Historic bank failures, interest rate hikes, inflation, etc.

But inflation has had BY FAR the biggest impact on average Americans.

In most circumstances, inflation is a sort of invisible tax that disproportionately affects the poor.

In this case, it’s not invisible at all…

Prices have risen so much, so fast, that everyone has felt it—significantly.

Need I say more than eggflation and $9.00 for a 2×4….

If this hasn’t been a lesson to the government that actions have consequences, I don’t know what it would take.

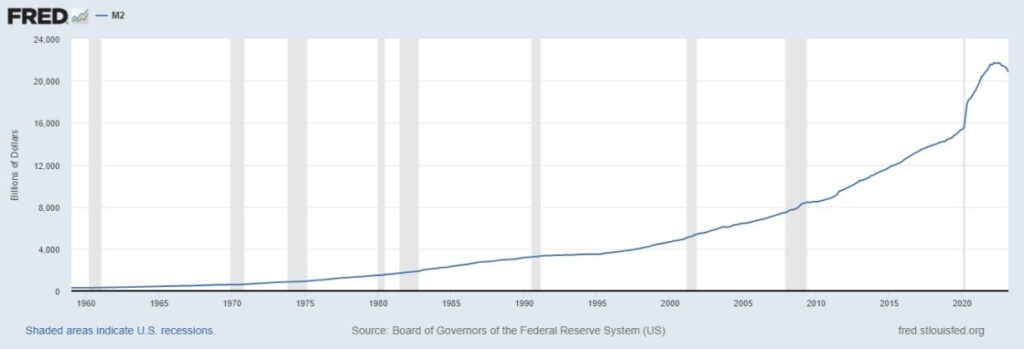

COVID was rather unprecedented, but it doesn’t take an expert economist to know that minting 1/3 of all USD in history in a year and a half would have MAJOR backlash.

Was there a way around it?

I’m not sure.

What I do know is that it would be a wise decision to never go down this road again.

—

Digging deep on banks is what I do.

🔔 Follow Brian on Linkedin: Brian Pillmore