Mastering Operations in the Banking Industry for Strategic Advantage

Brian's Banking Blog

For any bank executive, operations in the banking industry has shed its back-office reputation. It is no longer a cost center to be minimized, but the strategic core of the institution. This is the engine room that dictates profitability, customer loyalty, and regulatory standing. In short, it drives shareholder value. Superior operations separate market leaders from the laggards.

Redefining The Core of Banking Performance

In today's financial landscape, operations are not a checklist of tasks but a dynamic ecosystem. Core functions—deposit and loan processing, treasury management, client onboarding—are direct lines to the bottom line. Any inefficiency, however minor, creates a ripple effect felt across the entire organization.

The global banking industry has posted strong returns on paper, with an average Total Shareholder Return (TSR) of 30% from mid-2023 to mid-2024. This figure significantly outperforms the broader market. However, these gains are largely attributable to favorable macroeconomic conditions, not fundamental operational improvements. A recent BCG analysis on the future of finance underscores this reality.

From Cost Center to Competitive Advantage

Treating operations as a strategic asset is a necessary shift in mindset.

Every manual process, data entry error, or delayed transaction is a tangible cost and a potential catalyst for customer attrition. A minor inefficiency in the loan origination process, for instance, can easily compound into millions in lost revenue and elevated risk exposure over a single fiscal year.

The transition from a reactive, "fire-fighting" posture to a proactive, data-driven strategy is the hallmark of modern banking leadership. We explore this fundamental shift in our guide on digital transformation in finance.

Introducing Operational Intelligence

How does an institution unlock this latent potential? The answer is operational intelligence.

It is the discipline of using high-quality, real-time data to transform standard operating procedures into a competitive weapon. This requires moving beyond historical reports and asking forward-looking, strategic questions:

- Where are the true bottlenecks in our payment workflows?

- What is the fully loaded cost to onboard a new commercial client?

- How does our branch productivity actually compare to peers in similar demographic markets?

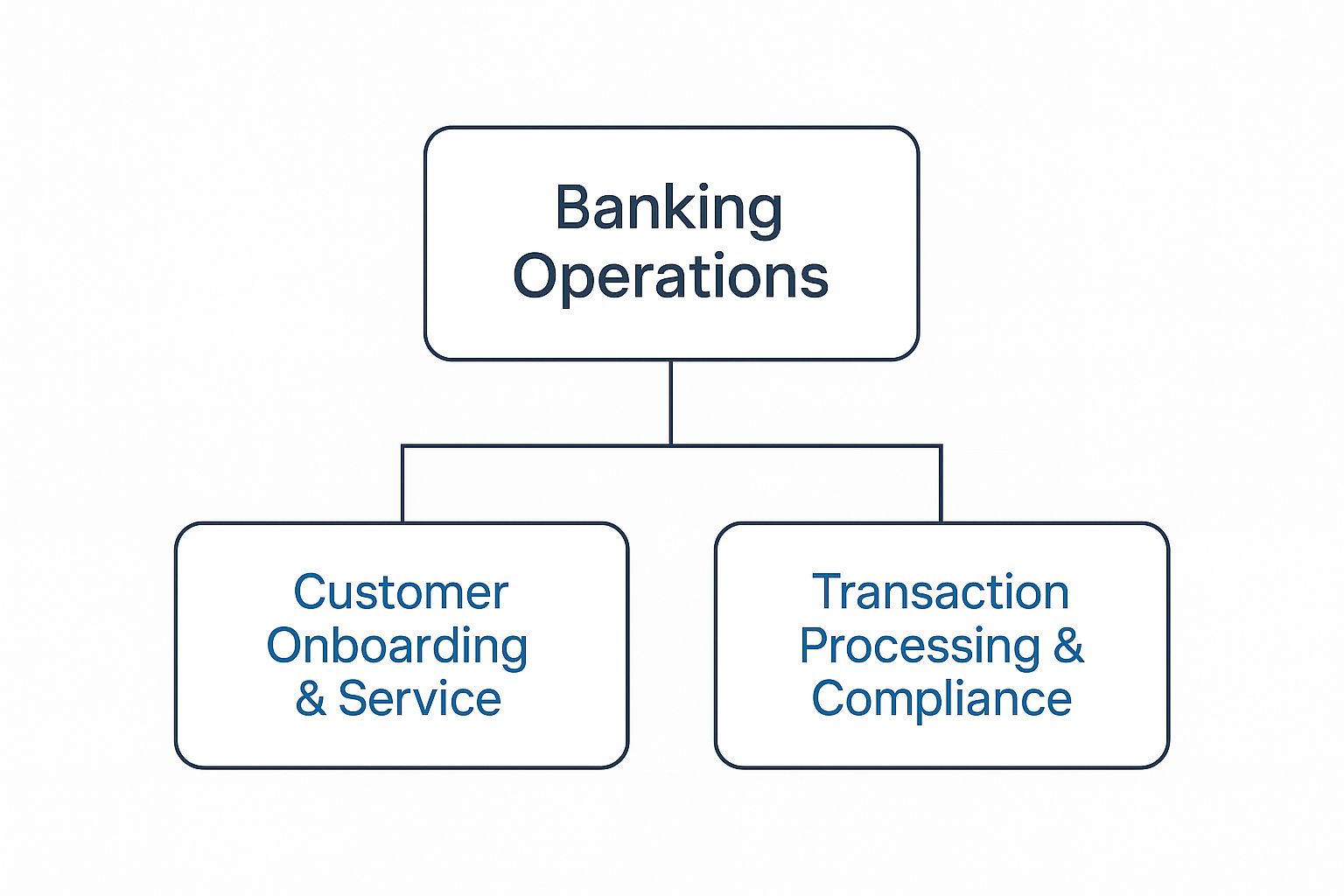

This diagram provides a clear overview of modern banking operations, delineating the customer-facing front office from the critical back-office functions that enable it.

The key takeaway is that customer experience and compliance are not siloed functions; they are direct outcomes of transaction processing quality.

An institution that cannot measure its operational performance cannot manage it. The most successful banks treat operational data with the same reverence as their balance sheet, because they understand one directly shapes the other.

To secure definitive answers to these critical questions, a data framework that delivers clarity—not just more numbers—is essential. This is how the components interconnect.

Core Banking Operations and Their Strategic Impact

| Operational Area | Key Processes | Impact on Key Performance Indicators (KPIs) |

|---|---|---|

| Account Management | New account opening, KYC/AML checks, account maintenance | Customer acquisition cost, onboarding time, regulatory compliance rates |

| Transaction Processing | Payments, deposits, withdrawals, loan servicing | Transaction speed, error rates, cost-per-transaction, operational efficiency |

| Treasury & Liquidity | Cash management, funding, interest rate risk | Net Interest Margin (NIM), liquidity coverage ratio, cost of funds |

| Compliance & Risk | Fraud detection, regulatory reporting, internal audits | Fines & penalties, risk-adjusted returns, compliance costs |

This table merely scratches the surface but illustrates a crucial point: every operational activity has a direct and measurable impact on the bank's financial health and strategic position.

With the right intelligence, bank leaders can connect disparate data points, identify systemic weaknesses, and make informed decisions that build a more resilient and competitive institution. To lead effectively, one must first master the engine that powers the bank.

Deconstructing Key Operational Pain Points

"Operational excellence" is not achieved through a single, grand initiative. It is forged in the daily execution of critical workflows that determine how effectively a bank serves clients, manages risk, and generates profit. To identify true opportunities for improvement, leaders must look past surface-level metrics and dissect the mechanics of core processes.

It is here that friction and hidden costs accumulate, quietly inflating expenses and degrading the client experience. These minor delays and manual workarounds compound over time into significant financial and reputational liabilities. The first step toward resolution is identification.

The True Cost of Inefficient Loan Origination

Consider commercial loan origination, a primary profit center for most banks. Executive dashboards typically track approval rates and closing times. The real story, however, is buried in the manual steps preceding a final credit decision.

Imagine a mid-sized commercial bank with $5 billion in assets processing approximately 100 applications per month. A deep analysis of its workflow data reveals a persistent bottleneck: manual document review. Each application requires four hours of an analyst's time for verification and data entry—tasks prone to human error.

This is not a minor snag; it is a systemic drag on performance:

- Time Delay: It adds an average of three days to the funding timeline. In a competitive lending market, this is a fatal flaw.

- Direct Labor Cost: At a blended rate, this translates to $250 in labor costs per application, totaling $300,000 annually.

- Opportunity Cost: The protracted process contributes to a 10% abandonment rate on loans exceeding $1 million as impatient borrowers seek faster execution elsewhere.

This is not merely an operational headache; it is a direct impediment to growth. The data clearly indicates the bank is losing business not due to its credit policies, but because its workflow is inefficient and data-starved.

Friction in Transaction Processing

Similar issues pervade transaction processing, particularly for high-value payments like ACH and wire transfers. The demands for speed and accuracy are immense, yet many banks rely on legacy systems requiring manual intervention for exceptions, reconciliations, and compliance checks.

A prime example is the process for investigating flagged transactions. A bank might handle 5,000 wire transfers daily, with 1% flagged for manual review. If each review takes 15 minutes, that is over 12 hours of staff time consumed each day in reactive problem-solving. This approach is operationally and financially unsustainable.

An operational process that relies on manual intervention is not a system; it is a recurring cost. The objective is to engineer processes where human expertise is reserved for strategic judgment, not routine verification.

This is where access to the right data becomes transformative.

By analyzing the root cause of flagged transactions, a bank can identify patterns. Perhaps 40% of flags originate from a single correspondent bank’s formatting anomalies, or are tied to recurring data entry errors from a specific client segment. Armed with such insights, the operations team can address the source of the problem rather than chasing individual exceptions.

This data-first mindset elevates banking operations from a cost center to a strategic asset. It provides the hard evidence required to justify investments in automation, re-engineer broken workflows, and deliver a superior client experience that protects the bottom line. Platforms like Visbanking are designed to illuminate these hidden drags on performance. By benchmarking process times and costs against peers, you can quickly identify where you lag and quantify the financial impact. Take a look at our data and see how you stack up.

Wrestling with the Regulatory Beast

In banking, compliance is not a peripheral function; it is interwoven into the fabric of every transaction. For bank leadership, the weight of regulations like the Bank Secrecy Act (BSA), Anti-Money Laundering (AML), and Know Your Customer (KYC) presents a constant, high-stakes operational challenge that impacts risk, cost, and growth.

Managing this complexity with outdated, manual processes is untenable. The risk extends beyond substantial fines. These cumbersome systems create operational bottlenecks that stifle business. A slow, paper-based KYC process for a new commercial client is an invitation for a competitor to step in. When onboarding a high-value customer takes days, they will migrate to the bank that can accomplish it in hours.

The Real Cost of Doing Things the Old Way

Consider the time consumed by a manual Suspicious Activity Report (SAR) investigation. A mid-sized bank might generate 500 AML alerts in a month. If just 10% require manual review, that is 50 complex cases for analysts.

If each case demands an average of four hours—pulling data from the core, sifting through transaction logs, and reviewing customer files—you are expending 200 hours of skilled labor monthly. This represents a six-figure annual expense for a process that only identifies problems after the fact. The inefficiency is profound: you are paying a premium for a defensive posture that never gets ahead of risk.

A compliance strategy built on manual reviews and after-the-fact checks is like trying to patch a leaky boat with duct tape. You’re only treating the symptom—a suspicious transaction—while completely ignoring the real problem of scattered data and broken workflows.

This is precisely where operational intelligence becomes a strategic imperative. It facilitates a shift from reactive, check-the-box compliance to a proactive, data-driven defense. This is not a minor adjustment; it is a fundamental re-architecting of strategy. The goal must be to move beyond meeting minimum requirements and start building a system that anticipates and neutralizes risk. For a closer look at this, check out our guide on modernizing regulatory compliance in banking.

Shifting from Reaction to Real Intelligence

A data intelligence platform fundamentally changes the equation. Instead of analysts hunting for information across disparate systems, a unified platform can aggregate data and identify patterns in real-time.

This empowers your compliance team to focus on strategic risk management, not data retrieval. For instance, what if an intelligent system could identify that 70% of your false-positive AML alerts originate from a specific set of international wire transfer codes? With that single insight, you can refine your monitoring rules, instantly reduce noise, and reclaim hundreds of analyst hours annually.

This data-first approach delivers tangible results:

- Fewer False Alarms: Intelligent analysis can reduce false alerts by over 50%, allowing experts to focus on genuinely high-risk activity.

- Faster Onboarding: By integrating with verification databases and automating checks, you can reduce new commercial account opening from a week to as little as 24-48 hours.

- Predictive Power: Instead of flagging historical transactions, analytics can identify emergent suspicious patterns, enabling intervention before significant damage occurs.

When data intelligence is embedded into compliance operations, a costly necessity becomes a powerful strategic asset. A critical first step is to see how your own compliance metrics and operational speed compare against your peers.

Weaving Data Intelligence into Your Operations

The banks winning today are not operating on experience and intuition alone. While institutional knowledge is invaluable, it is no longer sufficient to navigate the complexity of modern finance. The definitive edge comes from embedding genuine data intelligence deep within the operations in banking industry.

This is not about adopting buzzwords. It is about using granular data to diagnose the root causes of operational drag—the small, recurring inefficiencies that collectively erode the bottom line and frustrate clients.

From Looking in the Rearview Mirror to Charting a Course Forward

For too long, operations have been managed by looking backward through month-end reports and quarterly reviews. This is akin to steering a ship by observing its wake. By the time a problem is identified, the deviation from course is already significant.

True operational intelligence provides a live, forward-looking view by integrating data from the core, CRM, loan origination systems, and compliance platforms. This unified perspective allows leadership to make decisions based on current reality, not historical assumptions.

Consider a common problem: slow wire transfers. The traditional approach sets a service-level agreement—perhaps 15 minutes—and measures compliance. A data-driven approach is a surgical strike.

By analyzing the end-to-end workflow data, a bank might discover that 30% of all wire delays stem from a single, manual verification step for a specific transaction type. Automating that one checkpoint could reduce average processing time from 15 minutes to 3. That is a 5x improvement from one targeted insight.

This is the power of shifting from high-level metrics to actionable intelligence. You stop managing averages and start solving specific, high-impact problems. For a deeper look at this shift, check out our guide to banking data analytics.

This table illustrates the stark contrast between a traditional mindset and one powered by data intelligence.

Operational Metrics Transformation Through Data Intelligence

| Operational Metric | Traditional Approach (Lagging Indicators) | Data-Driven Approach (Predictive Insights) |

|---|---|---|

| Loan Processing Time | Monthly average processing time | Real-time bottleneck identification in the pipeline |

| Call Center Efficiency | Average handle time (post-call) | Predictive staffing based on call volume forecasts |

| Fraud Detection | Rule-based alerts on completed transactions | Proactive identification of unusual patterns before loss |

| Customer Onboarding | Time to open account (end-of-day report) | Drop-off point analysis to improve the application funnel |

The focus shifts from reporting what happened to predicting and preventing problems before they materialize.

Tying It All Together to Drive Strategy

A primary obstacle for any bank is data fragmentation. The core system does not communicate with the wealth management platform, which is isolated from the commercial lending software. This makes a holistic view impossible.

A business intelligence platform like Visbanking’s BIAS acts as a universal translator, consolidating these disconnected data streams into a single, coherent dashboard. This enables leadership to answer the questions that truly drive strategy:

- What is our true cost-to-serve for our top 10% of commercial clients?

- Which branches in similar markets are outperforming peers, and what are their differentiating practices?

- Where in our mortgage pipeline are we losing the most applicants, and why?

Answering these questions allows for precise resource allocation, process optimization, and a more profitable institution. The timing is critical. With roughly 73% of US banking CEOs forecasting profit increases, the opportunity for growth is significant. Seizing it requires operations lean enough to support expansion. For more on this, PwC offers some great insights on banking industry trends.

Knowing How You Stack Up

Finally, internal data provides only half the picture. Without external context, you are operating in a vacuum. How do you know if your "good" performance is truly competitive? This is where peer benchmarking becomes an indispensable strategic tool.

Knowing your average new account opening time is 45 minutes is one data point. Knowing that top-performing peers of your size complete it in 15 minutes is a call to action. It provides a clear, measurable target and builds an undeniable business case for investing in superior processes and technology.

Data intelligence is not about more reports; it is about making smarter, faster decisions. When woven into daily operations, it replaces assumption with certainty. The first step is to establish where you truly stand.

Using Technology as an Operational Force Multiplier

In today's financial environment, adherence to manual, legacy processes is not merely inefficient—it is a competitive liability. The single greatest advantage a bank can create is the strategic application of technology, specifically intelligent automation and AI. This is not about chasing trends; it is about systematically re-engineering workflows for efficiency, accuracy, and cost-effectiveness.

This extends beyond simple cost reduction. It is a fundamental redesign of core banking functions to meet the digital-first expectations of the modern client. The banks that will lead the next decade are those that treat technology not as an IT project, but as the centerpiece of their operational strategy.

From Manual Drudgery to Intelligent Automation

Consider the commercial lending process, often mired in manual reviews and repetitive data entry. AI-powered tools can now automatically extract and verify information from financial statements, contracts, and supporting documents. This accelerates the process and drastically improves its reliability.

For instance, a regional bank processing 200 commercial loan applications per month could reduce manual data entry errors by over 90%. This single change can shorten the average loan cycle by two full days, directly impacting client satisfaction. It also liberates experienced credit analysts to focus on structuring complex deals rather than performing clerical tasks.

The real win with automation in banking isn't about replacing people. It's about freeing them up. When you let machines handle the repetitive grunt work, your skilled professionals can focus their brainpower on strategic analysis, risk assessment, and building high-value client relationships.

This shift creates a significant competitive advantage. A faster, more accurate process means quicker decisions for clients and lower operational risk for the bank.

Predictive Power in Risk Management

Fraud detection is another area primed for technological advancement. Traditional systems rely on static rules that are perpetually one step behind sophisticated fraudsters. They also generate a high volume of false positives, wasting analyst time and potentially blocking legitimate transactions—a certain way to alienate a valuable customer.

Machine learning models, in contrast, provide a dynamic, adaptive defense. They analyze millions of data points in real-time to detect subtle, anomalous patterns that rule-based systems miss. A bank could reduce false positive fraud alerts by 40% within six months of implementation, while simultaneously increasing the detection of actual fraud by 25%. This translates to fewer resources spent on unproductive investigations and a defense that becomes more intelligent with every transaction.

Meeting the Digital Imperative

This strategic push into automation is not just about internal efficiency; it is a direct response to market demand. Operational transformation is now a matter of survival, with most banking CEOs recognizing automation as critical to competitiveness. The fact that 70% of clients globally are now comfortable using a fully digital bank as their primary financial institution cannot be ignored. For a deeper analysis of this trend, the 2025 Banking and Financial Markets Outlook from IBM is essential reading.

Customer behavior is the ultimate driver of strategy. A seamless digital experience is no longer a differentiator; it is table stakes. Winning at operations in banking industry today means building a technology foundation that is not just efficient and secure, but also delivers the speed and convenience that clients demand.

To make these strategic investments effectively, you need a crystal-clear understanding of your current performance. Knowing how your key metrics—from loan processing times to compliance costs—compare to the competition is the necessary first step. See how Visbanking’s data can help you benchmark your performance and identify your greatest opportunities for a technological leap forward.

Building an Operations Model That's Ready for Anything

In an unpredictable market, operational resilience is not an aspiration; it is the price of entry. We have examined the friction points, regulatory pressures, and data-driven solutions that define modern operations in the banking industry. The final step is to move from patching yesterday's problems to engineering an operational model built for tomorrow—one that is agile, intelligent, and scalable.

This is not a project with a finite timeline; it is a fundamental cultural shift. The objective is to build an institution that not only weathers economic volatility but can pivot decisively to seize emerging opportunities. A future-ready model is built on several non-negotiable principles.

The Cornerstones of Operational Excellence

First, a culture of continuous improvement is essential. This means moving beyond static annual reviews and embedding a cycle of measurement, analysis, and optimization into the bank's daily rhythm. Every process, from account opening to transaction settlement, must be viewed as a dynamic system capable of improvement.

Second, an unwavering commitment to a single, unified data infrastructure is critical. Information silos are where valuable insights are lost. A single source of truth allows leadership to connect seemingly disparate events—such as a spike in call center volume and a slowdown in mortgage processing—to diagnose the true root cause of operational drag.

A bank’s operational model is its promise to the market. An agile, data-informed model signals reliability and foresight, while a fragmented, reactive one signals risk. The latter is a liability no institution can afford.

Finally, a future-ready bank leverages analytics for predictive insight. This is about using data to model what could happen, not just report on what already did. For instance, a bank can use peer data to forecast how a 10% increase in commercial loan applications would strain its compliance team, allowing for proactive hiring rather than reactive crisis management.

From Insight to Action

Building this model requires a shift from intuition-based decisions to those grounded in hard evidence. Operational excellence is a discipline, fueled by a relentless pursuit of efficiency and guided by clean, contextualized data. It hinges on knowing precisely where you stand against your direct competitors on the metrics that drive performance.

Is your loan origination process 20% slower than the peer average? Is your cost-per-transaction increasing while the industry trend is downward? Answering these questions with certainty is the first step toward building an institution that not just survives, but thrives. Explore Visbanking’s data to see how you measure up and begin building a more resilient, future-ready bank today.

A Few Common Questions About Modernizing Banking Operations

Where Do We Even Start with Using Data to Improve Operations?

The first step is to establish a single source of truth. Currently, your operational data is likely fragmented across the core, loan origination software, and compliance tools. This lack of integration is the primary obstacle.

Begin by selecting two or three high-pain processes, such as account opening cycle times or the fully loaded cost of loan application processing. Consolidating the relevant data onto a single, unified dashboard will immediately illuminate bottlenecks. This provides a clear baseline for measurement and identifies where your efforts will yield the greatest and fastest impact.

How Can We Justify Spending Money on New Operations Tech?

Frame the investment in terms of business outcomes. This is the only language that resonates at the executive level. Focus on three areas:

- Cost Reduction: Quantify the savings from automating manual tasks. If manual reviews in wire processing were reduced by 50%, calculate the thousands of staff hours that would be reclaimed annually.

- Revenue Growth: Model how faster client onboarding reduces attrition. Reducing a commercial loan application from a three-week process to a one-week approval could capture millions in business currently being lost to more agile competitors.

- Risk Mitigation: Assign a dollar value to a potential compliance fine. Then, demonstrate how enhanced data monitoring reduces this regulatory exposure.

Using industry benchmarks to show how you compare to peers is also a powerful tool. It illustrates not just where you lag, but what is achievable.

Can a Community Bank Realistically Use Advanced Analytics?

Yes, absolutely. This is no longer the exclusive domain of money-center banks. Modern business intelligence platforms are designed for institutions of all sizes. In fact, community and regional banks possess a significant advantage: agility. You can implement changes and realize results far more quickly than larger competitors.

The key is to start with a narrow, focused scope. Select a single objective, such as optimizing call center efficiency or improving branch cash management. The ROI from a well-executed initial project can fund subsequent initiatives. The goal is not to build a massive data infrastructure, but to make smarter, faster decisions tailored to your specific market.

To truly modernize your operations in the banking industry, you must first have a clear, objective picture of your current state. The Visbanking BIAS platform provides the peer benchmarks and market intelligence needed to identify your greatest opportunities for improvement. Explore our data and see how your institution stacks up.

Similar Articles

Visbanking Blog

Revolutionize Your Bank with BIAS, the Bank Intelligence and Action System

Visbanking Blog

How Bank Efficiency Ratios Reveal Hidden Operational Costs

Visbanking Blog

BIAS: Pioneering the Future of Banking Analysis

Visbanking Blog

How US Banks are Capitalized: A Comprehensive Guide

Visbanking Blog

Banking Talent Crisis: Why Top Professionals Are Leaving

Visbanking Blog

Banking Data Analytics: Turning Information Into Profit

Visbanking Blog

Are you ready to transform your bank information services?

Visbanking Blog

Revolutionize Your Banking Operations with Data-Driven Insights from BIAS

Visbanking Blog

Capital Banking in the USA: An Overview of Investment Services, Financial Instruments, and Regulations

Visbanking Blog