Competitive benchmarking is the essential fourth pillar.

By measuring your performance against a curated peer group, you gain an objective understanding of your market position. This context helps identify strategic gaps and set targets that are both ambitious and realistic. It transforms performance measurement from an internal audit into a competitive weapon.

Translating Bank Metrics Into Market Advantage

A performance measurement system is an academic exercise unless it drives decisive, profitable action. Data residing on a server is a cost center. Channeled through a focused system, it becomes the foundation for gaining market share, optimizing operations, and outmaneuvering competitors.

The transition from data to decision is where leading banks create their advantage. They cease merely reviewing performance and begin actively shaping it, using granular insights to make high-stakes calls with confidence. The following scenarios illustrate how this discipline drives tangible results.

Optimizing the Branch Network

Consider a community bank evaluating its physical footprint. An older branch shows declining transaction volumes and new account openings. The reflexive response is closure. A robust performance system, however, compels a deeper analysis.

The data confirms the branch's profitability per square foot is 30% below the bank average. However, it also reveals this branch serves a small cohort of highly profitable commercial clients representing $15 million in low-cost deposits.

The decision is no longer a simple "close or keep" binary. It becomes a strategic calculation: Invest $250,000 in a renovation to attract new retail traffic, or consolidate to save $1.2 million in annual overhead while risking key commercial relationships?

With this level of clarity, executives can model the financial impact of each option. Using an integrated platform like Visbanking, they can benchmark against peer banks that have navigated similar decisions, transforming a difficult choice into a calculated strategic move.

Enhancing Loan Officer Productivity

Imagine a regional bank observes flat loan origination growth. The aggregate numbers obscure the full story, but a proper performance system reveals significant variance among individual loan officers that was lost in the averages.

The system tracks metrics for each officer: application-to-close time, approval rate, and net interest margin. The data reveals:

- Loan Officer A: Has an approval rate 20% higher than the team average, indicating mastery of underwriting standards.

- Loan Officer B: Closes loans five days faster than peers, demonstrating exceptional process efficiency.

Instead of deploying generic training, management acts with precision. It pairs these top performers to cross-train the department. Officer A shares best practices for structuring approvable deals, while Officer B details their workflow for accelerating the closing process. The result is a targeted, data-informed intervention that increases the team's overall loan origination productivity by 15% within two quarters.

Guiding Strategic Capital Allocation

The executive committee is planning the annual budget. The debate centers on where to allocate marketing and personnel resources for maximum return. A performance measurement system cuts through departmental politics with objective data.

A portfolio-level analysis shows the commercial real estate (CRE) book is generating a 1.2% Return on Assets (ROA). The small business lending division, however, is delivering a much stronger 1.8% ROA. This single insight reframes the entire strategic conversation.

The data provides a clear directive: shifting resources toward the more profitable small business sector offers the most direct path to growth. The executive team aligns around a new objective: achieve a 0.25% lift in the bank's overall ROA by concentrating efforts on a proven high-performer. This is how data transitions from a report into a driver of bottom-line results.

Picking the Right Game Plan: Strategic Frameworks

A performance measurement system is only as effective as the strategic framework guiding it. Deploying software without a coherent plan is like pairing a powerful engine with no steering wheel—it generates motion without direction. For banking leaders, the critical task is selecting a framework that connects technology to the institution's strategic destination.

This choice defines what success looks like and aligns the organization toward achieving it. In banking, two frameworks are paramount: the Balanced Scorecard (BSC) and Objectives and Key Results (OKRs). Both translate strategy into action, but they serve different purposes.

The Balanced Scorecard for the Long Haul

The Balanced Scorecard is a framework for building a stable, enduring institution. Its primary strength is preventing the tunnel vision that an exclusive focus on financial metrics can create. The BSC mandates a holistic view of performance across four perspectives:

- Financial: How do we appear to shareholders? (e.g., Achieve a 1.15% Return on Assets).

- Customer: How do customers perceive us? (e.g., Increase customer retention by 5% annually).

- Internal Processes: At what must we excel? (e.g., Reduce average loan processing time by 2 days).

- Learning & Growth: How can we continue to improve and create value? (e.g., Certify 75% of relationship managers in advanced credit analysis).

The BSC is ideal for institutions prioritizing steady, sustainable growth and rigorous risk management. It provides a 360-degree view, ensuring that the pursuit of aggressive financial targets does not compromise team morale or customer loyalty.

OKRs for Speed and Focus

OKRs, conversely, are engineered for velocity. This framework aligns the entire organization around a few ambitious, high-impact goals for a defined period. It separates the what (the aspirational Objective) from the how (the measurable Key Results).

For a bank seeking rapid market share gains, an OKR might be structured as follows:

- Objective: Become the #1 Mortgage Lender in the County.

- Key Result 1: Increase mortgage originations by 15% this quarter.

- Key Result 2: Establish partnerships with 10 new real estate agencies by year-end.

- Key Result 3: Reduce application-to-funding time to 21 days.

OKRs are designed to be "stretch goals"; hitting 70% of a target is often considered a success. The purpose is to push teams beyond perceived limits to achieve extraordinary results. This makes OKRs highly effective for banks in high-growth phases or those executing a significant strategic pivot.

The appropriate framework depends on your institution's strategic priorities. The BSC provides the steady hand for long-term, comprehensive health. OKRs provide the focused acceleration for rapid growth. The key is to commit to a framework and use a platform that provides clear visibility. Whether using the wide-angle lens of a scorecard or the laser focus of an OKR, you must benchmark your chosen metrics against peers to ensure your goals are both ambitious and grounded in market reality.

Getting the Most Bang for Your Buck When You Implement

A powerful performance measurement system is a significant investment. Realizing a return on that investment requires a disciplined, top-down implementation strategy. Deploying software without a clear operational plan results in an expensive, underutilized dashboard. The ROI is achieved when the system is embedded into the bank's daily rhythm, from the boardroom to the branch manager's desk.

Success requires unwavering commitment across four key domains. A failure in any one area can undermine the entire initiative. The objective is to transition from reviewing static reports to actively steering the institution with dynamic intelligence.

Get the C-Suite on Board

Executive and board-level sponsorship is non-negotiable. This is not an IT project; it is a fundamental shift in the bank's decision-making culture. Leadership commitment ensures the initiative receives the necessary resources, authority, and strategic priority to succeed. When executives consistently reference the system's data in strategic sessions, it sends an unambiguous message: this is how we operate. This top-down reinforcement is the single most critical factor in driving adoption and fostering a culture that values data over intuition.

Figure Out What Actually Matters

Next, define the KPIs that link directly to your bank's strategic plan. The temptation to measure everything creates noise and dilutes focus. Discard vanity metrics and concentrate on the few indicators that directly impact profitability, efficiency, and market position. For instance, a community bank focused on commercial lending should be fixated on metrics like cost per loan origination and portfolio yield, not just total loan volume. This focused approach ensures every metric is tied to a strategic business outcome, making the data immediately actionable for managers.

Build a Data-First Culture

A system is only as effective as the people using it. This requires training managers not just on how to access a report, but on how to act on the insights it provides. The system must be perceived as a tool for empowerment, not merely for oversight. The industry is rapidly evolving; projections indicate 65% of the performance management market will be cloud-based by 2025. This shift is driven by results: organizations that effectively leverage data-driven insights are three times more likely to achieve their business goals. You can read more about these performance management trends and their impact.

Partners like Visbanking accelerate this cultural shift by providing intuitive platforms with minimal learning curves. Access to clean, pre-integrated peer data removes barriers to adoption and encourages strategic thinking from day one. It allows your team to immediately benchmark performance and convert insights into a competitive advantage.

Outperforming Your Competition with Continuous Benchmarking

The static annual review is obsolete. In today's banking environment, waiting a year to assess performance is a strategic error. Superior performance measurement systems are not retrospective; they create a real-time feedback loop for continuous strategic adjustment based on current data, not historical assumptions.

This is not solely an internal process. A bank's performance can only be understood in the context of its competitive landscape. Without this external benchmark, your metrics lack meaning. A 10% increase in loan growth may appear successful, but if direct competitors are achieving 15%, you are losing market share. External benchmarking provides the necessary context to distinguish real progress from simply riding a market tide.

The Shift to Real-Time Intelligence

Performance management has migrated from the HR department to the executive strategy table. Leading organizations are replacing archaic annual reviews with dynamic feedback systems. The results are compelling: companies that adopt continuous feedback see a 44% improvement in talent retention and report an average ROI of 340% in the first 18 months. These figures provide a powerful business case for modernizing outdated models. You can see more details on these industry benchmarks and trends.

For bank leaders, this necessitates a system that facilitates weekly, if not daily, monitoring, benchmarking, and action. It means identifying a dip in your Net Interest Margin the moment it occurs and knowing immediately whether it is an institution-specific issue or a market-wide trend.

From Data Points to Competitive Edge

The ultimate value of a modern performance measurement system lies in its ability to transform benchmarking from a periodic, tedious task into an active, strategic weapon. Platforms like Visbanking deliver this critical context on demand, enabling you to answer the questions that drive strategy.

An ROA of 0.95% is just a number. Knowing this figure places you in the 40th percentile among peer banks in your region transforms it into an urgent call to action. This is the clarity that fuels decisive leadership.

Consider these strategic questions:

- Deposit Strategy: Your cost of funds increased by 25 basis points. Is this due to your product mix, or did a competitor make an aggressive rate move that requires a response?

- Loan Portfolio: You grew your commercial real estate portfolio by $50 million. How does this compare to the top three banks in your county? Are you leading the market or merely keeping pace?

Answering these questions requires a firm grasp of what financial benchmarking is and its disciplined application. It is the continuous process of measuring what matters, assessing it against the competition, and acting on the intelligence gained.

Stop operating in an informational silo. To win, you must have a clear view of the entire playing field.

The clarity and competitive edge your institution needs are within reach. Visbanking provides the Bank Intelligence and Action System designed to give you a decisive advantage. Explore our platform to see how you can outperform your competition.

Similar Articles

Visbanking Blog

Revolutionize Your Bank's Performance with BIAS: Unlocking the Future of Visual Banking Data

Visbanking Blog

Outperform with Confidence: How Visbanking's Performance Tool Transforms Banking Strategy

Visbanking Blog

Bank Efficiency Ratio Explained: What 60% Really Means

Visbanking Blog

BIAS: Your Competitive Edge in Banking Data Driven Strategy

Visbanking Blog

Banking Data Analytics: Turning Information Into Profit

Visbanking Blog

Revolutionize Your Banking Operations with Data-Driven Insights from BIAS

Visbanking Blog

How Bank Efficiency Ratios Reveal Hidden Operational Costs

Visbanking Blog

Unveiling Insights: Exploring Performance Conditions of US Banks with Visbanking Banking Report Portal

Visbanking Blog

Unlocking the Power of Multi-Sourced Data: How BIAS Empowers Banks

Visbanking Blog