The Strategic Guide to a Modern Loan Management System

Brian's Banking Blog

A modern loan management system is not merely another software application in your bank's technology stack; it is the engine that drives your entire lending portfolio. This system serves as the central command for all lending activities, from origination through servicing and collections, transforming vast amounts of disparate data into the actionable intelligence required to gain a competitive advantage.

Your Bank's Engine for Growth and Profitability

For many bank executives, the term "loan management system" may still evoke images of cumbersome back-office software—a necessary operational tool, but hardly a strategic asset. This perspective is dangerously outdated.

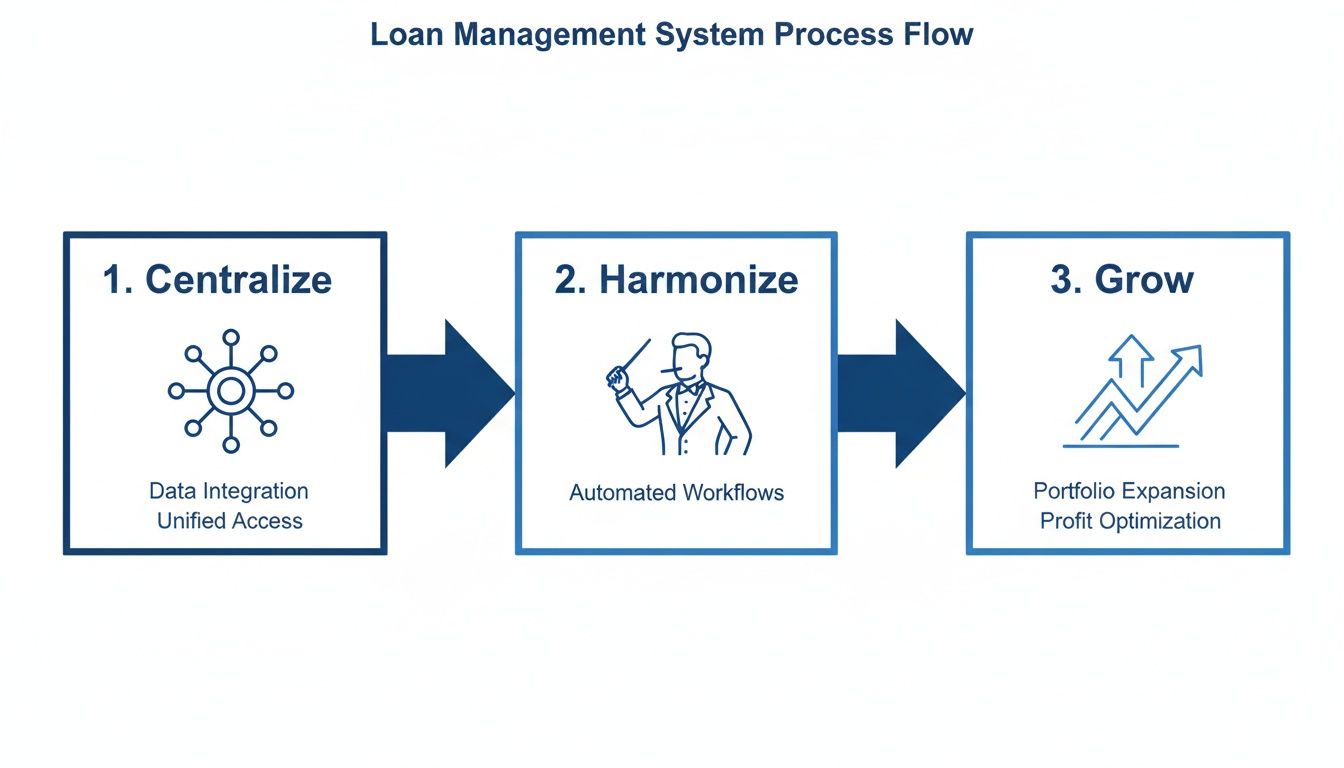

Today's Loan Management System (LMS) is a core component of your bank's strategic framework, directly influencing profitability, risk exposure, and market share. It functions less like a static database and more like an orchestra conductor, ensuring underwriting, servicing, and compliance teams operate from a single, harmonized score. Its primary value lies in converting raw transactional data into strategic foresight. Without a centralized system, critical information remains trapped in departmental silos, making a clear, unified assessment of your portfolio’s health nearly impossible.

From Operational Tool to Strategic Command Center

Consider two competing banks, each managing a $500 million commercial loan portfolio.

Bank A relies on a legacy system where underwriting data is segregated from servicing records. Bank B, conversely, has implemented a modern, integrated LMS.

When market interest rates shift unexpectedly, Bank B can model the impact across its entire portfolio within minutes. Its team can identify at-risk borrowers and proactively offer refinancing solutions the same day. Bank A, meanwhile, spends days manually reconciling spreadsheets, losing valuable time and, more critically, customers.

This scenario highlights the strategic delta: a modern LMS transforms operational burdens into a decisive competitive edge.

For leadership, optimizing the LMS is not an IT upgrade; it is a fundamental strategic imperative. The ability to instantly access, analyze, and act on comprehensive loan data is what separates market leaders from the competition.

The Bottom-Line Impact of Centralized Control

Centralized control through a modern LMS directly impacts the three metrics that matter most to bank executives: risk, cost, and growth. A properly implemented system provides the foundation for excelling in all three areas.

- Mitigate Risk Exposure: A single source of truth for all loan data provides a real-time, 360-degree view of risk. This allows you to identify portfolio concentrations by industry or geography, detect delinquency trends at their inception, and ensure unwavering regulatory compliance.

- Enhance Operational Efficiency: Automating routine tasks such as payment processing, notifications, and compliance reporting can reduce loan servicing costs by up to 30%. This frees your most skilled personnel to focus on high-value activities: building client relationships and sourcing new growth opportunities.

- Drive Portfolio Growth: An efficient system accelerates loan origination and underwriting, which improves the customer experience and increases loan volume. This agility enables you to capitalize on market opportunities while competitors remain encumbered by operational friction.

Ultimately, superior performance hinges on making smarter, faster decisions. The data within your LMS is the fuel, but an intelligence platform is required to refine that fuel into actionable insights. Understanding the core components of effective loan management services is the first step. When you connect a powerful engine like a modern LMS to a bank intelligence platform like Visbanking, you can accurately benchmark performance, uncover hidden opportunities, and steer your institution with precision and confidence.

Deconstructing The Core Architecture: From Origination To Reporting

A high-performance loan management system is not a monolithic application but a suite of specialized modules, each mastering a specific stage of the loan lifecycle. For bank executives, understanding this integrated architecture is non-negotiable, as it dictates data flow, decision-making velocity, and opportunities for efficiency gains.

The strategic power of an LMS is derived from the seamless integration of these components, creating a single, undisputed record for every loan.

The global market for these systems reflects their strategic importance, with forecasts projecting it to reach between USD 5.0 billion and USD 15.0 billion by 2025. This growth is driven by the rise of digital-first competitors and the adoption of AI for more precise risk pricing. With North American market growth projected as high as 16.0% annually, leading institutions are already leveraging these platforms for everything from AI-driven credit scoring to ensuring fair lending compliance.

This flow diagram illustrates how a modern LMS centralizes data, harmonizes operations, and drives sustainable growth.

The key takeaway for executives is clear: without this central data hub, efforts to streamline operations or pursue growth are built on an unstable foundation.

The Origination Module

This is the entry point for every new loan and where profitability is often determined. The origination module automates and standardizes the application and underwriting process, from initial data entry to final disbursement. Its primary function is to accelerate decision-making while ensuring strict adherence to the bank's credit policy.

A top-tier loan management system must manage every detail from application to closing, including the transparent handling of mortgage origination fees.

Consider a community bank managing a $150 million annual volume in small business loans. A manual underwriting process might average three days per loan, creating a significant operational bottleneck. By implementing an LMS with an automated decision engine, the bank can reduce this turnaround time to under one hour for most applications. This enhancement can increase loan processing capacity by 40% without additional headcount, enabling the bank to capture market share from slower competitors.

The Servicing Module

Once a loan is funded, it enters the servicing phase—the longest stage of its lifecycle. This module is the operational workhorse, designed to manage all daily activities with precision and efficiency.

Key functions of the servicing module include:

- Automated Payment Processing: Manages ACH, wire, and debit transactions without manual intervention, which can reduce error rates by over 90%.

- Escrow Management: Flawlessly handles tax and insurance payments, a critical function for both regulatory compliance and customer satisfaction.

- Interest and Fee Calculation: Applies complex interest rate structures and fees consistently across the entire portfolio.

- Customer Communications: Automates payment reminders, statements, and other notices to keep borrowers informed.

Excellence in servicing directly correlates with lower operational costs and higher customer retention. A deficient servicing process generates errors, disputes, and customer attrition, whereas superior servicing builds trust and creates cross-selling opportunities.

The Collections Module

In the event of delinquency, the collections module serves as the first line of defense against credit losses. It activates when an account becomes past due, providing a systematic, compliant framework for recovery. This is far more than a simple call log; it is a data-driven risk management tool.

An effective collections module does more than manage delinquent accounts—it functions as an early warning system. By analyzing payment behaviors across the portfolio, it can identify segments exhibiting elevated default risk, enabling proactive intervention before losses materialize.

For example, by tracking delinquency trends, a bank might identify a 15% increase in 30-day delinquencies for commercial real estate loans in a specific metropolitan area. This single data point, surfaced by the LMS and enriched with market data from a platform like Visbanking, allows the credit committee to immediately re-evaluate its underwriting standards for that sector.

The Reporting And Analytics Module

This module is the executive command center. It aggregates data from all other components to deliver actionable intelligence to leadership. It is the tool that transforms a bank from a loan processor into a strategic portfolio manager, answering critical questions about portfolio health, risk concentration, and profitability.

When you integrate your LMS with a powerful bank intelligence platform, static reports are transformed into dynamic competitive analyses. You can benchmark your loan yields, delinquency rates, and product mix against direct competitors with granular accuracy. This is how you discover how your portfolio truly performs.

Seeing the Whole Board: Why Your LMS Needs Market Intelligence

A modern loan management system is essential for maintaining internal operational control. However, its strategic value is fully realized not by looking inward, but by benchmarking internal performance against the external market.

For bank executives, the focus is not on the technical details of API integration but on the strategic imperative of competitive positioning. When your LMS evolves from a siloed record-keeper into a data source for a bank intelligence platform, you shift from a defensive posture to an offensive one. This integration is what enables the transition from reactive, intuition-based decisions to proactive, data-driven strategy.

Without external context, your internal data lacks meaning. An internal report showing a 0.75% delinquency rate on a $50 million auto loan portfolio is an isolated metric. It does not tell you whether this performance is cause for concern or celebration until it is benchmarked against the market.

From Internal Metrics to Competitive Edge

Let’s translate this into a practical scenario. Imagine your LMS indicates that your team originated commercial real estate loans last quarter with an average yield of 7.25%. In isolation, this number offers no strategic insight.

However, by integrating this data with a platform like Visbanking, you gain a critical yardstick. You discover the regional average for similar loans was 7.60%. That 35-basis-point gap, previously invisible, represents significant profit left on the table.

This insight enables you to ask targeted, strategic questions:

- Are we pricing our loan products too conservatively?

- Is our credit policy misaligned with current market conditions?

- Are our competitors securing higher-margin deals that we are not even seeing?

This is the power of integration. It converts raw internal data into sharp, actionable intelligence, providing leadership with the evidence needed to fine-tune pricing models, adjust sales incentives, and confidently calibrate risk appetite.

When your loan management system is integrated with market intelligence, it transforms from a simple flashlight into a comprehensive radar system, revealing opportunities and threats invisible to your competitors.

Putting Proactive Risk Management into Practice

This integrated approach is not just about maximizing yield; it is about preemptive risk mitigation.

Suppose your LMS flags a minor uptick in 30-day delinquencies within your small business portfolio, concentrated in a specific industry. Viewed in isolation, this might be dismissed as a statistical anomaly.

An integrated intelligence platform, however, can overlay this internal data with external economic indicators, such as UCC filings. It might reveal that suppliers in that precise sector are filing for trade credit protection at an accelerating rate—a definitive leading indicator of financial distress.

Armed with this combined insight, your credit committee can act decisively. Instead of waiting for delinquencies to escalate into defaults, you can proactively manage the risk. This may involve contacting specific borrowers, tightening underwriting standards for new loans in that sector, or adjusting concentration limits. Such preemptive actions can prevent millions in potential losses and are impossible when your LMS operates as an information island.

Of course, effective integration requires a solid technical foundation. Adhering to data integration best practices is crucial to ensure the information flowing between systems is clean, secure, and timely.

The takeaway is simple: a loan management system is a necessity, but its true strategic potential is unlocked only when it is connected to the broader market. That integration provides the context, benchmarks, and early warnings required to make smarter, faster decisions.

Building the Business Case and Quantifying ROI

Any significant technology investment demands a rigorous business case, and a modern loan management system is no exception. In discussions with the board and executive committee, the focus must shift from features and functionality to financial impact. A new LMS is not an IT expense; it is a strategic investment in the engine that drives the bank's profitability.

The return on investment (ROI) is not an abstract concept. It can be quantified by modeling its impact on three key pillars of banking: operational efficiency, risk reduction, and portfolio growth. By systematically addressing each of these areas, you can construct a compelling, data-driven argument that justifies the cost and aligns the project with the institution's primary financial objectives.

Modeling Gains in Operational Efficiency

The most immediate and tangible returns from a new LMS are derived from operational savings. Legacy systems and manual workflows are a persistent drag on the bottom line, consuming staff hours with tasks that modern software can automate flawlessly. The objective is not to reduce headcount but to reallocate your most valuable asset—your people—from low-value processing to high-value client engagement and strategic analysis.

Consider a community bank with a $750 million loan portfolio. A realistic financial model can demonstrate significant efficiency gains:

- Reduced Manual Servicing: Automating payment processing, escrow management, and customer communications can decrease manual hours in the servicing department by 30% or more. For a team of ten, this is the equivalent of reclaiming the capacity of three full-time employees.

- Accelerated Closing Times: A streamlined origination workflow can reduce the time from application to closing by 25-40%, allowing the same team to process a higher volume of loans without increasing headcount.

- Lower Compliance Burden: An LMS with built-in compliance rules that automatically generates regulatory reports drastically reduces the time and cost associated with manual audits and examiner requests.

These efficiencies compound quickly, leading to lower operating costs and a scalable business model.

Quantifying the Impact of Risk Reduction

While less direct than operational savings, the financial impact of enhanced risk management is often far greater. A modern LMS provides the granular, real-time data necessary to identify and mitigate credit risk before it results in losses. This represents a fundamental shift from a reactive to a proactive risk management posture.

For example, advanced analytics may flag early delinquency patterns, such as a 0.5% increase in 30-day delinquencies for auto loans in a specific county. This insight enables immediate adjustments to underwriting criteria, preventing further exposure. Furthermore, automated compliance controls help avoid significant six- and seven-figure penalties for fair lending violations or reporting errors. Lowering your provision for credit losses by even a few basis points can have a substantial positive impact on net income.

The core power of a modern LMS is its ability to transform portfolio data into a predictive risk management tool. It converts risk from a lagging indicator found in quarterly reports into a leading indicator that informs daily strategic decisions.

Projecting Accelerated Portfolio Growth

Finally, a top-tier loan management system is a direct driver of top-line revenue growth. In a competitive market, customer experience is a key differentiator. A cumbersome, paper-based application process is a significant deterrent, causing qualified borrowers to abandon the process and turn to a competitor.

By offering a faster, more transparent digital origination experience, a bank can achieve a measurable increase in its application completion rate. A conservative 10% lift in completed applications, combined with faster closing times, directly translates to increased loan volume and market share. This growth becomes self-reinforcing as the bank’s reputation for speed and service attracts more business from referral partners like real estate agents and brokers.

Market trends confirm this trajectory. The global loan servicing software market is projected to grow from $3.91 billion in 2025 to $9.89 billion by 2033. This is not speculative; it is fueled by tangible results, such as JP Morgan Chase reporting a 20% reduction in defaults and 15% cost savings after adopting AI-driven systems. You can explore these powerful loan management trends that are reshaping banking.

To assist executives in visualizing these benefits, we have developed a clear framework. This table serves as a template for modeling the real-world financial impact a new LMS could have on your institution.

ROI Projection Framework for LMS Implementation

| Benefit Category | Key Metric | Current State (Baseline) | Projected Improvement | Annual Financial Impact ($) |

|---|---|---|---|---|

| Operational Efficiency | Manual Servicing Hours/Month | e.g., 2,000 hours | 30% reduction | $XX,XXX |

| Avg. Days from App to Close | e.g., 45 days | 25% reduction | $XX,XXX | |

| Annual Compliance Audit Costs | e.g., $50,000 | 50% reduction | $25,000 | |

| Risk Reduction | Provision for Credit Losses | e.g., 0.50% of portfolio | 5 bps reduction | $XXX,XXX |

| Annual Regulatory Fines/Penalties | e.g., $0 (but risk exists) | Lowered probability | $XX,XXX (Risk-Adjusted) | |

| Delinquency Rate (30+ Days) | e.g., 1.25% | 10% reduction | $XX,XXX | |

| Portfolio Growth | Application Abandonment Rate | e.g., 20% | 50% reduction (to 10%) | $XXX,XXX (New Volume) |

| New Loan Volume (Annual) | e.g., $100M | 10% increase | $XXX,XXX (Net Interest Margin) |

By populating this framework with your bank's specific data, you can clearly demonstrate how incremental improvements across these categories translate into a significant, quantifiable return. The objective is to shift the conversation from "How much does it cost?" to "How much value will it generate?"

Ultimately, building the business case requires a disciplined articulation of these benefits. When supported by clear, conservative financial projections, investing in a new loan management system ceases to be a difficult decision and becomes an obvious strategic imperative. A crucial first step is to benchmark your current performance against your peers to identify the greatest opportunities for improvement.

Selecting the Right Platform: Key Criteria for Bank Leadership

Selecting a new loan management system is a decision that will profoundly impact your bank’s operations, agility, and competitive posture for the next decade. This is not a task to be delegated to the IT department; it is a strategic procurement process demanding executive oversight.

The primary consideration is not a checklist of features, but whether a potential system provides a scalable, secure, and future-proof foundation for the bank's strategic objectives. Leadership must ask the forward-looking questions that distinguish a true strategic partner from a mere software vendor.

Scalability and Future-Proof Architecture

The first critical question is: can this platform scale with our growth? A system that accommodates today’s loan volume but cannot support a projected 50% increase over the next five years is a failed investment from the outset. Scalability extends beyond volume to encompass product complexity.

If your bank plans to enter a new lending vertical, the LMS must be agile enough to handle new underwriting rules, fee structures, and compliance requirements without necessitating a costly and lengthy redevelopment project.

An API-first architecture is therefore non-negotiable. It is the only design that ensures seamless integration with your core banking system, CRM, and—most importantly—external intelligence platforms. This is fundamental to building the cohesive, data-driven ecosystem at the heart of the banking as a platform model.

Vendor Viability and a True Partnership

Choosing an LMS vendor is akin to entering a long-term strategic alliance. The vendor's financial stability, industry reputation, and commitment to research and development are as critical as the software itself. A promising startup with an impressive demonstration may be appealing, but if their viability depends on the next round of venture funding, you are inheriting their business risk.

The evaluation is not merely of the software, but of the organization behind it. A credible partner will present a clear product roadmap, offer transparent pricing, and provide expert support from professionals who understand banking regulations, not just software development.

Demand references from banks of a similar size and business model. A vendor's performance history with institutions like yours is the most reliable predictor of future success.

Security, Compliance, and the Real Cost of Ownership

In banking, security and compliance are table stakes. The platform must not only meet baseline regulatory requirements but also provide evidence of SOC 2 compliance and demonstrate its ability to automatically enforce fair lending rules. It should function as a proactive compliance guardrail, not simply a tool for retroactive reporting.

Finally, leadership must look beyond the initial license fee to the Total Cost of Ownership (TCO), which includes often-overlooked expenses:

- Implementation and Integration Fees: These can frequently exceed the cost of the software license.

- Data Migration: A notoriously complex and resource-intensive process.

- Staff Training: The cost of ensuring user proficiency and adoption.

- Ongoing Maintenance and Support: Annual fees that impact the long-term budget.

Overlooking these costs is a common mistake. A system with a lower upfront price can quickly become a financial liability. The goal is to identify a platform with predictable costs and a clear, measurable return. The global LMS market, valued at $5.9 billion in 2021, is projected to reach $29.9 billion by 2031, driven by AI and deep integrations. You are not just buying for today; you are investing in that future.

Before making a selection, establish a baseline. Use a platform like Visbanking to benchmark your current portfolio performance against your peers. This analysis will reveal precisely where a new LMS can deliver the greatest strategic impact.

Getting the Implementation Roadmap Right

A state-of-the-art loan management system is a powerful engine, but a flawed implementation can severely disrupt a bank’s lending operations for years. Migrating to a new platform is not merely a technology project; it is a fundamental shift in business processes and organizational culture.

Successful implementation depends less on the software's features and more on effective change management, genuine executive sponsorship, and disciplined execution.

A poorly managed rollout leads to internal resistance, degraded customer service, and an unrealized ROI. Conversely, a well-executed implementation aligns the organization, facilitates seamless adoption, and ensures immediate value capture. The roadmap for success is built on strong governance and meticulous attention to detail.

Secure Unwavering Executive Sponsorship

This is the single most critical success factor. The initiative requires visible, steadfast support from the C-suite. This cannot be a passive endorsement or a project delegated solely to the IT department.

The CEO, COO, and Chief Lending Officer must serve as the primary champions of the initiative. They are responsible for articulating its strategic importance and linking it directly to the bank's overarching goals of growth, efficiency, and prudent risk management.

Executive sponsors are essential for overcoming organizational inertia, securing necessary resources, and maintaining momentum through challenges. Their role is to communicate the "why" so that every employee, from front-line loan officers to back-office compliance staff, understands the project's value. Without this top-down commitment, departmental resistance and project fatigue are inevitable.

A successful LMS implementation is a business transformation initiative with a technology component, not the reverse. When leadership frames it as such, the entire organization is compelled to align, collaborate, and execute toward a shared objective.

Design a Phased Rollout Strategy

A "big bang" approach—simultaneously deactivating the old system and activating the new one—is exceedingly high-risk. It creates a single point of failure that could paralyze the entire lending operation.

A far more prudent strategy is a phased rollout. This approach minimizes disruption, allows for iterative learning, and builds institutional confidence.

The rollout can be structured in several ways:

- By Product Line: Begin with a less complex product, such as unsecured personal loans. This allows the project team to resolve unforeseen issues and gather user feedback in a controlled environment before addressing more complex products like commercial real estate loans.

- By Business Unit or Branch: Deploy the new system to a single branch or a specific lending team first. This pilot group provides invaluable real-world feedback and becomes a cohort of internal champions who can assist in training other teams during subsequent phases.

For example, a bank with a $1.2 billion portfolio could initiate the rollout with its $100 million auto loan book. This smaller-scale launch enables the team to perfect data migration protocols, user training, and workflow configurations, ensuring a much smoother process when migrating the larger $600 million commercial loan portfolio. This methodical approach significantly de-risks the entire implementation.

Your North Star: Data-Driven Benchmarking and Training

A successful implementation begins long before the first line of code is configured. It starts with a comprehensive, data-driven assessment of your current performance. You cannot measure success if you have not defined the starting line.

This is where a bank intelligence platform is indispensable. By benchmarking your current portfolio's performance—yields, delinquency rates, time-to-close—against your direct peers, you establish clear, quantifiable objectives for the new LMS.

This data does more than justify the investment; it steers the project. If benchmarking reveals your loan origination process is 40% slower than the regional average, then configuring the new system to address this specific bottleneck becomes the top priority. Insights from a platform like Visbanking provide the hard evidence needed to allocate resources for maximum impact.

Equally critical is a training program that extends beyond basic software functionality. Training must focus on the new workflows and how the LMS empowers your team to adopt a more strategic approach to lending. Loan officers must understand how the system facilitates faster, more informed credit decisions. Servicing teams must see how automation frees them to address complex customer issues.

When your personnel understand how the new system enhances their effectiveness and value, adoption becomes a natural outcome, not a mandated task.

The first step in any LMS project is knowing exactly where you stand. A clear picture of your performance against the market gives you the data-driven foundation to justify the spend and guide a flawless implementation. Visbanking gives bank executives the intelligence to benchmark their lending performance, pinpoint strategic priorities, and lead with confidence. See how our data can sharpen your competitive edge at https://www.visbanking.com.

Similar Articles

Visbanking Blog

<strong>The Ultimate Guide to Bank Loans: How to Find the Best Deal and Avoid Getting Burned</strong>

Visbanking Blog

VCs might give you money before you’re profitable

Visbanking Blog

How does a bank decide whether or not your business qualifies for a loan?

Visbanking Blog

Bank Regulatory Compliance: Navigating the Complex Maze

Visbanking Blog

Capital Banking in the USA: An Overview of Investment Services, Financial Instruments, and Regulations

Visbanking Blog

Bank Failure: Understanding the Risks and Protections for Consumers

Visbanking Blog

Bank Comparison Tools: Find Your Perfect Financial Match

Visbanking Blog

Bank Branch Networks: Are Physical Locations Still Relevant?

Visbanking Blog

Ever wondered about the secret recipe for a successful bank in today's economy?

Visbanking Blog