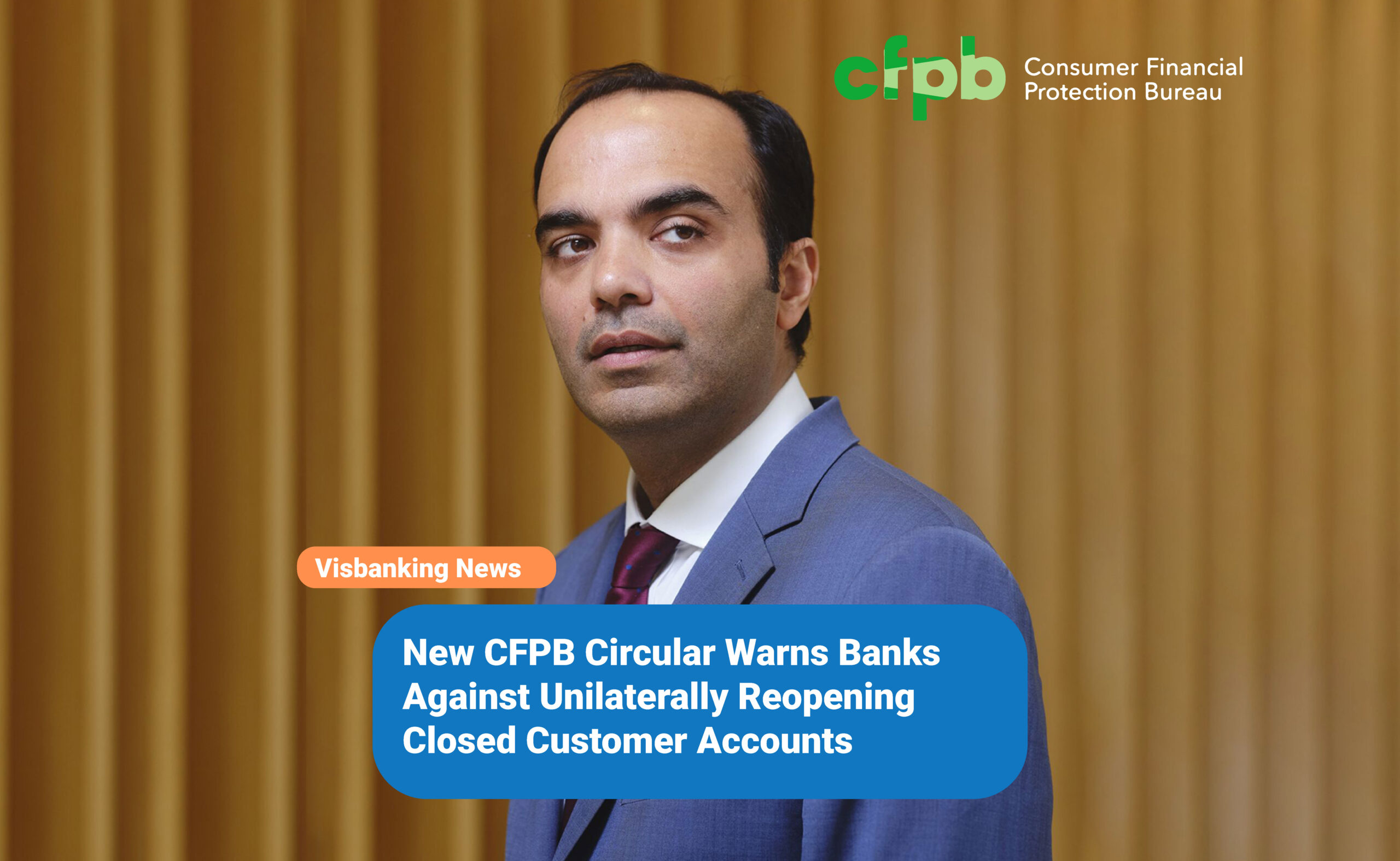

The Consumer Financial Protection Bureau issued a new CFPB circular this week, according to an agency press release. The circular is a warning to banks that unilaterally reopen customer deposit accounts to process fees. Banks that engage in that conduct could be violating federal law.

CFPB Director Rohit Chopra explained why the agency has adopted this interpretation of federal law:

“When a bank unilaterally chooses to open an account in someone’s name after they have already closed it, this is a fake account. The CFPB is acting on all fronts to halt the harvesting of illegal junk fees.”

Why the CFPB circular was issued

The CFPB offered banks and regulators clarity on an issue that has confounded many consumers. Bank customers have complained about seeing their closed accounts reopened by banks for the purpose of processing overdrafts, nonsufficient fund fees, and even account maintenance charges. In some instances, those maintenance fees were assessed even when the original account included no such fees.

The press release also explained the complex process involved in most account closures. According to the agency, it takes “time and effort” for consumers to complete an account closure. Bank policy can even require advance warning from consumers who wish to execute closures. Notice allows banks time to ensure that outstanding transactions and fees are properly processed before the account is closed.

However, once those accounts are closed, customers often lose access to account details. In addition, they may not receive further notifications of activity, including potential third-party access to their accounts. Moreover, banks that assess fees that overdraw the account may harm customers’ credit by reporting negative information to credit agencies.

The CFPB circular emphasized that these and other potential harms to consumers can cause unavoidable injury to consumers. It also noted that banks that engage in this conduct may be committing an “unfair act or practice under the Consumer Financial Protection Act.”