Mastering Operational Risk Management for Banks

Brian's Banking Blog

Operational risk management is all about keeping the bank's internal engine running smoothly. It’s the practice of identifying, evaluating, and preventing losses that stem from hiccups in your own house—things like failed internal processes, simple human error, system glitches, or even major external shocks.

Think of it as protecting the bank from the thousand little things that can go wrong every single day, from a simple typo in a wire transfer to a full-blown cyberattack. It's a discipline that has shot to the top of the priority list for financial institutions everywhere.

Why Operational Risk Is a Critical Priority for Banks Today

This isn’t just about ticking a box on a compliance form anymore. Managing operational risk has become a core strategic function. It's less like fixing a single, predictable leak and more like navigating a complex, constantly shifting weather system. One minute you're dealing with a clever phishing attack, the next a breakdown in the loan origination workflow, and then a key system outage right at peak business hours.

This new level of urgency is fueled by some powerful forces changing the face of finance. Rapid digitalization, intense regulatory pressure, and sky-high customer expectations have all dramatically expanded the operational risk landscape. Banks are no longer just brick-and-mortar buildings; they're technology companies, data guardians, and digital service providers, with each new role bringing its own set of potential failures.

The Expanding Universe of Operational Threats

Modern banking is a complex dance between intricate processes, advanced technology, and human judgment. Each of these is a potential source of risk. This broad category covers a surprisingly wide range of threats that can hit a bank's stability, bottom line, and reputation.

To better classify these threats, it's helpful to see where they typically come from.

Primary Sources of Operational Risk in Banking

| Risk Source Category | Description | Common Examples |

|---|---|---|

| People | Errors, misconduct, or negligence by employees, contractors, or even customers. | Data entry mistakes, internal fraud, unauthorized trading, failure to follow procedures. |

| Processes | Flawed, inadequate, or failed internal procedures and controls. | Poorly designed workflows, lack of segregation of duties, errors in transaction processing. |

| Systems | Failures, disruptions, or security breaches related to technology infrastructure. | Software bugs, hardware failures, system outages, data breaches, cyberattacks. |

| External Events | Events outside the bank's direct control that disrupt operations. | Natural disasters, utility outages, terrorism, supplier failures, regulatory changes. |

Understanding these categories helps risk managers see that a seemingly small issue, like an employee clicking a malicious link (People), can trigger a massive data breach (Systems). Similarly, an outdated procedure (Processes) can lead to hefty fines for non-compliance (External Events). These aren't just textbook theories; they are daily realities that demand proactive control.

Regulatory Pressure and Its Impact

Regulators are laser-focused on this expanding threat landscape. The Federal Reserve's Supervision and Regulation Report, for instance, flagged information technology and operational risk as the most common problems among community banks. Likewise, the Office of the Comptroller of the Currency (OCC) has put operational risk management for banks at the very top of its supervision priorities.

You can dig deeper into these emerging risks in banking and see firsthand how regulators are responding. This intense scrutiny means banks have to prove their operational controls aren't just in place, but that they actually work and can adapt to new threats.

This pressure is forcing banks to shift from a reactive stance to a proactive one. It’s no longer good enough to clean up messes after they happen. The real goal is to build a resilient operation that can absorb shocks—whether they come from a global pandemic, a new cyber threat, or a simple internal breakdown. Nailing this is fundamental to keeping the trust of customers, investors, and regulators, securing the bank's future in an uncertain world.

Building a Resilient Operational Risk Framework

A solid operational risk framework is much more than a compliance checkbox; it’s the very architecture of your bank's resilience. Forget the dry, academic models for a moment. Instead, think of it like building a skyscraper designed to withstand an earthquake. It’s not about just following the building code—it’s about creating an interconnected structure where every single component reinforces the others.

The absolute bedrock of this structure is the Three Lines of Defense model. This isn’t just a nice-to-have concept; it’s the essential foundation that clearly defines who is accountable for what. It ensures that critical checks and balances are baked directly into the bank's day-to-day rhythm. Without it, everything else you build is on shaky ground.

The Foundation: The Three Lines of Defense

This model is all about creating a powerful system of checks and balances by organizing risk responsibilities into three distinct groups. It’s designed to prevent any single point of failure.

- First Line of Defense (Risk Owners): Think of your frontline teams—the loan officers, the traders, the operations staff. They are in the thick of the action and are responsible for spotting, assessing, and controlling risks within their daily jobs. They truly own the risk.

- Second Line of Defense (Risk Oversight): This is where you find your independent functions, like the Risk Management and Compliance departments. Their job isn’t to manage risk directly, but to set the policies, build the framework, and challenge the first line to make sure they're doing their job effectively.

- Third Line of Defense (Independent Assurance): This is your Internal Audit team. They stand completely separate from the first two lines, providing objective assurance to the board and senior management that the entire risk management system is designed correctly and actually works as intended.

This layered approach ensures operational risk management is an active, living process—not some passive, once-a-year review that gathers dust on a shelf.

The Structural Beams: Risk Identification and Assessment

With the foundation poured, it’s time to erect the structural beams. These are the processes for identifying and assessing risk, and this is where a bank gets proactive, finding its weak spots before they turn into a full-blown crisis. These activities give the framework its real strength.

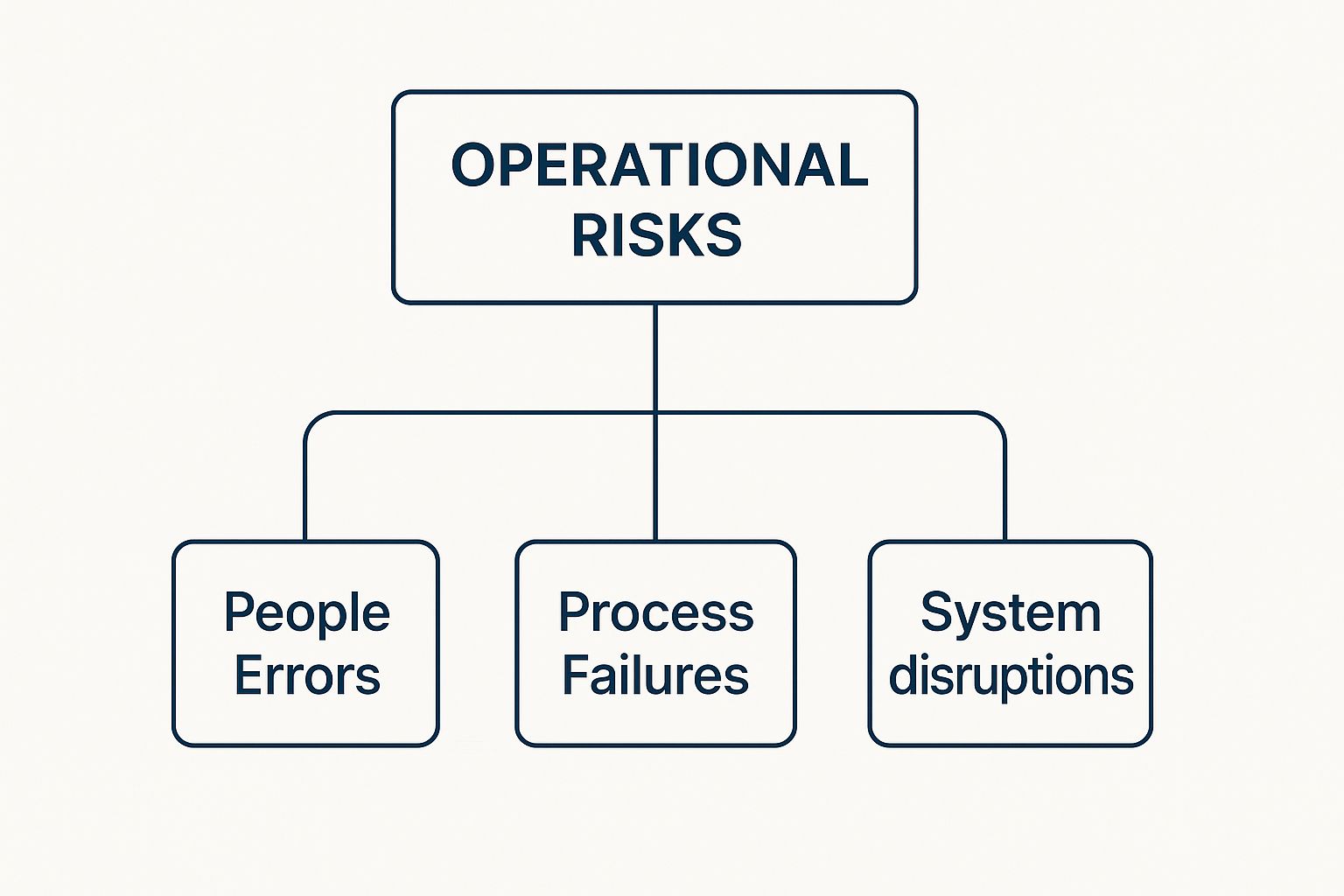

At their core, operational risks spring from three main areas: people, processes, and systems.

This simple hierarchy shows that no matter how complicated a threat seems, you can almost always trace it back to one of these fundamental sources.

To do this well, you need the right tools. Methods like Risk and Control Self-Assessments (RCSAs) are perfect for this, as they empower business units to systematically review their own controls and processes. This fosters a crucial culture of ownership right where the risks live. You can see how these pieces fit into the bigger picture of financial risk management strategies that protect the entire institution.

The Vital Systems: Continuous Monitoring and Reporting

Every strong building needs its vital systems—the electrical wiring, the plumbing, the fire alarms—to keep it functional and safe. For an operational risk framework, this is your continuous monitoring and reporting. These systems make sure information flows to the right people, that warning lights flash when they should, and that leaders have a clear view of the building's health.

A framework without robust monitoring is like a skyscraper with no fire alarms. The structure might be sound, but there's no way to detect a small fire before it becomes an uncontrollable blaze.

This means actively tracking Key Risk Indicators (KRIs)—things like transaction error rates, unexpected system downtime, or high employee turnover in a critical department. When these metrics cross a line, they need to trigger alerts so management can act fast. Reporting has to be clear, timely, and actionable, escalating the big issues from the front lines all the way up to the board.

By weaving these three components together—the foundational Three Lines of Defense, the structural beams of risk identification, and the vital systems of monitoring—a bank goes way beyond just ticking boxes. It builds a genuinely resilient operational risk framework, one that can handle the inevitable shocks that come with navigating the complex world of finance.

How to Identify and Assess Operational Risks

Managing operational risk used to be a game of looking in the rearview mirror—analyzing what went wrong after the fact. That approach just doesn't cut it anymore. Today, it’s all about becoming a proactive hunter, constantly scanning the horizon for potential trouble before it ever materializes.

Think of it this way: are you the ship's captain who only reads about yesterday's storm, or are you the one using live weather radar to steer clear of the hurricane forming right now? In a world of instant payments and 24/7 digital banking, you have to be the latter. The goal is to spot the cracks before they turn into catastrophic failures.

The speed of modern finance demands this kind of agility. We’ve all seen how recent banking crises spun out of control in the blink of an eye. In fact, a recent Risk Management Association (RMA) survey found that 82% of risk officers admitted their banks were caught off guard by just how fast risks popped up. New vulnerabilities from real-time payments and digital banking are emerging constantly, while old foes like cyber and fraud risks are still top-tier threats. If you want a deeper dive, check out what CROs are flagging as the biggest risks heading into 2025.

Adopting Proactive Identification Methods

So, how do you stay ahead? You need a solid combination of tools designed to continuously uncover and evaluate operational risks. This isn't just about checking a compliance box; it's about survival and finding a strategic edge.

A modern risk program really boils down to three core methods:

- Risk and Control Self-Assessments (RCSAs): This is where you empower your business units to own their risk. They evaluate their own operational weak spots and the controls meant to stop them. It’s a fantastic way to build accountability right on the front lines.

- Key Risk Indicators (KRIs): Think of these as your early warning system. They are specific, measurable metrics that flash red when a potential issue is brewing, giving you a chance to step in before any real damage is done.

- Scenario Analysis and Stress Testing: This is where you get creative and ask, "What if?" You model plausible but severe situations to see how the bank would hold up under extreme pressure. It’s the ultimate test of your operational resilience.

When you blend these three approaches, you get a rich, multi-layered picture of your risk landscape. It’s the perfect mix of internal gut-checks, data-driven alarms, and forward-looking war games.

Establishing Meaningful Key Risk Indicators

While all three methods are crucial, your KRIs are the real-time pulse of your entire operational risk framework. They turn abstract fears into hard numbers you can actually track. But here's the catch: they are only as good as the indicators you choose. A bad KRI is just noise. A great one is a signal you can't afford to ignore.

An effective KRI is like a smoke detector for your bank's operations. It doesn't wait for a fire to start; it sounds the alarm at the first sign of trouble, giving you precious time to act.

So, what makes a KRI effective? It needs to be:

- Predictive: It should hint at future problems, not just report on past incidents.

- Measurable: You have to be able to quantify it and track it easily over time.

- Actionable: When a KRI crosses a threshold, it must trigger a clear, pre-planned response.

- Relevant: The metric must tie directly to an operational risk that actually matters to the business.

From Theory to Practice: Scenario Analysis

Scenario analysis takes things a step further by forcing you to imagine different futures. It answers that all-important question: “What’s the worst that could happen, and are we ready for it?” This kind of forward-thinking exercise is how you build true resilience. When done right, it uncovers hidden weak spots in your processes, systems, and even your people that routine checks would completely miss.

For instance, a bank might run a scenario involving a major cyberattack that hits at the exact same time as a critical third-party vendor goes offline. This helps stress-test incident response plans and recovery strategies in a way a simple checklist never could. These exercises are closely related to the broader practice of stress testing for banks, which looks at how the whole institution holds up against severe shocks.

By systematically identifying, assessing, and modeling these potential threats, you can transform operational risk management from a passive, historical chore into a dynamic, forward-looking strategic advantage.

The Human Element of Operational Risk Management

You can have the most advanced tech and airtight frameworks in the world, but they're only as good as the people running them. When it comes to operational risk management for banks, the human element is always the most critical—and honestly, the most unpredictable—part of the equation. You can streamline processes and harden systems, but human judgment, error, and simple behavior will always introduce a wild card that needs constant attention.

Think of it like this: your risk framework is a state-of-the-art security system. It's got all the bells and whistles—sensors, alarms, reinforced doors. But what happens if the person holding the key forgets to lock up? Or worse, willingly lets a stranger inside? The whole system is compromised. This is exactly why a strong risk culture isn't just a nice-to-have; it's a bank's ultimate defense.

Cultivating a Culture of Proactive Accountability

A truly resilient risk culture is one where every single employee, from a part-time teller all the way up to the C-suite, feels personally responsible for spotting and reporting risks. It’s about shifting risk management from being a siloed department’s job to a mindset shared across the entire institution. This doesn't happen by sending out a few memos. It takes real, sustained effort.

So, how do you build it?

- Continuous, Effective Training: Forget the annual, check-the-box compliance modules. Training needs to be practical, role-specific, and ongoing. Teach your people to spot the real-world operational risks they might face in their day-to-day work.

- Clear, Safe Communication: Employees have to know they can raise a red flag without getting in trouble. Whether it's a dedicated hotline, an anonymous online portal, or a designated "risk champion" on their team, the channel must be accessible and safe.

- Incentives That Reward Awareness: Tie performance goals to proactive risk behavior. Don't just reward someone for hitting a sales target; reward them for pointing out a process flaw that prevented a loss.

A bank's risk culture is the immune system of the organization. When it's strong, it naturally detects and neutralizes threats. When it's weak, even minor issues can escalate into severe institutional illnesses.

The Growing Talent Shortage in Risk Management

Making this even tougher is a serious talent shortage. Banks are finding it incredibly difficult to hire and keep the skilled professionals needed to navigate today’s complex risk landscape. This isn't a small problem—it's a direct threat to a bank's ability to implement its own controls effectively.

And it's not just a feeling. The data backs it up. A recent central bank benchmarking survey found that a staggering 62.5% of respondents reported struggling to hire enough staff for their risk management teams. This talent gap directly weakens the ability of banks and even regulators to keep an eye on emerging threats. You can read more in the 2025 risk management benchmarks summary.

High employee turnover is especially toxic in this environment, creating knowledge gaps and instability right where you need consistency. This is where advanced analytics can help, by forecasting attrition risks and giving institutions a better handle on maintaining a stable, knowledgeable workforce.

At the end of the day, even the most beautifully crafted operational risk management framework is just a piece of paper. Without the right people to bring it to life, it’s worthless. Investing in your talent and empowering every single person to be a risk manager isn't just a best practice. It’s the only way to build a bank that's ready for whatever comes next.

Using Key Metrics to Measure and Mitigate Risk

If you can't measure operational risk, you can't manage it. It's that simple. Without the right metrics, you're flying blind, unable to tell the difference between a little turbulence and a full-blown engine failure.

Think of your risk management program as a car's dashboard. Some gauges tell you about the trip you just finished—your mileage, your average speed. Others are warning lights, screaming about a problem before it leaves you stranded. Both are critical, but they have very different jobs.

Leading vs. Lagging Indicators

In the world of risk, we call these lagging and leading indicators.

Lagging indicators are the rearview mirror. They look back at what's already happened, like historical loss data from fraud last quarter. It’s useful information, but it’s history.

Leading indicators, on the other hand, are your forward-looking radar. These are your Key Risk Indicators (KRIs), and they act like your oil pressure gauge or engine warning light. They’re designed to flag potential trouble down the road, giving you time to react before something breaks.

A strong set of KRIs is what separates a reactive, "clean-up" risk culture from a proactive, preventative one. It's the difference between documenting a car crash and seeing the warning signs that help you avoid it entirely.

For example, a sudden spike in failed login attempts on your mobile banking app is a massive leading indicator. It's a flashing red light for a potential cyberattack, giving you a chance to bolster defenses before a breach occurs, not just tally up the losses after the fact.

How Much Risk Can You Stomach?

Before setting your warning lights, you have to decide how much risk your bank is actually willing to take on. This is your risk appetite—the amount of operational risk you'll accept to hit your strategic goals.

From there, you define your risk tolerance. These are the specific, measurable thresholds that trigger your KRIs. If you have a low appetite for IT risk, your tolerance for system downtime might be razor-thin, maybe triggering an alert if a key platform is down for more than five minutes.

These aren't just fluffy statements for a policy document; they're the guardrails for your entire operation. Effective operational risk management for banks depends on solid risk analytics and monitoring to track these metrics and keep everyone inside the lines.

Connecting Metrics to Action

Metrics are useless if they don't lead to action. The real power comes when a flashing KRI triggers a specific, pre-planned response. This closes the loop between measurement and mitigation, turning your data into an active defense.

Let's look at how this plays out with a quick comparison.

Leading vs. Lagging Operational Risk Indicators

A good mix of indicators provides a full picture, but it's the leading indicators that give you the power to change the future. While lagging indicators tell you how big the fire was, leading indicators are the smoke detectors that help you prevent the fire in the first place.

| Indicator Type | Purpose | Example Metric | Actionability |

|---|---|---|---|

| Leading (KRI) | Predictive, early warning | Sharp increase in employee turnover in the compliance department | High: Triggers a review of workload, management, or compensation to prevent knowledge gaps and errors. |

| Lagging | Historical, post-event analysis | Number of regulatory fines paid in the previous fiscal year | Low: Informs future planning but cannot prevent the fines that were already incurred. |

| Leading (KRI) | Predictive, early warning | Rise in customer complaints about a new digital loan application process | High: Prompts an immediate usability review and process adjustments to prevent wider customer dissatisfaction. |

| Lagging | Historical, post-event analysis | Total financial loss from internal fraud last year | Low: Used for capital allocation and improving controls, but the loss has already happened. |

By focusing on leading indicators and tying them to clear action plans, banks can transform their operational risk function from a historical record-keeper into a proactive shield.

Turning these numbers into a coherent strategy is what modern banking data analytics is all about. It’s how you stop documenting risk and start actively dismantling it.

The Future of ORM: It’s All About Smart Tech

Let's be honest. The days of wrestling with operational risk using a patchwork of disconnected spreadsheets are officially over. Trying to manage risk that way is like trying to navigate rush hour traffic with a folded-up paper map—you're slow, outdated, and frankly, a danger to yourself.

The future of operational risk management for banks isn't just about better software; it's a complete shift in thinking. We're moving away from siloed data and clumsy manual processes toward smart, Integrated Risk Management (IRM) platforms. These systems aren't just a shiny new tool. They represent a fundamental change in how we see risk, connecting the dots across the entire bank to give you a single, clear picture that was impossible before.

AI and Predictive Analytics are Changing the Game

The real game-changer here is artificial intelligence (AI) and machine learning (ML). These aren't just buzzwords. They’re giving banks the power to stop looking in the rearview mirror and start looking ahead. Instead of just documenting what went wrong, we can now start predicting what could go wrong.

Think about it. AI and ML algorithms can sift through mountains of data in a blink, spotting tiny patterns and red flags that even the sharpest human team would miss. This has huge implications for how we manage risk:

- Predicting Operational Hiccups: By looking at everything from transaction data to system logs, these models can spot the early warning signs of a process failure or system outage. This lets you step in before things go sideways.

- Automating Compliance: AI can work around the clock, scanning transactions and messages for potential red flags like Money Laundering (AML) violations. It cuts down on human error and frees up your compliance experts to focus on the truly complex stuff.

- Catching the Odd Man Out: These systems learn what "normal" looks like for your bank's day-to-day operations. The second something deviates—an unusual payment, a dip in server performance—it raises an alert.

From Data Puzzles to a Cohesive Picture

This kind of tech integration creates a powerful feedback loop. A failed transaction (process risk) might link directly to a recent software patch (technology risk) and a spike in staff turnover in the IT department (people risk). Seeing these connections laid out in one place transforms risk management from a guessing game into a strategic advantage.

Modern IRM platforms are like the central nervous system for your bank's risk functions. They pull in signals from every corner of the business and translate them into one coherent, actionable story about your bank's health.

This unified view is no longer a "nice-to-have." The European Central Bank has been clear: with risks becoming more complex, from cyber threats to geopolitical surprises, regulators expect banks to have a solid, holistic strategy. An integrated platform isn't a luxury anymore; it's what's required to meet today's standards.

Ultimately, the future of ORM is about building a smarter, more forward-looking, and resilient bank. By embracing integrated technology, we can finally get out of the business of documenting past failures and start actively building a more secure future.

Got Questions About ORM? Let's Talk Brass Tacks.

Even after you've got the frameworks down, the real world always throws a few curveballs. When the theory meets the day-to-day of banking, questions pop up. Let's tackle some of the most common ones head-on.

What’s the Real Difference Between Operational and Credit Risk?

Think of it like this: credit risk is when someone else can't pay you back. Operational risk is when your own house isn't in order.

A borrower defaulting on their loan? That's a classic credit risk event. But what if one of your own employees punches in the wrong loan amount because of a typo? That's an operational risk event. One is about the customer's failure, the other is about your internal processes, people, or tech failing you.

How Can a Smaller Bank Build a Solid ORM Framework Without Breaking the Bank?

You don't need a cannon to kill a mosquito. Smaller banks can build incredibly effective ORM programs by staying focused and scalable. Start with the basics: get your "Three Lines of Defense" crystal clear so everyone knows who's responsible for what.

Next, zero in on your biggest threats. For a community bank, that usually means a sharp focus on cybersecurity, internal fraud, and making sure your critical vendors are buttoned up. You can run powerful Risk and Control Self-Assessments (RCSAs) with tools as simple as a well-organized spreadsheet.

The goal isn't to copy a global bank's bloated framework. It's about building a practical, right-sized system that manages your specific exposures and builds a real risk-aware culture.

Why is Everyone Obsessed with the Three Lines of Defense Model?

Because it works. The Three Lines of Defense model is vital because it creates a powerful system of checks and balances. It's all about accountability and making sure there's no single point of failure.

- First Line (Business Units): The folks on the front lines. They own and manage risk in their daily work.

- Second Line (Risk & Compliance): The independent oversight. They challenge the first line and set the standards.

- Third Line (Internal Audit): The ultimate backstop. They provide independent assurance that the whole system is actually working as designed.

This structure is resilient. It ensures risks are spotted, managed, and audited by different, independent groups, which makes the entire bank stronger.

How Does Regulatory Compliance Fit into All This?

Regulatory compliance isn't just a separate headache—it's a massive piece of operational risk management for banks. Failing to comply with major regulations like the Bank Secrecy Act (BSA/AML) or consumer protection laws is a textbook operational risk.

Why? Because these failures happen due to breakdowns in your internal processes or controls. The fallout—crippling fines, legal battles, and a damaged reputation—hits your bottom line directly. A strong ORM framework is your best tool for systematically finding and fixing these compliance gaps before the regulators do.

Ready to stop guessing and start knowing? The Visbanking Bank Intelligence and Action System (BIAS) transforms how you see risk. We turn mountains of raw data into clear, actionable intelligence that drives smart decisions. Benchmark your performance, find your next best customer, and get ahead of risk with a platform built for modern banking.